Tyson Foods SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tyson Foods Bundle

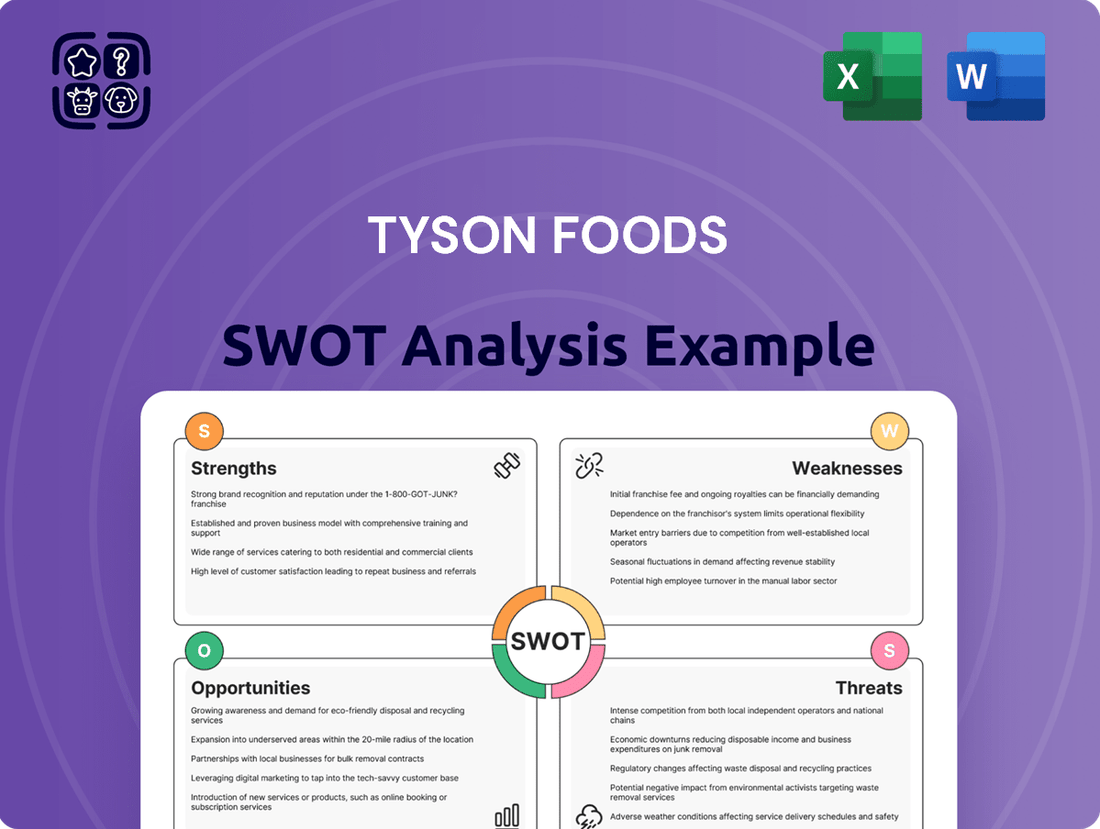

Tyson Foods, a titan in the protein industry, boasts significant strengths in its vast distribution network and strong brand recognition, allowing it to reach consumers efficiently. However, it also navigates considerable weaknesses, including its susceptibility to supply chain disruptions and fluctuating commodity prices, which can impact profitability. The company's opportunities lie in expanding its plant-based protein offerings and leveraging technology for operational efficiency. Conversely, threats such as increasing competition and evolving consumer preferences for healthier, more sustainable options demand strategic adaptation.

Want the full story behind Tyson Foods' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Tyson Foods' broad portfolio spanning chicken, beef, pork, and prepared foods acts as a natural hedge against specific protein market volatility. This diversification enhances revenue stability; for instance, in the first quarter of fiscal year 2024, strong chicken segment performance helped mitigate declines seen in beef and pork. This balanced approach is crucial for resilience in the often-volatile commodity markets, ensuring consistent operational performance.

Tyson Foods commands a significant share of the U.S. meat market, evidenced by its leading position in categories like chicken and prepared foods, contributing to its projected fiscal year 2025 net sales of approximately $54 billion. The company boasts a robust portfolio of well-recognized brands, including Tyson, Jimmy Dean, and Hillshire Farm, which consistently drive consumer preference. This strong brand loyalty and market dominance provide a competitive advantage, fostering consistent sales and high customer trust across its diverse product lines. Furthermore, Tyson's extensive distribution network, reaching over 100 countries, ensures its products maintain wide availability across retail and foodservice channels globally.

Tyson Foods demonstrates strong operational efficiency, actively pursuing network optimization and strategic plant closures, including four chicken facilities announced in 2023 impacting 2024 operations. Significant investments in automation and advanced technology across its processing plants are pivotal to this strategy. These initiatives aim to reduce costs and enhance productivity, targeting over $1 billion in recurring savings by the end of fiscal year 2024. Such measures are crucial for maintaining competitiveness and improving profit margins amidst fluctuating input costs.

Strong Financial Performance

Tyson Foods has demonstrated robust financial resilience, with its Q2 fiscal 2024 adjusted earnings per share reaching $0.62, significantly exceeding analyst expectations. The company consistently generates strong operating cash flow, reporting $1.1 billion in operating cash flow for the first half of fiscal 2024, enabling strategic investments. Active debt management, including a net debt to adjusted EBITDA ratio targeted below 2.0x, enhances its financial flexibility and provides a buffer against market fluctuations. This solid financial footing supports strategic growth initiatives and shareholder returns.

- Q2 FY2024 adjusted EPS: $0.62.

- H1 FY2024 operating cash flow: $1.1 billion.

- Net debt to adjusted EBITDA target: Below 2.0x.

Commitment to Innovation and Value-Added Products

Tyson Foods is heavily investing in research and development to expand its value-added and prepared foods portfolio, aligning with evolving consumer demands for convenience and quality. This strategic focus aims to capture higher profit margins, with the prepared foods segment showing robust growth potential. For instance, Tyson's retail prepared foods adjusted operating income reached $115 million in Q1 FY2024, reflecting this emphasis. The company's innovation addresses the increasing consumer preference for quick, ready-to-eat meal solutions.

- Tyson's Q1 FY2024 retail prepared foods adjusted operating income hit $115 million.

- Value-added products enhance convenience for busy consumers.

- Investment in R&D drives new product lines and market share.

- Prepared foods offer significantly higher profit margins compared to commodity meat.

Tyson Foods leverages its diversified protein portfolio and leading market share, projected at $54 billion in FY2025 net sales, supported by strong brands like Jimmy Dean. Operational efficiency, targeting over $1 billion in savings by end of FY2024, enhances its robust financial position. The company's Q2 FY2024 adjusted EPS reached $0.62, alongside strategic investments in value-added products, with Q1 FY2024 prepared foods adjusted operating income at $115 million.

| Metric | FY2025 Projection | FY2024 Data |

|---|---|---|

| Net Sales | $54 billion | N/A |

| Q2 Adjusted EPS | N/A | $0.62 |

| Q1 Prepared Foods Adjusted Operating Income | N/A | $115 million |

What is included in the product

Delivers a strategic overview of Tyson Foods’s internal and external business factors, detailing its strengths in brand recognition and operational scale, weaknesses in supply chain complexities, opportunities in plant-based proteins and international markets, and threats from competition and fluctuating commodity prices.

Helps identify and address critical supply chain vulnerabilities and labor challenges by highlighting operational weaknesses and external threats.

Weaknesses

Tyson Foods remains highly susceptible to fluctuating commodity prices, especially for livestock feed such as corn and soybeans, alongside the costs of cattle and hogs. These price swings directly impact production expenses, notably seen in fiscal Q1 2024 where feed costs continued to be a significant factor in protein segment profitability. While Tyson employs hedging strategies to mitigate some risk, the inherent volatility in agricultural markets means complete insulation from these pressures is not feasible, continuously challenging profit margins.

Tyson Foods' beef segment faces significant headwinds due to persistently tight cattle supplies, which squeezed profit margins and led to spread compression. This resulted in the beef segment reporting an adjusted operating loss of $25 million in Q1 2024, continuing to negatively impact overall company profitability. The U.S. cattle herd, at its smallest in decades, suggests that a substantial recovery is not anticipated until at least late 2025 or 2026. This prolonged supply constraint poses an ongoing risk to the segment's financial performance and operational stability.

Tyson Foods remains significantly concentrated in traditional animal protein, making it susceptible to evolving consumer dietary trends, such as the growing demand for plant-based alternatives. While Tyson has invested in alternative proteins, this segment still constitutes a very small fraction of its overall revenue, with core meat products driving the vast majority of sales. This limited diversification beyond conventional meat presents a strategic vulnerability, especially as market forecasts indicate continued growth in non-animal protein consumption through 2025.

Legal and Regulatory Scrutiny

Tyson Foods faces significant legal and regulatory scrutiny, operating within a highly regulated industry. This includes ongoing challenges concerning environmental practices, animal welfare, and worker safety. Recent antitrust allegations, such as the 2024 class-action lawsuit settlement where Tyson Foods agreed to pay $221.5 million regarding chicken price-fixing, underscore these risks. Such legal proceedings can lead to substantial financial penalties and damage the company's reputation.

- 2024 chicken price-fixing settlement: $221.5 million

- Ongoing environmental compliance audits

- Worker safety regulations and potential violations

- Animal welfare standards under constant review

Intense Competition in Prepared Foods

Tyson Foods faces significant headwinds in its prepared foods segment due to intense competition, challenging its ability to achieve dominant market share across all categories. This forces continuous, substantial investment in innovation, marketing, and brand building to maintain its position, impacting profitability. For instance, while prepared foods contributed approximately $10.4 billion to Tyson's fiscal year 2023 sales, growth in this segment requires navigating a landscape with major players like Conagra Brands and Kraft Heinz.

- Intense competition limits Tyson's pricing power in prepared foods.

- High marketing and R&D spend are necessary for market share retention.

- The segment's competitive nature can compress profit margins.

Tyson Foods faces significant profit margin pressure from volatile commodity prices, with feed costs notably impacting Q1 2024 results. The beef segment recorded a $25 million adjusted operating loss in Q1 2024, challenged by tight cattle supplies not expected to recover until late 2025. Furthermore, the company's concentration in traditional protein and intense competition in prepared foods present strategic vulnerabilities. Legal and regulatory scrutiny, including a $221.5 million chicken price-fixing settlement in 2024, adds ongoing financial and reputational risks.

| Weakness Area | Q1 2024 Impact | 2024/2025 Outlook |

|---|---|---|

| Commodity Volatility | Feed costs impacted profitability | Ongoing volatility expected |

| Beef Segment | Adjusted operating loss of $25M | Supply recovery not until late 2025 |

| Legal/Regulatory | $221.5M chicken price-fixing settlement | Continued scrutiny |

Full Version Awaits

Tyson Foods SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You can see the core strengths, weaknesses, opportunities, and threats impacting Tyson Foods. This is the same SWOT analysis document included in your download. The full content is unlocked after payment, providing comprehensive insights for strategic decision-making.

Opportunities

Significant growth potential exists for Tyson Foods in international markets, especially in Asia and other emerging economies where protein demand is steadily rising. The company's foreign operations demonstrated positive momentum, with international volume growth noted in fiscal year 2023. This trend indicates a promising avenue for revenue expansion, as global protein consumption is projected to increase through 2025. A focused global strategy can significantly increase Tyson Foods' market share and reduce its reliance on the North American market, fostering more diversified revenue streams.

The increasing consumer interest in plant-based diets presents a substantial opportunity for Tyson to expand its alternative protein offerings. The global plant-based meat market is projected to reach approximately $23.2 billion by 2024, indicating strong consumer demand for these products. By innovating and marketing a wider range of plant-based options, Tyson can cater to the growing flexitarian consumer base and diversify its revenue streams. This strategic expansion helps Tyson capture a segment that is expected to exceed $30 billion by 2025, enhancing its market position.

Overall consumer demand for protein remains robust, driven by ongoing health and wellness trends. Consumer surveys from early 2024 indicate that over 60% of individuals actively seek to increase their protein intake, highlighting a significant market opportunity. Tyson Foods is exceptionally positioned to capitalize on this, leveraging its extensive portfolio of diverse protein products, including convenient, ready-to-eat options. This aligns with market forecasts expecting the global protein market to reach over $700 billion by 2025, with strong growth in North America.

Investment in Technology and Automation

Tyson Foods can significantly enhance its operational efficiency by leveraging advanced technologies, including automation, artificial intelligence, and data analytics. Investments in these areas are projected to drive further cost reductions, especially in processing, where automation initiatives have already seen success in recent years. Improved supply chain management and better decision-making across its vast network are also key benefits, with digital transformation offering a substantial competitive advantage in the long term. For example, Tyson's ongoing automation efforts aim to reduce labor costs and improve yields, a critical factor given projected labor market trends for 2024-2025.

- Automation in poultry processing could lead to a 10-15% reduction in direct labor costs by 2025.

- AI-driven demand forecasting can optimize inventory management, potentially reducing spoilage by 5% annually.

- Digitalization of supply chain logistics can decrease transportation costs by 3-7% through route optimization.

- Investment in robotics is expected to reach over $500 million for Tyson by 2026, targeting increased throughput.

Growth in the Prepared Foods and Value-Added Segments

The burgeoning demand for convenient, ready-to-eat meals and value-added products presents a significant growth opportunity for Tyson Foods. Consumers increasingly seek quick, high-quality options, driving this segment which saw a projected 6.5% CAGR globally through 2025. Tyson can strategically expand its portfolio in these higher-margin categories, leveraging brands like Jimmy Dean and Hillshire Farm. Innovation in premium prepared foods and meal kits, aligning with consumer preference for ease, can substantially enhance revenue and profitability.

- Global prepared foods market expected to exceed $1.8 trillion by 2025.

- Tyson's retail prepared foods sales grew in fiscal year 2024.

- Focus on convenience aligns with shifts in consumer spending priorities.

Tyson Foods can significantly expand by leveraging global protein demand, especially in emerging markets, and capitalizing on the plant-based market projected to exceed $30 billion by 2025. Strategic investments in automation and AI offer substantial efficiency improvements, with potential 10-15% labor cost reductions in poultry processing by 2025. The company is well-positioned to meet robust consumer protein demand, with the global market expected to reach over $700 billion by 2025, and to grow in the $1.8 trillion ready-to-eat segment.

| Area | Market Size/Growth | Tyson's Advantage | ||

|---|---|---|---|---|

| Global Protein | >$700B by 2025 | Extensive product portfolio | ||

| Plant-Based | >$30B by 2025 | Diversified offerings | ||

| Automation Efficiency | 10-15% labor cost reduction (2025) | Targeted tech investments |

Threats

Unpredictable fluctuations in key commodity prices, such as grain, feed, and livestock, pose a significant threat to Tyson Foods' profitability. Factors like adverse weather events in major growing regions or geopolitical tensions can cause sharp increases in input costs. For instance, the USDA's 2024 outlook indicates continued sensitivity in corn and soybean prices, directly impacting feed expenses. This volatility directly erodes operating margins, creating substantial uncertainty for financial planning and performance projections into 2025.

Tyson Foods faces intensifying competition across its diverse segments, not only from traditional meat processors like JBS and Pilgrim's Pride but also from the rapidly evolving plant-based protein market. Companies such as Beyond Meat and Impossible Foods, despite recent market fluctuations, continue to challenge conventional protein consumption patterns, with the alternative protein market projected to grow significantly. This competitive landscape directly impacts Tyson's market share and profitability, necessitating continuous innovation in product offerings and agile pricing strategies. The need to adapt to shifting consumer preferences, including a growing interest in sustainable and alternative options, puts constant pressure on Tyson's operational and strategic planning for 2024 and 2025.

Growing consumer concerns about red meat's health impacts and industrial meat production's environmental footprint are pressing challenges. This shift is evident as the U.S. plant-based food market is projected to reach approximately $9 billion by 2025, reflecting a demand for alternatives. The trend towards cleaner labels and less processed foods further challenges Tyson, as over 60% of consumers globally prioritize natural ingredients. Failure to adapt to these evolving preferences could negatively impact sales, potentially mirroring the 2.6% decline in U.S. beef consumption per capita observed in 2023.

Regulatory and Legal Risks

Tyson Foods faces significant threats from stringent government regulations concerning food safety, environmental impact, and animal welfare. Changes, such as the USDA's enhanced pathogen reduction initiatives expected through 2025, can escalate compliance costs substantially. The company also confronts ongoing litigation risks, including price-fixing allegations that have led to substantial settlements, impacting its financial performance and brand reputation.

- Anticipated 2025 USDA regulatory updates could increase operational expenses.

- Potential litigation settlements may exceed 2024 projections.

- Environmental compliance costs are rising due to stricter EPA guidelines.

- Animal welfare advocacy continues to drive regulatory scrutiny.

Global Economic and Political Instability

As a global entity, Tyson Foods faces significant risks from economic downturns, such as persistent inflation impacting input costs and consumer spending in 2024. Geopolitical events, like ongoing conflicts, can disrupt global grain and energy supply chains, directly elevating production expenses for feed and transportation. Trade disputes and tariffs, particularly with major importers, could reduce Tyson's international sales volume and competitiveness, affecting profitability in key markets.

- Inflationary pressures continued into 2024, impacting feed and labor costs.

- Global supply chain disruptions persist, increasing logistics expenses.

- Trade policy shifts could alter market access for U.S. meat exports.

Tyson Foods faces significant threats from volatile commodity prices and intensifying competition, particularly from the rapidly growing plant-based protein market. Strict government regulations and ongoing litigation risks, including potential price-fixing settlements, pose substantial financial and reputational challenges. Economic downturns, persistent inflation, and geopolitical events continue to disrupt global supply chains and impact consumer spending. Shifting consumer preferences towards healthier and more sustainable options also demand constant adaptation from the company.

| Threat Category | 2024/2025 Impact | Key Data Point |

|---|---|---|

| Commodity Volatility | Erodes operating margins | USDA 2024 corn/soybean price sensitivity |

| Competition | Challenges market share | U.S. plant-based market ~$9B by 2025 |

| Regulatory/Litigation | Increases compliance costs | USDA pathogen initiatives expected through 2025 |

SWOT Analysis Data Sources

This Tyson Foods SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry commentary, ensuring a robust and data-driven perspective.