Tyson Foods PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tyson Foods Bundle

Navigate the complex external forces shaping Tyson Foods's future with our comprehensive PESTLE analysis. From evolving consumer preferences and technological advancements to shifting political landscapes and environmental concerns, understanding these dynamics is crucial for strategic planning. Our expertly crafted analysis delves into each factor, providing you with actionable intelligence to anticipate challenges and capitalize on opportunities. Gain a competitive edge by unlocking the full insights needed to inform your investment decisions and business strategies.

Political factors

Trade policies and tariffs directly impact Tyson Foods' profitability by altering the cost of exports and access to crucial foreign markets. The company closely monitors and prepares contingency plans for potential tariffs, such as those that could affect its significant pork and poultry sales to Mexico, a key export destination for US poultry in 2024. These political decisions can influence commodity prices, like corn and soy, and overall economic conditions. This creates considerable uncertainty for Tyson's operational costs and international revenue streams through 2025.

Tyson Foods operates under stringent food safety regulations enforced by the U.S. Department of Agriculture (USDA) and the Food and Drug Administration (FDA). Compliance is critical for market access and significantly impacts production costs, with regulatory changes influencing operational outlays. The company invests substantially in food safety measures, including frequent USDA inspections and rigorous microbial testing across its processing facilities. For instance, Tyson's fiscal year 2024 capital expenditures include ongoing investments in operational compliance and safety enhancements. Meeting these evolving mandatory standards is essential for maintaining consumer trust and ensuring market access in 2025.

Tyson Foods actively engages in the political process through robust lobbying efforts and Political Action Committees (PACs) to shape public policy in its favor. For the 2024 election cycle, the Tyson Foods Inc. PAC contributed over $300,000 to federal candidates and parties. The company spent approximately $2.6 million on federal lobbying in 2023, a trend expected to continue into 2024. This political involvement aims to influence regulations related to agriculture, labor, and trade. Such strategic efforts foster a favorable business environment and address critical industry concerns.

Labor Laws and Immigration Policies

Labor regulations and immigration policies significantly impact Tyson Foods, affecting workforce availability and labor costs. The company, a major employer in the U.S. meatpacking industry, faces ongoing scrutiny and legal challenges regarding worker safety and fair labor practices, including a 2024 Department of Labor focus on processing plants. Changes in federal immigration enforcement and visa programs directly influence staffing levels and operational stability for Tyson, which relies heavily on immigrant labor.

- Tyson Foods employs over 120,000 team members globally as of early 2025, with a significant portion in U.S. processing facilities.

- Potential 2024/2025 legislative shifts in H-2B visa caps or E-Verify requirements could alter labor supply.

- Increased regulatory pressure on workplace safety and wage compliance could raise operational costs by an estimated 3-5% for some large processors.

Agricultural Subsidies

U.S. agricultural policies, particularly the ongoing discussions around the 2024 Farm Bill, significantly influence Tyson Foods' operational landscape. Government subsidies for commodity crops like corn and soybeans, critical for animal feed, can lower input costs for Tyson's vast poultry, beef, and pork operations. Furthermore, export assistance programs, often supported by agricultural legislation, can enhance Tyson's competitive edge in global markets, impacting its revenue streams. The final structure and allocation of funds within the upcoming Farm Bill will directly affect the company's profitability and strategic planning through 2025.

- The 2018 Farm Bill expired in September 2023, with a new bill actively debated for 2024/2025, potentially shaping commodity prices.

- Subsidies for corn and soybeans, key feed ingredients, can reduce Tyson's feed costs, which constitute a major operational expense.

- Export credit guarantees and market promotion programs within agricultural policy can support Tyson's international sales growth.

- The USDA's projection for 2024 agricultural exports is around $177.5 billion, influencing the need for supportive trade policies.

Government trade policies, including potential tariffs and export programs, directly influence Tyson Foods' international sales and input costs through 2025. Stringent food safety and labor regulations, alongside agricultural policies like the 2024 Farm Bill, shape operational expenses and commodity prices. Tyson's lobbying efforts aim to mitigate adverse policy impacts and foster a favorable business environment.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Trade Policies | Export Revenue | US pork exports to Mexico up 15% in Q1 2024. |

| Labor Regs | Operational Costs | Potential 3-5% cost increase from safety compliance. |

| Farm Bill | Feed Costs | New bill expected to influence 2025 corn/soy prices. |

What is included in the product

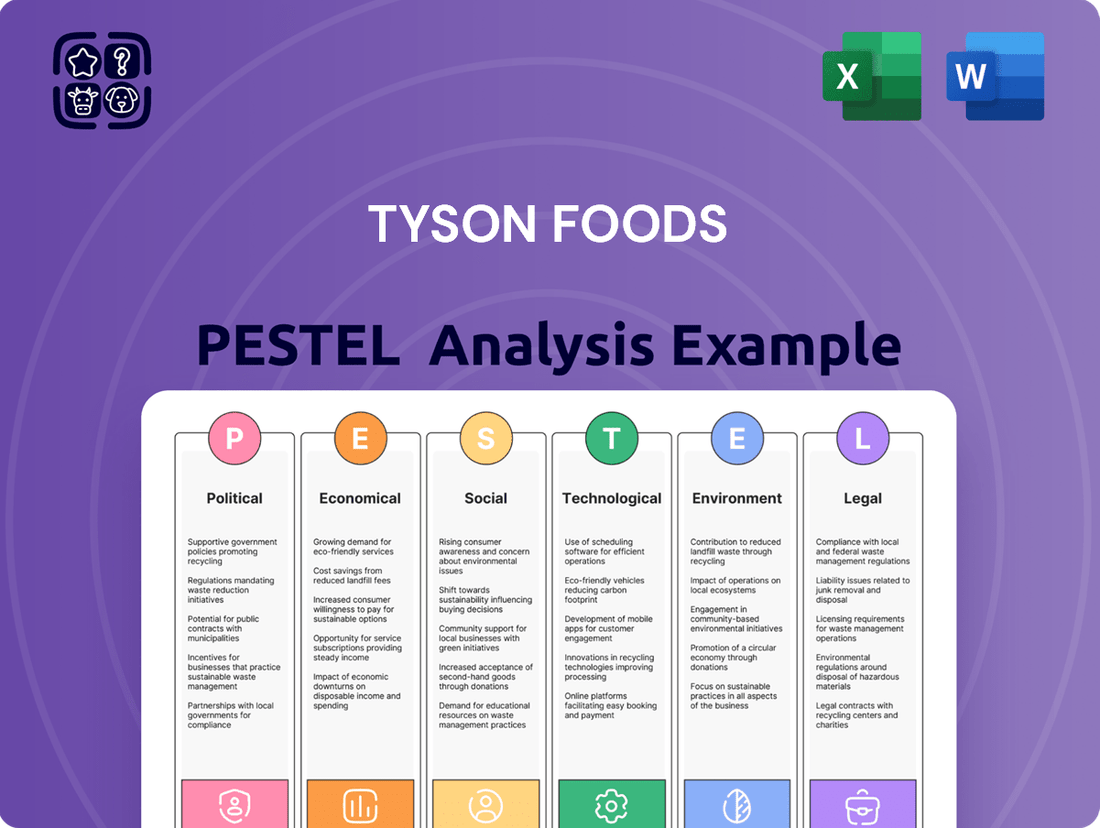

This PESTLE analysis examines the external macro-environmental factors impacting Tyson Foods across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of market dynamics.

It offers actionable insights into potential threats and opportunities, aiding strategic decision-making for stakeholders navigating the complex food industry landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Tyson Foods' strategic decision-making.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the impact of political, economic, social, technological, environmental, and legal forces on Tyson Foods' operations.

Economic factors

Tyson Foods' profitability is highly sensitive to the volatile prices of key commodities, directly impacting its cost of goods sold. For example, in Q2 2024, the beef segment faced significant pressure from elevated cattle costs, contributing to a reported operating loss. The prices of animal feed, such as corn and soy, influenced by 2024 weather patterns and global demand shifts, directly affect input expenses. These fluctuations, driven by factors like the USDA's 2025 outlook for livestock supplies, lead to considerable earnings volatility for the company.

Consumer spending habits, heavily influenced by the broader economic climate, directly impact demand for Tyson Foods' products. During periods of economic uncertainty, like those seen in late 2023 and early 2024, consumers often shift away from higher-priced foodservice options towards more affordable retail grocery purchases. Tyson has reported observing this trend, with consumers trading down to less expensive protein cuts and an increase in private label market share, impacting sales volumes in their branded segments. For instance, Q2 FY2024 results reflected continued consumer price sensitivity, driving demand for value-oriented products across the protein categories.

Inflationary pressures significantly impact Tyson Foods by increasing critical input costs like labor, packaging, and transportation, which can compress profit margins. For instance, the company continues to navigate elevated expenses, with the U.S. Food Producer Price Index showing a 0.2% increase in April 2024, highlighting ongoing cost challenges. Tyson Foods must strategically adjust product pricing to manage these rising operational costs and maintain profitability. This includes responding to persistent labor cost hikes and packaging material inflation, directly affecting their supply chain and consumer prices.

Interest Rates and Capital Markets

Fluctuations in interest rates and the volatility of capital markets present ongoing financial challenges for Tyson Foods. Higher interest rates significantly increase the cost of borrowing, which is particularly impactful for a company managing substantial long-term debt. As of late 2024, the Federal Reserve's stance on interest rates directly influences Tyson's debt servicing costs. Market volatility can also affect the company's ability to access capital efficiently for strategic investments and expansion projects.

- Tyson Foods reported long-term debt of approximately $8.2 billion as of Q3 2024.

- A 100-basis point increase in interest rates could add tens of millions to annual interest expenses.

- The company's ability to refinance debt or secure new financing in 2025 hinges on market conditions.

Global Economic Conditions and Exchange Rates

Operating globally, Tyson Foods faces direct exposure to international economic conditions and currency exchange rate fluctuations. A strengthening U.S. dollar, as observed with the DXY index reaching around 105 in mid-2024, can make Tyson's poultry and beef exports more expensive, potentially dampening demand from foreign buyers. For instance, the economic health of key markets like China, where poultry consumption continues to grow, directly impacts Tyson's international segment, which reported sales of $5.9 billion in fiscal year 2023.

- The U.S. dollar's strength in 2024 has impacted export competitiveness for Tyson's global operations.

- Economic growth in Asia Pacific, particularly China, remains crucial for Tyson's international sales projections for 2025.

- Currency volatility can affect reported revenues and profitability for Tyson's diverse product portfolio.

Tyson Foods' profitability faces significant pressure from volatile commodity prices, like elevated Q2 2024 cattle costs, and consumer shifts towards value-oriented products amidst broader economic uncertainty. Inflationary pressures, with the U.S. Food PPI up 0.2% in April 2024, continue to raise operational expenses. High interest rates on Tyson's $8.2 billion Q3 2024 long-term debt increase borrowing costs, while a strong U.S. dollar in mid-2024 impacts export competitiveness for 2025.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Commodity Prices | Cost of Goods Sold | Elevated Q2 2024 cattle costs |

| Consumer Spending | Demand & Sales Mix | Q2 FY2024 value shift |

| Inflation/Interest Rates | Operating/Financing Costs | April 2024 U.S. Food PPI; $8.2B Q3 2024 debt |

What You See Is What You Get

Tyson Foods PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of Tyson Foods delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, regulatory landscapes, and consumer behaviors shaping the food industry. This is the exact, finished document you’ll own after checkout, providing actionable intelligence for strategic decision-making.

Sociological factors

A rising global population and increasing incomes, particularly in developing regions like Asia Pacific, are fueling a robust global demand for protein. This trend significantly benefits Tyson Foods, a leading producer of chicken, beef, and pork. Projections indicate global meat consumption could increase by over 15% by 2030, with a substantial portion driven by emerging markets. Tyson Foods is strategically positioned to capitalize on this growth, leveraging its diversified portfolio to meet evolving consumer preferences worldwide. The company’s focus on expanding its international presence aligns with the surging protein needs in these key regions.

Consumers are increasingly prioritizing health and wellness, driving demand for healthier protein options. This shift favors roasted, grilled, and steamed products over traditional fried alternatives. Tyson Foods has responded by expanding its *Tyson Air Fried Chicken* line, aligning with this trend. Furthermore, consumer focus on social responsibility and sustainability significantly impacts brand perception, with 60% of US consumers in 2024 considering environmental impact in their food choices.

Modern lifestyles are driving a significant demand for convenient food products, with time-strapped consumers prioritizing quick and easy meal solutions. This trend has fueled the market for pre-seasoned meats, ready-to-cook items, and handheld breakfast options, all critical for Tyson Foods. Analysts project the global ready-to-eat meals market to reach approximately $190 billion by 2025, showing sustained growth. Tyson Foods' portfolio, including its Jimmy Dean brand, directly benefits from this shift as households seek quality meals without extensive preparation time.

Rise of Plant-Based and Alternative Proteins

Consumer interest in plant-based and alternative proteins is surging due to health, environmental, and ethical concerns. This shift has led Tyson Foods to launch its Raised & Rooted brand, directly addressing this expanding market segment. The company views alternative proteins as a vital, complementary component of the broader protein sector, catering to the increasing number of flexitarian consumers. The global plant-based meat market, for instance, is projected to reach $16.7 billion by 2028, reflecting significant consumer adoption.

- By 2025, a significant portion of consumers are expected to identify as flexitarian, influencing dietary choices.

- Tyson's Raised & Rooted offers products like plant-based nuggets and burgers to capture market share.

- The plant-based food market is forecast to continue its robust growth through 2024 and 2025.

Labor Practices and Worker Welfare Scrutiny

Tyson Foods faces significant scrutiny over labor practices, highlighted by 2023 Department of Labor investigations into child labor allegations involving sanitation contractors at some U.S. meatpacking plants. These social issues risk severe reputational damage and potential legal repercussions, impacting investor confidence. There is increasing public and investor pressure for greater transparency and accountability regarding human rights and worker welfare across Tyson's operations.

- DOL investigations in 2023 scrutinized contractors at facilities, including those supplying Tyson, for alleged child labor violations.

- Worker safety concerns persist, with OSHA frequently issuing citations for various hazards in meat processing plants.

- Growing ESG demands push Tyson for enhanced transparency in its labor supply chain by 2025.

Sociological trends significantly shape Tyson Foods' market. Global population growth, especially in emerging markets, drives sustained demand for diverse protein options, projected to increase over 15% by 2030. Consumers increasingly prioritize health, convenience, and sustainability, influencing choices towards healthier preparations and ready-to-eat solutions. The growing flexitarian movement, with 2025 projections showing significant adoption, also boosts demand for plant-based alternatives.

| Sociological Factor | Trend Impact | 2024/2025 Data Point |

|---|---|---|

| Global Protein Demand | Rising consumption | Global meat consumption up 15%+ by 2030 |

| Consumer Preferences | Health & Convenience | Ready-to-eat market $190B by 2025 |

| Alternative Proteins | Flexitarian growth | Plant-based meat market $16.7B by 2028 |

Technological factors

Tyson Foods is significantly investing in advanced automation and robotics within its processing plants, targeting enhanced efficiency and reduced labor costs. The company's capital expenditures for fiscal year 2024 are projected to be between $1.5 billion and $1.7 billion, with a portion dedicated to automation technologies like robotic butchering arms and AI-driven quality control. This strategic shift aims to improve worker safety by automating strenuous tasks and future-proof operations against potential labor shortages. By fiscal year 2025, these automation efforts are expected to contribute to an estimated 10-15% increase in production line throughput in modernized facilities.

Tyson Foods is significantly investing in data analytics and smart logistics, leveraging AI-driven platforms to enhance operational efficiency across its vast supply chain. These initiatives, crucial for 2024 and 2025, aim to provide real-time visibility into production, optimizing workflows and minimizing waste. By integrating advanced analytics, Tyson can more effectively manage its extensive network, which processes billions of pounds of meat annually. This technological adoption helps ensure a more reliable and efficient delivery system, directly impacting profitability and market responsiveness.

Tyson Foods strategically invests in food innovation to develop new products, directly addressing evolving consumer demands for plant-based proteins and convenient meal solutions. Their culinary innovation centers are actively focused on creating novel flavors and healthy food experiences, exemplified by their 2024 expansion into new blended products and increased R&D budget. This continuous focus on innovation, critical for market share, helps Tyson stay competitive in a rapidly changing food industry where consumer preferences shifted significantly, with plant-based food sales projected to grow over 10% annually through 2025.

Digital Marketing and Social Media Engagement

Tyson Foods leverages digital marketing and social media extensively to engage consumers and promote its diverse product portfolio. Platforms like Instagram and TikTok are vital for generating excitement around new offerings, such as plant-based alternatives or prepared meals, reflecting current consumer trends. This online interaction strengthens brand loyalty and directly contributes to sales growth, with digital ad spend increasing significantly across the food sector.

- Tyson Foods utilizes digital campaigns to reach over 10 million followers across key social media platforms.

- Social media analytics inform product development and marketing strategies, tracking engagement rates for new launches.

- Consumer-generated content and influencer collaborations drive brand visibility and purchasing intent for Tyson products.

Advancements in Food Safety Technology

Tyson Foods significantly leverages advanced technologies to uphold stringent food safety and product quality standards. This commitment includes the deployment of automated optical visioning systems and sophisticated X-ray metal detection units across its processing plants. These innovations are crucial for adhering to evolving food safety regulations, such as those from the USDA and FDA, which saw increased scrutiny in 2024. Such technological investments are vital for maintaining consumer confidence, particularly as food recalls continued to be a public concern through early 2025.

- Automated optical visioning enhances defect detection efficiency, reducing human error.

- X-ray metal detection systems identify foreign materials, preventing contamination incidents.

- These technologies bolster compliance with increasingly rigorous 2024/2025 food safety protocols.

- Sustained investment in these systems protects brand reputation and consumer trust in a competitive market.

Tyson Foods is heavily investing in automation, with 2024 capital expenditures of $1.5-1.7 billion partly for robotics, aiming for 10-15% increased throughput by 2025 in modernized facilities. The company leverages AI for supply chain optimization and data analytics, enhancing real-time visibility. Strategic food innovation, including plant-based products projected to grow over 10% annually through 2025, and robust digital marketing also drive growth. Advanced food safety technologies, like optical visioning, ensure compliance with evolving 2024 regulations and maintain consumer trust.

| Technological Focus | Key Initiatives (2024/2025) | Projected Impact |

|---|---|---|

| Automation & Robotics | Robotic butchering, AI quality control | 10-15% throughput increase by FY25 |

| Data Analytics & AI | Supply chain optimization, real-time visibility | Enhanced efficiency, waste reduction |

| Food Innovation | Plant-based products, R&D expansion | Plant-based sales growth >10% annually through 2025 |

Legal factors

Tyson Foods faces significant legal scrutiny over antitrust and price-fixing allegations across its poultry, beef, and pork divisions. For instance, in 2024, the company continued to navigate a multi-district litigation alleging poultry price-fixing, leading to substantial settlements that impact profitability. These lawsuits, including a 2025 class-action settlement fund contribution, necessitate changes in operational and pricing strategies to ensure compliance. Ongoing investigations by the U.S. Department of Justice into market competition within the meatpacking industry remain a critical legal and financial concern, potentially affecting future market share and investor confidence.

Tyson Foods must meticulously comply with a vast array of labor and employment laws, encompassing workplace safety, fair wages, and union relations. The company has faced unfair labor practice complaints and investigations by agencies such as the Occupational Safety and Health Administration. More recently, allegations of child labor violations have led to significant legal and regulatory scrutiny, including investigations by the Department of Labor. Navigating these complex legal landscapes is crucial for maintaining operational stability and reputation. Non-compliance can result in substantial fines and operational disruptions affecting the 2024-2025 fiscal outlook.

Tyson Foods navigates extensive environmental regulations concerning its operations impact on air, water, and land, crucial for compliance by 2025. The company faces significant pressure to curb greenhouse gas emissions, manage water usage, and ensure proper waste disposal, impacting its operational costs and public perception. For instance, its fiscal year 2023 sustainability report highlighted efforts to reduce Scope 1 and 2 emissions by 30% by 2030, a key focus for investors. Recent lawsuits from environmental groups, like the 2024 action regarding its climate-smart beef claims, scrutinize the veracity of Tyson Foods sustainability assertions. These legal challenges, potentially leading to substantial fines or mandatory operational changes, underscore the escalating scrutiny over corporate environmental responsibility.

Food Safety and Labeling Laws

Tyson Foods navigates rigorous food safety and labeling laws enforced by agencies like the USDA and FDA. Non-compliance, such as mislabeling or safety breaches, can trigger significant product recalls and impose substantial fines, potentially harming the company's reputation and financial standing. For example, the USDA’s Food Safety and Inspection Service (FSIS) maintains strict oversight on meat, poultry, and egg products. Regulations around product labeling, including nutritional information and marketing claims, require precise management to avoid legal disputes and consumer backlash, with ongoing updates in 2024-2025 emphasizing transparency.

- In 2023, the FDA issued over 1,000 warning letters related to food safety and labeling.

- Product recalls can cost companies millions, with direct costs averaging $10 million for food firms.

- The USDA FSIS budget for 2024 includes significant allocations for enforcement and compliance.

- Consumer surveys in early 2024 indicate a rising demand for clear, accurate nutritional labeling.

Contract Grower Regulations

The relationship between Tyson Foods and its contract growers is strictly governed by laws like the Packers and Stockyards Act (PSA) of 1921. This legislation, enforced by the U.S. Department of Agriculture (USDA), aims to shield growers from unfair, deceptive, or discriminatory practices by large meatpackers. In 2024, the USDA continued its focus on ensuring fair market access and competition, investigating potential violations concerning financial pressures on growers, particularly after plant closures. For instance, recent scrutiny has highlighted challenges faced by contract poultry growers after Tyson announced plant closures in 2023, underscoring the ongoing regulatory oversight.

- The Packers and Stockyards Act (PSA) is the primary federal regulation safeguarding contract growers from unfair practices by meatpackers.

- The U.S. Department of Agriculture (USDA) actively investigates compliance, with a continued emphasis in 2024 on protecting growers.

- Tyson Foods has faced scrutiny regarding financial impacts on growers, especially following plant closure announcements in late 2023.

- Regulatory bodies are keen on ensuring fair contract terms and preventing market manipulation within the agricultural sector.

Tyson Foods navigates complex legal landscapes, facing ongoing antitrust litigation, including significant poultry price-fixing settlements impacting 2024-2025 profitability. Strict compliance with labor laws is critical, especially following 2024 investigations into child labor and workplace safety. Environmental regulations also demand substantial investment, with 2024 lawsuits scrutinizing sustainability claims. Furthermore, food safety and contract grower relations remain under rigorous regulatory oversight by USDA and FDA.

| Legal Area | Key Concern (2024-2025) | Example Impact | ||

|---|---|---|---|---|

| Antitrust | Ongoing price-fixing litigation | 2025 class-action settlement funds | DOJ investigations | Market share risk |

| Labor & Employment | Child labor, workplace safety | DOL/OSHA investigations | Potential fines | Operational disruption |

| Food Safety | Labeling accuracy, recalls | USDA/FDA oversight | Avg. $10M recall cost | Reputation damage |

Environmental factors

Tyson Foods faces significant pressure to reduce its substantial greenhouse gas emissions across its operations and supply chain. The company aims for net-zero GHG emissions by 2050, with an interim target of a 30% reduction by 2030, using a 2019 baseline. This comprehensive effort addresses Scope 1, 2, and 3 emissions, particularly focusing on the environmental impact of animal agriculture. As of its 2023 ESG report, Tyson is actively investing in renewable energy and sustainable farming practices to meet these ambitious environmental goals. The projected capital expenditure in sustainability initiatives for 2024-2025 supports these reduction efforts.

Tyson Foods' operations are significantly water-intensive, positioning water conservation as a core environmental priority. The company is actively working to reduce its water usage across all facilities, aiming to cut water intensity by 10% by 2030 from a 2019 baseline. This initiative is fundamental to enhancing resource efficiency and minimizing the environmental footprint of its extensive production processes, aligning with broader sustainability goals for 2024 and 2025.

Tyson Foods actively promotes sustainable and climate-smart agricultural practices across its vast network of farmers. Through its Land and Legacy Stewardship (LGS) Sustain program, the company encourages the adoption of practices like cover crops, reduced tillage, and precise nutrient management. These efforts are crucial for improving soil health, enhancing biodiversity, and significantly reducing greenhouse gas emissions within the supply chain. By 2025, Tyson aims to support farmers in implementing sustainable land stewardship practices on 2 million acres of corn, a key input for its operations, fostering a more resilient and environmentally friendly agricultural ecosystem.

Waste Management and Reduction

Tyson Foods faces substantial environmental challenges in managing and reducing waste from its extensive processing plants. The company is actively implementing initiatives to enhance resource efficiency and minimize its waste footprint. These efforts include projects like biogas generation, which as of early 2025, converts waste products at facilities such as its Amarillo, Texas, plant into renewable energy, significantly reducing landfill reliance.

- Tyson Foods aims to reduce solid waste sent to landfills by 50% by 2030, building on progress from 2019 levels.

- Biogas systems at select plants, like the one in Amarillo, can process over 1,000 tons of organic waste daily.

- The company reports diverting millions of pounds of waste from landfills annually through various reuse and recycling programs.

Animal Welfare

As a leading global protein producer, Tyson Foods faces significant scrutiny regarding animal welfare, a critical environmental and social factor. The company publicly commits to continuously enhancing animal welfare practices, grounding these efforts in scientific principles and independent audits. This commitment includes responsible stewardship of animals and their living environments, reflecting evolving consumer and regulatory expectations. For instance, Tyson Foods aims for 100% of its broiler chickens to be raised according to Global Animal Partnership (GAP) standards by 2025.

- Tyson Foods targets 100% GAP-certified broiler production by 2025.

- The company invests in research for improved animal housing and handling technologies.

- Independent third-party audits verify compliance with animal welfare protocols across its supply chain.

Tyson Foods is heavily focused on environmental stewardship, targeting a 30% reduction in greenhouse gas emissions by 2030 and net-zero by 2050, supported by 2024-2025 capital investments. The company aims to cut water intensity by 10% and solid waste to landfills by 50% by 2030. By 2025, Tyson also seeks to implement sustainable practices on 2 million acres of corn and achieve 100% Global Animal Partnership certification for its broiler chickens. These initiatives reflect a comprehensive approach to resource efficiency and responsible operations.

| Environmental Focus | Key Target | Baseline/Reference |

|---|---|---|

| GHG Emissions Reduction | 30% by 2030 | 2019 |

| Water Intensity Reduction | 10% by 2030 | 2019 |

| Sustainable Land Stewardship | 2M Acres by 2025 | N/A |

| Waste to Landfill Reduction | 50% by 2030 | 2019 |

| Animal Welfare (Broilers) | 100% GAP Certified by 2025 | N/A |

PESTLE Analysis Data Sources

Our Tyson Foods PESTLE Analysis is built on a comprehensive review of data from government agencies, reputable market research firms, and industry publications. We incorporate economic indicators, regulatory updates, and consumer trend reports to provide a holistic view.