Tyson Foods Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tyson Foods Bundle

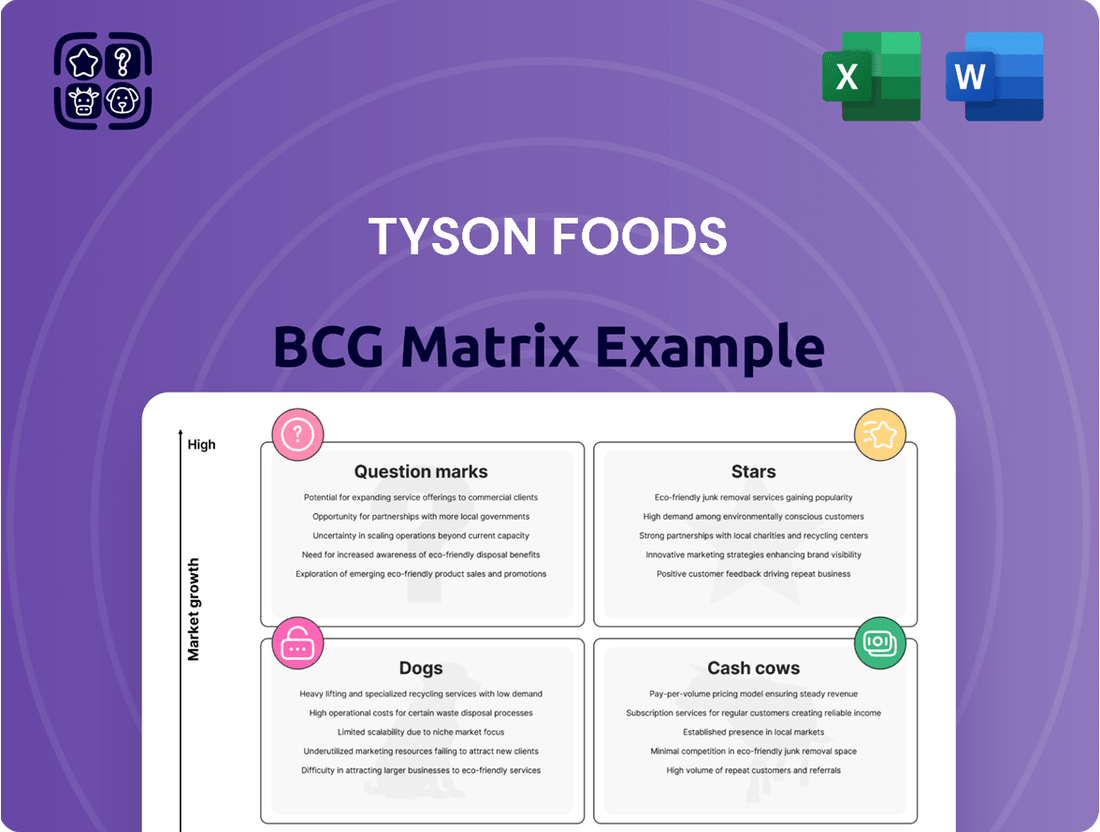

Tyson Foods operates in a dynamic market, so understanding its product portfolio is crucial. Analyzing its offerings through a BCG Matrix reveals valuable strategic insights. This framework categorizes products as Stars, Cash Cows, Question Marks, or Dogs. Seeing this overview can inform investment and resource allocation strategies. Identify growth opportunities and areas requiring strategic adjustments.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Tyson's chicken segment shines as a Star in its BCG matrix. It experienced robust growth in fiscal year 2024, with sales volume up. Operating margins also improved, boosted by strong consumer demand. Lower feed costs and operational efficiencies further fueled this success. For example, chicken sales were up by 3.5% in Q1 2024.

Tyson Foods' prepared foods segment includes high-margin products like Jimmy Dean Griddle Cakes and Hillshire snacking items, which are performing well. These products align with the increasing consumer preference for convenience. In 2024, Tyson's prepared foods segment saw a revenue of around $15.7 billion, demonstrating its importance. Tyson is expanding the distribution of these profitable products.

Tyson Foods is expanding its prepared foods offerings, including Honey Stung Chicken Chunks and Galileo Protein Snacks. This strategy aims to satisfy consumer demand for convenient and diverse protein options. In 2024, the prepared foods segment saw a rise in demand for convenient and flavorful options. This initiative aligns with the growing on-the-go consumption market, reflecting a shift towards innovative product lines.

International Expansion in Growth Markets

Tyson Foods strategically expands internationally, focusing on growth markets to meet rising protein demands. The company actively seeks to strengthen its global presence, although specific market entries for 2024-2025 are not always publicly disclosed. International expansion is a key driver for future growth, aligning with consumer trends. This approach aims to diversify revenue streams and reduce reliance on the US market.

- In 2023, Tyson's international sales were $6.4 billion, representing 17% of total sales.

- Tyson has a presence in over 140 countries.

- Emerging markets offer significant growth potential due to increasing middle-class populations and changing dietary habits.

- Tyson's focus is on markets in Asia and Latin America.

Investments in Sustainable Protein Technology

Tyson Foods' investments in sustainable protein technology are a "Star" in its BCG matrix. The company has shown revenue growth in its alternative protein segment. This segment is a smaller portion of the overall business. It's a high-growth market with potential for future market penetration.

- Tyson's alternative protein sales grew, reaching $234 million in fiscal year 2023.

- The global alternative protein market is projected to reach $125 billion by 2027.

- Tyson is investing in plant-based and cultivated meat.

- Consumer demand for alternative proteins is increasing.

Tyson Foods' Stars in its BCG Matrix include its robust chicken segment, which saw sales volume up 3.5% in Q1 2024, and its high-performing prepared foods, generating around $15.7 billion in 2024 revenue. International expansion is a key growth driver, with 2023 sales at $6.4 billion across over 140 countries. Additionally, sustainable protein technology, with sales reaching $234 million in fiscal year 2023, represents a high-growth future market for the company.

| Segment | Key 2024/Recent Data | BCG Status |

|---|---|---|

| Chicken | Sales volume up, Q1 2024 sales +3.5% | Star |

| Prepared Foods | 2024 revenue ~$15.7 billion | Star |

| International | 2023 sales $6.4 billion (17% of total) | Star |

| Sustainable Protein | FY 2023 sales $234 million | Star |

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, presenting Tyson Foods' portfolio in an easily digestible format.

Cash Cows

Within Tyson Foods' portfolio, core chicken products, such as those sold in grocery stores, operate as Cash Cows. These products hold a substantial market share in the mature, stable market for chicken. They generate consistent revenue and strong profit margins. In 2024, Tyson's chicken segment revenue was approximately $20 billion.

Tyson Foods' prepared foods, including Jimmy Dean and Hillshire Farm, are cash cows due to their strong market position. These brands generate steady cash flow, supported by consumer loyalty and broad distribution networks. In 2024, Tyson's prepared foods segment saw revenues of approximately $16 billion. They require less investment for sustained market presence.

The pork segment is a large part of Tyson Foods, bringing in substantial revenue. Despite market ups and downs, it's a key player. The segment acts as a Cash Cow due to its established market presence, generating a steady cash flow. In fiscal year 2024, the pork segment generated $6.2 billion in sales.

Beef Segment (despite challenges)

The beef segment remains a significant part of Tyson Foods, despite facing challenges. Although currently in operating losses, its large market share has historically made it a Cash Cow. The segment's substantial revenue generation is key. The business volume remains considerable.

- Beef segment contributed significantly to Tyson Foods' overall revenue in 2024, but faced operational losses.

- The beef segment has a large market share.

- The segment's revenue generation is substantial.

International Operations (Established Markets)

Tyson Foods' international operations in established markets function as cash cows, offering reliable revenue streams. These operations, though a smaller part of the whole, contribute to consistent cash flow due to steady demand. Tyson utilizes its global supply chain and experience to thrive in these markets. This stability helps bolster the overall business.

- International sales accounted for approximately 15% of Tyson Foods' total revenue in 2024.

- Established markets include regions in Asia and Europe with consistent protein consumption.

- Tyson's global supply chain efficiency reduces operational costs in these markets.

- These operations support investments in higher-growth areas of the business.

Tyson Foods' core chicken, prepared foods, and pork segments are Cash Cows, consistently generating substantial revenue and stable cash flow. These segments, with their strong market positions, provide crucial capital for the company. Established international operations also contribute reliable cash. While beef faced 2024 losses, its market share historically makes it a key cash generator.

| Segment | 2024 Revenue (Billion USD) | Status |

|---|---|---|

| Chicken | 20.0 | Cash Cow |

| Prepared Foods | 16.0 | Cash Cow |

| Pork | 6.2 | Cash Cow |

Delivered as Shown

Tyson Foods BCG Matrix

The preview shown is the complete Tyson Foods BCG Matrix you'll receive after purchase. This fully formatted report offers a clear, actionable analysis of Tyson's business units, ready for immediate integration.

Dogs

Products from closed Tyson plants likely fall into the Dogs quadrant of the BCG matrix. These products, with low market share and growth, were divested. Tyson closed six plants in 2023, including poultry plants, as part of its restructuring. The company's Q1 2024 results showed a net loss of $164 million.

Certain commodity beef products within Tyson Foods' portfolio face significant challenges. These products, impacted by supply constraints and negative margins, operate in a low-growth environment. In 2024, the beef segment saw a slight dip in sales volume. Market share for these specific products lags other beef offerings. For instance, in Q1 2024, beef segment operating margins were lower compared to previous periods.

Certain commodity pork products at Tyson Foods face margin pressure, akin to beef. These products, experiencing lower demand, might be classified as Dogs. While pork overall is a Cash Cow, specific offerings struggle. Tyson Foods' Q1 2024 report showed challenges in its pork segment.

Products in Declining or Stagnant Niches

Products in declining or stagnant niches for Tyson Foods, often categorized as "Dogs" in a BCG Matrix, are those in low-growth markets where Tyson has a small market share. These products typically drain resources, offering little return. Identifying these dogs requires a thorough internal market analysis, examining sales figures and profitability. For instance, in 2024, certain niche poultry products faced challenges.

- Low growth markets.

- Low market share.

- Resource drain.

- Internal market analysis.

Older, Undifferentiated Product Lines

Older, undifferentiated product lines within Tyson Foods' portfolio, particularly those in low-growth markets, often fit the "Dogs" category. These products lack recent innovation and market leadership. They typically contribute minimally to growth, potentially hindering overall profitability. Tyson's internal product analysis is crucial for identifying these specific "Dogs".

- Examples could include certain commodity meat products with limited brand differentiation.

- These products might face declining demand or intense price competition.

- 2024 data would show their financial performance.

- Tyson would assess whether to divest, reposition, or maintain them.

Tyson Foods' "Dogs" typically encompass products from divested operations like closed plants and certain commodity segments facing challenges. These offerings exhibit low market share within low-growth markets, often draining resources from the company. For example, Q1 2024 saw lower operating margins in specific beef segments. Undifferentiated product lines also fit this category, struggling with intense price competition.

| Category | Market Growth | Market Share |

|---|---|---|

| Divested Products | Low | Low |

| Commodity Beef (Specific) | Low | Low |

| Commodity Pork (Specific) | Low | Low |

Question Marks

Tyson Foods' recent launches, like State Fair Crispy Homestyle Beef Bites and Tyson Honey Stung Chicken Chunks, target the foodservice sector. This market is currently experiencing growth, fueled by recovery and demand for convenience. However, these new products have a low market share since they are newly introduced. In 2024, the foodservice industry is expected to grow, offering opportunity for Tyson.

Galileo Protein Snacks, a new ready-to-eat product from Tyson Foods, fits the Question Mark quadrant. The convenient protein snack market is expanding, indicated by a 7% growth in 2024. To become Stars, Galileo needs investments in marketing and distribution, with ad spending projected at $5 million in Q4 2024. Success hinges on gaining market share, aiming for a 2% share by the end of 2025.

Tyson's Honey Chicken Bites and Restaurant Style Crispy Wings are classified as question marks within the BCG matrix. These new retail products enter a growing frozen food market. The frozen food sector saw a 7.3% increase in sales in 2023. They face competition from established brands. Their success depends on gaining market share.

Tyson Mega Dino Nuggets

Tyson Mega Dino Nuggets, a playful product, is a Question Mark in the BCG Matrix. This means it's a new product in a growing market, but its market share is currently unknown. The success of this product is uncertain, requiring further investment and analysis. In 2024, Tyson Foods' net sales were approximately $52.8 billion.

- New product in a growing market.

- Market share is currently unknown.

- Requires further investment and analysis.

- Tyson Foods' net sales in 2024 were $52.8 billion.

Further Development in Alternative Proteins

Tyson Foods' alternative protein segment is categorized as a Question Mark in the BCG Matrix. While Tyson has invested in this area, substantial investment is needed for significant market share. The alternative protein market is experiencing high growth, but competition is fierce. Tyson's approach involves new product development and market penetration to capture more of this expanding market. In 2024, the global plant-based meat market was valued at approximately $6.1 billion.

- High Growth Potential: The alternative protein market is expanding.

- Investment Needs: Significant investment is required for market share.

- Competitive Landscape: The market is highly competitive.

- Market Value: In 2024, the global plant-based meat market reached $6.1 billion.

Tyson Foods' Question Marks, including new foodservice items and alternative protein products, operate in high-growth markets. These ventures currently hold low market shares, indicating their early development stages. They require substantial investment to determine their potential to become future Stars. The global plant-based meat market, for example, was valued at $6.1 billion in 2024.

| Product/Segment | Market Growth (2024) | Current Market Share |

|---|---|---|

| Foodservice Launches | Growing | Low |

| Galileo Protein Snacks | 7% | Low |

| Alternative Protein | High ($6.1B market) | Low |

BCG Matrix Data Sources

The Tyson Foods BCG Matrix leverages company financials, market reports, and expert analyses. Data from annual reports and industry forecasts are also integrated.