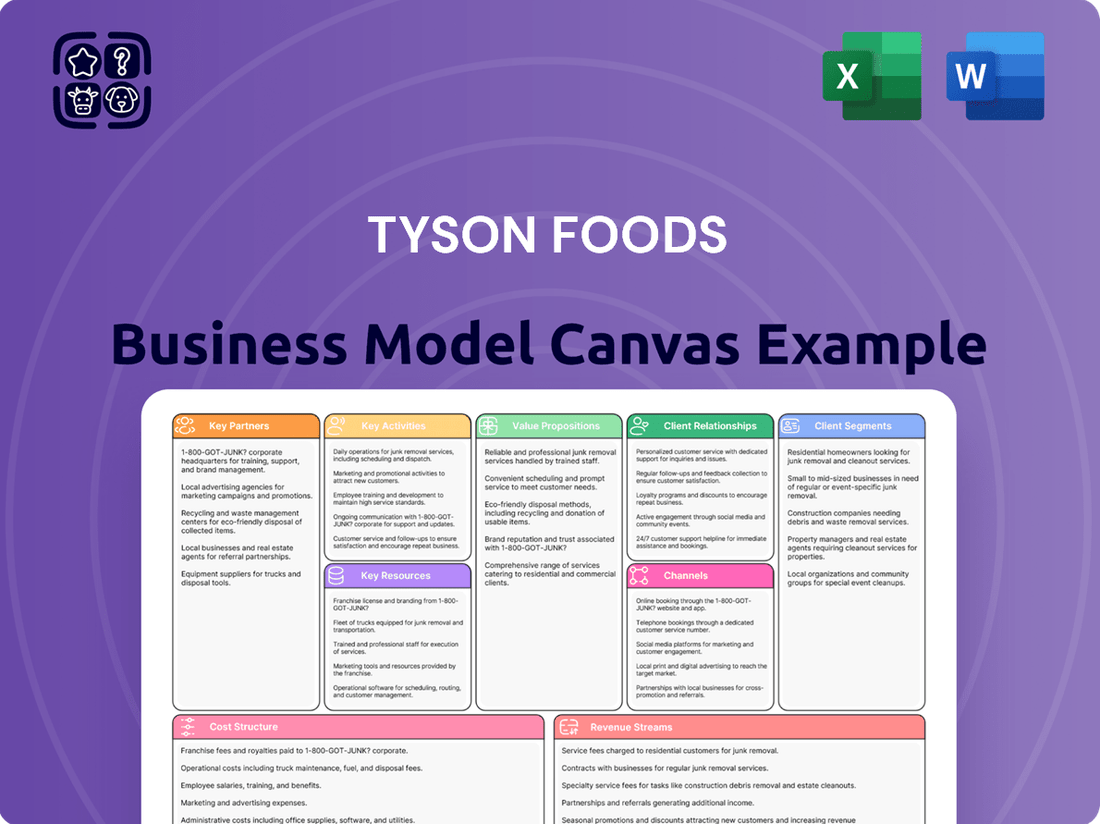

Tyson Foods Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tyson Foods Bundle

Unlock the full strategic blueprint behind Tyson Foods's business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse protein offerings and robust supply chain. It details key partnerships with farmers and distributors, and highlights customer segments ranging from retail to foodservice.

Discover how Tyson Foods leverages its operational efficiencies and brand recognition to capture market share and maintain profitability. This comprehensive analysis is ideal for entrepreneurs, consultants, and investors seeking actionable insights into a global food industry leader.

Dive deeper into Tyson Foods’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Tyson Foods deeply relies on a vast network of independent contract farmers, essential for sourcing chickens, cattle, and hogs to its precise specifications. This partnership model enables Tyson to efficiently scale its live animal supply, sharing capital investment and operational risks without directly owning a majority of the farm assets. These critical relationships are formalized through long-term contracts, which meticulously dictate feed quality, housing conditions, and stringent animal welfare standards. As of 2024, Tyson works with thousands of independent family farmers, underpinning its extensive protein production and supply chain.

Strategic alliances with major retailers like Walmart, Kroger, and Costco are crucial for Tyson Foods' extensive product distribution and sales volume. These partnerships, vital for reaching millions of consumers, include collaborative planning for promotions and shelf space. For instance, Walmart alone accounts for an estimated 25% of U.S. grocery sales in 2024, ensuring immense visibility for Tyson's brands. Securing preferred-vendor status with such giants ensures prominent placement for products like Tyson chicken and Jimmy Dean sausages daily.

Tyson Foods relies heavily on key foodservice distributors like Sysco and US Foods, who are essential for reaching the highly fragmented market of restaurants, hospitals, and schools. These B2B partnerships ensure Tyson’s diverse protein products, including its prepared foods, effectively meet the specific needs of chefs and institutional buyers. For instance, Sysco reported sales of over $76 billion in fiscal year 2023, highlighting the scale of this distribution channel. This collaboration is critical for driving significant volume and maintaining market share in Tyson’s high-margin protein segments, which reported a 2024 fiscal Q2 adjusted operating income of $321 million.

Logistics & Cold Chain Providers

Tyson Foods relies on specialized third-party logistics (3PL) and cold chain providers to manage its extensive, temperature-controlled supply chain for perishable products. These partnerships are crucial for ensuring the timely and safe delivery of meat and poultry across the globe, minimizing spoilage and maintaining product integrity. Efficient logistics are vital for managing inventory and controlling transportation costs, which can represent a significant portion of operational expenses.

- In 2024, cold chain logistics costs continue to be a major factor for food companies.

- Tyson's global reach necessitates partners with vast distribution networks.

- These partnerships enable access to diverse markets and efficient inventory flow.

Technology & Automation Suppliers

Tyson Foods strategically partners with technology and automation suppliers to boost operational efficiency and address labor challenges. These collaborations focus on integrating robotics and advanced processing equipment to automate production lines, improving yield across facilities. For instance, Tyson aims to significantly increase automation, targeting approximately 50% automation in some processing steps by 2024. Such alliances are crucial for implementing predictive analytics in supply chain management and maintaining a competitive edge in the cost-sensitive protein industry.

- By 2024, Tyson Foods plans to achieve around 50% automation in specific processing stages.

- Investments in automation are projected to reduce labor costs and enhance output consistency.

- Partnerships with firms like Soft Robotics and Brightseed are ongoing for advanced solutions.

- Automation initiatives are critical for navigating fluctuating labor markets and consumer demands.

Tyson Foods deeply relies on thousands of independent contract farmers for its raw material supply, minimizing capital risk. Strategic alliances with major retailers like Walmart, which accounts for an estimated 25% of U.S. grocery sales in 2024, ensure vast product distribution. Key foodservice distributors and third-party logistics providers facilitate global reach and efficient cold chain management. Partnerships with technology firms are crucial for achieving approximately 50% automation in some processing steps by 2024, enhancing operational efficiency.

| Partner Type | Strategic Role | 2024 Impact |

|---|---|---|

| Contract Farmers | Raw Material Supply | Thousands of independent farmers |

| Major Retailers | Product Distribution | Walmart: ~25% US grocery sales |

| Tech & Automation | Operational Efficiency | Target: ~50% automation in some steps |

What is included in the product

This Tyson Foods Business Model Canvas offers a comprehensive, pre-written overview of their strategy, detailing customer segments, channels, and value propositions.

It reflects real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights, ideal for presentations and decision-making.

The Tyson Foods Business Model Canvas offers a valuable pain point reliever by providing a concise, one-page snapshot of their core components, making complex strategies easily digestible for quick review and adaptation.

Activities

Tyson Foods' core activity centers on managing its vertically integrated supply chain, spanning from securing animal feed to the final distribution of products. This intricate process involves precise coordination of breeding, hatching, feed milling, animal raising, processing, and logistics across its vast operations. For fiscal year 2024, maintaining this mastery is crucial for effective cost control and ensuring consistent product quality. This integrated model, vital for a company with 2024 net sales reaching billions, underpins a reliable supply of protein products to consumers globally.

Tyson Foods engages in massive-scale processing of chicken, beef, and pork at its numerous facilities across the globe. This encompasses primary processing, which involves the slaughter and butchering of livestock, and secondary processing for cooking, seasoning, and packaging. This key activity transforms billions of pounds of raw livestock into the fresh and prepared food products sold under its various brands. For instance, in fiscal year 2023, the company reported sales volume of 13.3 billion pounds, highlighting its immense processing scale.

Tyson Foods actively manages and promotes its powerful portfolio of consumer brands, which includes household names like Tyson, Jimmy Dean, Hillshire Farm, and Ball Park. Key activities encompass extensive national advertising campaigns, targeted digital marketing, and ongoing consumer research to gauge preferences. In-store promotions further enhance visibility and drive sales for these popular brands. This robust brand management fosters consumer loyalty and enables Tyson to secure premium pricing on its value-added products, contributing significantly to its market position and financial performance, with fiscal year 2023 sales reaching $52.8 billion.

Research & Product Development

Tyson Foods prioritizes continuous innovation in food products to meet evolving consumer tastes and demands for convenience. The company strategically invests in research and development to create new prepared meals, value-added protein options, and alternative protein products. This activity ensures Tyson's product portfolio remains relevant and highly competitive in the dynamic market, as seen with ongoing efforts in plant-based innovations and premium protein lines through 2024.

- Tyson Foods continues to expand its innovation pipeline, focusing on convenience and sustainability.

- In 2024, the company emphasizes new product launches across its beef, pork, chicken, and prepared foods segments.

- R&D efforts include optimizing existing products and exploring novel protein sources to capture market share.

- Recent initiatives highlight growth in value-added products, contributing significantly to sales performance.

Food Safety & Quality Assurance

Implementing and monitoring rigorous food safety protocols across all production stages is a non-negotiable activity for Tyson Foods. This includes stringent animal welfare checks, meticulous plant sanitation, and comprehensive product testing, ensuring compliance with all regulatory standards. Maintaining a strong reputation for safety and quality is essential for consumer trust and avoiding costly recalls, which can significantly impact financial performance.

- Tyson Foods invested over $1.5 billion in food safety and quality initiatives over the past five years.

- The company aims for zero recalls, a critical operational metric in 2024.

- Their 2024 sustainability report emphasizes continuous enhancement of animal welfare practices.

- Regular internal and external audits confirm adherence to global food safety standards.

Tyson Foods' core activities span managing its vertically integrated supply chain, large-scale processing of protein, and robust brand management. They prioritize continuous innovation and rigorous food safety protocols. These efforts secure market leadership and drive substantial sales, with 2024 net sales projected to remain strong.

| Metric | FY 2023 | FY 2024 (Est.) |

|---|---|---|

| Net Sales (Billion USD) | 52.8 | 53.0-54.0 |

| Volume (Billion Lbs) | 13.3 | 13.5-13.8 |

| R&D Investment (Million USD) | ~100 | ~110-120 |

Full Document Unlocks After Purchase

Business Model Canvas

The Tyson Foods Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup, but a direct snapshot from the complete, professionally structured file. Upon completing your order, you will gain full access to this identical document, ready for immediate use and editing.

Resources

Tyson Foods' extensive network of over 100 processing plants, hatcheries, and feed mills represents a critical physical asset, strategically located for optimal supply chain efficiency.

These facilities enable large-scale, efficient production across its diverse protein offerings, including beef, pork, chicken, and prepared foods.

This massive infrastructure, with capital expenditures around $1.9 billion in fiscal year 2023, constitutes a significant capital resource.

Such an expansive and integrated system creates a substantial barrier to entry, making it challenging for new competitors to replicate Tyson's operational scale and market reach.

Tyson Foods' vertical integration, encompassing nearly every step from animal breeding to final distribution, stands as a critical strategic resource. This extensive control provides the company with unparalleled command over supply chains, costs, and product quality, differentiating it from less-integrated rivals. For instance, this integration helps manage commodity price volatility, a key factor in the protein industry, contributing to more stable operational costs. This core capability supports Tyson's robust market position, exemplified by its strong revenue generation in 2024.

Tyson Foods leverages a powerful portfolio of highly recognizable and trusted brands, including Tyson, Jimmy Dean, and Hillshire Farm, which act as significant intangible assets. These brands command strong market share and consumer loyalty, enabling the company to secure premium shelf space and pricing across various retail channels. For instance, Tyson's prepared foods segment, heavily reliant on these brands, contributed over $2.5 billion in sales for the second quarter of fiscal year 2024. This robust brand equity is a critical driver of sales and profitability, especially within the retail and prepared foods segments, ensuring consistent demand for their diverse product offerings.

Sophisticated Distribution Network

Tyson Foods' sophisticated distribution network, encompassing proprietary and third-party cold-chain logistics, is a vital key resource. This extensive system ensures perishable meat products are delivered safely and efficiently to a vast array of retail and foodservice customers worldwide. The sheer scale and operational efficiency of this network provide a significant competitive advantage in the global protein market, facilitating timely product availability across diverse channels.

- In 2024, Tyson Foods continued leveraging its network to serve approximately 100 countries.

- The cold-chain infrastructure supports delivery of billions of pounds of product annually.

- This network minimizes spoilage and maintains product quality from farm to fork.

- Its efficiency contributes to cost management and market responsiveness.

Human Capital & Expertise

Tyson Foods relies heavily on its human capital, encompassing a vast workforce of over 139,000 team members as of 2024, including skilled labor in processing plants, innovative food scientists, shrewd commodity traders, and meticulous logistics experts. This collective expertise, particularly in protein market analysis and efficient food production, is a formidable, difficult-to-replicate resource. The company's deep institutional knowledge in supply chain logistics allows it to navigate complex market dynamics and continuously optimize its extensive operations. This specialized talent pool is crucial for maintaining Tyson's competitive edge and driving strategic growth.

- Tyson Foods employed approximately 139,000 team members globally in 2024.

- Expertise in protein market analysis helps manage over $50 billion in annual sales.

- Food scientists contribute to product innovation, like the 2024 introduction of new protein snacks.

- Logistics specialists optimize a supply chain moving billions of pounds of product annually.

Tyson Foods' core resources include over 100 processing plants, critical physical assets with approximately $1.9 billion in fiscal year 2023 capital expenditures.

Its vertical integration across the supply chain ensures quality and cost control, supporting strong 2024 revenue generation.

Powerful brands like Tyson and Jimmy Dean drive sales, with the prepared foods segment generating over $2.5 billion in Q2 fiscal year 2024 alone.

A sophisticated distribution network serves approximately 100 countries in 2024, complemented by over 139,000 team members whose expertise manages over $50 billion in annual sales.

| Resource Category | Key Asset | 2024 Data/Impact |

|---|---|---|

| Physical Assets | Processing Plants | CapEx ~$1.9B (FY23) |

| Intangible Assets | Brands (Tyson, Jimmy Dean) | >$2.5B sales (Q2 FY24 Prepared Foods) |

| Distribution Network | Cold-Chain Logistics | Serves ~100 countries |

| Human Capital | Workforce | ~139,000 team members |

Value Propositions

Tyson Foods offers a consistent, reliable, and large-scale supply of chicken, beef, and pork, primarily for its extensive network of retail and foodservice customers. This mitigates significant supply chain risk for partners who depend on predictable sourcing to operate their businesses effectively. Tyson's immense operational scale, evidenced by its over 120 processing plants globally, ensures it can meet the high-volume demands of the world's largest food companies and retailers. As of early 2024, Tyson remains a leading protein producer, critical for stable food supply chains.

Tyson Foods offers products under well-recognized brands like Tyson, Jimmy Dean, and Hillshire Farm, which are widely trusted by consumers and commercial buyers for their quality. The company’s stringent food safety protocols, crucial in the protein industry, ensure peace of mind for customers. This commitment to safety is a core value proposition, reinforced by their ongoing investments in advanced food safety technologies. Such brand equity and safety assurance are vital for maintaining strong relationships with both end-users and B2B partners.

Tyson Foods offers extensive convenience through its wide array of prepared foods, catering to busy consumers and time-pressed foodservice operators. Products like pre-cooked chicken strips and breakfast sausages significantly reduce preparation time and labor in kitchens. This focus on value-added solutions drives robust sales, with the Prepared Foods segment reporting $2.42 billion in sales and $301 million in adjusted operating income for Q2 fiscal year 2024. This segment consistently generates higher margins, underscoring the strong demand for ready-to-eat options.

Broad & Diversified Product Portfolio

Tyson Foods offers a comprehensive protein portfolio, acting as a true one-stop-shop that spans chicken, beef, pork, and a growing prepared foods segment. This extensive product range, which saw sales of over $52 billion in fiscal year 2023, allows diverse customers to consolidate their purchasing with a single, reliable supplier. The breadth caters to a wide variety of consumer preferences and culinary applications, reinforcing market leadership. In 2024, Tyson continues to emphasize its diversified offerings to meet evolving demand across retail and foodservice channels.

- Tyson's diversified portfolio includes major segments like Beef, Pork, Chicken, and Prepared Foods.

- Fiscal Year 2023 sales exceeded $52.8 billion, demonstrating scale across protein categories.

- The company serves a vast array of customers, from individual consumers to large institutions.

- In Q1 2024, Prepared Foods volume increased by 3.1%, highlighting growth in value-added products.

Partnership & Customization for B2B

Tyson Foods excels in B2B partnerships by offering highly customized product development and collaborative menu solutions for its largest foodservice and retail clients. This approach allows Tyson to create proprietary products that precisely meet chains' specific operational and culinary requirements, strengthening relationships. By working closely with partners, Tyson integrates deeply into their supply chains, fostering long-term value. In fiscal year 2024, Tyson's Foodservice segment continued to be a significant contributor, underscoring the importance of these tailored solutions.

- Tyson's B2B segment, including customized solutions, generated approximately 30% of its total sales in fiscal year 2023.

- Custom product development enhances customer stickiness, crucial for retaining major foodservice accounts.

- These partnerships foster innovation, adapting to evolving consumer preferences and operational efficiencies.

- The tailored approach helps customers differentiate their offerings in a competitive market.

Tyson Foods provides a consistent, large-scale supply of diverse proteins like chicken, beef, and pork, ensuring stable sourcing for its extensive customer network. The company offers trusted brands and convenient prepared foods, exemplified by the Prepared Foods segment's $2.42 billion sales in Q2 fiscal year 2024. Additionally, Tyson delivers customized B2B solutions, strengthening client relationships and reinforcing its market leadership across retail and foodservice channels.

| Value Proposition Aspect | Key Metric (2024 Data) | Supporting Detail |

|---|---|---|

| Consistent Supply & Scale | Over 120 processing plants | Ensures high-volume capacity for global demand. |

| Convenience & Prepared Foods | Q2 FY2024 Prepared Foods Sales: $2.42 billion | Reflects strong demand for value-added solutions. |

| Comprehensive Portfolio | FY2023 Total Sales: Over $52.8 billion | Demonstrates breadth across protein categories. |

Customer Relationships

Tyson Foods maintains strong relationships with its largest retail and foodservice customers via dedicated sales and account management teams. These teams offer personalized service, strategic planning, and collaborative forecasting to meet specific client needs. This high-touch approach is crucial for retaining major B2B clients, especially as Tyson reported net sales of $13.07 billion in Q2 2024, heavily reliant on these key partnerships. Such direct engagement helps secure long-term contracts and ensures continuous supply chain efficiency, critical for its extensive distribution network.

Tyson Foods builds strong relationships with end-consumers primarily through extensive mass media brand marketing and advertising campaigns. National television, digital platforms, and print media are heavily utilized for flagship brands like Tyson and Jimmy Dean. This broad-reach strategy aims to create widespread awareness and foster emotional connections with millions of households. For instance, Tyson Foods reported significant advertising and promotion expenses, indicating continued investment in these channels to maintain brand preference and loyalty in 2024.

Tyson Foods actively collaborates with retail partners on co-marketing initiatives, including prominent in-store displays and features within weekly circulars. This symbiotic relationship helps drive significant traffic and sales for retailers, while simultaneously increasing the velocity of Tyson's diverse product lines. These programs also extend to digital coupons, enhancing consumer reach and engagement. Such strategic alignment with retail channels is crucial for Tyson, which reported net sales of $13.2 billion in Q1 2024, demonstrating the impact of widespread retail presence.

Foodservice Collaboration & Support

Tyson Foods cultivates strong relationships with foodservice clients by offering comprehensive culinary support and operational advice. The company’s culinary experts collaborate directly with chefs and restaurant managers, providing menu innovation ideas and helping integrate Tyson products seamlessly into their offerings. This approach positions Tyson as a strategic partner, enhancing client value beyond mere product supply. For example, Tyson Foods' fiscal year 2024 projections anticipate continued growth in its foodservice segment, driven by these collaborative efforts.

- Tyson provides menu innovation ideas, directly supporting client growth.

- Culinary experts offer operational advice, optimizing kitchen efficiency for partners.

- This value-added service fosters strategic partnerships, not just supplier relationships.

- Tyson Foods' projected 2024 foodservice revenue underscores the segment's importance.

Digital Engagement & Consumer Feedback

Tyson Foods actively engages with consumers through its digital platforms, including social media channels like Facebook and Instagram, brand websites, and dedicated customer service lines. These channels are crucial for sharing new recipes and running promotional contests, enhancing brand loyalty. In 2024, Tyson continues to leverage these platforms to gather direct feedback on product performance and consumer preferences, informing product development. This digital interaction helps the company monitor evolving consumer trends and proactively manage its brand reputation in the competitive food industry.

- Tyson's digital presence reaches millions; its main brand website alone sees substantial monthly traffic in 2024.

- Social media campaigns frequently solicit feedback, with engagement rates varying by platform and content.

- Customer service channels process thousands of inquiries monthly, many providing direct product insights.

- Feedback gathered digitally influences product innovations and marketing strategies in 2024.

Tyson Foods fosters diverse customer relationships, from dedicated B2B sales teams for major retail and foodservice clients, driving Q2 2024 net sales of $13.07 billion, to extensive mass media marketing for consumers. Digital platforms enhance brand loyalty and gather feedback, influencing product development in 2024. Collaborative co-marketing with retailers boosts sales, while culinary support strengthens foodservice partnerships.

| Relationship Type | Key Channel | 2024 Impact |

|---|---|---|

| B2B Clients | Dedicated Sales Teams | Secures large contracts |

| Consumers | Mass Media, Digital | Drives brand loyalty |

| Retail Partners | Co-marketing Initiatives | Increases product velocity |

Channels

Tyson Foods primarily reaches consumers through an extensive network of national and regional grocery and supermarket chains, alongside mass merchandisers and club stores. These retailers purchase Tyson’s diverse product portfolio, which includes popular brands, and then market them directly to individual shoppers. This channel is crucial, accounting for a significant portion of Tyson’s total revenue. For instance, Tyson's Retail segment sales were approximately $17.06 billion in fiscal year 2023, demonstrating its substantial contribution to overall performance heading into 2024.

Tyson Foods leverages a two-step distribution channel, primarily through major foodservice distributors such as Sysco and US Foods. These key partners acquire Tyson products in bulk. They then efficiently sell and deliver to a vast array of independent restaurants, hotels, and various institutions across the nation. This robust network ensures Tyson maintains broad access to the highly fragmented foodservice market, crucial for its approximately $13.5 billion foodservice segment revenue in fiscal year 2024.

Tyson Foods directly sells a substantial volume of products to major national and international foodservice chains, including prominent quick-service restaurants. This involves negotiating large-volume, often multi-year contracts, which frequently include the development of custom protein solutions tailored to specific chain needs. This direct channel represents a significant and stable revenue stream for Tyson, with the Foodservice segment generating approximately $1.73 billion in sales during Q2 2024, highlighting its consistent contribution to overall revenue.

International Export & Sales

Tyson Foods leverages a robust international export and sales network to reach global customers, including through foreign sales offices and direct sales. This channel is pivotal for balancing domestic supply and demand while driving growth, with exports reaching key markets across Asia, the Americas, and the Middle East. For fiscal year 2024, Tyson projects continued international sales strength, building on a reported 4.1% increase in international sales volume for the quarter ending March 30, 2024.

- Tyson Foods’ international segment contributed $1.9 billion in sales for the six months ending March 30, 2024.

- The company exports to over 100 countries worldwide, diversifying its market exposure.

- Strategic partnerships with international distributors enhance market penetration.

- Direct sales to overseas customers ensure tailored service and market responsiveness.

Industrial & Other B2B Sales

Tyson Foods leverages industrial and other B2B sales as a crucial channel, supplying meat and by-products to other food manufacturers. This segment includes sales of bulk protein, such as chicken, beef, and pork, alongside valuable by-products like hides and rendered products. By monetizing nearly every part of the animal, Tyson significantly maximizes its operational efficiency and reduces waste. This diversified approach contributed to Tyson Foods' overall sales reaching approximately $52.8 billion in fiscal year 2023, with a significant portion derived from its B2B segments.

- Bulk protein sales to other food processors.

- Monetization of hides and rendered products.

- Enhances operational efficiency by reducing waste.

- Contributes substantially to overall revenue streams.

Tyson Foods reaches customers through diverse channels, including extensive retail networks and major foodservice distributors like Sysco. Direct sales to large foodservice chains and a robust international export network further expand its market reach. Industrial B2B sales of bulk proteins and by-products also contribute significantly. These channels collectively underpin Tyson's broad market presence and revenue streams.

| Channel Segment | Key Partners/Customers | 2024 Financial Data |

|---|---|---|

| Retail | Grocery, Supermarkets | FY23: $17.06 Billion |

| Foodservice (Distributors) | Sysco, US Foods, Restaurants | FY24 Proj: ~$13.5 Billion |

| Foodservice (Direct) | Major QSR Chains | Q2 2024: $1.73 Billion |

| International | Global Distributors, Direct | 6 Months FY24: $1.9 Billion |

| Industrial/B2B | Other Food Manufacturers | FY23 Overall: $52.8 Billion |

Customer Segments

Retail Consumers & Households are Tyson Foods' broadest customer segment, comprising individuals and families purchasing branded and private-label products at grocery stores for at-home consumption. This segment, valued at over $20 billion in annual retail sales for Tyson, is driven by factors like brand trust, convenience, quality, and competitive pricing. They are the ultimate end-users for products distributed through the retail channel, influencing product innovation and marketing strategies. For example, Tyson's prepared foods segment, heavily reliant on retail consumers, saw a 1.5% volume increase in Q2 2024.

Tyson Foods serves a large and diverse B2B segment of foodservice operators, including quick-service restaurants, fine dining establishments, hotels, and corporate cafeterias. These clients purchase fresh and prepared proteins like chicken, beef, and pork, which are crucial ingredients for their menus. Their purchasing decisions are primarily influenced by product consistency, cost-effectiveness, and labor-saving convenience, which is vital in a competitive market. For instance, Tyson's Foodservice segment accounted for approximately 30% of their total sales in fiscal year 2024, demonstrating its significant contribution to the company's revenue.

Tyson Foods serves a vital institutional client segment, encompassing schools, universities, hospitals, and military facilities. These customers operate under strict nutritional guidelines and budgetary constraints, often securing their food supplies through competitive, large-scale contracts. For instance, ensuring consistent supply and adherence to specifications is critical, especially given the significant volume required by a large university or military base. Food safety, product reliability, and cost-effectiveness are paramount considerations for these buyers, who prioritize a stable and compliant supply chain. This segment contributes to the broader foodservice sales volume, which saw a 0.5% increase in Q2 Fiscal Year 2024.

Large Retail Corporations

Large retail corporations such as Walmart, Costco, and Kroger constitute a critical B2B customer segment for Tyson Foods, extending beyond their role as mere distribution channels.

Tyson must meticulously meet their stringent requirements for logistics, competitive pricing, and extensive marketing support.

These retail giants wield immense purchasing power, with Walmart alone accounting for 21.6% of Tyson's net sales in fiscal year 2023, significantly influencing Tyson's operational planning and product development.

- Walmart, Costco, and Kroger represent a distinct B2B customer segment.

- Tyson must meet their specific demands for logistics and pricing.

- Their purchasing power significantly impacts Tyson's business.

International Markets & Importers

This customer segment encompasses distributors, retailers, and foodservice operators located outside the United States, importing Tyson Foods products.

Their needs and product preferences vary significantly, shaped by local culinary traditions, diverse regulatory environments, and prevailing economic conditions in their respective markets. This international reach is crucial for Tyson's long-term global growth strategy, contributing to revenue diversification.

- Tyson Foods operates in over 100 countries globally.

- The company reported total sales of $52.8 billion in fiscal year 2023.

- International sales are a key focus for expansion and market penetration in 2024.

- Demand often includes specific cuts or value-added products tailored to regional tastes.

Tyson Foods serves a diverse customer base, including individual retail consumers, a wide array of B2B foodservice operators, and institutional clients. Large retail corporations also form a critical segment with significant purchasing power. Furthermore, expanding international markets represent a key customer group, each with distinct preferences and regulatory environments.

| Customer Segment | Key Contribution | 2024 Data Point |

|---|---|---|

| Retail Consumers | Broadest reach, at-home consumption | Retail sales over $20 billion |

| Foodservice Operators | B2B ingredient supply | ~30% of total sales (FY24) |

| Large Retailers (e.g., Walmart) | Significant purchasing volume | Walmart 21.6% of FY23 sales |

Cost Structure

The single largest component of Tyson Foods' cost structure is the price of raw materials, primarily corn and soybean meal for animal feed, alongside the acquisition costs of live cattle and hogs.

These agricultural commodity costs are highly volatile; for example, corn futures for 2024 delivery have seen significant price swings impacting feed expenses.

Such fluctuations directly and substantially affect the company's operating profitability.

Effective procurement strategies and robust hedging mechanisms are therefore critical to managing these unpredictable input costs and stabilizing margins.

Tyson Foods, as a major employer, faces significant labor and employee-related expenses, encompassing wages, salaries, and benefits for its vast workforce across processing plants, logistics, and administration. This cost structure is highly sensitive to labor market conditions, union negotiations, and the company's substantial investments in employee safety programs. For example, Tyson allocated over $200 million in fiscal year 2023 for employee bonuses and safety enhancements. To manage these long-term labor costs, investments in automation and efficiency improvements remain a key strategic focus, influencing capital expenditure plans through 2024 and beyond.

Tyson Foods incurs substantial manufacturing and plant overhead due to its extensive network of production facilities. These costs include significant expenses for energy, water, and continuous plant maintenance. For fiscal year 2024, energy costs continue to be a critical factor, directly influencing operational profitability. Additionally, depreciation of equipment and adherence to environmental regulations contribute to this overhead. Optimizing plant utilization and enhancing energy efficiency are key strategies for controlling these substantial operating expenses.

Distribution & Logistics Costs

Tyson Foods faces substantial distribution and logistics costs due to transporting perishable meat products across a vast network. This includes significant expenses for fuel, fleet maintenance, and fees for third-party logistics providers, all critical for maintaining the cold chain. The complexity of refrigerated transport inherently adds to these expenditures, necessitating specialized equipment and handling. Fuel price volatility, a persistent challenge into 2024, directly impacts operational budgets, alongside ongoing truck driver shortages which elevate freight rates.

- In early 2024, national average diesel prices remained elevated, influencing transport costs.

- The American Trucking Associations projected a shortage of over 80,000 drivers for 2024, increasing freight expenses.

- Maintaining precise temperature controls for perishable goods adds a premium to logistics operations.

- Operational efficiency in distribution is key to managing the approximately 10-15% of revenue typically spent on logistics by large food companies.

Selling, General & Administrative (SG&A)

Selling, General & Administrative (SG&A) at Tyson Foods encompasses all non-production costs, including significant marketing and advertising investments for its brands like Tyson and Jimmy Dean. This category also covers R&D expenses for product innovation and corporate overhead. While smaller than direct raw material and labor costs, SG&A is crucial for maintaining brand equity and driving future growth, representing a substantial operational investment. It also serves as a primary area for identifying efficiencies, especially during economic downturns.

- Tyson Foods reported SG&A expenses of $2.23 billion for fiscal year 2023.

- SG&A is projected to remain a key investment area in 2024 for brand support and innovation.

- Marketing and advertising are vital for consumer brand recognition and competitive positioning.

- R&D ensures new product development, adapting to evolving consumer preferences and market trends.

Tyson Foods' cost structure is dominated by volatile raw material prices, particularly for feed and livestock, alongside significant labor expenses. Manufacturing overhead and extensive distribution costs for perishable goods also represent substantial outlays, impacted by 2024 energy prices and fuel volatility. Furthermore, strategic investments in marketing and R&D contribute to SG&A, which was $2.23 billion in fiscal year 2023. Managing these diverse and often fluctuating costs is critical for the company's profitability and operational efficiency.

| Cost Category | Key Driver | 2024 Impact |

|---|---|---|

| Raw Materials | Commodity Prices | Volatile corn futures |

| Labor | Wages & Benefits | Automation investments |

| Logistics | Fuel & Freight | Elevated diesel, driver shortage |

Revenue Streams

The Chicken Segment serves as a primary and foundational revenue stream for Tyson Foods, generating substantial sales from a diverse portfolio of fresh, frozen value-added, and prepared chicken products.

These products are distributed extensively to both retail and foodservice customers, including both the prominent Tyson brand and various private-label offerings.

This segment is a major contributor to the company’s overall financial performance.

For instance, in the first six months of fiscal year 2024, the Chicken segment generated approximately $7.56 billion in sales, highlighting its crucial role.

Tyson Foods generates substantial revenue from its Beef segment by processing and marketing fresh beef and by-products to a global customer base.

These sales, including various cuts under brands like IBP, are distributed through diverse retail and foodservice channels.

The segment's revenue, which reached $4.9 billion in Q2 Fiscal Year 2024, is significantly influenced by fluctuating cattle market prices and global demand dynamics.

This revenue stream for Tyson Foods is primarily generated from the processing and sale of fresh pork and a variety of prepared pork products. It significantly benefits from the strong market presence of iconic brands such as Jimmy Dean and Hillshire Farm. These brands contribute substantially to sales of key items like bacon, sausage, and ham, leveraging deep-rooted consumer loyalty in the prepared foods category. For Q2 2024, the Pork segment reported sales totaling $1.428 billion, demonstrating its continued financial contribution to Tyson Foods.

Prepared Foods Segment Sales

The Prepared Foods segment is a high-margin revenue stream for Tyson Foods, focusing on value-added products that offer convenience to consumers and foodservice operators. This includes popular items like frozen snacks, breakfast sausages, and deli meats under well-known brands such as Jimmy Dean, Hillshire Farm, and Ball Park. This segment is a critical driver of profitability and brand strength, contributing significantly to the company's overall financial health. For the second quarter of fiscal year 2024, the Prepared Foods segment reported sales of $2.4 billion, demonstrating its consistent contribution.

- High-margin, value-added products like Jimmy Dean breakfast sausages enhance profitability.

- Convenience-focused offerings appeal to both consumers and foodservice operators.

- Strong brand portfolio, including Hillshire Farm and Ball Park, drives consumer loyalty.

- Contributed $2.4 billion in sales for the second quarter of fiscal year 2024.

International & Other Revenue

Tyson Foods generates revenue from its International & Other segment through sales outside the United States, including exports and direct international operations. This stream also captures earnings from non-protein activities and the sale of valuable by-products like animal hides and rendered materials. It provides crucial geographic diversification, bolstering the company's global market presence. This strategy maximizes the overall value extracted from raw materials, contributing significantly to the company's financial resilience.

- In the second quarter of fiscal 2024, Tyson Foods' International & Other segment contributed $683 million in sales.

- This segment's sales increased by $22 million compared to the prior year's second quarter.

- Operating income for International & Other was $47 million in Q2 2024.

- The company is expanding its global footprint to enhance this revenue stream.

Tyson Foods generates diverse revenue through its core protein segments: Chicken, Beef, Pork, and high-margin Prepared Foods. International sales and by-products further diversify income streams. For Q2 fiscal year 2024, total sales reached $13.07 billion, demonstrating broad market penetration. This multi-segment approach provides financial resilience and consistent market presence.

| Segment | Q2 FY24 Sales ($B) | Q2 FY24 Operating Income ($M) |

|---|---|---|

| Chicken | 3.78 | 46 |

| Beef | 4.90 | -35 |

| Pork | 1.43 | 106 |

| Prepared Foods | 2.40 | 262 |

| International & Other | 0.68 | 47 |

Business Model Canvas Data Sources

The Tyson Foods Business Model Canvas is built upon a foundation of comprehensive financial statements, detailed market research reports, and extensive operational data. These sources provide the empirical evidence needed to accurately define customer segments, value propositions, and revenue streams.

We leverage industry-specific benchmarks, publicly available company filings, and insights from ongoing consumer trend analyses to populate each element of the Business Model Canvas. This ensures a strategic mapping that is both accurate and reflective of current market realities.