Tyson Foods Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tyson Foods Bundle

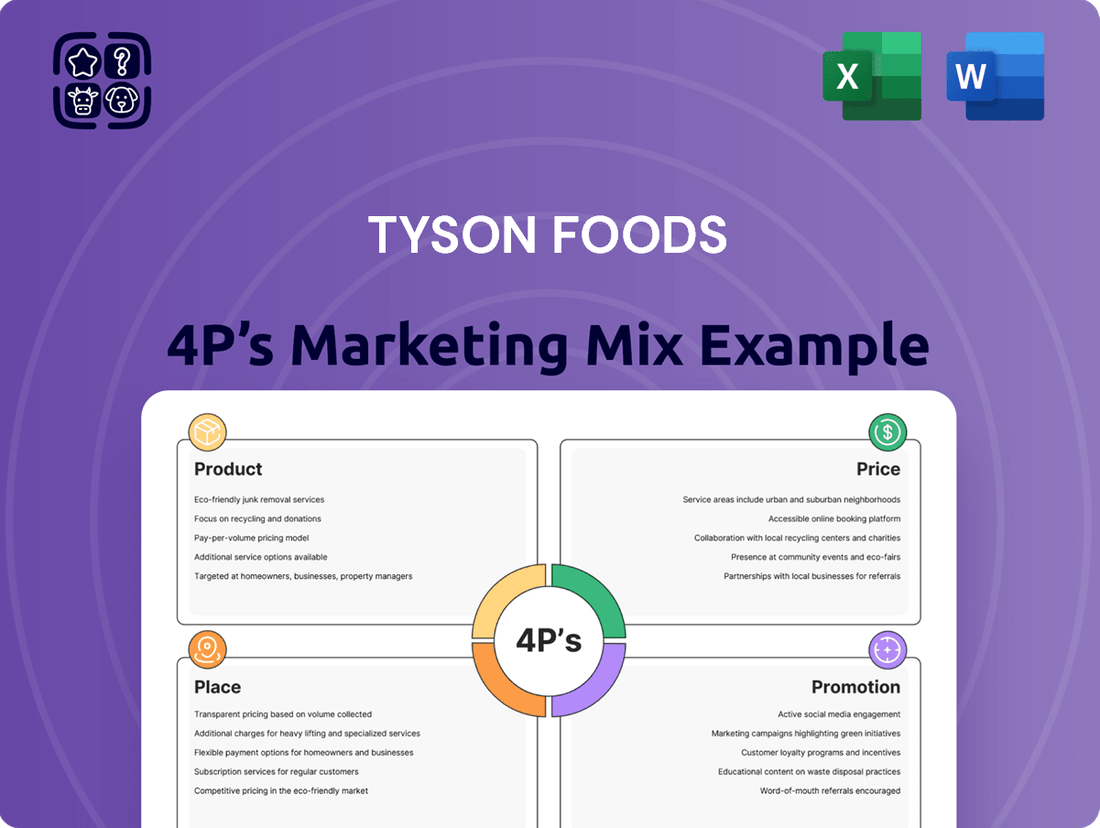

Tyson Foods expertly navigates the competitive food industry by strategically leveraging its 4Ps. Their product portfolio, ranging from value-driven staples to premium offerings, caters to a diverse consumer base.

The company's pricing strategy balances affordability with perceived quality, ensuring broad market appeal. Tyson's extensive distribution network ensures their products are readily available across various retail channels.

Their promotional efforts effectively build brand awareness and drive consumer demand. Want to understand the intricate details of how Tyson Foods masterfully integrates these elements for market dominance?

Unlock the full picture and gain actionable insights into their winning marketing formula. Get the complete 4Ps Marketing Mix Analysis for Tyson Foods, ready for your strategic use.

Product

Tyson Foods' product strategy centers on a diversified protein portfolio, making it one of the world's largest processors of chicken, beef, and pork. This multi-protein approach effectively caters to a wide range of consumer preferences and helps mitigate risks from commodity price fluctuations in any single protein category. The company maintains significant U.S. market shares, including approximately 21% in chicken, 23% in beef, and 17% in pork, based on 2024 market analysis. This broad offering ensures robust market presence and resilience across the protein sector.

Tyson Foods emphasizes higher-margin, value-added products through its robust portfolio, featuring iconic brands such as Tyson, Jimmy Dean, Hillshire Farm, and Ball Park. This segment, encompassing ready-to-eat meals, frozen foods, and breakfast items, generated approximately $30.6 billion in sales during fiscal 2023. It stands as a key driver of profitability and a core component of the company's financial performance. The strategy involves a deliberate shift in product mix towards these branded offerings to enhance returns and strengthen consumer loyalty. This focus aims to maximize value and secure market position through 2024 and 2025.

Tyson Foods actively drives innovation, consistently developing new products, flavors, and convenient meal solutions to maintain its competitive edge. This includes expanding its popular portfolio of seasoned and marinated items, alongside quick meal kits, addressing the robust consumer demand for flavorful, easy-to-prepare protein options. Through Tyson Ventures, its venture capital arm, the company strategically invests in emerging food technologies and innovative startups, such as its 2024 focus on sustainable protein alternatives and AI-driven supply chain efficiencies. This forward-looking approach supports future growth and market leadership in the evolving food industry.

Expansion into Alternative Proteins

Tyson Foods has strategically expanded its product portfolio into alternative proteins, recognizing evolving consumer preferences. The company launched its own plant-based brand, Raised & Rooted, offering products like plant-based burgers and sausages. This move positions Tyson to capitalize on the rapidly growing alternative protein market, projected to reach over $160 billion globally by 2025, diversifying its core meat business and enhancing long-term portfolio resilience. Tyson's strategic investments in this sector, including its venture capital arm, underscore a commitment to innovation beyond traditional protein.

- Raised & Rooted offers plant-based nuggets, burgers, and ground products.

- The global plant-based food market is anticipated to exceed $74 billion by 2027.

- Tyson's growth in alternative proteins addresses increasing consumer demand for sustainable options.

- This diversification strengthens Tyson's market position against dietary shifts.

Commitment to Food Safety and Quality

Tyson Foods' product strategy is deeply rooted in its unwavering commitment to food safety and quality. As a highly vertically integrated company, Tyson directly manages a significant portion of its supply chain, from feed production for livestock to processing facilities and final distribution networks. This control enables stringent quality assurance protocols across its operations, crucial for maintaining consumer confidence. For instance, Tyson invested over $100 million in fiscal year 2024 towards advanced food safety technologies and training programs, reinforcing its dedication to product integrity and consumer trust among its vast network of retail and foodservice partners.

- Tyson's vertical integration covers feed to distribution, ensuring direct oversight.

- Over $100 million invested in FY2024 for food safety technologies and training.

- This commitment is vital for maintaining trust with retail and foodservice clients.

Tyson Foods' product strategy spans a diverse portfolio of chicken, beef, and pork, with 2024 U.S. market shares of 21%, 23%, and 17% respectively. The company prioritizes higher-margin, value-added products like Jimmy Dean, generating $30.6 billion in FY2023 sales. Innovation, including a 2024 focus on sustainable proteins via Tyson Ventures, and expansion into plant-based options like Raised & Rooted, are key. Over $100 million was invested in FY2024 for food safety, reinforcing quality across its vertically integrated supply chain.

| Product Segment | 2024 Market Share (U.S.) | FY2023 Sales (Value-Added) |

|---|---|---|

| Chicken | 21% | |

| Beef | 23% | |

| Pork | 17% | |

| Branded/Value-Added | N/A | $30.6 Billion |

What is included in the product

This analysis provides a comprehensive breakdown of Tyson Foods' marketing mix, examining its product portfolio, pricing strategies, distribution channels, and promotional efforts.

It offers insights into how Tyson Foods leverages its 4Ps to maintain market leadership and cater to diverse consumer needs.

Simplifies Tyson Foods' marketing strategy, offering a clear roadmap to address consumer needs and build brand loyalty.

Provides a concise overview of Tyson's 4Ps, enabling quick understanding of how the company solves customer pain points.

Place

Tyson Foods leverages an extensive retail distribution network, ensuring its diverse product portfolio reaches consumers across major food retailers and grocery chains nationwide. The consumer retail segment is a cornerstone of its operations, contributing approximately 62% of total revenue, equating to around $34.6 billion as of recent fiscal data. This deep market penetration into supermarkets and club stores is critical for maintaining Tyson's strong market presence and driving significant sales volumes. The company's strategic placement in these channels underpins its accessibility and brand visibility.

Tyson Foods is a pivotal supplier to the foodservice industry, with this segment contributing approximately 36-38% of its total revenue in fiscal year 2024. The company provides a broad range of chicken, beef, and pork products to diverse clients including restaurant operators, hotel chains, schools, and healthcare facilities. Tyson is strategically focused on regaining and expanding its market share within this crucial channel. This growth is essential for driving overall sales volume and effectively leveraging its extensive production capacity across its operations.

Tyson Foods boasts a significant and expanding international presence, marked by strategic operations and partnerships designed for global reach. The company expanded through key acquisitions in Europe and established a robust foothold in Asian markets, including China, by supplying major international food chains and utilizing local e-commerce platforms. As of 2024, international sales contributed approximately 20% to Tyson Foods total revenue, underscoring its global market penetration.

Logistics and Supply Chain Optimization

Tyson Foods operates a complex, vertically integrated supply chain across its numerous production facilities and distribution centers. The company is currently undergoing a multi-year logistics transformation, aiming to significantly enhance efficiency and streamline operations. This involves divesting some conventional warehouses and establishing next-generation automated cold storage facilities through strategic partnerships, projected to yield substantial annual savings. This strategy, unfolding into 2025, is designed to reduce network complexity and optimize inventory flow.

- Tyson's logistics transformation targets an annual savings of over $300 million by fiscal year 2024.

- The company anticipates completing the sale of six conventional cold storage facilities by late 2024.

- Partnerships are forming for new automated cold storage facilities, enhancing 2025 distribution capabilities.

Growing E-commerce and Direct-to-Consumer Channels

Tyson Foods is significantly expanding its reach by leveraging online channels to connect directly with consumers. The company actively sells its diverse product portfolio through major e-commerce platforms such as Amazon and Walmart.com, adapting to evolving consumer shopping habits. This digital expansion allows Tyson to capture the robust growth in online grocery sales, projected to continue its upward trajectory into 2025.

This strategic shift enhances customer engagement and provides valuable data for more precise, targeted marketing efforts. Tyson has also explored direct-to-consumer (DTC) initiatives, including meal kits, to diversify its distribution model. This digital pivot is crucial as e-commerce grocery penetration is expected to increase, offering new avenues for market share growth.

- Online grocery sales in the U.S. are projected to exceed $180 billion by 2025.

- Tyson's digital presence on platforms like Amazon contributes to broader market penetration.

- DTC models allow for direct consumer feedback and personalized product offerings.

- Data collected from e-commerce transactions informs targeted marketing campaigns.

Tyson Foods strategically ensures widespread product availability through diverse channels, including a dominant retail presence contributing 62% of revenue and a pivotal role in foodservice, accounting for 36-38% in FY2024. Its growing international footprint now contributes 20% of revenue, bolstered by a significant digital expansion via major e-commerce platforms. A multi-year logistics transformation, aiming for over $300 million in annual savings by FY2024, optimizes its vertically integrated supply chain for enhanced efficiency into 2025.

| Channel | FY2024 Revenue Contribution | Strategic Focus |

|---|---|---|

| Retail | ~62% ($34.6B) | Market Penetration, Sales Volume |

| Foodservice | 36-38% | Market Share Expansion |

| International | ~20% | Global Reach, E-commerce |

Full Version Awaits

Tyson Foods 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Tyson Foods 4P's Marketing Mix analysis details their product strategies, pricing tactics, extensive distribution channels, and promotional activities. Understand how Tyson Foods positions its diverse range of meat and food products in the market. This is the same ready-made Marketing Mix document you'll download immediately after checkout.

Promotion

Tyson Foods employs comprehensive advertising campaigns across digital, television, and print media to bolster its diverse brand portfolio. The company allocated approximately $291.1 million in fiscal 2023 towards advertising efforts, aiming to build strong brand awareness and stimulate consumer demand. These strategic campaigns are often segmented, with distinct messaging tailored for specific brands such as Tyson, Jimmy Dean, or Hillshire Farm. This multi-faceted approach maximizes reach and resonance across various consumer demographics.

Tyson Foods actively deploys targeted omnichannel marketing campaigns, strategically aligning with key consumption periods like the summer grilling season. The 'A Fresh Spin' campaign, for instance, leveraged 2024 consumer segmentation insights to promote fresh beef and pork offerings. This initiative successfully aimed to reach approximately 78 million consumers by integrating in-store, digital, and social media elements. This cohesive strategy maximizes brand visibility and drives sales across diverse consumer touchpoints, reflecting a robust promotional effort for 2025.

Tyson Foods actively shapes its corporate reputation through public relations, emphasizing sustainability, animal welfare, and corporate responsibility. The company communicates its commitment to achieving net-zero greenhouse gas emissions across its global operations by 2050, a significant long-term goal. These PR efforts, including a 2024 focus on responsible protein production, align the brand with increasing consumer demand for ethically and sustainably sourced food products. This strategic communication reinforces Tyson's brand image among its diverse stakeholders and investor base.

Digital and Influencer Marketing

Tyson Foods actively leverages digital and influencer marketing, a key component of its promotional strategy. The company partners with social media influencers to create engaging content, such as recipes featuring Tyson products, which generates substantial reach. These campaigns often achieve over 15 million impressions and engagement rates exceeding 8% on platforms like Instagram and TikTok in 2024. This approach fosters authentic connections with consumers and provides valuable insights into product use.

- Influencer collaborations drive brand visibility.

- Content marketing focuses on practical product application.

- Campaigns yield high engagement metrics.

- Digital strategies enhance consumer relevance.

Strategic Partnerships and Customer Engagement

Tyson Foods prioritizes robust B2B strategic partnerships and deep customer engagement as a core promotional pillar. The company actively collaborates with retail partners on in-store promotions, aiming to increase brand visibility and drive sales volume for categories like fresh meats and prepared foods. These alliances are vital for securing prime shelf placement and fostering mutual growth, contributing significantly to Tyson's approximately $52.8 billion net sales in fiscal year 2024. This proactive engagement stabilizes earnings by ensuring consistent demand across diverse sales channels.

- Tyson's B2B focus ensures strong relationships with retailers and foodservice clients.

- Collaborative promotions with retailers boost in-store visibility and sales.

- Partnerships help secure placement and drive volume, stabilizing revenue.

- This strategy supports growth in key categories, enhancing Tyson's market position.

Tyson Foods employs a comprehensive promotional strategy, leveraging significant advertising investments and omnichannel campaigns to engage consumers and build strong brand awareness. Digital and influencer marketing drive consumer interaction, achieving high engagement rates for campaigns like the 2024 'A Fresh Spin' initiative. Public relations efforts emphasize sustainability and responsible production, bolstering corporate reputation and aligning with consumer values. Strategic B2B partnerships with retailers are crucial, supporting Tyson's fiscal 2024 net sales of approximately $52.8 billion by ensuring robust market presence and sales volume.

| Promotional Area | Key Metric (2024/2025 Focus) | Performance/Impact |

|---|---|---|

| Advertising Spend | Fiscal 2023 Allocation | Approximately $291.1 million towards brand awareness |

| Omnichannel Campaigns | 'A Fresh Spin' (2024) | Reached ~78 million consumers; integrated in-store, digital, social |

| Digital & Influencer Marketing | 2024 Campaign Engagement | Over 15 million impressions; >8% engagement on platforms |

| B2B Partnerships | Fiscal 2024 Net Sales | ~ $52.8 billion; driven by retail collaborations and shelf placement |

Price

Tyson Foods' pricing strategy is heavily influenced by the volatile commodity markets for live cattle, hogs, and animal feed. As of Q2 2024, Tyson reported a significant drop in average beef prices by 3.1% and pork prices by 7.5% year-over-year, directly reflecting lower input costs. The company must dynamically adjust product prices to reflect these fluctuating input costs, which can severely compress margins, particularly in the beef and pork segments. Managing the price spread between raw commodity costs and finished product selling prices, a critical element of its financial strategy, remains paramount as commodity markets are projected to see continued volatility into 2025.

Tyson Foods employs a value-based pricing strategy, offering products across various price points to align with its diverse brand portfolio. Premium brands such as Hillshire Farm and Jimmy Dean, part of Tyson's prepared foods segment which generated $2.275 billion in Q1 FY2024 net sales, command higher prices due to their quality and convenience. This tiered approach allows Tyson to capture a broad market, appealing to both price-sensitive consumers and those willing to pay more for branded, innovative poultry and meat products. The company strategically positions its offerings to ensure accessibility while maximizing profitability across its extensive product range, balancing volume with margin. This flexibility is crucial in the competitive 2024-2025 food market.

Tyson Foods strategically employs promotional pricing, seasonal discounts, and loyalty programs to boost sales volume and engage cost-conscious consumers. These tactics often include discounts of 10-20% on select product lines, such as their popular chicken or beef products, or for large bulk purchases, especially visible in Q3 2024 retail campaigns. Such promotions are crucial for maintaining competitiveness in the grocery retail channel, where price sensitivity remains high, and for encouraging product trial among new customers. This approach helps Tyson sustain market share amidst fluctuating commodity costs and consumer spending trends projected into 2025.

Foodservice Contract Pricing

For its large foodservice customers, Tyson Foods frequently employs long-term contracts, often utilizing cost-plus or market-based pricing structures. These agreements, common in the institutional sector, are designed to cultivate stable, enduring relationships, which are crucial given the sector's scale. This strategy helps stabilize Tyson’s earnings, providing a degree of predictability in the often-volatile protein market, where commodity prices can fluctuate significantly.

- Tyson's foodservice segment represented approximately 30% of its net sales in fiscal year 2024, emphasizing the importance of these contracts.

- Long-term contracts help mitigate the impact of fluctuating input costs, such as corn and soybean meal, which saw volatility through early 2025.

- Predictable revenue streams from these contracts support consistent operational planning and capital allocation for Tyson.

Managing Inflation and Consumer Sensitivity

Tyson Foods faces the challenge of managing inflation, which has led to more cautious and price-sensitive consumers, especially through late fiscal year 2024 and into 2025. The company’s pricing strategy must carefully balance passing on increased operational costs, like those seen in raw materials, with maintaining consumer value to prevent demand erosion. This equilibrium is crucial for sustaining sales volumes while protecting profit margins, particularly as household budgets remain constrained. For instance, Tyson's fiscal Q1 2025 results showed a net income of $133 million, reflecting ongoing efforts to optimize pricing amidst market pressures.

- Tyson's fiscal Q4 2024 results indicated a focus on operational efficiencies to counter inflationary pressures.

- Consumer demand for value-oriented protein options has intensified, impacting pricing flexibility.

- The company's pricing adjustments are critical to maintain competitiveness against private labels in 2025.

- Balancing price increases with consumer affordability directly influences market share retention.

Tyson Foods' pricing strategy dynamically adapts to volatile commodity markets, reflecting Q2 2024 declines of 3.1% in beef and 7.5% in pork prices. The company employs value-based pricing across its portfolio, with premium brands boosting the prepared foods segment to $2.275 billion in Q1 FY2024 net sales. Strategic promotional discounts, like 10-20% off in Q3 2024, and long-term foodservice contracts, representing 30% of FY2024 net sales, are vital. Managing inflation and consumer price sensitivity remains paramount, as shown by Q1 FY2025 net income of $133 million.

| Metric | Q2 2024 Impact | Q1 FY2024/2025 Data |

|---|---|---|

| Beef Price Change | -3.1% YoY | N/A |

| Pork Price Change | -7.5% YoY | N/A |

| Prepared Foods Sales | N/A | $2.275 billion (Q1 FY2024) |

| Foodservice Sales Share | N/A | ~30% of FY2024 Net Sales |

| Net Income | N/A | $133 million (Q1 FY2025) |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Tyson Foods is grounded in comprehensive data from official company disclosures, including SEC filings, annual reports, and investor presentations. We also integrate insights from their corporate website, product packaging, and public statements to ensure accuracy.

We supplement this with information gleaned from retail data, market research reports, and competitor analysis to provide a holistic view of Tyson Foods' marketing mix strategies. This multi-faceted approach ensures our insights are robust and actionable.