Tronox Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tronox Holdings Bundle

Tronox Holdings, a leader in titanium dioxide, boasts significant strengths in its integrated operations and global reach, offering a compelling foundation for growth. However, understanding the nuanced interplay of its opportunities and the potential impact of market volatility and regulatory shifts is crucial for informed decision-making.

Want the full story behind Tronox's robust production capabilities, strategic market positioning, and the potential headwinds it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment strategy and market analysis.

Strengths

Tronox's vertical integration, stretching from titanium ore mining to pigment manufacturing, grants it considerable sway over its entire supply chain. This control is a major strength, allowing the company to better manage the costs of essential raw materials like ilmenite and rutile, which are critical inputs for titanium dioxide (TiO2). This integrated approach also safeguards the stability of its feedstock supply, a key advantage in a market susceptible to volatility.

This deep integration sets Tronox apart from many competitors who might rely more heavily on external suppliers for their raw materials. By controlling more stages of production, Tronox can mitigate the impact of fluctuating raw material prices and potential supply chain interruptions, offering a more predictable and cost-effective operation. For instance, in 2023, Tronox reported that its upstream segment, which includes mining and beneficiation, contributed significantly to its operational efficiency by securing internal supply for its pigment plants.

Tronox's position as a global leader in titanium dioxide (TiO2) pigment production is a significant strength, fostering strong market recognition and a wide-reaching customer base across diverse industries. This leadership allows them to capitalize on economies of scale, enhancing their competitive advantage in product quality and distribution networks.

The essential nature of Tronox's TiO2 pigments in sectors like paints, coatings, plastics, and paper ensures a steady and consistent demand for their products. For instance, in 2023, the global TiO2 market was valued at approximately $26.1 billion, with Tronox holding a substantial market share as one of the top producers.

Tronox's titanium dioxide (TiO2) pigment is a fundamental component in countless everyday items, from the paint on our walls to the plastics in our electronics. Its ability to impart whiteness, brightness, and opacity makes it indispensable across industries like coatings, plastics, and paper. This broad utility ensures consistent demand.

The essential nature of TiO2 across diverse sectors, including automotive coatings and architectural paints, shields Tronox from significant volatility tied to any single market. For instance, in 2024, the global TiO2 market experienced steady growth, with demand from construction and automotive sectors remaining robust. This inherent demand across multiple applications provides a stable revenue foundation for the company.

Commitment to Sustainability and Operational Efficiency

Tronox Holdings has made substantial strides in sustainability, a key strength that bolsters its operational efficiency. The company has achieved a notable 21% reduction in its Scope 1 and 2 greenhouse gas (GHG) emissions intensity since 2019.

This achievement is largely thanks to strategic investments in renewable energy sources and the implementation of advanced process automation across its operations. These eco-friendly initiatives are not just about environmental responsibility; they translate directly into tangible, long-term cost savings by reducing energy consumption and waste.

Furthermore, the focus on operational efficiency driven by sustainability efforts enhances the company's overall performance and competitiveness in the market. This commitment is further validated by their ongoing efforts and targets for future emissions reductions, demonstrating a forward-looking approach to responsible resource management.

- Significant GHG Emission Reduction: Achieved a 21% decrease in Scope 1 and 2 GHG emissions intensity since 2019.

- Renewable Energy Adoption: Increased use of renewable energy sources to power operations.

- Process Automation: Implemented automation to optimize production and reduce environmental impact.

- Cost Savings: Realized long-term cost efficiencies through reduced energy consumption and improved resource utilization.

Strategic Cost Improvement Programs

Tronox Holdings has launched significant cost improvement programs designed to yield substantial, lasting savings. The company anticipates achieving $125 million to $175 million in run-rate cost improvements by the close of 2026. These initiatives are crucial for bolstering its market competitiveness and overall financial health.

Key actions, such as the strategic idling of the Botlek facility, are central to these cost-reduction efforts. This move, alongside other structural cost adjustments, is expected to directly address inefficiencies and pave the way for improved financial performance in the coming years.

- Targeted Savings: $125-$175 million in run-rate cost improvements by end of 2026.

- Strategic Actions: Includes idling of the Botlek facility.

- Objective: Enhance competitive position and financial performance.

Tronox's robust vertical integration, from mining to pigment production, offers significant control over its supply chain and raw material costs for critical inputs like ilmenite and rutile. This integration provides a buffer against market volatility and ensures feedstock stability, as evidenced by its upstream segment's contribution to operational efficiency in 2023.

As a global leader in titanium dioxide (TiO2) pigment, Tronox benefits from strong brand recognition and a broad customer base across essential industries like paints, coatings, and plastics. The company's significant market share in the approximately $26.1 billion global TiO2 market in 2023 underscores its economies of scale and competitive pricing power.

Tronox's commitment to sustainability is a tangible strength, marked by a 21% reduction in Scope 1 and 2 GHG emissions intensity since 2019, driven by renewable energy adoption and process automation. These initiatives not only reduce environmental impact but also generate long-term cost savings through decreased energy consumption.

The company's targeted cost improvement programs aim to achieve $125 million to $175 million in run-rate savings by the end of 2026, with strategic actions like idling the Botlek facility contributing to enhanced efficiency and competitiveness.

| Strength | Description | Supporting Data/Context |

|---|---|---|

| Vertical Integration | Control over the entire supply chain from mining to pigment manufacturing. | Secures feedstock stability and manages raw material costs (ilmenite, rutile). Upstream segment contributed to operational efficiency in 2023. |

| Market Leadership (TiO2) | Global leader in TiO2 pigment production. | Strong brand recognition, broad customer base. Holds significant market share in the $26.1 billion global TiO2 market (2023). |

| Sustainability Initiatives | Focus on reducing environmental impact and improving operational efficiency. | 21% reduction in Scope 1 & 2 GHG emissions intensity since 2019. Increased renewable energy use and process automation. |

| Cost Improvement Programs | Strategic initiatives to reduce operational costs and enhance competitiveness. | Targeting $125-$175 million in run-rate cost improvements by end of 2026. Includes idling of Botlek facility. |

What is included in the product

Delivers a strategic overview of Tronox Holdings’s internal and external business factors, highlighting its market strengths and potential threats.

Provides a clear breakdown of Tronox's competitive landscape, highlighting opportunities for market share growth and mitigating threats from fluctuating raw material prices.

Weaknesses

Tronox’s dominant position in the TiO2 market doesn't shield it from fluctuating pigment prices, which directly affect its earnings. For instance, the company experienced pricing pressure in Q1 2025, particularly in key regions like Asia and Latin America, underscoring this vulnerability.

These price swings create considerable uncertainty, complicating Tronox's ability to predict future revenue and manage its profit margins effectively. This inherent volatility is a significant weakness that requires constant monitoring and strategic adaptation.

Tronox Holdings faces a significant challenge with its high net leverage ratio. As of March 31, 2025, the company reported a net leverage ratio of 5.2 times, with total debt standing at $3.0 billion. This substantial debt burden can restrict the company's ability to maneuver financially.

The elevated debt level has direct implications for Tronox's operations and future prospects. It could lead to increased interest expenses, thereby reducing profitability. Furthermore, this financial strain might limit the company's capacity to invest in new projects or return capital to its shareholders, particularly if market conditions become less favorable.

Tronox's vertically integrated structure, a key strength, also necessitates substantial capital investment to maintain and upgrade its extensive mining and processing infrastructure. In the first quarter of 2025, the company reported capital expenditures of $110 million, largely driven by ongoing major mining projects.

The ongoing development and transition to new mining sites present temporary challenges, potentially impacting short-term profitability due to associated costs and operational adjustments.

Geographical Market Pressures

While Tronox operates globally, it encounters significant geographical market pressures. Intense competition and downward price movements are particularly noticeable in key regions like Latin America, the Middle East, and Asia. This intense competition in these areas can dampen overall company performance.

These regional challenges can counteract the benefits Tronox might experience elsewhere. For instance, while Europe has seen some stability due to anti-dumping duties on titanium dioxide (TiO2), this localized support doesn't fully negate the broader pressures faced in other growth markets.

The impact of these pressures is evident in financial reporting. For example, in its 2023 performance, Tronox noted that while demand in Europe remained relatively stable, other regions experienced weaker pricing due to oversupply and competitive dynamics, impacting overall revenue and profitability.

- Latin America: Faces significant competitive intensity and pricing erosion in the TiO2 market.

- Middle East: Experiencing similar pressures from increased competition and price sensitivity.

- Asia: High supply levels and aggressive pricing strategies from local players create a challenging environment.

- Europe: Benefits from some protection via anti-dumping duties, offering a more stable, albeit still competitive, market.

Dependence on Economic Cycles

Tronox Holdings' reliance on economic cycles presents a significant vulnerability. The demand for titanium dioxide (TiO2), their primary product, is directly influenced by the performance of key sectors such as construction, automotive, and consumer goods. This means that when the broader economy slows, Tronox often experiences a corresponding dip in sales and pricing power.

The economic landscape in early to mid-2025 illustrates this weakness clearly. A sluggish industry-wide recovery, coupled with persistent economic uncertainty, particularly within the crucial construction and automotive sectors, has led to subdued demand and depressed TiO2 prices. This environment directly impacts Tronox's revenue and profitability, highlighting their sensitivity to macroeconomic fluctuations.

- Economic Sensitivity: Demand for TiO2 is intrinsically linked to global economic health, impacting Tronox's sales volumes and pricing.

- Sector Dependence: Key customer industries like construction and automotive are cyclical, meaning downturns directly affect Tronox's performance.

- Q2 2025 Market Conditions: Slower recovery and economic uncertainty in major markets have resulted in depressed demand and prices for TiO2.

- Profitability Impact: Reduced demand and lower prices stemming from economic downturns directly pressure Tronox's profit margins.

Tronox's substantial debt, with a net leverage ratio of 5.2 times as of March 31, 2025, and total debt at $3.0 billion, limits financial flexibility and could increase interest expenses, impacting profitability.

The company's capital-intensive, vertically integrated model requires significant ongoing investment, as seen in $110 million in Q1 2025 capital expenditures, which can temporarily affect short-term earnings during major project transitions.

Intense competition and price erosion in key markets like Latin America, the Middle East, and Asia, despite some stability in Europe due to anti-dumping duties, create persistent regional revenue pressures.

Tronox's performance is highly sensitive to economic cycles, with downturns in construction, automotive, and consumer goods sectors directly reducing TiO2 demand and pricing power, as evidenced by subdued market conditions in early to mid-2025.

| Weakness | Description | Impact | Relevant Data (as of Q1 2025) |

|---|---|---|---|

| High Net Leverage | Significant amount of debt relative to earnings. | Restricts financial maneuverability, increases interest expense, potentially limits investment and capital returns. | Net Leverage Ratio: 5.2x; Total Debt: $3.0 billion |

| Capital Intensity | Need for continuous, substantial investment in mining and processing infrastructure. | Can strain short-term profitability during major project development and upgrades. | Q1 2025 Capital Expenditures: $110 million |

| Geographical Market Pressures | Intense competition and price sensitivity in specific regions. | Dampens overall performance and revenue growth in affected areas. | Pricing pressure noted in Latin America, Middle East, and Asia. |

| Economic Cyclicality | Dependence of TiO2 demand on global economic health and key end-user industries. | Leads to volatility in sales volumes and pricing power during economic downturns. | Subdued demand and prices in early-mid 2025 due to slower recovery in construction and automotive sectors. |

Preview Before You Purchase

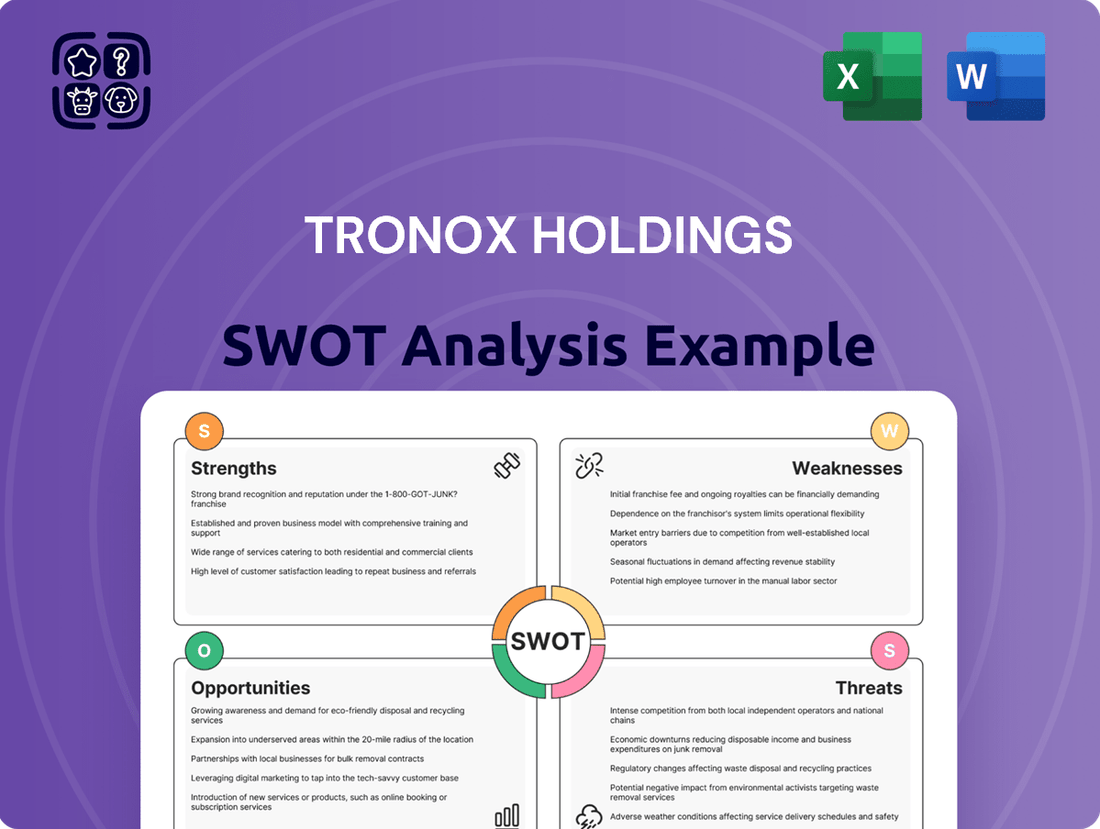

Tronox Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual SWOT analysis file, showcasing key insights into Tronox Holdings' market position. The complete version, offering a comprehensive breakdown of Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout. This detailed analysis is crucial for strategic decision-making.

Opportunities

The global titanium dioxide market is anticipated to expand steadily, with an estimated compound annual growth rate (CAGR) between 5% and 6% expected from 2024 through 2030. This growth is fueled by increasing demand across key sectors, including paints, plastics, and cosmetics. Tronox is well-positioned to capitalize on this trend by leveraging its global presence.

Emerging markets, especially within the Asia-Pacific region, are projected to exhibit particularly robust growth in titanium dioxide consumption. This presents a significant opportunity for Tronox to deepen its penetration and capture a larger market share in these dynamic and expanding economies. Strategic focus on these areas could drive substantial revenue increases.

Tronox has made substantial strides in sustainability, evidenced by its commitment to reducing greenhouse gas emissions and waste. For instance, in 2023, the company reported a 22% reduction in Scope 1 and 2 GHG emissions intensity compared to their 2019 baseline, a significant achievement. This focus on environmental responsibility directly addresses growing regulatory pressures and customer preferences for eco-friendly products, creating a distinct market advantage.

These proactive sustainability initiatives are not just about compliance; they actively bolster Tronox's brand image, making it more appealing to environmentally conscious investors. The company's strategic investments in renewable energy sources, such as solar power installations at its facilities, further solidify this positive perception. This can lead to enhanced access to capital and potentially unlock new market opportunities focused on sustainable solutions.

Tronox is strategically moving beyond its core titanium dioxide (TiO2) pigment business. The company is increasingly focusing on high-value specialty products, such as ultrafine TiO2 grades. These advanced materials command premium pricing compared to standard TiO2. In 2024, the specialty products segment is expected to contribute a larger share of overall revenue, reflecting this strategic shift.

Technological Advancements in Production

Tronox's commitment to technological advancement is a significant opportunity. By continuously investing in areas like process automation and optimizing how its assets perform, the company can significantly boost how efficiently it produces titanium dioxide and lower its overall costs. This focus on innovation directly supports ongoing cost improvement initiatives.

These technological upgrades are crucial for maintaining and strengthening Tronox's competitive edge in the market. As operational expenses decrease due to these advancements, Tronox becomes a more attractive supplier, potentially leading to increased market share. For instance, advancements in energy efficiency in their 2024 operations could translate to millions in savings.

- Enhanced Production Efficiency: Automation reduces manual labor and potential errors, leading to higher output.

- Cost Reduction: Optimized processes and energy-efficient technologies directly lower operating expenses.

- Competitive Advantage: Lower costs allow for more competitive pricing and improved profit margins.

- Asset Performance Optimization: Predictive maintenance and real-time monitoring minimize downtime and maximize utilization of production facilities.

Potential for Market Recovery and Price Stabilization

Despite facing current market challenges, there's a notable opportunity for Tronox Holdings. Analysts are forecasting a stabilization or even an increase in titanium dioxide (TiO2) prices by the third quarter of 2025. This positive outlook is underpinned by an anticipated recovery in demand during the same period.

Tronox, with its position as a low-cost producer, is particularly well-suited to benefit from this projected market rebound. The company is expected to see a significant uptick in sales volumes and a corresponding improvement in its profitability. This recovery is anticipated to gain momentum in the latter half of 2025 and continue into 2026, presenting a clear path for enhanced financial performance.

- TiO2 Price Forecast: Expected to stabilize or increase in Q3 2025.

- Demand Recovery: Anticipated alongside price stabilization.

- Tronox's Advantage: Low-cost production positions it to capitalize on the rebound.

- Financial Impact: Potential for increased sales volumes and improved profitability in late 2025 and 2026.

The global titanium dioxide market is projected for steady growth, with an estimated CAGR of 5-6% from 2024-2030, driven by demand in paints, plastics, and cosmetics. Tronox is also benefiting from a strategic shift towards higher-value specialty TiO2 products, which command premium pricing. The company’s ongoing investments in technological advancements and process automation are enhancing production efficiency and reducing costs, bolstering its competitive position.

Emerging markets, particularly in the Asia-Pacific region, offer significant growth potential for TiO2 consumption, allowing Tronox to expand its market share. Furthermore, Tronox's commitment to sustainability, evidenced by a 22% reduction in Scope 1 and 2 GHG emissions intensity by 2023 (vs. 2019 baseline), aligns with increasing customer and investor preferences for eco-friendly products, creating a distinct market advantage and enhancing brand image.

Analysts predict a stabilization or increase in TiO2 prices by Q3 2025, coupled with a demand recovery. As a low-cost producer, Tronox is well-positioned to capitalize on this rebound, anticipating increased sales volumes and improved profitability through late 2025 and into 2026.

Threats

The titanium dioxide industry is a battlefield, with global giants constantly fighting for dominance. This fierce rivalry, especially when coupled with excess supply in various markets, creates ongoing downward pressure on prices. For Tronox, this means navigating a landscape where achieving favorable pricing, as evidenced by challenges in early 2025, directly impacts their financial performance and profitability.

Tronox, like many in the chemical sector, is navigating a landscape of tightening environmental rules. These regulations, covering everything from air emissions to waste disposal and water consumption, are becoming more rigorous. For instance, in the EU, the Industrial Emissions Directive (IED) sets strict limits that require ongoing investment in abatement technologies.

Meeting these evolving environmental standards translates into substantial costs. Tronox has previously highlighted the need for significant capital expenditures to ensure compliance, which can impact operational budgets and the company's financial flexibility. These compliance costs are a direct operational expense that can affect the bottom line.

The financial burden of environmental compliance can create a competitive disadvantage, especially when compared to competitors in regions with less stringent regulations. For 2024, Tronox anticipates continued investment in environmental initiatives to meet these global standards.

Economic uncertainties, particularly a potential global slowdown in late 2024 and into 2025, pose a significant threat. Downturns in crucial sectors such as construction and automotive directly dampen the demand for titanium dioxide (TiO2), Tronox's primary product. For instance, if housing starts in major markets like the US or Europe contract by 5-10% in 2025, this would translate to lower TiO2 consumption for paints and coatings.

A prolonged economic slowdown or regional recessions could severely impact Tronox's sales volumes. If global GDP growth forecasts are revised downwards by 1-2% for 2025, this could lead to a similar or greater contraction in TiO2 demand. Such conditions would likely exacerbate price erosion, squeezing Tronox's profit margins and affecting its overall financial performance.

Raw Material Supply Risks and Price Volatility

Even though Tronox is vertically integrated, it still faces risks related to the supply and price swings of titanium-bearing mineral sands. For instance, in 2023, global titanium dioxide (TiO2) prices experienced fluctuations, impacting the cost of key inputs for pigment production.

Disruptions in mining operations, whether due to weather, labor issues, or regulatory changes, can directly affect Tronox's ability to secure essential raw materials. Significant increases in the cost of these minerals, even from internal sources, can squeeze profit margins and hinder production efficiency.

This exposure to price volatility means that Tronox's profitability can be directly influenced by external market forces affecting its primary inputs. For example, a surge in the price of ilmenite or rutile, crucial for TiO2 production, would increase Tronox's cost base.

- Raw Material Dependence: Tronox relies on titanium-bearing mineral sands, making it susceptible to supply chain disruptions.

- Price Volatility Impact: Fluctuations in mineral sand prices directly affect production costs and profitability.

- Operational Risks: Mining disruptions, even within its integrated model, can interrupt the consistent flow of raw materials.

- Cost Management Challenges: Managing the cost of raw materials is critical for maintaining competitive pricing and healthy margins.

Potential for Substitute Materials

While titanium dioxide (TiO2) is a vital component with limited direct replacements in many sectors, the chemical industry's continuous innovation poses a long-term risk. Emerging alternative materials could offer comparable functionality, potentially at a reduced price point or with enhanced environmental benefits, thereby impacting TiO2 demand.

For instance, advancements in nanoparticle technology or novel pigment formulations could present viable substitutes. Tronox Holdings, a major TiO2 producer, faces this threat as companies explore materials like calcium carbonate or advanced plastics for certain coating and plastic applications where TiO2's opacity and UV resistance are currently dominant. The development of more sustainable or cost-effective alternatives could shift market preferences.

The threat is not immediate but represents a strategic consideration for the future. For example, by 2024, the global market for paints and coatings, a key consumer of TiO2, is projected to reach hundreds of billions of dollars, but the potential for material substitution remains a factor in long-term market share. Companies investing heavily in R&D for alternative materials could disrupt the established TiO2 value chain.

- Emerging Alternatives: Ongoing research into novel pigments and composite materials could offer functional substitutes for TiO2.

- Cost and Environmental Pressures: Lower-cost or more environmentally friendly alternatives could gain traction, especially in price-sensitive markets.

- Long-Term Demand Risk: While TiO2 has few direct substitutes currently, sustained innovation could erode its market dominance over time.

- Industry R&D Focus: Significant investment in alternative material development by competitors represents a potential threat to Tronox's core business.

Intensifying competition and potential oversupply situations, particularly evident in early 2025 market analyses, exert continuous downward pressure on titanium dioxide (TiO2) prices. This dynamic directly challenges Tronox's ability to secure favorable pricing, thereby impacting its financial performance and overall profitability.

The company also faces the significant threat of increasing regulatory burdens concerning environmental standards, necessitating substantial capital investment in compliance technologies. For instance, the EU's Industrial Emissions Directive requires ongoing upgrades, with Tronox anticipating continued investment in environmental initiatives throughout 2024 to meet global standards.

Economic downturns, predicted for late 2024 and into 2025, pose a considerable risk by reducing demand in key sectors like construction and automotive, which are major consumers of TiO2. A projected 5-10% contraction in housing starts in 2025, for example, would translate to lower TiO2 consumption.

Tronox's reliance on titanium-bearing mineral sands exposes it to supply chain disruptions and price volatility, as seen with fluctuations in TiO2 input costs in 2023. Operational risks, including weather or labor issues at mining sites, can interrupt raw material flow and increase production costs.

SWOT Analysis Data Sources

This Tronox Holdings SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry analyses to ensure a thorough and reliable assessment.