Tronox Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tronox Holdings Bundle

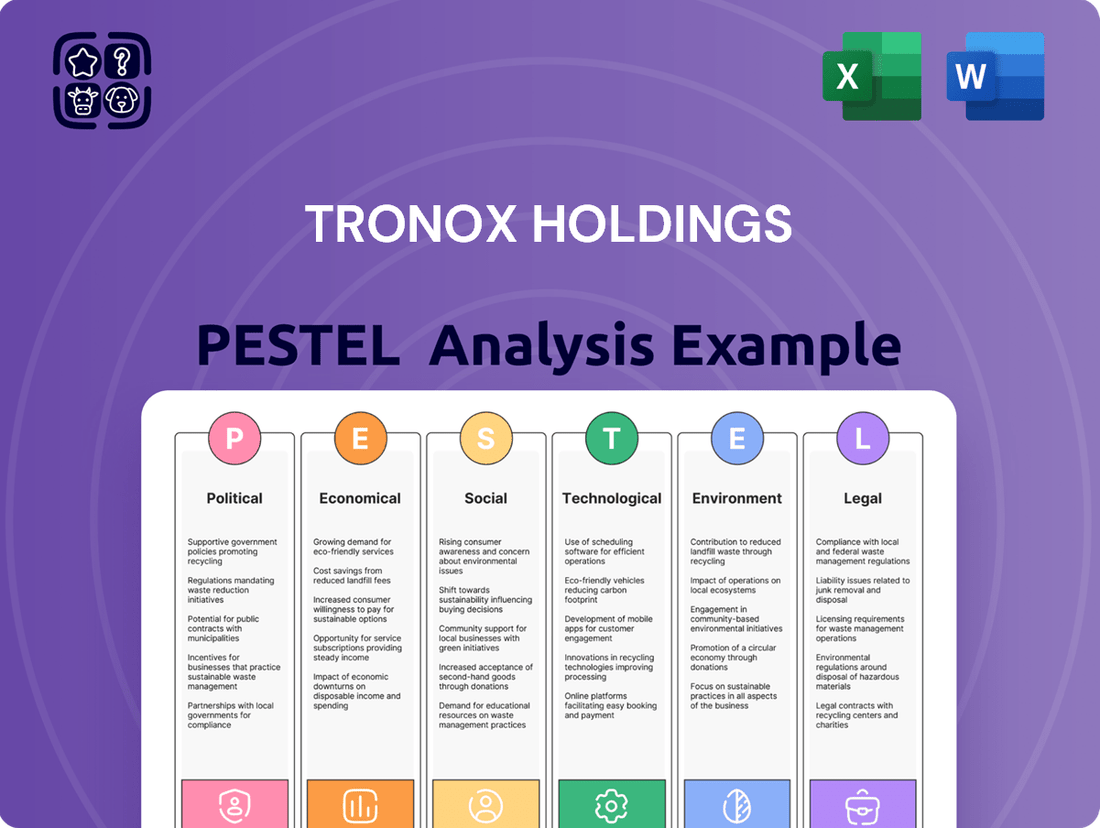

Navigate the complex external forces shaping Tronox Holdings with our in-depth PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for the company. Our analysis highlights critical technological advancements and environmental regulations impacting the titanium dioxide industry. Gain a competitive edge by leveraging these insights to refine your market strategy. Download the full PESTLE analysis now for actionable intelligence and a clearer view of Tronox Holdings's future.

Political factors

Tronox Holdings, a major player in titanium dioxide and mineral sands, faces substantial influence from government regulations governing mining and chemical production. These rules, covering everything from obtaining permits to meeting specific operational standards and fulfilling land reclamation duties, directly impact the company's expenses, how flexibly it can operate, and its capacity to grow or sustain its mining and processing sites. For instance, in 2023, environmental compliance costs represented a notable portion of operating expenses for global chemical producers, a trend expected to continue into 2024.

Navigating these varied regulatory landscapes across different countries is essential for Tronox to maintain its social license to operate and ensure its long-term business sustainability. Failure to comply can lead to fines, operational shutdowns, and reputational damage, making regulatory adherence a critical strategic priority. The company's 2024 sustainability reports highlighted ongoing investments in environmental management systems to meet evolving international standards.

Global trade policies, including tariffs and import/export restrictions on titanium dioxide (TiO2) and its raw materials, significantly impact Tronox's international sales and supply chain expenses. For instance, in 2024, ongoing trade disputes and the potential for new tariffs in major markets like the US and EU could increase the cost of imported ilmenite and rutile, key feedstocks for Tronox. This directly affects their cost of production and, consequently, the competitiveness of their TiO2 products in regions implementing such measures.

Changes in trade relations between major economic blocs, such as potential shifts in agreements between China and Western nations, can create either barriers or opportunities for Tronox. These shifts influence the competitive landscape by altering the cost advantages of different producers and impacting the profitability of cross-border transactions. For example, if a major trading partner imposes new quotas on TiO2 imports, Tronox might need to re-evaluate its distribution strategies to mitigate lost market share.

Monitoring and adapting to these trade policy shifts are crucial for Tronox to maintain market access and optimize its global distribution strategies. The company's ability to navigate evolving trade agreements, such as the potential renegotiation of trade deals impacting key supply chains in 2024 and 2025, will be a critical determinant of its operational efficiency and financial performance across its diverse international markets.

Tronox's global footprint, with significant operations in South Africa and Australia, exposes it to the direct impact of geopolitical instability. Political unrest or sudden policy shifts in these key regions can severely disrupt mining and processing activities. For instance, in 2024, South Africa's ongoing energy crisis and political uncertainties continue to pose operational challenges, impacting electricity supply crucial for Tronox's facilities.

Changes in government regulations or fiscal policies are also a substantial risk. A shift in mining laws or tax structures in Australia, for example, could directly affect Tronox's profitability and investment decisions. Understanding and actively managing these geopolitical variables is essential for maintaining the security of its supply chains and safeguarding its long-term asset value.

Industrial Policies and Subsidies

Government industrial policies, particularly those involving subsidies and incentives, play a crucial role in shaping the competitive landscape for companies like Tronox Holdings. For instance, in 2024, many nations are actively pursuing policies to bolster domestic manufacturing and encourage the adoption of environmentally friendly technologies. These initiatives can provide direct financial support or tax advantages to chemical producers, potentially benefiting Tronox if its operations align with these governmental priorities.

Conversely, policies that restrict certain manufacturing processes or favor alternative materials could pose challenges. For example, regulations targeting emissions from titanium dioxide production, a core business for Tronox, might necessitate significant capital investment in abatement technologies. The company's strategic planning must therefore account for potential shifts in government support or the imposition of new operational constraints.

- Government incentives for green technologies can reduce operational costs for Tronox.

- Policies promoting domestic production may create opportunities for market share expansion.

- Stricter environmental regulations could lead to increased compliance expenses.

- Subsidies for competing materials could impact Tronox's pricing power.

International Environmental Agreements

Tronox Holdings' global operations are directly shaped by international environmental agreements and treaties. These accords, such as the Paris Agreement and various conventions on hazardous waste, set benchmarks for emissions, waste handling, and the sustainable use of resources. For instance, the increasing global focus on reducing greenhouse gas emissions, a key tenet of the Paris Agreement, directly impacts industrial processes like those employed by Tronox, potentially requiring investments in cleaner technologies and operational adjustments. Failure to comply can lead to significant fines and reputational damage, especially as customers increasingly scrutinize supply chains for environmental responsibility.

The translation of these international standards into national legislation means Tronox must navigate a complex web of regulatory requirements across its operating regions. These regulations influence everything from the types of chemicals used in processing to the methods of effluent discharge. For example, tightening regulations on per- and polyfluoroalkyl substances (PFAS) in various jurisdictions, driven by international concern, could necessitate costly reformulation or waste treatment upgrades for Tronox's operations. The company's environmental footprint is therefore intrinsically linked to its ability to adapt to and meet these evolving global and local environmental mandates.

Adherence to these environmental agreements is more than just a legal obligation; it's becoming a critical differentiator in the market. Companies demonstrating strong environmental stewardship, often benchmarked against international standards, gain favor with environmentally conscious investors and customers. In 2024, a growing number of B2B customers are integrating sustainability criteria into their procurement processes, making compliance with international environmental norms a prerequisite for market access and a potential competitive advantage for Tronox.

Key international environmental considerations impacting Tronox include:

- Global climate change mitigation targets: Affecting energy consumption and emissions from production facilities.

- Chemicals management regulations: Such as those pertaining to heavy metals or specific industrial byproducts, impacting processing and waste disposal.

- Biodiversity and conservation directives: Influencing land use and operational impact assessments in sensitive areas.

- Circular economy initiatives: Encouraging resource efficiency and waste reduction, potentially driving innovation in recycling and by-product utilization.

Government regulations concerning mining permits, environmental standards, and land reclamation directly influence Tronox's operational costs and flexibility. For instance, in 2023, environmental compliance was a significant expense for global chemical producers, a trend projected to persist through 2024, impacting Tronox's bottom line.

Trade policies, including tariffs and import/export restrictions on titanium dioxide (TiO2), affect Tronox's international sales and supply chain expenses. Ongoing trade disputes in 2024 could increase feedstock costs, impacting the competitiveness of their TiO2 products in affected regions.

Geopolitical instability in key operational regions like South Africa and Australia can disrupt mining and processing activities. South Africa's energy crisis and political uncertainties in 2024 continue to pose operational challenges for Tronox.

Government industrial policies, such as subsidies for green technologies or domestic production, can create opportunities or challenges for Tronox. Conversely, stricter regulations on emissions might necessitate costly upgrades, as seen with evolving environmental mandates globally.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces influencing Tronox Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers forward-looking insights and actionable strategies to help stakeholders navigate opportunities and mitigate risks within the global titanium dioxide industry.

A concise PESTLE analysis of Tronox Holdings, presented with actionable insights, alleviates the pain of navigating complex external factors by offering a clear roadmap for strategic decision-making.

Economic factors

Global economic growth is a major driver for titanium dioxide (TiO2) pigment demand, as this essential ingredient is used across key sectors like paints, coatings, plastics, and paper.

A slowdown in global economic activity, such as the projected 2.6% GDP growth in 2024 by the IMF, can directly dampen demand in construction, automotive, and consumer goods, impacting Tronox's sales volumes and pricing power.

Conversely, periods of strong economic expansion, like the estimated 3.1% global growth for 2025, typically correlate with increased demand for TiO2 and more favorable market conditions for Tronox.

Tronox Holdings' vertically integrated model, while offering supply chain advantages, also means it's directly exposed to the fluctuating costs of essential raw materials, especially energy needed for its processing operations. For instance, the price of natural gas, a significant energy input for chemical production, saw considerable volatility in 2024, with global benchmarks experiencing sharp swings. Similarly, the cost of sulfuric acid, a key chemical input for titanium dioxide production, can also be unpredictable, directly impacting Tronox's cost of goods sold.

Tronox Holdings, as a global entity, is significantly impacted by currency exchange rate fluctuations. With operations and sales across numerous countries, shifts in major currencies relative to the US dollar, Tronox's reporting currency, directly influence its competitive edge in export markets and the expenses incurred in its international operations. For instance, a stronger US dollar can make Tronox's products more expensive for international buyers, potentially dampening sales volumes.

These currency movements also affect the reported value of Tronox's foreign earnings when translated into US dollars. In 2023, the company reported that foreign currency translation adjustments had a notable impact on its financial results, highlighting the ongoing challenge of managing this economic factor. The volatility of exchange rates, such as those between the Australian dollar and the US dollar, or the South African rand and the US dollar, requires continuous monitoring and strategic hedging to mitigate potential negative impacts on profitability.

Inflationary Pressures

Global inflationary pressures present a significant challenge for Tronox Holdings, potentially escalating operational expenses across various fronts. This includes the cost of labor, essential transportation services, and the procurement of key raw materials. For instance, in early 2024, global inflation rates remained a concern, impacting supply chains and input costs for many industrial companies.

Tronox, like many in its sector, faces the delicate task of absorbing or passing on these increased costs to its customers. The success of such price adjustments is heavily reliant on prevailing market conditions and the competitive landscape for titanium dioxide (TiO2) products. If competitors also face similar cost pressures and implement price hikes, Tronox may find it easier to maintain its margins.

However, sustained high inflation rates pose a risk to Tronox’s profitability by potentially squeezing profit margins. Furthermore, a general decline in consumer purchasing power due to inflation can dampen demand for end-products that incorporate TiO2, such as paints, plastics, and paper.

- Rising input costs: Global inflation in 2024 has seen increases in energy, transportation, and key chemical inputs crucial for TiO2 production.

- Pricing power limitations: Tronox's ability to pass on costs is constrained by competition and the price sensitivity of its downstream customers in sectors like construction and automotive.

- Demand erosion: Persistent inflation can reduce consumer spending on durable goods and construction, directly impacting demand for TiO2.

Supply and Demand Dynamics for TiO2

The global titanium dioxide (TiO2) market's supply and demand balance is a critical economic factor for Tronox Holdings. When supply outstrips demand, we often see price decreases, impacting revenue. Conversely, a tighter supply situation generally allows for higher pricing power.

Market analysts projected the global TiO2 market to reach approximately $20.8 billion in 2024, with an expected compound annual growth rate (CAGR) of 4.5% through 2029. This growth is driven by demand in coatings, plastics, and paper industries. However, periods of overcapacity, such as those experienced in earlier years, can lead to significant price erosion, as seen in fluctuating contract prices throughout 2023 and early 2024.

Tronox's operational strategies are directly tied to these dynamics. Decisions on production volumes, potential capacity expansions, and how much inventory to hold are all influenced by the prevailing supply and demand conditions. Effectively managing these aspects helps Tronox aim for optimal revenue and maintain its market position.

- Global TiO2 Market Size: Projected to reach ~$20.8 billion in 2024.

- Projected Growth: Expected CAGR of 4.5% from 2024 to 2029.

- Key Demand Drivers: Coatings, plastics, and paper industries.

- Price Sensitivity: Market prices are highly responsive to shifts in supply and demand balances, impacting profitability.

Global economic growth significantly influences titanium dioxide (TiO2) demand, with the IMF forecasting 2.6% GDP growth in 2024 and an anticipated 3.1% in 2025, directly impacting Tronox's sales in construction and automotive sectors.

Rising input costs, including energy and chemicals, due to global inflation in 2024, challenge Tronox's margins, requiring careful pricing strategies against competitor actions and consumer price sensitivity.

The TiO2 market, projected at $20.8 billion in 2024 with a 4.5% CAGR through 2029, is sensitive to supply-demand shifts, with overcapacity leading to price erosion, affecting Tronox's revenue and production planning.

| Economic Factor | 2024 Projection/Data | 2025 Projection | Impact on Tronox |

|---|---|---|---|

| Global GDP Growth | 2.6% (IMF) | 3.1% (IMF) | Higher demand for TiO2 during growth periods. |

| TiO2 Market Size | ~$20.8 billion | (Continuing growth) | Market volume and pricing power. |

| TiO2 Market CAGR | 4.5% (2024-2029) | (Continuing growth) | Long-term demand outlook. |

| Inflationary Pressures | Elevated in early 2024 | (Continued concern) | Increased operating costs, potential margin squeeze. |

What You See Is What You Get

Tronox Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Tronox Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future. Understanding these external influences is crucial for strategic planning and risk management within the global chemical industry, particularly for a major producer of titanium dioxide and specialty chemicals.

Sociological factors

There's a clear shift in what consumers want, with a significant rise in demand for products seen as eco-friendly and ethically made. This global movement is pushing Tronox's customers, who make things like paints and plastics, to look for titanium dioxide (TiO2) suppliers who are serious about sustainability. They're asking about responsible mining and a smaller environmental impact.

For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for products with clear sustainability benefits, a figure that has steadily climbed. This means companies like Tronox need to showcase their commitment to greener practices, from how they extract raw materials to their manufacturing processes.

Tronox's progress in this area directly impacts its market standing. By proving its dedication to sustainability, such as through initiatives aimed at reducing greenhouse gas emissions – reporting a 15% reduction in Scope 1 and 2 emissions intensity in their 2023 sustainability report – the company can significantly boost its appeal and gain a crucial edge over competitors who lag in these efforts.

Tronox's mining and chemical processing operations are heavily reliant on a skilled labor force. In 2024, the company's global workforce, exceeding 6,000 employees, underscores the critical nature of labor relations. Ensuring fair compensation and safe working environments is paramount to maintaining operational continuity and productivity.

The availability of specialized skills, particularly in remote mining locations and for complex chemical manufacturing, presents ongoing recruitment challenges. In 2024, industry-wide shortages in skilled trades and engineering roles, as reported by various labor market analyses, can directly influence Tronox's recruitment timelines and associated costs, potentially impacting project development and operational efficiency.

Tronox Holdings emphasizes community engagement to secure its social license to operate at mining and processing locations. This involves clear communication, investing in local development projects, and actively responding to community worries about environmental effects, job creation, and equitable resource distribution. For instance, in 2023, Tronox reported investing $31 million in community initiatives globally, supporting education, health, and infrastructure projects, aiming to foster trust and mitigate operational risks.

Health and Safety Standards

Societal expectations and regulations around workplace health and safety are constantly changing, especially for companies like Tronox operating in mining and chemical production. These evolving standards mean Tronox must consistently meet rigorous requirements to safeguard its workforce, prevent incidents, and avoid legal trouble or harm to its reputation.

Adherence to these health and safety standards is not just about compliance; it's crucial for maintaining employee morale and boosting productivity. A robust safety culture directly impacts how employees feel about their work environment and their ability to perform effectively.

For instance, the mining industry, where Tronox has significant operations, faces particular scrutiny. In 2023, mining-related workplace fatalities in Australia, a key operational region for some mining giants, saw a concerning increase, highlighting the ongoing challenges and the critical need for stringent safety protocols. While specific figures for Tronox are not publicly detailed for this exact period, industry-wide trends underscore the importance of their commitment.

Tronox's commitment to safety is reflected in its reporting and initiatives. For example, companies in this sector often track metrics like Total Recordable Injury Frequency Rate (TRIFR) and Lost Time Injury Frequency Rate (LTIFR). While specific 2024 or early 2025 data for Tronox is still emerging, industry benchmarks for safety performance are a key focus for investor and societal evaluation.

- Evolving Regulations: Increasing societal demand for safer workplaces necessitates continuous updates to health and safety legislation globally.

- Reputational Risk: Failures in health and safety can lead to significant brand damage and loss of public trust.

- Employee Morale: A strong safety record directly correlates with higher employee satisfaction and retention.

- Operational Efficiency: Preventing accidents minimizes disruptions and associated costs, enhancing overall productivity.

Demographic Shifts and Urbanization

Global demographic shifts are significantly reshaping markets for TiO2. The United Nations projects the world population to reach approximately 9.7 billion by 2050, a growth that fuels demand across various sectors. Specifically, the accelerating trend of urbanization, with over half the world's population now living in cities and this figure projected to rise, directly impacts the need for construction materials, including paints and coatings that utilize TiO2. This urban expansion is particularly pronounced in emerging economies, where a growing middle class translates to increased consumption of durable goods and infrastructure projects.

These macro trends create a robust underlying demand for Tronox's core products. As more people move to cities and disposable incomes rise in developing regions, there's a concurrent surge in demand for housing, transportation, and consumer products, all of which rely on TiO2 for opacity, brightness, and durability. For instance, the automotive sector, a key consumer of TiO2-infused plastics and coatings, saw global vehicle production reach approximately 78.5 million units in 2023, demonstrating the scale of this demand. Tronox's strategic planning must account for these evolving demographic patterns to accurately forecast long-term market needs.

Understanding these demographic undercurrents allows Tronox to refine its market forecasting and strategic planning. Key demographic factors influencing TiO2 demand include:

- Global Population Growth: The UN estimates a continued population increase, driving overall demand for manufactured goods.

- Urbanization Rates: By 2050, an estimated 68% of the world's population will be urban, increasing construction and infrastructure needs.

- Emerging Market Middle Class Expansion: A rising middle class in regions like Asia-Pacific leads to greater purchasing power for consumer goods and housing.

- Aging Populations in Developed Nations: While potentially slowing overall growth in some areas, this can shift demand towards specific product categories and healthcare infrastructure.

Societal expectations for ethical business practices and sustainable operations are increasingly influencing consumer and investor behavior, compelling companies like Tronox to prioritize corporate social responsibility. This includes a strong focus on fair labor practices and community well-being, which are critical for maintaining a positive brand image and securing a social license to operate. For instance, Tronox reported investing $31 million in community initiatives globally in 2023, underscoring its commitment to local development and stakeholder engagement.

The availability and stability of a skilled workforce are paramount for Tronox's operational success, particularly in specialized areas like mining and chemical processing. In 2024, addressing industry-wide skill shortages, as highlighted in labor market reports, directly impacts recruitment timelines and costs, potentially affecting project execution and overall efficiency.

Workplace health and safety standards are continuously evolving, demanding rigorous adherence from companies in the mining and chemical sectors. Tronox's proactive management of safety protocols is essential not only for regulatory compliance but also for fostering employee morale and ensuring operational continuity. While specific 2024 safety data for Tronox is still being compiled, industry trends in 2023, such as a concerning rise in mining-related fatalities in certain regions, emphasize the critical importance of robust safety measures.

Demographic shifts, including global population growth and accelerating urbanization, are creating sustained demand for Tronox's titanium dioxide products. The projected increase in urban populations, reaching an estimated 68% by 2050, directly translates to higher demand for construction materials and consumer goods that rely on TiO2 for enhanced performance and aesthetics.

Technological factors

Technological advancements are continuously reshaping titanium dioxide (TiO2) production, focusing on enhanced efficiency and reduced environmental footprints. Tronox is actively investing in research and development, particularly to refine its chloride and sulfate processes. This innovation drive aims to lower operational costs and improve product quality, crucial for meeting evolving global environmental regulations.

For instance, Tronox's ongoing efforts in process optimization are designed to achieve significant energy savings, a critical factor given the energy-intensive nature of TiO2 manufacturing. By improving yields and reducing waste streams, these technological upgrades directly translate to a more competitive cost structure.

Staying ahead in process innovation is paramount for Tronox to maintain its market leadership. The company's commitment to R&D ensures it can adapt to stricter environmental mandates and capitalize on opportunities for more sustainable production methods, ultimately bolstering its long-term viability and competitive advantage.

The quest for more sustainable and cost-effective materials is driving innovation in pigment technology, presenting a potential long-term challenge for TiO2 dominance. While titanium dioxide (TiO2) remains a benchmark for whiteness and opacity, research into alternative pigments, such as advanced composite materials or novel inorganic compounds, could gradually erode TiO2's market share in specific sectors. For instance, advancements in nanostructured materials are being explored for their optical properties, potentially offering comparable performance with reduced environmental impact or at a lower production cost.

Tronox Holdings, as a major player in the TiO2 market, needs to closely track these technological advancements. The company's strategy should include monitoring emerging pigment technologies and their potential adoption rates across key industries like paints, coatings, plastics, and paper. A proactive approach might involve investing in its own research and development to identify new applications for TiO2 or to explore the feasibility of incorporating or developing alternative pigment solutions to diversify its product offering, ensuring resilience against potential market shifts.

Technological progress in mining is crucial for Tronox's vertically integrated operations. Innovations like autonomous haul trucks and advanced drilling systems are streamlining extraction processes. For instance, in 2023, mining companies globally saw a significant uptake in AI-driven predictive maintenance, reducing downtime by an average of 15-20%.

Remote sensing and drone technology offer improved geological surveying and mine planning, leading to better resource utilization. Data analytics are also playing a larger role in optimizing extraction efficiency and minimizing waste. These advancements directly support Tronox's ability to source raw materials competitively.

Furthermore, the development of more environmentally friendly extraction techniques, such as dry mining methods and enhanced water management systems, aligns with sustainability goals and can reduce operational costs. Tronox's investment in these areas is vital for maintaining its edge in the mineral sands market.

Research and Development for New Applications

Tronox Holdings, a major player in the titanium dioxide (TiO2) industry, is actively exploring new frontiers for its core product. Beyond its established roles in paints, plastics, and paper, research and development into novel applications like photocatalysis, advanced solar cells, and specialized materials is a key technological driver for the company. These emerging uses hold the potential to significantly expand market opportunities.

For instance, TiO2's photocatalytic properties are being investigated for environmental remediation, such as air and water purification, and for self-cleaning surfaces. In the renewable energy sector, advancements in TiO2-based dye-sensitized solar cells (DSSCs) and perovskite solar cells could offer more efficient and cost-effective solar energy solutions. Tronox's commitment to R&D in these areas is crucial for diversifying its revenue base and securing future growth by identifying and capitalizing on high-value, innovative applications for titanium dioxide.

The company's investment in research is directly tied to its long-term strategy. For example, Tronox has highlighted its focus on innovation in its 2024 investor presentations, emphasizing the development of new product grades and applications. While specific R&D spending figures for new applications are often embedded within broader R&D budgets, the strategic emphasis suggests a significant allocation. The global TiO2 market, valued at approximately $20 billion in 2023 and projected to grow, benefits from such technological advancements, with new applications potentially unlocking further market expansion beyond the current scope.

- Photocatalysis: Research is ongoing into TiO2's use in breaking down pollutants and creating self-cleaning materials.

- Solar Cells: Advancements in TiO2 utilization for dye-sensitized and perovskite solar cells aim for improved efficiency and lower costs.

- Advanced Materials: Exploration of TiO2 in areas like coatings, electronics, and biomedical applications is expanding its utility.

- Market Diversification: These new applications offer Tronox opportunities to reduce reliance on traditional markets and tap into high-growth sectors.

Digitalization and Data Analytics for Operations

Tronox is increasingly integrating digitalization and advanced data analytics across its entire value chain, from raw material sourcing to final product delivery. This technological shift is designed to unlock substantial operational efficiencies. For instance, predictive maintenance, powered by real-time data from mining and processing equipment, aims to reduce downtime and maintenance costs. In 2024, Tronox reported advancements in its digital transformation initiatives, focusing on optimizing its global supply chain network.

The company is leveraging data analytics for real-time inventory tracking and logistics optimization. This allows for more precise demand forecasting and efficient transportation, minimizing delays and associated expenses. By enhancing decision-making in production planning through these analytical tools, Tronox can better align output with market demand, improving responsiveness and overall productivity. For example, in Q1 2025, the company highlighted the impact of data-driven insights on improving its shipping schedules and reducing fuel consumption.

- Predictive Maintenance: Implementing sensor data and machine learning algorithms to anticipate equipment failures, reducing costly unplanned outages.

- Supply Chain Visibility: Real-time tracking of raw materials and finished goods to optimize inventory levels and improve delivery reliability.

- Logistics Optimization: Utilizing data analytics to streamline transportation routes and modes, leading to cost savings and reduced transit times.

- Enhanced Production Planning: Employing advanced analytics for better forecasting of demand and production scheduling, maximizing asset utilization.

Technological advancements are continuously reshaping titanium dioxide (TiO2) production, focusing on enhanced efficiency and reduced environmental footprints. Tronox is actively investing in research and development, particularly to refine its chloride and sulfate processes. This innovation drive aims to lower operational costs and improve product quality, crucial for meeting evolving global environmental regulations.

For instance, Tronox's ongoing efforts in process optimization are designed to achieve significant energy savings, a critical factor given the energy-intensive nature of TiO2 manufacturing. By improving yields and reducing waste streams, these technological upgrades directly translate to a more competitive cost structure.

Staying ahead in process innovation is paramount for Tronox to maintain its market leadership. The company's commitment to R&D ensures it can adapt to stricter environmental mandates and capitalize on opportunities for more sustainable production methods, ultimately bolstering its long-term viability and competitive advantage.

The quest for more sustainable and cost-effective materials is driving innovation in pigment technology, presenting a potential long-term challenge for TiO2 dominance. While titanium dioxide (TiO2) remains a benchmark for whiteness and opacity, research into alternative pigments, such as advanced composite materials or novel inorganic compounds, could gradually erode TiO2's market share in specific sectors. For instance, advancements in nanostructured materials are being explored for their optical properties, potentially offering comparable performance with reduced environmental impact or at a lower production cost.

Tronox Holdings, as a major player in the TiO2 market, needs to closely track these technological advancements. The company's strategy should include monitoring emerging pigment technologies and their potential adoption rates across key industries like paints, coatings, plastics, and paper. A proactive approach might involve investing in its own research and development to identify new applications for TiO2 or to explore the feasibility of incorporating or developing alternative pigment solutions to diversify its product offering, ensuring resilience against potential market shifts.

Technological progress in mining is crucial for Tronox's vertically integrated operations. Innovations like autonomous haul trucks and advanced drilling systems are streamlining extraction processes. For instance, in 2023, mining companies globally saw a significant uptake in AI-driven predictive maintenance, reducing downtime by an average of 15-20%.

Remote sensing and drone technology offer improved geological surveying and mine planning, leading to better resource utilization. Data analytics are also playing a larger role in optimizing extraction efficiency and minimizing waste. These advancements directly support Tronox's ability to source raw materials competitively.

Furthermore, the development of more environmentally friendly extraction techniques, such as dry mining methods and enhanced water management systems, aligns with sustainability goals and can reduce operational costs. Tronox's investment in these areas is vital for maintaining its edge in the mineral sands market.

Tronox Holdings, a major player in the titanium dioxide (TiO2) industry, is actively exploring new frontiers for its core product. Beyond its established roles in paints, plastics, and paper, research and development into novel applications like photocatalysis, advanced solar cells, and specialized materials is a key technological driver for the company. These emerging uses hold the potential to significantly expand market opportunities.

For instance, TiO2's photocatalytic properties are being investigated for environmental remediation, such as air and water purification, and for self-cleaning surfaces. In the renewable energy sector, advancements in TiO2-based dye-sensitized solar cells (DSSCs) and perovskite solar cells could offer more efficient and cost-effective solar energy solutions. Tronox's commitment to R&D in these areas is crucial for diversifying its revenue base and securing future growth by identifying and capitalizing on high-value, innovative applications for titanium dioxide.

The company's investment in research is directly tied to its long-term strategy. For example, Tronox has highlighted its focus on innovation in its 2024 investor presentations, emphasizing the development of new product grades and applications. While specific R&D spending figures for new applications are often embedded within broader R&D budgets, the strategic emphasis suggests a significant allocation. The global TiO2 market, valued at approximately $20 billion in 2023 and projected to grow, benefits from such technological advancements, with new applications potentially unlocking further market expansion beyond the current scope.

- Photocatalysis: Research is ongoing into TiO2's use in breaking down pollutants and creating self-cleaning materials.

- Solar Cells: Advancements in TiO2 utilization for dye-sensitized and perovskite solar cells aim for improved efficiency and lower costs.

- Advanced Materials: Exploration of TiO2 in areas like coatings, electronics, and biomedical applications is expanding its utility.

- Market Diversification: These new applications offer Tronox opportunities to reduce reliance on traditional markets and tap into high-growth sectors.

Tronox is increasingly integrating digitalization and advanced data analytics across its entire value chain, from raw material sourcing to final product delivery. This technological shift is designed to unlock substantial operational efficiencies. For instance, predictive maintenance, powered by real-time data from mining and processing equipment, aims to reduce downtime and maintenance costs. In 2024, Tronox reported advancements in its digital transformation initiatives, focusing on optimizing its global supply chain network.

The company is leveraging data analytics for real-time inventory tracking and logistics optimization. This allows for more precise demand forecasting and efficient transportation, minimizing delays and associated expenses. By enhancing decision-making in production planning through these analytical tools, Tronox can better align output with market demand, improving responsiveness and overall productivity. For example, in Q1 2025, the company highlighted the impact of data-driven insights on improving its shipping schedules and reducing fuel consumption.

- Predictive Maintenance: Implementing sensor data and machine learning algorithms to anticipate equipment failures, reducing costly unplanned outages.

- Supply Chain Visibility: Real-time tracking of raw materials and finished goods to optimize inventory levels and improve delivery reliability.

- Logistics Optimization: Utilizing data analytics to streamline transportation routes and modes, leading to cost savings and reduced transit times.

- Enhanced Production Planning: Employing advanced analytics for better forecasting of demand and production scheduling, maximizing asset utilization.

| Technological Factor | Description | Impact on Tronox | Examples/Data (2023-2025) | Strategic Relevance |

| Process Innovation | Improving efficiency and sustainability of TiO2 production methods. | Lower operational costs, enhanced product quality, compliance with regulations. | Energy savings in manufacturing; reduced waste streams. | Maintaining market leadership, competitive cost structure. |

| Alternative Pigments | Development of new materials that could compete with TiO2. | Potential market share erosion in specific sectors. | Nanostructured materials with optical properties. | Monitoring emerging technologies, potential diversification. |

| Mining Technology | Adoption of automation and data analytics in extraction. | Streamlined operations, better resource utilization, cost competitiveness. | AI-driven predictive maintenance reducing downtime by 15-20% (2023); autonomous haul trucks. | Competitive raw material sourcing, operational efficiency. |

| New TiO2 Applications | Exploring uses beyond traditional markets (e.g., photocatalysis, solar cells). | Market expansion, revenue diversification, future growth opportunities. | TiO2 in environmental remediation; advanced solar cells. | Securing future growth, capitalizing on high-value applications. |

| Digitalization & Analytics | Integrating data and digital tools across the value chain. | Operational efficiencies, improved decision-making, supply chain optimization. | Advancements in digital transformation initiatives (2024); improved shipping schedules and reduced fuel consumption (Q1 2025). | Enhanced productivity, responsiveness, and asset utilization. |

Legal factors

Tronox Holdings navigates a dense regulatory landscape, with environmental protection laws significantly impacting its mining and processing operations worldwide. These regulations dictate standards for air emissions, water quality, waste management, and land reclamation, essential for maintaining operational licenses.

Obtaining and renewing the multitude of environmental permits required is a substantial undertaking, often involving lengthy approval processes and considerable financial investment. For instance, in 2023, Tronox reported ongoing efforts to manage environmental compliance across its global sites, which directly influences capital expenditure and operational planning.

Failure to adhere to these environmental mandates can trigger severe penalties, including hefty fines and enforced operational suspensions. Such non-compliance risks not only disrupt production but also damage the company's reputation and shareholder value, as seen in past environmental enforcement actions against industry peers.

Tronox, operating in the mining and chemical sectors, faces stringent Occupational Health and Safety (OHS) regulations designed to ensure worker well-being and prevent hazardous incidents. These laws require robust safety protocols, meticulous handling of chemicals, and comprehensive employee training programs. For instance, in 2023, mining operations globally saw a continued focus on reducing lost-time injury frequency rates, with many companies reporting rates below 1.0 per 200,000 hours worked, reflecting the industry's commitment to OHS.

Compliance with these OHS standards is not merely a legal obligation but a critical business imperative. Failure to adhere can lead to severe consequences, including significant fines, costly investigations by regulatory bodies, and damage to Tronox's reputation. In 2024, regulatory bodies in key operating regions like Australia and South Africa have increased oversight and penalties for OHS violations, underscoring the financial and operational risks associated with non-compliance.

Antitrust and competition laws are a significant legal factor for Tronox Holdings as a global leader in the titanium dioxide (TiO2) industry. These regulations, enforced by bodies like the U.S. Federal Trade Commission (FTC) and the European Commission, aim to prevent market manipulation and ensure fair competition. For instance, the FTC actively scrutinizes mergers and acquisitions to prevent excessive market concentration, which could impact Tronox's strategic growth plans.

Tronox's pricing strategies and distribution agreements are also under scrutiny. Authorities monitor for potential collusion or anti-competitive practices that could harm consumers or smaller market participants. Failure to comply can result in severe penalties; for example, in 2023, a chemical company faced a €1.1 billion fine from the European Commission for participating in a cartel.

The company must navigate a complex web of regulations across different jurisdictions, each with its own interpretation and enforcement priorities. This requires ongoing legal counsel and robust internal compliance programs to ensure all commercial activities, from product pricing to market access, adhere to these critical laws and avoid substantial fines or legal disputes.

Intellectual Property Rights

Intellectual property rights are a cornerstone for Tronox Holdings, given its reliance on proprietary technologies for titanium dioxide production and mineral sands beneficiation. The company’s competitive edge is directly tied to the legal protection afforded to its innovations through patents, trademarks, and trade secrets. Tronox actively manages its patent portfolio, which included approximately 3,000 granted patents and pending applications globally as of its 2023 annual report, to safeguard its technological advancements.

Maintaining and defending these IP rights is crucial. Tronox must vigilantly monitor for and address any potential infringement to preserve its market position. The company’s strategy involves not only securing new intellectual property but also strategically enforcing its existing rights to prevent unauthorized use of its core technologies.

- Patented Technologies: Tronox holds patents covering its specialized processes for titanium dioxide (TiO2) manufacturing and mineral processing.

- Trade Secrets: Critical operational know-how and proprietary formulations are protected as trade secrets, providing an ongoing competitive advantage.

- Global Protection: IP protection is sought and maintained across key operating and market regions worldwide.

- Enforcement: The company actively defends its IP rights against infringements to maintain its technological exclusivity.

International Trade Laws and Customs Regulations

Tronox Holdings operates a complex global supply chain and sales network, making adherence to diverse international trade laws and customs regulations absolutely critical. These legal structures govern the movement of goods across borders, specifying everything from necessary paperwork and product categorization to applicable duties and tariffs. For instance, the Harmonized System (HS) codes used for classifying goods can vary in interpretation and application across different countries, impacting import duties. In 2024, the World Trade Organization (WTO) continued its efforts to streamline trade facilitation agreements, aiming to reduce border compliance costs, which can directly affect companies like Tronox. Navigating these requirements ensures efficient logistics, prevents costly delays, and avoids significant penalties, ultimately influencing the overall cost-effectiveness of Tronox's worldwide operations.

Compliance with these evolving international trade frameworks is paramount for Tronox. Changes in trade policies, such as the implementation of new tariffs or the modification of non-tariff barriers, can directly impact the company's profitability and market access. For example, if a major trading partner were to impose stricter import quotas on titanium dioxide, a key product for Tronox, it could disrupt supply chains and necessitate adjustments to sales strategies. The company must remain vigilant in monitoring these legal shifts to maintain smooth cross-border transactions and safeguard its competitive position in the global market.

- Global Trade Compliance: Tronox must navigate over 100 countries' customs regulations, each with unique documentation and classification requirements for its titanium dioxide and zircon products.

- Tariff and Duty Management: Fluctuations in import duties, such as potential tariff increases on raw materials or finished goods in key markets like Europe or Asia, directly affect product pricing and profitability.

- Import/Export Controls: Adherence to export control regulations, including those related to dual-use goods or sanctioned entities, is essential to avoid severe legal repercussions and reputational damage.

- Trade Facilitation Agreements: Leveraging international agreements aimed at simplifying customs procedures, like the WTO's Trade Facilitation Agreement, can reduce transit times and associated costs for Tronox's shipments.

Tronox faces significant legal and regulatory scrutiny in its operations, particularly concerning environmental compliance and worker safety. The company must adhere to stringent rules regarding emissions, waste, and land reclamation, with permits often requiring lengthy and costly approval processes. For instance, during 2023, Tronox highlighted ongoing environmental compliance efforts across its global sites, directly impacting capital expenditures and operational planning.

Antitrust and competition laws are also critical, as Tronox operates as a major player in the titanium dioxide market. Regulatory bodies like the FTC and European Commission monitor pricing and distribution to prevent anti-competitive practices. In 2023, a chemical company received a €1.1 billion fine for cartel involvement, underscoring the severe financial penalties for non-compliance.

Intellectual property rights are vital for Tronox's competitive edge, with the company holding approximately 3,000 granted patents and pending applications globally as of its 2023 annual report. Protecting these innovations through patents, trademarks, and trade secrets is crucial for maintaining technological exclusivity and market position.

International trade laws and customs regulations are paramount for Tronox's global supply chain. Navigating over 100 countries' customs requirements for its titanium dioxide and zircon products ensures efficient logistics and avoids penalties. For example, changes in import duties or stricter quotas in key markets can significantly affect profitability and market access, requiring constant vigilance in monitoring evolving trade policies.

Environmental factors

Tronox's titanium dioxide (TiO2) production is inherently energy-intensive, leading to significant carbon emissions. This places the company directly in the crosshairs of global decarbonization efforts and tightening climate change regulations. For instance, as of early 2024, many regions are implementing or strengthening carbon pricing mechanisms, directly increasing the cost of operations for emitters like Tronox.

The company's strategic response to these environmental pressures involves substantial investment in energy efficiency upgrades across its facilities and a serious exploration of renewable energy sources to power its operations. For example, by 2025, Tronox aims to further integrate energy-saving technologies, potentially reducing its Scope 1 and Scope 2 emissions. This proactive approach is crucial for meeting its own corporate sustainability targets and navigating the evolving landscape of environmental accountability.

Tronox's extensive mining and chemical processing operations demand significant water resources, placing water management and wastewater treatment at the forefront of its environmental responsibilities. The company's sustainability reports highlight its commitment to responsible water use, a crucial factor given the water-intensive nature of titanium dioxide production. For instance, in 2023, Tronox reported on its efforts to reduce freshwater withdrawal intensity across its global sites, aiming for a 15% reduction by 2030 against a 2019 baseline, demonstrating a clear focus on this critical resource.

Navigating the complex web of water regulations is paramount for Tronox. These regulations dictate everything from how much water can be withdrawn to the quality standards for discharged wastewater, directly impacting operational costs and permitting. The company's adherence to these stringent rules, including those related to pollution prevention and discharge limits, is essential for maintaining its license to operate and avoiding potential penalties. Effective wastewater treatment is not just a compliance issue but a core component of minimizing their ecological footprint.

Tronox Holdings generates a significant amount of waste, including mineral processing residues and chemical byproducts from its operations. For example, in 2023, the company reported managing substantial volumes of tailings and other waste streams, with specific figures detailed in their sustainability reports. Stringent environmental regulations worldwide govern the handling, storage, and final disposal of these materials to prevent any harm to land and water resources.

Compliance with these regulations necessitates ongoing investment in robust waste management infrastructure and practices. Tronox is actively exploring avenues for waste valorization, aiming to transform waste materials into valuable resources, thereby enhancing resource efficiency and minimizing environmental impact. Failure to adhere to these strict requirements can result in significant environmental liabilities and reputational damage.

Biodiversity Conservation and Land Rehabilitation

Tronox Holdings, as a global mining company, operates within diverse natural landscapes, making biodiversity conservation and land rehabilitation critical environmental factors. The company is obligated to implement comprehensive plans to protect native species and restore disturbed areas after mining activities cease. This commitment is essential for maintaining its social license to operate and securing regulatory approvals. For instance, in 2024, Tronox reported progress on its rehabilitation programs across various sites, aiming to return land to a state that supports local ecosystems.

Adherence to these environmental standards is not just a matter of compliance but also a key indicator of responsible corporate citizenship. Failure to meet biodiversity targets or effectively rehabilitate land can lead to significant reputational damage and operational disruptions. Tronox's 2024 sustainability report highlighted investments in biodiversity monitoring and the development of new rehabilitation techniques.

- Biodiversity Management Plans: Tronox develops site-specific plans to minimize impacts on flora and fauna, including measures for species protection and habitat restoration.

- Land Rehabilitation Goals: The company sets targets for the successful rehabilitation of mined-out areas, focusing on re-establishing native vegetation and ecological functions.

- Regulatory Compliance: Tronox ensures its operations align with national and international environmental regulations concerning biodiversity and land rehabilitation.

- Stakeholder Engagement: Collaboration with local communities and environmental organizations is integral to developing and implementing effective conservation strategies.

Circular Economy Principles

The global push for circular economy principles is reshaping industrial practices, emphasizing waste reduction and efficient resource management through recycling, reuse, and extending product lifespans. For Tronox, this movement presents a strategic imperative to investigate avenues for recovering titanium dioxide (TiO2) from retired products, thereby maximizing the value derived from mineral sands and diminishing the ecological footprint across its value chain. This embrace of circularity is likely to spur innovation, unlock cost efficiencies, and bolster the company's environmental credentials.

Key implications for Tronox include:

- Resource Optimization: Investigating methods to recycle TiO2 from post-consumer and post-industrial waste streams, potentially reducing reliance on virgin materials.

- Product Lifecycle Management: Focusing on product design and manufacturing processes that enhance durability and facilitate easier disassembly and material recovery.

- Environmental Impact Reduction: Minimizing waste generation at every stage of operations, from mining to product delivery, aligning with increasing regulatory and consumer expectations.

- Market Opportunities: Developing new business models centered on resource recovery and closed-loop systems, creating competitive advantages in a resource-constrained world.

Environmental regulations are a significant concern for Tronox, particularly regarding emissions and resource usage. As of early 2024, carbon pricing mechanisms are increasingly being implemented globally, directly impacting the cost of operations for companies like Tronox. These regulations necessitate substantial investments in energy efficiency and renewable energy sources to meet corporate sustainability targets and navigate evolving environmental accountability standards.

Water management is another critical environmental factor for Tronox due to the water-intensive nature of TiO2 production. By 2030, the company aims to reduce freshwater withdrawal intensity by 15% compared to a 2019 baseline, highlighting a strong commitment to responsible water use. Strict adherence to water withdrawal and wastewater discharge regulations is essential for operational continuity and avoiding penalties.

Waste management and biodiversity conservation are also key environmental considerations. Tronox manages substantial waste streams, requiring compliance with global regulations for handling and disposal to prevent environmental harm. The company is also actively engaged in land rehabilitation programs and biodiversity monitoring, with investments in new techniques reported in 2024 to ensure alignment with environmental standards and maintain its social license to operate.

The growing emphasis on circular economy principles encourages Tronox to explore avenues for resource recovery, such as recycling TiO2 from retired products. This strategic shift aims to maximize value, reduce reliance on virgin materials, and minimize the company's ecological footprint. By 2025, Tronox is exploring further integration of energy-saving technologies to reduce emissions.

PESTLE Analysis Data Sources

Our PESTLE analysis for Tronox Holdings draws from a robust dataset including reports from the International Energy Agency (IEA), the U.S. Environmental Protection Agency (EPA), and key financial institutions like the World Bank. This ensures a comprehensive understanding of political, economic, and environmental factors impacting the titanium dioxide industry.