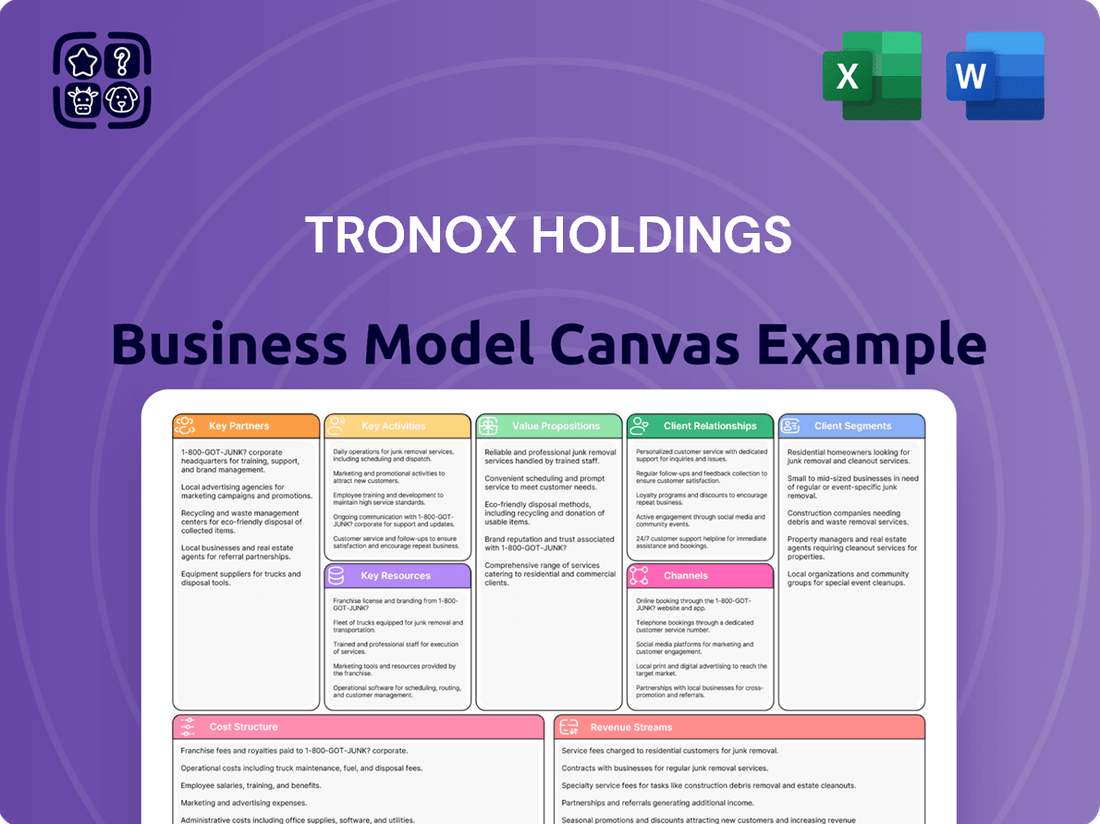

Tronox Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tronox Holdings Bundle

Unlock the full strategic blueprint behind Tronox Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value through its integrated titanium dioxide operations and global reach, captures market share by leveraging its extensive resource base, and stays ahead in a competitive landscape by focusing on operational efficiency and innovation. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading pigment producer.

Partnerships

Tronox Holdings plc strategically partners with key suppliers for critical ancillary materials, including chemicals, energy, and various consumables vital to its titanium dioxide (TiO2) production. These partnerships are not merely transactional; they are foundational to maintaining a consistent and cost-effective inflow of essential inputs that supplement the company's mined mineral sands.

For instance, in 2024, Tronox continued to solidify its relationships with global chemical providers to secure necessary reagents for the ore processing and pigment manufacturing stages. The company’s operational efficiency and cost management are directly influenced by the reliability and pricing of these supplier agreements, ensuring that production lines remain active and competitive in the global market.

Maintaining robust ties with these strategic suppliers is paramount for operational continuity and overall efficiency. These relationships enable Tronox to navigate supply chain complexities, mitigate potential disruptions, and optimize input costs, which directly impacts the company's profitability and its ability to meet market demand effectively.

Tronox Holdings actively pursues technology and R&D collaborations with leading research institutions and specialized technology firms. These partnerships are crucial for enhancing pigment properties, such as durability and opacity, and for pioneering novel applications for titanium dioxide. For example, in 2024, Tronox continued its work with universities on advanced photocatalytic materials, aiming to integrate these into coatings for improved air purification capabilities.

These strategic alliances are instrumental in driving innovation and ensuring Tronox maintains a competitive edge. By leveraging external expertise, the company can accelerate the development of next-generation products and processes, ultimately improving product performance and meeting evolving customer demands in sectors like automotive and construction.

Access to cutting-edge research and development through these collaborations allows Tronox to remain at the forefront of material science. This continuous influx of advanced knowledge supports the company's commitment to sustainability and the development of more environmentally friendly pigment solutions.

Tronox Holdings relies heavily on its logistics and shipping providers to maintain its global operations. These partnerships are essential for moving raw materials like ilmenite and rutile from mining sites to processing plants and then delivering finished titanium dioxide (TiO2) products to customers across the globe. For instance, in 2023, Tronox generated $2.2 billion in revenue, underscoring the sheer volume of product needing efficient transport.

The company's extensive global footprint necessitates strong relationships with a variety of shipping companies and freight forwarders. These collaborations ensure that Tronox can navigate international trade regulations and manage the complexities of cross-border transportation, whether by sea, rail, or road. Reliable logistics are paramount to meeting customer demand and managing inventory effectively across its diverse markets.

Efficient logistics directly impact Tronox's ability to deliver products on time, a critical factor in customer satisfaction and competitive advantage within the TiO2 industry. These partnerships are not just about moving goods; they are about ensuring the integrity of the supply chain, minimizing transit times, and optimizing costs to support profitability. For a company operating in multiple continents, these relationships are foundational.

Equipment and Machinery Vendors

Tronox Holdings relies heavily on its partnerships with manufacturers of mining equipment, processing machinery, and plant infrastructure to keep its operations running smoothly. These relationships are vital for both maintaining existing facilities and acquiring the latest technology to boost efficiency. For instance, in 2024, Tronox continued to invest in upgrading its mining fleets and processing plants, underscoring the importance of these vendor relationships. Access to timely spare parts and expert maintenance services from these vendors directly impacts production uptime and cost control, which are critical for profitability in the titanium dioxide industry.

These strategic alliances ensure Tronox has access to cutting-edge equipment and the necessary support to operate it effectively. This is fundamental for maintaining high production volumes and achieving operational efficiencies, which are key competitive advantages. In 2024, Tronox's capital expenditure of approximately $350 million was largely directed towards growth projects and sustaining capital, much of which involved new equipment procurement and upgrades from these key equipment and machinery vendors.

- Access to Advanced Technology: Partnerships ensure Tronox can integrate the newest mining and processing technologies, improving extraction and refining processes.

- Reliability and Uptime: Strong vendor relationships guarantee the availability of critical spare parts and maintenance services, minimizing costly production downtime.

- Operational Efficiency: Up-to-date and well-maintained equipment from trusted vendors is essential for maximizing output and controlling operational costs.

- Strategic Upgrades: Collaboration with manufacturers facilitates the planning and execution of plant upgrades and new equipment installations, supporting long-term growth strategies.

Local Community and Government Relations

Tronox Holdings prioritizes robust engagement with local communities and government entities in its operational areas. This collaboration is fundamental for obtaining necessary permits and maintaining a social license to operate, which is critical for long-term sustainability. For example, in 2024, Tronox continued its proactive dialogue with stakeholders in Western Australia, where its mining operations are significant, to address environmental concerns and community development initiatives.

These partnerships are built on open communication, community investment programs, and strict adherence to evolving regulatory frameworks. By fostering these relationships, Tronox aims to ensure responsible environmental stewardship and mitigate operational risks. The company's commitment to community development, including job creation and infrastructure support, underpins its approach to building trust and ensuring smooth operations.

- Permitting and Social License: Essential for securing operational approvals and maintaining community acceptance.

- Environmental Stewardship: Adherence to regulations and proactive engagement on environmental impact.

- Community Investment: Programs focused on local development, job creation, and social well-being.

- Risk Mitigation: Strong relationships reduce the likelihood of operational disruptions and regulatory challenges.

Key partnerships for Tronox Holdings are crucial for securing essential inputs, driving innovation, and ensuring seamless global operations. These relationships span from critical raw material suppliers and technology collaborators to logistics providers and equipment manufacturers.

In 2024, Tronox continued to strengthen ties with chemical suppliers for reagents and invested in R&D collaborations with universities on advanced materials. The company also relied on a robust network of shipping partners to manage its extensive global supply chain, which supported its 2023 revenue of $2.2 billion. Furthermore, strategic vendor relationships were vital for equipment upgrades, with approximately $350 million in capital expenditure in 2024 allocated to new machinery and plant improvements.

These diverse partnerships are fundamental to Tronox's ability to maintain production efficiency, control costs, and deliver products reliably to customers worldwide, underpinning its competitive position in the titanium dioxide market.

What is included in the product

Tronox Holdings' Business Model Canvas centers on its vertically integrated operations in the mining and processing of titanium dioxide (TiO2) and zircon, serving diverse industrial customers. Its value proposition lies in providing high-quality, essential pigments and minerals, leveraging its global asset base and cost leadership.

Tronox Holdings' Business Model Canvas acts as a pain point reliever by offering a high-level, one-page snapshot of their complex operations, simplifying the understanding of their titanium dioxide and mineral sands value chain for stakeholders.

This concise canvas effectively addresses the pain of information overload by condensing Tronox's extensive strategy into a digestible format, ideal for quick reviews and identifying core components.

Activities

At the heart of Tronox Holdings' operations lies the critical activity of mineral sands mining and processing. This involves extracting valuable titanium-bearing mineral sands from the earth and then undertaking initial processing steps to concentrate these minerals. This foundational stage is absolutely crucial for Tronox's vertically integrated business model, as it directly ensures a consistent and controlled supply of their primary raw material. In 2023, Tronox reported producing 1.2 million tonnes of heavy mineral concentrate, highlighting the scale of this core activity.

The company's commitment to efficient and responsible mining practices is paramount. These practices are not only vital for the long-term sustainability of their operations but also play a significant role in managing operational costs effectively. For instance, Tronox continues to invest in advanced mining technologies to improve recovery rates and minimize environmental impact. Their focus on responsible resource management is a key differentiator.

Tronox's core activity involves transforming processed mineral sands into high-quality titanium dioxide (TiO2) pigment. This sophisticated process utilizes advanced chemical and thermal techniques to achieve the desired pigment properties. For instance, in 2023, Tronox reported that its pigment segment generated approximately $2.7 billion in revenue, highlighting the scale and importance of this manufacturing operation.

This manufacturing requires deep technical knowledge and rigorous quality assurance at every stage. The company's expertise ensures the production of a consistent, high-purity TiO2 pigment, which is fundamental to its customer value proposition. This consistency is crucial for industries relying on TiO2 for color, opacity, and UV protection in products ranging from paints to plastics.

Continuous process optimization is key to maintaining efficiency and cost-effectiveness in TiO2 pigment production. Tronox invests in research and development to refine its manufacturing methods, aiming to reduce waste and energy consumption. For example, improvements in chloride process technology, a key method used by Tronox, have led to significant gains in product yield and environmental performance over the years.

Tronox Holdings' commitment to Research and Development is central to its strategy, with ongoing efforts focused on enhancing titanium dioxide (TiO2) properties and creating new grades tailored for specific customer applications. This drive for innovation is crucial for adapting to changing market demands and solidifying its position as a leader in the industry.

The company's R&D initiatives also prioritize improving production efficiency and exploring more sustainable manufacturing processes. For instance, in 2023, Tronox reported investing $161 million in capital expenditures, a significant portion of which supports these ongoing innovation and efficiency projects, underscoring their importance for future growth and environmental responsibility.

By consistently investing in R&D, Tronox ensures it remains at the forefront of technological advancements within the TiO2 sector. This forward-looking approach allows them to develop and offer cutting-edge solutions, meeting the sophisticated needs of diverse industries and maintaining a competitive edge in the global market.

Global Sales and Marketing

Global Sales and Marketing is crucial for Tronox, involving understanding what customers need, highlighting how their products solve problems, and keeping track of client relationships. This activity is all about reaching the right people and making sure sales keep going up. They focus on building lasting connections with their customers.

Their sales and marketing efforts are designed to drive demand for their titanium dioxide products across various industries. In 2023, Tronox reported that their sales and marketing teams were instrumental in securing new contracts and expanding their market presence, contributing to their overall revenue performance.

- Customer Needs Identification: Tronox actively researches market trends and engages with customers to understand evolving requirements for pigments and chemicals.

- Product Promotion: They showcase the technical advantages and application benefits of their titanium dioxide products through industry events, digital platforms, and direct sales engagement.

- Account Management: Dedicated teams manage key customer accounts, ensuring consistent supply, technical support, and fostering long-term partnerships.

- Geographic Market Execution: Tronox employs a global sales force with regional expertise to tailor strategies and effectively serve diverse international markets.

Supply Chain Management

Tronox Holdings, as a vertically integrated producer of titanium dioxide (TiO2) and other chemicals, places immense importance on managing its entire supply chain. This involves everything from securing raw materials like ilmenite ore and other feedstocks to the final delivery of finished products to global customers. In 2024, Tronox continued to focus on optimizing these processes to ensure cost efficiency and reliable product availability, a cornerstone for their industrial clientele.

Efficient supply chain management is absolutely crucial for Tronox. It directly impacts their ability to control costs associated with mining, processing, and transportation, while simultaneously guaranteeing that their TiO2 pigments and other products reach customers when and where they are needed. This operational efficiency directly contributes to customer satisfaction and strengthens their market position.

Key activities within Tronox's supply chain management include:

- Global Sourcing and Procurement: Securing consistent and cost-effective access to essential raw materials like ilmenite, rutile, and other feedstocks from diverse global suppliers.

- Logistics and Transportation: Managing the complex movement of raw materials to processing plants and finished goods to customers worldwide, utilizing various modes of transport to minimize transit times and costs.

- Inventory Management: Maintaining optimal levels of raw materials, work-in-progress, and finished goods across its network to meet demand without incurring excessive holding costs.

- Distribution Network Oversight: Operating and coordinating a global network of warehouses and distribution centers to ensure timely and efficient product delivery to a broad customer base.

Tronox's key activities are centered around vertically integrated operations. This begins with the mining and processing of mineral sands to secure raw materials, extending to the sophisticated manufacturing of titanium dioxide (TiO2) pigment. Innovation through Research and Development is vital for product enhancement and process efficiency, while global sales and marketing ensure market reach and customer relationships. Effective supply chain management underpins the entire operation, ensuring timely delivery of products worldwide.

In 2023, Tronox demonstrated significant operational scale and market presence. The company's commitment to innovation is reflected in its capital expenditures, and its sales and marketing efforts directly contributed to revenue generation. Supply chain optimization remains a constant focus to ensure cost efficiency and product availability.

| Key Activity | Description | 2023/2024 Data Point | Impact/Focus |

| Mineral Sands Mining & Processing | Extraction and initial concentration of titanium-bearing minerals. | 1.2 million tonnes of heavy mineral concentrate produced in 2023. | Ensures consistent, controlled raw material supply; cost management. |

| TiO2 Pigment Manufacturing | Transforming processed sands into high-quality TiO2 pigment. | Segment revenue of approximately $2.7 billion in 2023. | Core value creation; requires technical expertise and quality assurance. |

| Research & Development | Enhancing TiO2 properties, developing new grades, and improving processes. | $161 million in capital expenditures in 2023, supporting innovation. | Maintains competitive edge; meets evolving market demands; sustainability. |

| Global Sales & Marketing | Understanding customer needs, promoting products, and managing relationships. | Instrumental in securing new contracts and expanding market presence in 2023. | Drives demand; builds long-term customer partnerships. |

| Supply Chain Management | Managing raw material sourcing, logistics, inventory, and distribution. | Ongoing focus in 2024 on optimization for cost efficiency and availability. | Ensures reliable product delivery; impacts customer satisfaction and market position. |

Preview Before You Purchase

Business Model Canvas

The preview you are seeing is a direct representation of the complete Tronox Holdings Business Model Canvas you will receive upon purchase. This means the structure, content, and formatting are exactly as they will be delivered, ensuring no surprises and immediate usability. You are not viewing a sample or a mockup; this is an authentic snapshot of the final document. Once your order is processed, you will gain full access to this ready-to-use Business Model Canvas, allowing you to immediately leverage its insights for strategic planning and decision-making.

Resources

Tronox Holdings' extensive mineral reserves of titanium-bearing sands, primarily ilmenite and rutile, are the bedrock of its vertically integrated business model. These reserves, located in key regions like Western Australia, South Africa, and Mozambique, provide a secure and long-term supply of essential raw materials for its pigment and titanium dioxide production. As of the end of 2023, Tronox reported approximately 892 million tonnes of proven and probable mineral reserves, a crucial asset base that underpins its market position.

The company's secure mining rights and access to high-quality, cost-effective deposits represent a significant competitive advantage in the global titanium dioxide market. This access allows Tronox to control a substantial portion of its value chain, from extraction to final product, mitigating supply chain risks and enhancing operational efficiency. In 2024, continued exploration and development efforts are focused on maintaining and expanding these critical reserves.

Tronox's manufacturing plants and infrastructure are the backbone of its operations, featuring state-of-the-art facilities for titanium dioxide (TiO2) pigment production and mineral processing. These physical assets are critical for achieving large-scale, efficient output of its core products. In 2023, Tronox reported that its global operations included significant TiO2 production capacity, underscoring the importance of these physical resources.

The company's infrastructure encompasses specialized chemical processing units, robust energy supply systems, and advanced quality control laboratories. These components are vital for maintaining product consistency and meeting stringent industry standards. For example, the technological sophistication of these plants directly influences both the volume of production and the high quality of the TiO2 pigments supplied to customers worldwide.

Intellectual Property and Proprietary Technology are cornerstone resources for Tronox Holdings. Their portfolio includes patents and trade secrets focused on titanium dioxide (TiO2) production, advanced pigment formulations, and specific application techniques. This proprietary knowledge grants a significant competitive advantage, enabling the creation of unique, high-performance products.

Tronox’s commitment to innovation is evident in its continuous investment in research and development, which safeguards its market position. For instance, in 2023, the company reported R&D expenses of $76 million, a clear indication of their dedication to maintaining and expanding their technological leadership in the TiO2 industry.

Skilled Workforce and Technical Expertise

Tronox Holdings relies heavily on a highly skilled workforce. This includes geologists who identify and assess mineral reserves, chemical engineers who optimize production processes, and experienced process operators who ensure efficient and safe plant operations. Their collective technical expertise is fundamental to the company's success.

The company's sales professionals are also a key resource, leveraging their deep understanding of titanium dioxide (TiO2) markets and customer needs to build and maintain strong relationships. This human capital drives innovation in product development and application, directly impacting market share and profitability.

In 2024, Tronox continued to invest in its people through targeted training and development programs. For instance, their commitment to operational excellence is reflected in programs designed to enhance the skills of their plant operators, aiming to reduce downtime and improve yield.

- Geologists and mining engineers ensure efficient and responsible resource extraction.

- Chemical and process engineers optimize production, driving efficiency and quality.

- Skilled plant operators maintain safe and high-performing operations.

- Sales and technical support teams foster customer loyalty and drive demand.

Global Distribution Network

Tronox Holdings' global distribution network is a cornerstone of its business model, leveraging a robust infrastructure of warehouses, logistics hubs, and transportation channels. This extensive network is crucial for the efficient and timely delivery of titanium dioxide (TiO2) products to a diverse customer base spanning over 100 countries. In 2023, Tronox managed its supply chain across numerous global sites, ensuring product availability and responsiveness to market demands. This physical and organizational resource directly underpins customer satisfaction and the company's broad market penetration.

The effectiveness of this network is a key differentiator, enabling Tronox to meet the varied needs of industries such as paints and coatings, plastics, and paper. For instance, the company's strategic placement of distribution centers minimizes lead times and transportation costs, enhancing its competitive edge. This operational efficiency is vital for maintaining strong customer relationships and capturing market share in the highly competitive TiO2 sector.

- Global Reach: Tronox operates a distribution network that serves customers in over 100 countries, underscoring its extensive international presence.

- Logistical Efficiency: The network includes strategically located warehouses and transportation assets designed to optimize delivery and minimize costs for its titanium dioxide products.

- Customer Satisfaction: This well-established infrastructure directly contributes to meeting customer delivery expectations, a critical factor in maintaining client loyalty and expanding market reach.

- Competitive Advantage: An efficient and reliable distribution system allows Tronox to respond effectively to market dynamics and customer needs, providing a significant advantage in the global TiO2 market.

Tronox's key resources are deeply rooted in its substantial mineral reserves, particularly ilmenite and rutile, which are the primary feedstocks for its titanium dioxide (TiO2) production. These reserves are strategically located in resource-rich areas, ensuring a consistent and long-term supply. As of the close of 2023, Tronox held approximately 892 million tonnes of proven and probable mineral reserves, a testament to its significant resource base.

The company's manufacturing facilities and advanced production technologies are critical for transforming these raw materials into high-quality TiO2 pigments. These assets represent a significant capital investment and are central to Tronox's operational capacity and product quality. In 2023, Tronox's global operations included substantial TiO2 production capacity, highlighting the importance of these physical resources.

Intellectual property, including proprietary production processes and patented pigment formulations, provides Tronox with a distinct competitive edge. Continuous investment in research and development, evidenced by $76 million spent in 2023, fuels innovation and maintains technological leadership in the TiO2 industry.

A highly skilled workforce, encompassing geologists, engineers, and experienced operators, is indispensable to Tronox's success. Their expertise ensures efficient resource management, optimized production, and safe, reliable operations. Furthermore, a global distribution network ensures timely product delivery to customers worldwide, reinforcing market presence and customer satisfaction.

Value Propositions

Tronox's high-quality TiO2 pigments are a cornerstone value proposition, offering exceptional whiteness, brightness, opacity, and durability. These attributes are vital for customers in industries like paints, coatings, plastics, and paper, where visual appeal and product longevity are paramount. For instance, in 2024, demand for TiO2 remained robust, driven by construction and automotive sectors, where pigment performance directly impacts product quality and marketability.

The consistent quality of Tronox's TiO2 ensures that customers can rely on their end products to meet stringent performance standards and consumer expectations. This reliability fosters strong customer relationships and reduces the likelihood of product returns or quality-related issues. In 2024, Tronox continued to focus on operational excellence, aiming to maintain its reputation for dependable pigment supply.

By providing pigments that enhance aesthetics and performance, Tronox enables its customers to differentiate their offerings in competitive markets. This means paints that cover better, plastics that resist UV degradation, and paper that appears brighter. The global TiO2 market, valued at over $25 billion in 2023, underscores the significant economic impact of these pigment properties.

Tronox's vertically integrated model, controlling the entire process from mining titanium ore to producing finished titanium dioxide (TiO2) pigment, offers customers unparalleled supply reliability. This integration shields clients from the volatility and potential disruptions inherent in external raw material markets, ensuring a consistent and secure source of essential TiO2.

This end-to-end control translates directly into minimized supply chain risks for customers, a critical advantage, especially in today's unpredictable global economic landscape. For instance, Tronox's 2023 financial reports highlighted their commitment to operational efficiency, which underpins this supply assurance.

By managing upstream mining and downstream pigment production, Tronox provides a robust buffer against market fluctuations. This inherent reliability is a key differentiator, offering customers peace of mind and operational stability that external market sourcing simply cannot match.

Tronox offers crucial technical support and deep application expertise, guiding customers on how to best integrate titanium dioxide (TiO2) into their unique product recipes. This hands-on assistance helps clients achieve superior performance and overcome any technical hurdles they face.

By providing this value-added service, Tronox not only helps customers succeed but also builds stronger, more loyal partnerships. For instance, in 2024, Tronox's customer support initiatives were instrumental in several key product launches across the coatings and plastics sectors, highlighting the practical impact of their expertise.

Sustainability and Responsible Sourcing

Tronox Holdings emphasizes sustainability and responsible sourcing as a core value proposition. This commitment resonates deeply with customers who are increasingly scrutinizing their supply chains for environmental and ethical credentials. By focusing on sustainable mining practices and responsible environmental stewardship, Tronox offers a compelling advantage to environmentally conscious clients.

This dedication translates into tangible benefits such as reducing their overall environmental footprint and championing ethical labor practices throughout their operations. For instance, in 2023, Tronox reported a 14% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating progress in their environmental stewardship efforts. This focus on responsible operations makes them a preferred partner for businesses prioritizing sustainability.

- Sustainable Mining Practices: Tronox invests in technologies and processes aimed at minimizing environmental impact during extraction, such as water management and land rehabilitation.

- Environmental Stewardship: The company actively works to reduce its ecological footprint, including efforts to lower emissions and manage waste responsibly.

- Ethical Labor Practices: Tronox is committed to fair labor standards and ensuring the well-being of its workforce across all its global operations.

- Supply Chain Transparency: This value proposition enhances supply chain transparency, assuring clients of the ethical and sustainable origins of their titanium dioxide products.

Global Reach and Local Service

Tronox leverages its extensive global manufacturing footprint and sales network to provide customers with both robust worldwide supply capabilities and highly personalized local service. This dual approach ensures a consistent supply of high-quality titanium dioxide products, no matter where a customer operates.

The company’s strategy of combining global reach with local service allows for deep market penetration and the development of tailored solutions that meet the specific needs of diverse customer bases. This is crucial in the pigment industry where regional demands and regulations can vary significantly.

For instance, as of late 2023, Tronox operated manufacturing facilities across North America, Europe, and Australia, supported by sales offices in key global markets. This infrastructure was vital in navigating supply chain complexities and ensuring timely delivery to customers in over 100 countries, demonstrating their commitment to accessibility and responsiveness.

- Global Manufacturing Footprint: Tronox operates multiple production sites worldwide, guaranteeing a broad and reliable supply of titanium dioxide.

- Localized Customer Support: Dedicated sales and technical teams provide region-specific assistance, understanding local market nuances.

- Consistent Product Quality: Despite geographical diversity, Tronox maintains uniform product standards across all its operations.

- Market Penetration: The ability to serve customers globally while offering local touchpoints facilitates deeper engagement and market share growth.

Tronox's commitment to sustainability extends to its mining operations, where it implements practices focused on minimizing environmental impact and promoting land rehabilitation. This responsible approach to resource extraction appeals to an increasingly eco-conscious customer base. In 2024, the company continued its focus on reducing its environmental footprint, aligning with global sustainability trends in the chemical industry.

Customer Relationships

Tronox Holdings cultivates deep customer loyalty through dedicated sales teams and account managers. These professionals act as direct liaisons, fostering understanding of each client's unique requirements and delivering tailored solutions. This personalized approach is crucial for building enduring partnerships in the competitive chemical industry, emphasizing responsiveness and long-term collaboration.

The company's focus on direct relationship management directly translates into high customer satisfaction and retention rates. By having dedicated personnel who intimately understand customer needs and market dynamics, Tronox can proactively address challenges and identify opportunities. This strategy is a cornerstone of their business model, ensuring consistent engagement and reinforcing trust.

Tronox Holdings strengthens customer ties by offering extensive technical support and troubleshooting for its titanium dioxide products. This hands-on approach ensures clients can effectively utilize Tronox's materials, minimizing operational disruptions.

Furthermore, Tronox actively engages in collaborative research and development with its customers, focusing on specific product applications. This innovation partnership allows for the co-creation of tailored solutions that precisely meet evolving market demands.

These collaborative R&D projects not only position Tronox as a valuable problem-solver but also foster deeper integration of its products within customer processes, driving mutual growth and technological advancement.

Long-term supply agreements are a crucial element for Tronox Holdings, providing a bedrock of stability. These agreements, often spanning multiple years, lock in volumes and establish pricing mechanisms, offering predictability in a historically cyclical industry. For instance, in 2023, Tronox continued to leverage these relationships to secure a significant portion of its sales, mitigating the impact of fluctuating titanium dioxide (TiO2) market prices.

These customer relationships are more than just transactions; they represent a deep commitment to reliable supply and consistent quality. By entering into these long-term contracts, Tronox ensures a steady demand for its products, while its customers gain assurance of supply, a vital factor for their own production planning and market competitiveness.

Customer Feedback and Continuous Improvement

Tronox Holdings actively seeks customer feedback to refine its product offerings and services, ensuring alignment with market dynamics. This commitment to listening and adapting enhances product relevance, a critical factor in building lasting customer loyalty.

- Data-Driven Iteration: In 2024, Tronox's focus on customer feedback played a role in its strategic adjustments, particularly in responding to shifts in demand for titanium dioxide (TiO2) pigments across various industries.

- Strengthening Partnerships: By incorporating customer insights into its innovation pipeline, Tronox aims to foster deeper relationships, moving beyond transactional exchanges to collaborative development.

- Market Responsiveness: Regular feedback mechanisms allow Tronox to remain agile, anticipating and addressing evolving customer requirements in a competitive global market.

- Service Enhancement: Feedback also drives improvements in logistics, technical support, and supply chain reliability, all crucial elements for customer satisfaction in the chemical industry.

Industry Engagement and Conferences

Tronox actively participates in key industry associations and events, fostering direct engagement with a wide spectrum of its customer base. These gatherings, such as the Titanium Dioxide (TiO2) Global Summit and various chemical industry trade shows, are instrumental in understanding evolving market dynamics and customer needs.

By showcasing its latest product innovations and technological advancements at these forums, Tronox enhances its market visibility and brand presence. For example, at recent TiO2 industry conferences in 2023 and early 2024, Tronox highlighted its advancements in sustainable pigment production, resonating with customers focused on environmental, social, and governance (ESG) criteria.

These platforms are vital for building and strengthening relationships within the global titanium dioxide and pigment industry. They provide unparalleled opportunities for networking, exchanging technical knowledge, and gathering crucial market intelligence, directly informing Tronox’s strategic customer relationship management.

- Industry Association Membership: Tronox is a member of prominent industry bodies that shape standards and promote collaboration in the chemical and mining sectors.

- Trade Show Participation: The company regularly exhibits at major international trade shows, including those focused on coatings, plastics, and pigments, directly engaging with current and potential clients.

- Conference Presentations: Tronox executives and technical experts present at industry conferences, sharing insights on market trends, product development, and sustainability initiatives.

- Networking Opportunities: These events facilitate direct interaction, allowing Tronox to gather feedback, identify new opportunities, and solidify partnerships with customers worldwide.

Tronox Holdings prioritizes building strong customer relationships through dedicated account management and direct engagement. This approach ensures a deep understanding of client needs, leading to tailored solutions and fostering long-term loyalty in the competitive chemical sector.

Channels

Tronox Holdings leverages its direct sales force as a crucial channel for engaging with its significant industrial clientele. This approach allows for a high degree of personalized customer interaction, offering tailored solutions and direct negotiation of terms, particularly for their titanium dioxide (TiO2) products. This direct engagement is vital for building strong relationships and understanding the specific technical and commercial needs of major buyers.

This direct sales model is particularly effective for the high-value, complex transactions characteristic of the TiO2 market, where technical support and bespoke product offerings are often required. By having their own sales teams, Tronox can ensure a consistent message and provide in-depth product knowledge, fostering customer loyalty and facilitating the sale of specialized grades. For example, in 2023, Tronox reported that approximately 70% of its sales were to large industrial customers, underscoring the importance of this direct channel.

Tronox Holdings utilizes a robust global distribution network to reach a wide customer base. For smaller clients or niche markets, they rely on authorized distributors who provide essential local support and maintain inventory, ensuring broader market penetration and accessibility.

This strategy is crucial for efficient market coverage, especially in regions where establishing a direct sales force would be cost-prohibitive. In 2023, distributors were instrumental in Tronox's sales, contributing to over 30% of their titanium dioxide (TiO2) volume, a significant portion of their total revenue.

Tronox Holdings leverages its corporate website and professional social media platforms like LinkedIn to build its brand and communicate with stakeholders. These digital channels are vital for sharing company news, financial reports, and sustainability initiatives, enhancing transparency and accessibility. For instance, their investor relations section provides crucial data, supporting informed decision-making for a diverse financial audience.

While not a direct sales channel for bulk titanium dioxide (TiO2), Tronox's online presence is instrumental in generating leads and managing product inquiries. This digital engagement facilitates communication with potential customers and partners, fostering relationships and driving business opportunities. By maintaining a robust online presence, Tronox ensures it remains a visible and accessible entity in the global chemical market.

Industry Trade Shows and Conferences

Tronox Holdings actively participates in key industry trade shows and conferences. These events are crucial for displaying their titanium dioxide (TiO2) products and other offerings directly to a global audience. This direct engagement allows for showcasing innovation and reinforcing their position as a market leader.

These platforms are invaluable for networking, enabling Tronox to connect with current and prospective customers, distributors, and industry partners. Such interactions foster stronger relationships and identify new business opportunities. For instance, participation in events like the Global Titanium Conference is a direct channel for market outreach.

Conferences also serve as a vital avenue for Tronox to demonstrate thought leadership and share insights on industry trends and technological advancements in TiO2 production and application. This helps shape market perception and build brand equity.

Key benefits derived from these channels include:

- Enhanced Brand Visibility: Direct exposure to industry professionals and potential clients.

- Lead Generation: Opportunities to identify and engage with new business prospects.

- Market Intelligence: Gathering insights into competitor activities and customer needs.

- Customer Relationship Management: Strengthening ties with existing clients through face-to-face interactions.

Technical Publications and Whitepapers

Tronox Holdings leverages technical publications and whitepapers as a key channel to disseminate its in-depth research and technological advancements within the titanium dioxide (TiO2) industry. This strategic approach serves to educate the market about their innovations and solidify their position as a thought leader.

By publishing in reputable industry journals and scientific publications, as well as on their own corporate website, Tronox showcases its expertise. This practice directly supports sales efforts by providing potential customers and partners with credible, data-backed information, building trust and demonstrating the value of their offerings.

For instance, in 2024, Tronox continued to highlight its advancements in sustainable TiO2 production and the application of its products in various sectors. The company's commitment to R&D is often reflected in these publications, which can include details on process efficiencies and product performance enhancements.

- Dissemination of Technical Information: Tronox actively shares research findings and technical papers through established industry journals and scientific platforms.

- Market Education and Expertise Demonstration: This channel educates the market on TiO2 technology and showcases Tronox's deep understanding and innovative capabilities.

- Authority Establishment: Publishing technical content reinforces Tronox's standing as a leading authority in the TiO2 sector.

- Sales Process Support: Credible technical documentation provided through these publications directly supports the sales cycle by offering verifiable product and process information.

Tronox Holdings utilizes a multi-faceted channel strategy focusing on direct sales to large industrial clients and a global distributor network for broader market reach. Their digital presence and participation in industry events further enhance brand visibility and lead generation.

Technical publications serve to educate the market and establish Tronox as a thought leader, supporting sales by providing credible, data-backed information. This comprehensive approach ensures efficient market penetration and strong customer relationships.

| Channel | Key Function | Target Audience | 2023 Significance |

|---|---|---|---|

| Direct Sales Force | Personalized engagement, tailored solutions, complex transactions | Large industrial clients | Approx. 70% of sales |

| Global Distributor Network | Local support, inventory, broad market penetration | Smaller clients, niche markets | Over 30% of TiO2 volume |

| Corporate Website/Social Media | Brand building, stakeholder communication, lead generation | All stakeholders, potential customers | Enhances transparency and accessibility |

| Industry Trade Shows/Conferences | Product display, networking, thought leadership | Industry professionals, partners | Direct market outreach and relationship building |

| Technical Publications/Whitepapers | Disseminate research, educate market, establish authority | Technical community, potential customers | Showcases R&D and innovation |

Customer Segments

Paints and coatings manufacturers represent a core customer segment for Tronox. Titanium dioxide (TiO2) is an essential component, imparting crucial properties like opacity, whiteness, and enhanced durability to a wide array of products, from house paints to heavy-duty industrial coatings and automotive finishes.

These companies depend on a steady and high-quality supply of TiO2 to maintain their production schedules and product integrity. In 2023, the global paints and coatings market was valued at approximately $170 billion, demonstrating the significant scale of this customer base and their substantial need for TiO2.

The demand from this segment is closely tied to the health of major economic drivers. Specifically, the construction sector's activity, which saw global construction output projected to grow by around 2.5% in 2024, and the automotive industry are key indicators of their TiO2 requirements.

Plastics and Polymers Producers are key customers for Tronox. They utilize titanium dioxide (TiO2) extensively for its ability to impart opacity, achieve brilliant whiteness, and offer crucial UV resistance in a vast array of products. Think of everything from durable PVC pipes and window frames to everyday packaging and critical automotive components.

These clients have specific requirements, needing particular grades of TiO2 that are formulated to integrate seamlessly with various polymer types. The performance of their end products hinges on this compatibility, ensuring consistent processing and desired physical properties.

Beyond just color, these customers are looking for pigments that actively enhance the material performance of their plastics. This means pigments that contribute to longevity, durability, and resistance to environmental degradation, ultimately adding value to their manufactured goods.

In 2024, the global plastics market continued its steady growth, with demand for high-performance additives like TiO2 remaining robust. Companies in this sector are keenly focused on solutions that improve product aesthetics and functional attributes, directly impacting consumer appeal and product lifespan.

The paper and pulp industry is a key customer segment for titanium dioxide (TiO2) pigments. In 2024, this sector continues to rely on TiO2 to enhance the visual appeal and performance of various paper products. Specifically, TiO2 improves brightness, opacity, and printability in fine papers, coated papers, and specialty grades, crucial for high-quality visual presentation.

Demand within this segment is driven by the need for pigments with superior scattering power and excellent dispersion characteristics. These properties are essential for achieving the desired aesthetic and functional qualities in paper manufacturing. For instance, the global paper and pulp market was valued at approximately $700 billion in 2023, with a significant portion of this value dependent on the quality imparted by TiO2.

Specialty Chemicals and Inks

Manufacturers of specialty chemicals and printing inks represent a crucial customer segment for Tronox Holdings, leveraging titanium dioxide (TiO2) for its distinctive optical characteristics and inherent chemical stability. This group includes businesses producing coatings, plastics, and advanced materials where TiO2's performance is paramount.

This segment often demands highly specialized or micronized grades of TiO2, meticulously engineered to meet the precise requirements of their unique formulations. Their purchasing decisions are heavily influenced by the technical expertise and tailored solutions that suppliers can offer, often seeking collaborative development.

- Demand for Specialty Grades: This segment prioritizes TiO2 with specific particle sizes and surface treatments for optimal performance in applications like high-performance inks and advanced coatings.

- Value Proposition: Customers in this segment seek technical support, product customization, and consistent quality to ensure their end products meet stringent performance standards.

- Market Trends: Growth in digital printing and advanced material science fuels demand for innovative TiO2 solutions, indicating a need for continuous product development from suppliers like Tronox.

- Competitive Landscape: The specialty chemicals market is competitive, with success often depending on a supplier's ability to provide unique value-added services and specialized product grades.

Rubber and Ceramics Manufacturers

For Tronox Holdings, rubber and ceramics manufacturers represent key customer segments that utilize titanium dioxide (TiO2) for its performance-enhancing qualities. In the rubber industry, TiO2 acts as a crucial reinforcing agent and a whitening pigment, contributing to the durability and aesthetic appeal of products such as tires and footwear. The demand in these sectors is closely tied to global manufacturing output and consumer spending on durable goods and apparel. As of 2024, the global rubber market is projected to continue its growth trajectory, driven by automotive production and infrastructure development, which directly impacts TiO2 consumption by rubber product manufacturers.

Within the ceramics sector, TiO2 plays a vital role in the formulation of glazes and enamels, providing essential opacity and vibrant color. This application is critical for everything from sanitary ware and tiles to decorative ceramics. The construction industry’s health is a significant indicator for this segment’s demand. In 2023, global construction spending saw moderate growth, a trend expected to continue into 2024, supporting the demand for TiO2 in ceramic applications.

These segments, while perhaps not the largest in terms of volume compared to coatings, are nonetheless important due to the specialized needs they fulfill. The versatility of TiO2 makes it indispensable across a wide array of industrial applications, underscoring its broad market reach for Tronox.

Key aspects of this customer segment include:

- Reinforcement and Whitening: TiO2 enhances the physical properties and visual appearance of rubber goods like tires and footwear.

- Opacity and Color: In ceramics, it provides essential opacity and color stability for glazes and enamels used in construction and decorative items.

- Market Linkages: Demand is closely linked to the performance of the automotive, construction, and consumer goods industries.

- Specialized Demand: These segments represent important, albeit potentially smaller, volume users requiring specific TiO2 grades.

Tronox's customer base is diverse, encompassing major industries that rely on titanium dioxide (TiO2) for product enhancement. The paints and coatings sector, a primary consumer, utilizes TiO2 for opacity and durability in architectural and industrial applications. In 2023, this market was valued at approximately $170 billion, highlighting its significance.

The plastics and polymers industry is another key segment, using TiO2 for whiteness, opacity, and UV resistance in products ranging from packaging to automotive parts. Growth in the global plastics market in 2024 continues to drive demand for these performance additives.

Furthermore, the paper and pulp industry incorporates TiO2 to improve brightness and printability in various paper grades, with the global market valued around $700 billion in 2023. Specialty chemical producers and printing ink manufacturers also represent crucial, albeit more niche, consumers, often requiring highly specialized TiO2 grades for advanced formulations.

Finally, rubber and ceramics manufacturers leverage TiO2 for reinforcement and opacity, respectively, with demand linked to automotive and construction sectors. These varied segments underscore TiO2's essential role across a broad industrial spectrum.

Cost Structure

The extraction and processing of mineral sands represent a substantial portion of Tronox Holdings' cost structure. These mining operations incur significant expenses related to equipment operation, skilled labor, and energy consumption, all vital for efficient mineral recovery.

Environmental remediation is another critical cost factor, ensuring compliance with regulatory standards and responsible land management post-extraction. For instance, in 2023, Tronox reported total cost of goods sold of $3.05 billion, a significant portion of which is attributable to these raw material activities.

Despite its vertical integration, which internalizes many raw material costs, these remain a fundamental component of the company's overall expenses. Efficiently managing these extraction and processing expenditures is paramount to maintaining healthy profit margins and competitive pricing in the global market.

Manufacturing and production costs are a major component for Tronox Holdings, encompassing the significant expenses involved in transforming mineral sands into titanium dioxide (TiO2) pigment. These costs include energy, chemical reagents, operational labor, and the upkeep of sophisticated machinery.

Energy consumption represents a particularly substantial portion of these manufacturing expenses. For instance, in 2024, Tronox reported that its cost of goods sold, which heavily features manufacturing expenses, stood at $2.77 billion. This highlights the significant impact of energy and other production inputs.

Controlling these high fixed and variable costs is crucial, and Tronox leverages economies of scale and ongoing process optimization to manage them effectively. These efforts are essential for maintaining profitability in a competitive global market.

Tronox Holdings consistently invests heavily in Research and Development (R&D) to drive innovation and maintain its competitive edge in the titanium dioxide (TiO2) and zircon industries. These investments are crucial for improving product quality, discovering novel applications for their materials, and optimizing production processes for greater efficiency. For instance, in 2023, Tronox reported R&D expenses of $59 million, reflecting their commitment to these long-term growth initiatives.

The significant costs associated with R&D at Tronox encompass a variety of expenditures. These include the competitive salaries and benefits for their team of scientists, engineers, and technical staff, as well as the acquisition and maintenance of advanced laboratory equipment. Furthermore, the operation of pilot plants, which are essential for testing and scaling up new processes and products, represents a substantial financial commitment.

Logistics and Distribution Costs

Tronox Holdings faces significant logistics and distribution costs due to its worldwide manufacturing footprint and customer base. These expenses encompass the movement of raw materials like ilmenite and rutile to production facilities and the shipment of finished titanium dioxide (TiO2) pigment to diverse global markets. In 2023, the company reported that freight and logistics expenses were a notable component of its overall cost of goods sold.

Efficiently managing this complex supply chain is paramount for controlling expenditures and maintaining competitive pricing for its TiO2 products. Key areas of focus include optimizing transportation modes, negotiating favorable shipping rates, and strategically locating warehouses to reduce transit times and associated costs. The company’s efforts in 2024 will likely continue to center on streamlining these operations to mitigate the impact of global supply chain volatility and fuel price fluctuations.

- Global Transportation: Costs related to ocean freight, trucking, and rail for both inbound raw materials and outbound finished goods are substantial.

- Warehousing and Storage: Maintaining inventory across various global locations incurs expenses for storage facilities, handling, and management.

- Customs and Duties: Navigating international trade involves paying tariffs, import/export duties, and compliance costs, which vary by country.

- Supply Chain Optimization: Investments in technology and processes to improve route planning, inventory visibility, and carrier management are crucial for cost reduction.

Environmental Compliance and Sustainability Investments

Environmental compliance and sustainability investments represent a crucial element of Tronox Holdings' cost structure. This includes the significant expenses incurred to meet rigorous environmental regulations, manage waste effectively, and undertake land rehabilitation efforts after mining operations conclude. For instance, in 2023, Tronox reported environmental, health, and safety expenses totaling $133 million. These costs are not merely operational necessities but also reflect a deliberate commitment to responsible corporate citizenship.

These expenditures often involve substantial capital outlays for advanced pollution control technologies and ongoing operational costs for environmental monitoring and remediation. The company's dedication to sustainable practices, which can encompass reducing emissions, conserving water, and minimizing environmental impact, also contributes to this cost category. As global environmental standards continue to tighten, these investments are becoming increasingly vital for maintaining a license to operate and for long-term business viability.

Key cost components within this area include:

- Regulatory Compliance: Costs associated with permits, reporting, and adherence to local and international environmental laws.

- Waste Management: Expenses for the safe disposal, treatment, and recycling of mining and processing by-products.

- Land Rehabilitation: Funds allocated for restoring mined land to its natural or an economically viable state post-operation.

- Sustainability Initiatives: Investments in cleaner technologies, energy efficiency, and initiatives to reduce the company's overall environmental footprint.

Selling, General, and Administrative (SG&A) expenses are a significant part of Tronox's cost structure, covering operational overhead, marketing, and corporate functions. In 2023, SG&A expenses were $491 million, reflecting investments in sales teams, brand building, and administrative support necessary for a global enterprise.

These costs are essential for market penetration and customer relationship management. The company also incurs substantial costs related to financing its operations, including interest expenses on debt. For instance, Tronox reported interest expenses of $251 million in 2023, highlighting the financial leverage employed.

Depreciation and amortization also represent significant non-cash expenses, reflecting the wear and tear of its extensive mining and processing assets. These costs are vital for maintaining the value and operational capacity of its capital-intensive infrastructure.

| Cost Category | 2023 (Millions USD) | Notes |

| Cost of Goods Sold | 3,050 | Includes raw materials, manufacturing, and energy. |

| SG&A Expenses | 491 | Covers operational overhead, sales, and marketing. |

| Interest Expense | 251 | Cost of servicing debt financing. |

| R&D Expenses | 59 | Investment in innovation and process improvement. |

| Environmental, Health & Safety Expenses | 133 | Compliance, remediation, and sustainability initiatives. |

Revenue Streams

Tronox Holdings' primary revenue stream is the global sale of titanium dioxide (TiO2) pigment. This versatile pigment finds its way into numerous applications, including paints, plastics, paper, and inks, serving a broad customer base across various industries.

Revenue is generated through both direct sales to end-users and agreements with a network of distributors. These channels ensure wide market reach and efficient product delivery to customers worldwide.

The company's financial performance is significantly tied to the volume of TiO2 sold and the prevailing market prices for this key commodity. For instance, in the first quarter of 2024, Tronox reported total sales of $488 million, with TiO2 sales volume averaging 241 kilotons.

Fluctuations in TiO2 demand, driven by global economic activity and specific industry trends, directly influence Tronox's top-line revenue. The average selling price for TiO2 in Q1 2024 was approximately $2,025 per ton, highlighting the importance of pricing power in their revenue generation model.

Tronox Holdings generates revenue by selling titanium-bearing mineral sands, like ilmenite and rutile, to external customers. This complements their internal use, capitalizing on strong market demand or surplus production capacity. In 2023, Tronox's mineral sands segment reported revenue of $1.54 billion, demonstrating the significance of these sales.

Tronox Holdings generates revenue by selling specialized or high-performance grades of titanium dioxide (TiO2). These premium products are developed through dedicated research and development efforts, catering to customers with specific, often demanding, technical needs in niche markets. For instance, in 2023, Tronox's specialty products contributed to their overall sales, reflecting the value placed on these tailored solutions.

By-product Sales

Tronox Holdings generates revenue not only from its primary titanium dioxide (TiO2) pigment but also from the sale of valuable by-products. These co-products, extracted during the mining and processing of titanium ore, represent an efficient use of resources and contribute to overall profitability. For instance, zircon is a significant by-product, finding applications in ceramics, refractories, and foundry industries.

Beyond zircon, Tronox's operations also yield monazite, which contains rare earth elements. The sale of these elements can provide an additional and potentially lucrative revenue stream, further diversifying the company's income sources. This strategy enhances resource utilization and improves the economic viability of its mining operations.

- Zircon Sales: Zircon is a key by-product with diverse industrial applications, contributing to Tronox's revenue diversification.

- Rare Earth Elements: Monazite, containing rare earth elements, offers another avenue for by-product sales, enhancing profitability.

- Resource Efficiency: The extraction and sale of by-products demonstrate efficient resource utilization within Tronox's mining and processing activities.

- Revenue Diversification: By-product sales complement primary TiO2 pigment revenue, creating a more resilient financial model.

Technical Services and Consulting

Tronox Holdings, while primarily known for its titanium dioxide (TiO2) production, can also leverage its extensive technical knowledge to offer specialized consulting and technical services. This segment, though not a major revenue contributor, taps into the company's deep understanding of TiO2 applications and processing.

These services could include advanced material testing, process optimization advice for customers, and troubleshooting assistance related to TiO2 integration into various products. By offering these high-value, knowledge-based services, Tronox can create a niche revenue stream that complements its core product sales. This approach capitalizes on their internal expertise, potentially generating higher profit margins than commodity sales.

While specific figures for this segment are not typically broken out in detail, Tronox's commitment to research and development, evidenced by their ongoing innovation in TiO2 production and application, underpins the potential for such service offerings. For instance, as of their latest reporting, Tronox continues to invest in R&D to improve product performance and discover new applications for TiO2, which directly translates to enhanced consulting capabilities.

- Leveraging Expertise: Tronox's deep technical knowledge in TiO2 chemistry and applications forms the basis for its consulting services.

- Value-Added Services: Offerings may include advanced material analysis, process optimization, and application-specific guidance for clients.

- Niche Revenue Stream: These services can generate high-margin revenue by addressing specialized customer needs.

- Complementary to Core Business: The technical services enhance customer relationships and support the primary TiO2 sales.

Tronox Holdings generates revenue primarily through the sale of titanium dioxide (TiO2) pigment, a key component in paints, plastics, and paper. The company also sells titanium-bearing mineral sands like ilmenite and rutile, which are crucial raw materials for TiO2 production and have independent market demand. In 2023, mineral sands sales contributed $1.54 billion to revenue, highlighting their significance.

Additional revenue streams are derived from the sale of valuable by-products such as zircon and monazite, which contains rare earth elements. These sales enhance resource utilization and diversify income. For instance, zircon is widely used in ceramics and refractories.

Tronox also leverages its technical expertise by offering specialized consulting and technical services related to TiO2 applications and processing. This segment, though smaller, provides high-margin revenue by addressing specific customer needs and reinforcing its core business.

| Revenue Stream | Description | 2023 Contribution/Example | Key Drivers | Market Relevance |

| TiO2 Pigment Sales | Primary product for paints, plastics, paper | Significant portion of total revenue; Q1 2024 sales: $488 million (241 kilotons) | Global demand for coatings and plastics, economic activity | Ubiquitous in everyday products |

| Mineral Sands Sales | Ilmenite, rutile, and other titanium-bearing ores | $1.54 billion in 2023 | Demand for raw materials in TiO2 production, industrial applications | Essential feedstock for TiO2 industry |

| By-product Sales (Zircon, Rare Earths) | Valuable co-products from ore processing | Zircon for ceramics, Monazite for rare earth elements | Demand in ceramics, electronics, and advanced materials sectors | Resource efficiency and value addition |

| Consulting & Technical Services | Leveraging TiO2 expertise for clients | Niche, high-margin revenue | Client demand for specialized knowledge, R&D advancements | Value-added service supporting core business |

Business Model Canvas Data Sources

The Tronox Holdings Business Model Canvas is informed by a blend of internal financial reports, operational data, and external market intelligence. This comprehensive approach ensures a data-driven understanding of customer segments, value propositions, and revenue streams.