Tronox Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tronox Holdings Bundle

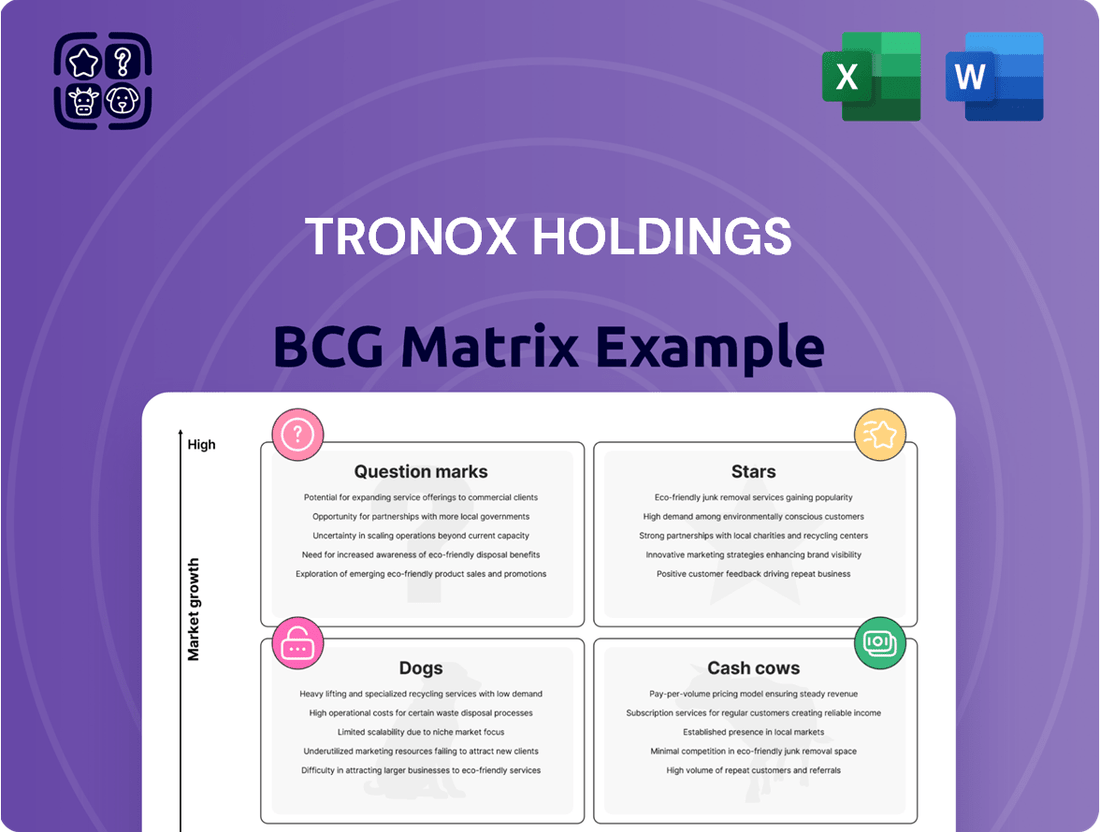

Unlock the strategic positioning of Tronox Holdings with a glimpse into its BCG Matrix. This powerful framework categorizes its product portfolio into Stars, Cash Cows, Dogs, and Question Marks, offering a high-level view of market dynamics.

Understanding which segments are driving growth and which require careful consideration is crucial for any investor or business strategist. This preview highlights the importance of a comprehensive analysis.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Tronox's high-purity specialty TiO2 products are positioned for strong future growth, likely falling into the Star category of the BCG matrix. These aren't your everyday TiO2 for paints; they're engineered for demanding applications like advanced ceramics and electronics. This focus on niche markets allows for premium pricing and significant market share capture in high-growth segments.

Tronox Holdings' rare earths concentrates from tailings initiative is a prime example of a potential star in its BCG Matrix. The company is actively extracting these critical metals from its waste streams, aiming to become a major supplier for the burgeoning clean energy sector. This strategic move taps into a high-growth market driven by increasing demand for materials essential in electric vehicles, wind turbines, and advanced electronics.

Tronox is actively innovating with CristalACTiV™ materials, especially ultrafine titanium dioxide (TiO2) products. These advancements are crucial for meeting evolving environmental regulations and enabling new applications like reducing NOx emissions in Selective Catalytic Reduction (SCR) catalysts. This strategic direction places Tronox at the forefront of a market segment fueled by sustainability demands and increasingly stringent environmental standards. In 2024, the global SCR catalyst market was valued at approximately USD 3.5 billion, with expectations for significant growth driven by these eco-friendly material innovations.

Strategic Expansion in Emerging Markets (e.g., India)

Tronox Holdings is actively exploring strategic avenues for growth, with emerging markets like India presenting compelling opportunities. The company views India as a key market where its titanium dioxide (TiO2) products can capitalize on increasing demand.

Developing economies, particularly India, are undergoing rapid urbanization and industrialization. This trend is directly fueling a significant rise in the need for TiO2 across various sectors, including construction, automotive, and consumer goods. Tronox is well-positioned to expand its market share in such a high-growth environment.

India's TiO2 market is projected for robust expansion. For instance, the Indian paints and coatings industry, a major consumer of TiO2, was valued at approximately $6.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 10-12% through 2028. This growth is driven by increased infrastructure spending and a rising middle class.

- Demand Drivers: Urbanization and industrialization in India are key factors increasing TiO2 consumption in construction and manufacturing.

- Market Potential: India's paints and coatings sector, a significant TiO2 user, is anticipated to see a CAGR of 10-12% from 2023 to 2028.

- Strategic Focus: Tronox aims to leverage this burgeoning demand to enhance its market presence and sales volume in India.

- Competitive Landscape: While competitive, the market offers ample room for established players like Tronox to gain traction through strategic investments and product offerings.

Advanced Coatings for Self-Cleaning and UV Resistance

Tronox Holdings is actively investing in advanced coatings, particularly focusing on titanium dioxide (TiO2) technologies that offer self-cleaning and superior UV resistance. These innovations cater to a growing demand for durable and functional surfaces across various industries.

Research and development in the TiO2 market is increasingly centered on nanoparticle synthesis and advanced surface treatments. These advancements are key to enabling trends like self-cleaning, antimicrobial properties, and the development of low-VOC coatings, reflecting a significant shift in consumer and regulatory preferences.

Tronox's specialized products and ongoing R&D in these functional coating segments, especially their work with UV-resistant pigments, position them to capture a substantial market share. For instance, the global market for TiO2 pigments was valued at approximately USD 23.7 billion in 2023 and is projected to grow, with functional coatings representing a key growth driver.

- Focus on Nanoparticle Synthesis: Tronox is exploring advanced methods to create TiO2 nanoparticles for enhanced performance in coatings.

- Surface Treatment Innovation: Development of specialized surface treatments aims to imbue TiO2 pigments with self-cleaning and antimicrobial properties.

- UV Resistance Expertise: The company's established strength in UV-resistant pigments directly supports the demand for long-lasting, weather-resilient coatings.

- Market Share Potential: These targeted R&D efforts are expected to solidify Tronox's position in high-growth segments of the functional coatings market.

Tronox's specialty TiO2 for advanced applications like ceramics and electronics, along with its rare earths extraction from tailings for the clean energy sector, are strong candidates for the Star category. These initiatives target high-growth markets with significant future potential, allowing Tronox to command premium pricing and expand its market share in specialized segments.

The company’s innovative CristalACTiV™ ultrafine TiO2, crucial for SCR catalysts reducing NOx emissions, positions it well in the environmentally driven market. Furthermore, Tronox’s strategic focus on emerging markets like India, driven by rapid industrialization and urbanization, offers substantial growth opportunities for its TiO2 products. The company's investment in advanced coatings with self-cleaning and UV-resistant properties also taps into a growing demand for functional surfaces.

| Initiative | Market Focus | Growth Potential | 2024 Data Point |

|---|---|---|---|

| Specialty TiO2 | Advanced Ceramics, Electronics | High | Global advanced ceramics market projected to reach USD 40 billion by 2028. |

| Rare Earths from Tailings | Clean Energy, EVs, Wind Turbines | Very High | Global rare earth market expected to grow significantly, driven by EV adoption. |

| CristalACTiV™ (SCR Catalysts) | Environmental Regulations, Emission Control | High | Global SCR catalyst market valued at approx. USD 3.5 billion in 2024. |

| India Market Expansion | Construction, Automotive, Consumer Goods | High | Indian paints and coatings market expecting 10-12% CAGR through 2028. |

| Advanced Coatings (Self-cleaning, UV-resistant) | Durable & Functional Surfaces | High | Global TiO2 pigments market valued at approx. USD 23.7 billion in 2023. |

What is included in the product

The Tronox Holdings BCG Matrix analyzes its product portfolio, categorizing segments into Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

The Tronox Holdings BCG Matrix offers a clear, one-page overview, alleviating the pain of complex strategic analysis for quick decision-making.

Cash Cows

Tronox's core titanium dioxide (TiO2) pigment business for paints and coatings is a classic Cash Cow. It holds a significant market share in a mature, yet stable, global market. This segment is a consistent generator of cash flow, largely because TiO2 is an essential component in numerous applications, from construction paints to automotive finishes.

In 2023, Tronox reported that TiO2 pigment sales represented a substantial portion of its overall revenue, underscoring its importance. The demand for TiO2 is closely tied to global GDP growth and construction activity, which remained relatively steady in many developed economies throughout 2023 and into early 2024. This stability allows Tronox to leverage its scale and efficient operations to extract maximum profit from this segment.

Tronox Holdings' vertically integrated mineral sands operations are a prime example of a Cash Cow within the BCG Matrix. This integration, from mining titanium-bearing mineral sands to processing them, gives Tronox a significant edge by controlling its supply chain and reducing costs.

This control is vital in the mature titanium dioxide (TiO2) industry, allowing for optimized operations and cost efficiencies. In 2023, Tronox reported that its vertically integrated model contributed to a strong cash flow generation, underscoring its position as a reliable performer.

The company's ability to manage its entire value chain efficiently translates into consistent profitability and a stable source of cash, a hallmark of a Cash Cow. This business segment is expected to continue generating substantial cash for Tronox in the near future.

Zircon is a significant contributor to Tronox Holdings' revenue, with the company actively mining and processing this mineral. While the zircon market can be volatile, Tronox's robust production capabilities and established market position enable it to generate consistent revenue and cash flow.

In 2024, Tronox is expected to see a notable increase in zircon sales volume, which will further bolster its cash generation. This growth is driven by strong demand in key end-use markets, positioning zircon as a reliable cash cow within the company's portfolio.

Established Global Production and Distribution Network

Tronox's established global production and distribution network is a significant strength, positioning its core titanium dioxide (TiO2) business as a cash cow. With operations spanning six continents and nine pigment facilities, the company boasts a substantial global footprint. This extensive infrastructure underpins its ability to efficiently produce and deliver TiO2 products to a wide array of customers worldwide.

This robust network directly contributes to Tronox's high market share in the TiO2 industry, a key characteristic of a cash cow. The company's approximately 6,500 employees worldwide are instrumental in managing this complex, integrated system. For instance, in 2023, Tronox reported net sales of $2.16 billion, with a significant portion driven by its TiO2 segment, demonstrating the consistent cash generation from these operations.

- Global Reach: Operations across six continents and nine pigment facilities worldwide.

- Employee Base: Approximately 6,500 employees dedicated to global operations.

- Market Dominance: High market share in the TiO2 sector, reflecting strong customer relationships and efficient supply chains.

- Consistent Cash Flow: The established network facilitates reliable and ongoing revenue generation from TiO2 sales, as evidenced by consistent historical sales figures.

Long-Standing Relationships with Key Industrial Customers

Tronox Holdings, as a leading titanium dioxide (TiO2) producer, benefits from deep-rooted relationships with significant industrial clients. These long-standing partnerships are primarily within mature sectors such as paints, coatings, plastics, and paper, where TiO2 is a crucial component.

These established customer bases ensure a consistent and predictable demand for Tronox's products. For instance, in 2024, the paints and coatings segment remained a substantial driver of TiO2 consumption, reflecting the ongoing need for brightness and opacity in architectural and industrial applications. This stability translates into reliable, recurring revenue streams, a hallmark of a cash cow.

- Stable Demand: Key industrial customers in mature markets provide consistent demand for TiO2.

- Recurring Revenue: Long-term relationships foster predictable and ongoing sales, a key characteristic of cash cows.

- Market Position: Tronox's preeminence in the TiO2 market solidifies these customer ties.

- Industry Dependence: Sectors like paints, plastics, and paper rely heavily on TiO2, ensuring continued business.

Tronox's core titanium dioxide (TiO2) business, particularly its pigment segment, stands as a quintessential Cash Cow. This segment benefits from a dominant market share in the mature and stable global TiO2 market, a critical component for paints, coatings, and plastics. The company's vertically integrated operations, from mining to processing, further solidify its cost advantages and cash-generating capabilities.

In 2024, Tronox continues to leverage its extensive global production and distribution network, which spans nine pigment facilities across six continents. This infrastructure, supported by approximately 6,500 employees, ensures efficient product delivery and reinforces its market leadership. Established, long-term relationships with key industrial clients in sectors like paints and coatings guarantee consistent demand and predictable revenue streams, characteristic of a Cash Cow.

| Metric | Value (2023/2024 Data) | Significance for Cash Cow Status |

|---|---|---|

| TiO2 Pigment Sales Contribution | Substantial portion of 2023 revenue | Highlights core business's revenue generation |

| Global Market Share (TiO2) | High | Indicates market dominance and pricing power |

| Vertical Integration | Controlled supply chain | Drives cost efficiency and stable margins |

| Global Production Facilities | Nine pigment facilities | Ensures broad market reach and operational scale |

| Customer Base | Established, long-term relationships | Provides stable and recurring demand |

Delivered as Shown

Tronox Holdings BCG Matrix

The BCG Matrix analysis of Tronox Holdings you are currently previewing is the identical, fully comprehensive document you will receive immediately after purchase. This report provides an in-depth strategic breakdown of Tronox's product portfolio, categorizing each business unit within the Stars, Cash Cows, Question Marks, and Dogs quadrants, enabling informed decision-making and resource allocation for optimal market performance.

Dogs

Tronox's European operations have historically been a challenge, experiencing sluggish demand and intense price competition. While Q1 2025 saw a brief uptick thanks to anti-dumping measures, these markets have consistently demonstrated low growth potential. This persistent underperformance positions Europe as a potential 'dog' within the BCG Matrix, requiring careful resource allocation to avoid draining profitability.

Tronox's decision to idle its Botlek pigment plant in the Netherlands underscores the challenges faced by older, less efficient production facilities. This move was a direct response to global supply imbalances and a difficult operating environment. It highlights how such assets can struggle to remain competitive.

These underperforming facilities often contribute to higher-cost inventories, making it difficult to compete effectively. In markets characterized by low growth and intense competition, having a low market share with these older plants is a significant disadvantage. For instance, in 2023, Tronox reported that the idling of certain facilities impacted production volumes, contributing to a more concentrated focus on its core, efficient operations.

Consequently, these older, less efficient assets become prime candidates for divestiture or outright closure. This strategic pruning allows companies to reallocate capital and resources towards more modern, cost-effective operations. By shedding these burdens, Tronox aims to improve its overall operational efficiency and profitability moving forward.

Revenue from opportunistic sales of ilmenite and heavy mineral concentrate tailings, excluding rare earths, saw a substantial year-over-year decrease in Q4 2024. This decline highlights the volatile and non-recurring nature of these sales, which are driven by market opportunities rather than steady demand.

Such transactions, characterized by their opportunistic nature, suggest a low market share and limited growth potential when viewed as a core business segment. For instance, in Q4 2024, this specific revenue stream contributed minimally to Tronox's overall performance, reflecting its position as a peripheral offering.

Products Facing Intense Price Competition

Tronox's titanium dioxide (TiO2) products, especially those facing aggressive pricing from competitors, particularly in China, can be categorized as dogs within its BCG matrix. This intense price competition directly pressures Tronox's average selling prices, impacting profitability in a market that, in many segments, exhibits low growth. For instance, in 2024, the global TiO2 market experienced fluctuations, with certain grades seeing price declines due to oversupply and increased production from emerging players.

Products caught in this scenario often have low market share and low growth potential, making them challenging to manage. Tronox’s exposure to these price-sensitive segments means that some of its offerings might be struggling to maintain their competitive edge, leading to reduced returns on investment. The company’s financial reports often highlight regional price differentials, underscoring where these competitive pressures are most acute.

- Intense Price Pressure: Certain TiO2 product grades face significant price erosion due to strong competition, particularly from Chinese manufacturers.

- Low Market Growth: The overall TiO2 market, or specific segments within it, may be experiencing sluggish demand, exacerbating the impact of price competition.

- Profitability Concerns: Products with high exposure to these competitive dynamics may struggle to achieve or maintain healthy profit margins for Tronox.

- Market Share Challenges: In a low-growth, price-sensitive environment, maintaining or growing market share becomes increasingly difficult for these product lines.

Segments with Declining Market Demand

While the titanium dioxide (TiO2) market generally shows robust growth, certain niche segments within it are facing headwinds. These areas might be experiencing reduced demand due to evolving consumer preferences or stricter environmental and health regulations. For instance, the use of TiO2 in certain food and cosmetic applications is under increased scrutiny, prompting a shift away from traditional grades in these specific sectors. This regulatory pressure is a key factor influencing demand for particular TiO2 products.

The changing regulatory landscape, particularly concerning nanoparticles and potential health impacts, is a significant driver of this segment decline. For example, some regions have introduced or are considering bans on TiO2 in certain food applications, impacting demand for food-grade TiO2. This is leading manufacturers to explore alternative ingredients or specialized TiO2 formulations that meet new compliance standards. By 2024, the impact of these regulations is becoming more pronounced, affecting specific product lines within the broader TiO2 industry.

- Shifting Consumer Preferences: Consumers are increasingly seeking products perceived as more natural or free from certain additives, impacting demand for TiO2 in some food and cosmetic items.

- Regulatory Scrutiny: Heightened concerns regarding the safety of TiO2, especially in nanoparticle form, have led to stricter regulations and potential bans in specific applications, such as certain food colorants.

- Market Adaptations: TiO2 producers are responding by developing specialized grades or alternative solutions to meet evolving regulatory requirements and consumer demands, potentially reducing reliance on traditional grades in affected segments.

Certain Tronox titanium dioxide (TiO2) product lines are showing characteristics of 'dogs' in the BCG matrix due to intense competition and low market growth in specific segments. For instance, in 2024, the global TiO2 market faced oversupply, leading to price declines for certain grades, particularly those challenged by lower-cost producers. These products often have a low market share and struggle to generate significant returns, requiring careful management of resources.

The company's European operations, facing sluggish demand and intense price competition, also fit the 'dog' profile. While anti-dumping measures provided a brief Q1 2025 uplift, these markets have historically shown limited growth potential. Idling older, less efficient plants, such as the Botlek pigment plant, is a direct response to these challenging conditions, highlighting how such assets can struggle to remain competitive and contribute to higher-cost inventories.

Opportunistic sales of ilmenite and heavy mineral concentrate tailings, excluding rare earths, also represent 'dog' characteristics. Revenue from these sales saw a substantial year-over-year decrease in Q4 2024, indicating volatility and a lack of consistent demand. These transactions contribute minimally to overall performance, reflecting their position as peripheral offerings with limited growth potential as a core business segment.

Additionally, specific TiO2 applications facing regulatory scrutiny, such as in certain food and cosmetic sectors, are also showing 'dog' traits. Evolving consumer preferences and stricter regulations are reducing demand for traditional grades in these areas, forcing adaptation. By 2024, the impact of these regulations is becoming more pronounced, affecting particular product lines within the broader TiO2 industry.

Question Marks

Tronox Holdings launched a new global coatings product in 2024, a strategic move driven by evolving regulations impacting a crucial chemical in titanium dioxide (TiO2) production. This innovation addresses the industry's need for compliant materials in a dynamic market environment.

The market for compliant coatings is experiencing significant shifts due to these regulatory changes. While this presents an opportunity for growth for solutions like Tronox's new product, it also introduces complexities regarding how quickly the market will adopt these new offerings and how competitors will respond.

Tronox's investments in new mining projects like Namakwa East OFS and the Fairbreeze extension in South Africa position them as potential Stars or Question Marks within the BCG Matrix. These ventures represent significant capital expenditure aimed at securing future high-grade ilmenite supply, crucial for replacing aging mines. In 2024, Tronox continued to advance these projects, with capital expenditures focused on development and infrastructure, underscoring their long-term strategic importance.

While these projects are vital for long-term sustainability, their current market share contribution is minimal as they are in development or augmenting existing capacity. The substantial upfront investment means their immediate return on investment is not yet realized, classifying them more as Question Marks requiring further development and market acceptance. For instance, the Fairbreeze extension, planned to extend the life of the existing mine, represents a significant capital outlay for future production rather than current market dominance.

Tronox Holdings is actively exploring expansion beyond India, identifying several high-growth geographical markets as potential question marks. These are regions where the company currently holds a small market share, but where the demand for titanium dioxide (TiO2) is anticipated to surge in the coming years. For instance, Southeast Asia, with its burgeoning manufacturing sector and increasing infrastructure development, presents a compelling opportunity.

Markets like Vietnam and Indonesia are showing robust GDP growth and a rising middle class, which directly correlates with increased demand for TiO2 in applications such as paints, plastics, and coatings. While Tronox's current presence in these areas might be limited, the long-term potential warrants careful consideration and strategic investment.

The company's willingness to commit capital to establish a stronger foothold in these nascent markets is crucial for future growth. This involves building local infrastructure, forging partnerships, and adapting product offerings to meet regional needs. For example, Tronox's 2024 strategic reviews likely include detailed analyses of market entry costs and projected returns for these regions.

Advanced Applications of TiO2 in Clean Energy and Catalysis

Tronox's specialty business is actively pursuing advanced applications of titanium dioxide (TiO2) in clean energy and catalysis, particularly for Selective Catalytic Reduction (SCR) systems. These high-growth sectors are crucial for the global energy transition. For instance, the demand for SCR catalysts is projected to grow significantly as emissions regulations tighten worldwide, driving the need for effective NOx reduction technologies.

While these specialized niches offer substantial growth potential, Tronox's current market share may be relatively small. Establishing a leading position will likely necessitate substantial investment in research and development, as well as specialized production capabilities. The global market for automotive catalysts, a key segment for SCR, was valued at approximately $20 billion in 2023 and is expected to see continued expansion.

- Focus on SCR: Tronox is targeting the growing demand for TiO2 in SCR systems essential for reducing nitrogen oxide emissions.

- Clean Energy Alignment: These applications directly support the company's strategy of providing eco-friendly solutions for the energy transition.

- High-Growth Potential: The markets for advanced catalytic applications are experiencing rapid expansion due to environmental regulations.

- Investment Imperative: Significant investment is required to capture a leading market share in these specialized, competitive niches.

Integration of Process Automation and Digital Architecture

Tronox's strategic investment in process automation and digital architecture is a key element of its business transformation, aiming to streamline global operations and enhance efficiency. This initiative is particularly focused on its U.S. facilities, with significant deployment planned for 2025. These advancements are designed to build a more agile and competitive operational foundation for the future.

The integration of these digital tools and automated processes represents a substantial capital expenditure for Tronox, underscoring a commitment to long-term operational excellence. While the direct, immediate impact on market share is not yet fully quantifiable, the program is projected to yield significant efficiency gains and cost reductions over time, positioning the company favorably against competitors.

- Operational Excellence: Implementing standardized, automated processes across all sites to drive efficiency.

- Digital Architecture: Building a robust digital infrastructure to support data-driven decision-making and integration.

- U.S. Focus for 2025: Prioritizing the deployment of these technologies in U.S. operations for early impact and learning.

- Future Competitiveness: These investments are crucial for maintaining and enhancing Tronox's competitive edge in the global TiO2 market.

Tronox's nascent international markets, such as Southeast Asia, represent classic Question Marks. While these regions offer substantial future demand potential for TiO2, Tronox's current market penetration is limited, requiring significant investment to build presence and capture share. For instance, the company's 2024 strategic planning would involve detailed market entry cost analyses for countries like Vietnam and Indonesia, where rising middle classes are expected to drive TiO2 consumption in sectors like paints and plastics.

The company's investments in new mining projects like Namakwa East OFS and Fairbreeze extension in South Africa are also in the Question Mark category. These are crucial for future ilmenite supply but are currently in development, meaning their contribution to current market share is minimal, despite substantial capital expenditure in 2024 for their advancement.

Similarly, Tronox's focus on advanced applications in clean energy, particularly for SCR systems, positions these segments as Question Marks. While the global market for automotive catalysts was valued around $20 billion in 2023 and is growing, Tronox's current share in these specialized niches is likely small, demanding significant R&D and specialized production investment to gain traction.

Tronox's strategic push into new geographic markets and specialized applications, where its current market share is low but future growth potential is high, firmly places these initiatives as Question Marks in the BCG Matrix. These ventures require careful nurturing and strategic investment to transition into Stars or Cash Cows.

BCG Matrix Data Sources

Our Tronox Holdings BCG Matrix is powered by comprehensive market data, including Tronox's official financial reports, industry growth forecasts, and competitor analysis.