Tronox Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tronox Holdings Bundle

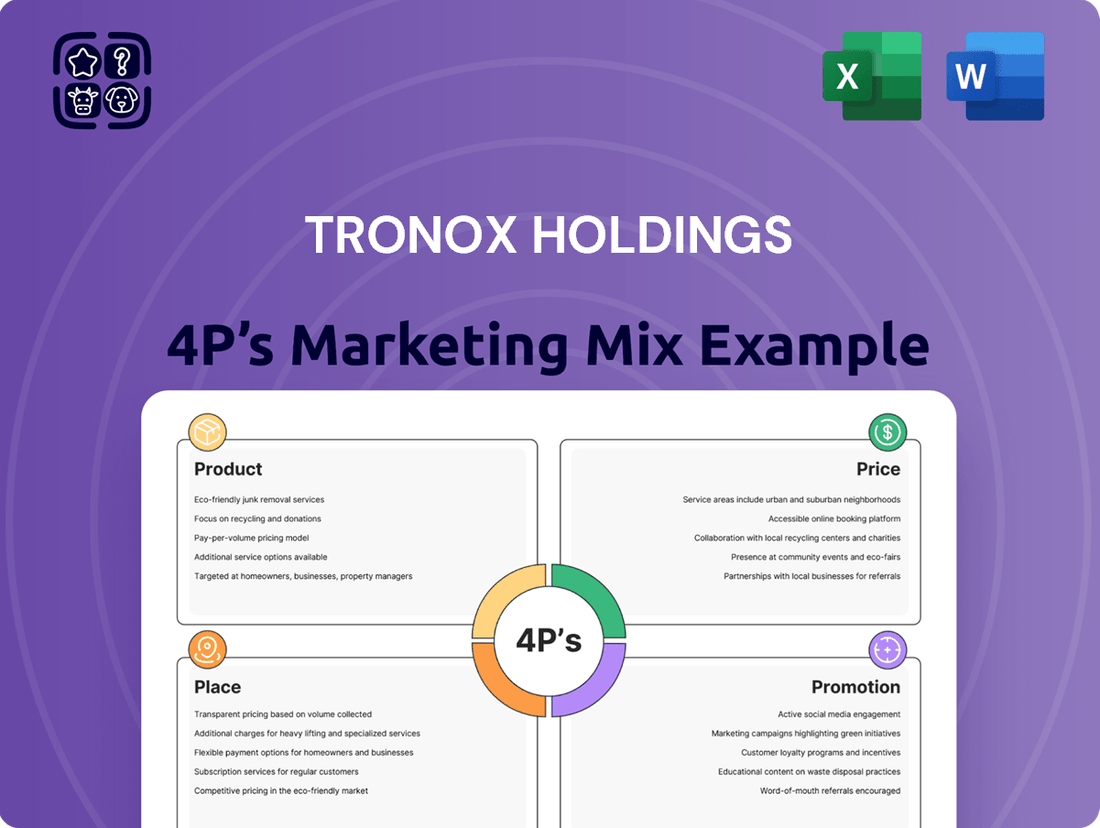

Tronox Holdings, a global leader in titanium dioxide (TiO2), strategically leverages its 4Ps to dominate the pigment market. Their product portfolio, a cornerstone of their strategy, features high-quality TiO2 pigments essential for diverse applications.

Delve into Tronox's pricing architecture, understanding how they balance value and market competitiveness for their specialized products. Discover the intricate network of distribution channels they employ to reach global customers efficiently.

Explore how Tronox's promotional tactics, from industry trade shows to digital engagement, build brand awareness and drive demand for their critical chemical components.

This preview offers a glimpse into the strategic brilliance behind Tronox Holdings' marketing success. To truly grasp their market dominance and gain actionable insights, unlock the full 4Ps Marketing Mix Analysis.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

Tronox Holdings' core product is titanium dioxide (TiO2) pigment, a vital white pigment celebrated for its superior whiteness, brightness, and hiding power. This indispensable material is a key component in numerous consumer and industrial goods, imparting essential performance characteristics. For instance, in 2023, the global TiO2 market size was valued at approximately $16.5 billion, with Tronox being a significant player.

The company strategically offers a broad spectrum of TiO2 grades. These are meticulously developed to cater to the distinct needs of various sectors, from coatings and plastics to paper and cosmetics. This product differentiation allows Tronox to address specific performance requirements, such as durability in exterior paints or UV resistance in plastics, thereby maximizing its market reach and value proposition.

Vertically integrated raw materials are a cornerstone of Tronox's product strategy. The company controls the entire process, from mining titanium-bearing mineral sands like ilmenite and rutile to processing them into titanium dioxide (TiO2) pigment. This means Tronox has a secure and consistent supply of the essential ingredients needed for its products.

This deep integration, from mine to pigment, gives Tronox significant advantages. It allows for tighter control over product quality throughout the manufacturing process. Furthermore, it helps manage costs more effectively, as the company isn't reliant on external suppliers for its key raw materials. This was evident in their 2024 performance, where they highlighted the benefits of their integrated model in navigating supply chain volatility.

Tronox Holdings' product strategy extends beyond its core titanium dioxide (TiO2) pigment business. The company offers specialized TiO2 grades and high-purity titanium chemicals like titanium tetrachloride and ultrafine TiO2. These advanced materials serve demanding niche markets and specialized applications, highlighting Tronox's commitment to innovation and tailored solutions.

Beyond titanium-based products, Tronox also leverages its operational efficiencies to produce zircon, a valuable co-product. This mineral finds significant use in the ceramics and refractories industries, diversifying Tronox's revenue streams and broadening its market reach. For 2024, the global zircon market is projected to grow, with demand driven by construction and industrial applications.

Diverse End-Use Applications

Tronox's titanium dioxide (TiO2) pigments are fundamental to a vast array of end-use applications, touching nearly every facet of modern life. Their products are critical in the manufacturing of paints and coatings, where TiO2 provides essential opacity, brightness, and UV resistance, contributing to product longevity and aesthetic appeal. In 2023, the global paints and coatings market was valued at approximately $170 billion, with TiO2 being a key ingredient.

Beyond coatings, Tronox's TiO2 plays a crucial role in the plastics industry, enhancing whiteness, opacity, and weatherability for everything from automotive components to consumer packaging. The plastics market is a significant consumer of TiO2, with demand driven by growth in construction and automotive sectors. Furthermore, their pigments are vital in paper manufacturing for brightness and printability, and in printing inks to ensure vibrant and stable colors across diverse media.

- Paints and Coatings: Imparts opacity, durability, and UV protection. The global market for TiO2 in paints and coatings is substantial, reflecting its essential role.

- Plastics: Enhances whiteness, opacity, and weatherability in a wide range of plastic products.

- Paper: Contributes to brightness and improved printability in paper products.

- Printing Inks: Provides color vibrancy and stability for various printing applications.

Innovation and Development

Tronox Holdings actively invests in innovation and development, focusing on enhancing its titanium dioxide (TiO2) offerings. This commitment translates into continuous research and development efforts aimed at improving existing TiO2 formulations and pioneering new grades. For instance, in 2023, Tronox reported significant progress in developing specialty TiO2 products tailored for high-performance applications.

The company’s R&D strategy involves exploring advanced technologies such as performance-enhancing additives, precise nanoparticle synthesis, and sophisticated surface treatments. These initiatives are designed to proactively address the dynamic demands of various market sectors. Tronox’s strategic focus remains on creating differentiated products that provide unique solutions for specific customer requirements, particularly within the automotive and construction industries, where performance and durability are paramount.

This drive for innovation is supported by substantial investment. While specific R&D expenditure figures for 2024 are still emerging, Tronox consistently allocates resources to its innovation pipeline, aiming to maintain a competitive edge. Their efforts include:

- Developing advanced TiO2 pigments with enhanced UV resistance for improved product longevity.

- Exploring novel nanoparticle structures to boost opacity and brightness in coatings.

- Creating surface-treated TiO2 grades for specialized applications like photocatalysis and antimicrobial surfaces.

- Collaborating with customers to co-develop tailored solutions for emerging market needs.

Tronox's product portfolio centers on titanium dioxide (TiO2) pigment, a critical white pigment prized for its exceptional whiteness, brightness, and opacity, essential for countless consumer and industrial goods. The company also provides specialized TiO2 grades and high-purity titanium chemicals for niche markets, alongside zircon as a valuable co-product, diversifying its offerings and revenue streams.

| Product Category | Key Characteristics | Primary Applications | Market Relevance (2023/2024 Projections) |

|---|---|---|---|

| Titanium Dioxide (TiO2) Pigment | Superior whiteness, brightness, hiding power | Paints & Coatings, Plastics, Paper, Printing Inks | Global TiO2 market valued at ~$16.5 billion (2023); Tronox offers diverse grades for specific performance needs. |

| Specialty TiO2 & Titanium Chemicals | High performance, purity | Niche markets, advanced applications | Ongoing R&D for enhanced UV resistance, novel structures, and surface treatments. |

| Zircon | Valuable co-product | Ceramics, Refractories | Global zircon market projected for growth (2024) driven by construction and industrial demand. |

What is included in the product

This analysis offers a comprehensive examination of Tronox Holdings' marketing strategies, detailing their product portfolio, pricing structures, distribution channels, and promotional activities to provide actionable insights for competitive positioning.

Simplifies Tronox's complex marketing strategy by distilling the 4Ps into actionable insights, easing the burden of understanding their competitive positioning.

Provides a clear, concise overview of Tronox's 4Ps, alleviating the pain of deciphering intricate marketing plans for busy executives.

Place

Tronox operates a substantial global manufacturing footprint, essential for its titanium dioxide (TiO2) pigment business. This network comprises nine TiO2 pigment production plants strategically located across continents.

Further strengthening its supply chain, Tronox manages multiple mineral sands mines and upgrading facilities. These operations are primarily situated in Australia and South Africa, securing critical raw material inputs.

With production sites in key regions like the United States, the Netherlands, and Western Australia, Tronox ensures proximity to major markets. This widespread presence allows the company to efficiently cater to a diverse and global customer base.

Tronox Holdings' vertically integrated supply chain is a cornerstone of its strategy, controlling everything from mining titanium ore to producing titanium dioxide (TiO2) pigment. This end-to-end control, from mine to market, ensures a consistent and reliable supply of its core raw materials, a critical factor in the volatile chemical industry. For instance, in 2024, Tronox's Australian operations, including the Fairbreeze mine, continued to be a vital source of feedstock, underpinning their pigment production capabilities.

This integration directly translates into enhanced logistical efficiency for distributing bulk materials like TiO2, a key component in paints, plastics, and paper. By managing its own mining and processing, Tronox can optimize transportation and reduce reliance on third-party suppliers, minimizing potential disruptions. This control is particularly valuable in the current economic climate, where global supply chains have faced significant challenges.

The competitive advantage derived from this model is substantial, especially in securing raw materials like ilmenite and rutile, which are essential for TiO2 production. Tronox's ability to manage its own resource base provides a buffer against price volatility and scarcity. In 2024, with ongoing global demand for TiO2, estimated to reach over 7 million metric tons, this secure access to raw materials is a significant differentiator.

Tronox Holdings leverages a dedicated direct sales and technical service organization to effectively implement its marketing strategies, ensuring high-quality customer engagement. This direct model is crucial for building robust customer relationships and offering specialized support, especially given the intricate technical demands of titanium dioxide (TiO2) applications.

The company's commitment to customer service is evident in its geographically dispersed regional customer service staff, strategically placed in key global markets to bolster these direct sales initiatives. This hands-on approach allows Tronox to deeply understand and respond to the unique needs of its diverse clientele.

Strategic Distribution Channels

Tronox Holdings' strategic distribution channels are designed for efficient global delivery to industrial clients, utilizing its extensive network of production facilities. This approach ensures timely product availability by focusing on robust logistics and supply chain optimization.

The company serves a vast customer base, reaching approximately 1,200 clients across roughly 100 countries. This wide reach underscores their commitment to global market penetration and customer service.

- Global Reach: Serves approximately 1,200 customers in around 100 countries.

- Operational Efficiency: Leverages widespread operational sites for efficient product delivery.

- Logistics Focus: Employs optimized logistics and supply chain management to meet customer needs.

Optimized Production and Logistics

Tronox is actively refining its global production network. A key move is the idling of the Botlek plant, a strategic decision expected to boost free cash flow and EBITDA starting in 2026. This focus on operational efficiency is crucial for meeting diverse regional market needs effectively.

Capital expenditures are also strategically allocated to mining initiatives. These investments are designed to lower the company's overall mining cost structure, enhancing profitability. For instance, ongoing projects are targeting improvements in the cost per ton of mined material, supporting a more competitive pricing strategy.

- Capacity Utilization: Tronox aims to maximize output from its existing facilities, a critical factor in managing production costs.

- Logistics Network: The company leverages its global presence to ensure timely and cost-effective delivery of titanium dioxide products to customers worldwide.

- Mining Cost Reduction: Investments in mining efficiency are projected to yield significant savings, directly impacting the cost of raw materials.

- Strategic Plant Decisions: Actions like the Botlek plant's idling demonstrate a commitment to optimizing the production footprint for financial performance.

Tronox's place within the marketing mix is defined by its extensive global manufacturing and mining footprint, ensuring proximity to key markets and raw material sources. This strategic placement supports efficient delivery and supply chain reliability for its titanium dioxide (TiO2) pigment products, serving approximately 1,200 customers across roughly 100 countries. Ongoing efforts to optimize this network, such as the planned idling of the Botlek plant by 2026, underscore a commitment to operational efficiency and enhanced financial performance.

| Asset Type | Number of Facilities | Primary Location(s) | Strategic Importance |

|---|---|---|---|

| TiO2 Pigment Plants | 9 | USA, Netherlands, Western Australia, etc. | Market proximity, global customer service |

| Mineral Sands Mines | Multiple | Australia, South Africa | Raw material security, vertical integration |

| Upgrading Facilities | Multiple | Australia, South Africa | Feedstock preparation, cost optimization |

What You Preview Is What You Download

Tronox Holdings 4P's Marketing Mix Analysis

The document you see here is not a sample; it's the actual, fully completed Tronox Holdings 4P's Marketing Mix Analysis you’ll receive right after purchase. This comprehensive breakdown covers Product, Price, Place, and Promotion strategies. You can confidently preview the exact content you'll be downloading to understand Tronox's market approach. No surprises, just the detailed analysis you need.

Promotion

Tronox Holdings' B2B customer relationship promotion is built on deep engagement. Their strategy involves direct interaction via dedicated sales teams, technical service experts, and R&D personnel, ensuring a comprehensive understanding of client requirements. Senior management also participates in key customer visits, reinforcing the importance of these partnerships.

This multi-faceted approach aims to deliver customized solutions, moving beyond transactional sales to foster long-term collaborations. By actively listening and responding to specific customer needs, Tronox strengthens its market position. For instance, their focus on direct communication channels facilitated the successful launch of new pigment grades in early 2024, driven by detailed customer feedback.

Tronox's commitment to technical sales and support is crucial given the complex nature of titanium dioxide (TiO2) applications. Their direct sales force receives extensive training on all products and their diverse applications, ensuring they can effectively advise customers.

This technical expertise is further amplified by regional customer service teams, creating a comprehensive support network. This structure empowers clients with expert guidance, facilitating optimal product utilization and efficient problem resolution, a key differentiator in the specialized TiO2 market.

Tronox actively engages in industry conferences and trade shows, crucial avenues for B2B promotion. These events allow them to display new product developments and share technical insights, directly reaching potential clients and partners in sectors like coatings, plastics, and paper. For example, participation in events like the Titanium Dioxide Global Summit or regional chemical industry forums provides direct access to industry leaders and decision-makers.

Thought leadership is also a key component of their promotional strategy, often demonstrated through presentations at these same conferences. By sharing expertise on titanium dioxide production, sustainability, and market trends, Tronox positions itself as an authority. This builds credibility and fosters stronger relationships within the industry, influencing purchasing decisions and strategic partnerships.

Investor presentations, while primarily for financial stakeholders, also function as a promotional tool. These presentations often highlight technological advancements, market growth strategies, and company performance, indirectly showcasing the value and innovation of Tronox's offerings to a broader audience. For instance, their 2024 investor day likely detailed their strategic advantages in the growing demand for high-performance TiO2.

Sustainability and Responsible Operations Messaging

Tronox Holdings places sustainability at the forefront of its corporate identity and outreach, emphasizing the responsible transformation of natural resources. This commitment is not just a statement but is backed by tangible actions and communicated through various channels. The company's 2024 sustainability report, for instance, showcases concrete advancements in key environmental metrics.

The report highlights a significant reduction in greenhouse gas (GHG) emissions, a critical step in addressing climate change. Furthermore, Tronox is actively working to decrease its waste generation, a testament to its focus on operational efficiency and environmental stewardship. The strategic utilization of rare earth concentrates also underscores their innovative approach to resource management.

These efforts translate into enhanced brand reputation and stakeholder trust. By transparently reporting on its sustainability progress, Tronox demonstrates accountability and a forward-thinking approach. This can attract environmentally conscious investors and customers, strengthening its market position.

- GHG Emission Reduction: Tronox reported progress in lowering its greenhouse gas emissions in its 2024 sustainability report.

- Waste Minimization: The company is actively engaged in decreasing waste generation across its operations.

- Rare Earth Concentrate Utilization: Tronox is leveraging rare earth concentrates as part of its responsible resource management strategy.

- Stakeholder Communication: The commitment to sustainability is a key message communicated to all stakeholders to build trust and enhance brand reputation.

Investor Relations and Financial Communications

Tronox Holdings places a strong emphasis on investor relations and financial communications to engage with its financially-literate audience. This proactive approach involves disseminating detailed financial information through various channels.

Key components of their strategy include quarterly earnings releases, live webcasts of financial results, comprehensive annual reports, and in-depth investor presentations. These materials offer transparent financial data and outline the company's strategic direction and future outlook.

For instance, in their Q1 2024 earnings report, Tronox highlighted adjusted EBITDA of $132 million, demonstrating their ongoing commitment to financial performance transparency. The company also noted a significant capital expenditure program focused on growth initiatives, providing insights into future value creation.

- Regular Earnings Releases: Providing timely financial performance updates.

- Investor Presentations: Detailing strategic initiatives and market outlooks.

- Annual Reports: Offering a comprehensive overview of financial health and operations.

- Webcasts: Facilitating direct engagement and Q&A with management.

Tronox's promotional strategy for its titanium dioxide (TiO2) products centers on building strong B2B relationships through direct engagement, technical expertise, and thought leadership. Their active participation in industry events and transparent financial communications further solidify their market presence.

The company leverages its deep understanding of TiO2 applications, showcased by its technical sales teams and customer service experts, to provide tailored solutions. This focus on customer needs, exemplified by the successful launch of new pigment grades in early 2024 driven by feedback, fosters long-term partnerships.

Tronox also highlights its commitment to sustainability, as detailed in its 2024 sustainability report, which includes progress on reducing GHG emissions and waste. This emphasis on environmental responsibility enhances brand reputation and attracts stakeholders who prioritize sustainable practices.

Financial communications, including quarterly earnings and investor presentations, serve as a promotional tool by showcasing technological advancements and growth strategies. For instance, their Q1 2024 earnings report detailed adjusted EBITDA of $132 million, underscoring their financial health and strategic focus.

Price

Tronox navigates a global titanium dioxide (TiO2) market inherently cyclical and tied to construction and manufacturing trends. This means pricing can fluctuate significantly based on broader economic health.

To manage this volatility, Tronox employs a dual pricing strategy, utilizing both annual contracts for stability and spot market sales for flexibility.

In 2024, the TiO2 market has experienced pricing pressure, with average selling prices for TiO2 experiencing a decline compared to the previous year, even as some segments saw volume increases. For instance, while specific contract prices vary, market reports indicate a general downward trend in contract settlements for 2024, reflecting softer demand in key end-use sectors like automotive and construction.

Despite these pressures, Tronox aims to maintain competitive positioning by adjusting its pricing mechanisms to align with market dynamics and securing volumes through its contract base, which provides a degree of revenue predictability against spot market fluctuations.

Tronox Holdings plc employs a value-based pricing strategy, capitalizing on its vertically integrated operations and unwavering commitment to high-quality titanium dioxide (TiO2) products. This approach allows them to command premium prices from customers who value consistent performance and a reliable supply chain.

The company's ability to guarantee product quality and ensure supply chain dependability serves as a significant differentiator. This allows Tronox to move beyond simple commodity pricing, as demonstrated by their operational efficiency and market position. For instance, Tronox's **2024 Q1 revenue reached $473 million**, reflecting ongoing market demand for their specialized products.

The cost of raw materials, especially titanium-bearing ores, is a major factor in Tronox's production expenses, directly impacting their pricing. In 2023, the company's cost of sales was $3.6 billion, highlighting the significant weight of these inputs. Securing these materials affordably is key to staying profitable and competitive on price.

Impact of Market Dynamics and Trade Policies

Tronox Holdings' pricing strategy is heavily influenced by the ebb and flow of global supply and demand for titanium dioxide (TiO2). When demand outstrips supply, prices naturally tend to rise, allowing Tronox to potentially command higher prices for its products. Conversely, oversupply situations can pressure prices downward.

Trade policies, particularly anti-dumping duties, introduce another layer of complexity to Tronox's pricing. For example, the imposition of anti-dumping tariffs on Chinese TiO2 imports by major markets like the United States and the European Union can significantly alter regional pricing structures. This can create opportunities for Tronox by making imports less competitive, thereby supporting its own pricing power in those regions.

- Global TiO2 Market Dynamics: The TiO2 market experienced price volatility in 2024, with benchmark prices for rutile TiO2 in Europe averaging around $2,500-$2,700 per metric ton in early 2024, influenced by supply constraints and recovering industrial demand.

- Impact of Trade Measures: Anti-dumping duties on Chinese TiO2, such as those in the US, can increase the cost of competing products, potentially allowing Tronox to maintain or increase its prices in those markets.

- Regional Pricing Variations: Pricing strategies must be agile, adapting to different regional market conditions and the specific impact of trade policies in each area.

- Competitive Landscape: Trade policies can reshape the competitive landscape, affecting the landed cost of imported TiO2 and influencing Tronox's market share and pricing decisions.

Cost Improvement Initiatives to Support Margins

Tronox is actively pursuing cost improvement initiatives to bolster its profit margins. These programs are designed to yield substantial sustainable savings through to the end of 2026. Key components include strategic capital investments in mining operations and the temporary idling of specific production sites.

These actions are strategically aimed at reducing overall operating expenses and boosting operational efficiency. By lowering costs, Tronox gains greater flexibility in its pricing strategies, allowing it to better navigate market fluctuations and protect its profitability. For instance, the company has highlighted that by the end of 2023, its cost optimization efforts contributed to a $50 million improvement in adjusted EBITDA compared to 2022. Looking ahead, the company anticipates further benefits from these ongoing programs throughout 2024 and beyond.

- Capital Investments: Funding allocated to enhance mining efficiency and reduce extraction costs.

- Production Facility Idling: Strategic shutdown of less efficient plants to cut operational expenditures.

- Targeted Savings: Aiming for significant, sustainable cost reductions through 2026.

- Margin Enhancement: Initiatives directly support improved profit margins and pricing power.

Tronox's pricing strategy is deeply intertwined with global supply and demand dynamics for titanium dioxide (TiO2). When demand is strong and supply is constrained, Tronox can leverage its vertically integrated operations and commitment to quality to command premium prices. Conversely, oversupply situations can lead to price pressures.

Trade policies, such as anti-dumping duties, play a crucial role in shaping regional pricing. For example, tariffs on Chinese TiO2 can make imports less competitive in markets like the US and EU, potentially bolstering Tronox's pricing power in those areas. This requires an agile approach to pricing, adapting to diverse regional market conditions.

Cost management is also paramount. Tronox's 2023 cost of sales was $3.6 billion, emphasizing the impact of raw material costs. Initiatives aimed at cost reduction, which contributed $50 million to adjusted EBITDA in 2023, provide greater pricing flexibility and support profitability amidst market fluctuations.

| Metric | 2023 Value | 2024 Trend (Early) | Impact on Pricing |

|---|---|---|---|

| Cost of Sales | $3.6 Billion | Ongoing cost optimization | Supports pricing flexibility and margins |

| TiO2 Market Prices (Rutile) | Varies (declining trend in contract settlements) | ~$2,500-$2,700/mt (Europe, early 2024) | Subject to supply/demand and trade policies |

| Adjusted EBITDA Improvement (from cost savings) | $50 Million (vs. 2022) | Continued initiatives | Enhances profitability and competitive pricing |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Tronox Holdings is grounded in comprehensive data from SEC filings, annual reports, and investor presentations. We also incorporate insights from industry publications, competitor analyses, and official company press releases to capture their strategic positioning and market activities.