TFI International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TFI International Bundle

TFI International, a logistics powerhouse, boasts significant strengths in its diversified service offerings and robust operational efficiency. However, potential investors and strategists should be aware of the competitive pressures and evolving regulatory landscape that could impact its growth trajectory.

Want the full story behind TFI International's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

TFI International's strength lies in its remarkably diversified business model, encompassing Package and Courier, Less-Than-Truckload (LTL), Truckload, and Logistics segments. This broad operational scope creates a robust revenue stream, significantly mitigating the risks associated with over-reliance on any single market. The company's strategic geographic spread, with 69.4% of its operations in the United States and 30.6% in Canada as of early 2024, further enhances its ability to capitalize on varying economic conditions and demand across North America.

TFI International boasts a remarkably strong acquisition strategy, evidenced by its completion of 91 acquisitions since 2016, including five significant ones. This consistent activity highlights a focused approach to growth.

The company’s acquisition criteria are clearly defined, prioritizing targets that immediately enhance earnings per share (EPS) and free cash flow. This focus ensures that new additions contribute positively from the outset.

Furthermore, TFI seeks acquisitions that align well with its existing business segments and demonstrate strong free cash flow generation potential. Synergy opportunities are also a key consideration in their evaluation process.

A prime example of this strategy in action is the acquisition of Daseke in April 2024. This move substantially strengthened TFI’s Truckload segment, showcasing the effectiveness of their disciplined M&A approach in driving tangible business improvements.

TFI International demonstrates exceptional strength in generating free cash flow. For instance, in the first quarter of 2025, the company reported a robust free cash flow of $192 million, marking a significant 40% increase compared to the same period in the prior year. This impressive performance is a direct result of their effective working capital management and a strategic reduction in capital expenditures.

Asset-Light Model and Operational Efficiency

TFI International's asset-light strategy is a significant strength, evidenced by net capital expenditures representing a mere 2.7% of total revenue in 2023. This lean approach allows for greater financial flexibility compared to asset-heavy competitors.

The company actively pursues operational efficiency through strategic technology investments. For instance, the implementation of Optum software for linehaul planning and enhancements to pricing tools are designed to streamline operations and boost route optimization, especially within the crucial U.S. LTL segment.

- Asset-Light Advantage: Low capital expenditure as a percentage of revenue (2.7% in 2023) provides financial agility.

- Technology-Driven Efficiency: Investments in software like Optum enhance route planning and operational cost reduction.

- Focus on Optimization: Continuous efforts to improve pricing tools and route efficiency contribute to profitability.

Extensive North American Network

TFI International's extensive North American network is a significant strength, encompassing over 100 operating companies and 646 facilities. This robust infrastructure includes a substantial fleet of 20,756 trucks and 42,710 trailers, providing broad operational reach. The company's presence extends into Mexico, facilitating cross-border freight opportunities. This wide geographical coverage allows TFI to effectively serve a diverse customer base and capitalize on increasing e-commerce logistics demands.

Key aspects of TFI's network strength include:

- Vast Operational Footprint: Operates across North America with 646 facilities.

- Significant Fleet Size: Possesses 20,756 trucks and 42,710 trailers.

- Cross-Border Capabilities: Includes operations in Mexico, ideal for international trade.

- Customer Reach: Enables service to a wide array of industries and client needs.

TFI International's diversified business model provides resilience, with segments like Package and Courier, LTL, and Truckload. This broad operational scope, complemented by a strategic geographic presence (69.4% U.S. and 30.6% Canada as of early 2024), allows it to navigate varied economic conditions effectively.

Their consistent and disciplined acquisition strategy, completing 91 acquisitions since 2016, including five major ones, fuels growth. TFI prioritizes acquisitions that immediately boost EPS and free cash flow, like the April 2024 Daseke acquisition, enhancing their Truckload segment.

Exceptional free cash flow generation is a key strength, with a 40% year-over-year increase to $192 million in Q1 2025, driven by working capital management and reduced capital expenditures.

| Metric | 2023 | Q1 2025 |

|---|---|---|

| Net CapEx as % of Revenue | 2.7% | N/A |

| Free Cash Flow | N/A | $192 million |

| Acquisitions Completed (Since 2016) | 91 | N/A |

What is included in the product

Analyzes TFI International’s competitive position through key internal and external factors, detailing its strengths in diverse operations and opportunities for acquisitions, while also addressing potential weaknesses in integration and threats from economic downturns.

Offers a clear, actionable breakdown of TFI International's competitive landscape and internal capabilities, enabling targeted strategies to overcome market challenges.

Weaknesses

TFI International's U.S. Less-Than-Truckload (LTL) segment has been a notable underperformer, impacting the company's overall financial health. In the first quarter of 2025, this segment saw declines in revenue and operating income, with a concerning drop in return on invested capital.

Several headwinds contributed to this weakness. The U.S. LTL market experienced challenging conditions, compounded by increased accident-related expenses. Furthermore, the company reported a loss of small and medium-sized business customers, a key demographic for LTL services.

This underperformance is further highlighted by a weaker operating ratio in the U.S. LTL segment when compared to its Canadian counterpart. For Q1 2025, the U.S. LTL operating ratio stood at 91.2%, a significant difference from the Canadian LTL segment's 78.5%.

While TFI International has demonstrated impressive revenue expansion, largely through strategic acquisitions, its profitability metrics tell a more nuanced story. The broader freight market's weakness, characterized by declining freight volumes and intensified competitive pressures, has directly impacted TFI's net income and operating margins. For instance, in the first quarter of 2024, TFI reported a net income of $166 million, a decrease from $232 million in the same period of 2023, reflecting these headwinds.

This dip in net income, despite top-line growth, highlights how macroeconomic factors and industry softness can directly affect TFI's bottom line. Even with a diversified business model that should, in theory, offer some buffer against sector-specific downturns, the company is clearly susceptible to adverse economic conditions. The ongoing competitive landscape further exacerbates these challenges, demanding constant strategic adjustments to maintain profitability.

TFI International has experienced a notable underperformance in its one-year total shareholder return compared to its industry peers. This trend suggests that despite solid operational execution, the company is facing significant market headwinds that are impacting investor perception.

The market's reaction has been evident in the stock's volatility throughout 2025, culminating in a substantial price correction. Such performance can erode investor confidence, potentially impacting the company's ability to attract capital and maintain a favorable stock valuation moving forward.

Integration Challenges with Acquisitions

Integrating acquired companies, a cornerstone of TFI International's growth strategy, can be complex. For instance, the acquisition of Daseke in 2022, a significant move in the North American less-than-truckload (LTL) and truckload (TL) freight sector, highlights this. Realizing the full potential of such acquisitions requires substantial effort to align systems and cultures.

CEO Alain Bédard has openly discussed the work needed to make Daseke more efficient, aiming to make it lean and mean. This implies that the anticipated operational synergies and margin improvements from this acquisition may not be immediate, potentially impacting short-term financial performance as integration progresses.

- Integration Hurdles: Streamlining operations across acquired entities like Daseke presents ongoing challenges.

- Synergy Realization: Achieving desired financial margins and operational efficiencies from acquisitions can be a lengthy process.

- CEO Acknowledgment: Leadership has identified significant work required to optimize newly acquired businesses for better performance.

- Strategic Focus: While acquisitions drive scale, the internal focus must remain on successful integration to unlock full value.

Vulnerability to Tariff Uncertainty and Industrial Sector Weakness

TFI International faces significant headwinds due to ongoing tariff uncertainty, which directly impacts its cross-border freight operations. This uncertainty contributed to a notable decline in freight volumes in 2024, even forcing TFI to withdraw from a major acquisition opportunity in early 2025 that was contingent on more stable trade environments.

Furthermore, a slowdown in key industrial sectors, specifically agriculture and manufacturing, presents another substantial weakness. These sectors are critical drivers of freight demand, and their current weakness has led to deferred client spending and a reduction in overall freight volumes. This directly affects TFI's U.S. truckload segment, which relies heavily on these industries for business.

- Tariff Uncertainty: Led to reduced cross-border freight volumes in 2024.

- M&A Impact: Caused TFI to exit a significant acquisition in early 2025.

- Industrial Sector Slump: Weakness in agriculture and manufacturing is delaying spending.

- Segment Impact: Reduced freight volumes specifically hitting the U.S. truckload division.

TFI International's U.S. Less-Than-Truckload (LTL) segment continues to be a drag on overall performance, marked by declining revenue and operating income in Q1 2025. This underperformance is exacerbated by increased accident-related expenses and the loss of small to medium-sized business customers, a critical segment for LTL services.

The U.S. LTL operating ratio of 91.2% in Q1 2025 starkly contrasts with the Canadian LTL segment's more efficient 78.5%, highlighting operational disparities. Despite overall revenue growth driven by acquisitions, net income for Q1 2024 fell to $166 million from $232 million in Q1 2023, indicating vulnerability to broader freight market weaknesses and intense competition.

Integration challenges with major acquisitions, such as Daseke, present ongoing hurdles. CEO Alain Bédard has acknowledged the significant work required to optimize these acquired businesses, suggesting that expected synergies and margin improvements may not be immediate, potentially impacting short-term financial results.

Tariff uncertainties and a slump in key industrial sectors like agriculture and manufacturing have negatively impacted freight volumes throughout 2024 and early 2025. This slowdown forced TFI to withdraw from a significant acquisition opportunity in early 2025 and directly affected the U.S. truckload segment's business.

| Segment | Q1 2025 Revenue Change vs. PY | Q1 2025 Operating Income Change vs. PY | Q1 2025 Operating Ratio |

| U.S. LTL | -4.5% | -12.1% | 91.2% |

| Canadian LTL | +7.2% | +15.0% | 78.5% |

| U.S. Truckload | -6.8% | -10.5% | 94.1% |

What You See Is What You Get

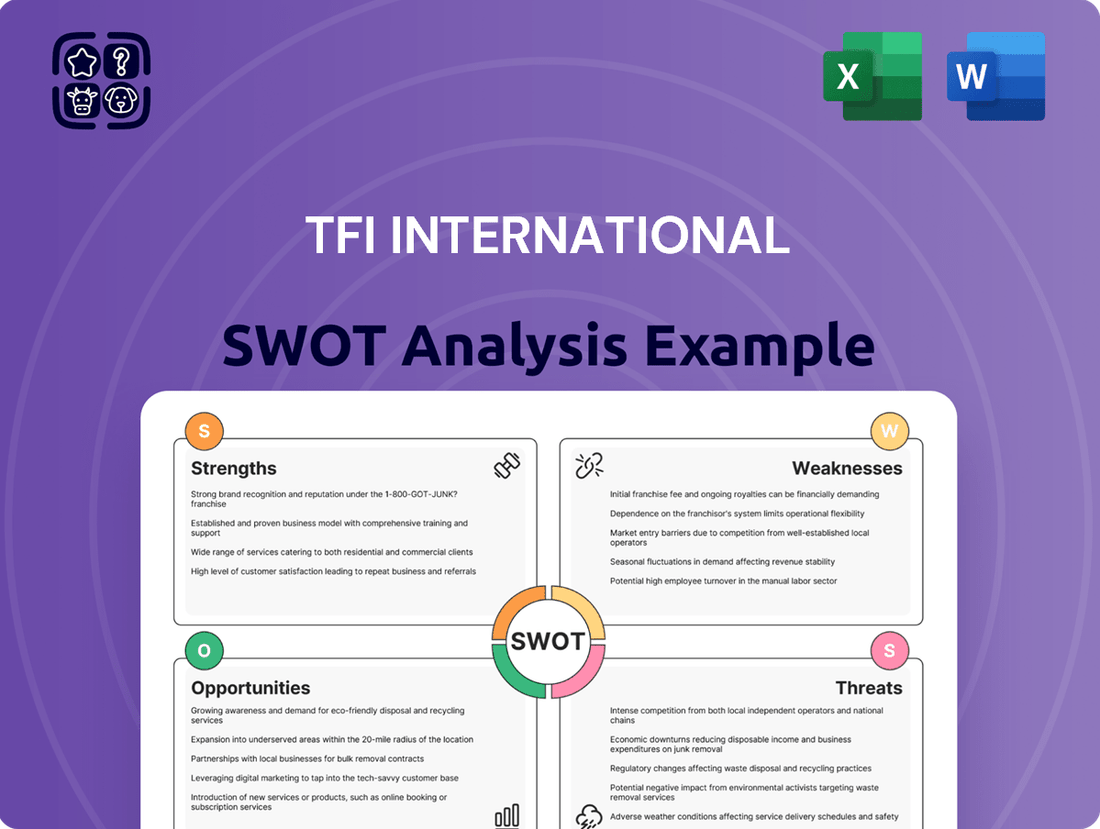

TFI International SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You'll gain a comprehensive understanding of TFI International's Strengths, Weaknesses, Opportunities, and Threats. This analysis is designed to equip you with actionable insights for strategic planning and decision-making. The full, detailed report is unlocked immediately after purchase.

Opportunities

E-commerce presents a substantial avenue for TFI International's growth, evidenced by consistent revenue increases in this segment and a rising B2C contribution. The company's extensive network, serving e-commerce clients from close to 80 North American cities, strategically positions it to leverage the ongoing expansion of online retail. This reach is particularly advantageous given the significant $1.5 trillion U.S.-Canada cross-border e-commerce market, a sector where TFI can further solidify its market share.

TFI International's robust free cash flow and solid financial position in 2024 and projected into 2025 offer significant capacity for strategic acquisitions. This financial strength enables the company to pursue both truckload and less-than-truckload (LTL) opportunities, potentially making substantial deals. For instance, TFI's consistent generation of free cash flow, which has historically supported its growth, is expected to continue, providing the war chest for these strategic moves.

The company's proven track record of disciplined acquisitions, always targeting those that enhance earnings per share, positions it well for future expansion. This focus on accretive targets allows TFI to effectively broaden its operational network and diversify its service portfolio. A prime example of this strategy could be the acquisition of a significant LTL carrier, which might then facilitate the strategic spin-off of Daseke, further optimizing TFI's business structure.

TFI International's U.S. Less-Than-Truckload (LTL) segment is ripe for operational enhancement. The company has been actively revamping its U.S. LTL operations, which includes bringing in new leadership and refocusing its strategy on small and medium-sized businesses (SMBs). These initiatives, coupled with planned technology upgrades, are designed to drive greater efficiency and ultimately improve profitability within this key division.

The strategic pivot towards SMBs is particularly promising, as this segment often offers higher yields compared to larger accounts. By tailoring services and pricing to the needs of smaller shippers, TFI can unlock new revenue streams and solidify its market position. This targeted approach is a departure from a more generalized strategy and aims to capture a more profitable customer base.

A crucial metric to watch is the operating ratio, which reflects a company's operating expenses as a percentage of its revenue. TFI has set an ambitious goal of achieving an operating ratio below 90% for its U.S. LTL operations. Successfully reaching this sub-90% target would represent a substantial improvement and significantly contribute to TFI's overall financial performance, potentially boosting earnings per share in the 2024-2025 period.

Technological Advancements for Efficiency

TFI International's strategic investments in technology are a significant opportunity to boost efficiency. For instance, their utilization of Optum software for linehaul planning and sophisticated AI-powered pricing tools are designed to streamline operations and reduce costs across all business segments. This technological edge can be instrumental in narrowing the performance gap between their U.S. Less-Than-Truckload (LTL) operating ratio and the superior efficiency seen in their Canadian operations, potentially leading to substantial financial gains.

These advancements empower TFI to:

- Optimize route planning and fuel consumption through Optum software.

- Improve pricing accuracy and revenue management with AI tools.

- Enhance overall network efficiency by leveraging data analytics.

- Drive down operating costs, thereby improving profit margins.

Sustainability and Green Logistics Initiatives

TFI International is strategically positioning itself within the growing sustainability movement. A significant portion of its future fleet, 40.3% of its backlog, is slated to be zero-emission vehicles. This proactive approach directly addresses the escalating demand from urban centers, corporations, and individual consumers for environmentally responsible logistics services.

This focus on green logistics presents a clear opportunity for TFI to cultivate a competitive edge. By investing in cleaner transportation solutions, the company can unlock new avenues for revenue generation and strengthen its market standing as a forward-thinking provider in the logistics sector.

- Growing Demand: Cities, companies, and consumers are increasingly prioritizing eco-friendly shipping.

- Fleet Modernization: 40.3% of TFI's vehicle backlog comprises zero-emission vehicles.

- Competitive Advantage: Early adoption of green logistics can differentiate TFI from competitors.

- New Revenue Streams: Sustainable practices can attract environmentally conscious clients and open up new service offerings.

TFI International's strategic focus on e-commerce logistics, supported by its extensive North American network reaching nearly 80 cities, positions it to capitalize on the substantial $1.5 trillion U.S.-Canada cross-border e-commerce market. The company's strong free cash flow generation in 2024 and projected into 2025 provides ample capital for strategic acquisitions, particularly in the truckload and LTL sectors, aiming for earnings per share accretion.

Further enhancing its U.S. LTL operations, TFI is implementing leadership changes and a renewed strategy targeting small and medium-sized businesses (SMBs), which often offer higher yields. The company's commitment to technology, including Optum software for linehaul planning and AI pricing tools, aims to improve efficiency and reduce operating costs, with a target of achieving a sub-90% operating ratio in its U.S. LTL segment by 2025.

TFI International is also embracing sustainability, with 40.3% of its vehicle backlog comprising zero-emission vehicles, aligning with the growing demand for eco-friendly logistics and potentially creating a competitive advantage. This proactive stance on green logistics could unlock new revenue streams and strengthen its market position.

| Segment | Key Opportunity | 2024/2025 Data/Projections |

|---|---|---|

| E-commerce Logistics | Leverage extensive network in growing cross-border market | $1.5 trillion U.S.-Canada e-commerce market; Network covers ~80 North American cities |

| Acquisitions | Fund strategic acquisitions with strong free cash flow | Projected strong free cash flow generation for 2024-2025; Focus on EPS accretion |

| U.S. LTL Operations | Improve efficiency and profitability targeting SMBs | Targeting sub-90% operating ratio; Revamping operations with new leadership and tech |

| Technology & Sustainability | Drive efficiency with AI and zero-emission fleet | 40.3% of vehicle backlog is zero-emission; Utilizes Optum and AI pricing tools |

Threats

The North American transportation and logistics landscape is fiercely competitive. TFI International faces significant pressure from established giants who command substantial market shares, making it challenging to expand or even maintain its current position.

This intense rivalry directly translates into pricing wars, forcing companies to operate on thinner margins. For TFI, this is particularly evident in the Less-Than-Truckload (LTL) sector, where they've already seen a dip in their market standing, highlighting the difficulty in navigating this aggressive environment.

In 2024, the LTL market, a key area for TFI, continues to be a battleground. While TFI has made strategic acquisitions to bolster its presence, competitors like FedEx Freight and XPO Logistics remain formidable, consistently vying for market dominance through service innovation and aggressive pricing strategies.

Economic headwinds continue to challenge the freight industry, with ongoing weak market conditions and reduced freight demand presenting a significant threat to TFI International. Macroeconomic uncertainty further amplifies these risks, impacting the company's revenue streams and overall profitability.

TFI International has already felt the sting of these market dynamics, reporting income reductions and noticeable volume declines in specific operating segments throughout 2023 and into early 2024. For instance, the company's Less-Than-Truckload (LTL) segment, a key revenue driver, experienced slower growth compared to previous periods due to softer freight volumes.

Uncertainty regarding tariffs and trade policies, particularly concerning cross-border freight volumes, poses a significant threat to TFI International's operations and strategic planning. This instability was notably highlighted when a potential merger or acquisition agreement was reportedly abandoned due to such concerns, demonstrating a tangible impact on the company's growth trajectory.

Furthermore, shifts in regulatory landscapes or escalating geopolitical tensions can create substantial headwinds for international and cross-border logistics. For instance, ongoing trade disputes and evolving customs regulations can directly impact TFI's ability to efficiently move goods across borders, affecting transit times and costs, which are critical for its business model.

The company's reliance on international trade means it is directly exposed to these external risks. In 2023, TFI generated a substantial portion of its revenue from cross-border operations, making it particularly vulnerable to any disruptions that impede the free flow of goods.

Rising Operating Costs

Rising operating costs present a significant challenge for TFI International. Increased expenses for labor, fuel, and equipment maintenance can directly impact the company's bottom line, potentially squeezing profit margins. For instance, in the first quarter of 2024, TFI reported a substantial increase in operating expenses, driven by wage pressures and higher equipment costs.

While TFI utilizes an asset-light model, which typically offers some insulation from capital expenditures, broader inflationary trends still pose a threat. Segments of TFI's business that operate with thinner margins are particularly vulnerable to these cost increases. This necessitates a vigilant approach to cost management and operational efficiency to preserve profitability.

Key areas contributing to these rising costs include:

- Labor Costs: Competition for qualified drivers and warehouse staff continues to drive up wages and benefits.

- Fuel Prices: Fluctuations in diesel prices directly impact transportation expenses, a core component of TFI's operations.

- Equipment and Maintenance: The cost of new trucks, trailers, and ongoing maintenance has seen an upward trend.

- Regulatory Compliance: Evolving regulations can necessitate additional investments in technology and training, adding to operating expenses.

Litigation and Reputation Risk

TFI International faces significant threats from litigation and reputational damage. A class action lawsuit alleges misleading statements and withheld information concerning operational issues and revenue drops within its Less-Than-Truckload (LTL) division. This legal entanglement could negatively sway investor confidence and affect stock prices.

Such legal actions often result in considerable financial penalties and heightened regulatory oversight, which can strain resources and divert management attention. The perception of financial impropriety or operational mismanagement can erode customer trust and make it harder to attract and retain talent, further impacting business performance.

- Class Action Lawsuit: TFI International is currently facing a class action lawsuit alleging misrepresentation of operational performance and revenue in its LTL segment.

- Investor Sentiment Impact: Legal challenges of this nature can significantly damage investor confidence, potentially leading to a decline in TFI's stock valuation.

- Reputational Damage: Allegations of concealed information and operational challenges can harm TFI's public image, affecting customer loyalty and business partnerships.

- Financial Penalties and Scrutiny: Adverse legal outcomes could result in substantial financial penalties and increased regulatory scrutiny, impacting profitability and operational flexibility.

Intense competition within the North American transportation sector continues to pressure TFI International, particularly in the LTL market. Weak market conditions and reduced freight demand, evident in income reductions and volume declines reported in late 2023 and early 2024, pose significant threats. Additionally, escalating operating costs, including labor, fuel, and equipment, are impacting profitability, with Q1 2024 showing substantial expense increases due to wage pressures and higher equipment costs.

Trade policy uncertainty and geopolitical tensions directly threaten TFI's cross-border operations, which represented a substantial revenue portion in 2023. The company is also facing a class action lawsuit related to alleged misrepresentations in its LTL division, which could negatively impact investor confidence and incur financial penalties.

| Threat Category | Specific Threat | Impact on TFI | Example/Data Point (2023/2024) |

|---|---|---|---|

| Competition | Intense rivalry in LTL market | Pricing pressure, market share challenges | Competitors like FedEx Freight, XPO Logistics actively vying for market share. |

| Economic Conditions | Weak market conditions, reduced freight demand | Revenue stream impact, profitability concerns | Reported income reductions and volume declines in late 2023/early 2024. |

| Operating Costs | Rising labor, fuel, and equipment expenses | Margin compression, increased operating expenses | Q1 2024 saw substantial expense increases, driven by wage pressures. |

| Trade Policy & Geopolitics | Tariff uncertainty, trade disputes | Disruption to cross-border freight, strategic planning challenges | Substantial revenue generated from cross-border operations in 2023. |

| Legal & Reputational | Class action lawsuit (LTL operations) | Investor confidence impact, potential financial penalties | Lawsuit alleges misleading statements regarding operational issues and revenue. |

SWOT Analysis Data Sources

This SWOT analysis leverages a robust combination of TFI International's official financial filings, comprehensive industry market research, and expert commentary to provide a data-driven and insightful overview.