TFI International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TFI International Bundle

Gain a significant competitive advantage with our meticulously crafted PESTLE Analysis of TFI International. We dissect the critical political, economic, social, technological, legal, and environmental factors impacting its operations. Discover how shifting regulations and evolving consumer behaviors are shaping the logistics landscape. Equip yourself with actionable intelligence to refine your market strategy and anticipate future challenges. Download the full, in-depth analysis now and unlock the insights you need to stay ahead.

Political factors

TFI International navigates a complex web of government regulations across Canada, the United States, and Mexico, impacting its extensive North American operations. These rules govern everything from driver hours to vehicle emissions, directly influencing operational efficiency and compliance costs.

Trade policies are a major driver for TFI. Agreements like the United States-Mexico-Canada Agreement (USMCA) shape cross-border freight flows. For example, anticipated tariff changes in 2025 have caused TFI to exercise caution, pausing significant merger and acquisition activities to mitigate potential financial risks and maintain strategic flexibility.

Government spending on transportation infrastructure, such as roads, bridges, and intermodal facilities, directly benefits TFI International. In 2024, the US Bipartisan Infrastructure Law continued to allocate significant funds, with over $42 billion earmarked for bridge repair and replacement alone through 2026. This improved infrastructure enhances TFI's network efficiency and can reduce transit times, leading to lower operational costs and more reliable service.

Geopolitical stability across North America is crucial for TFI International's operations. For instance, the USMCA agreement, effective since July 1, 2020, aims to provide a stable trade framework, but ongoing political dialogues and potential policy shifts can still introduce uncertainty. This directly impacts TFI's cross-border trucking and logistics services, which rely heavily on predictable transit times and regulatory environments.

Any escalation of trade disputes or unexpected border policy changes between Canada, the United States, and Mexico could lead to increased transit times and operational costs for TFI. For example, during periods of heightened trade tensions, companies like TFI often face more rigorous inspections and potential delays, impacting their ability to meet delivery schedules efficiently. This makes forecasting demand and capacity planning more complex.

Taxation Policies

Changes in corporate tax rates, fuel taxes, and other industry-specific levies by governments at all levels can significantly affect TFI International's bottom line. Favorable tax environments boost profitability and encourage expansion, whereas higher taxes can increase operational expenses and shrink profit margins.

TFI's exploration of re-domiciling to the United States in 2024 was a direct response to potential tax benefits, illustrating the substantial influence of these policies on strategic decisions. For instance, the U.S. federal corporate tax rate stands at 21%, a key factor in evaluating international business environments.

- Corporate Tax Rates: Fluctuations in corporate tax rates in Canada, the U.S., and Mexico directly impact TFI's net income.

- Fuel Taxes: As a transportation company, changes in fuel excise taxes levied by various jurisdictions can significantly increase operating costs. For example, federal fuel taxes in the U.S. are currently $0.184 per gallon for diesel.

- Industry-Specific Levies: Potential new or increased taxes on freight, emissions, or specific transportation services could add further cost pressures.

- Tax Treaties and Incentives: Favorable tax treaties or government incentives for the logistics sector can provide a competitive advantage and improve financial performance.

Labor and Employment Regulations

Government policies concerning labor, such as hours of service for truck drivers, minimum wage, and unionization, directly impact TFI International's operational strategies and labor expenses. For instance, in 2024, the average hourly wage for truck drivers in North America continued to rise, with some regions seeing increases of 5-10% due to driver shortages. Compliance with these evolving regulations is non-negotiable and significantly influences TFI's ability to recruit and retain drivers, manage its workforce effectively, and maintain its legal standing.

Strict adherence to labor laws is fundamental for TFI International's uninterrupted operations. Failure to comply can result in substantial fines and operational disruptions. The company must remain vigilant in adapting to changes in these regulations to ensure continued compliance and operational efficiency.

- Hours of Service Regulations: These rules, like those from the Federal Motor Carrier Safety Administration (FMCSA) in the US, limit driving time to prevent fatigue, impacting delivery schedules and driver utilization.

- Minimum Wage Laws: As minimum wages increase across different jurisdictions where TFI operates, the company's labor costs for non-driving personnel, and potentially for drivers depending on contractual structures, will be directly affected.

- Unionization Rules: Government policies on unionization can influence TFI's relationships with its workforce, potentially leading to collective bargaining agreements that affect wages, benefits, and working conditions.

- Driver Shortage Impact: In 2024, the ongoing driver shortage in the US and Canada, exacerbated by regulatory pressures and an aging workforce, continued to drive up wages and create recruitment challenges for companies like TFI.

Government policies directly shape TFI International's operational landscape, influencing everything from trade agreements to labor laws. The USMCA, for instance, provides a framework for cross-border trade, but potential tariff changes in 2025 necessitate careful navigation. Furthermore, infrastructure spending, like the continued allocation of funds from the US Bipartisan Infrastructure Law in 2024, directly benefits TFI by improving transit efficiency.

What is included in the product

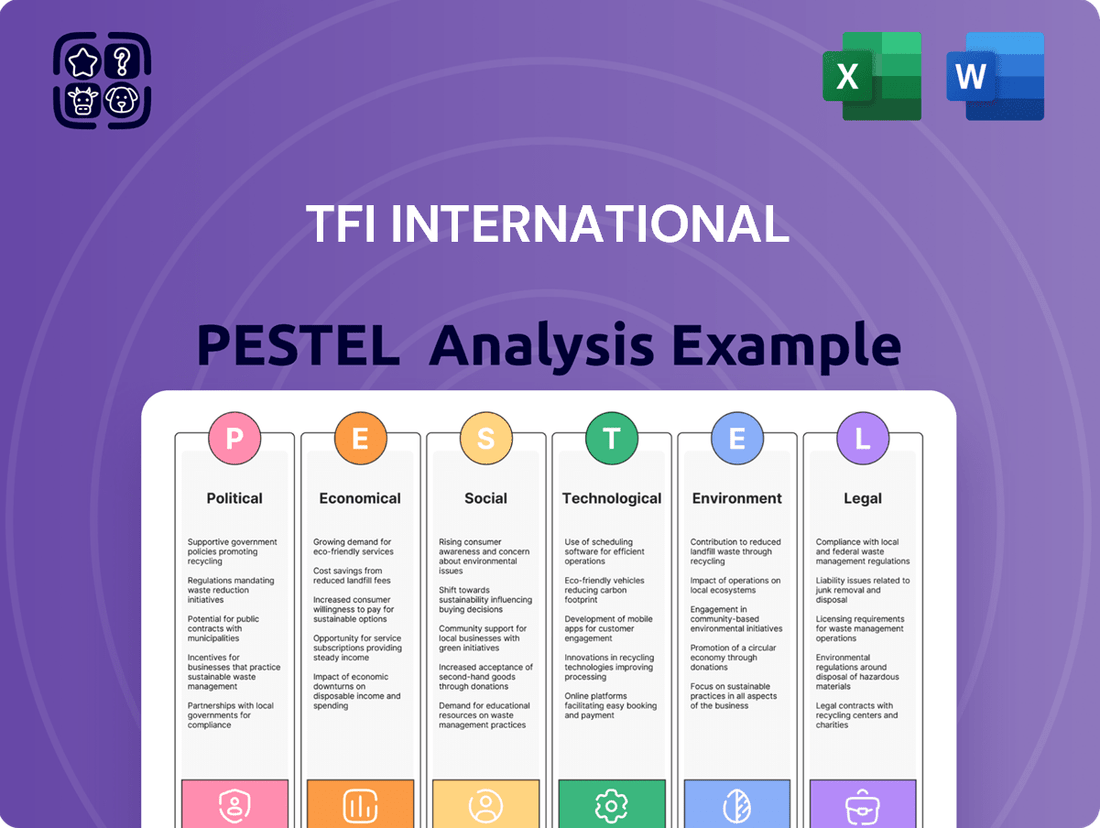

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting TFI International, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

A clear, actionable summary of TFI International's PESTLE factors, providing immediate insights into external influences to streamline strategic decision-making and mitigate potential disruptions.

Economic factors

Overall economic growth in North America is a key driver for TFI International's business. When the economy is expanding, consumer spending and business investment typically rise, leading to more goods being produced and transported. This translates directly into higher demand for TFI's freight services, from individual packages to full truckloads.

For instance, a strong North American economy in 2024 saw continued activity in manufacturing and retail, bolstering freight volumes. This positive trend supported TFI's revenue streams across its various segments, including its less-than-truckload (LTL) and truckload operations. Increased e-commerce penetration also played a significant role in driving parcel delivery demand.

However, economic headwinds can quickly shift this dynamic. Projections for late 2024 and early 2025 indicated a potential slowdown in certain sectors, which could lead to reduced freight volumes. This economic deceleration might put pressure on pricing as shippers become more cost-conscious, impacting TFI's profitability if not managed effectively.

Fuel prices are a major concern for TFI International, as their large fleet of trucks means significant spending on diesel. For example, in 2023, fuel costs represented a substantial portion of their operating expenses, impacting profitability.

While TFI uses fuel surcharges to help offset price swings, persistent increases or volatility in fuel costs can still squeeze their profit margins if these costs can't be fully passed on to customers. This is a continuous hurdle for any company in the trucking sector.

Looking ahead to 2024 and into 2025, diesel prices are projected to remain a key variable. The U.S. Energy Information Administration (EIA) forecasts average on-highway diesel prices to be around $4.00-$4.50 per gallon in 2024, with similar levels anticipated for 2025, depending on global supply and demand dynamics.

Changes in interest rates directly impact TFI International's cost of capital. For instance, if the Bank of Canada raises its key policy rate, TFI's borrowing costs for crucial investments like fleet modernization or strategic acquisitions will likely increase.

Higher interest rates could potentially slow TFI's acquisition-driven growth strategy by making debt financing more expensive. However, TFI's robust free cash flow generation, which stood at approximately $1.3 billion for the fiscal year ending December 31, 2023, provides a cushion against rising borrowing costs and supports its capital allocation plans.

The Federal Reserve's monetary policy decisions in the US also play a significant role, given TFI's substantial US operations. For example, if the Fed maintains its target range for the federal funds rate, it influences the overall cost of debt available to TFI for its various business segments.

Consumer Spending and E-commerce Growth

Robust consumer spending, especially within the booming e-commerce landscape, directly fuels the demand for TFI International's core services like package delivery and last-mile logistics. This trend is a significant tailwind for TFI, given its substantial footprint in these critical areas of the supply chain. The ongoing surge in online shopping translates into higher shipment volumes, underscoring the persistent need for efficient and reliable logistics networks. TFI is strategically positioned to leverage this expanding market and its associated opportunities.

In 2024, e-commerce sales in the US were projected to reach $1.3 trillion, a significant increase from previous years, highlighting the sustained consumer shift towards online purchasing. This growth directly translates into greater demand for freight and logistics services, benefiting companies like TFI. The company's investments in its less-than-truckload (LTL) and package and courier segments are well-aligned with this consumer behavior. TFI's ability to handle increased shipment volumes efficiently is crucial for capturing market share in this dynamic environment.

- E-commerce Growth: The US e-commerce market is expected to continue its upward trajectory, with sales anticipated to grow by approximately 8-10% annually through 2025, creating sustained demand for logistics.

- Shipment Volumes: Increased online retail sales directly correlate to higher package volumes, a key driver for TFI's parcel and courier divisions.

- Last-Mile Demand: The convenience of online shopping necessitates efficient last-mile delivery solutions, a service area where TFI has a strong presence and is actively investing.

- Consumer Confidence: High levels of consumer confidence generally support increased spending, which, in turn, boosts demand for goods and the transportation services required to deliver them.

Industry Overcapacity and Pricing Pressures

The North American trucking and logistics sector often faces overcapacity, intensifying competition and driving down freight rates. This directly impacts TFI International's ability to set prices and maintain profitability, particularly in the Less-Than-Truckload (LTL) segment where market fluctuations can be more pronounced. For instance, during periods of economic slowdown, available truck capacity can significantly outstrip demand, forcing carriers to reduce prices to fill trailers.

TFI International's strategic focus on operational efficiency is crucial for navigating these pricing pressures. By optimizing routes, improving fuel economy, and leveraging technology to enhance asset utilization, the company aims to mitigate the impact of falling rates. In 2024, the industry continues to grapple with the aftermath of supply chain disruptions, with freight demand showing volatility. Reports from the American Trucking Associations (ATA) in late 2024 indicated that while overall freight volumes were recovering, the surplus of available trucks in certain lanes kept spot market rates under pressure.

- Overcapacity Impact: Periods of excess trucking capacity in North America lead to intense competition and downward pressure on freight rates, directly affecting TFI International's pricing power.

- LTL Segment Vulnerability: The Less-Than-Truckload (LTL) market is particularly susceptible to overcapacity, often experiencing more challenging market conditions that squeeze margins.

- Operational Efficiency Focus: TFI International prioritizes operational efficiency to counter pricing pressures by optimizing routes, fuel consumption, and asset utilization.

- 2024 Market Conditions: In 2024, the trucking industry experienced volatile freight demand, with available truck capacity in some regions continuing to suppress spot market rates, as noted by industry associations like the ATA.

Economic growth in North America directly influences TFI International's freight demand. A robust economy in 2024 supported strong freight volumes, particularly driven by e-commerce. However, potential economic slowdowns in late 2024 and early 2025 could reduce demand and pressure pricing, impacting TFI's profitability.

Fuel costs, specifically diesel, are a significant operational expense for TFI. While fuel surcharges help offset volatility, persistent price increases, projected to remain around $4.00-$4.50 per gallon for on-highway diesel in 2024-2025, can still affect profit margins if not fully passed on.

Interest rates influence TFI's cost of capital, potentially increasing borrowing costs for investments. Despite this, TFI's strong free cash flow of approximately $1.3 billion in 2023 provides a buffer against rising rates and supports its growth strategies.

The sustained growth of e-commerce, with US sales projected to reach $1.3 trillion in 2024, is a major tailwind for TFI, boosting demand for its parcel and LTL services. This trend is expected to continue with annual growth of 8-10% through 2025.

North American trucking faces overcapacity, leading to competitive pricing pressures, especially in the LTL segment. TFI's focus on operational efficiency is key to navigating these conditions, as the industry saw volatile freight demand and suppressed spot rates in 2024.

Preview Before You Purchase

TFI International PESTLE Analysis

This preview of the TFI International PESTLE Analysis is the exact document you’ll receive after purchase—fully formatted and ready to use.

You'll gain a comprehensive understanding of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting TFI International.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights.

No placeholders, no teasers—this is the real, ready-to-use file you’ll get upon purchase, detailing TFI International's strategic landscape.

Sociological factors

Societal shifts strongly favor e-commerce, with consumers demanding quicker, more transparent, and dependable deliveries. This means TFI International must consistently upgrade its last-mile operations, tracking technology, and delivery flexibility to keep pace with these rising expectations.

TFI's e-commerce revenue saw a significant increase, reaching $3.6 billion in 2024, underscoring the direct impact of this consumer trend on their business performance.

The trucking industry, including TFI International, faces ongoing challenges with skilled labor availability, especially for truck drivers. A shortage of qualified drivers is a significant concern, impacting the sector's ability to meet demand.

Demographic trends, such as an aging workforce in the transportation sector, contribute to this shortage. Many experienced drivers are nearing retirement age, and there are difficulties in attracting younger generations to the profession, creating a potential talent gap.

These labor dynamics directly affect operational capacity and can lead to increased labor costs for companies like TFI International. To combat this, significant investment in robust recruitment and retention strategies is essential to ensure a stable and skilled workforce.

Societal expectations are increasingly shaping how companies operate, and TFI International is no exception. Consumers and employees alike are paying closer attention to a company's ethical labor practices, its impact on the communities it serves, and its commitment to safety. For TFI, demonstrating strong corporate social responsibility (CSR) directly impacts its brand image and its ability to attract top talent. In 2023, for instance, TFI reported a 7% increase in employee engagement scores, partly attributed to enhanced safety training programs, indicating that proactive CSR can yield tangible benefits.

Adhering to high standards in these areas builds crucial public trust and strengthens relationships with all stakeholders, from investors to the general public. TFI has made a point of highlighting its Environmental, Social, and Governance (ESG) commitments. Their 2024 ESG report detailed a 15% reduction in workplace incidents compared to the previous year, demonstrating a tangible commitment to safety and employee well-being, which in turn bolsters their public perception.

Urbanization and Traffic Congestion

Urbanization continues to drive increased traffic congestion in major metropolitan areas, directly impacting TFI International's urban delivery operations. By 2025, it's projected that over 60% of the world's population will reside in urban centers, exacerbating these challenges.

This trend leads to longer transit times for TFI, increasing fuel usage and overall operational expenses. For instance, delivery times in densely populated cities can extend by up to 30% during peak hours. This necessitates sophisticated route optimization software and creative last-mile delivery strategies.

- Increased Delivery Times: Urban congestion can add significant delays to delivery schedules.

- Higher Fuel Costs: Idling in traffic and longer routes directly increase fuel consumption.

- Operational Efficiency Demands: TFI must invest in technology to mitigate these impacts.

- Last-Mile Innovation: Solutions like urban consolidation centers and electric cargo bikes are becoming crucial.

Health and Safety Standards

Societal expectations for robust health and safety standards are increasingly stringent, especially within physically demanding sectors like transportation where TFI International operates. This societal emphasis necessitates that TFI International maintains and continuously improves its safety protocols, investing significantly in employee well-being and accident prevention. Failing to do so can result in severe financial penalties and damage to the company's reputation, underscoring the critical importance of a strong safety culture for maintaining operational integrity and public trust.

The financial repercussions of safety lapses are substantial. For instance, the U.S. Bureau of Labor Statistics reported that in 2023, workplace injuries and illnesses in the transportation and warehousing sector resulted in billions of dollars in direct medical costs and lost wages, not to mention indirect costs like productivity loss and increased insurance premiums. TFI International's commitment to safety, therefore, directly impacts its bottom line and long-term sustainability.

- Employee Training Programs: TFI International invests in comprehensive driver and warehouse staff training focused on safe operating procedures and hazard recognition.

- Safety Technology Adoption: The company actively incorporates advanced safety technologies in its fleet, such as collision avoidance systems and driver monitoring, to mitigate risks.

- Regulatory Compliance: Adherence to strict health and safety regulations, including those from OSHA and Transport Canada, is a non-negotiable aspect of TFI's operations.

- Incident Investigation and Prevention: Robust processes are in place to thoroughly investigate all safety incidents, identify root causes, and implement preventative measures to avoid recurrence.

Societal trends are increasingly prioritizing convenience and speed in deliveries, a demand TFI International must meet by enhancing its last-mile logistics and tracking systems. The company's 2024 e-commerce revenue of $3.6 billion highlights the direct financial impact of these consumer expectations. Furthermore, the persistent shortage of skilled truck drivers, exacerbated by an aging workforce, presents a significant operational challenge for TFI, necessitating focused recruitment and retention efforts.

Public scrutiny regarding ethical labor practices and corporate social responsibility is intensifying, influencing TFI International's brand reputation and talent acquisition. Demonstrating a commitment to safety and community well-being, as evidenced by a 7% rise in employee engagement in 2023 linked to improved safety training, is crucial for stakeholder trust. Urbanization, with over 60% of the global population projected to live in cities by 2025, intensifies delivery challenges and operational costs for TFI due to increased congestion.

Technological factors

The increasing adoption of automation and robotics within TFI International's operations, particularly in its warehouses and sorting facilities, is a significant technological factor. This trend promises to boost efficiency and accuracy, directly impacting cost reduction through lower labor expenses. For example, companies in the logistics sector saw a 15% increase in operational efficiency with the integration of automated guided vehicles (AGVs) in 2024.

TFI's strategic investments in these advanced technologies are paramount for streamlining its complex logistics processes. By embracing automation, TFI can optimize its supply chain, leading to faster delivery times and improved customer satisfaction. This technological push is essential for maintaining and enhancing its competitive position in the dynamic transportation and logistics market.

TFI International is significantly enhancing its operations through advanced data analytics and artificial intelligence. By leveraging big data, the company can more accurately forecast demand, a crucial factor in the logistics industry. This allows for better resource allocation and inventory management, directly impacting profitability.

The application of AI extends to optimizing delivery routes, a key area for efficiency gains. This not only reduces fuel consumption and transit times but also minimizes empty miles, which is a substantial cost saving. For instance, sophisticated AI can dynamically reroute fleets based on real-time traffic and delivery updates, maximizing asset utilization.

Predictive maintenance is another critical area where AI is making a difference. By analyzing sensor data from their fleet, TFI can anticipate equipment failures before they occur, scheduling maintenance proactively. This minimizes unexpected downtime and costly emergency repairs, ensuring a more reliable service for customers.

TFI's strategic investments in AI-powered pricing tools and Optum software underscore their commitment to data-driven decision-making. These tools enable dynamic pricing strategies that respond to market conditions, enhancing competitiveness and revenue generation. In 2024, the logistics sector saw a significant increase in AI adoption, with companies reporting an average of 15% improvement in operational efficiency attributed to AI integration.

Telematics and IoT devices are transforming TFI International's fleet operations by providing a constant stream of data. This technology monitors everything from vehicle health and precise location to how drivers behave and the condition of the goods being transported.

This real-time information allows for predictive maintenance, meaning TFI can address potential mechanical issues before they cause breakdowns, significantly reducing downtime. For instance, by tracking engine diagnostics, they can schedule servicing based on actual usage rather than fixed intervals, a practice that can save on unnecessary maintenance costs and improve vehicle availability.

Furthermore, the insights gained from telematics enhance safety by monitoring driving patterns like speeding or harsh braking, enabling targeted driver training. It also bolsters cargo security and provides unparalleled visibility across the entire supply chain, from dispatch to final delivery, leading to more efficient and reliable service for TFI's customers.

Advanced Safety Systems and Autonomous Vehicles

Technological advancements in advanced driver-assistance systems (ADAS) and autonomous vehicle technology present significant opportunities for TFI International. These systems can enhance operational safety and efficiency. For instance, in 2024, the global ADAS market was valued at approximately $36.4 billion, with projections indicating robust growth. This suggests increasing adoption and potential for integration into TFI's fleet.

The gradual integration of these technologies can lead to tangible benefits, such as reduced accident rates. By 2025, it's anticipated that ADAS features will become standard in a larger percentage of new commercial vehicles. This trend can directly translate to lower insurance premiums and reduced repair costs for TFI, improving overall profitability.

Furthermore, autonomous driving capabilities, even in their early stages, could help alleviate persistent driver shortages within the logistics sector. While fully autonomous trucking is not expected to be widespread until later in the decade, even partial automation in tasks like highway driving or platooning can optimize routes and fuel consumption. For example, platooning technology has demonstrated potential fuel savings of up to 10%.

- ADAS Market Growth: The global ADAS market is projected to reach over $60 billion by 2026, indicating a strong upward trend in technological adoption.

- Safety Improvement: Studies show that ADAS features like automatic emergency braking can reduce rear-end collisions by up to 40%.

- Autonomous Trucking Advancements: Companies are actively testing and deploying autonomous trucks on specific routes, with some pilots in 2024 reporting significant efficiency gains.

- Fuel Efficiency Gains: Technologies like adaptive cruise control and platooning can contribute to fuel savings, a critical factor in the trucking industry's operating costs.

Cybersecurity and Data Protection

As TFI International increasingly relies on digital systems for its extensive logistics operations, customer data management, and intricate supply chain coordination, cybersecurity and data protection are non-negotiable. The company’s ability to maintain operational integrity and customer trust hinges on its defense against evolving cyber threats. Ensuring robust protection against these threats is paramount for continued business success and regulatory compliance.

The escalating threat landscape, marked by a significant surge in ransomware attacks throughout 2024, underscores the urgency for TFI International to invest heavily in advanced cybersecurity infrastructure and protocols. Protecting sensitive operational data and customer information is critical for preventing disruptions and maintaining a strong reputation. Failure to do so could result in significant financial losses and damage to brand loyalty.

- Ransomware Attacks: Global ransomware attacks on businesses saw an estimated increase of 70% in the first half of 2024 compared to the same period in 2023, according to cybersecurity reports.

- Data Breach Costs: The average cost of a data breach in 2024 reached an all-time high of $4.73 million globally, a 15% increase from 2023, impacting businesses across all sectors.

- Regulatory Fines: Non-compliance with data protection regulations like GDPR or CCPA can result in substantial fines, potentially reaching millions of dollars, directly affecting profitability.

- Operational Disruption: Cyber incidents can halt logistics operations, leading to significant delays, missed deliveries, and increased operational expenses, impacting TFI's service reliability.

TFI International is increasingly leveraging automation and AI to enhance operational efficiency and reduce costs. For instance, AI-driven route optimization can lead to significant fuel savings, a critical factor in the logistics industry. In 2024, companies implementing advanced AI for logistics reported an average of 15% improvement in operational efficiency.

The integration of telematics and IoT devices provides real-time data for predictive maintenance, minimizing costly downtime and improving fleet reliability. Furthermore, advancements in Advanced Driver-Assistance Systems (ADAS) are enhancing safety, with the global ADAS market projected to exceed $60 billion by 2026.

Cybersecurity is paramount as TFI relies on digital systems for its operations and customer data. The escalating threat of ransomware, which saw an estimated 70% increase in global attacks in early 2024, necessitates robust investment in data protection to prevent operational disruptions and maintain customer trust.

| Technological Factor | Impact on TFI International | Supporting Data (2024/2025) |

| Automation & Robotics | Increased efficiency, reduced labor costs | 15% operational efficiency increase in logistics with AGVs (2024) |

| AI & Data Analytics | Improved demand forecasting, optimized routes, predictive maintenance | AI integration led to 15% efficiency gains in logistics (2024) |

| Telematics & IoT | Enhanced fleet management, predictive maintenance, driver safety | Proactive maintenance via sensor data reduces unnecessary costs |

| ADAS & Autonomous Tech | Improved safety, reduced accident rates, potential to alleviate driver shortages | Global ADAS market valued at $36.4 billion in 2024; projected over $60 billion by 2026 |

| Cybersecurity | Protection of operations and customer data, prevention of disruption | 70% increase in global ransomware attacks (H1 2024); average data breach cost $4.73 million (2024) |

Legal factors

TFI International navigates a stringent regulatory environment, impacting its North American operations. These include federal and state/provincial laws on vehicle weight, emissions, and driver fatigue, such as the U.S. Department of Transportation's Hours of Service (HOS) rules. For instance, failing to adhere to HOS can lead to significant fines and operational disruptions.

Cross-border transportation also introduces complex customs regulations and trade agreements, like the USMCA, that TFI must meticulously follow. Non-compliance in these areas, such as improper documentation or duty payments, can result in shipment delays, seizure of goods, and substantial financial penalties, impacting overall supply chain efficiency.

Furthermore, evolving environmental regulations, particularly concerning greenhouse gas emissions from its fleet, require continuous investment in newer, more fuel-efficient vehicles and alternative fuel technologies. Failure to meet these standards, such as those set by the EPA, could lead to increased operating costs and potential restrictions on vehicle usage.

TFI International must strictly adhere to labor laws covering wages, working conditions, collective bargaining, and employee benefits to maintain operational integrity and avoid legal challenges. For instance, in 2023, the average hourly wage for truck drivers in the US ranged from approximately $20 to $25, with variations based on experience and location, highlighting the importance of compliance with minimum wage and overtime regulations across TFI's operations.

Managing diverse labor laws across Canada, the U.S., and Mexico is a significant undertaking for TFI International. Each country has distinct regulations regarding employee rights, unionization, and workplace safety standards, necessitating robust compliance frameworks to prevent costly disputes and ensure consistent employment practices throughout its North American network.

TFI International navigates a complex web of environmental regulations, including stringent rules on vehicle emissions and waste management. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce its greenhouse gas (GHG) emission standards for heavy-duty vehicles, pushing companies like TFI towards fleet modernization. Failure to comply can result in significant penalties, directly impacting operational costs and profitability.

The ongoing global push for decarbonization means TFI International must proactively invest in cleaner fleet technologies. By 2025, many jurisdictions are expected to implement even tighter emissions standards, potentially requiring a larger portion of TFI's fleet to be electric or utilize alternative fuels. This necessitates substantial capital expenditure on new vehicles and charging infrastructure to maintain compliance and market competitiveness.

Data Privacy and Security Laws

TFI International's increasing reliance on digital platforms necessitates strict adherence to data privacy and security regulations like GDPR, CCPA, and PIPEDA. These laws govern how TFI collects, stores, and utilizes sensitive customer and employee information. Failure to comply can lead to substantial fines; for instance, GDPR violations can incur penalties up to 4% of annual global turnover or €20 million, whichever is higher.

The potential legal ramifications of data breaches are significant, impacting not only financially but also the company's reputation. In 2024, data breaches continued to be a major concern across industries, with the average cost of a data breach reaching an estimated $4.73 million globally, according to IBM's 2024 Cost of a Data Breach Report. This highlights the critical need for robust data protection measures within TFI's operations.

To mitigate these risks, TFI must implement comprehensive data governance frameworks. These frameworks should include:

- Regular security audits and vulnerability assessments.

- Employee training on data privacy best practices.

- Clear policies for data collection, consent, and retention.

- Robust incident response plans for data breaches.

Mergers and Acquisitions (M&A) Antitrust Laws

TFI International's growth model is deeply rooted in strategic mergers and acquisitions, making antitrust and competition laws a critical legal consideration. These laws, particularly in Canada and the United States, govern the process of acquiring other companies to prevent the creation of monopolies or undue market concentration. Regulatory bodies scrutinize deals to ensure they do not harm competition, potentially leading to required divestitures or outright blocking of transactions.

For TFI, navigating these regulations is essential for the legal soundness of its expansion strategy. The company must ensure that each acquisition complies with the relevant antitrust frameworks, which often involves providing detailed information about market share and potential competitive impacts. For instance, in 2023, the U.S. Federal Trade Commission (FTC) and the U.S. Department of Justice (DOJ) continued to actively enforce antitrust laws, reviewing numerous transactions across various sectors. While specific TFI deal details may not be publicly scrutinized at the same level as mega-mergers, the underlying legal principles remain paramount.

- Regulatory Scrutiny TFI's acquisition-driven growth necessitates careful compliance with Canadian Competition Bureau and U.S. antitrust regulations.

- Market Impact Assessment Each M&A transaction is evaluated for its potential to reduce competition or lead to monopolistic practices.

- Legal Compliance Burden Ensuring adherence to these complex laws requires dedicated legal resources and thorough due diligence on target companies.

- Risk of Deal Blockage Non-compliance or adverse findings by regulators can lead to significant delays, onerous conditions, or the termination of acquisition agreements.

TFI International faces significant legal and regulatory hurdles impacting its operations, particularly concerning transportation standards and cross-border activities. Compliance with federal and state regulations on vehicle weight, emissions, and driver hours is paramount, with violations leading to fines and operational disruptions. For example, the U.S. Department of Transportation's Hours of Service (HOS) rules directly govern driver schedules to prevent fatigue.

Navigating international trade agreements like the USMCA is crucial for TFI's cross-border logistics, as improper customs documentation or duty payments can result in shipment delays and financial penalties. Furthermore, evolving environmental regulations, such as the EPA's greenhouse gas standards for heavy-duty vehicles, necessitate ongoing investment in fleet modernization, with stricter standards anticipated by 2025.

Labor laws regarding wages, working conditions, and collective bargaining are also critical, especially given the 2023 average hourly wage for US truck drivers ranging from $20-$25. TFI must manage diverse labor laws across Canada, the US, and Mexico, ensuring compliance with employee rights and workplace safety to avoid legal disputes. The company's acquisition strategy also requires strict adherence to antitrust and competition laws, which scrutinize deals for market concentration and potential anti-competitive effects.

Environmental factors

The intensifying global commitment to combating climate change is significantly shaping the operational landscape for TFI International. New regulations targeting carbon emissions are compelling the transportation industry to adapt, necessitating substantial capital outlays for greener technologies.

The push for decarbonization within the logistics sector requires TFI International to invest in advanced fuel-efficient fleets and explore the integration of alternative fuels, such as renewable natural gas, which saw a significant increase in adoption across the industry in 2024. Furthermore, mandatory carbon reporting, now a requirement for many publicly traded companies as of 2024, adds a layer of compliance and transparency to TFI's environmental footprint management.

Government-mandated fuel efficiency standards for commercial vehicles directly impact TFI International's operational strategy. These regulations necessitate ongoing investment in newer, more fuel-efficient truck fleets or the implementation of technologies aimed at reducing fuel consumption. For instance, by 2027, the U.S. Environmental Protection Agency (EPA) aims to significantly improve greenhouse gas (GHG) emissions standards for medium and heavy-duty vehicles, pushing companies like TFI to upgrade.

Adhering to these evolving standards not only ensures regulatory compliance but also presents an opportunity for substantial operational cost savings. Companies that proactively adopt more efficient vehicles and technologies can see a reduction in their fuel expenditures, a major component of operating costs in the trucking industry. TFI International, with its extensive fleet operations, is particularly positioned to benefit from these efficiencies.

Stakeholders are increasingly prioritizing sustainability, driving TFI International to enhance its environmental practices. This includes focusing on efficient route optimization to cut down on mileage, a critical factor in reducing the company's carbon footprint in the logistics sector. For instance, in 2023, TFI reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity, demonstrating progress in its sustainability efforts.

TFI is committed to adopting greener logistics solutions, such as exploring alternative fuel vehicles and improving fuel efficiency across its fleet. The company’s 2024 sustainability report highlights investments in newer, more fuel-efficient trucks and the piloting of electric vehicles in select urban routes. This strategic shift aligns with global trends and growing pressure for transparency in environmental performance.

Waste Management and Pollution Control

TFI International's logistics and transportation operations inherently generate waste, from packaging materials to vehicle maintenance byproducts. Strict adherence to environmental regulations concerning waste disposal and the handling of potentially hazardous materials is paramount. For instance, in 2023, the transportation sector faced increasing scrutiny over its carbon footprint, with ongoing discussions and potential policy shifts aimed at reducing emissions, impacting fuel consumption and vehicle maintenance practices.

Effective pollution control measures are essential to mitigate TFI's environmental impact. This includes managing noise pollution from its fleet, controlling water runoff from depots, and ensuring proper disposal of lubricants and other vehicle fluids. The company must remain vigilant in adapting to evolving environmental standards, which can influence operational costs and require investments in greener technologies. For example, the push towards electric or alternative fuel vehicles in the freight industry, gaining momentum in 2024 and projected to accelerate through 2025, necessitates strategic planning for fleet upgrades and charging infrastructure.

- Regulatory Compliance: TFI must navigate a complex web of environmental laws governing waste, emissions, and pollution across its operating regions.

- Operational Impact: Waste generation from packaging, vehicle maintenance, and general operations requires robust management systems.

- Pollution Control: Addressing noise, water runoff, and air quality from transportation activities is a key responsibility.

- Sustainability Investments: The company may need to invest in cleaner technologies and sustainable practices to meet future environmental expectations and regulations.

Impact of Extreme Weather Events

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, pose significant challenges to TFI International's extensive transportation networks. These disruptions can manifest as costly delays, heightened operational expenses due to rerouting or repairs, and critical safety risks for both personnel and cargo. For instance, the prolonged heatwaves experienced in Western Canada during 2023, reaching temperatures over 40°C in some regions, strained road infrastructure and impacted rail operations, potentially affecting TFI's cross-border movements.

To mitigate these environmental impacts, TFI International must prioritize the development and implementation of robust contingency planning and resilient supply chain strategies. This includes diversifying transportation routes, investing in weather-resilient infrastructure where feasible, and leveraging advanced weather forecasting technologies to anticipate and proactively manage potential disruptions. Such proactive measures are crucial for maintaining service reliability and minimizing financial losses. The company's commitment to sustainability, as highlighted in its 2024 ESG report, increasingly focuses on adapting to these climate-related operational risks.

- Increased Operational Costs: Extreme weather events can lead to higher fuel consumption due to detours, increased maintenance needs for vehicles operating in adverse conditions, and potential overtime pay for drivers dealing with delays.

- Supply Chain Vulnerability: Disruptions to key transportation arteries, such as flooded highways or snow-bound rail lines, can halt or significantly slow the movement of goods, impacting TFI's ability to meet customer delivery schedules and potentially leading to lost business.

- Safety Imperatives: Ensuring the safety of drivers, vehicles, and cargo during severe weather conditions, such as hurricanes, blizzards, or heavy fog, is paramount and requires strict adherence to safety protocols and potential operational suspensions.

- Need for Advanced Forecasting and Planning: Proactive investment in sophisticated weather prediction tools and dynamic route planning systems is essential for TFI to anticipate and navigate the impacts of climate change on its operations.

TFI International's environmental strategy is increasingly shaped by global decarbonization efforts and stricter emissions regulations. By 2024, the company was investing in fuel-efficient fleets and exploring alternative fuels like renewable natural gas to meet new standards, such as the EPA's proposed 2027 GHG emission standards for heavy-duty vehicles. These shifts aim for both compliance and long-term operational savings.

The logistics sector faces direct impacts from environmental regulations, particularly concerning fuel efficiency and emissions. TFI International's commitment to sustainability, evidenced by its 2024 sustainability report detailing investments in newer trucks and electric vehicle pilots, reflects a broader industry trend. Proactive adoption of cleaner technologies is crucial for managing operational costs and meeting stakeholder expectations for environmental performance.

Extreme weather events, amplified by climate change, pose significant operational risks for TFI International, leading to delays and increased costs. For example, 2023 saw severe heatwaves in Western Canada impacting infrastructure. To counter this, TFI is enhancing contingency planning and supply chain resilience, as outlined in its 2024 ESG report, to maintain service reliability amidst climate-related disruptions.

PESTLE Analysis Data Sources

Our PESTLE analysis for TFI International is built upon a robust foundation of data sourced from leading economic institutions, government regulatory bodies, and respected industry-specific publications. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the logistics and transportation sector.