TFI International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TFI International Bundle

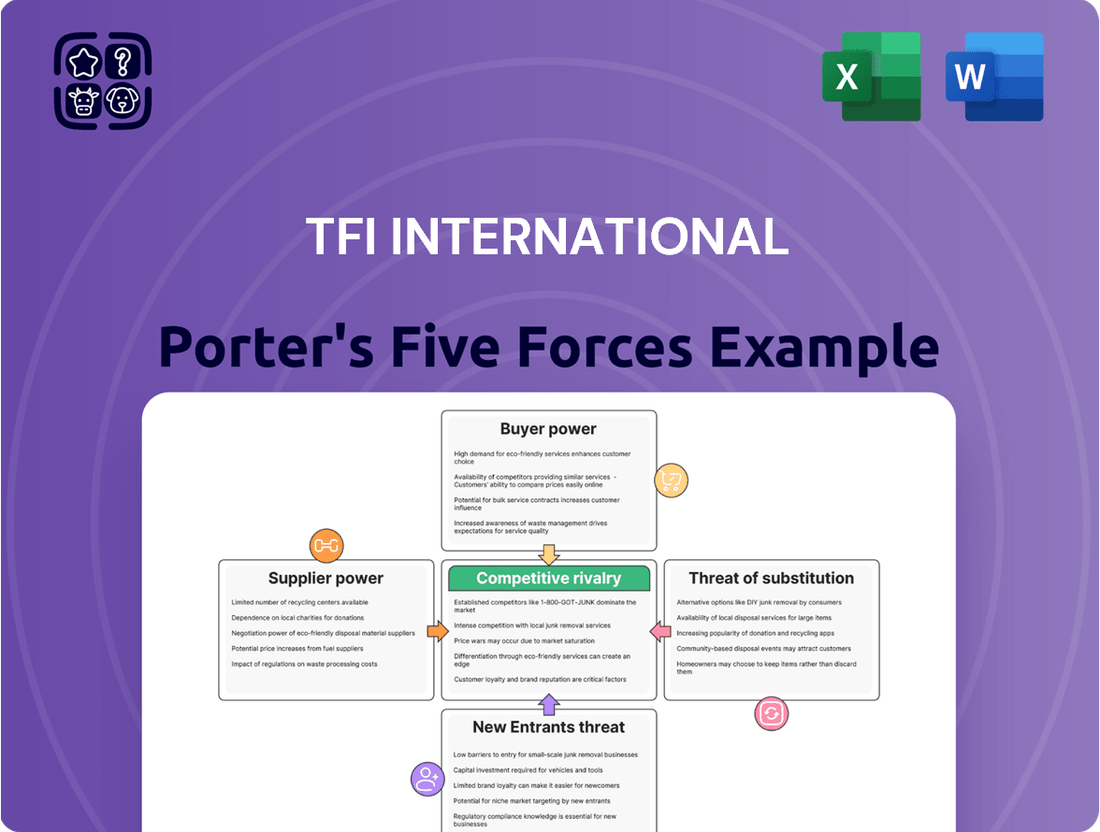

TFI International operates within a dynamic logistics landscape, where understanding the competitive forces at play is crucial for success. Our Porter's Five Forces analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes. These forces collectively shape TFI's profitability and strategic options within the transportation and logistics sector.

The complete report reveals the real forces shaping TFI International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

TFI International's reliance on a concentrated group of key suppliers for critical assets such as trucks, trailers, and specialized hauling equipment grants these suppliers considerable leverage. For instance, the limited number of major truck manufacturers, such as PACCAR and Daimler Truck, who produce advanced, compliant vehicles, means TFI has fewer options. This concentration can particularly impact TFI when acquiring new, fuel-efficient, or environmentally mandated fleets, as seen with the increasing demand for electric or alternative fuel vehicles.

Fuel represents a significant operational cost for TFI International, directly impacting its profitability. The price of diesel, a key component for trucking, is notoriously volatile, influenced by global supply and demand dynamics, OPEC decisions, and geopolitical instability. For instance, in early 2024, diesel prices saw fluctuations, with West Texas Intermediate (WTI) crude oil prices trading in the $70-$80 per barrel range for much of the first half, impacting transportation costs.

While TFI International employs fuel surcharges to mitigate these price swings, sudden and sharp increases in fuel costs can still compress profit margins. This is especially true if these surcharges cannot be immediately or fully passed on to customers, or if hedging strategies are insufficient to cover the unexpected rises. Effective management of fuel expenses is therefore crucial for maintaining competitive pricing and stable earnings in the logistics sector.

The transportation industry, especially trucking, continues to grapple with a persistent shortage of qualified drivers and difficulties in retaining them. This scarcity of skilled labor is a significant factor.

The potential for unionization among drivers, coupled with their increasing demands for higher wages and better benefits, significantly amplifies their bargaining power. This directly influences TFI International's ability to manage its workforce and associated costs.

To attract and keep its drivers, TFI International must provide competitive compensation packages and attractive benefits. This necessity directly impacts the company's operating expenses and overall profitability.

In 2024, the average annual wage for heavy and tractor-trailer truck drivers in the US was approximately $57,000, according to the Bureau of Labor Statistics, highlighting the cost pressures faced by companies like TFI.

Technology and Software Providers

The bargaining power of technology and software providers for TFI International is significant, especially as the logistics sector leans heavily on digital solutions. As TFI invests in advanced transportation management systems (TMS) and other optimization software, their reliance on these specialized vendors grows. For instance, in 2024, TFI continued its digital transformation initiatives, aiming to enhance efficiency through technology, which inherently increases the leverage of its software partners. These providers are crucial for route planning, real-time tracking, and overall supply chain visibility.

High switching costs associated with complex, integrated IT systems further bolster the bargaining power of these suppliers. Migrating from one sophisticated software platform to another involves substantial expense, training, and potential operational disruption. This situation means that TFI must carefully manage relationships with its technology vendors to mitigate the risk of unfavorable contract terms or price increases. The dependence on these specialized systems is a key factor in assessing this aspect of supplier power.

- Increased reliance on specialized logistics software for route optimization and supply chain visibility.

- Significant investments in advanced Transportation Management Systems (TMS) by TFI International.

- High switching costs for complex IT systems create vendor lock-in.

- Strategic importance of technology providers in maintaining operational efficiency and competitive advantage.

Maintenance and Parts Suppliers

TFI International's substantial fleet necessitates a consistent influx of maintenance services and replacement parts. When specialized equipment or unique proprietary components are involved, the limited pool of suppliers grants them significant bargaining power.

This dependency on a narrow supplier base can translate into elevated repair and maintenance expenses for TFI. For instance, in 2023, TFI International reported total operating expenses of approximately $7.1 billion. A substantial portion of this would be attributable to fleet maintenance and parts, making any increase in supplier costs directly impactful.

- Limited Supplier Options: The need for specialized parts for certain truck models or maintenance equipment restricts TFI's choices, empowering those specific suppliers.

- Impact on Costs: Higher prices from these suppliers can directly inflate TFI's operating costs, potentially squeezing profit margins.

- Operational Efficiency: Delays or increased costs in obtaining essential parts can disrupt maintenance schedules, affecting fleet availability and overall operational efficiency.

The bargaining power of TFI International's suppliers is moderate, influenced by the availability of alternatives and the importance of the supplied goods or services. While TFI operates a large fleet, the concentration of major truck manufacturers and the specialized nature of certain parts can give these suppliers leverage. For example, the need for specific, emissions-compliant engines limits TFI's options, as seen with manufacturers like PACCAR and Daimler Truck. Fuel suppliers also hold significant power due to the commodity nature of diesel and its price volatility, with 2024 seeing ongoing fluctuations impacting transportation costs.

| Supplier Category | Leverage Factors | Impact on TFI |

|---|---|---|

| Truck & Trailer Manufacturers | Concentrated market, specialized components | Higher acquisition costs for new fleets, potential for increased maintenance expenses. |

| Fuel Suppliers | Commodity price volatility, global supply/demand | Significant operational cost, requires effective fuel surcharge strategies to mitigate margin compression. |

| Technology Providers (TMS, Software) | High switching costs, critical for efficiency | Vendor lock-in, potential for increased software licensing fees, reliance on specialized IT infrastructure. |

| Parts & Maintenance Services | Dependence on proprietary components, specialized services | Elevated repair and maintenance expenses, potential disruptions to fleet availability if parts are scarce. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to TFI International's logistics and transportation operations.

Instantly assess competitive intensity across TFI International's landscape, revealing critical leverage points to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

TFI International's diverse customer base significantly dilutes the bargaining power of its customers. By serving multiple segments like Package and Courier, Less-Than-Truckload (LTL), Truckload, and Logistics, TFI avoids over-reliance on any single industry or major client. This broad customer footprint, encompassing everything from small e-commerce businesses to large industrial shippers, means that the loss of one or a few customers would have a limited impact on overall revenue. For instance, in 2023, TFI reported total revenue of $6.57 billion, spread across its various operating segments, underscoring this diversification.

In highly commoditized areas of the transportation industry, such as general freight trucking and less-than-truckload (LTL) services, customers often view offerings as interchangeable. This perception fuels intense price competition, as clients primarily focus on cost savings. TFI International's Q1 2025 earnings report highlighted softness in its LTL and logistics divisions, directly linked to prevailing weak freight market conditions, which amplifies customer bargaining power.

For many standard freight services, customers face minimal switching costs, making it easy to change carriers based on price or slight service variations. This low barrier to entry means customers hold considerable power in these segments, often prioritizing cost-effectiveness.

However, TFI International enhances its customer relationships and increases switching costs in specialized logistics and integrated solutions. By offering tailored services and reliable technology, TFI can create stickier customer relationships, thereby mitigating some of this customer bargaining power.

In 2023, the transportation and warehousing sector saw an average customer retention rate that varied significantly by service type. For less-than-truckload (LTL) services, which are often commoditized, retention rates were around 75%. In contrast, for dedicated fleet management and complex supply chain solutions, retention rates often exceeded 90%.

Customer Concentration Risk (Large Shippers)

While TFI International boasts a diversified customer base, the concentration of business with large enterprise clients presents a significant bargaining power dynamic. These major shippers, due to their substantial freight volumes and strategic importance to TFI's operations, are in a strong position to negotiate more favorable pricing and service terms. The potential loss of even a single large contract could indeed have a noticeable impact on TFI's overall revenue.

TFI's strategic approach, which involves acquiring businesses to bolster its network and expand its service capabilities, directly addresses this customer concentration risk. By enhancing its value proposition and offering a more comprehensive suite of logistics solutions, TFI aims to solidify relationships with its larger clients and mitigate the leverage they might otherwise wield.

- Customer Concentration: Large enterprise clients can exert significant bargaining power due to their volume.

- Revenue Impact: Losing a major shipper contract could notably affect TFI's revenue streams.

- Strategic Acquisitions: TFI's M&A activity strengthens its network, improving its appeal to large customers.

- Value Proposition Enhancement: Expanded services and network reach reduce customer reliance on individual contract terms.

Information Availability and Digital Platforms

The increasing transparency brought about by digital freight platforms and online brokerage services significantly bolsters the bargaining power of customers. These platforms provide readily accessible data on pricing and available capacity, allowing shippers to easily compare options. For instance, in 2024, the freight brokerage market continued to expand, with digital platforms facilitating millions of transactions, giving customers unprecedented visibility into market rates.

This enhanced market data empowers customers to negotiate more aggressively with carriers, as they can readily identify the most competitive prices. This can lead to pressure on carrier margins, as customers leverage this information to secure lower shipping costs. TFI International’s strategic deployment of new billing and IT systems in 2023 and ongoing updates in 2024 are aimed at improving operational efficiency and maintaining competitiveness in this environment.

The ease of comparison means that a slight price difference can sway customer decisions, forcing carriers to be more competitive on price. This dynamic is especially pronounced in markets with abundant capacity, where customers have a wider array of choices.

- Digital Freight Platforms: Increased market transparency and accessibility of pricing data.

- Customer Negotiation Power: Enhanced ability for customers to compare rates and negotiate aggressively.

- Margin Erosion: Potential for reduced carrier profit margins due to competitive pricing pressures.

- TFI's Response: Investment in new billing and IT systems to boost efficiency and competitiveness.

The bargaining power of TFI International's customers is a significant factor, particularly in commoditized segments like LTL and general freight. Customers in these areas can easily switch carriers due to low switching costs and the availability of comparable services. This allows them to leverage price as a primary negotiation point, putting pressure on TFI's margins, especially when market capacity is high.

However, TFI mitigates this power by fostering strong relationships in specialized logistics and integrated solutions, where higher switching costs and tailored services create customer loyalty. While its diverse customer base generally dilutes individual customer power, the concentration of business with large enterprise clients remains a key consideration, as these shippers have substantial leverage due to their volume.

| Factor | Impact on TFI | Supporting Data/Observation |

| Customer Diversification | Lowers individual customer bargaining power | TFI serves multiple segments (Package & Courier, LTL, Truckload, Logistics) |

| Commoditization (LTL/Freight) | Increases customer bargaining power | Customers focus on cost; Q1 2025 reports softness linked to weak freight markets. |

| Switching Costs | Low in commoditized areas, high in specialized logistics | Easy to switch carriers for standard freight; tailored solutions increase stickiness. |

| Customer Concentration | Increases bargaining power for large clients | Major shippers' volume allows negotiation for better terms. |

| Digital Platforms | Enhances customer transparency and negotiation leverage | 2024 saw continued expansion of digital freight platforms, increasing rate visibility. |

Same Document Delivered

TFI International Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of TFI International provides an in-depth examination of the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're previewing the final version—precisely the same document that will be available to you instantly after buying, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The North American transportation sector is remarkably fragmented, featuring a multitude of smaller trucking firms alongside significant, well-established companies. This dense landscape fosters fierce rivalry, as numerous entities aggressively pursue market share across various logistics segments.

TFI International navigates this competitive environment, contending with prominent industry leaders such as UPS Freight, FedEx Freight, and XPO Logistics. These larger players often possess substantial economies of scale and extensive networks, intensifying the pressure on TFI.

In 2024, the trucking industry continues to grapple with capacity challenges and driver shortages, which can exacerbate competitive pressures as companies fight for available resources and contract opportunities. For instance, the American Trucking Associations reported ongoing concerns regarding the truck driver shortage, impacting operational costs and service availability for all participants.

The transportation industry, especially in the Less-Than-Truckload (LTL) and Truckload sectors, is characterized by intense price competition. This often squeezes operating margins for companies like TFI International.

For instance, TFI International’s 2023 annual report highlighted how challenging freight market conditions, including reduced shipping volumes across the industry, directly impacted their financial performance, leading to lower operating income.

This competitive pricing environment means that companies must constantly seek efficiencies to maintain profitability. The pressure to offer competitive rates can limit a company's ability to invest in growth or absorb unexpected cost increases.

Such market dynamics underscore the importance of cost management and operational excellence for sustained success in this sector, as demonstrated by the financial results reported for 2023.

TFI International’s growth hinges on strategic acquisitions, a key driver of competitive rivalry. In April 2024, the company finalized its significant acquisition of Daseke, a move that substantially bolsters its Truckload segment. This aggressive M&A approach not only enhances TFI’s network and service portfolio but also consolidates market power, directly intensifying competition as rivals must adapt to a larger, more capable TFI.

Service Differentiation and Operational Efficiency

Competitive rivalry in the less-than-truckload (LTL) sector, where TFI International operates, is intense, with companies striving to stand out through superior service. This differentiation often hinges on reliability, delivery speed, and offering specialized freight handling. TFI actively pursues operational excellence to maintain its edge. For instance, in 2024, the company continued its focus on upgrading IT and billing systems within its LTL segment to streamline operations and enhance customer experience. This strategic investment aims to bolster efficiency, allowing TFI to better manage costs while delivering a higher quality of service compared to rivals.

The ability to effectively control costs and simultaneously provide a superior customer experience is paramount for success in this competitive landscape. TFI's commitment to operational optimization, including the implementation of advanced technological solutions, directly addresses this need. These efforts are crucial for navigating the pressures of intense competition and securing market share by offering tangible benefits to customers.

- Service Quality: Competitors differentiate through reliability, speed, and specialized capabilities.

- TFI's Focus: Operational optimization and efficiency improvements, including IT system upgrades in LTL.

- Key Success Factor: Effective cost management combined with superior service delivery.

- 2024 Impact: Continued investment in systems to enhance competitive positioning.

Capacity Management and Utilization

Capacity management is a crucial battleground for TFI International, directly impacting its profitability. When the market experiences overcapacity, freight rates tend to fall, squeezing margins across the industry. This is a constant consideration for logistics providers aiming to maintain healthy returns.

TFI has strategically addressed its capacity, particularly within its Truckload segment. Following the Daseke acquisition, the company identified excess capacity. Consequently, TFI has signaled a reduction in capital expenditures for its Truckload operations, reflecting a measured approach to fleet expansion in light of current market conditions.

- Fleet Utilization: TFI's ability to maximize the use of its existing fleet is paramount.

- Market Overcapacity: Periods of too many trucks chasing too few loads depress freight rates.

- Capital Expenditure Strategy: TFI is moderating its investment in new equipment due to identified excess capacity in its Truckload division.

- Profitability Impact: Efficient capacity management directly translates to better financial performance.

The competitive rivalry within the North American transportation sector remains intense, with TFI International facing off against major players like UPS Freight and FedEx Freight. This crowded market forces continuous efforts to optimize operations and manage costs effectively, as seen in TFI's 2023 financial reports which noted impacts from challenging market conditions.

In 2024, strategic acquisitions, such as TFI's purchase of Daseke, are actively reshaping the competitive landscape by consolidating market power. This aggressive M&A strategy compels rivals to adapt, while TFI's focus on operational efficiency, including IT system upgrades in its LTL segment, aims to enhance service quality and cost control against competitors.

The battle for capacity utilization is a critical factor, especially when market overcapacity leads to depressed freight rates. TFI's approach of moderating capital expenditures in its Truckload segment, following the Daseke acquisition, highlights the delicate balance required to manage fleet size against market demand, directly influencing profitability.

| Metric | TFI International (2023 Data) | Industry Trend (2024 Outlook) | Impact on Rivalry |

|---|---|---|---|

| Operating Income | Impacted by challenging freight market conditions | Continued pressure from economic factors and fuel costs | Intensifies focus on cost efficiency and service differentiation |

| Acquisitions | Daseke acquisition completed April 2024 | Ongoing consolidation and strategic M&A activity | Raises the bar for competitors and increases market concentration |

| LTL Operational Focus | IT and billing system upgrades | Emphasis on technology adoption for efficiency | Drives service quality improvements and cost advantages |

SSubstitutes Threaten

For non-time-sensitive, long-haul, and bulk freight, rail transport stands as a significant substitute for TFI International's truckload services. This is particularly true for shipments where speed is not the primary concern, and large volumes of goods need to be moved economically across considerable distances.

Intermodal solutions, which strategically combine trucking with rail, further solidify rail's position as a viable alternative. These hybrid approaches can offer a compelling cost advantage on specific freight lanes, making them attractive to shippers looking to optimize their logistics spend.

TFI International itself has recognized the strategic advantage of rail, admitting to shifting some of its freight traffic to rail to improve its cost structure. This move highlights the competitive pressure from rail, even from within TFI's own operational considerations.

However, TFI also points to challenges related to control over rail operations. Unlike their own trucking fleets, TFI has less direct command over rail schedules and capacity, which can introduce complexities and potential disruptions, impacting service reliability.

Air cargo presents a significant threat to TFI International, especially for time-sensitive shipments. While considerably more expensive than ground transport, air cargo offers unparalleled speed, making it the preferred choice for high-value, urgent, or perishable goods where delays can be costly or lead to spoilage. This directly challenges TFI's expedited parcel and courier segments, where speed is a key selling proposition.

The decision between air and ground for time-critical deliveries hinges on a clear trade-off between cost and speed. For instance, in 2024, the average cost of air freight per kilogram was substantially higher than LTL or parcel services, but the transit times could be reduced by several days for international shipments. This means TFI must continually assess its pricing and service offerings to remain competitive against faster, albeit pricier, air alternatives.

Large manufacturers, retailers, and distributors increasingly consider developing or expanding their own private fleets and in-house logistics capabilities. This strategy offers them more direct control over their supply chains, potentially reducing their dependence on third-party logistics providers like TFI International. For instance, companies with substantial and consistent shipping volumes might find it economically viable to manage their own transportation, effectively substituting TFI's services.

Digital Freight Brokerage Platforms

The emergence of digital freight brokerage platforms represents a significant threat of substitutes for traditional carriers like TFI International. These online marketplaces connect shippers directly with available trucking capacity, often bypassing established logistics providers entirely. For example, platforms like Uber Freight and Convoy offer shippers real-time visibility, competitive bidding, and streamlined booking processes, directly challenging the need for traditional brokerage services. This disintermediation is powered by technology, offering a more efficient and transparent alternative to conventional freight matching.

These digital platforms empower shippers by providing:

- Greater transparency in pricing and carrier selection.

- Direct access to a wider pool of available trucking capacity.

- Potentially lower freight costs through competitive online bidding.

- Simplified booking and tracking functionalities, reducing administrative overhead.

In 2024, the digital freight brokerage market continued its robust growth trajectory, with estimates suggesting it could capture a substantial portion of the overall freight market share in the coming years. This technological shift necessitates that traditional carriers adapt their strategies to remain competitive, potentially by integrating with or leveraging these platforms themselves, or by enhancing their own digital offerings to provide comparable transparency and efficiency.

Emerging Technologies (e.g., Drones, Autonomous Vehicles)

Emerging technologies represent a significant, albeit longer-term, threat of substitutes for TFI International. Drones are showing promise for last-mile delivery, potentially bypassing traditional ground transportation for certain packages. Autonomous vehicles could eventually revolutionize line-haul operations, reducing the reliance on human drivers and altering the cost structure of freight movement.

While these technologies are still maturing for widespread commercial use, their potential to disrupt the transportation sector is substantial. For instance, by 2024, the global drone delivery market is projected to reach billions of dollars, indicating growing investment and development in this area. Similarly, advancements in autonomous trucking continue, with pilot programs demonstrating feasibility for long-haul routes.

- Drone Delivery Potential: Drones could offer faster, more direct delivery for high-value or time-sensitive items, acting as a substitute for a portion of TFI's parcel services.

- Autonomous Vehicle Impact: Autonomous trucks might reduce labor costs and improve efficiency in long-haul freight, posing a substitute for TFI's traditional trucking segments.

- Market Development: Significant investment in autonomous vehicle technology, exceeding tens of billions globally by 2024, underscores the serious potential for these substitutes to evolve.

- Future Landscape: These innovations could fundamentally reshape the logistics industry, offering alternative methods for moving goods that compete with TFI's current business models.

The threat of substitutes for TFI International is multifaceted, encompassing rail, air cargo, private fleets, digital freight platforms, and emerging technologies. Rail offers a cost-effective alternative for bulk, non-time-sensitive freight, a segment TFI itself utilizes to manage costs. Air cargo, though pricier, provides speed for urgent shipments, directly competing with TFI's expedited services. The growing trend of companies building private fleets and the rise of digital freight brokers also present significant competitive pressures, offering shippers more control and potentially lower costs.

Digital freight brokerage platforms are a substantial threat, connecting shippers directly with capacity and bypassing traditional providers like TFI. These platforms, such as Uber Freight, offer enhanced transparency and efficiency. By 2024, the digital freight market was experiencing robust growth, poised to capture a significant share of the logistics industry. This shift necessitates that TFI adapt by either integrating with these platforms or bolstering its own digital capabilities to match their transparency and ease of use.

Emerging technologies like drones for last-mile delivery and autonomous vehicles for long-haul transport represent longer-term but potentially disruptive substitutes. The drone delivery market was projected to reach billions by 2024, highlighting investment in this area. Autonomous trucking pilot programs are also advancing, suggesting a future where these technologies could fundamentally alter freight movement, impacting TFI's core business models.

| Substitute | Impact on TFI | Key Differentiating Factor | 2024 Data/Trend |

|---|---|---|---|

| Rail Transport | Cost-effective for bulk, long-haul | Lower cost, but less control and speed | TFI leverages rail for cost optimization. |

| Air Cargo | Competes for time-sensitive shipments | Speed, but significantly higher cost | Air freight costs substantially higher than ground. |

| Private Fleets | Reduces reliance on 3PLs | Direct control over logistics | Growing trend for high-volume shippers. |

| Digital Freight Platforms | Disintermediation, increased transparency | Efficiency, competitive pricing, direct access | Robust growth, capturing market share. |

| Drones & Autonomous Vehicles | Long-term disruption potential | Automation, speed (drones), cost reduction (AVs) | Billions invested in drone delivery market by 2024. |

Entrants Threaten

Entering the transportation and logistics sector, particularly in areas such as truckload (TL) and less-than-truckload (LTL) shipping, demands a significant upfront capital outlay. This includes purchasing a fleet of trucks, establishing and maintaining terminal facilities, and investing in advanced technology for tracking and management. These substantial initial costs act as a considerable deterrent for many aspiring companies.

TFI International's business model necessitates continuous and substantial capital investment. For instance, the company allocated an estimated $200 million towards capital expenditures in 2025. This level of investment underscores the high barrier to entry, making it challenging for new, smaller entities to compete effectively with established players like TFI.

Established networks and infrastructure present a formidable barrier to new entrants in the transportation and logistics sector. Companies like TFI International have invested heavily over years to build a vast web of terminals, cross-docking facilities, and a diverse fleet of trucks and trailers. For example, as of the first quarter of 2024, TFI International reported operating a significant number of tractors and trailers, underscoring the scale of their existing infrastructure.

The sheer cost and time required to replicate this extensive operational footprint are prohibitive for most potential new competitors. Building a similar network involves acquiring real estate for terminals, purchasing and maintaining a large fleet, and establishing relationships with suppliers and regulatory bodies. This capital-intensive undertaking means new entrants often struggle to achieve the same geographic reach and operational efficiency that incumbents like TFI International already command, thereby limiting the threat of new competition.

The transportation and logistics industry faces significant regulatory and compliance challenges that act as a substantial barrier to entry. New companies must navigate a complex web of licensing, safety mandates, environmental standards, and intricate cross-border customs procedures. For instance, in 2024, the U.S. Department of Transportation continues to enforce stringent safety regulations for commercial vehicles, requiring significant investment in equipment and training for compliance.

Meeting these diverse regulatory requirements demands considerable financial resources and specialized expertise, which can be prohibitive for startups. The cost of obtaining and maintaining necessary permits, adhering to evolving environmental protection laws, and managing international trade compliance often necessitates a robust operational infrastructure from the outset.

Brand Recognition and Customer Relationships

Building a reputation for reliability and efficiency in the logistics sector is a lengthy process, often taking years. TFI International has cultivated strong, long-standing customer relationships and established significant brand recognition throughout North America. This deep-seated trust and loyalty presents a substantial barrier for new companies attempting to enter the market and compete effectively.

New entrants face considerable challenges in replicating TFI International's established brand equity. For instance, in 2024, the logistics industry continued to see consolidation, with companies like TFI actively acquiring smaller players to bolster their market position and customer base. This makes it even harder for a new, independent entity to gain traction against a competitor with decades of proven service and a wide network.

- Brand Loyalty: TFI International's established customer base demonstrates a high degree of loyalty, built on consistent performance and service quality.

- Reputation for Reliability: Decades of operation have cemented TFI's reputation, a critical asset in an industry where dependability is paramount.

- Customer Acquisition Costs: New entrants face high costs to acquire customers, as they must overcome the inertia of existing relationships and prove their worth.

- Scale and Network Effects: TFI's extensive network provides efficiencies that new entrants struggle to match, further deterring market entry.

Access to Skilled Labor and Driver Shortages

The ongoing scarcity of qualified commercial drivers and other essential logistics professionals presents a substantial barrier for new companies aiming to enter the transportation sector. This shortage makes it difficult for emerging businesses to build and maintain an adequate workforce. For instance, the American Trucking Associations reported a shortage of over 78,000 drivers in 2023, a figure projected to grow significantly.

New entrants would likely struggle to compete with established companies like TFI International, which possess robust recruitment pipelines and competitive compensation packages. Without these established advantages, attracting and retaining skilled personnel becomes a considerable challenge, directly impacting a new company's ability to scale and operate efficiently.

- Driver Shortage Impact: The U.S. trucking industry faced a deficit of approximately 78,000 drivers in 2023, as per the American Trucking Associations.

- Recruitment Challenges: New entrants lack the established recruitment networks and brand recognition of industry leaders like TFI to attract scarce talent.

- Retention Difficulties: Competing with the compensation and benefits offered by larger, established carriers makes retaining drivers a significant hurdle for new businesses.

- Operational Scaling: The inability to secure sufficient skilled labor directly impedes a new entrant's capacity to scale operations and meet market demand.

The threat of new entrants for TFI International is relatively low due to significant capital requirements, established infrastructure, and strong brand loyalty. These factors create high barriers to entry, making it difficult for new companies to compete effectively. For instance, the substantial investment needed for a fleet and terminals, coupled with the complexities of regulatory compliance and a persistent driver shortage, deters many potential newcomers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | High upfront costs for fleet, terminals, and technology. | Significant deterrent; limits scale for new players. | TFI's 2025 CAPEX estimate of $200 million highlights ongoing investment needs. |

| Infrastructure & Scale | Extensive network of terminals and diverse fleet. | Difficult and costly to replicate TFI's operational footprint. | TFI operated a substantial fleet of tractors and trailers as of Q1 2024. |

| Brand Loyalty & Reputation | Established customer relationships and proven reliability. | High customer acquisition costs for new entrants; trust is hard-earned. | Industry consolidation in 2024 sees companies like TFI acquiring smaller entities, strengthening their market position. |

| Regulatory & Compliance | Complex licensing, safety, and environmental standards. | Requires substantial financial resources and specialized expertise. | Continued stringent safety regulations by the U.S. DOT in 2024 necessitate ongoing compliance investments. |

| Labor Shortages | Scarcity of qualified drivers and logistics professionals. | Challenges recruitment and retention for new businesses. | U.S. trucking industry faced a deficit of ~78,000 drivers in 2023 (ATA). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for TFI International leverages financial statements, annual reports, industry-specific market research, and competitor news to provide a comprehensive view of the competitive landscape.