TFI International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TFI International Bundle

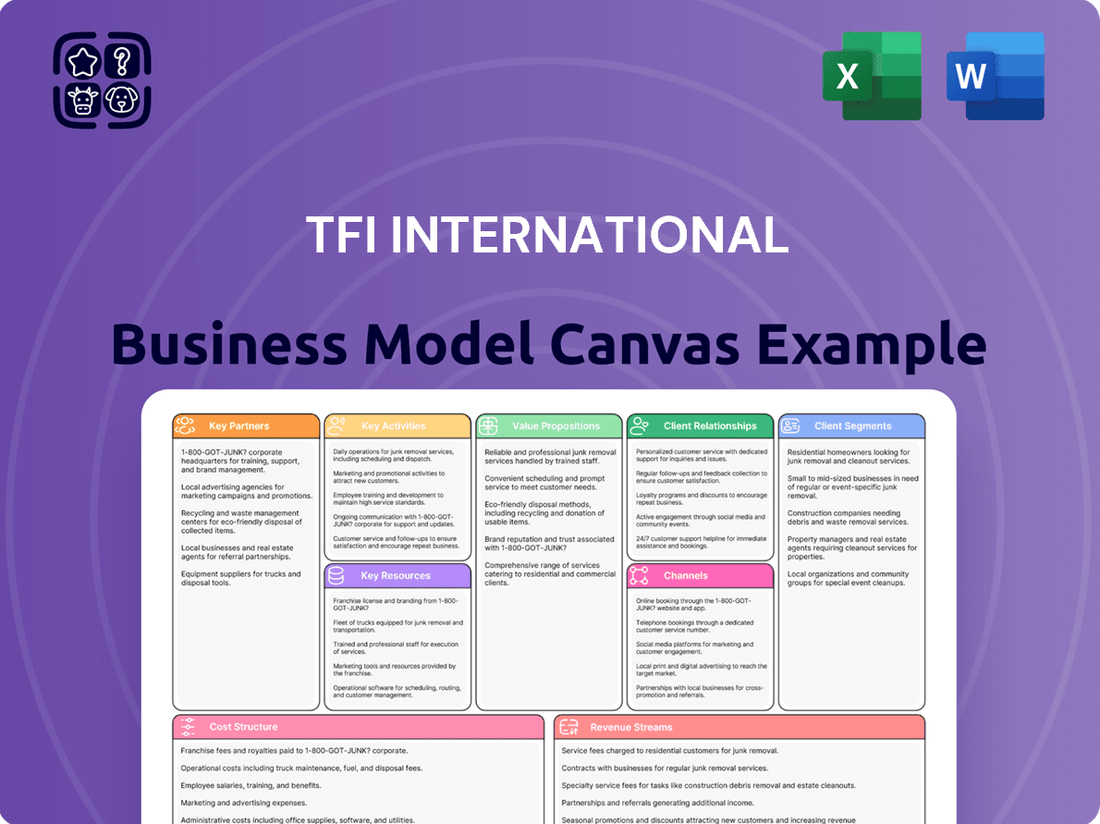

Curious about TFI International's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. See how they've built a logistics powerhouse.

Unlock the full strategic blueprint behind TFI International's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into TFI International’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how TFI International operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out TFI International’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Partnerships

TFI International actively pursues strategic acquisitions, integrating wholly-owned subsidiaries as a fundamental pillar of its expansion. These partnerships are vital for broadening its operational footprint, diversifying its service portfolio, and solidifying its market position throughout North America.

Notable acquisitions in 2024 and early 2025 include Daseke, a significant player in specialized truckload services, and Hercules Forwarding, strengthening its less-than-truckload (LTL) capabilities. Further bolstered by the integration of Keystone Western and several other smaller carriers, these moves have substantially enhanced both TFI's Truckload and LTL segments, demonstrating a consistent commitment to inorganic growth.

TFI International's partnerships with technology and software providers are crucial for enhancing its operational capabilities. These collaborations focus on areas like optimizing delivery routes, implementing dynamic pricing strategies, and boosting overall supply chain visibility. For instance, TFI has been actively upgrading its Optum linehaul planning software. This upgrade is designed to streamline long-haul operations and improve efficiency.

Furthermore, TFI is integrating AI-powered pricing tools, particularly within its Less-Than-Truckload (LTL) division. This move leverages advanced analytics to set more competitive and profitable rates in real-time. In 2024, the logistics sector saw significant investment in digital transformation, with companies like TFI prioritizing technology to gain a competitive edge. The adoption of such technologies is expected to drive substantial improvements in cost management and customer service.

TFI International leverages key partnerships with major rail carriers to enhance its intermodal offerings. These collaborations are crucial for optimizing cost structures and extending the company's geographical reach, especially for long-haul freight movements.

By utilizing rail for a substantial portion of its traffic, TFI can significantly reduce its reliance on over-the-road trucking, leading to lower fuel consumption and a smaller carbon footprint. This strategic approach also helps alleviate road congestion, a persistent challenge in the logistics sector.

In 2023, intermodal transportation represented a significant component of TFI's overall freight volume. For instance, the company's Canadian Less-Than-Truckload (LTL) segment, a major beneficiary of intermodal efficiency, demonstrated robust performance, contributing to TFI's strong financial results.

Equipment Manufacturers and Suppliers

TFI International's operations heavily rely on strong relationships with truck and trailer manufacturers, as well as critical parts suppliers. These collaborations are fundamental to sustaining TFI's vast fleet and ensuring operational efficiency.

These partnerships grant TFI access to cutting-edge, fuel-efficient vehicles and a consistent supply of essential components for both routine maintenance and fleet expansion initiatives. For instance, in 2023, TFI continued to invest in modernizing its fleet, a process directly enabled by its manufacturer relationships.

- Fleet Modernization: Access to the latest truck and trailer models ensures TFI maintains a competitive edge through fuel savings and reduced downtime.

- Component Availability: Reliable access to parts from suppliers is crucial for minimizing vehicle downtime and supporting ongoing maintenance needs across its large fleet.

- Negotiating Power: Strong, long-term partnerships can lead to favorable pricing and terms for new equipment and spare parts.

- Technological Integration: Collaborations with manufacturers facilitate the integration of new technologies, such as advanced safety features and telematics, into TFI's fleet.

Brokerage and Third-Party Logistics (3PL) Networks

TFI International actively collaborates with a wide array of freight brokers and third-party logistics (3PL) providers to supplement its owned fleet capacity. This strategic reliance on external networks is particularly crucial for its Logistics segment, enabling the company to offer a broader range of specialized services and manage more intricate supply chain demands. For instance, in 2024, TFI International's Logistics segment, which heavily utilizes these partnerships, continued to demonstrate robust performance, contributing significantly to the company's overall revenue streams by providing agile and scalable solutions for its diverse customer base.

These partnerships allow TFI International to access a vast pool of carriers and resources, thereby enhancing its ability to meet fluctuating customer needs and expand its geographic reach without substantial capital investment in additional owned assets. This flexibility is a cornerstone of their business model, particularly in dynamic markets where demand can shift rapidly. The company's ability to seamlessly integrate these third-party services into its own operations ensures a consistent and reliable experience for clients, even for shipments that extend beyond TFI's direct operational control.

- Extended Capacity: Access to a larger network of trucks and specialized equipment beyond TFI's owned fleet.

- Service Diversification: Ability to offer niche services like specialized temperature-controlled transport or oversized cargo handling through partners.

- Operational Flexibility: Agility to scale operations up or down rapidly in response to market demand and customer requirements.

- Cost Efficiency: Reduced need for fixed asset investment by leveraging partner assets, optimizing cost structures.

TFI International's strategic acquisitions are a cornerstone of its growth, integrating companies like Daseke and Hercules Forwarding in 2024 to bolster its Truckload and LTL segments. These inorganic growth strategies significantly expand its operational footprint and service offerings across North America.

Key partnerships with rail carriers are vital for TFI's intermodal strategy, reducing reliance on trucking, lowering fuel consumption, and enhancing cost structures for long-haul freight. In 2023, intermodal transportation represented a significant portion of TFI's freight volume, contributing to the strong performance of its Canadian LTL segment.

Collaborations with technology providers are critical for optimizing operations, from route planning with upgraded software like Optum to implementing AI-powered pricing tools in the LTL division, aiming for improved efficiency and competitive rates. The logistics sector's 2024 focus on digital transformation aligns with TFI's investment in these tech partnerships.

TFI also relies on strong relationships with truck and trailer manufacturers for fleet modernization, ensuring access to fuel-efficient vehicles and technological integration. Similarly, partnerships with parts suppliers guarantee component availability, minimizing downtime and supporting fleet maintenance and expansion initiatives.

External partnerships with freight brokers and 3PL providers are essential for TFI's Logistics segment, offering extended capacity and service diversification. This approach provides operational flexibility and cost efficiency by leveraging partner assets to meet fluctuating customer demands and expand reach without significant capital outlay.

What is included in the product

TFI International's Business Model Canvas focuses on its diversified transportation and logistics services, detailing customer segments in trucking, package, and specialized freight, and outlining its value propositions of reliable delivery and cost-efficiency.

TFI International's Business Model Canvas acts as a pain point reliever by providing a clear, high-level overview of their diverse operations, enabling quick identification of synergistic opportunities and potential inefficiencies across their distinct segments.

Activities

TFI International's freight transportation operations are the backbone of its business, encompassing its Less-Than-Truckload (LTL), Truckload, and Package and Courier segments. These activities are centered on the physical movement of goods throughout North America, making efficiency and reliability paramount. For instance, in 2023, TFI's LTL segment generated approximately $5.4 billion in revenue, showcasing the sheer scale of its freight movement capabilities.

Managing this vast network requires intricate coordination of thousands of trucks and drivers, along with a widespread array of terminals and cross-docking facilities. The company's commitment to timely and secure deliveries is crucial for its customers across various industries. TFI reported a total revenue of $22.3 billion in 2023, with freight transportation forming a significant portion of this financial performance.

TFI International's strategic mergers and acquisitions are a cornerstone of its growth. The company actively seeks out and integrates new businesses to broaden its reach geographically and enhance its service offerings. This disciplined approach has led to a history of successful integrations, with a keen focus on targets that immediately boost earnings and free cash flow.

In 2024, TFI International continued this strategy, notably acquiring a significant regional less-than-truckload (LTL) carrier in the United States, a move expected to strengthen its presence in a key market and contribute positively to its financial performance from the outset. This acquisition aligns with their ongoing objective of achieving immediate accretive impact on earnings and free cash flow.

TFI International's core activities revolve around aggressively optimizing operations across its vast network of subsidiaries. This includes a sharp focus on enhancing efficiency within its U.S. Less-Than-Truckload (LTL) segment, a critical area for profitability. For instance, in 2024, TFI continued its strategic initiative to improve its U.S. LTL network density and asset utilization, aiming to drive down per-mile costs.

A significant part of this operational push involves the seamless integration of recently acquired companies. TFI actively works to merge these new entities into its existing infrastructure, standardizing processes and leveraging economies of scale. This integration strategy is key to unlocking synergistic benefits and achieving cost savings, as seen in the successful onboarding of acquired businesses throughout 2024.

The company's commitment to operational optimization extends to route planning, fuel management, and equipment utilization. By employing advanced analytics and technology, TFI strives to reduce transit times, minimize empty miles, and enhance overall service reliability. These efforts directly contribute to improving profitability and reinforcing TFI's competitive market position.

Supply Chain Management and Logistics Solutions

TFI International's key activities extend beyond basic freight hauling to encompass sophisticated supply chain and logistics solutions. These services are designed to streamline operations for their clients, ensuring goods move efficiently from origin to destination. This comprehensive approach is crucial for businesses aiming to reduce costs and improve delivery times.

The company offers a range of specialized services that go beyond traditional transportation. This includes freight forwarding, which manages the movement of goods across international borders, and transportation management systems that provide visibility and control over shipments. TFI also develops bespoke solutions tailored to the unique needs of each customer's supply chain.

- Freight Forwarding: Facilitating the international shipment of goods, managing documentation and customs.

- Transportation Management: Utilizing technology to plan, execute, and optimize the physical movement of freight.

- Customized Solutions: Developing unique logistics strategies to meet specific client operational requirements.

- Supply Chain Optimization: Analyzing and improving all aspects of a client's supply chain for greater efficiency.

In 2024, TFI International continued to invest in technology and infrastructure to enhance these offerings. Their focus on integrated logistics solutions allows them to manage complex networks, offering clients a single point of contact for their diverse shipping and warehousing needs.

Technology Development and Implementation

TFI International's commitment to technology development and implementation is central to its strategy. They invest in and deploy advanced solutions to boost service delivery and operational efficiency. This focus ensures they remain competitive in the logistics and transportation sector.

Key to this is the continuous upgrading of software for critical functions like planning and pricing. By leveraging sophisticated data analytics, TFI gains deeper insights, enabling better decision-making across all its business segments. For instance, in 2023, TFI reported significant investments in its IT infrastructure, which contributed to improved route optimization and fuel efficiency, directly impacting their bottom line.

- Investing in advanced technology

- Upgrading software for planning and pricing

- Leveraging data analytics for improved decision-making

- Enhancing service delivery and operational efficiency

TFI International's core activities blend the physical movement of goods with strategic growth through acquisitions and operational optimization. These key activities are supported by investments in technology to enhance service delivery and efficiency across its diverse freight transportation segments, including LTL, Truckload, and Package & Courier.

In 2024, TFI International's strategic acquisitions, such as a U.S. regional LTL carrier, aimed to immediately bolster earnings and free cash flow, reinforcing its market presence. Simultaneously, the company aggressively pursued operational efficiencies, particularly within its U.S. LTL network, focusing on improved density and asset utilization to reduce per-mile costs.

Furthermore, TFI International provides value-added supply chain and logistics solutions, including freight forwarding and transportation management, to streamline client operations. Continuous investment in technology, such as upgrading planning and pricing software and leveraging data analytics, underpins these efforts, enhancing decision-making and overall service delivery throughout 2024.

Full Document Unlocks After Purchase

Business Model Canvas

The preview you see is the actual TFI International Business Model Canvas, not a mockup or sample. Upon purchase, you will receive this exact, fully populated document, ready for your immediate use and analysis. This ensures you get precisely what you expect, with all sections intact and professionally formatted. You can be confident that the insights and structure presented here are what you will own and utilize.

Resources

TFI International's extensive fleet of trucks and trailers represents a core physical asset vital to its operations. This significant investment underpins its ability to provide diverse transportation services across its various segments.

As of the first quarter of 2025, TFI International managed a substantial fleet, reporting ownership of 20,756 trucks and 42,710 trailers. This vast network of vehicles is instrumental in facilitating the movement of goods for its numerous clients.

TFI International's North American Facility Network is a cornerstone of its operations, comprising a vast array of terminals, cross-dock facilities, and warehouses strategically located throughout the United States, Canada, and Mexico.

This extensive physical infrastructure, which included 646 facilities as of the first quarter of 2025, is fundamental to the company's ability to efficiently manage the movement of goods.

The network facilitates streamlined freight handling, enabling the consolidation of shipments and effective distribution across the continent.

Its sheer scale and strategic placement allow TFI International to offer reliable and timely transportation services, a key competitive advantage in the logistics industry.

TFI International's approximately 13,468 drivers and other logistics professionals represent a critical intangible asset. This skilled workforce is the backbone of their service delivery, ensuring efficient and reliable transportation for their diverse customer base.

The expertise held by these individuals spans crucial areas such as operational execution, customer-facing sales, and strategic management, all of which are indispensable for TFI's success in the competitive logistics landscape.

Their deep understanding of logistics operations, route optimization, and regulatory compliance directly translates into the company's ability to meet and exceed customer expectations, fostering strong, long-term relationships.

In 2023, TFI International reported that its workforce, including these vital drivers and logistics professionals, was instrumental in handling a significant volume of freight, contributing directly to their robust financial performance and market position.

Advanced Technology and IT Systems

TFI International leverages advanced technology as a cornerstone of its operations. This includes proprietary and licensed software critical for dispatch, routing, tracking, and optimizing the entire supply chain. These systems are not just tools but are integral to maintaining efficiency and providing a competitive edge in the logistics market.

Significant investments are made in sophisticated IT systems. For instance, platforms like Optum are utilized for linehaul planning, ensuring efficient movement of goods across long distances. Furthermore, the integration of AI-powered pricing tools allows TFI to dynamically adjust rates, enhancing profitability and customer satisfaction.

The technological infrastructure directly impacts TFI's operational output and financial performance. In 2024, the company continued to focus on digital transformation initiatives, aiming to further streamline operations and reduce costs. These technological advancements are key enablers for achieving TFI's strategic growth objectives.

- Proprietary and licensed software for dispatch, routing, tracking, and supply chain optimization.

- Investments in systems like Optum linehaul planning and AI-powered pricing tools.

- Enhancement of operational efficiency and competitive advantage through technology.

- Digital transformation initiatives to streamline operations and reduce costs in 2024.

Strong Financial Capital and Access to Funding

TFI International maintains strong financial capital, which is crucial for its day-to-day operations, paying down debt, and pursuing growth opportunities through acquisitions. This robust financial foundation ensures the company can operate smoothly and invest in its future.

The company has consistently generated healthy free cash flow, a key indicator of its financial strength and operational efficiency. This free cash flow allows TFI to reinvest in the business, manage its debt effectively, and provide returns to shareholders.

TFI International employs a disciplined approach to capital allocation, meaning they carefully consider where and how to deploy their financial resources for the greatest impact and return. This strategic thinking is vital for long-term success and shareholder value.

For instance, in the first quarter of 2024, TFI International reported strong financial results, including a significant increase in operating income and a healthy free cash flow generation. This performance underscores their ability to manage costs and generate cash efficiently, even in dynamic market conditions.

- Strong Free Cash Flow: TFI International's ability to generate substantial free cash flow supports its operational needs and strategic investments.

- Debt Management: The company effectively utilizes its financial resources to reduce outstanding debt, strengthening its balance sheet.

- Acquisition Capability: Robust capital ensures TFI can pursue and integrate strategic acquisitions, expanding its market reach and service offerings.

- Disciplined Capital Allocation: A clear strategy for deploying capital maximizes returns and supports sustainable growth.

TFI International's key resources include its extensive fleet of over 20,000 trucks and 42,000 trailers, a network of nearly 650 facilities across North America, a skilled workforce of over 13,000 drivers and logistics professionals, and advanced technology for operational optimization. The company also maintains strong financial capital, evidenced by its consistent generation of free cash flow, enabling debt management and strategic acquisitions.

| Key Resource | Description | 2024/2025 Data Point |

|---|---|---|

| Fleet | Trucks and Trailers for freight movement | 20,756 trucks, 42,710 trailers (Q1 2025) |

| Facility Network | Terminals, cross-docks, and warehouses | 646 facilities (Q1 2025) |

| Human Capital | Drivers and logistics professionals | Approximately 13,468 individuals |

| Technology | Software for dispatch, routing, tracking, and AI pricing | Continued digital transformation initiatives in 2024 |

| Financial Capital | Cash flow for operations and growth | Strong free cash flow generation reported in Q1 2024 |

Value Propositions

TFI International boasts a powerful North American presence, covering the United States, Canada, and Mexico. This extensive reach is a cornerstone of their value proposition, enabling them to offer integrated logistics solutions across these key markets.

Through a network of specialized subsidiaries, TFI International provides customers with seamless domestic and cross-border transportation services. This broad geographical footprint is crucial for businesses operating in or trading with these regions.

For instance, TFI International's Canadian operations are substantial, with a significant portion of their revenue often generated north of the border. Their US segment is also a major contributor, highlighting their deep penetration into the American market.

This comprehensive coverage allows TFI International to act as a one-stop shop for many clients' logistical needs. They facilitate efficient movement of goods, whether within a single country or across international boundaries within North America.

TFI International offers a comprehensive suite of transportation and logistics services, catering to a broad spectrum of customer requirements. This includes specialized Package and Courier services for smaller shipments, Less-Than-Truckload (LTL) for consolidated freight, and full Truckload (TL) for larger, dedicated hauls.

This extensive service portfolio enables clients to consolidate their shipping needs with a single, reliable provider. For instance, in the first quarter of 2024, TFI International reported total revenue of $2.5 billion, reflecting the demand for their diverse offerings across various market segments.

The company's ability to handle everything from small parcels to complex, specialized transportation needs is a key differentiator. This integrated approach simplifies supply chains for businesses, allowing them to focus on their core operations while TFI manages their diverse logistics challenges.

TFI International prioritizes seamless operational integration of its acquired companies to ensure consistent and dependable service delivery. This focus on optimizing operations, including improving operating ratios and enhancing service levels, directly translates to reliable freight movement for their customers.

In 2024, TFI continued to demonstrate strong operational efficiency, evident in key financial metrics. For instance, their operating income for the first quarter of 2024 reached $331.7 million, showcasing their ability to manage costs effectively while delivering services.

The company's commitment to reliability is a core value proposition, underpinning its strategy to attract and retain customers who depend on timely and secure transportation solutions. This reliability is a direct result of their ongoing efforts to streamline processes across their diverse business segments.

Value Creation through Strategic Acquisitions

TFI International's strategic acquisition approach is a cornerstone of its value proposition, directly benefiting customers by broadening service offerings and deepening network reach. This allows the company to deliver more comprehensive solutions and maintain competitive pricing within a highly fragmented transportation and logistics industry.

By integrating acquired businesses, TFI enhances its operational efficiency and expands its geographic footprint. For instance, in 2024, TFI continued its acquisitive growth, notably with the acquisition of a regional less-than-truckload (LTL) carrier, which bolstered its network density in key Midwestern markets, directly improving transit times for customers in that region.

- Expanded Service Capabilities: Acquisitions allow TFI to integrate new services, such as specialized freight handling or cross-border logistics, offering customers a more complete suite of transportation solutions.

- Improved Network Density: By adding carriers, TFI strengthens its presence in specific regions, leading to more efficient routing and faster delivery times for its clientele.

- Competitive Pricing: The scale and efficiency gained through acquisitions enable TFI to offer more attractive pricing to customers, particularly in competitive lanes.

- Access to New Markets: Strategic purchases open doors to new geographic territories and customer segments, providing greater value through wider accessibility.

Tailored Supply Chain Solutions

TFI International excels at crafting bespoke logistics and supply chain strategies, moving beyond standard freight services to precisely meet unique client needs. They provide comprehensive solutions that encompass freight forwarding, sophisticated transportation management, and specialized services tailored for diverse industrial sectors.

Their approach ensures that each customer's specific operational challenges are addressed with innovative and efficient supply chain designs. This commitment to customization is a cornerstone of their value proposition, differentiating them in a competitive market.

- Customized Freight Forwarding: TFI designs international and domestic freight forwarding strategies that optimize routes and costs for specific cargo types.

- Transportation Management Systems: They offer advanced TMS solutions that provide real-time visibility, tracking, and management of shipments across various modes.

- Industry-Specific Expertise: TFI possesses deep knowledge in sectors like automotive, retail, and healthcare, developing specialized logistics capabilities for each.

- Value-Added Services: Beyond core transport, they include services like warehousing, cross-docking, and final-mile delivery as part of integrated solutions.

TFI International's value proposition centers on its expansive North American network, offering integrated logistics solutions across the US, Canada, and Mexico. This broad reach, combined with a diverse service portfolio including Package & Courier, LTL, and TL, positions them as a comprehensive provider.

Their strategy of operational integration and strategic acquisitions, exemplified by bolstering LTL density in Midwestern markets in 2024, enhances efficiency and service reliability. This focus on seamless operations and tailored solutions ensures dependable freight movement and addresses unique client needs.

| Metric | Q1 2024 | Year-over-Year Growth (approx.) |

|---|---|---|

| Total Revenue | $2.5 Billion | N/A (specific YoY not provided for Q1 2024 alone) |

| Operating Income | $331.7 Million | N/A (specific YoY not provided for Q1 2024 alone) |

Customer Relationships

Dedicated account managers are crucial for TFI International's larger and more complex clients. These professionals act as the main point of contact, offering tailored support and building lasting partnerships. This approach ensures TFI deeply understands each client's unique operational needs and strategic objectives.

TFI International heavily relies on its online portals and digital tools to foster strong customer relationships by offering unparalleled convenience and transparency. These platforms serve as a central hub where clients can seamlessly track shipments in real-time, manage their orders efficiently, and access crucial billing information at their fingertips.

This self-service model empowers customers, allowing them to proactively manage their logistics needs without constant direct interaction, thereby streamlining operations and enhancing overall satisfaction. For instance, during 2024, TFI reported a significant increase in digital self-service adoption across its various segments, with over 70% of customer inquiries being resolved through online portals and automated systems.

TFI International prioritizes accessible customer service through multiple channels like phone and email, ensuring prompt responses to inquiries and issues. This dedication to real-time assistance is vital for maintaining strong customer relationships and fostering loyalty.

For instance, in 2024, TFI International likely handled a significant volume of customer interactions, leveraging their support centers to address operational questions and provide logistical updates, a key component of their service offering.

Long-Term Contracts and Partnerships

TFI International cultivates enduring customer relationships through long-term contracts, especially with major enterprise clients. These agreements offer predictable revenue streams and facilitate a deeper integration of TFI's logistics and transportation solutions into their clients' operations, solidifying partnerships.

These strategic alliances are crucial for TFI's stability. For instance, in 2023, TFI reported a significant portion of its revenue was derived from recurring business with its largest clients, demonstrating the value of these multi-year commitments. This approach not only ensures consistent demand but also allows TFI to tailor its service offerings to meet evolving client needs.

- Long-Term Contracts: Securing multi-year agreements with key clients provides revenue predictability.

- Deep Integration: These contracts allow for closer alignment of TFI's services with client supply chains.

- Customer Loyalty: The stability and tailored service foster strong, lasting customer loyalty.

- Revenue Stability: In 2023, TFI's reliance on long-term contracts contributed to its robust financial performance, with repeat business forming a substantial revenue base.

Problem Resolution and Proactive Communication

TFI International prioritizes problem resolution and proactive communication to build and maintain customer trust, particularly within its Less-Than-Truckload (LTL) operations. Effectively managing service disruptions and efficiently addressing claims are key to customer satisfaction and retention.

The company actively works to reduce claims costs, a significant factor in LTL, while simultaneously aiming to elevate overall service quality. This dual focus ensures that when issues arise, they are handled swiftly and transparently, reinforcing TFI's commitment to its clients.

- Service Recovery: TFI focuses on minimizing the impact of service disruptions through rapid response mechanisms and clear communication channels to keep clients informed of progress and expected resolution times.

- Claims Management: The company strives to streamline the claims process, aiming for quicker settlements and reduced administrative overhead, which directly contributes to a better customer experience.

- Proactive Updates: Implementing robust systems for proactive status updates on shipments, especially those experiencing delays or issues, is crucial for managing customer expectations and preventing dissatisfaction.

- LTL Segment Focus: TFI's LTL segment, known for its complexity and higher potential for service exceptions, receives particular attention in these customer relationship management efforts.

TFI International nurtures customer relationships through a multi-pronged approach, blending personalized service with efficient digital tools. Long-term contracts with major clients provide stability and allow for deep integration of TFI's logistics solutions, fostering loyalty. In 2023, a significant portion of TFI's revenue stemmed from these recurring business relationships, underscoring the value of these commitments.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Dedicated Account Management | Personalized support for large, complex clients. | Ensures tailored solutions and builds lasting partnerships. |

| Digital Self-Service Portals | Online platforms for shipment tracking, order management, and billing. | In 2024, over 70% of customer inquiries were resolved via these portals, indicating high adoption and efficiency. |

| Multi-Channel Customer Support | Accessible assistance via phone and email. | Crucial for real-time issue resolution and maintaining customer satisfaction. |

| Long-Term Contracts | Multi-year agreements with enterprise clients. | Contributed to robust financial performance in 2023 through revenue predictability and repeat business. |

| Proactive Problem Resolution | Focus on managing service disruptions and claims efficiently. | Key to customer trust and retention, particularly in the LTL segment. |

Channels

TFI International leverages a direct sales force to cultivate business-to-business relationships, focusing on securing large accounts and intricate logistics contracts. This approach facilitates personalized client engagement, enabling the creation of bespoke solutions and fostering strong, lasting partnerships.

This direct engagement allows for in-depth understanding of client needs, leading to more effective and tailored logistics proposals. For instance, in 2024, TFI's direct sales efforts were instrumental in closing several multi-year contracts with major e-commerce retailers, significantly boosting their specialized freight segment.

The direct sales team acts as the primary point of contact, managing negotiations and ensuring seamless integration of TFI's services with client operations. This hands-on management is crucial for complex, high-volume shipping requirements, where precision and reliability are paramount.

By maintaining a dedicated sales force, TFI International can directly address the evolving demands of the logistics market and adapt its service offerings proactively. This direct channel provides invaluable real-time feedback, informing strategic adjustments and service enhancements to maintain a competitive edge.

TFI International leverages its website as a cornerstone of its online presence, functioning as a central hub for detailed company information, service inquiries, and even direct booking capabilities for specific offerings. This digital gateway is crucial for engaging with customers and streamlining the initial contact process.

Beyond static information, TFI's digital platforms are designed to foster customer engagement and provide essential self-service functionalities. Customers can readily access shipment tracking, manage their accounts, and find answers to frequently asked questions, enhancing convenience and operational efficiency.

In 2024, TFI International continued to invest in its digital infrastructure, aiming to improve user experience and data accessibility across all platforms. While specific figures for website traffic or online booking conversion rates are proprietary, the company's consistent focus on digital channels underscores their importance in customer acquisition and retention strategies.

TFI International's business model thrives on its network of wholly-owned subsidiaries, each operating with its own distinct brand and customer engagement channels. This decentralized approach allows TFI to effectively tap into specialized market niches and maintain strong relationships with local customer bases.

For instance, TFI's Less-Than-Truckload (LTL) segment, which represents a significant portion of its operations, likely features brands that have built long-standing reputations for reliability and service within specific geographic regions. This allows for tailored marketing and sales efforts that resonate directly with the needs of those customers.

The company's diverse portfolio means that customer acquisition and retention strategies can be highly customized per subsidiary. This adaptability is crucial in the transportation and logistics sector, where customer expectations and competitive landscapes can vary greatly from one market segment to another.

In 2024, TFI International continued to emphasize the strength of its subsidiary network, reporting robust performance across its various operating segments. This structure enables them to respond nimbly to market shifts and maintain a competitive edge by leveraging the unique brand equity and established channels of each individual operating company.

Customer Service and Call Centers

Customer service and call centers are a crucial touchpoint for TFI International, acting as direct channels for customer inquiries, support, and issue resolution. These centers are vital for providing immediate assistance and maintaining customer satisfaction across all their service segments, which include less-than-truckload (LTL), package and courier, and truckload services. In 2023, TFI reported a strong focus on operational efficiency, which directly impacts the effectiveness of their customer service interactions.

- Direct Customer Interaction: Call centers handle a significant volume of customer contacts, addressing questions about shipment status, delivery times, and billing.

- Issue Resolution: They are the first line of defense for resolving any problems customers may encounter, ensuring a smoother experience.

- Customer Satisfaction Driver: Efficient and helpful customer service is key to retaining clients in the competitive logistics industry.

- Operational Efficiency: TFI's commitment to streamlining operations supports the call centers' ability to provide timely and accurate information, contributing to overall service quality.

Industry Events and Trade Shows

Industry events and trade shows are a crucial touchpoint for TFI International. These gatherings provide a prime opportunity to physically demonstrate their diverse service offerings, from less-than-truckload (LTL) to specialized heavy haulage. Networking at these events is key to identifying and securing new business partnerships, particularly in niche logistics sectors. In 2024, TFI’s presence at major logistics expos like the American Trucking Associations (ATA) Management Conference & Exhibition would have been instrumental in showcasing their expanded fleet and technological advancements.

Staying informed about evolving market trends and competitor strategies is another significant benefit. This allows TFI to adapt its business model proactively, ensuring they remain competitive. For example, observing new sustainability initiatives or digital integration strategies discussed at these shows can inform TFI's future investments. The company’s focus on specialized hauling, a segment that often requires tailored solutions, benefits greatly from direct engagement with potential clients and industry peers.

- Showcasing Capabilities: Demonstrating advanced logistics technology and specialized fleet at events.

- Networking: Building relationships with potential clients and strategic partners in the transportation sector.

- Market Intelligence: Gathering insights on industry trends, innovations, and competitive landscapes.

- New Business Acquisition: Directly engaging with prospects to secure contracts for specialized hauling and logistics management.

TFI International utilizes a multi-faceted channel strategy, combining direct sales forces with a robust online presence and a network of wholly-owned subsidiaries. This approach ensures comprehensive market coverage and tailored customer engagement across its diverse logistics services.

Key channels include direct sales for B2B relationships, the company website for information and booking, and subsidiary brands catering to specific niches. Customer service centers and industry events further support client interaction and market intelligence gathering.

In 2024, TFI's digital investments aimed at enhancing user experience and data accessibility, while their subsidiary network continued to leverage established local relationships. This integrated channel approach is vital for their continued growth in specialized freight and LTL services.

The effectiveness of these channels is reflected in their 2023 performance where TFI International reported strong revenue growth, driven by strategic acquisitions and organic expansion across its various segments.

| Channel | Description | 2024 Focus/Activity | Impact |

|---|---|---|---|

| Direct Sales Force | B2B relationship building, securing large contracts | Securing multi-year contracts with e-commerce retailers | Significant boost to specialized freight segment |

| Website & Digital Platforms | Company information, service inquiries, booking, self-service | Investing in infrastructure for improved user experience | Streamlining customer contact and enhancing convenience |

| Wholly-Owned Subsidiaries | Specialized market niches, local customer engagement | Leveraging unique brand equity and established channels | Effective market penetration and customer retention |

| Customer Service & Call Centers | Direct inquiry, support, issue resolution | Focus on operational efficiency for timely assistance | Key driver of customer satisfaction and retention |

| Industry Events & Trade Shows | Demonstrating services, networking, market intelligence | Showcasing expanded fleet and technological advancements | Identifying new business partnerships and staying competitive |

Customer Segments

Large enterprises and corporations are a cornerstone of TFI International's customer base, seeking robust and integrated transportation and logistics services across North America. These major businesses often manage high-volume shipments and intricate supply chains, making TFI's extensive network and diverse service portfolio invaluable. For instance, TFI’s less-than-truckload (LTL) segment, which heavily serves this market, saw significant revenue growth, indicating strong demand from corporate clients. In 2023, TFI’s total revenue reached approximately $7.4 billion, with a substantial portion attributed to these large-scale operations.

TFI International heavily relies on small and medium-sized businesses (SMBs) as a core customer segment for its parcel delivery and Less-Than-Truckload (LTL) services. This focus is particularly evident in their U.S. LTL operations, where they are strategically shifting to serve SMBs.

The rationale behind this pivot is that SMBs often present more attractive profit margins than some of their larger corporate counterparts. For instance, in 2024, TFI's U.S. LTL segment has shown consistent growth, partly attributed to its success in onboarding and serving a broader base of these smaller, yet often more loyal and profitable, business clients.

TFI International recognizes the booming e-commerce sector as a key customer segment. The company provides specialized parcel delivery and fulfillment solutions tailored to the unique needs of online retailers, ensuring timely and reliable shipment of goods to consumers.

The e-commerce market has experienced robust expansion, with global online retail sales projected to reach over $7 trillion by 2025. TFI's strategic focus on this segment allows them to capitalize on this sustained growth trend, offering services essential for businesses operating in the digital marketplace.

In 2024, TFI International reported significant contributions from its e-commerce related operations. For instance, their US Express division, heavily involved in parcel delivery, saw continued demand driven by online shopping patterns. This indicates a successful alignment with a high-growth industry.

Clients in Specific Industries

TFI International’s client base spans a diverse array of industry sectors, demonstrating its broad market reach and adaptability. Key sectors served include retail, manufactured goods, building materials, automotive, metals & mining, and food & beverage.

This industry diversification is a strategic advantage, helping to buffer against economic downturns in any single sector. It also enables TFI to develop specialized logistics and transportation solutions that directly address the unique needs and challenges of each industry.

For instance, the company’s operations in 2024 likely saw significant activity supporting the robust demand in sectors like e-commerce retail and construction, driven by ongoing infrastructure projects and consumer spending. TFI's ability to handle temperature-sensitive goods is crucial for its food and beverage clients, while its expertise in heavy haulage benefits the metals & mining and building materials industries.

- Retail: Supporting the high-volume, time-sensitive demands of consumer goods delivery, particularly with the continued growth of e-commerce.

- Manufacturing: Facilitating the movement of raw materials and finished products for a wide range of industrial clients.

- Building Materials: Transporting essential components for construction and infrastructure development.

- Automotive: Managing the logistics of vehicle parts and finished vehicles for manufacturers and dealerships.

- Metals & Mining: Handling the bulk transport of raw and processed materials.

- Food & Beverage: Ensuring the safe and timely delivery of perishable and non-perishable food products.

Businesses Requiring Specialized Hauling

TFI International’s Truckload segment caters to businesses with very specific hauling requirements. This means they work with clients who need more than just a standard dry van trailer. Think about industries like mining, energy production, and chemical manufacturing – these sectors often need specialized trailers like flatbeds for oversized equipment or tanks for bulk liquids and gases.

This specialization allows TFI to address niche market needs where standard carriers might not have the right equipment or expertise. For example, their specialized equipment capabilities are crucial for transporting raw materials or finished products in industries with unique handling and safety regulations. In 2024, the demand for such specialized transport remained robust, driven by ongoing infrastructure projects and industrial activity.

TFI’s ability to provide these specialized services is a key differentiator, enabling them to build strong relationships with customers in demanding sectors. These customers often prioritize reliability and the correct equipment over simply the lowest price. The company's investment in a diverse fleet, including specialized units, directly supports these customer segments.

- Specialized Equipment: Flatbed, tank, and other niche trailers are essential for industries like mining, energy, and chemicals.

- Industry Focus: TFI serves sectors with unique transportation and regulatory needs, such as oil and gas or heavy manufacturing.

- Market Niche: The company targets customers requiring specific hauling solutions beyond standard dry van services.

- Customer Value: Reliability and appropriate equipment are paramount for these specialized hauling clients.

TFI International’s customer segments are diverse, ranging from large enterprises requiring extensive logistics networks to small and medium-sized businesses (SMBs) seeking cost-effective LTL solutions. The company also actively serves the booming e-commerce sector with specialized parcel delivery and fulfillment. Furthermore, TFI caters to a broad spectrum of industries, including retail, manufacturing, and food & beverage, demonstrating significant market reach.

The company's strategy includes a focus on SMBs within its U.S. LTL operations, aiming for higher profit margins. TFI's commitment to the e-commerce market capitalizes on sustained growth, with online retail sales projected to exceed $7 trillion by 2025. In 2024, TFI's U.S. LTL segment has shown growth, partly due to its success with smaller businesses.

TFI International also targets niche markets through its Truckload segment, providing specialized hauling solutions for industries like mining, energy, and chemicals. These clients prioritize reliability and specialized equipment, such as flatbeds or tank trailers, for unique transportation needs.

| Customer Segment | Key Characteristics | TFI Service Focus | 2024 Relevance/Data Point |

|---|---|---|---|

| Large Enterprises | High-volume, complex supply chains | Integrated logistics, North American network | Significant revenue driver; TFI's LTL segment growth |

| Small & Medium Businesses (SMBs) | Seeking cost-effective, reliable transport | U.S. LTL services, parcel delivery | Strategic growth area for TFI U.S. LTL; attractive profit margins |

| E-commerce Businesses | Online retailers, direct-to-consumer | Specialized parcel delivery, fulfillment | Capitalizing on global online retail sales exceeding $7 trillion by 2025 |

| Industry-Specific Clients | Retail, Manufacturing, Building Materials, Automotive, etc. | Tailored logistics solutions for diverse sector needs | Continued demand in sectors like e-commerce retail and construction |

| Specialized Hauling Clients | Mining, Energy, Chemicals | Flatbed, tank, and other niche trailer services | Robust demand for specialized transport driven by industrial activity |

Cost Structure

Fuel costs represent a substantial variable expense for TFI International, directly influencing its day-to-day operational outlays in the trucking and logistics sectors.

In 2024, the volatility of diesel prices remained a key factor, with average national prices fluctuating throughout the year, impacting TFI's bottom line. For instance, if diesel prices averaged $4.00 per gallon in a given period, a large fleet would see significant expenditures.

While TFI utilizes fuel surcharges to pass on a portion of these rising costs to customers, these mechanisms don't always perfectly offset the price swings, creating ongoing margin management challenges.

The company's efficiency in fuel purchasing and consumption, including investments in more fuel-efficient vehicles and route optimization technologies, is critical for mitigating the impact of these fuel cost fluctuations.

Labor costs are a significant expense for TFI International, encompassing wages, benefits, and training for a broad range of employees. This includes the drivers who operate the fleet, dispatchers who manage logistics, maintenance personnel who keep vehicles running, and administrative staff who support operations. In 2023, TFI reported total employee compensation and benefits of approximately $2.9 billion, highlighting the substantial investment in its workforce.

Effectively managing labor efficiency and optimizing workforce deployment are therefore critical levers for TFI in controlling overall operating expenses. This involves strategic scheduling, efficient route planning to minimize driver downtime, and investing in training to enhance productivity and safety across all operational roles. For instance, improving driver utilization by just a few percentage points can translate into millions in cost savings.

TFI International incurs significant costs for keeping its extensive fleet of trucks and trailers in optimal working condition. This includes routine maintenance, unexpected repairs, and the ongoing procurement of necessary parts. In 2024, the company's commitment to fleet upkeep is a cornerstone of its operational efficiency.

Depreciation is another major factor in TFI's cost structure. As vehicles and equipment age, their value decreases, creating a substantial non-cash expense that impacts profitability calculations. This ongoing devaluation requires careful management within the company's financial planning.

Acquisition and Integration Costs

TFI International's commitment to growth through strategic acquisitions means significant investment in acquisition and integration costs. These are not one-off expenses but rather ongoing elements of their business model. For instance, in 2023, TFI completed several key acquisitions, including the purchase of Daseke, Inc. for approximately $1 billion. This substantial transaction alone would have generated considerable expenses related to due diligence, legal counsel, and the complex process of merging Daseke’s operations and IT systems into TFI's existing infrastructure.

These integration efforts are crucial for realizing the full value of acquired businesses and ensuring operational synergy. Costs can include:

- Due Diligence: Thorough examination of financial, operational, and legal aspects of target companies.

- Legal and Advisory Fees: Expenses for lawyers, investment bankers, and consultants involved in deal structuring and negotiation.

- System Integration: Costs associated with merging IT systems, accounting platforms, and operational software.

- Restructuring and Harmonization: Expenses related to aligning policies, procedures, and potentially workforce structures.

Technology and IT Infrastructure Expenses

TFI International's cost structure heavily relies on technology and IT infrastructure. Significant investments are made in software licenses, cloud services, and the ongoing maintenance of their IT systems. For instance, in 2024, companies in the transportation and logistics sector continued to see rising costs related to digital transformation initiatives, including advanced analytics platforms and route optimization software, which are crucial for TFI's operations. These expenses are vital for enhancing operational efficiency, ensuring robust data management, and maintaining a competitive edge in a rapidly evolving market.

Furthermore, cybersecurity is a non-negotiable expense, protecting sensitive customer and operational data from threats. The company also allocates resources to technology development, aiming to innovate and improve its service offerings. In 2024, the demand for enhanced visibility solutions and real-time tracking technologies, often requiring substantial IT investment, remained a key driver for expenditure in the industry. These technology outlays are fundamental to TFI's ability to manage its vast network effectively.

- Software Licenses and Subscriptions: Costs associated with transportation management systems (TMS), enterprise resource planning (ERP) software, and other operational applications.

- IT Infrastructure: Expenses for servers, data centers, cloud hosting services, and network equipment.

- Cybersecurity: Investments in firewalls, intrusion detection systems, data encryption, and security personnel to protect against cyber threats.

- Technology Development: Funding for research and development of new technological solutions, such as AI for logistics optimization or advanced telematics.

TFI International's cost structure is heavily influenced by its extensive fleet operations, with fuel and labor being the most significant variable expenses. The company also faces substantial costs related to maintenance, depreciation of its assets, and strategic investments in technology and cybersecurity. Acquisition and integration costs represent another key component, particularly as TFI pursues its growth strategy.

| Cost Category | Description | Impact on TFI | 2023/2024 Relevance |

|---|---|---|---|

| Fuel | Diesel fuel for trucking operations | Major variable expense; directly tied to mileage and fuel prices | Continued price volatility in 2024 impacted operational costs |

| Labor | Wages, benefits, training for drivers, staff | Significant fixed and variable expense; crucial for service delivery | Total compensation and benefits were approximately $2.9 billion in 2023 |

| Maintenance & Repairs | Routine and unexpected upkeep of fleet | Essential for operational efficiency and safety; direct cost | Ongoing commitment in 2024 to ensure fleet reliability |

| Depreciation | Non-cash expense from asset value decline | Reduces reported profit; impacts asset-based financial ratios | A consistent factor impacting profitability calculations |

| Acquisitions & Integration | Costs associated with mergers and acquisitions | Significant investment for growth; includes due diligence, legal, system integration | $1 billion acquisition of Daseke in 2023 highlights substantial integration expenses |

| Technology & IT | Software, cloud services, cybersecurity, R&D | Enables efficiency, data management, and competitive advantage | Continued investment in digital transformation and cybersecurity in 2024 |

Revenue Streams

TFI International generates significant revenue from its Less-Than-Truckload (LTL) freight services, which involve transporting smaller shipments that don't fill an entire truck. This business line is a cornerstone of their operations, demonstrating consistent demand for efficient consolidation of goods.

In the second quarter of 2025, LTL services represented a substantial portion of TFI's financial performance, contributing roughly 41% to their total revenue. This highlights the critical role LTL plays in their overall success and market position within the freight transportation sector.

TFI International generates income by transporting entire truckloads of goods directly from their starting point to their final destination. This includes handling specialized cargo and operating dedicated fleets for consistent client needs.

In the first quarter of 2025, the Truckload (TL) segment represented approximately 38% of TFI's overall revenue. This substantial contribution was notably bolstered by strategic acquisitions, such as the integration of Daseke.

TFI International generates revenue through asset-light logistics services, which include brokerage, freight forwarding, and comprehensive transportation management solutions. These services leverage TFI's network and expertise without requiring significant capital investment in physical assets. This strategic approach allows for flexibility and scalability in meeting diverse customer needs.

In the first quarter of 2025, this segment represented a substantial portion of TFI's overall income, contributing approximately 20% to the company's total revenue. This highlights the growing importance of these value-added services within TFI's diversified business model.

Package and Courier Services

TFI International's package and courier services generate revenue by handling expedited, time-sensitive deliveries of parcels, documents, and smaller freight shipments. This distinct offering, often separate from their Less-Than-Truckload (LTL) operations, caters to urgent shipping needs.

In 2024, TFI International's package and courier segment, primarily driven by its US Express and Canada-based operations like TFI Road & Rail, continued to be a significant revenue contributor. While specific standalone figures for this exact service category within the broader segments aren't always isolated in public reporting, the overall performance of these divisions indicates robust demand. For example, TFI International reported strong results across its segments in 2023, setting a positive trajectory into 2024. The company's strategic focus on e-commerce growth and expedited delivery solutions underpins the revenue generated from these services.

- Revenue Generation: Primarily from fast, reliable delivery of small parcels and time-critical documents.

- Service Focus: Differentiates from LTL by prioritizing speed and smaller shipment sizes.

- Market Position: Leverages extensive networks for efficient last-mile delivery, especially in e-commerce.

- 2024 Outlook: Continued growth expected, supported by increasing demand for expedited shipping solutions.

Fuel Surcharges and Ancillary Fees

TFI International's revenue generation extends beyond base freight rates, significantly boosted by fuel surcharges. These surcharges are crucial for mitigating the impact of volatile energy prices on operational costs, ensuring profitability. For instance, in 2024, fuel costs remain a primary concern for logistics companies, making these surcharges a consistent revenue stream.

Beyond fuel, TFI leverages various ancillary fees to enhance its income. These include charges for detention, specialized equipment, and additional services such as liftgates or residential deliveries. These fees reflect the complexity and specific demands of freight transportation, allowing TFI to capture value for customized solutions.

- Fuel Surcharges: Directly linked to market fuel prices, these fees provide a dynamic revenue component that protects margins against cost fluctuations.

- Detention Fees: Applied when trucks are delayed at pickup or delivery points, these fees compensate for unproductive driver and equipment time.

- Accessorial Charges: These cover a range of non-standard services, such as inside delivery, appointment scheduling, or delivery notifications.

- Specialized Handling: Revenue is also generated from fees associated with handling hazardous materials, oversized cargo, or temperature-controlled shipments.

TFI International's revenue streams are diversified, encompassing core freight services, logistics solutions, and specialized courier operations. Fuel surcharges and ancillary fees further bolster income by addressing volatile energy costs and providing value-added services. This multi-faceted approach allows TFI to adapt to market demands and maintain profitability across its operations.

| Revenue Stream | Description | Key Drivers | 2024/2025 Data Insight |

|---|---|---|---|

| Less-Than-Truckload (LTL) | Consolidating smaller shipments into single truckloads. | Demand for efficient freight movement, network density. | Represented ~41% of revenue in Q2 2025. |

| Truckload (TL) | Dedicated truck transport for full loads. | Client needs for direct, end-to-end shipping, fleet utilization. | Accounted for ~38% of revenue in Q1 2025, boosted by acquisitions. |

| Logistics Services | Asset-light brokerage, forwarding, and management. | Network leverage, expertise in supply chain optimization. | Contributed ~20% of revenue in Q1 2025, showing growth. |

| Package & Courier | Expedited, time-sensitive delivery of parcels. | E-commerce growth, demand for fast shipping. | Significant contributor in 2024, supported by strong segment performance. |

| Ancillary Fees | Fuel surcharges, detention, specialized handling, etc. | Energy price volatility, need for premium services. | Crucial for margin protection and revenue enhancement in 2024. |

Business Model Canvas Data Sources

The TFI International Business Model Canvas is built using a combination of internal financial data, extensive market research reports, and operational metrics. These sources provide the foundation for understanding TFI's current business and strategic direction.