TFI International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TFI International Bundle

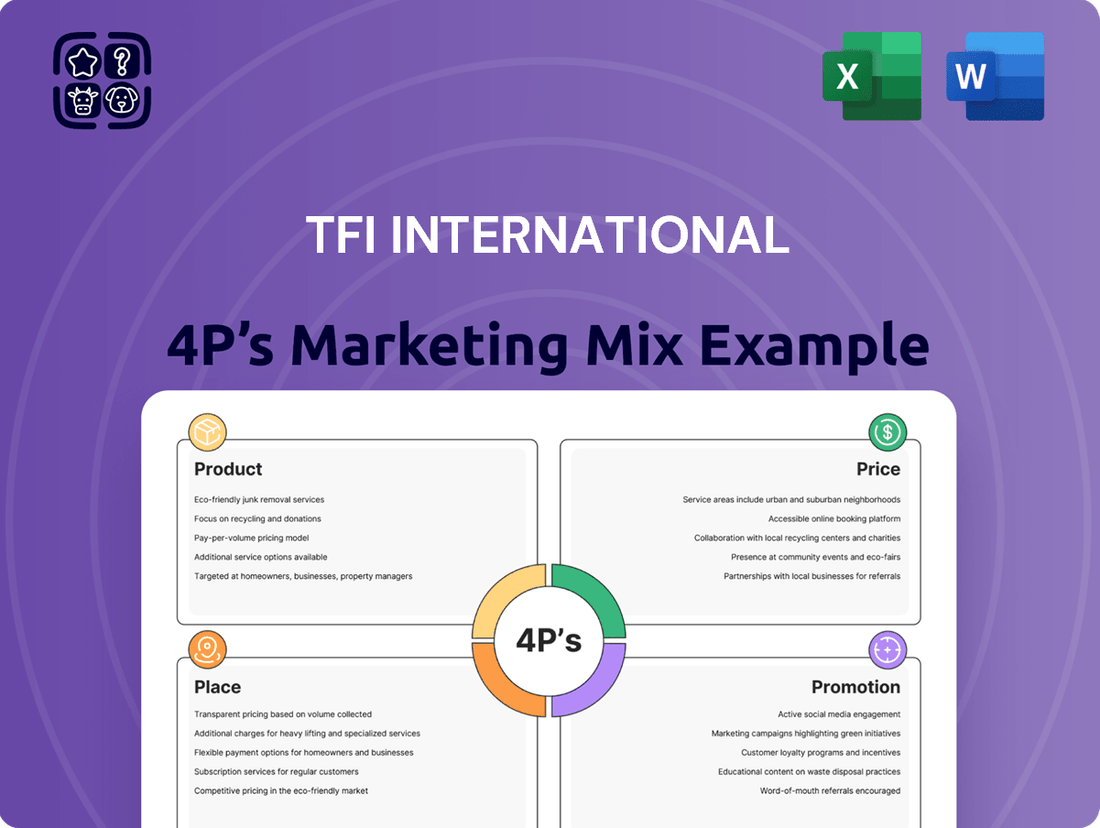

TFI International's marketing success hinges on a well-orchestrated blend of its 4Ps. Understanding their product diversification, from specialized freight to logistics solutions, reveals a strategic approach to meeting diverse customer needs.

Delve into TFI International's pricing strategies, examining how they balance competitive rates with value-added services across their extensive portfolio.

Discover the intricate network and distribution channels TFI International leverages to ensure efficient and timely delivery of services, a critical component of their market presence.

Explore the promotional tactics TFI International employs to build brand awareness and communicate its value proposition effectively within the competitive transportation and logistics landscape.

Unlock the complete, in-depth 4Ps Marketing Mix Analysis of TFI International. This professionally crafted, editable report provides actionable insights and strategic frameworks, perfect for business professionals, students, and consultants seeking a competitive edge.

Product

TFI International boasts a diverse service portfolio, a key element in its marketing mix. This includes Package and Courier, Less-Than-Truckload (LTL), Truckload, and Logistics segments. This broad range allows TFI to serve a wide spectrum of customer needs, from individual parcel deliveries to complex supply chain management.

The company's offerings encompass everything from expedited parcel delivery to specialized freight hauling and comprehensive logistics solutions. For instance, their LTL segment provides efficient transportation for smaller, consolidated shipments, while their Truckload division handles full trailer loads. This multi-faceted approach positions TFI to capture a significant share of the transportation market.

In 2023, TFI International reported strong performance across its segments. Their LTL operations, particularly in the United States, remained a significant revenue driver. The company's strategic acquisitions have further broadened this service offering, integrating new capabilities and expanding their geographic reach.

TFI International's product strategy heavily leans on strategic acquisitions to bolster its service suite and capabilities. For instance, in 2024, the acquisition of Daseke significantly strengthened its Truckload segment by adding a major flatbed carrier. This move, alongside the purchase of Hercules Forwarding, an LTL provider, directly increased TFI's terminal network and truck fleet for U.S.-Canada freight, demonstrating a clear intent to expand service reach.

TFI International is actively pursuing operational optimization, especially in its Less-Than-Truckload (LTL) segment, to boost service quality and efficiency. This focus is evident in their strategic technology investments.

Key technology upgrades include enhancing the Optum linehaul planning software and implementing dynamic pricing tools. These advancements are designed to refine route planning, leading to more efficient operations and improved customer service delivery.

For instance, in the first quarter of 2024, TFI reported a revenue of $2.73 billion, a slight decrease from $2.84 billion in Q1 2023, highlighting the ongoing efforts to enhance efficiency and cost management within their operations.

These technological integrations are crucial for TFI to stay competitive in the logistics market and to effectively meet the ever-changing demands of their customer base, ensuring robust service performance.

Specialized Hauling and Niche Market Services

TFI International's product strategy extends beyond standard freight to encompass specialized hauling and niche market services. This focus allows them to address unique client needs, as seen with companies like Sharp Trucking Services Ltd., acquired in 2024, which caters specifically to the Canadian mining sector. This strategic move underscores TFI's commitment to expanding its footprint in specialized transportation segments.

These specialized services are crucial for industries with demanding logistics requirements. For instance, TFI's capabilities in handling oversized or temperature-sensitive cargo provide a competitive edge. The company's ability to integrate acquired niche players like Sharp Trucking allows for the seamless transfer of expertise and market access, strengthening its overall service portfolio.

The financial impact of this specialization is evident in TFI's growth. While specific revenue breakdowns for these niche services are not always granularly reported, TFI International's overall revenue for the first quarter of 2024 reached approximately $2.2 billion, indicating a robust performance across its diverse business segments, including these specialized areas.

- Niche Market Entry: Acquisitions like Sharp Trucking Services Ltd. in 2024 facilitate entry into specialized sectors such as Canadian mining.

- Tailored Solutions: This specialization enables TFI to offer customized transportation for complex and demanding logistical needs.

- Revenue Growth Support: Specialized services contribute to TFI's overall financial strength, with Q1 2024 revenues nearing $2.2 billion.

- Competitive Advantage: Handling unique cargo types like oversized or temperature-controlled goods differentiates TFI in the market.

Supply Chain Management Solutions

TFI International's Logistics segment offers comprehensive supply chain management solutions, including freight brokerage, transportation management, warehousing, and distribution. These services are engineered for dock-to-destination efficiency and adaptability, ensuring customer confidence by handling intricate logistical challenges end-to-end.

This approach provides customers with a unified and streamlined process, from the initial pickup of goods to their final delivery. TFI's commitment to managing these complex needs allows businesses to focus on their core operations, knowing their supply chain is in capable hands.

In 2023, TFI's Logistics segment reported revenue of approximately $2.2 billion, showcasing its significant market presence and the demand for its integrated supply chain services. This segment's performance highlights its capability to deliver value through optimized logistics.

- Freight Brokerage: Connecting shippers with carriers to optimize freight movement and cost.

- Transportation Management: Overseeing all aspects of freight transport, including planning, execution, and tracking.

- Warehousing and Distribution: Providing secure storage and efficient movement of goods through distribution networks.

- Dock-to-Destination Efficiency: Ensuring seamless transit and timely delivery from origin to final point.

TFI International's product strategy is characterized by a broad service portfolio and strategic expansion through acquisitions. They cater to diverse logistics needs, from parcel delivery to specialized freight, significantly enhancing their market reach and service capabilities.

The company's offerings are designed for efficiency and adaptability, covering Less-Than-Truckload (LTL), Truckload, and comprehensive Logistics solutions. This multi-faceted approach allows TFI to serve a wide range of customer requirements, solidifying its position in the transportation sector.

In 2024, TFI International continued its aggressive acquisition strategy, notably acquiring Daseke to bolster its Truckload segment and Hercules Forwarding to expand its LTL network, demonstrating a clear commitment to enhancing its service breadth and operational capacity.

TFI International's product development is heavily influenced by technological integration to optimize operations, particularly in its LTL segment. Investments in software like Optum and dynamic pricing tools aim to improve route planning and customer service delivery.

| Service Segment | Key Offerings | Recent Developments (2024) | Q1 2024 Revenue (Approximate) |

| Package and Courier | Parcel delivery services | Continued investment in network efficiency | Included in overall segment reporting |

| Less-Than-Truckload (LTL) | Consolidated shipments, expedited services | Acquisition of Hercules Forwarding, technology upgrades | Strong revenue driver, particularly in the U.S. |

| Truckload | Full trailer loads, specialized hauling | Acquisition of Daseke (major flatbed carrier) | Significant growth potential |

| Logistics | Freight brokerage, supply chain management, warehousing | Focus on dock-to-destination efficiency | $2.2 billion (2023) |

| Specialized Services | Niche market transport (e.g., mining) | Acquisition of Sharp Trucking Services Ltd. | Contributes to overall revenue strength |

What is included in the product

This analysis offers a comprehensive breakdown of TFI International's marketing strategies, examining their Product, Price, Place, and Promotion tactics with real-world examples.

It serves as an excellent resource for understanding TFI International's market positioning and can be easily adapted for various business and academic purposes.

Simplifies TFI International's complex marketing strategy into actionable insights, easing the burden of strategic decision-making.

Provides a clear, concise framework for understanding how TFI International's 4Ps address market challenges, relieving the pressure of identifying core competitive advantages.

Place

TFI International boasts an extensive network throughout North America, a key element of its marketing strategy. This vast presence covers the United States, Canada, and Mexico, solidifying its position as a premier transportation and logistics provider in the region. This significant geographical footprint is a major draw for clients needing broad coverage.

Supporting this expansive network are over 645 facilities strategically located across these countries. Furthermore, TFI International operates through more than 100 distinct operating companies. This infrastructure ensures a high degree of accessibility and a comprehensive suite of services available to a wide range of customers.

TFI International's decentralized operating model empowers its wholly-owned subsidiaries with significant autonomy. This structure allows each segment, like TForce Freight or TForce Logistics, to tailor strategies to their specific regional markets and specialized customer needs. For instance, TForce Freight's focus on less-than-truckload (LTL) services in North America differs greatly from TForce Logistics' cross-border solutions, demonstrating this localized approach.

TFI International actively strengthens its physical infrastructure by strategically acquiring and consolidating terminals. This approach directly impacts the Place element of their marketing mix, ensuring their network is robust and geographically advantageous.

In the past year alone, TFI expanded its reach by integrating 90 new facilities through strategic business acquisitions, significantly broadening its operational footprint.

Concurrently, the company engaged in terminal consolidation, a crucial step in optimizing its network density and improving overall operational efficiency, making its services more accessible and timely.

This deliberate expansion and refinement of their physical presence ensures TFI's terminal network effectively aligns with current market demands and future growth opportunities across its service areas.

Omni-Channel Distribution Approach

TFI International's distribution strategy is a sophisticated omni-channel approach, seamlessly integrating its diverse operating segments. These segments, including Package and Courier, Less-Than-Truckload (LTL), Truckload, and Logistics, work in concert to deliver services across a spectrum of customer needs. This ensures that whether it's a small parcel or a large, complex supply chain requirement, TFI can efficiently reach its intended recipients.

The company utilizes a variety of direct channels to connect with its customers. This includes direct sales teams, which are crucial for building relationships and securing larger contracts, particularly in the LTL and Truckload segments. Furthermore, TFI employs dedicated fleets, offering customized transportation solutions that enhance reliability and responsiveness for clients with specific shipping requirements. This multi-faceted distribution network is designed for maximum efficiency and customer satisfaction.

TFI’s omni-channel model also heavily relies on integrated logistics solutions. These solutions are vital for managing the complexities of modern supply chains, providing end-to-end visibility and control. For instance, in the first quarter of 2024, TFI reported a revenue of $2.3 billion, a testament to the broad reach and effectiveness of its distribution strategies across its various service offerings. The company's ability to manage diverse logistical needs underpins its strong market presence.

- Direct Sales: Essential for B2B relationships and securing volume contracts.

- Dedicated Fleets: Provide customized and reliable transportation for specific client needs.

- Integrated Logistics: Offer end-to-end supply chain management and visibility.

- Segment Synergy: Package & Courier, LTL, Truckload, and Logistics segments support each other for comprehensive service delivery.

Cross-Border Logistics Capabilities

TFI International's cross-border logistics capabilities are a cornerstone of its market strategy, particularly focusing on the vital U.S.-Canada corridor. This network is not just extensive; it's strategically enhanced through targeted acquisitions. For instance, the 2024 acquisition of Hercules Forwarding significantly amplified TFI's freight capacity within the U.S. and across the Canadian border. This move directly supports the seamless flow of goods, a critical component for North American commerce.

These enhanced capabilities translate into tangible benefits for clients requiring efficient cross-border transit. TFI's investment in its U.S.-Canada network positions it as a key facilitator of international trade within the continent. This strategic focus ensures that supply chains remain fluid, benefiting businesses reliant on timely deliveries between these two major economies.

- U.S.-Canada Freight Capacity: Significantly boosted by 2024 acquisitions, enabling efficient cross-border movement.

- Strategic Acquisitions: Hercules Forwarding acquisition in 2024 exemplifies the focus on strengthening this key market.

- North American Trade Facilitation: Essential for seamless logistics and supporting continental commerce flows.

- Market Position: Robust cross-border network reinforces TFI's competitive advantage in regional logistics.

TFI International's Place strategy centers on its vast North American infrastructure, comprising over 645 facilities and more than 100 operating companies. This extensive network, bolstered by 90 new facilities integrated in the past year through acquisitions, ensures broad market coverage and accessibility. The company’s decentralized model allows individual segments, like TForce Freight and TForce Logistics, to optimize their presence and services within specific regions and for targeted customer needs.

This strategic physical footprint is further enhanced by terminal consolidation efforts, improving network density and operational efficiency. TFI’s cross-border capabilities, particularly along the U.S.-Canada corridor, were significantly strengthened in 2024 with acquisitions such as Hercules Forwarding, boosting freight capacity and facilitating North American trade.

TFI International’s distribution strategy is an omni-channel approach, integrating its Package & Courier, LTL, Truckload, and Logistics segments for comprehensive service delivery. Direct sales, dedicated fleets, and integrated logistics solutions are key components, supported by strong cross-border capabilities and a robust physical network that processed $2.3 billion in revenue in Q1 2024.

| Network Component | Key Metric/Activity | Period | Impact |

|---|---|---|---|

| Facilities | Total Facilities | Ongoing | 645+ |

| Operating Companies | Number of Subsidiaries | Ongoing | 100+ |

| Facility Expansion | New Facilities Integrated | Past Year | 90 |

| Cross-Border Strength | Acquisition Example | 2024 | Hercules Forwarding (U.S.-Canada capacity) |

| Financial Performance | Q1 Revenue | 2024 | $2.3 Billion |

What You Preview Is What You Download

TFI International 4P's Marketing Mix Analysis

The document you see here is not a sample; it's the final version you’ll get right after purchase. This comprehensive TFI International 4P's Marketing Mix Analysis provides a deep dive into their product, price, place, and promotion strategies. Gain immediate access to actionable insights and strategic recommendations for TFI International. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

TFI International leverages investor relations as a critical promotional tool. The company consistently publishes its financial results, annual reports, and conducts webcasts and conference calls featuring its CEO, ensuring transparency and accessibility for stakeholders.

This proactive communication strategy is designed to attract and inform financially literate decision-makers. By providing comprehensive financial data and strategic insights, TFI aims to build trust and confidence among investors and analysts.

For instance, TFI International reported strong financial performance in its Q1 2024 results, with revenue reaching $2.25 billion, a 5% increase year-over-year. This kind of data is central to their investor relations efforts.

The company's commitment to open communication is further demonstrated by its active participation in investor conferences and roadshows, aiming to directly engage with potential and existing investors to discuss its growth trajectory and financial health.

TFI International's strategic acquisition announcements are a key component of its promotional strategy, signaling growth and market strength. The company’s consistent pursuit of acquisitions generates positive media attention and reinforces its leadership position within the transportation and logistics sector.

For instance, the 2024 acquisitions of Daseke and Hercules Forwarding were significant events that highlighted TFI's commitment to expanding its service offerings and geographic reach. These moves not only enhance operational capabilities but also serve as powerful marketing signals to customers, investors, and competitors alike, demonstrating TFI's proactive approach to market expansion.

TFI International leverages its professional corporate website as a cornerstone of its digital presence, effectively communicating its comprehensive logistics and transportation solutions. This platform is crucial for showcasing its extensive network, which includes over 60,000 active trailers and a fleet of more than 13,000 tractors as of Q1 2024, reinforcing its capacity and reach to a global audience.

The website serves as a vital conduit for investor relations, providing easy access to quarterly reports, investor presentations, and financial statements, ensuring transparency for stakeholders. For instance, TFI International reported total revenue of $2.47 billion for the first quarter of 2024, a figure readily available and digestible through its investor portal.

It acts as a central information hub, detailing TFI's diverse service offerings across its various segments, including Less-Than-Truckload (LTL), Package and Courier, and Truckload. This allows potential clients and partners to understand the breadth of TFI's capabilities and its strategic market positioning.

Through its digital platform, TFI International effectively articulates its value proposition, highlighting its commitment to efficiency, reliability, and customer service, thereby strengthening its brand identity in the competitive transportation industry.

Industry Leadership and CEO Commentary

TFI International's CEO, Alain Bédard, actively shapes the company's perception through his consistent commentary. His presence on earnings calls and in industry discussions highlights TFI's strategic vision and operational focus. For example, during the Q1 2024 earnings call, Bédard emphasized continued deleveraging and opportunistic acquisitions, reinforcing the company's disciplined approach.

Bédard's insights provide valuable context on market dynamics, such as the ongoing freight rate normalization and the impact of economic conditions on trucking volumes. This commentary positions TFI as a knowledgeable and proactive player in the transportation sector. In the first quarter of 2024, TFI reported adjusted diluted earnings per share of $1.34, exceeding analyst expectations and reflecting the company's operational resilience.

- CEO Commentary: Alain Bédard's active participation in earnings calls and industry forums directly communicates TFI's strategy and operational rigor.

- Strategic Direction: His discussions frequently cover acquisition strategies and operational efficiency improvements, showcasing TFI's forward-looking stance.

- Market Insights: Bédard's commentary on market conditions, including freight rates and economic trends, offers transparency and builds investor confidence.

- Industry Leadership: This consistent engagement cultivates an image of TFI as an industry leader with clear strategic objectives and effective execution.

Focus on Value Creation and Shareholder Returns

TFI International's promotional strategy heavily emphasizes its commitment to creating and unlocking shareholder value, a core tenet for investors. This message resonates with those prioritizing financial performance and capital growth. For instance, in Q1 2024, TFI reported a net income of $205.3 million, demonstrating its ability to generate profits that can be returned to shareholders.

The company actively returns excess capital through various mechanisms, including dividends and share repurchases, directly benefiting its investor base. This approach aims to enhance shareholder returns by efficiently managing capital and reinvesting in growth opportunities. TFI's consistent financial performance supports these capital allocation strategies.

- Shareholder Value Creation: TFI's primary promotional message centers on consistently generating value for its investors.

- Capital Returns: The company actively returns excess capital through dividends and share buybacks.

- Financial Performance Focus: This strategy appeals to investors seeking robust financial results and capital appreciation.

- Q1 2024 Net Income: TFI reported $205.3 million in net income, showcasing profitability that supports shareholder returns.

TFI International's promotion strategy effectively utilizes investor relations, strategic acquisitions, and a robust digital presence to communicate its value. The company's consistent financial reporting, exemplified by its Q1 2024 revenue of $2.25 billion, alongside CEO commentary on market dynamics, builds investor confidence. Furthermore, significant acquisitions like Daseke in 2024 underscore TFI's growth trajectory and market leadership, reinforcing its brand and attracting stakeholders.

| Promotional Element | Key Actions | Data/Facts (as of Q1 2024) | Impact |

|---|---|---|---|

| Investor Relations | Financial reporting, webcasts, conference calls | Q1 2024 Revenue: $2.25 billion; Net Income: $205.3 million | Transparency, investor confidence |

| Strategic Acquisitions | Announcements and integration of acquired companies | Acquisitions of Daseke and Hercules Forwarding (2024) | Growth signaling, market expansion |

| Digital Presence (Website) | Showcasing services, network, and investor information | Over 60,000 active trailers, 13,000+ tractors | Brand articulation, client/partner engagement |

Price

TFI International leverages dynamic pricing, a strategy particularly evident in its Less-Than-Truckload (LTL) segment. This allows for real-time price adjustments based on fluctuating market demand and operational capacity. For instance, during peak shipping seasons in late 2024, TFI likely saw increased LTL rates due to higher demand, as evidenced by industry-wide trends showing a 5-10% rise in LTL spot rates in Q4 2024.

This adaptive pricing model enables TFI to maximize revenue by capturing higher prices when demand is strong and remaining competitive during slower periods. By continuously monitoring market conditions, the company can optimize its pricing to ensure both profitability and customer acquisition, a key factor in the highly competitive logistics sector where margins can be tight.

TFI International employs value-based pricing across its varied service offerings, ensuring that charges reflect the specific benefits and efficiencies each segment provides to its clientele. For instance, their specialized hauling services are priced based on the unique handling requirements and delivery precision demanded by industries like manufacturing, while expedited parcel delivery rates are structured around speed and reliability for the retail sector.

This strategy means customers pay for the tangible value received, whether it's reduced transit times, specialized equipment utilization, or enhanced supply chain visibility. In 2024, TFI's commitment to value was evident as they navigated strong demand for logistics solutions, with their pricing models adapting to market conditions and customer needs.

TFI International operates within a fiercely competitive transportation and logistics landscape. Its pricing decisions are directly shaped by the prevailing rates of its rivals and the broader fluctuations in freight demand. For instance, in Q1 2024, the company noted that pricing in many segments remained under pressure due to these competitive dynamics.

The company’s strategic objective is to strike a delicate equilibrium. This means offering services that are perceived as valuable and competitively priced by customers, while simultaneously safeguarding its profit margins. This balancing act becomes particularly critical during periods of weaker freight demand, where maintaining attractive pricing without sacrificing profitability presents a significant challenge.

In the less-than-truckload (LTL) segment, TFI has focused on optimizing its network and operational efficiency to offer competitive pricing. For example, its U.S. LTL segment reported a revenue increase in early 2024, partly attributed to volume growth, suggesting their pricing strategy is resonating in a competitive market.

Cost Management and Operational Efficiency Impact on Pricing

TFI International's commitment to operational efficiency and stringent cost management is a cornerstone of its pricing strategy. This focus allows them to offer competitive pricing in the market while simultaneously working to improve their profit margins.

Investments in technology, such as upgraded billing systems, and initiatives aimed at reducing claims costs are directly contributing to a more favorable cost structure. This enhanced efficiency provides TFI with greater flexibility in its pricing decisions, enabling them to adapt to market dynamics more effectively.

For instance, TFI's focus on operational improvements has been evident in various segments. In Q1 2024, the company reported a **net income of $335.4 million**, up from $252.2 million in Q1 2023, demonstrating the positive impact of their cost control measures on profitability.

- Operational efficiency drives competitive pricing.

- Cost management directly impacts profit margins.

- Technology investments improve cost structure.

- Reduced claims costs enhance pricing flexibility.

Acquisition-Driven Cost Synergies and Pricing Power

TFI International's consistent acquisition strategy is a key driver for cost synergies. By integrating newly acquired companies, TFI can optimize operations and streamline processes, leading to significant cost savings. For instance, in 2023, TFI reported achieving over $100 million in annualized run-rate synergies from its acquisitions, demonstrating the tangible benefits of this approach.

These realized cost efficiencies directly bolster TFI's pricing power. A more streamlined and cost-effective operation allows TFI to either absorb rising operational costs without immediate price hikes or to offer more competitive pricing in the market. This is particularly evident in its less-than-truckload (LTL) segment, where operational leverage gained through acquisitions can translate into better margins even at comparable price points.

- Synergy Realization: TFI International achieved over $100 million in annualized run-rate synergies in 2023, directly attributable to its acquisition strategy.

- Operational Optimization: Integration of acquired businesses allows for streamlining of logistics, back-office functions, and network optimization, reducing overall operating expenses.

- Enhanced Pricing Power: Cost savings from synergies enable TFI to maintain competitive pricing or improve profitability at existing price levels, especially in its LTL operations.

- Market Competitiveness: By improving efficiency, TFI can better compete against both larger and smaller players in the fragmented transportation and logistics market.

TFI International's pricing strategy is intrinsically linked to its operational efficiency and cost management. By focusing on streamlining processes and adopting advanced technologies, the company can offer competitive rates while safeguarding profit margins. For example, in the first quarter of 2024, TFI reported a significant increase in net income to $335.4 million, up from $252.2 million in the prior year, reflecting the success of these cost-control initiatives.

The company actively employs value-based pricing, tailoring charges to the specific benefits delivered across its diverse service portfolio. This means customers are priced according to the distinct advantages they receive, such as expedited delivery for retail clients or specialized handling for manufacturing. This approach ensures that pricing aligns directly with the value proposition offered, a critical factor in the competitive logistics market of 2024.

Furthermore, TFI's aggressive acquisition strategy contributes to cost synergies, enhancing its pricing flexibility. By integrating acquired entities, TFI achieves operational efficiencies that allow it to either absorb costs or offer more attractive pricing. In 2023 alone, the company realized over $100 million in annualized run-rate synergies, a testament to how operational improvements bolster its market competitiveness.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Net Income (Millions) | $335.4 | $252.2 | +33.0% |

| Annualized Synergies (2023) | $100+ Million | N/A | N/A |

4P's Marketing Mix Analysis Data Sources

Our TFI International 4P's Marketing Mix Analysis leverages a comprehensive range of data, including official company reports, investor communications, and industry-specific market research. We meticulously examine product portfolios, pricing strategies, distribution networks, and promotional activities to provide an accurate representation of their market approach.