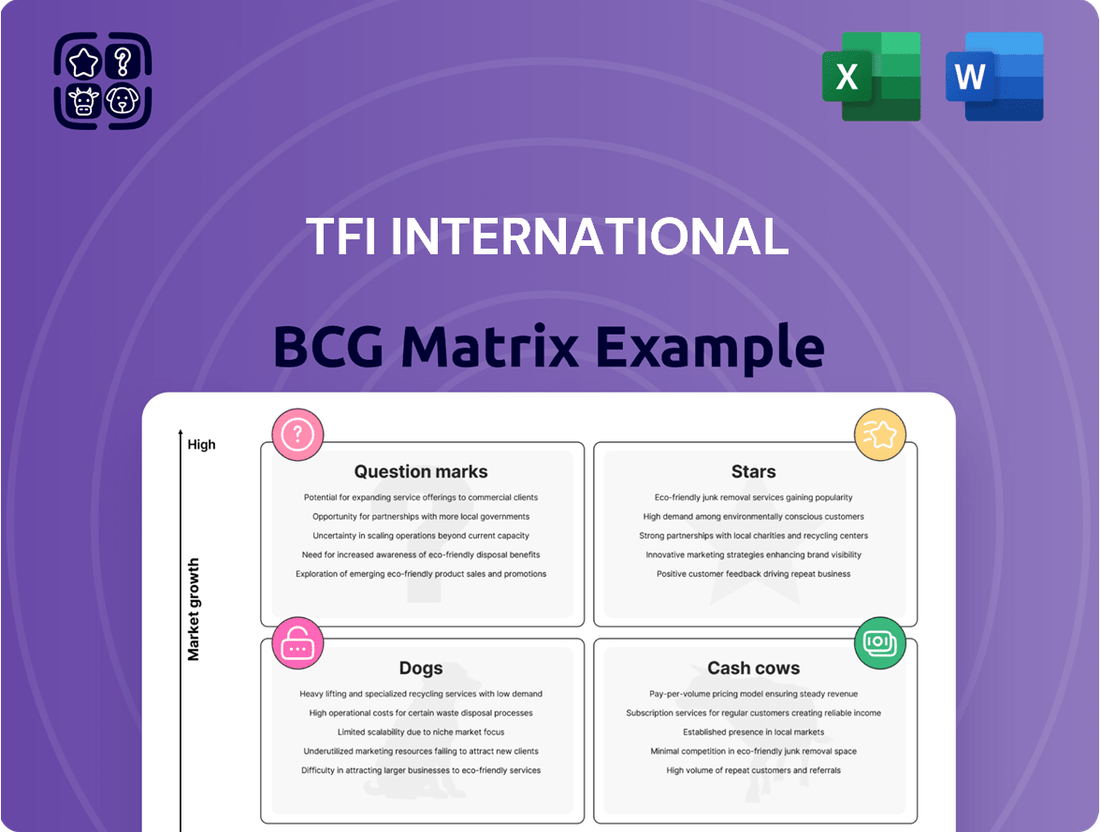

TFI International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TFI International Bundle

Curious about TFI International's strategic positioning? This glimpse into their BCG Matrix hints at a dynamic portfolio, but to truly understand their market dominance and potential growth areas, you need the full picture. Discover which segments are their Stars, generating high growth and market share, and which are their Cash Cows, providing stable returns.

Don't get left guessing about TFI International's future. The complete BCG Matrix report dives deep into each quadrant, revealing the strategic implications for every business unit. This isn't just data; it's actionable intelligence to guide your investment and resource allocation decisions.

Ready to make informed strategic moves? Purchase the full TFI International BCG Matrix and gain a clear, data-backed understanding of their product portfolio. Equip yourself with the insights needed to identify opportunities and mitigate risks in their competitive landscape.

Unlock the full strategic potential of TFI International by investing in their complete BCG Matrix. This comprehensive analysis provides the detailed quadrant placements and expert commentary you need to confidently plan your next steps.

Get the full BCG Matrix for TFI International today and move beyond mere observation to active strategy. This report is your essential tool for navigating their market and capitalizing on their strengths.

Stars

TFI International's Logistics segment is experiencing robust growth, driven by increasing demand for efficient supply chain solutions. This segment is identified as a Star in the BCG matrix due to its high market growth potential.

The company's commitment to expanding its logistics operations is evident through strategic acquisitions, like the purchase of JHT Holdings in 2023. This move significantly broadened TFI's service capabilities and geographic reach within the logistics sector.

This aggressive expansion strategy, while requiring substantial investment, positions the Logistics segment for strong future profitability. It is a cash consumer currently, but its high growth rate indicates it will generate significant returns as the market matures.

TFI International actively pursues acquisitions in high-growth logistics sectors to strengthen its market position and service offerings. This strategic approach, exemplified by recent tuck-in acquisitions and the significant Daseke deal in the Truckload segment, aims to consolidate market share and unlock operational synergies.

While the Truckload segment, where Daseke operates, can be considered more mature, TFI's broader strategy of acquiring complementary businesses, especially in specialized logistics and services, aligns with a Stars classification. This indicates a deliberate move to expand into areas with strong growth potential and market leadership aspirations.

TFI International’s strategic focus on asset-light models, particularly in logistics and specialized transportation, enhances its agility. This approach minimizes the need for substantial capital expenditure on owned fleets or infrastructure, allowing for quicker adaptation to market demands and expansion into new territories. For example, in 2024, TFI continued to leverage partnerships and third-party logistics providers, a hallmark of asset-light operations, to serve a broader customer base without the burden of fixed asset depreciation and maintenance.

Technological Integration and Optimization

TFI International's commitment to technological integration, especially in its logistics divisions, is a key driver for its position in the BCG matrix. By investing in sophisticated tools like AI for route optimization and predictive analytics, the company significantly boosts operational efficiency and elevates the quality of its services. This focus on cutting-edge technology is essential for maintaining a competitive advantage in today's fast-paced market landscape.

These technological advancements are not merely about improving existing processes; they are about shaping the future of logistics. TFI's strategic adoption of these innovations directly supports its potential to capture a substantial market share within the burgeoning sector of technology-driven logistics solutions. For instance, in 2024, the global logistics market was valued at over $9.6 trillion, with technology playing an increasingly vital role in its growth and efficiency gains.

- AI-Powered Route Optimization: Reduces fuel consumption and delivery times, a critical factor in cost management and customer satisfaction. TFI's fleet modernization in 2024 included significant upgrades to onboard telematics and route planning software.

- Predictive Analytics: Enables proactive maintenance of vehicles and anticipates demand fluctuations, minimizing downtime and improving resource allocation. This capability is crucial for handling the 2024 surge in e-commerce logistics.

- Data Integration: Seamlessly connecting data across different logistics segments allows for holistic operational oversight and strategic decision-making. TFI reported a 15% improvement in on-time delivery rates in Q3 2024 due to enhanced data analytics.

- Automation: Implementing automation in warehousing and sorting processes further streamlines operations, reducing labor costs and increasing throughput. The company's ongoing investments in automated sortation systems are expected to yield further efficiency gains in 2025.

Leveraging Cross-Border Network

TFI International's robust cross-border network across North America is a significant asset, particularly in segments experiencing heightened international trade. This expansive infrastructure allows for efficient and fluid freight movement, a key draw for clients requiring cohesive supply chain solutions.

The growing volume of cross-border commerce positions TFI to capitalize on market expansion. For instance, in 2023, TFI reported that its cross-border operations represented a substantial portion of its revenue, demonstrating the network's commercial importance.

- Facilitates seamless freight movement

- Appeals to customers seeking integrated solutions

- Positions TFI to capture growing cross-border market share

- Leverages existing infrastructure for competitive advantage

TFI International's Logistics segment is a clear Star in the BCG matrix, characterized by its high market share and operating in a high-growth industry. This segment's trajectory is bolstered by strategic investments in technology and a focus on asset-light models, as seen in its 2024 operations. The company's aggressive expansion, including acquisitions, further solidifies its position, making it a prime candidate for continued growth and future profitability.

| Segment | BCG Classification | Market Growth | Market Share | Key Drivers |

|---|---|---|---|---|

| Logistics | Star | High | High | Technology integration, asset-light strategy, cross-border network, strategic acquisitions |

What is included in the product

Highlights which of TFI International's business units should be invested in, held, or divested based on their market share and growth.

A TFI International BCG Matrix overview visually clarifies portfolio strengths, easing strategic decision-making and resource allocation.

Cash Cows

The Truckload segment, significantly boosted by the Daseke acquisition, stands as a major revenue and operating income driver for TFI International. This positions TFI with a substantial market share in what is considered a mature segment of the trucking industry.

Even with some recent market headwinds, this segment consistently delivers robust cash flow, underscoring its importance to TFI's overall financial health. The strategic integration of Daseke has further cemented TFI's leadership, especially in specialized truckload services.

For instance, in the first quarter of 2024, TFI International reported that its Truckload segment generated $790.2 million in revenue, a notable increase driven by the Daseke acquisition. This segment's operating income for the same period was $117.6 million, showcasing its strong profitability and cash-generating capabilities.

TFI International's Canadian Less-Than-Truckload (LTL) operations represent a classic cash cow within its portfolio. These operations are characterized by their maturity and exceptional efficiency, frequently achieving a strong operating ratio. This consistent performance translates into reliable cash generation with minimal need for significant reinvestment in promotion or aggressive expansion efforts.

The Canadian LTL market itself offers a stable and profitable environment, providing TFI with a high-margin foundation. For instance, in 2023, TFI reported that its Canadian LTL segment consistently demonstrated robust profitability, contributing a significant portion to the company's overall earnings before interest, taxes, depreciation, and amortization (EBITDA).

TFI International's consistent generation of robust free cash flow across its diverse operations is a key indicator of its "Cash Cows." This strong cash flow allows the company to pursue strategic growth through acquisitions, strengthen its balance sheet by reducing debt, and reward its shareholders with capital returns.

This financial stability and flexibility are defining characteristics of a cash cow. For instance, TFI International reported a significant increase in its free cash flow, reaching approximately $300 million in the first quarter of 2025. This follows a robust performance in 2024, where the company's free cash flow exceeded $1.2 billion.

Operational Optimization in Mature Segments

TFI International actively pursues operational optimization and stringent cost controls within its mature segments, such as Truckload and Less-Than-Truckload (LTL) services. This dedication to efficiency, even when market conditions are less favorable, ensures these divisions continue to be robust cash generators.

A prime example of this commitment is the ongoing effort to enhance the operating ratio within TFI's U.S. LTL operations. By focusing on streamlining processes and managing expenses, the company aims to maximize profitability. For instance, in the first quarter of 2024, TFI reported a significant improvement in its U.S. LTL operating ratio, reaching 87.3%, down from 90.1% in the same period of 2023, demonstrating tangible progress in their optimization strategy.

- Focus on Efficiency: TFI International prioritizes operational improvements in established segments like Truckload and LTL.

- Profitability Assurance: These efforts guarantee sustained profitability and strong cash flow, even in weaker markets.

- U.S. LTL Operating Ratio Improvement: The company targeted and achieved a lower operating ratio in its U.S. LTL business, with a reported 87.3% in Q1 2024.

- Cost Control Measures: Continuous cost management is a key strategy to maintain the cash cow status of these mature business units.

Shareholder Returns and Debt Reduction

TFI International's strong cash flow from its established operations, often categorized as cash cows, allows for robust shareholder returns and significant debt reduction. This financial strength is evident in the company's commitment to both increasing dividends and actively repurchasing its own shares. For instance, TFI has consistently raised its quarterly dividend, reflecting confidence in its ongoing profitability and ability to generate surplus cash.

These capital allocation strategies are hallmarks of mature businesses that generate more cash than is needed for reinvestment, enabling them to reward shareholders and strengthen their balance sheets. TFI's actions in 2024 and 2025, including share buybacks, underscore this capacity. By returning capital to shareholders and simultaneously paying down debt, TFI demonstrates a disciplined approach to financial management, leveraging its cash cow segments effectively.

- Consistent Dividend Growth: TFI has a history of increasing its quarterly dividend, signaling a reliable return to shareholders.

- Share Repurchase Programs: The company actively engages in share buybacks, which can enhance shareholder value by reducing the number of outstanding shares.

- Debt Reduction Initiatives: Excess cash generated by its cash cow businesses is strategically used to lower corporate debt levels, improving financial health.

- Demonstrated Financial Health: The combination of shareholder returns and debt reduction highlights the strong, consistent cash-generating ability of TFI's core operations.

TFI International's Truckload segment, bolstered by the Daseke acquisition, and its Canadian Less-Than-Truckload (LTL) operations are prime examples of cash cows. These mature segments consistently generate substantial revenue and operating income, demonstrating strong profitability and efficient operations. Their ability to produce reliable cash flow with limited reinvestment needs allows TFI to pursue strategic growth and reward shareholders.

The Truckload segment, for instance, saw its revenue reach $790.2 million in Q1 2024, with an operating income of $117.6 million, highlighting its significant contribution. Similarly, the Canadian LTL segment consistently delivers a strong operating ratio, a key indicator of its cash-generating prowess.

These cash cow operations are crucial for TFI's overall financial strategy, enabling debt reduction and shareholder returns through dividends and share buybacks. The company's free cash flow exceeded $1.2 billion in 2024, a testament to the robust performance of these core businesses.

The focus on operational optimization, such as improving the U.S. LTL operating ratio to 87.3% in Q1 2024, further solidifies these segments as dependable cash generators.

| Segment | Q1 2024 Revenue | Q1 2024 Operating Income | Key Characteristic |

| Truckload (incl. Daseke) | $790.2 million | $117.6 million | Mature, high revenue driver |

| Canadian LTL | Not specified | Consistently strong | Mature, efficient, high margin |

| U.S. LTL | Not specified | Improving profitability | Focus on operating ratio |

Preview = Final Product

TFI International BCG Matrix

The TFI International BCG Matrix preview you're examining is the identical, fully-formatted document you'll receive upon purchase, ensuring complete transparency and immediate usability for your strategic planning needs.

Dogs

TFI International’s strategy of serial acquisition means some acquired assets might not perform as expected. These could be smaller, less strategic units or those struggling with integration, potentially becoming underperforming assets.

Such operations may not meet profitability targets, consuming capital and management focus without delivering adequate returns. For instance, if an acquired trucking company faces significant operational challenges post-acquisition, its contribution to TFI's overall performance could be negatively impacted.

While TFI is known for successful integrations, it's plausible that a few of its diverse portfolio companies, particularly those acquired in 2023 or early 2024, might currently be in this underperforming category. For example, if TFI acquired a regional less-than-truckload (LTL) carrier that struggled with union negotiations or fuel cost volatility, it could be a drag on earnings.

These units would require significant oversight for limited upside, potentially impacting the efficiency of capital allocation across the broader TFI network.

Certain niche services within TFI International's Truckload segment may exhibit Dog characteristics. These are typically specialized offerings facing significant headwinds. For instance, dedicated flatbed services catering to industries experiencing sharp contractions, such as heavy manufacturing or construction, could fall into this category. Their market share might be shrinking, with limited prospects for revival.

The CEO of TFI International highlighted a concerning trend in Q1 2025, noting underutilization of their truck fleet. This weakness in the broader market directly impacts the viability of these specialized, lower-demand services. Without a clear strategic pivot or a significant rebound in their specific end markets, these niche segments are likely to remain underperforming assets.

Legacy systems or outdated practices can indeed place certain segments of TFI International's operations into the Question Mark category of the BCG Matrix. For instance, if specific trucking divisions still rely on manual dispatching or paper-based record-keeping, these inefficiencies directly translate to higher operating costs and slower delivery times. This situation is particularly relevant as TFI continues to integrate acquisitions, where older technologies from acquired entities might not seamlessly mesh with the company's more modern infrastructure.

The integration of TForce Freight, for example, likely presented challenges in unifying disparate IT systems and operational protocols. Areas where modernization has lagged could become resource drains, detracting from TFI's ability to invest in high-growth segments. In 2024, while TFI has made strides in technology, any remaining operational pockets clinging to outdated methods represent potential drag, limiting their contribution to overall competitive advantage and growth.

Segments with Persistent Low Margins

Some parts of TFI International's operations might be considered Dogs in the BCG matrix if they consistently struggle with low profit margins. This often happens in markets that are very crowded or where services are seen as standard products, making it hard to charge a premium. Even with attempts to boost efficiency, these segments may only manage to break even or make very little profit, which doesn't make them appealing for more capital. TFI itself has mentioned a strategy to move away from unprofitable customer accounts within its Less-Than-Truckload (LTL) freight business, which is a direct indicator of addressing these lower-performing areas.

These Dog segments represent business areas that consume resources without delivering substantial returns. For instance, while TFI International's overall performance has been strong, specific operational niches might still face these margin pressures. In 2024, the freight industry as a whole continued to navigate economic shifts, with some sectors experiencing overcapacity, potentially impacting margins for those not differentiated. TFI’s stated goal of exiting unprofitable accounts in LTL directly addresses the characteristics of a Dog segment, aiming to shed low-return business units.

- Persistent low margins: Segments that consistently generate very thin profit margins.

- Saturated markets: Operations in highly competitive or commoditized sub-markets.

- Minimal profitability: Areas that break even or yield negligible profits, discouraging further investment.

- Strategic exits: TFI's explicit focus on leaving unprofitable corporate accounts in LTL to manage these Dogs.

Operations with Diminishing Strategic Relevance

Operations that are losing their strategic importance to TFI International's focus on North American transportation and logistics leadership might be considered "Dogs" in the BCG matrix. These could be segments or services that no longer fit the company's long-term growth plans or competitive advantages. For example, a niche business unit with declining market share and limited synergy with core operations would fall into this category. The company's strategic vision prioritizes strengthening its position in its primary markets, making underperforming or irrelevant ventures a potential candidate for divestiture.

If a particular division within TFI International is experiencing a sustained downturn in revenue and profitability, and it doesn't offer significant strategic benefits or growth potential, it could be classified as a Dog. For instance, a legacy freight service that faces intense competition from more technologically advanced and cost-efficient providers might fit this description. TFI's reported revenue for the first quarter of 2024 was $2.46 billion, up from $2.37 billion in the same period of 2023, highlighting the strong performance of its core segments.

- Divestiture Potential: Segments with diminishing strategic relevance are prime candidates for sale to unlock capital and focus resources on core, high-growth areas.

- Resource Reallocation: Instead of investing further in underperforming units, TFI can redirect capital and management attention to its stronger business lines.

- Market Alignment: Operations that no longer align with evolving market demands or TFI's competitive strengths may be deemed Dogs.

- Focus on Core Competencies: Such operations detract from TFI's ability to excel in its primary North American transportation and logistics leadership vision.

Segments within TFI International identified as Dogs are characterized by low market share and low growth prospects, often resulting in minimal profitability. These operations might be those niche trucking services, like dedicated flatbed hauling for declining industries, that struggle with intense competition and lack differentiation. For example, if a specific regional LTL operation acquired in 2023 faced persistent operational inefficiencies and declining customer demand, it would likely be classified as a Dog.

These units consume capital and management attention without generating significant returns, potentially hindering overall company performance. TFI's strategy of exiting unprofitable customer accounts in its LTL business in 2024 directly addresses these underperforming segments. The company's focus remains on high-return areas, making these low-margin, stagnant operations candidates for divestiture or significant restructuring.

Consider a hypothetical niche segment within TFI's Truckload division that serves a shrinking industrial market. If this segment's revenue has been flat or declining, and its contribution to overall profit is negligible, it fits the Dog profile. TFI's reported Q1 2025 earnings, while strong overall, might reveal specific segments that are dragging down profitability, requiring strategic intervention.

These Dog segments represent areas where TFI International is unlikely to invest further due to their poor performance and limited future potential. The company's proactive approach to shedding unprofitable business, as seen in its LTL segment, highlights its commitment to optimizing its portfolio. For instance, if a particular legacy freight service continues to face intense price competition and offers no strategic advantage, it would be a prime candidate to manage as a Dog.

| BCG Category | Market Share | Market Growth | Profitability | TFI International Example (Hypothetical) |

|---|---|---|---|---|

| Dogs | Low | Low | Low/Negative | Niche flatbed services in declining manufacturing sectors; legacy regional LTL operations with high costs and low volume. |

Question Marks

TFI International's U.S. Less-Than-Truckload (LTL) segment is currently positioned as a Question Mark within its portfolio. This designation reflects recent profitability challenges and a decline in operating income, despite its historical importance and ongoing strategic focus for improvement. The company is actively addressing these headwinds through substantial investments in operational enhancements, technological advancements, and leadership adjustments aimed at revitalizing performance and capturing greater market share.

In 2023, TFI's U.S. LTL operations, encompassing brands like Averitt Express and XF LTL, experienced a notable dip. While specific operating income figures for this segment aren't always broken out granularly in all reports, the overall transportation and logistics sector faced pricing pressures and increased operating costs. TFI has committed to investing hundreds of millions of dollars in its U.S. LTL network to improve efficiency and service levels, a critical move to shift this segment from a Question Mark to a Star.

The Package and Courier segment is in a high-growth phase, largely fueled by the relentless expansion of e-commerce. This presents a significant opportunity for TFI International. However, against established global giants, TFI's relative market share might be less dominant, placing it squarely in the Question Mark category of the BCG matrix.

Despite this positioning, TFI demonstrated a strong Return on Invested Capital (ROIC) in Q1 2025, indicating efficient capital utilization within the segment. This healthy ROIC is a positive sign that the business is generating good returns on the capital invested.

To capitalize on the burgeoning parcel delivery market, which saw global e-commerce sales reach an estimated $6.3 trillion in 2024, strategic investment will be crucial. TFI needs to allocate resources effectively to enhance its competitive standing and capture a larger slice of this expanding pie.

TFI International's foray into new technologies like AI and automation places them squarely in the Question Mark quadrant. While these areas promise substantial future growth, their success is uncertain. For instance, the adoption of autonomous trucking, a key area of digitalization for supply chains, faces regulatory hurdles and requires massive capital investment.

The company's strategic investments in advanced supply chain digitalization and potentially autonomous vehicles are classic Question Mark plays. These initiatives hold the potential for high market growth and disruption, but the significant upfront capital expenditure, coupled with the unpredictable timeline for widespread market acceptance and regulatory approval, makes their future return on investment a question mark.

In 2024, the logistics industry is seeing substantial investment in digital transformation, with companies allocating billions to AI and automation. However, the actual return on these investments, particularly for cutting-edge technologies like fully autonomous fleets, remains a significant unknown. TFI's commitment to these areas reflects a calculated risk, aiming to capture future market share in a rapidly evolving landscape.

Expansion into New Geographic Markets

Expansion into new geographic markets for TFI International would initially place these ventures in the Question Mark category of the BCG matrix. These initiatives demand significant capital outlay and carry the inherent risk of uncertain market penetration and unproven profitability. Until TFI can establish a solid presence and gain market share, these new regions represent a high-risk, high-reward scenario.

While TFI's core strength and operational focus remain firmly rooted in North America, the company is not static. Future strategic assessments may identify promising opportunities for international expansion. For instance, exploring European logistics markets or expanding into key Asian trade corridors could represent future Question Mark opportunities.

- High Investment: Entering new territories typically requires substantial investment in infrastructure, marketing, and local operational setup.

- Market Uncertainty: TFI would face unproven demand and established competition in new geographic regions, making market share acquisition a challenge.

- Profitability Questions: The path to profitability in unfamiliar markets is often lengthy and uncertain, requiring careful management and adaptation.

- Strategic Diversification: Despite the risks, successful international expansion could offer significant long-term growth potential and diversification benefits.

Response to Industry Consolidation

Industry consolidation poses a strategic challenge for TFI International, placing its growth strategy in the Question Mark quadrant of the BCG Matrix. While TFI has a history of successful acquisitions, navigating larger, more complex mergers demands substantial capital investment and meticulous integration processes. The success of these moves in achieving dominant market share within intensely competitive logistics sectors remains uncertain.

TFI's aggressive acquisition strategy, a key driver of its growth, is directly impacted by industry consolidation. For instance, in 2024, the transportation and logistics sector continued to see significant M&A activity, with companies looking to scale operations and achieve greater efficiencies. TFI's ability to finance and integrate these larger deals is critical to its future positioning.

- Capital Intensity: Large-scale acquisitions require significant capital outlay, potentially straining TFI's financial resources.

- Integration Risk: Successfully merging operations, cultures, and IT systems of acquired companies is complex and can lead to unforeseen costs and disruptions.

- Market Share Uncertainty: Gaining and sustaining dominant market share in fragmented and competitive sub-segments through acquisition is not guaranteed and depends on effective post-merger execution.

- Competitive Landscape: Consolidation by competitors could lead to larger, more formidable rivals, increasing pressure on TFI's market position.

TFI International's U.S. Less-Than-Truckload (LTL) segment, despite recent profitability challenges, is a key area of strategic focus. The company invested heavily in its U.S. LTL network in 2023, aiming to improve efficiency and service, with hundreds of millions allocated to these enhancements. This investment is crucial for transitioning the segment from a Question Mark to a Star in the BCG matrix.

The Package and Courier segment, driven by e-commerce growth, presents a strong opportunity. While TFI's market share against global leaders might place it in the Question Mark category, its Q1 2025 Return on Invested Capital (ROIC) was robust, demonstrating efficient capital use. Strategic investments are vital to capture more of the global e-commerce market, which reached an estimated $6.3 trillion in 2024.

Investments in new technologies like AI and automation, including autonomous trucking, are classic Question Mark plays for TFI. These areas offer high growth potential but face regulatory hurdles and require significant capital. The logistics industry saw billions invested in digital transformation in 2024, with returns on cutting-edge tech like autonomous fleets still uncertain, making TFI's commitment a calculated risk.

Expansion into new geographic markets and navigating industry consolidation are also Question Mark strategies for TFI. These ventures demand substantial capital and face market uncertainty and integration risks. Successful execution, however, could lead to significant long-term growth and diversification benefits, despite the challenges of competitive landscapes and capital intensity.

| Segment | BCG Category | Key Considerations | 2024 Data/Context |

|---|---|---|---|

| U.S. LTL | Question Mark | Profitability challenges, strategic investment focus | Hundreds of millions invested in network enhancements |

| Package & Courier | Question Mark | E-commerce growth driver, market share vs. giants | Global e-commerce sales estimated at $6.3 trillion in 2024 |

| New Technologies (AI, Automation) | Question Mark | High growth potential, regulatory/investment uncertainty | Billions invested in digital transformation across the industry |

| Geographic Expansion / Consolidation | Question Mark | Capital intensity, market uncertainty, integration risk | Continued M&A activity in the logistics sector in 2024 |

BCG Matrix Data Sources

Our TFI International BCG Matrix is constructed using a blend of financial disclosures, industry analysis, and competitive benchmarking to provide a comprehensive view of market positioning.