SPX Technologies SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPX Technologies Bundle

SPX Technologies possesses significant strengths in its diverse portfolio and established market presence, but faces opportunities for further innovation and market expansion. However, potential threats from economic volatility and competitive pressures demand careful navigation. Understanding these dynamics is crucial for strategic decision-making.

Want the full story behind SPX Technologies' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

SPX Technologies demonstrates considerable strength through its leadership in specific niche markets, particularly within HVAC and Detection & Measurement. This focus translates into substantial market share and strong brand recognition for their critical infrastructure equipment and technologies. For instance, in the first quarter of 2024, SPX reported that its HVAC segment revenue grew by 10% year-over-year, highlighting continued demand in this specialized area.

SPX Technologies has showcased impressive financial results, with significant growth observed throughout 2024 and into Q1 2025. The company reported substantial increases in key metrics such as GAAP EPS, net income, and adjusted EPS, signaling strong operational execution. Revenue also saw a notable uptick, reflecting successful market penetration and product demand.

This robust financial performance is a testament to effective management strategies and the company's ability to navigate market dynamics. The positive financial trajectory is further bolstered by an optimistic outlook and raised guidance for the remainder of 2025, indicating sustained growth and financial stability.

SPX Technologies has a strong track record of strategic acquisitions, notably integrating Ingénia and Kranze Technology Solutions (KTS). These moves have demonstrably broadened its product offerings and customer reach.

The company's acquisition of Sigma & Omega further solidified its market position, contributing significantly to inorganic revenue growth. This aggressive approach to M&A is a primary engine for both current and anticipated expansion.

Operational Excellence and Continuous Improvement

SPX Technologies is deeply committed to operational excellence, consistently driving continuous improvement initiatives. This dedication has translated into tangible gains, such as increased production throughput and enhanced efficiency throughout its various segments. For instance, the company reported notable margin expansion in its fiscal year 2023 results, a direct benefit of these optimized processes.

This focus on refining operations significantly contributes to higher profitability and builds a more resilient business model, allowing SPX to better absorb market fluctuations. The ability to execute projects more effectively and strategically manage its product mix, especially within its communications technologies division, underscores the strength of its operational discipline.

- Increased Production Throughput: SPX's operational focus directly boosts output capacity.

- Enhanced Efficiency & Margin Expansion: Demonstrated by fiscal 2023 financial performance, leading to improved profitability.

- Resilient Business Model: Operational optimization fortifies the company against market volatility.

- Improved Project Execution & Product Mix: Particularly evident in the communications technologies segment, driving better outcomes.

Diverse End Markets and Global Presence

SPX Technologies' strength lies in its broad reach across numerous essential industries. They cater to sectors such as power generation, industrial processing, oil and gas, healthcare, pharmaceuticals, education, data centers, and defense. This wide customer base means their performance isn't tied to the fortunes of just one or two markets.

Their global footprint, spanning operations in over 15 countries, further insulates them from regional economic downturns. This international presence allows them to tap into diverse growth opportunities worldwide, balancing out any localized challenges.

Furthermore, SPX Technologies is well-positioned in high-growth sectors. Their involvement in providing cooling solutions for data centers, a rapidly expanding area, highlights their strategic alignment with future market demands. For instance, the global data center market was valued at approximately $276.2 billion in 2023 and is projected to grow significantly in the coming years.

- Diverse End Markets: Powers the company's resilience by reducing dependency on any single industry.

- Global Operations: A presence in over 15 countries mitigates regional economic risks.

- Exposure to Growth Areas: Technologies for data centers, a sector experiencing substantial expansion, enhance future prospects.

SPX Technologies is a market leader in specialized sectors like HVAC and Detection & Measurement, translating to strong brand recognition and significant market share. Their HVAC segment saw a 10% year-over-year revenue increase in Q1 2024, demonstrating sustained demand.

The company exhibits robust financial health, marked by substantial growth in GAAP EPS, net income, and adjusted EPS throughout 2024 and into Q1 2025. Revenue also saw a notable increase, reflecting successful market penetration and product demand.

SPX's strength is further amplified by its strategic acquisition history, including Ingénia and Kranze Technology Solutions, which have expanded its product portfolio and customer base. The acquisition of Sigma & Omega notably fueled inorganic revenue growth, a key driver for current and future expansion.

Operational excellence is a core strength, evidenced by continuous improvement initiatives that have boosted production throughput and efficiency. This focus resulted in margin expansion in fiscal year 2023, contributing to increased profitability and a more resilient business model.

| Strength | Description | Supporting Data/Example |

|---|---|---|

| Market Leadership | Dominance in niche markets like HVAC and Detection & Measurement. | HVAC segment revenue grew 10% YoY in Q1 2024. |

| Financial Performance | Consistent growth in key financial metrics. | Raised full-year 2025 guidance; strong EPS and revenue increases in 2024. |

| Strategic Acquisitions | Successful integration of companies to broaden offerings and reach. | Acquisitions like Sigma & Omega driving inorganic revenue growth. |

| Operational Excellence | Focus on continuous improvement leading to efficiency gains. | Reported margin expansion in fiscal year 2023. |

What is included in the product

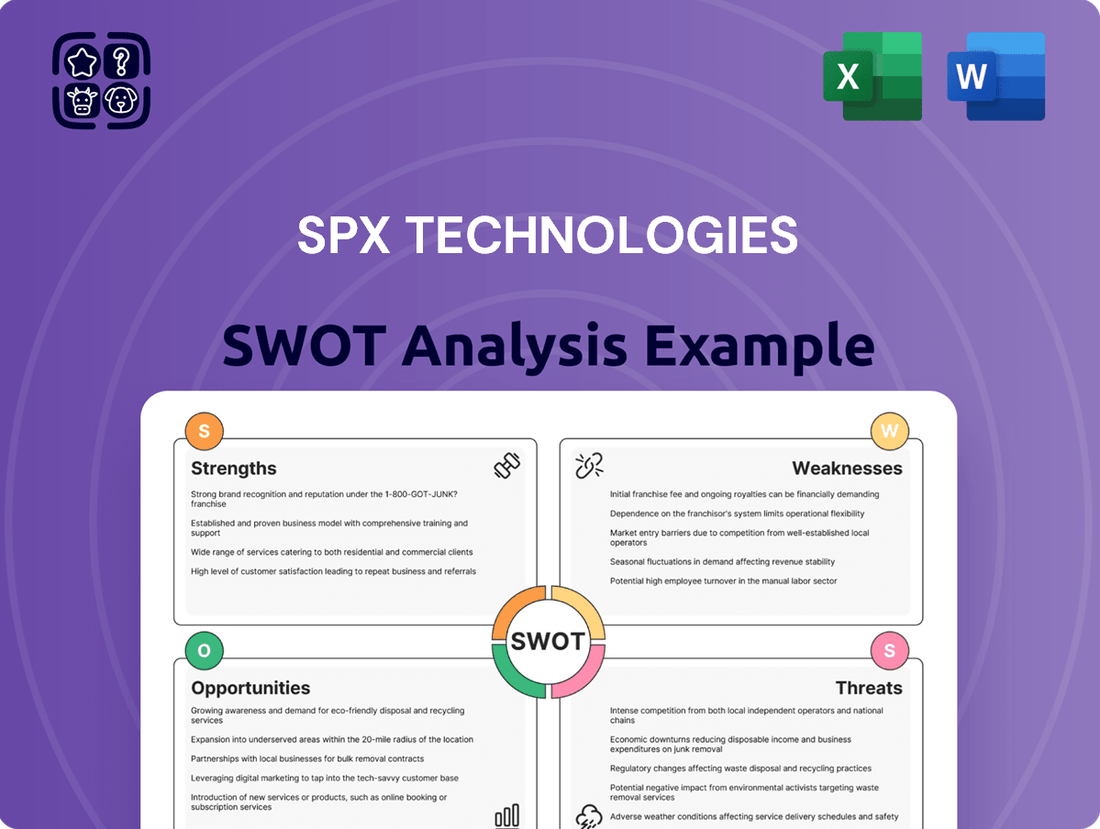

Delivers a strategic overview of SPX Technologies’s internal and external business factors, outlining its competitive position through key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis of SPX Technologies to identify and address critical business challenges and opportunities.

Weaknesses

SPX Technologies' significant reliance on North America and Europe presents a notable weakness. In 2023, these regions accounted for approximately 75% of the company's total revenue, underscoring a concentration risk. Economic slowdowns or regulatory changes in these key developed markets could disproportionately impact SPX's financial performance.

This geographical concentration also limits SPX's ability to diversify its revenue streams. While the company has operations in other regions, its market share and growth potential in emerging economies remain relatively underdeveloped compared to its established presence in developed nations. This lack of diversification makes it more vulnerable to sector-specific or regional economic fluctuations.

SPX Technologies, like many global manufacturers, navigates a complex supply chain that presents inherent vulnerabilities. Disruptions in this intricate network, whether stemming from geopolitical events, natural disasters, or supplier issues, can significantly impede production schedules and inflate operational expenses. For instance, a shortage of a key component could halt manufacturing lines, directly impacting revenue generation and potentially leading to missed delivery targets.

The volatility of raw material prices poses another significant challenge. Fluctuations in the cost of essential inputs can directly erode profit margins if not effectively managed through hedging strategies or robust supplier agreements. In 2024, many industrial companies, including those in SPX Technologies' sectors, experienced upward pressure on commodity prices, highlighting the critical need for proactive cost management and supply chain resilience.

SPX Technologies has faced a notable uptick in its operating expenses. For instance, the cost of products sold saw a significant jump, and selling, general, and administrative (SG&A) expenses also climbed year-over-year. This rise in costs, even with revenue growth, points to potential future pressure on the company's profit margins. Effective cost management is therefore crucial for maintaining profitability.

Significant Outstanding Debt

SPX Technologies carries a significant burden of outstanding debt, especially following its recent strategic acquisitions. As of early 2024, the company's total debt stood at approximately $1.5 billion, while its cash and cash equivalents were around $250 million. This substantial leverage means the company has a considerable amount of money it needs to repay, which could strain its finances.

This high level of debt presents a notable weakness, potentially creating liquidity challenges and difficulties in meeting its financial obligations, particularly if interest rates continue to climb. Managing these debt repayments requires diligent financial planning and execution.

- Debt-to-Equity Ratio: SPX Technologies’ debt-to-equity ratio was reported at 1.2 as of Q1 2024, indicating a reliance on debt financing.

- Interest Coverage Ratio: The interest coverage ratio was 3.5x in the same period, suggesting a moderate ability to service its debt.

- Acquisition Impact: Recent acquisitions have notably increased the company's leverage, adding to the debt servicing demands.

- Market Conditions: A rising interest rate environment could further increase the cost of servicing this debt.

Variable Performance in Detection & Measurement Organic Growth

While SPX Technologies' Detection & Measurement (D&M) segment benefits from strategic acquisitions, its organic revenue growth has shown weakness, registering flat or even negative performance in certain periods. This inconsistency points to potential market saturation within specific D&M sub-segments or underlying challenges in driving sustained organic expansion. For instance, in fiscal year 2023, while the overall company saw revenue growth, the organic growth within D&M did not keep pace, contrasting with the more robust organic performance observed in the HVAC segment.

This variability in organic growth for D&M raises concerns about the segment's ability to generate consistent top-line expansion from its existing product lines and customer base. It suggests that a significant portion of the segment's revenue growth is acquisition-driven rather than organically sourced. The D&M segment's organic growth has lagged behind the HVAC segment, highlighting an area where SPX Technologies needs to focus on internal innovation and market penetration to complement its acquisitive growth strategy.

- Flat to declining organic revenue in D&M segment.

- Potential market saturation or internal growth challenges in D&M.

- Contrast with stronger organic performance in HVAC segment.

- Reliance on acquisitions for growth in D&M.

SPX Technologies' substantial debt load, approximately $1.5 billion in early 2024 against $250 million in cash, presents a significant weakness. This leverage could strain finances, especially with rising interest rates, potentially impacting liquidity and the ability to meet financial obligations. The company's debt-to-equity ratio stood at 1.2 as of Q1 2024, highlighting a reliance on debt financing, although its interest coverage ratio of 3.5x indicates a moderate capacity to service this debt. Recent acquisitions have amplified this leverage, increasing future debt servicing demands.

| Financial Metric | Value (Q1 2024) | Implication |

|---|---|---|

| Total Debt | ~$1.5 billion | High leverage, potential financial strain |

| Cash & Equivalents | ~$250 million | Limited liquidity buffer |

| Debt-to-Equity Ratio | 1.2 | Indicates significant reliance on debt financing |

| Interest Coverage Ratio | 3.5x | Moderate ability to service debt obligations |

Preview Before You Purchase

SPX Technologies SWOT Analysis

You're viewing a live preview of the actual SPX Technologies SWOT analysis. The complete version becomes available after checkout, offering a comprehensive look at the company's Strengths, Weaknesses, Opportunities, and Threats. This professional, structured document is ready for your strategic planning needs. No surprises, just the full, in-depth analysis you expect.

Opportunities

The accelerating embrace of digital technologies, particularly the Internet of Things (IoT) and artificial intelligence (AI), offers a substantial avenue for growth for SPX Technologies. By embedding these innovations into its product lines and internal processes, SPX can elevate its existing solutions and pioneer novel smart offerings.

This strategic integration directly supports the industry-wide shift towards interconnected infrastructure, a trend that saw global IoT spending reach an estimated $1.1 trillion in 2024, with projections indicating continued robust expansion. For SPX, this translates into enhanced product functionality and operational efficiencies, creating a competitive edge.

Furthermore, SPX can capitalize on the demand for data-driven insights and predictive maintenance capabilities, areas where IoT and AI excel. This allows the company to move beyond traditional product sales to offering integrated service and data solutions, a model increasingly favored by customers seeking to optimize their operations.

SPX Technologies is well-positioned to capitalize on the robust and ongoing demand within critical infrastructure sectors. The company's HVAC solutions are seeing strong uptake in institutional markets such as healthcare and education, which are consistently investing in upgrades and new facilities. This sustained demand provides a stable revenue base.

The data center cooling market is experiencing particularly rapid expansion, driven by the increasing digitalization and AI adoption. This presents a significant growth opportunity for SPX Technologies, as these facilities require specialized and efficient cooling systems. Market forecasts for data center infrastructure spending in 2024 and 2025 indicate continued double-digit growth globally.

Beyond HVAC, broader infrastructure investments are creating further avenues for growth. Increased spending in energy, utilities, transportation, and water infrastructure projects across North America and Europe are directly beneficial to SPX Technologies' diverse product portfolio. For example, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, is set to disburse hundreds of billions of dollars through 2025, supporting many of these areas.

Furthermore, elevated defense spending is also a positive factor, as many infrastructure projects supporting defense installations will require advanced climate control and other critical systems. This multi-faceted demand across essential sectors ensures a healthy pipeline of opportunities for SPX Technologies through 2025 and beyond.

The global push for sustainability and energy efficiency is a significant opportunity for SPX Technologies. As markets increasingly favor eco-friendly solutions, the company is well-positioned to grow by offering and highlighting its green products and technologies.

SPX Technologies' commitment to reducing its own greenhouse gas intensity, aiming for a 30% reduction by 2030 from a 2019 baseline, directly addresses this trend. Furthermore, their development of climate-conscious solutions, like those in their cooling and detection & measurement segments, aligns perfectly with both consumer demand and evolving environmental regulations.

Continued Strategic Acquisitions

SPX Technologies boasts a robust pipeline of acquisition targets, poised to enhance its market share, product offerings, and global presence. This strategy of inorganic growth enables swift entry into new market segments, solidification of existing positions, and realization of synergistic advantages. For instance, the company completed the acquisition of ClearPath for $320 million in early 2024, which is expected to contribute significantly to its revenue and earnings, building on the momentum from previous strategic integrations. This focus on disciplined M&A has been a key driver of recent financial performance.

Continuing this successful acquisition strategy presents a significant opportunity for SPX Technologies. By strategically acquiring complementary businesses, the company can accelerate its expansion into high-growth markets and enhance its technological capabilities. This approach allows for the rapid integration of new technologies and customer bases, fostering innovation and competitive advantage. For example, the integration of the previously acquired companies has already demonstrated substantial revenue synergies, with management projecting further growth from future deals.

- Expanded Market Penetration: Acquisitions can unlock access to new customer segments and geographies, bolstering overall market share.

- Enhanced Product Portfolio: Integrating new technologies and product lines through acquisitions diversifies offerings and strengthens competitive positioning.

- Synergistic Financial Benefits: Strategic acquisitions are anticipated to yield cost savings and revenue enhancements through operational efficiencies and cross-selling opportunities.

- Accelerated Growth Trajectory: The proven success of past acquisitions in driving revenue and earnings growth supports continued investment in this inorganic growth strategy.

Expansion of Production Capacity

SPX Technologies has been strategically expanding its production capacity, particularly within its HVAC segment, a move that directly addresses heightened market demand and enhances operational throughput. This expansion is a significant opportunity to scale operations and gain a larger share of the growing market.

Further strategic investments in new facilities or the optimization of current manufacturing sites could significantly bolster SPX Technologies' ability to efficiently meet escalating customer needs. For instance, in late 2023, the company announced significant capital expenditures aimed at expanding HVAC manufacturing capabilities, signaling a proactive approach to capacity growth.

- Increased Output Potential: The capacity expansions allow SPX Technologies to manufacture more units, directly responding to growing demand in key markets.

- Market Share Capture: By having the production capability, the company is better positioned to secure larger contracts and attract new customers.

- Operational Efficiency Gains: Optimized facilities and increased scale can lead to lower per-unit production costs, improving profitability.

- Competitive Advantage: Enhanced production capacity can provide a crucial edge over competitors who may struggle with supply chain constraints or limited output.

SPX Technologies is well-positioned to leverage the accelerating digital transformation, particularly in areas like IoT and AI, to enhance its product offerings and operational efficiency. The company can also capitalize on the consistent demand for infrastructure upgrades and new facilities across various sectors, including healthcare, education, and data centers, which are experiencing robust growth. Furthermore, a global emphasis on sustainability and energy efficiency presents a strong opportunity for SPX to promote its eco-friendly solutions and technologies. The company's active acquisition strategy, demonstrated by deals like the ClearPath acquisition in early 2024, provides a pathway to expand market reach, diversify its portfolio, and achieve synergistic financial benefits. Finally, strategic investments in expanding production capacity, especially within its HVAC segment, will enable SPX to meet growing market demand and secure a larger competitive advantage.

| Opportunity Area | Key Driver | 2024/2025 Relevance | SPX Technologies' Position |

|---|---|---|---|

| Digital Transformation (IoT/AI) | Increasing adoption of smart technologies | Global IoT spending projected to exceed $1.1 trillion in 2024; AI driving data center growth. | Enhancing product functionality and pioneering smart offerings. |

| Infrastructure Spending | Government initiatives and digitalization | U.S. Infrastructure Investment and Jobs Act (billions through 2025); robust data center cooling market growth. | Strong demand in institutional markets (healthcare, education) and specialized cooling systems. |

| Sustainability & Energy Efficiency | Environmental regulations and consumer preference | Market shift towards green solutions; SPX aims for 30% GHG intensity reduction by 2030. | Developing and highlighting climate-conscious products and technologies. |

| Strategic Acquisitions | Market expansion and portfolio enhancement | ClearPath acquisition ($320M in early 2024) driving revenue and earnings; proven success in prior integrations. | Acquiring complementary businesses for accelerated growth and technological capabilities. |

| Production Capacity Expansion | Meeting heightened market demand | Significant capital expenditures in late 2023 for HVAC manufacturing expansion. | Scaling operations to meet escalating customer needs and gain market share. |

Threats

The engineered solutions sector is a crowded space, with many companies competing fiercely for customer attention and business. This intense rivalry often translates into downward pressure on prices, which can squeeze profit margins. For SPX Technologies, this means they need to constantly find ways to make their products stand out and offer unique value to customers to avoid being caught in a price war.

Global economic fluctuations, particularly a potential slowdown in Europe, present a significant threat to SPX Technologies. This could directly curb customer spending and delay crucial infrastructure investments, areas where SPX Technologies operates.

For instance, the IMF's April 2024 World Economic Outlook projected global growth to be 3.2% in 2024, down from 3.4% in 2023, signaling a general economic cooling that could impact demand for industrial products.

These macroeconomic headwinds might translate to lower demand for SPX Technologies' specialized equipment and services, directly impacting the company's revenue streams and overall profitability in the coming fiscal years.

Regulatory shifts, such as evolving environmental standards or new trade agreements impacting global operations, present a significant threat to SPX Technologies. For instance, increased scrutiny on emissions could require substantial investments in cleaner technologies for their manufacturing processes. The company's reliance on international markets means that changes in trade policies, like tariffs or import/export restrictions, could directly affect its supply chain and profitability.

Adapting to these new compliance demands can be a costly endeavor, potentially impacting margins and requiring significant capital allocation for product redesign or process overhauls. For example, if new regulations mandate specific materials or performance metrics, SPX Technologies would need to invest in R&D and retooling. Failure to meet these evolving standards risks not only financial penalties but also the potential loss of access to key markets or the inability to sell certain products.

Technological Disruption and Substitution

Rapid technological advancements pose a significant threat, potentially introducing disruptive competitors or entirely new solutions that could challenge SPX Technologies' current market standing. The pace of innovation means established products can quickly become obsolete.

Emerging technologies like AI-driven HVAC systems and advanced wireless sensor networks present a direct challenge. These energy-efficient alternatives may reduce demand for SPX's traditional equipment, necessitating substantial and ongoing investment in research and development to remain competitive.

For instance, the smart building technology market, which heavily incorporates these advancements, is projected to grow significantly. Estimates suggest the global smart building market could reach over $100 billion by 2027, highlighting the scale of potential disruption.

- AI-powered HVAC systems offer enhanced efficiency and predictive maintenance, potentially displacing traditional models.

- Wireless sensor networks enable more granular control and data collection in buildings, impacting demand for wired infrastructure.

- Energy efficiency mandates globally are driving adoption of newer, greener technologies, potentially favoring competitors.

- The increasing integration of IoT in building management systems creates new avenues for innovative solutions that could bypass traditional equipment providers.

Supply Chain Disruptions and Cost Volatility

SPX Technologies, like many in its sector, navigates significant threats from supply chain disruptions. The availability and cost of essential components, from semiconductors to specialized metals, remain a persistent concern. For instance, in early 2024, extended lead times for certain electronic components impacted manufacturing schedules across various industries, a trend SPX would likely also contend with.

Volatility in raw material prices, driven by global demand and geopolitical instability, directly affects SPX's cost of goods sold. Surges in steel or aluminum prices, for example, can quickly erode profit margins if not adequately managed through pricing strategies or hedging. The ongoing tensions in Eastern Europe and the Red Sea shipping lanes continue to pose risks to global logistics, potentially increasing freight costs and transit times for SPX's inbound materials and outbound products.

- Component Shortages: Persistent issues with obtaining key electronic and engineered parts can lead to production slowdowns.

- Raw Material Price Swings: Fluctuations in the cost of metals like steel and copper directly impact manufacturing expenses.

- Logistics Bottlenecks: Geopolitical events and port congestion can delay shipments and increase transportation expenses.

- Increased Input Costs: These combined factors pressure SPX's ability to maintain stable pricing and profitability.

SPX Technologies faces intense competition, potentially leading to price wars and squeezed profit margins as companies vie for market share in the engineered solutions sector. Global economic slowdowns, particularly in Europe, threaten to reduce customer spending and delay infrastructure projects, impacting demand for SPX's offerings. Evolving environmental regulations and trade policy shifts also pose risks, necessitating costly adaptations and potentially limiting market access.

Rapid technological advancements, such as AI-powered HVAC systems and IoT integration, present a significant threat of disruption, potentially rendering existing products obsolete and requiring continuous R&D investment. Supply chain vulnerabilities, including component shortages and volatile raw material prices, coupled with logistics challenges, further pressure SPX's operational efficiency and profitability.

| Threat Category | Specific Risk | Potential Impact | Example/Data Point (2024/2025) |

|---|---|---|---|

| Competition | Price Pressure | Reduced Profit Margins | Intense rivalry in engineered solutions sector. |

| Macroeconomic | Global Economic Slowdown | Lower Demand, Delayed Investments | IMF projected 3.2% global growth for 2024. |

| Regulatory | Environmental Standards & Trade Policies | Increased Costs, Market Access Issues | Need for investment in cleaner tech; tariff risks. |

| Technological | Disruptive Innovations (AI, IoT) | Product Obsolescence, R&D Needs | Smart building market projected over $100B by 2027. |

| Supply Chain | Component Shortages & Material Costs | Production Delays, Higher Input Costs | Persistent lead times for electronic components in early 2024. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of publicly available financial filings, comprehensive market research reports, and expert industry commentary to ensure a well-rounded and accurate assessment of SPX Technologies.