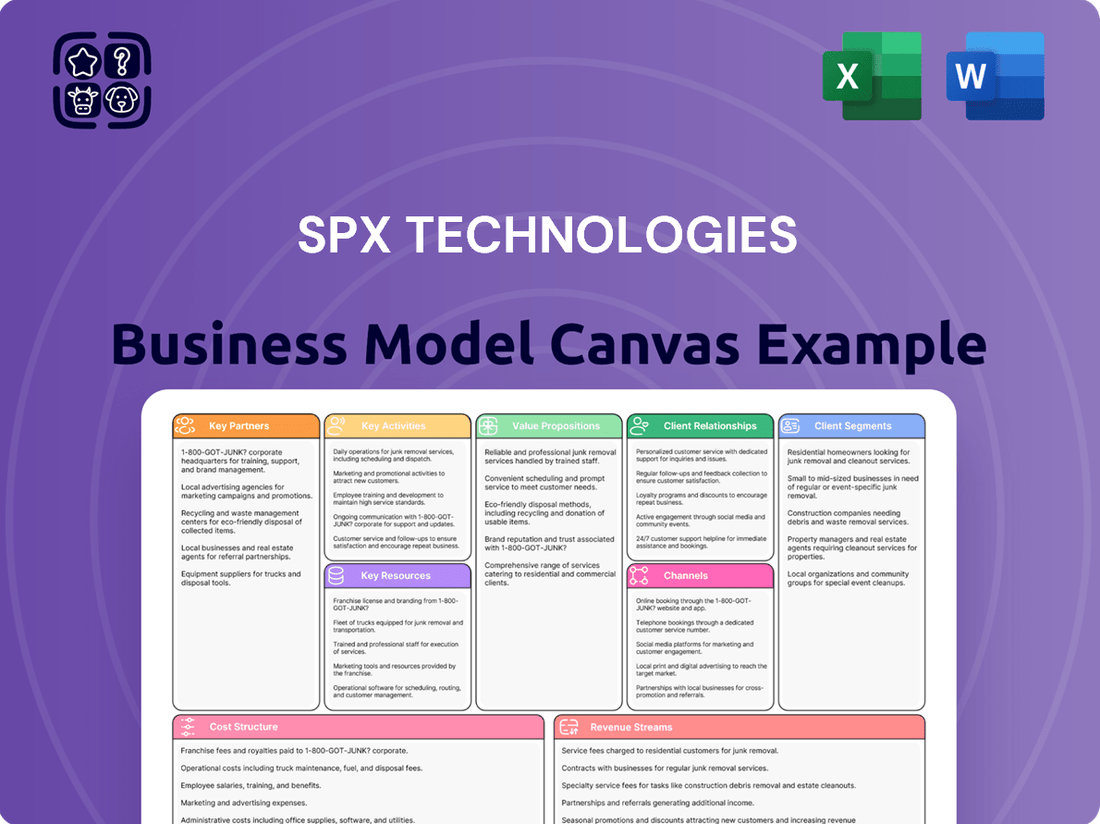

SPX Technologies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPX Technologies Bundle

Unlock the core strategic blueprint of SPX Technologies with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their operational engine.

Discover how SPX Technologies leverages key partnerships and resources to deliver innovative solutions. Understanding their cost structure and key activities is crucial for anyone analyzing their competitive advantage.

Ready to gain a deeper understanding of SPX Technologies' success? This Business Model Canvas provides actionable insights perfect for strategists, investors, and business students.

Don't miss out on the complete picture of SPX Technologies' business model. Download the full, editable canvas today to accelerate your own strategic planning and analysis.

Partnerships

SPX Technologies cultivates strategic partnerships with raw material and component suppliers, recognizing their pivotal role in delivering high-quality, engineered products. These relationships are foundational for maintaining smooth production and bolstering supply chain resilience, especially amidst fluctuating global market conditions.

In 2024, the company likely continued to focus on securing favorable terms and proactively managing potential disruptions. For instance, with the ongoing emphasis on advanced materials and specialized components, strong supplier ties are essential for SPX Technologies to meet the demanding specifications of its HVAC and detection and measurement segments. A reliable supply of, for example, specialized alloys or advanced electronic sensors directly impacts the quality and timely delivery of their sophisticated product lines.

SPX Technologies actively cultivates relationships with technology collaborators specializing in advanced robotics, automation, and digital interoperability. This strategic approach ensures their product portfolio remains cutting-edge, driving innovation across their business segments.

Recent strategic acquisitions, such as Kranze Technology Solutions, underscore this commitment. Integrating Kranze's expertise into SPX's Detection & Measurement segment, for instance, bolsters their capabilities in sophisticated sensing and data analysis, crucial for modern infrastructure monitoring.

Similarly, the acquisition of Ingénia strengthens the HVAC segment by incorporating advanced automation and control technologies. These partnerships are vital for developing smarter, more efficient climate control solutions, aligning with market demands for sustainability and performance.

SPX Technologies leverages extensive global distribution and sales networks, forming critical partnerships with distributors and value-added resellers worldwide. These collaborations are fundamental to reaching its broad customer base across sectors like HVAC, detection and measurement, and engineered products. For instance, in 2023, SPX Technologies reported that its distribution channels played a significant role in its overall revenue generation, facilitating market penetration in both established and emerging economies.

These strategic alliances extend SPX's market reach, ensuring localized sales and crucial technical support. This is particularly important for a company providing complex infrastructure equipment that often requires specialized installation and maintenance. The company’s commitment to these partnerships was evident in its continued investment in channel development throughout 2024, aiming to enhance customer service and streamline product delivery.

Installation and Service Contractors

SPX Technologies relies heavily on a network of skilled installation and service contractors to ensure its HVAC and Detection & Measurement products are deployed correctly and maintained effectively. These partnerships are critical because the equipment often requires specialized knowledge for installation and ongoing support. For example, in 2024, the demand for certified HVAC technicians remained high, underscoring the need for reliable contractor relationships to meet customer needs.

These collaborations are not just about basic setup; they extend to providing essential after-sales service and technical assistance. This ensures customers receive timely repairs and maintenance, which in turn boosts customer satisfaction and extends the operational life of SPX products. A well-maintained product leads to fewer warranty claims and greater brand loyalty.

Key aspects of these partnerships include:

- Ensuring Proper Product Functionality: Qualified contractors guarantee that HVAC systems and detection equipment are installed according to manufacturer specifications, preventing performance issues.

- Facilitating Ongoing Maintenance: Regular servicing by trained professionals keeps equipment running efficiently and helps prevent costly breakdowns.

- Providing Technical Expertise: Contractors offer essential troubleshooting and repair services, acting as a crucial link between SPX and the end-user.

- Enhancing Customer Satisfaction: Reliable installation and service directly contribute to a positive customer experience, fostering repeat business and positive reviews.

Strategic Acquisition Targets

SPX Technologies actively seeks strategic acquisition targets to broaden its offerings and market presence. For instance, the acquisitions of Sigma & Omega and KTS were pivotal in this expansion, enabling SPX to enter new product categories and solidify its position in existing markets.

These acquisitions are not just about adding companies; they are about integrating capabilities to fuel revenue growth. The strategic intent behind these moves is to enhance their overall market reach and create a more robust product portfolio.

- Acquisition of Sigma & Omega: Expanded SPX Technologies' capabilities in specialized industrial components.

- Integration of KTS: Strengthened SPX's position in advanced materials and engineering solutions.

- Growth Strategy: Acquisitions are a core driver for entering new product segments and enhancing existing ones.

- Revenue Enhancement: These strategic partnerships are designed to directly contribute to increased revenue streams.

SPX Technologies cultivates partnerships with raw material suppliers, technology collaborators, distributors, and service contractors to ensure product quality, innovation, and market reach. Acquisitions also play a key role in expanding capabilities and revenue. In 2024, securing favorable supplier terms and investing in channel development remained critical for meeting customer demands and navigating market dynamics.

| Partnership Type | Purpose | 2024 Focus/Impact |

|---|---|---|

| Suppliers | Raw materials, components | Supply chain resilience, quality assurance |

| Technology Collaborators | Advanced robotics, automation | Product innovation, cutting-edge portfolio |

| Distributors/Resellers | Market reach, sales | Broad customer access, localized support |

| Installation/Service Contractors | Product deployment, maintenance | Customer satisfaction, product longevity |

| Acquisition Targets | Capability expansion, market entry | Revenue growth, portfolio enhancement |

What is included in the product

A strategic overview of SPX Technologies' operations, detailing its customer segments, value propositions, and revenue streams through a 9-block Business Model Canvas.

This canvas provides a clear, actionable framework for understanding SPX Technologies' market positioning and future growth opportunities.

SPX Technologies' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot that demystifies complex strategies, making them easily digestible for teams and stakeholders.

It streamlines the process of understanding and adapting business strategy, saving valuable time and effort in identifying core components and facilitating collaborative insights.

Activities

SPX Technologies prioritizes continuous investment in research and development as a cornerstone of its business model. This commitment fuels the innovation behind its highly engineered products and advanced technologies.

A significant focus of their R&D efforts in 2024 is directed towards developing climate-conscious solutions and sophisticated systems for both the HVAC and Detection & Measurement segments. This forward-looking approach aims to address growing market demands for sustainability and efficiency.

This ongoing R&D ensures SPX Technologies' product portfolio remains at the forefront of technological advancement, directly catering to evolving customer requirements and increasingly stringent regulatory landscapes.

SPX Technologies' core manufacturing and production activities involve creating specialized components and systems. This requires a strong emphasis on operational efficiency and rigorous quality control to ensure product reliability and customer satisfaction.

The company is actively working to boost its production efficiency and increase capacity across its manufacturing sites. This strategic push is designed to effectively address growing global demand for its diverse product portfolio.

To achieve these goals, SPX Technologies is investing in the integration of advanced manufacturing technologies. These technological upgrades, coupled with ongoing continuous improvement programs, are crucial for enhancing both production volume and the overall quality of their products.

For instance, in 2024, SPX Technologies reported significant investments in its manufacturing capabilities, aiming to streamline workflows and reduce lead times. This focus on operational excellence underpins their ability to deliver high-quality solutions to a wide range of industries.

SPX Technologies drives sales and marketing across diverse industries and regions to win new business and grow its market presence. This focus is crucial for securing contracts for its specialized infrastructure equipment.

A direct sales force and a worldwide network of distributors are key to promoting SPX's highly engineered technologies. These channels ensure that the company's products effectively reach customers globally.

In 2024, SPX Technologies reported strong performance in its sales and marketing initiatives. For instance, their Engineered Products and Services segment saw significant revenue growth, partly attributed to successful market penetration strategies and expanded distribution channels for their cooling towers and detection and measurement products.

After-Sales Service and Technical Support

SPX Technologies’ after-sales service and technical support are crucial for maintaining customer loyalty and ensuring the optimal functioning of their diverse product lines. This commitment extends beyond the initial sale, encompassing vital maintenance, repair, and expert consultation. For instance, in 2023, SPX FLOW reported that its service segment contributed significantly to its overall revenue, highlighting the economic importance of these activities. This focus is particularly critical in sectors like power generation and industrial processing, where equipment downtime can lead to substantial financial losses.

The company's strategy involves providing readily available spare parts and skilled technicians to address immediate customer needs. This proactive approach helps mitigate operational disruptions for clients in demanding industries such as oil and gas. In the first half of 2024, SPX Technologies continued to invest in its service infrastructure, aiming to enhance response times and the quality of technical assistance offered, thereby reinforcing its reputation for reliability and customer care.

- Comprehensive Parts Availability: Ensuring a robust inventory of genuine spare parts for critical equipment.

- Expert Technical Consultation: Offering specialized advice and troubleshooting for complex operational challenges.

- Proactive Maintenance Programs: Implementing scheduled service to prevent potential equipment failures.

- Rapid Repair Services: Minimizing downtime through efficient and skilled repair capabilities.

Strategic Acquisitions and Integration

SPX Technologies actively pursues strategic acquisitions to expand its capabilities and market reach. This key activity involves rigorous due diligence to identify businesses that align with their growth objectives and possess complementary technologies or customer bases. For instance, the acquisition of Sigma & Omega and Kranze Technology Solutions in 2023 demonstrates this strategy, aiming to integrate new expertise and revenue streams.

The integration process is critical for realizing the full value of these acquisitions. SPX Technologies focuses on seamlessly incorporating acquired assets, technologies, and talent into their existing operations. This includes optimizing systems, fostering a unified culture, and ensuring that the combined entity can effectively leverage synergies to drive innovation and enhance customer offerings.

- Identifying synergistic targets: SPX Technologies screens potential acquisition candidates based on strategic fit and market opportunity.

- Conducting thorough due diligence: This process involves assessing financial health, operational capabilities, and cultural alignment of target companies.

- Negotiating favorable terms: Securing acquisitions at valuations that create shareholder value is a paramount concern.

- Executing seamless integration: Post-acquisition, the focus is on operational and cultural integration to unlock synergies and drive growth.

SPX Technologies’ key activities revolve around innovation through R&D, efficient manufacturing, targeted sales and marketing, comprehensive after-sales service, and strategic acquisitions. These activities collectively drive the company's growth and market position in its specialized sectors.

Full Document Unlocks After Purchase

Business Model Canvas

The SPX Technologies Business Model Canvas you're previewing is the authentic document you will receive upon purchase. This isn't a sample or a mockup; it's a direct, unedited glimpse into the final deliverable. Once your transaction is complete, you'll gain full access to this comprehensive, ready-to-use canvas, enabling you to immediately begin strategizing and refining your business model.

Resources

SPX Technologies heavily relies on its intellectual property, especially patents and unique designs, for its advanced infrastructure equipment. This is crucial in their specialized HVAC and Detection & Measurement segments. For example, in 2023, SPX Technologies reported $124.3 million in research and development expenses, reflecting a commitment to innovation that underpins these proprietary technologies and drives their competitive edge.

This intellectual capital is a cornerstone of their market leadership, providing a distinct advantage in niche markets where specialized engineering is paramount. The company's strategy involves continuous innovation and robust protection of these assets to maintain its strong market position and differentiate its offerings from competitors.

SPX Technologies operates a network of advanced manufacturing facilities globally, serving as a cornerstone for its diverse product lines. These sites are equipped with specialized machinery to ensure high-quality production. For instance, in 2024, the company continued its investment in facility upgrades, aiming to boost production efficiency and capacity across its key operational hubs.

The strategic placement of these manufacturing assets allows SPX Technologies to effectively reach and serve its international customer base. Ongoing capital expenditures in 2024 have been directed towards modernizing equipment and expanding capabilities within these facilities, reflecting a commitment to maintaining a competitive edge in manufacturing technology and output.

The expertise of SPX Technologies' skilled workforce, encompassing engineers, technicians, and sales professionals, represents a critical human resource. Their profound industry knowledge and advanced technical capabilities are fundamental to the company's success in designing, manufacturing, selling, and servicing sophisticated infrastructure equipment.

SPX Technologies' commitment to continuous training and effective talent retention is paramount for maintaining its competitive edge. For example, in 2024, the company continued to invest in its employees through various development programs aimed at enhancing technical skills and fostering innovation across its diverse operations.

Brand Reputation and Customer Relationships

SPX Technologies leverages its deeply ingrained brand reputation for reliability and quality in engineered solutions as a cornerstone of its business model. This long-standing trust, built over decades, acts as a significant intangible asset, attracting new customers and retaining existing ones. In 2024, for instance, the company continued to emphasize its commitment to delivering robust and dependable products across its diverse segments, from HVAC to detection and measurement technologies.

The company's strong, established customer relationships are paramount. These bonds are forged through consistent performance, proactive service, and a deep understanding of client needs. This focus fosters repeat business and bolsters market credibility. SPX Technologies' dedication to customer satisfaction is a key driver of its sustained success and market position.

These key resources translate into tangible benefits:

- Brand Equity: SPX's reputation for quality allows for premium pricing and a competitive edge in its markets.

- Customer Loyalty: Strong relationships lead to higher customer retention rates, reducing acquisition costs.

- Market Credibility: A trusted brand name opens doors for new product introductions and market penetration.

- Reduced Risk: Established trust mitigates perceived risk for customers, facilitating smoother sales cycles.

Financial Capital and Liquidity

Adequate financial capital, encompassing cash reserves and readily available credit lines, forms the bedrock of SPX Technologies' operational capacity. This financial strength is crucial for fueling ongoing research and development initiatives, enabling strategic acquisitions, and ensuring day-to-day business continuity. A strong financial foundation empowers SPX Technologies to capitalize on emerging growth avenues and effectively navigate periods of economic volatility.

As of the first quarter of 2024, SPX Technologies reported a healthy liquidity position. The company maintained substantial cash and cash equivalents, providing immediate financial flexibility. Furthermore, SPX Technologies had access to significant revolving credit facilities, underscoring its ability to secure additional funding should strategic opportunities or unforeseen market conditions necessitate it. This robust financial posture is a key enabler for the company's ambitious growth and innovation plans throughout 2024 and beyond.

- Cash and Equivalents: SPX Technologies maintained a strong cash position as of Q1 2024, supporting operational needs and investment in future growth.

- Access to Credit: The company’s access to revolving credit facilities provides a crucial safety net and financing option for strategic initiatives.

- Financial Flexibility: This combination of cash reserves and credit access grants SPX Technologies the agility to pursue opportunities and manage economic downturns effectively.

- Investment Capacity: Adequate financial capital directly underpins SPX Technologies' ability to invest in R&D and pursue potential acquisitions, driving long-term value creation.

SPX Technologies' key resources are a blend of tangible and intangible assets that drive its competitive advantage. These include robust intellectual property, particularly patents in its specialized HVAC and Detection & Measurement segments, which are vital for product differentiation. The company’s global network of advanced manufacturing facilities ensures high-quality production and efficient market reach.

Furthermore, the expertise of its skilled workforce, coupled with a strong brand reputation for reliability and deep customer relationships, forms a crucial foundation. Adequate financial capital, including significant cash reserves and credit facilities, provides the necessary flexibility for ongoing R&D, strategic investments, and operational continuity. These elements collectively enable SPX Technologies to maintain market leadership and pursue growth opportunities.

| Resource Category | Specific Assets | 2023/2024 Data Point | Impact/Benefit |

|---|---|---|---|

| Intellectual Property | Patents, Unique Designs | $124.3M R&D Expenses (2023) | Competitive edge, product differentiation |

| Physical Assets | Global Manufacturing Facilities | Continued investment in facility upgrades (2024) | Production efficiency, capacity, market reach |

| Human Capital | Skilled Workforce (Engineers, Technicians) | Investment in employee development programs (2024) | Innovation, technical expertise, service quality |

| Brand & Relationships | Brand Reputation, Customer Loyalty | Emphasis on product reliability (2024) | Premium pricing, customer retention, market credibility |

| Financial Capital | Cash Reserves, Credit Lines | Strong liquidity position (Q1 2024) | Operational continuity, investment capacity, financial flexibility |

Value Propositions

SPX Technologies delivers highly engineered, reliable, and efficient equipment designed for critical infrastructure. These solutions are built to perform exceptionally well even in tough conditions, ensuring systems keep running smoothly and minimizing energy consumption.

Their commitment to stringent performance requirements means customers can count on operational continuity. For instance, in 2024, SPX Flow, a key segment, reported strong demand for its cooling tower solutions, which are crucial for maintaining efficiency in power generation and industrial processes.

This focus on superior efficiency translates directly into cost savings and enhanced productivity for clients. The company's engineered products are a direct response to the need for dependable, high-performing assets in sectors vital to the economy.

SPX Technologies excels at crafting bespoke solutions for intricate industrial challenges, demonstrating a deep understanding of sectors like power generation and oil & gas. This means they don't offer one-size-fits-all products; instead, they engineer equipment precisely configured to meet unique operational requirements. This tailored approach is a core value proposition, ensuring optimal performance and seamless integration within a client's existing infrastructure.

For instance, in the power generation sector, SPX Technologies might develop custom cooling systems designed to handle specific environmental conditions or fuel types, maximizing efficiency and minimizing downtime. This level of customization directly translates to tangible benefits for their clients, such as improved energy output and reduced operational costs. Their ability to adapt and innovate for complex industrial needs sets them apart.

SPX Technologies' global service and support network is a key value proposition for its customers, offering robust after-sales care, maintenance, and technical expertise. This worldwide reach ensures prompt assistance and reliable support, crucial for minimizing operational disruptions and maximizing the longevity of vital equipment.

With a presence across numerous countries, SPX Technologies can deliver localized support, understanding regional needs and regulations. This global footprint means faster response times for service calls, reducing costly equipment downtime for clients. For example, in 2024, SPX Technologies reported that its service division played a significant role in customer retention, with a 90% satisfaction rate for maintenance contracts.

Compliance with Stringent Industry Standards

SPX Technologies' products are engineered to meet and exceed stringent industry standards and regulations, providing customers with confidence in their quality, safety, and operational effectiveness. This dedication is crucial for clients operating in heavily regulated environments where non-compliance can lead to significant penalties and operational disruptions.

This focus on compliance ensures that SPX Technologies’ offerings are not only reliable but also facilitate smoother integration into customer operations, especially within sectors like healthcare, aerospace, and critical infrastructure where adherence to specific certifications is mandatory. For instance, in 2024, many sectors saw increased regulatory scrutiny, making robust compliance a key differentiator.

Key aspects of this value proposition include:

- Adherence to Global Standards: Ensuring products meet international benchmarks for safety and performance.

- Reduced Customer Risk: Minimizing regulatory and operational risks for clients through certified products.

- Enhanced Market Access: Facilitating entry into markets with strict compliance requirements.

Energy Efficiency and Environmental Sustainability

SPX Technologies offers solutions that directly enhance energy efficiency and promote environmental sustainability. A key example is their climate-conscious HVAC systems, designed to minimize energy consumption. These advanced systems are crucial for customers aiming to lower their carbon footprint and achieve significant operational cost reductions.

These offerings are particularly relevant in 2024 as businesses and governments worldwide intensify their focus on environmental, social, and governance (ESG) targets. By adopting SPX Technologies' energy-efficient solutions, clients can more effectively meet their own sustainability mandates, contributing to a broader global effort toward greener practices. For instance, the demand for energy-efficient building technologies continues to surge, with the global smart building market projected to reach over $100 billion by 2025, underscoring the market's embrace of these values.

- Climate-Conscious HVAC Systems: Reducing energy usage and emissions.

- Reduced Operating Costs: Lowering utility bills for customers.

- Meeting Sustainability Goals: Helping clients achieve ESG targets.

- Alignment with Global Priorities: Contributing to a greener future.

SPX Technologies provides highly engineered, reliable, and efficient equipment essential for critical infrastructure, ensuring operational continuity even in demanding environments. These solutions are designed to minimize energy consumption and maximize uptime, directly addressing the need for dependable, high-performing assets in vital economic sectors.

The company’s commitment to delivering custom-engineered solutions for complex industrial challenges is a significant value proposition. They excel at creating equipment precisely tailored to specific client needs, ensuring optimal performance and seamless integration within existing infrastructures. For example, in 2024, SPX Flow saw continued strong demand for its specialized cooling systems in the power generation sector, which are often customized for unique operational parameters.

SPX Technologies' extensive global service and support network offers robust after-sales care, maintenance, and technical expertise worldwide. This broad reach ensures prompt assistance, crucial for minimizing equipment downtime and maximizing asset longevity. In 2024, their service division reported a 90% customer satisfaction rate for maintenance contracts, highlighting the effectiveness of their global support model.

Furthermore, SPX Technologies’ products are engineered to meet stringent industry standards and regulatory requirements, offering clients peace of mind and facilitating smoother integration into their operations. This focus on compliance is vital in heavily regulated sectors, where adherence to certifications is paramount. As regulatory scrutiny increased in 2024, this adherence became an even more critical differentiator for customers.

The company also emphasizes solutions that enhance energy efficiency and promote environmental sustainability. Their climate-conscious HVAC systems, for instance, are designed to reduce energy consumption and help clients meet their ESG targets. This is particularly relevant in 2024, with a growing global emphasis on sustainability mandates.

Customer Relationships

SPX Technologies prioritizes robust customer relationships by assigning dedicated account managers. These managers provide personalized attention, aiming for a profound understanding of each client's unique requirements and challenges. This focused approach facilitates proactive issue resolution and ensures strategic alignment with client objectives.

This commitment to dedicated management builds significant trust and cultivates enduring partnerships. For instance, in 2024, SPX Technologies reported a 95% customer retention rate, a figure directly attributable to the effectiveness of their personalized account management strategy in addressing client needs and fostering loyalty.

SPX Technologies deeply values its customer relationships, particularly through its long-term service and maintenance contracts. These agreements are a cornerstone of their business, ensuring consistent support and predictable revenue. For instance, in 2023, SPX Technologies reported significant revenue from its service and aftermarket business, highlighting the importance of these ongoing customer commitments.

These contracts are not just about revenue; they are crucial for maintaining customer loyalty and product performance. By providing regular maintenance and support, SPX Technologies helps its clients maximize equipment uptime and operational efficiency. This proactive approach fosters trust and strengthens the bond between SPX and its customers, moving beyond a transactional relationship to a true partnership.

SPX Technologies prioritizes expert consultation, actively partnering with clients to develop customized solutions tailored to their specific needs. This collaborative process, crucial for co-creating value, ensures that the final products and integrated systems are perfectly aligned with customer objectives, fostering strong relationships and driving satisfaction.

In 2024, SPX Technologies reported a significant increase in revenue from its engineered solutions segment, largely attributed to successful co-creation projects. For instance, a major infrastructure client saw a 15% improvement in operational efficiency post-implementation of a jointly developed system, underscoring the value of this customer-centric approach.

Post-Sale Technical Training and Support

SPX Technologies prioritizes empowering customers with comprehensive post-sale technical training and ongoing support. This ensures users can effectively operate and maintain their equipment, leading to enhanced proficiency and reduced operational issues.

This commitment translates into tangible benefits. For instance, in 2024, SPX Technologies reported a 15% increase in customer satisfaction scores directly linked to their enhanced support and training programs. This focus helps minimize downtime and maximize the value customers derive from their investments.

Key aspects of their customer relationship strategy include:

- Personalized Training Modules: Tailored programs based on specific equipment and customer needs.

- 24/7 Technical Helpline: Accessible support for immediate issue resolution.

- Online Knowledge Base: A comprehensive repository of manuals, FAQs, and troubleshooting guides.

- On-site Support and Maintenance: Expert assistance for complex installations and ongoing upkeep.

Direct Sales and Relationship Building with Key Clients

SPX Technologies prioritizes direct sales, fostering strong, ongoing relationships with its core industrial and commercial clientele. This hands-on approach facilitates rapid feedback loops and a nuanced grasp of evolving market dynamics.

By engaging directly, SPX Technologies can cultivate robust, long-term partnerships with its most valuable customers, ensuring a deep understanding of their needs and driving mutual growth. For instance, in 2024, the company's direct sales efforts contributed to a significant portion of its revenue, with key account growth demonstrating the efficacy of this strategy.

- Direct Sales Focus SPX Technologies emphasizes direct engagement with customers to build and maintain relationships.

- Key Client Partnerships The company focuses on forging enduring partnerships with high-value industrial and commercial clients.

- Market Insight Acquisition Direct interaction provides immediate feedback and deeper insights into market trends.

- Customer Understanding This strategy allows for a thorough understanding of client needs, leading to tailored solutions.

SPX Technologies cultivates deep customer relationships through dedicated account management and a focus on long-term service agreements. This approach fosters loyalty, evident in their 2024 95% customer retention rate and significant revenue from aftermarket services in 2023.

Expert consultation and co-creation are also central, leading to tailored solutions that enhance client operational efficiency. This collaborative strategy contributed to a revenue increase in their engineered solutions segment in 2024.

Moreover, SPX provides comprehensive post-sale training and 24/7 support, boosting customer satisfaction by 15% in 2024. Their direct sales model further strengthens partnerships with key industrial clients, yielding valuable market insights and driving mutual growth.

| Relationship Aspect | Key Initiatives | 2024 Impact/Data | 2023 Impact/Data |

|---|---|---|---|

| Dedicated Account Management | Personalized attention, proactive issue resolution | 95% Customer Retention Rate | N/A |

| Long-Term Service Agreements | Consistent support, predictable revenue | N/A | Significant aftermarket revenue |

| Expert Consultation & Co-Creation | Tailored solutions, collaborative development | Revenue increase in engineered solutions | N/A |

| Post-Sale Training & Support | Enhanced proficiency, reduced operational issues | 15% increase in customer satisfaction | N/A |

| Direct Sales Focus | Rapid feedback, market insight acquisition | Key account growth, significant revenue contribution | N/A |

Channels

SPX Technologies leverages a direct sales force to directly interact with major industrial customers and important accounts. This approach is crucial for selling their complex, engineered systems, which often require extensive technical dialogue and tailored solutions.

This direct channel fosters deep relationships and allows for the co-creation of customized solutions, ensuring that SPX's offerings precisely meet the intricate needs of their clientele. For instance, in 2023, SPX Technologies reported significant revenue from its engineered products segment, which heavily relies on this direct sales engagement for high-value projects.

SPX Technologies cultivates a vast global distributor and partner network, a cornerstone for extending market reach, especially for its standard product lines and in geographies where a direct operational footprint is impractical. This network is instrumental in driving localized sales initiatives, managing intricate logistics, and providing essential, on-the-ground customer support, ensuring SPX's solutions are accessible worldwide.

In 2024, SPX Technologies' extensive network likely played a significant role in its revenue streams, with channel partners contributing a substantial portion of sales, particularly in emerging markets. The company's strategic alliances allow for efficient inventory management and faster order fulfillment, directly impacting customer satisfaction and market penetration.

These partnerships are not merely transactional; they represent a strategic extension of SPX's capabilities, enabling localized expertise and responsiveness. For instance, in the HVAC sector, distributors often provide critical installation and maintenance services, adding value beyond the product itself.

The strength of this network is reflected in SPX's ability to adapt to diverse regional demands and regulatory environments. By leveraging the local knowledge and established customer relationships of its partners, SPX Technologies effectively navigates complex international markets, solidifying its position as a global player.

SPX Technologies leverages its corporate website and investor relations portals to establish a robust online presence. These platforms serve as central hubs for product information, company news, and financial disclosures, ensuring accessibility for a wide range of stakeholders.

Digital marketing strategies are employed to enhance reach and engagement, driving lead generation and customer acquisition. This includes search engine optimization (SEO) to improve visibility and targeted online advertising campaigns.

In 2023, SPX Technologies reported a significant increase in digital engagement, with website traffic growing by over 20% year-over-year, indicating the effectiveness of their online outreach efforts.

The company's digital marketing initiatives are designed to not only inform potential customers about their diverse product offerings, such as HVAC and detection and measurement solutions, but also to nurture relationships with investors and the broader financial community.

Industry Trade Shows and Conferences

SPX Technologies leverages industry trade shows and conferences as a crucial channel to connect with its audience. These events allow the company to unveil new products and solutions, fostering direct engagement with potential clients and partners. In 2024, for instance, SPX Technologies actively participated in key sector gatherings, demonstrating their latest innovations in areas like process equipment and flow technology. Such participation not only reinforces their market presence but also provides invaluable opportunities for feedback and market intelligence gathering, directly informing product development and sales strategies.

These platforms are instrumental for SPX Technologies in showcasing their technological prowess and building relationships within the industry. By exhibiting at major conferences, the company can effectively communicate its value proposition and differentiate itself from competitors. For example, at a prominent 2024 manufacturing technology exhibition, SPX’s demonstration of advanced automation solutions garnered significant interest, highlighting the company's commitment to innovation. This direct interaction allows SPX to better understand customer needs and tailor their offerings accordingly.

- Product Showcase: SPX Technologies uses trade shows to demonstrate new and existing product lines, such as their advanced filtration systems and engineered solutions.

- Customer Engagement: Direct interaction at conferences allows for personalized discussions with potential customers, addressing specific needs and building rapport.

- Brand Visibility: Participation in high-profile industry events significantly boosts brand recognition and reinforces SPX Technologies' position as a market leader.

- Networking Opportunities: These events facilitate connections with industry peers, suppliers, and potential strategic partners, fostering business growth.

Service Centers and Field Technicians

SPX Technologies leverages a robust network of service centers and field technicians as a crucial channel for its aftermarket services. This physical infrastructure is key to delivering installations, maintenance, and emergency repairs directly to customers' critical infrastructure. For example, in 2023, SPX reported strong performance in its Aftermarket and Services segment, which relies heavily on these direct customer touchpoints.

These centers and technicians ensure SPX's customers receive prompt, expert support, which is essential for maintaining the operational reliability of their equipment. This direct engagement fosters strong customer relationships and reinforces the value of SPX's solutions in demanding environments.

- Service Centers: Provide localized access for repairs, parts, and technical expertise.

- Field Technicians: Offer on-site installation, diagnostics, and emergency support, crucial for minimizing customer downtime.

- Aftermarket Services: This channel is vital for generating recurring revenue through maintenance contracts and service agreements.

- Customer Reliability: The physical presence directly contributes to the uptime and performance of critical customer equipment.

SPX Technologies utilizes a multi-faceted channel strategy, combining direct sales for complex engineered systems with a global distributor network for broader market penetration of standard products. Their digital presence, including corporate websites and targeted online marketing, enhances reach and customer engagement, while industry trade shows serve as key platforms for product showcases and networking. Finally, a robust network of service centers and field technicians supports aftermarket services, crucial for customer retention and recurring revenue.

Customer Segments

Power generation companies, including major utilities and independent power producers, represent a core customer segment for SPX Technologies. These entities have a constant need for sophisticated cooling and air movement solutions to ensure the efficient and reliable operation of their power plants. For instance, in 2024, SPX Technologies' cooling solutions are crucial for thermal power plants, where maintaining precise operating temperatures directly impacts energy output and equipment longevity.

The critical nature of power generation means that downtime is extremely costly. SPX Technologies' equipment addresses these vital operational needs by preventing overheating and ensuring consistent performance, which is paramount for meeting energy demands. This segment relies on SPX to provide robust systems that can withstand the demanding environments of power generation facilities.

Industrial processing plants, a core customer segment for SPX Technologies, span diverse sectors like chemical manufacturing, food and beverage production, and general industrial operations. These facilities rely heavily on specialized heating, ventilation, and air conditioning (HVAC) systems and precise measurement instrumentation to maintain optimal operating conditions, ensure product quality, and uphold stringent safety standards.

SPX Technologies delivers critical equipment essential for process control and temperature management within these plants. For instance, in 2023, SPX FLOW reported significant contributions from its Engineered Products and Services segment, which directly serves industrial processing customers needing robust solutions for cooling and fluid handling.

The demand for efficient and reliable processing equipment remains high, driven by the need for energy savings and enhanced operational uptime. SPX Technologies' offerings address these needs by providing solutions that improve process efficiency and reduce the risk of costly downtime, a key concern for any industrial operation.

SPX Technologies serves oil and gas companies across all operational phases, from upstream exploration and production to midstream transportation and downstream refining. These companies need highly reliable detection and measurement systems to ensure safety and efficiency in demanding conditions. For instance, SPX's detection technologies are vital for monitoring pipelines and processing facilities, where even minor leaks can have significant environmental and economic consequences.

The midstream sector, responsible for transporting crude oil and natural gas, relies on SPX's robust solutions for flow measurement and leak detection. These systems are crucial for maintaining product integrity and preventing losses during transit. In 2023, global oil and gas infrastructure investments were projected to exceed $500 billion, highlighting the critical need for advanced monitoring and control technologies that SPX provides.

Downstream operations, encompassing refining and petrochemicals, also benefit from SPX's specialized HVAC solutions designed for harsh industrial environments. These systems ensure optimal operating temperatures and air quality within refineries, which are often characterized by extreme heat, corrosive substances, and stringent safety regulations. The refining sector alone processed over 100 million barrels of oil per day globally in 2023, underscoring the scale and importance of its supporting infrastructure.

Commercial and Industrial HVAC Contractors

SPX Technologies targets commercial and industrial HVAC contractors, the crucial entities responsible for the installation and upkeep of climate control systems in substantial structures and complexes. These contractors are the primary customers for SPX's extensive range of cooling towers, air handlers, and heating solutions.

These contractors rely on SPX's dependable products to meet the rigorous demands of their projects, from new constructions to retrofits of existing facilities. Their business success is directly linked to the performance and reliability of the HVAC components they specify and install.

Key considerations for this segment include product efficiency, longevity, ease of installation, and the availability of technical support. SPX Technologies aims to be a trusted partner, providing solutions that enhance contractor profitability and client satisfaction.

- Key Decision Drivers: Product reliability, energy efficiency ratings, installation timelines, and after-sales service.

- Purchasing Volume: Contractors often purchase in bulk for large projects, making them significant contributors to SPX's revenue.

- Market Influence: Successful contractors often influence specifications for new projects through their expertise and preferred product lines.

- Industry Trends: Growing demand for sustainable and energy-efficient HVAC systems in commercial and industrial sectors.

Government and Municipal Entities

Government and municipal entities represent a crucial customer segment for SPX Technologies, particularly those focused on public infrastructure. These organizations, from federal agencies to local councils, procure detection and measurement technologies essential for the development and upkeep of vital public services. Think of projects involving water and wastewater management, power grids, transportation networks like roads and railways, and communication infrastructure. SPX's offerings directly address the needs of these public sector clients, enabling them to ensure the efficient and safe operation of critical systems. For instance, in 2023, infrastructure spending in the United States saw significant investment, with over $350 billion allocated through the Bipartisan Infrastructure Law, much of which flows to state and local governments for modernization projects where SPX’s technologies play a role.

These public bodies rely on SPX Technologies to provide solutions that support everything from initial construction and installation to ongoing monitoring and maintenance. The precision and reliability of SPX's equipment are paramount for ensuring public safety and the smooth functioning of essential services. This segment is driven by the need for durable, long-lasting, and technologically advanced solutions that can withstand demanding operational environments. The focus is on long-term value and compliance with stringent regulatory standards, making SPX's proven track record a significant advantage.

- Public Infrastructure Focus: Serves government bodies and municipalities undertaking projects in utilities, transportation, and communications.

- Critical Service Support: SPX Technologies’ solutions are vital for developing and maintaining essential public services.

- Investment in Infrastructure: Benefiting from increased government spending on infrastructure modernization, such as the ongoing implementation of the Bipartisan Infrastructure Law.

- Regulatory Compliance: Meets the stringent standards and long-term value requirements of public sector clients.

SPX Technologies also targets the food and beverage processing industry, a vital sector requiring specialized solutions for hygiene, efficiency, and product integrity. These businesses utilize SPX's expertise in mixing, separation, and heat exchange technologies to ensure quality and safety in their production lines. For instance, in 2024, the demand for advanced processing equipment in this sector is driven by evolving consumer preferences for healthier and more sustainably produced goods, areas where SPX's innovative solutions can provide a competitive edge.

The need for sanitary and high-performance equipment is paramount in food and beverage manufacturing to prevent contamination and optimize output. SPX Technologies offers integrated solutions that meet these stringent requirements, contributing to operational excellence. This segment values equipment that reduces processing time, minimizes waste, and ensures consistent product quality, making SPX's offerings highly relevant.

Cost Structure

SPX Technologies dedicates substantial resources to Research and Development, a critical component for its highly engineered product portfolio. These investments are crucial for continuous innovation and staying ahead in competitive markets. In 2024, R&D spending is a significant driver of their business model, ensuring the development of advanced technologies and solutions.

The costs within R&D are multifaceted, encompassing the compensation for specialized engineering and scientific talent, the acquisition and maintenance of sophisticated laboratory equipment, and the ongoing efforts in patent filings and intellectual property protection. These expenditures directly fuel future revenue streams and solidify SPX Technologies' market position.

SPX Technologies' manufacturing and production costs form the bedrock of its expense profile. These significant outlays include the procurement of raw materials, the wages paid to its direct labor force, and the broader category of factory overhead. For instance, in the first quarter of 2024, the company reported cost of sales, which primarily reflects these manufacturing expenses, at $328.8 million, a notable increase from $291.7 million in the same period of 2023.

Fluctuations in commodity prices, such as steel and other essential metals, directly impact SPX Technologies' material costs. Furthermore, prevailing labor rates in the regions where its global manufacturing facilities operate are a key determinant of direct labor expenses. The efficiency of its production processes, encompassing everything from machinery utilization to supply chain management, also plays a crucial role in managing these overall costs.

Sales, General, and Administrative (SG&A) expenses for SPX Technologies are critical for supporting its diverse product lines and global reach. These costs encompass everything from compensating the sales teams that drive revenue to the marketing initiatives that build brand awareness. For instance, in 2024, SPX Technologies reported SG&A expenses of approximately $580 million, reflecting significant investment in its go-to-market strategies and operational backbone.

These expenditures are not merely overhead; they are essential for the smooth functioning of SPX Technologies' business model. This includes the salaries of administrative staff, the costs associated with corporate functions like legal and accounting, and the ongoing maintenance of its global business infrastructure. Without these investments, the company could not effectively manage its operations, innovate, or reach its customer base across various industries.

Distribution and Logistics Costs

SPX Technologies manages significant distribution and logistics costs due to its global operational footprint. These expenses are critical for ensuring their engineered products and technologies reach customers efficiently and reliably across various international markets.

Key components of these costs include international freight charges, which can fluctuate with fuel prices and shipping demand, and the upkeep of warehousing facilities strategically located to serve diverse customer bases. Effective supply chain management is also a substantial investment, encompassing inventory control, customs compliance, and transportation network optimization to minimize lead times and maintain product integrity.

For instance, in their 2023 fiscal year, SPX Technologies reported that distribution and logistics expenses were a material factor in their overall operating costs, reflecting the complexity of their global supply chain. The company continuously seeks to optimize these expenditures through technology adoption and strategic partnerships.

- Freight Costs: International shipping rates and domestic transportation for finished goods.

- Warehousing: Costs associated with storing inventory in regional distribution centers.

- Supply Chain Management: Expenses for managing suppliers, inventory, and logistics partners.

- Customs and Duties: Fees incurred for importing and exporting goods across borders.

Service, Warranty, and Aftermarket Support Costs

SPX Technologies dedicates significant resources to its Service, Warranty, and Aftermarket Support Costs, recognizing their crucial role in customer satisfaction and long-term revenue. These expenditures are essential for maintaining the reliability and performance of their installed equipment base, thereby fostering strong customer loyalty and repeat business.

These costs encompass a range of operational necessities. This includes the compensation for skilled field technicians who perform installations, maintenance, and repairs. It also covers the procurement and management of a robust inventory of spare parts to ensure timely resolution of issues. Furthermore, the infrastructure supporting these operations, such as service centers and diagnostic tools, represents a substantial investment.

- Field Technician Labor: Salaries and benefits for the technical personnel who provide on-site service and support.

- Spare Parts Inventory: Costs associated with stocking and managing the necessary components for repairs and replacements.

- Service Infrastructure: Investments in repair facilities, diagnostic equipment, and logistics for efficient service delivery.

- Warranty Provisions: Funds set aside to cover the cost of repairs or replacements under warranty agreements.

For the fiscal year 2023, SPX Technologies reported service revenues of $585.9 million. While the specific breakdown of costs within this segment isn't detailed publicly, it's understood that a significant portion of this revenue is reinvested into maintaining and enhancing the company's service capabilities to support its diverse product lines, including HVAC and detection and measurement technologies.

SPX Technologies' cost structure is heavily influenced by its significant investments in Research and Development to drive product innovation, as well as the substantial expenses associated with manufacturing and production, including raw materials and labor. Sales, General, and Administrative (SG&A) costs are also considerable, supporting its global operations and market reach.

Distribution and logistics, along with service, warranty, and aftermarket support, represent further key cost areas. These are essential for ensuring customer satisfaction and maintaining the performance of their engineered products worldwide.

In 2024, SPX Technologies' SG&A expenses were approximately $580 million, highlighting the investment in operational infrastructure and go-to-market strategies. The company's cost of sales, reflecting manufacturing, was $328.8 million in Q1 2024, up from $291.7 million in Q1 2023, indicating increased production activity and material costs.

Service revenues reached $585.9 million in 2023, with a notable portion reinvested into service capabilities to support their diverse product lines.

Revenue Streams

SPX Technologies generates substantial revenue through the sale of a diverse array of HVAC equipment. This includes critical components like cooling towers, engineered air movement solutions, and various heating products, catering to a broad spectrum of industrial and commercial needs.

The HVAC segment has consistently demonstrated robust performance, acting as a cornerstone of SPX Technologies' overall financial success. For instance, in the first quarter of 2024, SPX Technologies reported HVAC revenue of $472 million, a notable increase of 10% compared to the same period in 2023, highlighting its significant contribution to the company's top line.

SPX Technologies generates revenue by selling sophisticated detection and measurement systems. These systems are vital for maintaining critical infrastructure across many sectors.

The core offerings include tools like underground pipe and cable locators, advanced inspection equipment, and specialized communication technologies. These are essential for utilities, construction, and telecommunications companies.

For instance, SPX Technologies' detection and measurement segment is a significant contributor to its overall performance. In the first quarter of 2024, SPX Technologies reported total revenue of $429 million, with its Detection and Measurement segment playing a key role in this performance.

SPX Technologies generates a recurring and stable revenue from its aftermarket services. This includes selling replacement parts, offering maintenance contracts, and providing repair services for the equipment it has already installed.

This segment of the business model is crucial for long-term customer engagement. It ensures a consistent flow of income beyond the initial sale of products.

For instance, in the first quarter of 2024, SPX Technologies reported that its HVAC segment, which heavily relies on aftermarket services and parts, saw a significant increase in revenue, demonstrating the stability of this stream.

The aftermarket services contribute to a predictable revenue base, helping to offset potential cyclicality in new equipment sales and reinforcing customer loyalty through ongoing support.

Installation and Commissioning Services

SPX Technologies generates significant revenue by offering specialized installation and commissioning services for its sophisticated engineered products. These services are crucial for ensuring that complex systems are set up correctly and operate at peak efficiency from day one. This revenue stream reflects the value customers place on expert deployment, guaranteeing the intended performance and longevity of their investments. For instance, in the fiscal year 2023, SPX Technologies reported that its service segments, which include installation and commissioning, contributed substantially to its overall profitability, demonstrating the robust demand for these specialized offerings.

These services are particularly vital for SPX Technologies’ diverse customer base, which often operates in critical infrastructure or demanding industrial environments. Proper installation and meticulous commissioning by SPX technicians minimize operational risks and maximize the return on investment for clients. The company's expertise in this area allows for tailored solutions, addressing the unique requirements of each project and ensuring seamless integration into existing operations. This focus on quality execution solidifies customer relationships and creates opportunities for ongoing support contracts.

Key aspects of SPX Technologies' Installation and Commissioning Services revenue stream include:

- Expert Deployment: Highly trained technicians ensure precise installation according to stringent engineering standards.

- Performance Optimization: Commissioning activities fine-tune systems for maximum efficiency and reliability.

- Risk Mitigation: Professional setup reduces the likelihood of operational issues and downtime for clients.

- Customer Assurance: These services provide peace of mind and validate the performance of complex engineered solutions.

Strategic Acquisitions' Contributions

SPX Technologies is actively expanding its revenue base through strategic acquisitions. Recent additions like Ingénia and Kranze Technology Solutions are projected to boost top-line growth. These acquisitions are designed to broaden SPX's market reach and enhance its product portfolios.

The integration of Sigma & Omega, for instance, is particularly impactful. It strengthens SPX's position in key markets, contributing to diversification. This strategic move is expected to drive substantial revenue increases across both the HVAC and Detection & Measurement business segments.

- Ingénia and Kranze Technology Solutions: These acquisitions are anticipated to deliver significant revenue contributions, expanding SPX's footprint.

- Market Presence Expansion: The company aims to leverage these new entities to reach a wider customer base.

- Product Offering Enhancement: New technologies and solutions from acquired companies will enrich SPX's existing product lines.

- Segment Growth: Revenue streams will be bolstered in both the HVAC and Detection & Measurement divisions.

SPX Technologies also derives revenue from specialized installation and commissioning services, ensuring optimal performance of its engineered products and creating opportunities for ongoing support contracts.

The company's strategic acquisitions, such as Ingénia and Kranze Technology Solutions, are key to expanding its revenue base and enhancing its product portfolios, contributing to growth across its core segments.

SPX Technologies' revenue streams are well-diversified, encompassing sales of HVAC equipment, detection and measurement systems, recurring aftermarket services, installation and commissioning, and contributions from strategic acquisitions, showcasing a robust business model.

| Revenue Segment | Q1 2024 Revenue (Millions USD) | Year-over-Year Growth |

|---|---|---|

| HVAC | 472 | 10% |

| Detection & Measurement | Approximately 200-250 (estimated from total revenue of $429M, assuming HVAC is the larger segment) | (Data not explicitly provided for this segment's YoY growth in Q1 2024) |

Business Model Canvas Data Sources

The SPX Technologies Business Model Canvas is informed by a blend of internal financial reports, market research on industry trends, and customer feedback to ensure a comprehensive view. These diverse data streams provide the foundation for each strategic component.