SPX Technologies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPX Technologies Bundle

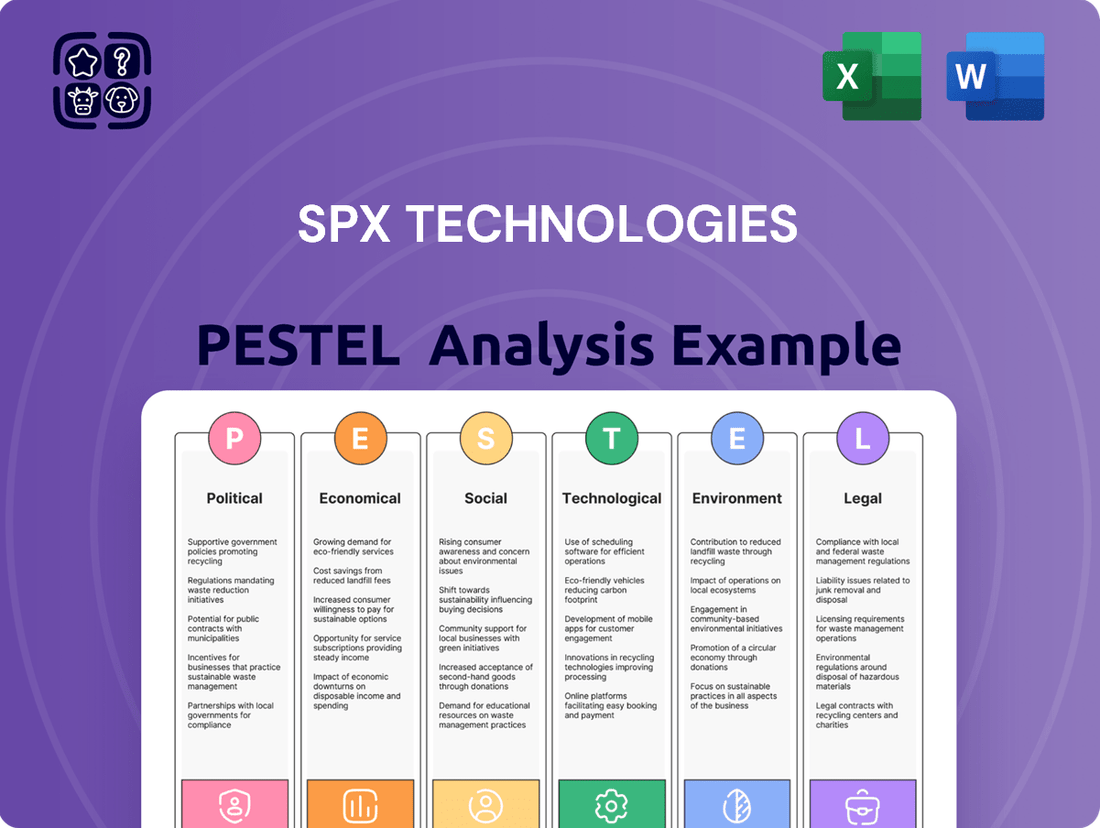

Navigate the complex external environment of SPX Technologies with our meticulously crafted PESTLE analysis. Understand how political shifts, economic fluctuations, technological advancements, social trends, environmental regulations, and legal frameworks are poised to impact the company's trajectory. This comprehensive report offers invaluable insights for strategic planning and risk assessment. Unlock actionable intelligence to sharpen your competitive edge and inform your investment decisions. Download the full PESTLE analysis now and gain a strategic advantage.

Political factors

Global governments are significantly boosting infrastructure spending, a trend directly benefiting SPX Technologies. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in late 2021, allocates over $1 trillion towards improving roads, bridges, power grids, and water systems, much of which will involve equipment and technologies SPX provides. This increased investment is particularly strong in power generation and industrial processing sectors, core areas for SPX’s highly engineered solutions.

These substantial government outlays translate into direct demand for SPX Technologies' specialized equipment. As nations prioritize modernizing aging infrastructure and constructing new facilities, especially in rapidly developing economies, SPX is well-positioned to capitalize on these growth opportunities. For example, many European countries are accelerating investments in renewable energy infrastructure, requiring advanced cooling and processing technologies where SPX excels.

Stricter energy efficiency regulations, particularly from bodies like the U.S. Department of Energy and the EPA, are increasingly influencing the HVAC and industrial process sectors. These mandates, such as proposed updates to energy conservation standards for certain commercial and residential equipment, compel manufacturers to innovate. For example, the DOE's ENERGY STAR program continues to set higher benchmarks for energy performance, driving demand for more advanced and efficient technologies.

SPX Technologies, with its focus on engineered solutions, is well-positioned to benefit from these regulatory shifts. The company's offerings in cooling towers, heat exchangers, and HVAC components can be designed to meet or exceed these evolving efficiency standards. This allows SPX to provide customers with products that not only reduce operational costs through lower energy consumption but also ensure compliance with environmental mandates.

The ongoing transition to refrigerants with lower global warming potential (GWP) presents another significant market opportunity. Regulations phasing down high-GWP refrigerants are spurring the development and adoption of new HVAC systems that utilize more environmentally friendly alternatives. SPX's expertise in thermal management and fluid handling systems allows it to adapt its product lines to accommodate these new refrigerant technologies, creating a competitive advantage.

Global trade policies, including tariffs and trade agreements, significantly influence SPX Technologies' international supply chains and market access. For instance, shifts in import/export duties or the imposition of new trade barriers can directly affect the cost of raw materials and the competitive pricing of SPX's products in various global markets.

With operations spanning 15 countries, SPX Technologies is inherently exposed to these evolving geopolitical trade dynamics. Changes in tariffs, such as those seen in recent years impacting specific industrial goods, could alter the landed cost of components or finished products, impacting profitability and market share.

For example, the US-China trade tensions and the implementation of tariffs in 2018-2019 highlighted the vulnerability of global manufacturing to such policy changes, affecting companies with extensive international sourcing and sales networks like SPX. The potential for further trade disputes or the renegotiation of trade pacts in 2024 and 2025 necessitates ongoing vigilance and strategic adaptation for SPX.

Geopolitical Stability

Geopolitical stability in SPX Technologies' key operating regions and customer markets is a crucial factor influencing business continuity and investment decisions. Political unrest or conflicts can significantly disrupt global supply chains, impacting everything from raw material sourcing to product delivery. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continued to affect energy prices and logistics networks, which can indirectly impact SPX's operational costs and project execution timelines.

The demand for SPX Technologies' products and services can also be directly affected by regional instability. Areas experiencing conflict or significant political upheaval often see a reduction in infrastructure spending and industrial activity, which are core markets for SPX. While SPX Technologies' diversified geographic footprint, spanning North America, Europe, and Asia, helps to spread these risks, significant global instability remains a pertinent consideration for strategic planning.

The company's exposure to specific regions means that localized political events can have a tangible effect. For example, changes in trade policies or regulatory environments stemming from political shifts in major customer nations can influence market access and profitability.

Key considerations for SPX Technologies regarding geopolitical stability include:

- Supply Chain Resilience: Monitoring and mitigating disruptions caused by regional conflicts or political tensions in sourcing and manufacturing hubs.

- Market Demand Fluctuations: Assessing how geopolitical events impact economic activity and infrastructure investment in key customer markets.

- Operational Risk Management: Implementing strategies to ensure business continuity and protect assets in regions prone to political instability.

- Regulatory and Trade Environment: Adapting to evolving trade agreements and regulatory frameworks influenced by geopolitical relationships.

Government Incentives for Green Technologies

Government incentives play a crucial role in driving the adoption of green technologies, directly benefiting companies like SPX Technologies. The Inflation Reduction Act (IRA) in the US, for instance, offers significant tax credits and subsidies for energy-efficient building materials and sustainable technologies. These financial boosts can make SPX's energy-saving HVAC systems and measurement solutions more attractive to a wider customer base.

These incentives are designed to accelerate the market's transition towards sustainability. For SPX Technologies, this translates into increased demand for their environmentally conscious products. The IRA’s provisions, like the 30% investment tax credit for solar energy and energy storage, indirectly support the broader green infrastructure that utilizes SPX's advanced climate control and monitoring equipment.

- IRA Investment Tax Credit: A 30% credit for investments in clean energy technologies, including solar and energy storage, which SPX's solutions can complement.

- Energy Efficient Home Improvement Credit: Provides credits for homeowners to make energy-saving upgrades, boosting demand for efficient HVAC systems.

- Commercial Clean Energy Projects: Incentives for businesses to adopt renewable energy and energy efficiency measures, creating opportunities for SPX's industrial solutions.

Government infrastructure spending continues to be a significant driver for SPX Technologies, with the U.S. Infrastructure Investment and Jobs Act alone allocating over $1 trillion. This trend is mirrored globally, with many European nations increasing investments in renewable energy infrastructure. These substantial outlays directly translate into demand for SPX's specialized equipment, especially in power generation and industrial processing sectors.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing SPX Technologies, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and data-driven perspectives to equip stakeholders in identifying strategic opportunities and mitigating potential risks.

The SPX Technologies PESTLE Analysis provides a clear, summarized version of external factors, acting as a pain point reliever by offering easy referencing during meetings or presentations.

Economic factors

Global economic growth directly impacts SPX Technologies by shaping demand for its industrial and infrastructure equipment. During periods of robust expansion, such as the projected 3.1% global GDP growth for 2024 according to the IMF, companies tend to increase capital expenditures. This uptick in investment fuels sales for SPX's HVAC solutions as businesses expand or upgrade facilities, and boosts its detection and measurement segment as infrastructure projects move forward.

Conversely, economic downturns present headwinds. A slowdown in global growth, perhaps a dip to 2.6% as the IMF forecast for 2025, can lead to reduced investment in new projects. This directly affects SPX Technologies by potentially decreasing the volume of orders for its equipment, as clients delay or scale back their capital spending plans in response to economic uncertainty.

The construction industry, a key driver for SPX Technologies, is showing strong growth. In 2024, the U.S. construction spending reached an estimated $2.1 trillion, with commercial and industrial sectors seeing significant increases. This expansion fuels demand for SPX's HVAC and detection solutions, as new projects require robust climate control and safety systems.

Retrofitting existing buildings for enhanced energy efficiency is another major trend positively impacting SPX. With rising energy costs and a focus on sustainability, many older commercial properties are undergoing upgrades. This presents a substantial market for SPX's energy-efficient HVAC components and advanced detection technologies, expected to contribute to a growing segment of the market through 2025.

SPX Technologies, like many industrial manufacturers, faces significant impact from fluctuating raw material and component costs. For instance, the prices of key metals such as copper and aluminum, vital for electrical and structural components, saw considerable volatility through 2024. Global demand surges and geopolitical events can quickly drive up these input expenses.

In 2024, the semiconductor shortage, while easing compared to prior years, continued to affect the availability and cost of critical electronic components used in SPX's advanced systems. This can directly increase production expenses, potentially squeezing profit margins if these costs cannot be fully recouped through pricing adjustments.

Inflationary pressures observed in late 2023 and continuing into 2024 have also contributed to higher overall input costs for SPX. The ability to pass these increased costs onto customers in competitive markets remains a key challenge, directly influencing the company's profitability for the 2024-2025 period.

Interest Rates and Access to Capital

Changes in interest rates directly impact SPX Technologies by altering the cost of borrowing for both the company and its clientele. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate, signaling a period of sustained borrowing costs for businesses and consumers. Higher rates can make large infrastructure projects and industrial expansions less appealing due to increased financing expenses, potentially dampening demand for SPX Technologies' specialized equipment and engineered solutions.

Access to affordable capital is a critical determinant for the viability of significant investments and operational expansions. In 2024, while inflation showed signs of moderating, the cost of capital remained a key consideration for many of SPX Technologies' customers in sectors like construction, energy, and infrastructure. Companies relying on debt financing for major capital expenditures may scale back or delay projects if borrowing becomes prohibitively expensive.

- Interest Rate Environment: The Federal Funds Rate, a key benchmark, remained in the 5.25%-5.50% range through mid-2024, impacting the cost of capital for businesses.

- Impact on Project Financing: Higher borrowing costs can reduce the number of economically feasible infrastructure and industrial projects, affecting demand for SPX Technologies' offerings.

- Customer Investment Decisions: Affordability of capital directly influences customer willingness to invest in new equipment or undertake expansion projects, a crucial factor for SPX Technologies' revenue streams.

- Global Capital Markets: Fluctuations in global interest rates and credit availability, influenced by central bank policies worldwide, also play a role in the demand for SPX's products and services.

Currency Exchange Rate Fluctuations

SPX Technologies, a global entity present in 15 countries, faces significant exposure to currency exchange rate fluctuations. These shifts directly influence the company's reported financial results as foreign earnings are translated into its primary reporting currency.

For instance, a strengthening US dollar against other currencies would decrease the translated value of SPX Technologies' foreign revenues and profits. Conversely, a weakening dollar would have the opposite effect, potentially boosting reported figures. This dynamic can impact investor sentiment and the company's overall financial health.

- Impact on Revenue: In 2024, many multinational corporations reported challenges due to currency headwinds; for example, companies with substantial European operations saw their reported USD revenues diminish as the Euro weakened against the dollar throughout parts of the year.

- Profitability Margins: Fluctuations can compress profit margins if costs incurred in a stronger currency outpace revenues generated in weaker ones.

- Investor Perception: Volatile currency movements can create uncertainty, potentially leading to a more cautious view from investors regarding the company's earnings stability.

- Hedging Strategies: SPX Technologies likely employs currency hedging strategies, such as forward contracts, to mitigate some of this risk, though these also carry costs and complexities.

SPX Technologies' performance is closely tied to the health of the global economy. The International Monetary Fund projected global GDP growth of 3.1% for 2024, a figure that generally supports increased capital expenditure by businesses. This positive economic outlook translates to higher demand for SPX's industrial and infrastructure solutions, from HVAC systems in expanding commercial spaces to detection and measurement tools for new infrastructure development.

However, economic forecasts for 2025 suggest a potential slowdown, with the IMF anticipating 2.6% global GDP growth. Such a deceleration could lead to reduced investment in capital projects, impacting SPX Technologies by delaying or scaling back customer orders for its equipment.

The construction sector is a significant market for SPX, and its continued expansion in 2024, with U.S. construction spending reaching an estimated $2.1 trillion, is a strong positive. This growth, particularly in commercial and industrial building, directly boosts demand for SPX's HVAC and detection technologies needed for new builds and upgrades.

The trend of retrofitting older buildings for better energy efficiency also presents a substantial opportunity for SPX. With energy costs remaining a concern and sustainability efforts gaining momentum, many building owners are investing in upgrades. This creates a growing market for SPX's energy-efficient HVAC components and advanced monitoring systems through 2025.

Full Version Awaits

SPX Technologies PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details a comprehensive PESTLE analysis for SPX Technologies, covering Political, Economic, Social, Technological, Legal, and Environmental factors that could impact the company's operations and strategic decisions. This thorough examination provides valuable insights for understanding the external landscape SPX Technologies navigates.

Sociological factors

There's a growing awareness and concern about the air we breathe indoors, in our homes, offices, and factories. This heightened focus on Indoor Air Quality (IAQ) is a significant sociological shift. People are increasingly demanding better air, driving the market for advanced ventilation and air purification systems.

SPX Technologies, through its HVAC segment, is well-positioned to capitalize on this trend. Their product lines can offer solutions specifically designed to enhance air filtration and contribute to healthier indoor environments, directly addressing this societal demand.

This concern for IAQ has been significantly amplified by recent global health events. For instance, studies in late 2023 and early 2024 highlighted the correlation between poor IAQ and increased transmission of airborne pathogens, further solidifying public and governmental interest in improving indoor air.

Global demographic trends show a continued push towards urbanization, with the UN projecting that 68% of the world's population will live in urban areas by 2050. This surge in city living directly fuels demand for construction, creating significant opportunities for companies like SPX Technologies that supply essential infrastructure components such as HVAC systems and detection and measurement equipment.

Population growth, particularly in developing nations, further amplifies this demand. For instance, countries in Sub-Saharan Africa are expected to experience substantial population increases in the coming decades, necessitating widespread development of residential, commercial, and industrial facilities.

This increasing urbanization and population growth translate into a heightened need for reliable building systems. SPX Technologies, through its HVAC solutions and detection and measurement segments, is well-positioned to benefit as more infrastructure is built and existing systems require upgrades to meet the demands of a growing urban populace.

The availability of a skilled workforce for manufacturing, installing, and servicing complex engineered equipment is a crucial sociological factor for SPX Technologies. A scarcity of trained technicians or engineers can directly hinder the company's capacity to execute projects efficiently and uphold high service quality standards. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 4% growth in industrial machinery mechanics, installation, and repairers, highlighting a competitive landscape for specialized talent.

Consequently, SPX Technologies must prioritize robust training programs and effective talent retention strategies to mitigate potential workforce shortages. Investing in apprenticeships and ongoing professional development can ensure a pipeline of qualified personnel capable of managing advanced manufacturing processes and providing expert field service. The company's success in securing and maintaining a skilled labor pool will be a significant determinant of its operational effectiveness and market competitiveness in the coming years.

Consumer and Industry Demand for Sustainability

Societal expectations are increasingly prioritizing sustainability, driving both consumer and business choices. This trend directly impacts industries like HVAC, where energy efficiency and reduced carbon footprints are becoming paramount. SPX Technologies, with its focus on sustainable solutions, is well-positioned to capitalize on this growing demand.

Consumers are actively seeking out environmentally friendly products, with a significant portion willing to pay a premium for them. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability when making purchase decisions. This shift influences purchasing behaviors towards companies demonstrating clear environmental commitments, aligning with SPX Technologies' offerings in areas like advanced climate control and water management systems.

- Rising Consumer Demand: A majority of consumers now factor sustainability into their buying habits, favoring energy-efficient and low-carbon options.

- Industry Alignment: SPX Technologies' portfolio, including energy-saving HVAC components and smart measurement technologies, directly addresses this growing market need.

- Corporate Responsibility: Businesses are also under pressure to adopt sustainable practices, creating a dual market opportunity for SPX.

- Market Growth: The global market for green building technologies, including efficient HVAC systems, is projected to reach hundreds of billions of dollars by 2025, showcasing the substantial economic incentive for sustainable solutions.

Health and Safety Standards Awareness

Societal emphasis on health and safety is a significant driver for SPX Technologies. As awareness grows, so does the demand for sophisticated monitoring and measurement tools, particularly in industrial and commercial settings. This trend directly benefits SPX's offerings designed to ensure safety in critical applications, aligning with evolving public and regulatory expectations.

The push for safer workplaces is evident in global trends. For instance, in 2024, workplace safety regulations continued to tighten across major economies, with a particular focus on areas like air quality monitoring and equipment integrity. SPX Technologies' portfolio, which includes solutions for environmental monitoring and industrial process control, is well-positioned to capitalize on this heightened focus on safety compliance.

SPX Technologies' involvement in sectors like food and beverage processing, where hygiene and safety are paramount, highlights this sociological factor. For example, the global food safety testing market was projected to reach over $25 billion by 2025, indicating a substantial societal and economic commitment to ensuring product safety, a domain where SPX's analytical instruments play a crucial role.

- Increased regulatory scrutiny on workplace safety is compelling businesses to invest in advanced monitoring systems, directly benefiting SPX Technologies.

- Consumer demand for safe products, particularly in food and beverage, drives the need for precise measurement and detection technologies supplied by SPX.

- Worker advocacy groups continue to push for better safety standards, influencing corporate behavior and procurement decisions favoring companies like SPX with relevant solutions.

Societal concerns regarding health and well-being continue to grow, directly impacting demand for improved indoor environments. This heightened awareness of indoor air quality (IAQ) and the desire for safer, cleaner spaces are key sociological drivers for SPX Technologies' HVAC and detection and measurement segments. For example, studies in late 2023 and early 2024 reinforced the link between poor IAQ and health issues, further solidifying public interest.

The global trend towards urbanization, with 68% of the world's population expected to live in urban areas by 2050, fuels construction and infrastructure development. This demographic shift, coupled with population growth in developing nations, creates a sustained need for building systems like those provided by SPX Technologies, from HVAC to critical monitoring equipment.

Sustainability is no longer a niche concern but a mainstream societal expectation, influencing consumer and business purchasing decisions. With over 60% of consumers in a 2024 survey considering sustainability, SPX Technologies' focus on energy-efficient and environmentally conscious solutions positions it favorably within a market increasingly valuing green technologies.

The increasing emphasis on workplace safety and product integrity, driven by both consumer demand and regulatory pressures, directly benefits SPX Technologies. Sectors like food and beverage, where safety is paramount, underscore this trend; the food safety testing market was projected to exceed $25 billion by 2025, highlighting the critical role of precise measurement and detection instruments.

| Sociological Factor | Impact on SPX Technologies | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Growing IAQ Awareness | Increased demand for HVAC and air purification solutions. | Studies in late 2023/early 2024 linked poor IAQ to pathogen transmission. |

| Urbanization & Population Growth | Sustained demand for building infrastructure and systems. | UN projects 68% urban population by 2050; growth in developing nations. |

| Prioritization of Sustainability | Market preference for energy-efficient and eco-friendly products. | Over 60% of consumers consider sustainability in purchases (2024 survey). |

| Emphasis on Health & Safety | Demand for advanced monitoring and measurement in critical sectors. | Food safety testing market projected over $25 billion by 2025. |

Technological factors

Technological advancements are significantly reshaping the HVAC sector. The introduction of stricter energy efficiency standards, like SEER2 and HSPF2, is pushing manufacturers towards developing more sophisticated systems. SPX Technologies, to remain competitive, needs to prioritize research and development, focusing on creating next-generation HVAC solutions that offer superior energy savings and enhanced connectivity.

The integration of smart controls and the Internet of Things (IoT) is a critical trend. These technologies enable remote monitoring, predictive maintenance, and optimized performance, leading to reduced operational costs for end-users. SPX Technologies should leverage these innovations to offer connected HVAC systems that provide greater value and anticipate potential issues before they arise.

Technological progress in sensor development, data analytics, and automation is significantly enhancing the capabilities of detection and measurement equipment. For instance, advancements in IoT sensors allow for real-time, granular data collection in industrial settings, improving efficiency and safety. The global industrial sensors market was valued at approximately $67.1 billion in 2023 and is projected to reach $103.6 billion by 2030, indicating substantial growth driven by these innovations.

SPX Technologies can leverage these advancements to offer more precise, reliable, and integrated solutions. By incorporating sophisticated analytics, their offerings can provide deeper insights into process performance, enabling predictive maintenance and optimizing operational outputs. This integration of advanced technologies allows SPX to address complex challenges in sectors like industrial processing and oil & gas more effectively.

The ongoing wave of digitalization and the advancement of Industry 4.0 principles are fundamentally reshaping SPX Technologies' operational landscape and market opportunities. This means that smart factories, cloud connectivity, and AI are becoming increasingly crucial. For SPX, this translates into integrating their core equipment with these advanced systems.

By doing so, SPX Technologies can unlock significant value. This integration allows for enhanced performance optimization, enabling real-time adjustments and predictive maintenance. Furthermore, it facilitates remote monitoring capabilities, which are highly sought after by customers seeking greater control and efficiency in their operations.

The market is actively seeking solutions that leverage these technological shifts. For instance, the global industrial automation market was projected to reach over $200 billion in 2023 and is expected to continue robust growth through 2025. SPX's ability to offer smart, connected equipment positions them to capitalize on this expanding demand.

Emergence of New Refrigerants

The HVAC industry is undergoing a significant shift with the phase-out of refrigerants that have a high Global Warming Potential (GWP), like R-410A. This mandates a transition to newer, more environmentally friendly alternatives, such as A2L refrigerants like R-454B and R-32. SPX Technologies must adapt its product designs and manufacturing processes to accommodate these new refrigerants, ensuring compliance with evolving environmental regulations and maintaining market competitiveness.

This transition presents both challenges and opportunities. For instance, the U.S. Environmental Protection Agency (EPA) finalized a rule in 2024 to cut HFCs by 40% by 2028, impacting the availability and cost of older refrigerants. SPX Technologies' ability to innovate and integrate these low-GWP refrigerants into its HVAC solutions will be crucial for its future success.

- Regulatory Compliance: SPX Technologies must ensure all new and existing HVAC products meet or exceed the GWP limits set by regulations like the AIM Act in the United States.

- Product Development: Investment in research and development is necessary to redesign equipment, including compressors, seals, and leak detection systems, to safely and efficiently utilize A2L refrigerants.

- Supply Chain Adjustments: Securing a reliable supply of new refrigerants and ensuring compatibility with manufacturing equipment are key operational considerations.

- Market Positioning: Companies that proactively adopt and promote low-GWP solutions can gain a competitive edge by appealing to environmentally conscious consumers and businesses.

Innovation in Sustainable Materials and Manufacturing

The push for greener construction methods is accelerating innovation in sustainable materials. We're seeing a significant rise in bio-based materials, like cross-laminated timber and mycelium insulation, alongside advanced insulation technologies. For example, the global market for sustainable building materials was valued at over $250 billion in 2023 and is projected to grow substantially in the coming years, driven by regulatory support and consumer demand for eco-friendly options.

SPX Technologies, with its focus on HVAC and building solutions, is well-positioned to capitalize on this trend. Integrating these next-generation materials into their product design or adapting their HVAC systems for buildings utilizing them can offer significant competitive advantages. Consider the potential for improved energy efficiency and reduced environmental impact, aligning with increasing corporate sustainability goals and government mandates, such as stricter building codes aimed at carbon reduction.

The adoption of these materials directly impacts the construction and HVAC sectors by influencing building design and performance requirements. For SPX Technologies, this presents opportunities:

- Product Development: Designing HVAC components that seamlessly integrate with or complement sustainable building materials, such as bio-based insulation or advanced façade systems.

- Market Adaptation: Modifying existing solutions to meet the unique performance characteristics and installation methods of new sustainable materials.

- Partnerships: Collaborating with material manufacturers to co-develop integrated building systems that maximize energy efficiency and sustainability.

- Research & Development: Investing in R&D to understand the thermal properties and air sealing capabilities of emerging sustainable materials to inform future product innovation.

The increasing sophistication of building management systems, driven by IoT and AI, allows for granular control over HVAC operations. SPX Technologies can integrate advanced analytics into its products, offering predictive maintenance and real-time performance optimization. The global industrial automation market, valued at over $200 billion in 2023, highlights the demand for these smart solutions.

Legal factors

The U.S. Environmental Protection Agency (EPA) sets critical environmental regulations that directly impact SPX Technologies' operations. For instance, the mandated phase-out of R-410A refrigerant by 2025 significantly influences the company's HVAC product development and manufacturing processes, requiring a shift to alternative, lower global warming potential (GWP) refrigerants.

Furthermore, the EPA's increasingly stringent minimum energy efficiency standards for HVAC equipment necessitate continuous innovation and investment in more efficient technologies. SPX Technologies must ensure its product lines comply with these evolving standards to remain competitive and legally operational in the U.S. market.

Compliance with these EPA regulations is not optional; it's a fundamental requirement that drives SPX's research and development efforts and dictates the lifecycle management of its product portfolio. Failure to adapt can lead to significant penalties and market exclusion.

The EU's revised F-Gas Regulation (EU 2024/573), effective from early 2024, significantly tightens restrictions on the use of fluorinated greenhouse gases in refrigeration, air conditioning, and heat pumps. This means SPX Technologies must accelerate the transition of its HVAC-R products to lower Global Warming Potential (GWP) refrigerants, impacting product development cycles and market competitiveness in Europe.

For instance, the regulation mandates a drastic phase-down of HFCs, with a projected reduction of 48% by 2027 compared to 2015 levels, impacting SPX's current product lines. Compliance necessitates substantial investment in research and development for alternative refrigerant technologies and product redesigns.

Beyond the EU, similar environmental regulations are emerging globally, such as potential carbon pricing mechanisms and refrigerant bans in other major markets. SPX Technologies needs to monitor and adapt to these evolving international legal frameworks to maintain a broad market presence and avoid compliance penalties.

SPX Technologies' commitment to adhering to stringent national and international product safety and quality standards, such as UL, CE, and ISO certifications, is paramount. Failure to meet these benchmarks, which are constantly updated, can result in costly product recalls, significant legal liabilities, and severe damage to the company's reputation. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 300,000 product-related injuries requiring emergency room visits, underscoring the critical nature of these standards.

International Trade Laws and Compliance

SPX Technologies navigates a complex web of international trade laws, including export controls, sanctions, and anti-corruption regulations, which are critical for its global operations. Failure to comply can lead to significant financial penalties, damage to reputation, and even the suspension of international business activities. For example, in 2023, the US Department of Commerce’s Bureau of Industry and Security (BIS) continued to enforce stringent export controls, impacting technology and manufacturing sectors.

Adherence to these regulations is not merely a legal obligation but a strategic imperative for maintaining market access and operational continuity. SPX Technologies must remain vigilant regarding evolving sanctions regimes, such as those imposed by the US, EU, and UK, which can affect trade with specific countries or entities.

- Export Control Compliance: SPX Technologies must ensure all its products and technologies adhere to regulations like the Export Administration Regulations (EAR) in the US, preventing unauthorized transfer to restricted countries or end-users.

- Sanctions Screening: Robust processes are needed to screen customers, partners, and transactions against global sanctions lists, including those from OFAC (US), the EU, and the UN.

- Anti-Corruption Laws: Compliance with laws such as the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act is paramount to prevent illicit payments and maintain ethical business practices worldwide.

- Trade Agreements and Tariffs: Understanding and adapting to changes in international trade agreements and tariff structures, such as those impacting goods traded between major economic blocs, is crucial for cost management and supply chain stability.

Intellectual Property Rights and Patents

Protecting its intellectual property (IP) through patents and trademarks is a significant legal factor for SPX Technologies, especially given its focus on highly engineered products. These legal protections are fundamental to maintaining its competitive advantage in the market. For instance, as of early 2024, SPX Technologies held a robust portfolio of patents covering various aspects of its thermal equipment, flow technology, and detection and measurement products, ensuring that its innovative designs are legally safeguarded against infringement.

The legal frameworks governing IP rights are essential for SPX Technologies to prevent the unauthorized use of its proprietary technologies. This allows the company to secure its innovations and reap the benefits of its research and development investments. Such legal safeguards are critical in industries where technological advancement is a primary driver of success, enabling SPX to differentiate its offerings and command premium pricing.

SPX Technologies actively manages its patent portfolio, strategically filing new patents and defending existing ones to deter competitors. This legal diligence is vital, as demonstrated by the company's consistent investment in R&D, which directly fuels the creation of new IP. In 2023, SPX Technologies reported significant R&D expenditures, underscoring the importance of patent protection for these innovations.

The company's ability to leverage its IP legally allows it to enter into licensing agreements or to prevent market saturation by competitors using similar technologies. This legal control over its innovations directly impacts SPX Technologies' market position and profitability, ensuring that its technological lead translates into sustained commercial success.

SPX Technologies faces stringent environmental regulations globally, impacting its product design and operational efficiency. The EU's F-Gas Regulation (EU 2024/573) and the EPA's phase-out of R-410A by 2025 mandate a swift transition to lower Global Warming Potential refrigerants, requiring significant R&D investment. These evolving standards necessitate continuous product innovation to ensure market compliance and competitiveness.

Environmental factors

Global initiatives to address climate change, like the Paris Agreement's aim to limit warming to 1.5°C and various nations setting net-zero targets by 2050, are significantly influencing market demand. This creates a strong push for products that reduce energy consumption and carbon emissions, directly benefiting companies like SPX Technologies that offer HVAC and industrial cooling solutions designed for efficiency.

SPX Technologies is well-positioned to capitalize on these trends by highlighting its sustainable product portfolio. For instance, their cooling towers and heat exchangers are engineered to optimize water and energy usage, aligning with stricter environmental regulations and corporate sustainability mandates that are becoming increasingly prevalent in 2024 and 2025.

The company's investment in advanced technologies for its cooling solutions, such as variable speed drives and improved heat transfer surfaces, directly supports customer decarbonization efforts. This strategic focus is crucial as industries worldwide, particularly in sectors like power generation and manufacturing, are under pressure to reduce their environmental footprint, with many aiming for substantial emissions cuts in the coming years.

Growing global awareness of resource scarcity is significantly impacting manufacturing, pushing companies like SPX Technologies towards more sustainable sourcing. This trend means a greater emphasis on using recycled content and renewable materials in production processes.

For instance, the demand for critical minerals used in advanced manufacturing, such as those found in renewable energy components, is projected to surge. Copper demand could double by 2030, and lithium demand could increase by over 40 times, according to the International Energy Agency's 2024 outlook, directly affecting supply chains for companies like SPX Technologies.

SPX Technologies will likely face increased pressure from stakeholders, including investors and consumers, to demonstrate ethical and environmentally responsible supply chain management. This involves ensuring fair labor practices and minimizing the environmental footprint associated with raw material extraction and processing.

The global push towards waste reduction and circular economy principles is reshaping product design. Companies are increasingly expected to create items that are durable, easily repaired, and recyclable, minimizing their environmental footprint. This trend directly influences how businesses like SPX Technologies approach innovation and manufacturing.

SPX Technologies can leverage this environmental shift by focusing on product lifecycle management. Developing solutions that extend product life, incorporate recycled materials, and are designed for disassembly and recycling can create a competitive advantage. For instance, advancements in industrial equipment that reduce energy consumption and operational waste align with circular economy goals.

The World Economic Forum reported in 2024 that the circular economy could generate $4.5 trillion in economic gains by 2030. SPX Technologies' commitment to sustainable practices, such as offering remanufacturing services for its HVAC and detection and measurement equipment, directly taps into this growing market. This approach not only addresses environmental concerns but also appeals to a customer base increasingly prioritizing sustainability in their purchasing decisions.

By integrating circular economy principles, SPX Technologies can enhance its brand reputation and unlock new revenue streams through service-based models and the sale of refurbished or remanufactured products. This strategic alignment with environmental imperatives is crucial for long-term resilience and growth in the evolving industrial landscape.

Water Conservation and Management

Water conservation is a critical environmental factor for SPX Technologies, particularly impacting its cooling and industrial process solutions. As global water scarcity intensifies, companies offering technologies that reduce water usage are poised for significant growth. For instance, SPX Cooling Technologies' solutions, such as its Marley cooling towers, are designed with water efficiency in mind, which is increasingly valued by clients operating in water-stressed areas. In 2024, many regions continued to face drought conditions, driving demand for advanced water management systems.

SPX Technologies can leverage its expertise in water-efficient technologies to capture market share. Their commitment to developing solutions that minimize water consumption offers a distinct competitive advantage. This focus aligns with growing regulatory pressures and corporate sustainability goals worldwide. For example, by 2025, it's projected that a substantial percentage of the global population will reside in water-stressed regions, underscoring the long-term relevance of SPX's water-saving innovations.

- Water Scarcity Impact: Increasing global water stress, particularly in 2024 and projected for 2025, directly influences demand for water-efficient industrial solutions.

- Competitive Advantage: SPX Technologies' ability to offer reduced water consumption in its cooling and process technologies provides a key differentiator in the market.

- Market Demand: Corporate sustainability initiatives and stricter water usage regulations are driving a higher demand for advanced water management systems.

- Technological Innovation: Continued investment in water-saving technologies is crucial for SPX to maintain its competitive edge and meet evolving client needs.

Corporate Sustainability Reporting and ESG Pressures

SPX Technologies faces growing demands for detailed ESG reporting from investors, regulators, and the public. This pressure is intensifying, with a significant portion of institutional investors now considering ESG factors in their decision-making processes, a trend that has only accelerated in 2024 and is projected to continue through 2025.

To maintain a positive reputation and strong investor relations, transparent sustainability reports are crucial. These reports need to clearly demonstrate environmental progress, such as a reduction in greenhouse gas intensity. For instance, many industrial companies are setting targets to reduce emissions by 30-50% by 2030, and SPX Technologies will likely need to align with similar benchmarks.

- Investor Scrutiny: A growing number of asset managers are integrating ESG criteria, with BlackRock CEO Larry Fink emphasizing its importance in 2024.

- Regulatory Landscape: Evolving disclosure requirements, like those proposed by the SEC or EU equivalents, necessitate robust ESG data collection and reporting.

- Public Perception: Consumers and stakeholders increasingly favor companies with strong environmental track records, impacting brand loyalty.

- Data Authenticity: The demand is for verifiable data, pushing companies towards standardized reporting frameworks such as GRI or SASB.

The increasing emphasis on sustainability and the circular economy presents a dual opportunity and challenge for SPX Technologies. Companies are now expected to design products for longevity, repairability, and recyclability, influencing manufacturing and innovation strategies. For instance, the global circular economy could generate $4.5 trillion in economic gains by 2030, according to the World Economic Forum in 2024, making SPX's remanufacturing services a strategic advantage.

PESTLE Analysis Data Sources

Our SPX Technologies PESTLE Analysis is built on comprehensive data from government agencies, reputable financial institutions, and leading market research firms. We incorporate economic indicators, regulatory updates, technological advancements, and socio-cultural trends to provide a holistic view.