SPX Technologies Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPX Technologies Bundle

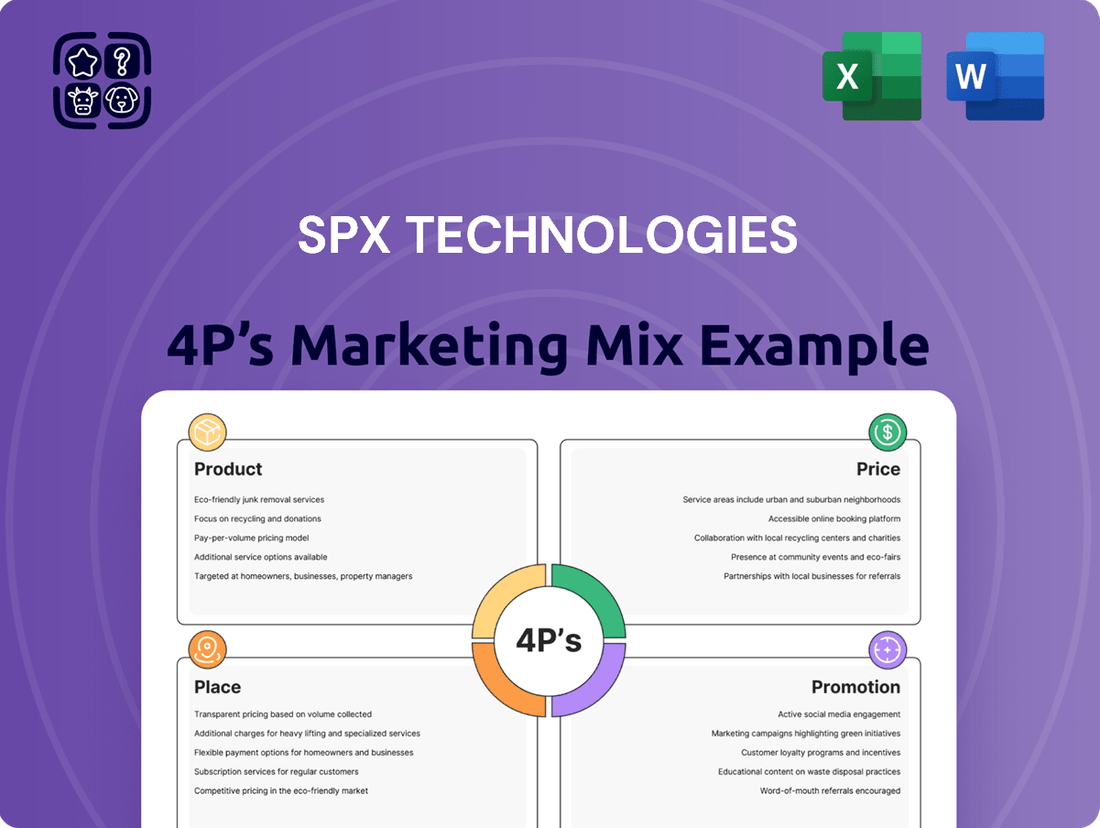

Discover how SPX Technologies masterfully leverages its Product, Price, Place, and Promotion strategies to maintain its market leadership. This analysis delves into their innovative product portfolio, competitive pricing models, strategic distribution channels, and impactful promotional campaigns. Understanding these elements is crucial for anyone looking to replicate their success or benchmark against industry leaders.

Go beyond the basics and gain access to an in-depth, ready-made Marketing Mix Analysis covering SPX Technologies' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants seeking actionable strategic insights.

Explore how this brand’s product strategy, pricing decisions, distribution methods, and promotional tactics work in synergy to drive its impressive market performance. Get the full analysis in an editable, presentation-ready format to tailor it to your needs.

Save hours of valuable research and analysis time. This pre-written Marketing Mix report for SPX Technologies provides actionable insights, real-world examples, and structured thinking – perfect for reports, benchmarking, or your next business planning session.

Gain instant access to a comprehensive 4Ps analysis of SPX Technologies. Professionally written, fully editable, and meticulously formatted for both business and academic use, it’s your shortcut to strategic understanding.

The full report offers a detailed view into SPX Technologies’ market positioning, pricing architecture, channel strategy, and communication mix. Learn what truly makes their marketing effective and how you can apply those principles yourself.

This full 4Ps Marketing Mix Analysis provides a deep dive into how SPX Technologies aligns its marketing decisions for competitive success. Use it for learning, comparison, or sophisticated business modeling.

Product

SPX Technologies offers highly engineered infrastructure equipment, a key part of their product strategy. These are not off-the-shelf items; they are complex systems built for demanding sectors like power generation and industrial processing. Think specialized cooling towers and heat exchangers, crucial for keeping vital operations running smoothly.

The company's commitment to this segment is evident in their revenue streams. For the first quarter of 2024, SPX Technologies reported revenue of $407 million, with their Engineered Solutions segment, which houses much of this infrastructure equipment, contributing significantly. This demonstrates a strong market demand for their specialized, high-performance offerings.

These highly engineered products are designed for reliability and longevity in challenging environments, meeting rigorous global industry standards. This focus on quality and performance justifies premium pricing and builds long-term customer relationships, as seen in their backlog, which stood at $1.4 billion at the end of Q1 2024, indicating sustained demand for their engineered solutions.

SPX Technologies' HVAC Solutions Portfolio offers a wide array of products, including package and process cooling equipment, residential and commercial boilers, and engineered air movement solutions. This broad offering caters to diverse climate control needs across various sectors.

The company has strategically bolstered its HVAC portfolio through recent acquisitions. In early 2024, Ingénia was acquired, followed by Sigma & Omega in April 2025. These moves significantly enhance their hydronics and air handling unit capabilities.

These acquisitions are particularly impactful for high-growth markets such as healthcare, pharmaceuticals, education, and data centers. SPX Technologies is now better positioned to serve the specialized needs of these critical industries with advanced HVAC solutions.

SPX Technologies' Detection & Measurement segment offers a broad portfolio of specialized components and systems. This includes essential tools like underground pipe and cable locators, advanced inspection and rehabilitation equipment, and sophisticated robotic systems. Their offerings also extend to vital transportation systems, communication technologies, and obstruction lighting, serving critical infrastructure and safety needs.

The strategic acquisition of Kranze Technology Solutions (KTS) in January 2025 was a pivotal move for SPX Technologies. This acquisition substantially amplified their capabilities within the communication technologies sector. It specifically bolstered their digital interoperability and tactical networking solutions, which are crucial for modern defense platforms.

In 2024, the Detection & Measurement segment contributed significantly to SPX Technologies' overall revenue, with specific figures expected to be released in their Q1 2025 earnings report, building on a strong 2023 performance. The KTS integration is projected to add an estimated $50 million to $75 million in annual revenue starting in fiscal year 2025.

Tailored Solutions for Industrial Verticals

SPX Technologies excels in providing tailored solutions for industrial verticals, recognizing that one size does not fit all. Their product and service development is meticulously crafted to meet the stringent demands of sectors like power generation, industrial processing, and oil and gas.

This focus on specific industries means SPX Technologies doesn't just offer generic equipment; they deliver customized applications designed to solve unique operational challenges. For instance, in the power generation sector, their offerings might include specialized heat exchangers engineered for specific fuel types or cooling tower components optimized for particular environmental conditions. This client-centric philosophy ensures that customers receive high-value, problem-solving solutions that directly address their operational needs, rather than simply acquiring standard products.

The company's commitment to sector-specific innovation is reflected in its market approach. By deeply understanding the nuances of each industrial vertical, SPX Technologies can anticipate future needs and develop advanced technologies. This strategic positioning allows them to command premium pricing and build strong, lasting relationships with clients who rely on their expertise. For example, in 2023, SPX Technologies reported revenue growth driven by strong performance in its HVAC and Detection & Power segments, highlighting the success of its specialized approach.

- Power Generation: Solutions designed for efficiency and reliability in energy production.

- Industrial Processing: Equipment and services optimized for complex manufacturing environments.

- Oil & Gas: Specialized components and systems for upstream, midstream, and downstream operations.

- Customization: Focus on sector-specific challenges and client-unique requirements.

Continuous Innovation and Enhancement

SPX Technologies prioritizes continuous innovation and enhancement, a key aspect of their marketing strategy. This commitment is evident in their proactive approach to integrating new technologies and refining their product offerings to maintain market leadership. For instance, their strategic acquisitions, such as Sigma & Omega, have bolstered their capabilities with proprietary configuration software, directly improving production efficiency for their custom HVAC equipment. This focus ensures they remain competitive and offer advanced solutions.

The company's dedication to technological advancement and continuous improvement initiatives is designed to optimize existing product lines and introduce novel, differentiated products. This strategy aims to solidify their strong positions in their core markets. For example, in the first quarter of 2024, SPX Technologies reported a revenue increase of 7% year-over-year, partly driven by new product introductions and enhancements in their HVAC segment. This growth underscores the financial impact of their innovation efforts.

Key aspects of their continuous innovation include:

- Acquisition of advanced technologies: Integrating tools like the Sigma & Omega configuration software to streamline custom HVAC production.

- Focus on efficiency improvements: Utilizing proprietary software to enhance operational effectiveness and reduce lead times.

- Development of differentiated products: Introducing new offerings that provide unique value and competitive advantages.

- Maintaining market leadership: Consistently refining product lines to meet evolving customer needs and industry standards.

SPX Technologies' product strategy centers on highly engineered infrastructure equipment, focusing on specialized solutions for demanding sectors like power generation and industrial processing. Their HVAC Solutions Portfolio offers a broad range, enhanced by strategic acquisitions in 2024 and 2025, strengthening hydronics and air handling capabilities for high-growth markets like healthcare and data centers. The Detection & Measurement segment, bolstered by the January 2025 acquisition of Kranze Technology Solutions, significantly expands their communication technologies and tactical networking solutions, projecting an additional $50 million to $75 million in annual revenue starting fiscal year 2025.

| Segment | Key Product Areas | Recent Developments/Impact |

|---|---|---|

| Engineered Solutions | Cooling towers, heat exchangers | Q1 2024 Revenue: $407 million (total company); Backlog: $1.4 billion (Q1 2024) |

| HVAC Solutions | Boilers, air movement, cooling equipment | Acquisitions: Ingénia (early 2024), Sigma & Omega (April 2025) |

| Detection & Measurement | Pipe locators, inspection equipment, communication tech | Acquisition: Kranze Technology Solutions (January 2025); Projected revenue addition: $50M-$75M annually from FY2025 |

What is included in the product

This analysis delves into SPX Technologies' Product, Price, Place, and Promotion strategies, offering a comprehensive understanding of their market positioning and competitive advantage.

It provides a detailed breakdown of SPX Technologies' marketing mix, grounded in actual brand practices and strategic implications, making it ideal for managers and consultants.

Addresses the challenge of complex marketing strategies by providing a clear, actionable breakdown of SPX Technologies' 4Ps, simplifying decision-making.

Eliminates the frustration of scattered marketing information by consolidating all critical 4P elements into one cohesive, easy-to-understand analysis.

Place

SPX Technologies leverages direct sales and service networks across roughly 16 countries, a key element of its market strategy. This global presence ensures close proximity to its industrial and commercial customer base, facilitating efficient delivery of specialized solutions. The company's direct sales force is instrumental in fostering deep customer relationships by providing expert consultation and comprehensive support throughout the product lifecycle.

SPX Technologies strategically utilizes a hybrid distribution model, blending direct sales with specialized partners. This approach is particularly evident in their HVAC segment, where they engage independent manufacturing representatives, third-party distributors, and retailers.

This multi-channel strategy allows SPX to effectively reach a broader customer base and cater to the unique needs of different market segments. For instance, in 2023, SPX Flow, a segment that includes many HVAC-related products, reported net sales of $2.2 billion, showcasing the significant market penetration achieved through such diverse distribution networks.

By partnering with these specialized entities, SPX Technologies can leverage their existing market knowledge and customer relationships, enhancing product accessibility and driving sales volume. This ensures that products reach both industrial clients and a wider consumer audience efficiently.

SPX Technologies strategically positions its manufacturing and assembly facilities across key global regions to optimize operations and shorten delivery times. This geographic distribution is crucial for efficiently serving a worldwide customer base.

Following the Sigma & Omega acquisition, SPX Technologies is actively expanding its U.S.-based production capabilities. This move aims to bolster market penetration within the American market, working in tandem with existing Canadian operations.

The expansion of U.S. manufacturing is designed to enhance logistical efficiency across North America. This strategic placement supports faster product delivery and improved supply chain responsiveness.

By investing in regional production, SPX Technologies not only reduces lead times but also better adapts to local market demands and regulatory environments. This approach is a cornerstone of their global fulfillment strategy.

Integrated Supply Chain Management

SPX Technologies' place strategy hinges on a highly integrated supply chain for its engineered components and systems. This ensures critical parts reach customers precisely when and where they are required, a vital aspect of their market presence.

The acquisition and integration of entities like Sigma & Omega into SPX's hydronics division are key to streamlining this supply chain. This consolidation aims for better coordination and operational efficiency across the board.

By merging these operations, SPX Technologies is working to create a more cohesive and responsive distribution network. This focus on supply chain integration is designed to enhance reliability and reduce lead times.

- Enhanced Availability: SPX aims to ensure its specialized hydronic components are readily accessible to customers globally.

- Efficiency Gains: Integration of acquired businesses is projected to improve inventory management and logistics.

- Customer Service: A robust supply chain directly supports timely delivery and customer satisfaction for complex systems.

Digital Presence and Online Accessibility

SPX Technologies leverages its digital presence to connect with a global audience, even as a predominantly B2B entity. Its corporate website serves as a central hub for information, detailing its diverse product portfolio and solutions across various industries. This online accessibility is crucial for reaching potential customers and partners worldwide.

The company's investor relations portal offers readily available financial reports and company updates, fostering transparency and engagement with shareholders. In 2024, SPX Technologies continued to enhance its digital resources, providing detailed product specifications, case studies, and technical documentation, thereby simplifying information access for its stakeholders.

Key aspects of SPX Technologies' digital presence include:

- Corporate Website: A comprehensive platform showcasing business segments, technologies, and global operations.

- Investor Relations Portal: Providing timely financial disclosures, annual reports, and SEC filings.

- Online Resources: Offering product brochures, datasheets, and support documentation.

- Global Reach: Facilitating communication and engagement with customers and stakeholders across international markets.

SPX Technologies’ place strategy emphasizes a global distribution network, supported by direct sales and strategic partnerships across approximately 16 countries. This extensive reach, particularly in industrial and commercial sectors, ensures close customer proximity and efficient delivery of specialized solutions. The company’s HVAC segment, for example, utilizes independent representatives, distributors, and retailers to broaden market access.

| Distribution Channel | Key Segments Served | 2023 Net Sales (SPX Flow) |

|---|---|---|

| Direct Sales | Industrial, Commercial | $2.2 Billion (SPX Flow) |

| Specialized Partners | HVAC, Industrial | |

| Retailers | HVAC |

Full Version Awaits

SPX Technologies 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive SPX Technologies 4P's Marketing Mix Analysis covers product, price, place, and promotion, offering actionable insights for your business strategy. You’re viewing the exact version of the analysis you’ll receive, fully complete and ready to use, providing a clear understanding of SPX Technologies' market approach. This detailed breakdown will equip you with the knowledge to refine your own marketing efforts effectively.

Promotion

SPX Technologies actively pursues targeted B2B marketing, focusing on key decision-makers within the industrial, power generation, and defense industries. This strategic approach aims to connect directly with those who specify and purchase their engineered solutions.

Participation in specialized industry trade shows and conferences is a cornerstone of their engagement strategy. For example, SPX FLOW, a segment of SPX Technologies, regularly exhibits at events like the World Ag Expo and various power generation industry forums, demonstrating their commitment to direct client interaction.

These engagements allow SPX Technologies to showcase their advanced technologies and solutions, fostering direct dialogue with potential clients and partners. This hands-on approach is crucial for building relationships and understanding specific industry needs.

In 2024, SPX Technologies reported significant revenue growth, with their Engineered Solutions segment, which heavily relies on B2B engagement, showing strong performance. This underscores the effectiveness of their targeted industry outreach in driving business.

SPX Technologies leverages technical content and thought leadership as a core promotional strategy. This involves publishing detailed whitepapers, case studies, and technical manuals that showcase the performance and unique advantages of their HVAC and detection & measurement solutions.

These publications are designed to position SPX Technologies as a knowledgeable authority, building trust and demonstrating their problem-solving expertise. For instance, in 2023, SPX Flow, a related entity, reported a 7% increase in their order book for engineered solutions, partly attributed to strong technical marketing efforts.

By providing in-depth technical information, SPX Technologies educates potential customers and reinforces its brand reputation. This approach is crucial for markets where product complexity and performance are key purchasing drivers, ensuring clients understand the value proposition of their specialized offerings.

SPX Technologies, as a publicly traded entity, prioritizes robust investor relations and financial communications. This commitment is evident in their regular earnings calls, detailed financial results releases, and comprehensive investor presentations. These platforms are crucial for fostering transparency and building confidence among stakeholders. For instance, in their Q1 2024 earnings call, management highlighted a 7% organic revenue growth, underscoring operational performance and strategic execution.

These communications often feature webcasts and accompanying slides, designed to clearly articulate SPX Technologies' strategic growth initiatives and financial outlook. The company aims to provide stakeholders with a clear understanding of their business trajectory and future prospects. This proactive approach to communication is vital for attracting and retaining investment, especially as the company navigates its strategic priorities for 2024 and beyond.

Direct Sales Force and Customer Relationship Management

SPX Technologies leverages a highly skilled direct sales force as a cornerstone of its promotional strategy. This team is crucial for cultivating and sustaining robust relationships with their industrial and commercial clientele. Their expertise allows for detailed conversations addressing intricate technical needs, leading to the creation of customized solutions.

This direct engagement fosters enduring partnerships by ensuring customers receive personalized attention and expert guidance. It’s through these interactions that SPX Technologies can effectively communicate the value of its offerings and build trust, which is vital in their target markets. For instance, in 2023, SPX Technologies reported approximately $1.5 billion in revenue, a significant portion of which is attributed to the effectiveness of their direct sales approach in closing complex deals.

- Direct Sales Force: SPX Technologies employs a specialized sales team adept at understanding and addressing complex industrial customer requirements.

- Customer Relationship Management: The company prioritizes building long-term partnerships through personalized interactions and tailored solution development.

- Key Market Focus: This approach is particularly effective in their core markets, including HVAC, detection and measurement, and engineered products.

- Sales Effectiveness: The direct sales model supports higher-value transactions and deeper customer integration, contributing to revenue growth.

Strategic Acquisitions as Brand and Market Expansion

SPX Technologies leverages strategic acquisitions as a key promotional element within its marketing mix, driving brand expansion and market penetration. Recent moves, like the acquisition of Kranze Technology Solutions, not only broaden its technological capabilities but also serve to elevate brand visibility and strengthen its market standing. These acquisitions are designed to signal robust growth and a commitment to innovation to customers and stakeholders alike.

These strategic integrations bring tangible benefits that act as powerful promotional signals. By incorporating new technologies and customer segments, SPX Technologies enhances its value proposition and competitive edge. For instance, the integration of Sigma & Omega's offerings is expected to bolster SPX's position in key markets, directly impacting customer perception and attracting new business. This proactive approach to portfolio enhancement is crucial for maintaining market relevance and driving future growth.

- Acquisition of Kranze Technology Solutions: Expanded SPX's software and IT solutions portfolio, enhancing its brand as a comprehensive technology provider.

- Integration of Sigma & Omega: Strengthened SPX's presence in specialized industrial markets, adding new customer bases and revenue streams.

- Market Positioning Boost: Acquisitions signal innovation and growth, improving SPX's competitive advantage and brand perception in a dynamic market.

- Enhanced Brand Recognition: The combined entities and expanded offerings contribute to greater overall brand awareness and market influence.

SPX Technologies utilizes a multi-faceted promotional strategy, emphasizing direct engagement through a skilled sales force and participation in industry-specific events. They also leverage technical content, investor relations, and strategic acquisitions to build brand authority and market presence.

Their B2B focus targets key decision-makers, with events like the World Ag Expo providing direct client interaction opportunities. In 2023, SPX Technologies reported approximately $1.5 billion in revenue, with their direct sales approach being a significant contributor to closing complex deals.

Technical whitepapers and case studies position them as experts, exemplified by SPX Flow's 7% order book increase in 2023, partly due to strong technical marketing. Furthermore, strategic acquisitions, such as Kranze Technology Solutions, enhance their brand as a comprehensive technology provider.

SPX Technologies' promotional activities are designed to communicate value and build trust, particularly in markets where product complexity is a key driver. Their Q1 2024 earnings call highlighted a 7% organic revenue growth, reflecting successful strategic execution.

| Promotional Tactic | Key Activities | Impact/Data Point |

|---|---|---|

| Direct Sales Force | Expert engagement with industrial/commercial clients | Contributed to ~$1.5 billion revenue in 2023 |

| Industry Events | Trade shows, conferences (e.g., World Ag Expo) | Facilitates direct client interaction and solution showcasing |

| Technical Content | Whitepapers, case studies, technical manuals | SPX Flow saw 7% order book increase in 2023 |

| Investor Relations | Earnings calls, financial releases, webcasts | Highlighted 7% organic revenue growth in Q1 2024 |

| Strategic Acquisitions | Kranze Technology Solutions, Sigma & Omega | Expands technology portfolio and market presence |

Price

SPX Technologies leverages value-based pricing for its engineered solutions, a strategy directly tied to the substantial engineering expertise and specialized applications embedded in its offerings. This approach prioritizes the long-term advantages and operational efficiencies its products provide to industrial and commercial clients.

Rather than focusing purely on manufacturing costs or what competitors charge, SPX Technologies sets prices based on the tangible value and economic benefits customers receive. For instance, a critical cooling system for a data center might be priced based on the avoided downtime and energy savings it generates, which often far exceed the unit's production cost.

This strategy is particularly evident in sectors like HVAC and detection and measurement, where the reliability and performance of SPX solutions directly impact customer profitability and operational continuity. In 2023, SPX Technologies reported revenue of $1.57 billion, demonstrating the market's acceptance of its value-driven pricing model for complex engineered products.

SPX Technologies frequently engages in competitive bidding for significant infrastructure and industrial projects. This necessitates a pricing strategy that is both competitive and ensures profitability, taking into account the project's scope, detailed technical requirements, and the enduring value SPX's engineered solutions offer. For instance, in the robust 2024 infrastructure spending environment, where government and private sector investments are high, SPX's ability to accurately price complex bids is crucial for securing contracts.

SPX Technologies leverages long-term service and support contracts to build a robust recurring revenue base, extending beyond initial equipment sales. These contracts are priced to encompass essential elements like regular maintenance, necessary spare parts, dedicated technical assistance, and future upgrade possibilities. This pricing strategy not only ensures predictable income for SPX but also fosters stronger customer loyalty by offering comprehensive, ongoing support.

Customized Project Quotes and Solution Packages

SPX Technologies’ pricing strategy for its customized project quotes and solution packages reflects the bespoke nature of its offerings. This approach allows the company to adapt to diverse client requirements, integrating various technological components and service levels. For instance, a significant portion of their revenue in 2024 has been driven by these tailored solutions, often encompassing installation, commissioning, and extended operational support. This ensures that each proposal delivers comprehensive value aligned with specific customer needs and project scopes.

The flexibility inherent in customized quoting enables SPX Technologies to factor in the complexity of each project, the specific technologies deployed, and the duration of support services. This granular approach to pricing is crucial for projects involving advanced HVAC, detection and measurement, or engineered products, where integration and specialized services are paramount. The company aims to provide transparent and value-driven proposals that account for the full lifecycle of the solution, from initial deployment to ongoing performance optimization.

- Customized Quotes: Pricing is project-specific, reflecting unique client needs and solution complexity.

- Solution Packages: Bundled offerings integrate hardware, software, installation, and support for comprehensive solutions.

- Value-Driven Pricing: Focuses on the total value delivered, including long-term operational benefits and efficiency gains.

- 2024 Revenue Contribution: Tailored solutions and packages formed a substantial part of SPX Technologies' revenue streams during the fiscal year.

Consideration of Global Market Dynamics and Economic Factors

SPX Technologies' pricing is keenly attuned to global market dynamics. As a worldwide supplier, the company must navigate varying regional economic conditions and the volatility of currency exchange rates. For instance, in Q1 2024, the company highlighted how currency headwinds impacted reported revenues, underscoring the need for flexible pricing models.

Furthermore, SPX Technologies actively manages pricing to counteract external economic shifts. Recent investor calls in late 2024 and early 2025 have emphasized strategic adjustments to pricing in response to evolving tariff landscapes. This proactive approach is crucial for maintaining profitability and ensuring the company's competitive edge in diverse international markets. The company's ability to adapt pricing in response to these global economic factors is a key component of its 4P's marketing mix, directly influencing market share and revenue generation.

- Global Demand: Pricing strategies are calibrated to align with the strength of demand across different geographic regions, acknowledging that market appetite varies significantly.

- Regional Economic Health: Fluctuations in GDP growth, inflation rates, and employment figures in key operating countries directly inform pricing decisions to ensure local market viability.

- Currency Fluctuations: As a global entity, SPX Technologies monitors exchange rates closely, adjusting prices to mitigate adverse impacts and capitalize on favorable currency movements.

- Trade Policy Impact: Changes in international trade policies, including tariffs and import/export regulations, necessitate dynamic pricing adjustments to preserve margins and market access.

SPX Technologies' pricing strategy centers on value, reflecting the engineered solutions and long-term benefits provided to customers. This approach, which prioritizes economic advantages over pure cost, was evident in their 2023 revenue of $1.57 billion. The company often prices based on the tangible value, such as energy savings or avoided downtime, that its products deliver, particularly in critical sectors like HVAC and detection & measurement.

Competitive bidding for large projects in 2024, a year marked by strong infrastructure spending, requires SPX to balance competitiveness with profitability. Their pricing must account for project scope, technical specifics, and the enduring value of their engineered products. Furthermore, SPX Technologies builds recurring revenue through service and support contracts, priced to include maintenance, parts, and technical assistance, fostering customer loyalty and predictable income.

Customized quotes and solution packages are a significant driver of SPX's business, with a notable portion of 2024 revenue stemming from these tailored offerings. This flexibility allows them to precisely price for diverse client needs, integrating various technologies and support levels. Pricing adjustments are also crucial for navigating global market dynamics, including currency fluctuations and trade policy shifts, as highlighted by their Q1 2024 revenue impacts from currency headwinds.

| Pricing Element | Description | 2023 Revenue | 2024 Outlook (Q1 Commentary) |

|---|---|---|---|

| Value-Based Pricing | Based on customer economic benefits and operational efficiencies. | $1.57 Billion (Total Revenue) | Continued focus on value delivered. |

| Competitive Bidding | Pricing for infrastructure projects considering scope, technical needs, and long-term value. | N/A (Project-specific) | Crucial in strong infrastructure spending environment. |

| Service Contracts | Pricing for ongoing maintenance, parts, and technical support. | Contributes to recurring revenue. | Focus on customer loyalty and predictable income. |

| Customized Solutions | Project-specific pricing for tailored hardware, software, and services. | Significant revenue driver. | Substantial portion of 2024 revenue. |

| Global Market Adjustments | Pricing adapts to regional economies, currency fluctuations, and trade policies. | Impacted by currency headwinds in Q1 2024. | Strategic adjustments to tariffs and trade policies. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for SPX Technologies leverages official company disclosures, including SEC filings and investor presentations, to understand product development, pricing strategies, and promotional activities. We also incorporate data from industry reports and competitive intelligence to provide a comprehensive view of their market presence.