SPX Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SPX Technologies Bundle

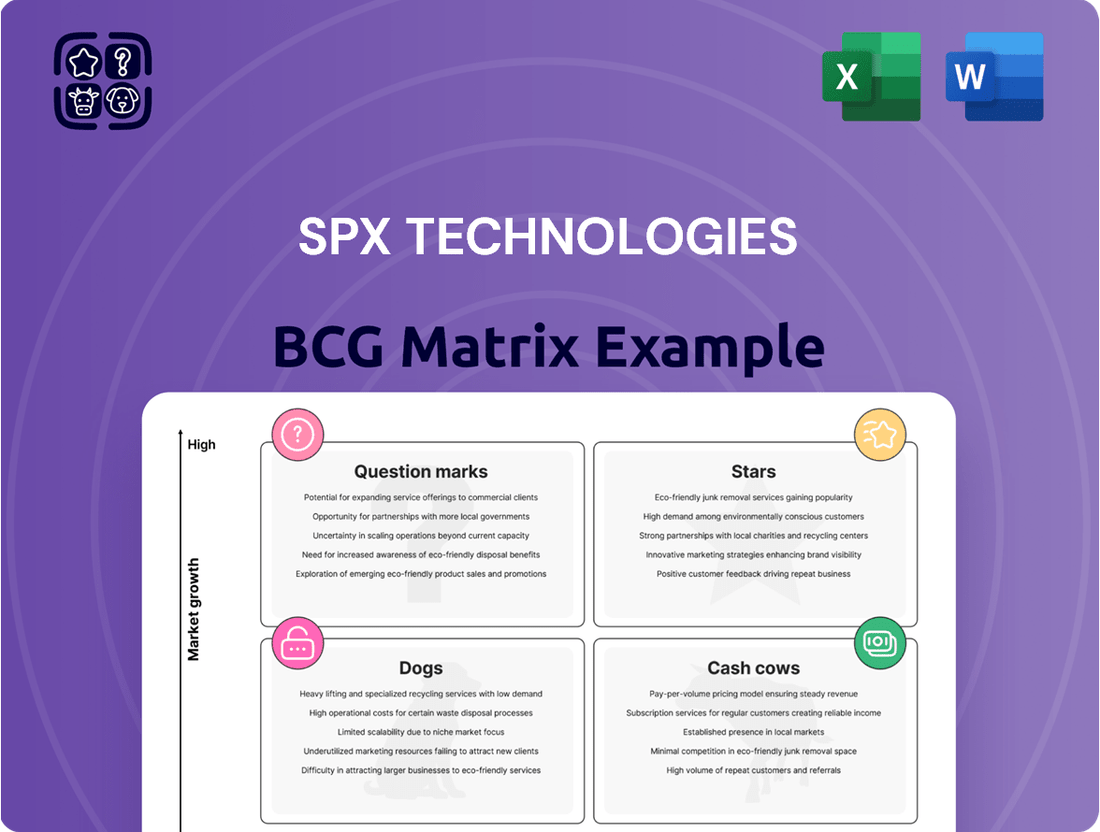

Curious about SPX Technologies' strategic positioning? Our BCG Matrix preview highlights their key product categories, revealing which are driving growth and which might need a closer look. Understand the core dynamics of their portfolio at a glance.

This glimpse into SPX Technologies' business is just the start. To truly grasp their competitive advantage and future potential, you need the full BCG Matrix. It provides a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks, offering actionable insights.

Don't just skim the surface; dive deep into SPX Technologies' product portfolio with the complete BCG Matrix. Gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

SPX Technologies' engineered air movement solutions are a star performer, particularly within the booming data center industry. The company projected its data center revenue to double in 2024, a clear indicator of its strong growth trajectory and market leadership in this critical sector. This segment thrives on the constant need for efficient cooling in vital IT infrastructure, making it a primary engine for SPX's expansion.

The February 2024 acquisition of Ingenia Technologies significantly strengthened SPX Technologies' HVAC offerings, especially in custom air handling units designed for demanding sectors such as healthcare, pharmaceuticals, and education. This strategic move has injected considerable momentum into the HVAC segment, contributing to its already impressive growth trajectory and record-breaking profit margins.

Ingenia's integration brings advanced robotics and automation capabilities, creating a distinct competitive edge for SPX. This technological advantage helps solidify Ingenia's position with a substantial market share within a specialized and expanding market niche, underscoring its value as a Stars category asset.

Kranze Technology Solutions (KTS), acquired in January 2025, is positioned within SPX Technologies' Detection & Measurement segment, specifically bolstering the Communication Technologies platform. This strategic integration is designed to enhance SPX's footprint in the burgeoning defense sector. The company's expertise in digital interoperability and tactical networking is a key differentiator.

KTS primarily serves defense platforms, with a significant focus on the U.S. Marine Corps, providing critical communication solutions. This acquisition is projected to be accretive to SPX's earnings in 2025, signaling strong growth prospects and a clear strategy to expand market share. The defense market is experiencing robust demand for advanced networking capabilities.

Advanced Cooling Technologies for Industrial Processes

SPX Technologies is making significant strides in advanced cooling technologies for industrial processes, positioning itself strongly within its HVAC segment. These innovative solutions are designed for enhanced efficiency and reliability, meeting the rigorous demands of modern industrial applications.

The company's focus on these high-growth areas is evident in its market performance. SPX Technologies' HVAC segment has shown robust overall growth, indicating that these differentiated, energy-efficient cooling products are successfully capturing market share. This success is driven by the increasing industry demand for sustainable and high-performing solutions.

- High-Growth Potential: SPX's advanced cooling systems address critical needs in sectors like data centers and manufacturing, which are experiencing rapid expansion.

- Efficiency and Reliability Focus: These technologies offer significant improvements in energy consumption and operational uptime, a key differentiator in the industrial market.

- Market Share Gains: The HVAC segment's strong performance, with revenue growth reported in recent quarters, directly reflects the market's positive reception of these specialized cooling offerings. For instance, SPX Technologies reported HVAC segment revenue of $400 million in Q1 2024, up 8% year-over-year, driven by these advanced solutions.

- Sustainability Driver: As industries increasingly prioritize environmental impact, SPX's energy-efficient cooling solutions are well-positioned to benefit from this trend.

Next-Generation Detection Systems for Critical Infrastructure

SPX Technologies' Detection & Measurement segment is experiencing robust growth, fueled by significant investments in critical infrastructure, energy, utilities, and defense sectors. This trend directly benefits the demand for next-generation detection systems, essential for the modernization and upkeep of these vital industries. SPX is strategically positioned to capitalize on this expanding market by prioritizing technological innovation and smart market placement.

The company's focus on high-value, high-growth solutions within this segment is evident in its margin performance. While organic revenue might see some natural fluctuations, the improved profitability underscores the segment's strength and SPX's ability to deliver advanced detection capabilities. For instance, in the first quarter of 2024, SPX Technologies reported a 3% increase in revenue for its Detection and Measurement segment, reaching $378 million, with an operating margin of 19.3%, up from 18.5% in the prior year, reflecting this strategic emphasis.

- Market Drivers: Increased global spending on infrastructure renewal and energy transition projects is a primary catalyst.

- SPX's Strategy: Focus on advanced, mission-critical detection solutions for utilities, aerospace, and defense applications.

- Financial Performance: The segment delivered strong operating margins in Q1 2024, indicating pricing power and operational efficiency for its specialized products.

- Future Outlook: Continued investment in R&D for next-generation systems is expected to drive further market share gains.

SPX Technologies' engineered air movement solutions, particularly those serving data centers, are clear stars. The company projected data center revenue to double in 2024, underscoring its leadership in this high-demand area. The acquisition of Ingenia Technologies further bolsters its HVAC segment, especially with custom air handling units for critical sectors like healthcare and education, contributing to record profit margins.

Kranze Technology Solutions (KTS), acquired in early 2025, strengthens the Detection & Measurement segment's Communication Technologies platform, targeting the defense sector. KTS's expertise in digital interoperability for defense platforms, including the U.S. Marine Corps, is a key differentiator. This acquisition is expected to be accretive to earnings in 2025, reflecting strong growth prospects in the defense market.

| Category | Key Products/Segments | Growth Drivers | 2024 Outlook Indicators | Strategic Importance |

| Stars | Engineered Air Movement (Data Centers) | Data center expansion, demand for efficient cooling | Projected doubling of data center revenue | Primary growth engine |

| Stars | HVAC (Custom Air Handling Units) | Healthcare, pharmaceutical, education sector needs; automation integration | Strengthened by Ingenia acquisition; record profit margins | Competitive edge, market share in niche |

| Stars | Detection & Measurement (Communication Technologies) | Defense sector modernization, advanced networking demand | Accretive to earnings in 2025 (KTS acquisition) | Expansion into burgeoning defense market |

What is included in the product

SPX Technologies' BCG Matrix offers a strategic overview, identifying which business units to invest in, hold, or divest based on market growth and share.

SPX Technologies' BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Weil-McLain's traditional commercial and residential boilers represent a significant cash cow for SPX Technologies. This established brand holds a strong position within the mature boiler market, consistently generating substantial and reliable cash flow. Despite not operating in high-growth sectors, these products benefit from their long lifespan and the recurring need for maintenance and replacement, ensuring continued demand.

In 2024, SPX Technologies reported that its HVAC segment, which includes Weil-McLain, demonstrated robust performance. While specific figures for Weil-McLain alone aren't always broken out, the segment's overall contribution highlights the stability these mature product lines offer. This consistent revenue stream allows SPX to allocate capital effectively to higher-growth opportunities within its portfolio.

Standard industrial cooling towers and heat exchangers are SPX Technologies' established cash cows. This core business serves critical functions in general industrial processing and power generation, making it a stable, high-market-share category.

These are essential, well-understood products operating in mature markets. Demand is consistent, driven by the ongoing need for replacement and servicing of existing infrastructure, ensuring a predictable revenue stream.

SPX Technologies' strong position in this segment allows for reliable profit margins and robust cash flow generation. The established nature of these products and their high, consistent demand are key drivers of this financial strength.

For example, in 2024, SPX Technologies reported significant revenue from its Engineered Products and Services segment, which includes these core offerings. This segment consistently contributes to the company's overall profitability, highlighting the cash-generating power of its mature product lines.

Within SPX Technologies’ Detection & Measurement segment, their established underground pipe and cable locators are classic Cash Cows. These products cater to a mature but consistent market, driven by the ongoing needs of infrastructure maintenance and new development projects.

The strong market share these locators command is a testament to their proven reliability and extensive adoption across the industry. This established presence means they don't require significant investment to maintain their position.

While the market for these basic locator technologies might exhibit low growth, their essential nature guarantees a steady and predictable demand. This consistent demand translates directly into reliable cash generation for SPX Technologies.

For example, SPX’s Detection & Measurement segment, which includes these locators, saw revenue growth in the low single digits for much of 2024, reflecting the stable demand characteristic of Cash Cow products.

Aids to Navigation (ATON) and Marine Lighting

SPX Technologies' Aids to Navigation (ATON) and Marine Lighting segment functions as a classic cash cow within its portfolio. This business serves a specialized, mature market characterized by consistent demand from government maritime agencies and port authorities globally. SPX likely maintains a dominant position here, built on decades of trust and product durability.

The ATON and Marine Lighting division generates predictable, substantial cash flow with minimal reinvestment needs. This stability stems from the essential nature of navigational aids and the long procurement cycles typical for these critical infrastructure components. For instance, in 2024, the global maritime lighting market was valued at approximately $4.5 billion, with steady growth projected, underscoring the resilience of this sector.

- Market Maturity: The ATON and Marine Lighting market is established and stable, showing consistent demand.

- Strong Market Share: SPX benefits from its likely significant share, driven by long-term customer relationships and product dependability.

- Consistent Cash Flow: The segment reliably generates strong cash flow with limited need for aggressive investment or marketing.

- Low Investment Needs: Future capital expenditures for this business are expected to be manageable, primarily for maintenance and incremental upgrades rather than disruptive innovation.

Basic Fan Coils and Hydronic Components for Existing Buildings

For SPX Technologies, basic fan coils and hydronic components catering to existing buildings are a classic cash cow. These aren't about chasing new growth, but about milking a steady income from a well-established market. Think of them as the reliable workhorses of the HVAC world.

These components are crucial for keeping existing heating, ventilation, and air conditioning systems running smoothly in commercial and institutional settings. Their value lies in the predictable demand driven by replacement cycles and the continuous need for servicing and repairs. This segment of the HVAC market is mature, meaning slower growth but consistent, dependable cash flow.

In 2024, the demand for these components is sustained by the sheer volume of existing infrastructure requiring upkeep. For instance, a significant portion of commercial building stock, often decades old, relies on these fundamental hydronic systems. SPX Technologies benefits from this by providing parts that are essential for maintaining operational efficiency and occupant comfort.

- Stable Revenue: These products generate predictable income through replacement parts and ongoing service contracts.

- Mature Market: The HVAC market for existing buildings is established, offering less volatility and more consistent demand.

- Essential Components: Fan coils and hydronic parts are critical for the functioning of a vast number of commercial and institutional HVAC systems.

- Replacement Cycles: The natural lifespan of these components necessitates regular replacements, ensuring continuous sales opportunities for SPX Technologies.

SPX Technologies’ range of specialized pumps and fluid handling solutions for various industrial applications also represent stable cash cows. These products are integral to processes in sectors like food and beverage, and general manufacturing, where reliability is paramount.

Operating in mature industrial sectors means that while growth might be modest, demand for these essential components remains consistently high. This is largely driven by the need to maintain and replace existing equipment, ensuring a steady revenue stream for SPX.

In 2024, SPX Technologies' industrial products, including these pumps, continued to be a bedrock of its financial performance. The company's ability to consistently generate strong cash flow from these established lines allows for strategic reinvestment in other areas.

The consistent performance of these industrial pumps is a key indicator of their cash cow status. They require minimal ongoing innovation investment due to their established designs and proven efficacy, thus maximizing profit margins.

| Product Category | BCG Matrix Status | Key Characteristics | 2024 Financial Relevance |

| Specialized Industrial Pumps | Cash Cow | Mature market, high reliability, consistent demand, low reinvestment needs | Contributes stable cash flow to SPX Technologies' overall financial health. |

What You See Is What You Get

SPX Technologies BCG Matrix

The SPX Technologies BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. Rest assured, this is not a sample or demo but the complete, analysis-ready report, free from watermarks or placeholder content, designed for immediate strategic application.

Dogs

Legacy, non-connected HVAC controls, often found in older buildings, represent a category likely classified as dogs within the SPX Technologies BCG Matrix. These systems, lacking the smart features and IoT connectivity demanded by today's energy-conscious market, are experiencing a predictable decline in sales. For instance, the global smart HVAC market, a direct competitor, was projected to reach over $50 billion by 2024, highlighting the shrinking relevance of non-connected alternatives.

As the industry rapidly embraces advanced energy management and remote accessibility, these older systems face diminishing demand and squeezed profit margins. SPX Technologies would likely adopt a strategy of minimal investment in this segment, recognizing that costly turn-around efforts for such outdated technology are rarely effective. The focus would instead be on phasing out these products or servicing existing installations with limited new development.

Within SPX Technologies' heating portfolio, products that fall short of current energy efficiency standards or rely on outdated technology are likely candidates for the dog quadrant. These items face increasing pressure from more sustainable and cost-effective alternatives.

The market's growing demand for energy savings and environmental responsibility means these older heating products would find it difficult to gain traction against newer, more efficient models. This makes their competitive position increasingly challenging.

Such offerings typically possess a low market share within a shrinking segment of the heating market. Their continued presence might represent a drain on capital, offering minimal returns for the investment required.

For example, in 2024, the global market for residential heating systems saw a significant shift, with energy-efficient technologies like heat pumps experiencing robust growth, while older furnace types saw a decline in demand. This trend directly impacts products that do not align with these efficiency gains.

Within SPX Technologies' transportation systems segment, niche, low-volume product lines that haven't experienced substantial innovation or market growth can be classified as dogs. These offerings might cater to a declining or highly fragmented market, where SPX holds minimal competitive advantage. Consequently, they would likely yield low returns, potentially draining resources rather than contributing to overall profitability. For instance, if a particular type of specialized rail component, a product line that saw its peak demand in earlier decades, has seen minimal technological advancement and faces competition from more modern solutions, it would fit this dog category.

Older Generation Inspection Equipment Without Digital Integration

Within SPX Technologies' Detection & Measurement segment, older generation inspection equipment that lacks digital integration and advanced analytics would likely be positioned as Dogs in the BCG Matrix. These products face a rapidly evolving market where industries increasingly demand sophisticated, automated inspection solutions. Consequently, these older systems would exhibit low market share.

The market for modern, digitally integrated inspection equipment is growing, leaving these legacy products behind. For example, the global industrial inspection market was valued at approximately USD 18.6 billion in 2023 and is projected to reach USD 31.5 billion by 2030, growing at a CAGR of 7.8%. This growth is largely driven by advancements in AI, IoT, and robotics, areas where older equipment is deficient.

- Low Market Share: These products struggle to compete with newer, digitally enabled alternatives.

- Declining Demand: Industries are shifting towards automated and data-driven inspection processes.

- High Investment Needs: Significant capital would be required to upgrade or redevelop these offerings to meet current market standards, with uncertain returns.

- Limited Future Prospects: Without substantial reinvestment, their competitive position is likely to continue deteriorating.

Commoditized Components in Highly Competitive Markets

SPX Technologies may have commoditized components within its portfolio, particularly those facing intense price competition in stagnant markets. These products, offering little differentiation, typically result in low profit margins and minimal strategic value. For instance, if SPX supplies basic industrial fasteners or generic electrical components where numerous competitors exist and innovation is limited, these could be classified as dogs. The company's strategy would likely involve minimizing its investment in such offerings to free up resources for more promising ventures.

In 2024, many segments of the industrial supply chain experienced price pressures due to oversupply and a slowdown in certain manufacturing sectors. For SPX Technologies, this could translate into specific product lines where components are largely undifferentiated and subject to aggressive pricing by competitors. For example, basic stamped metal parts or standard plastic injection molded components, if a significant part of SPX's business, could fall into this category. The focus would be on reducing the capital and operational expenditure associated with these lower-margin, low-growth areas.

- Commoditized Components: Products with little differentiation and high price sensitivity.

- Market Dynamics: Stagnant or low-growth markets with intense competition.

- Profitability: Characterized by low profit margins and minimal strategic value.

- SPX Strategy: Minimize exposure and resource allocation to these offerings.

Products categorized as Dogs within SPX Technologies' BCG Matrix are those with low market share in slow-growing or declining industries. These often include legacy technologies or undifferentiated components that face intense price competition. For instance, older, non-connected HVAC controls and commoditized industrial components would fit this classification, as they yield minimal returns and require significant investment to remain competitive.

SPX Technologies' strategy for these Dog products typically involves minimizing further investment and exploring options for divestiture or managed decline. The focus is on optimizing existing operations for cash generation while phasing out less profitable lines. This approach allows the company to reallocate resources to its more promising Stars and Cash Cows.

The market's increasing demand for innovation and efficiency means that products lacking these attributes are likely to be relegated to the Dog quadrant. For example, in 2024, the automotive sector saw a significant shift towards electric vehicles, making traditional internal combustion engine components in niche, low-volume applications potential candidates for the Dog category if SPX Technologies had exposure there.

These products often represent a drain on resources, offering little potential for future growth or profitability. SPX Technologies would likely aim to reduce its reliance on such offerings to improve overall portfolio performance and financial health.

| SPX Technologies Product Category | BCG Matrix Quadrant | Key Characteristics | Market Trend Example (2024) |

| Legacy HVAC Controls | Dogs | Low market share, declining demand, low innovation | Global smart HVAC market projected over $50B, highlighting decline of non-connected systems. |

| Commoditized Industrial Components | Dogs | Little differentiation, intense price competition, low margins | Price pressures in industrial supply chains due to oversupply in certain sectors. |

| Outdated Inspection Equipment | Dogs | Lacks digital integration, low market share in evolving segment | Industrial inspection market growth driven by AI/IoT, leaving older tech behind. |

Question Marks

The acquisition of Sigma & Omega in April 2025 brought hydronic heating and cooling equipment into SPX Technologies' portfolio, with an initial focus on Canada. SPX’s clear objective is to leverage this acquisition for substantial growth by pushing these products into the U.S. market. This move positions Sigma & Omega within the Question Mark quadrant of the BCG matrix due to its high-growth potential in a new, largely untapped U.S. geography where SPX currently has a low market share.

Significant investment will be necessary to build brand awareness and distribution channels across the diverse U.S. market for these hydronic solutions. For context, the U.S. HVAC market was valued at approximately $130 billion in 2024, offering a vast landscape for expansion. SPX's strategy here involves channeling resources into sales, marketing, and potentially product adaptation to meet U.S. building codes and consumer preferences, aiming to transform this low-share asset into a market leader.

Kranze Technology Solutions (KTS) is exploring new avenues beyond its core U.S. defense business, leveraging its digital interoperability and tactical networking expertise. These new ventures, targeting sectors like critical infrastructure and industrial automation, represent potential high-growth markets. For instance, the increasing need for robust, real-time data communication in smart grids and advanced manufacturing could be a significant opportunity for KTS's technologies.

By venturing into these new sectors, KTS is positioning its offerings in the Question Mark quadrant of the BCG matrix. While the defense sector provided a strong foundation, these emerging markets offer substantial growth potential. For example, the global industrial IoT market, a key area for KTS's potential expansion, was projected to reach over $200 billion by 2024, indicating a fertile ground for new entrants with specialized capabilities.

The market for smart HVAC systems and AI-driven predictive maintenance is experiencing robust growth, projected to reach over $30 billion globally by 2028, according to recent industry analyses. This indicates a strong demand for advanced solutions that optimize energy efficiency and reduce downtime. SPX Technologies' potential involvement in this sector positions them within a dynamic and expanding segment of the building technology market.

If SPX Technologies is indeed investing in or has early-stage products related to AI-powered HVAC or advanced predictive maintenance, these initiatives would likely fall into the "Question Marks" category of the BCG Matrix. This classification reflects their significant future potential in a high-growth market, alongside the considerable investment and development required to capture substantial market share.

Developing AI-powered HVAC systems and predictive maintenance capabilities demands substantial research and development resources. Companies in this space must navigate complex integration challenges, data analytics, and the continuous evolution of AI algorithms to offer truly competitive solutions. SPX's focus here would represent a strategic bet on future market trends and technological advancements.

Wireless Sensor Networks for Industrial Detection

Wireless sensor networks (WSNs) for industrial detection are a burgeoning segment, fueled by the growing integration of digital and IoT technologies. This trend positions WSNs as a high-growth market for detection systems. For SPX Technologies, if they've recently introduced or are actively investing in WSN solutions for industrial applications, these products would likely fall into the question mark category of the BCG matrix.

These solutions typically represent a high-growth potential market but may currently hold a relatively low market share as they strive for wider industry adoption. The global market for industrial IoT, which heavily relies on technologies like WSNs, was projected to reach over $700 billion by 2024. SPX's involvement in this space would place them at the forefront of this expanding technological wave.

- Market Growth: The industrial IoT market, a key driver for WSN adoption, is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond.

- SPX Position: If SPX Technologies is investing in or has launched WSN solutions for industrial detection, these products would represent emerging technologies within a rapidly evolving market.

- Market Share: These WSN solutions likely possess low current market share as they are in the early stages of broader market penetration and customer acceptance.

- Strategic Importance: Such offerings are crucial for SPX to establish a foothold in the high-growth IoT-enabled industrial monitoring sector, despite the initial investment and market development required.

Sustainable and Climate-Conscious HVAC Solutions in Emerging Markets

SPX Technologies' development of sustainable and climate-conscious HVAC solutions for emerging markets positions it as a Question Mark in the BCG matrix. The company is actively investing in innovative, eco-friendly technologies, aligning with a global surge in demand for green building solutions. For instance, the HVAC market in developing regions is projected for substantial growth, with estimates suggesting a compound annual growth rate of over 6% through 2030, driven by urbanization and stricter environmental mandates.

These new offerings target high-growth segments within the global HVAC industry, fueled by escalating environmental awareness and regulatory pressures. Emerging markets, in particular, are experiencing increased adoption of energy-efficient systems due to government incentives and a growing understanding of long-term operational cost savings. In 2024, many emerging economies are implementing or strengthening building codes that favor lower-emission HVAC technologies.

- High Market Growth: The global HVAC market is expanding rapidly, with emerging economies being key drivers of this growth due to infrastructure development and a focus on sustainability.

- Significant Investment Required: Establishing a strong foothold in these new markets necessitates substantial capital outlay for research, development, manufacturing, and distribution networks.

- Strategic Execution is Key: Success hinges on effective market penetration strategies, understanding local needs, and building robust partnerships to navigate diverse regulatory landscapes.

- Potential for High Returns: If SPX can successfully capture market share, these climate-conscious solutions could become significant cash cows as environmental regulations tighten globally.

SPX Technologies' acquisition of Sigma & Omega and its expansion into new markets like industrial automation and AI-driven HVAC solutions place these ventures in the Question Mark quadrant. These areas offer high growth potential but require significant investment to build market share, mirroring the strategic positioning of new technologies in burgeoning sectors.

The company's foray into sustainable HVAC for emerging markets also fits the Question Mark profile. While these markets show strong growth, projected at over 6% CAGR through 2030, SPX's current market share is low, necessitating substantial capital for R&D and distribution to capitalize on demand driven by urbanization and environmental regulations.

Similarly, Kranze Technology Solutions' exploration into critical infrastructure and industrial automation, leveraging its defense sector expertise, represents a strategic move into high-growth areas. The global industrial IoT market, a key target for KTS, was expected to exceed $700 billion in 2024, highlighting the opportunity for specialized technology providers.

| SPX Technologies Ventures | BCG Quadrant | Market Growth Potential | Current Market Share | Investment Needs |

|---|---|---|---|---|

| Sigma & Omega (US Expansion) | Question Mark | High (US HVAC Market ~$130B in 2024) | Low | High (Sales, Marketing, Product Adaptation) |

| Kranze Tech Solutions (New Sectors) | Question Mark | High (Industrial IoT >$700B in 2024) | Low | High (R&D, Market Entry) |

| AI-Powered HVAC/Predictive Maintenance | Question Mark | High (Global Market >$30B by 2028) | Low | High (R&D, Integration) |

| Wireless Sensor Networks (Industrial) | Question Mark | High (Industrial IoT) | Low | High (Market Penetration) |

| Sustainable HVAC (Emerging Markets) | Question Mark | High (Emerging HVAC >6% CAGR) | Low | High (R&D, Distribution) |

BCG Matrix Data Sources

Our SPX Technologies BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry trend analyses to provide a robust strategic overview.