Siemens SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Bundle

Siemens, a global powerhouse in electrification, automation, and digitalization, possesses significant strengths in its diversified portfolio and technological innovation. However, it also navigates potential weaknesses related to market competition and the complexities of its vast operations.

Opportunities abound for Siemens in the burgeoning fields of smart infrastructure and sustainable energy solutions, yet it must also contend with external threats like geopolitical instability and evolving regulatory landscapes.

Want the full story behind Siemens' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Siemens' strength lies in its highly diversified global technology portfolio, encompassing Digital Industries, Smart Infrastructure, Mobility, and Siemens Healthineers. This broad market presence significantly mitigates risks associated with reliance on any single sector. For example, in fiscal year 2023, Siemens Healthineers alone reported revenue growth of 5% in local currency, showcasing the independent strength of its segments.

This strategic diversification fosters resilience, allowing Siemens to weather sector-specific economic downturns more effectively. Furthermore, it enables valuable cross-sector synergies, where innovations and expertise from one division can benefit others. The company's deliberate focus on essential and resilient sectors such as healthcare and infrastructure underpins a stable demand base, even amidst market volatility.

Siemens stands as a formidable global leader in industrial automation and software, with a significant commitment to advancing digitalization and Industry 4.0. Its dedicated Siemens Xcelerator platform is a testament to this, actively merging the physical and digital realms to cater to the growing demand for industrial digital transformation.

This strategic emphasis on bridging the real and digital worlds places Siemens in a strong position for continued expansion as industries worldwide increasingly embrace digital solutions. The company's proactive integration of Artificial Intelligence and the Internet of Things further bolsters its competitive advantage in the evolving market landscape.

Siemens boasts a robust innovation engine, consistently pouring resources into research and development. In fiscal year 2023, the company reported R&D expenses of approximately €5.6 billion, underscoring its dedication to pioneering advancements.

This significant investment fuels a continuous stream of patents, particularly in high-growth areas like digitalization, artificial intelligence, and digital twin technology. Siemens secured over 4,000 new patents globally in 2023, reinforcing its position at the forefront of technological development.

These R&D capabilities allow Siemens to consistently introduce cutting-edge products and solutions, ensuring it remains a technological leader in its diverse markets. This innovative capacity is vital for adapting to and shaping evolving customer demands and market trends.

Robust Financial Performance and Order Backlog

Siemens has showcased impressive financial performance, with its fiscal year 2024 results highlighting significant revenue and profit growth. This momentum carried into Q2 2025, further solidifying its robust financial standing. The company also maintains a substantial order backlog, providing a strong foundation for future revenue. This healthy financial position allows for continued investment in innovation and strategic initiatives, offering considerable stability and visibility into upcoming earnings.

Key financial highlights and their implications include:

- Strong Revenue Growth: Siemens reported a substantial increase in revenue for FY2024, with further positive trends observed in Q2 2025. This demonstrates the company's ability to capture market share and grow its top line effectively.

- Healthy Profitability: Profitability metrics also saw significant improvement in the recent fiscal periods, indicating efficient operations and successful cost management alongside revenue generation.

- Substantial Order Backlog: As of the latest reports, Siemens holds a considerable order backlog, providing excellent visibility into future revenue streams and mitigating short-term market uncertainties. This backlog, exceeding €190 billion in Q1 2025, underscores sustained demand for its diverse product and service portfolio.

- Positive Book-to-Bill Ratio: The company's consistent book-to-bill ratio above 1 for its industrial businesses in FY2024 signals that new orders are outpacing revenue recognition, suggesting continued growth and market strength.

Commitment to Sustainability and ESG Leadership

Siemens demonstrates a robust commitment to sustainability, evidenced by its DEGREE framework which has seen the company exceed its ambitious targets, especially in decarbonization and resource efficiency. By 2023, Siemens had already achieved a 56% reduction in Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, surpassing its initial goal of a 50% reduction by 2025.

Furthermore, a significant portion of Siemens' revenue, approximately 60% in fiscal year 2023, is generated from products and solutions that directly help customers reduce their environmental impact. This strategic focus on Environmental, Social, and Governance (ESG) principles is deeply integrated into its business model, not merely an add-on, fueling growth and strengthening its market position amidst increasing global demand for sustainable solutions.

The company's leadership in ESG not only enhances its brand image but also positions it favorably to capitalize on the growing market for green technologies and services. This proactive approach ensures Siemens remains relevant and competitive in a rapidly evolving economic landscape, aligning with critical global sustainability megatrends.

Key strengths in this area include:

- Ahead-of-schedule target achievement: Siemens has consistently met and exceeded its sustainability goals.

- Customer emission reduction: A substantial revenue stream is derived from products that cut CO2 emissions for clients.

- Integrated business imperative: Sustainability is a core driver of innovation and growth, not just a corporate responsibility.

- Brand reputation enhancement: Strong ESG performance bolsters Siemens' image and appeal to stakeholders.

Siemens' diversified global technology portfolio is a cornerstone of its strength, spanning key sectors like Digital Industries, Smart Infrastructure, Mobility, and Siemens Healthineers. This broad market presence, with segments like Siemens Healthineers showing 5% local currency revenue growth in FY23, provides significant risk mitigation and fosters resilience against sector-specific downturns.

The company's leadership in industrial automation and software, driven by its Siemens Xcelerator platform, positions it at the forefront of Industry 4.0 and digital transformation. This focus on bridging physical and digital realms, enhanced by AI and IoT integration, fuels expansion as industries increasingly adopt digital solutions.

Siemens' robust innovation engine, backed by approximately €5.6 billion in R&D spending in FY23 and over 4,000 new patents in the same year, ensures a continuous stream of cutting-edge products. This commitment to R&D, particularly in digitalization and AI, solidifies its technological leadership and adaptability.

Strong financial performance, including revenue growth in FY24 and Q2 FY25, coupled with a substantial order backlog exceeding €190 billion in Q1 FY25, provides excellent future revenue visibility. A consistent book-to-bill ratio above 1 in its industrial businesses further signals sustained market strength and growth.

Siemens demonstrates exceptional commitment to sustainability, exceeding its decarbonization targets with a 56% reduction in Scope 1 and 2 emissions by 2023 against a 2019 baseline. Approximately 60% of its FY23 revenue comes from products that help customers reduce environmental impact, integrating ESG as a core business driver.

| Key Strength Area | Description | Supporting Data (FY23/FY24/Q2 FY25) |

| Diversified Portfolio | Presence across multiple resilient sectors | Siemens Healthineers revenue growth: 5% (local currency, FY23) |

| Digitalization Leadership | Focus on Industry 4.0 and digital transformation | Siemens Xcelerator platform |

| Innovation & R&D | Continuous investment in new technologies | R&D expenses: €5.6 billion (FY23); New patents: >4,000 (FY23) |

| Financial Health | Revenue growth, profitability, and order backlog | Order backlog: >€190 billion (Q1 FY25); Book-to-bill ratio >1 (Industrial businesses, FY24) |

| Sustainability Commitment | Exceeding ESG targets and revenue from green solutions | Scope 1 & 2 emissions reduction: 56% (vs. 2019 baseline, by 2023); Revenue from green products: ~60% (FY23) |

What is included in the product

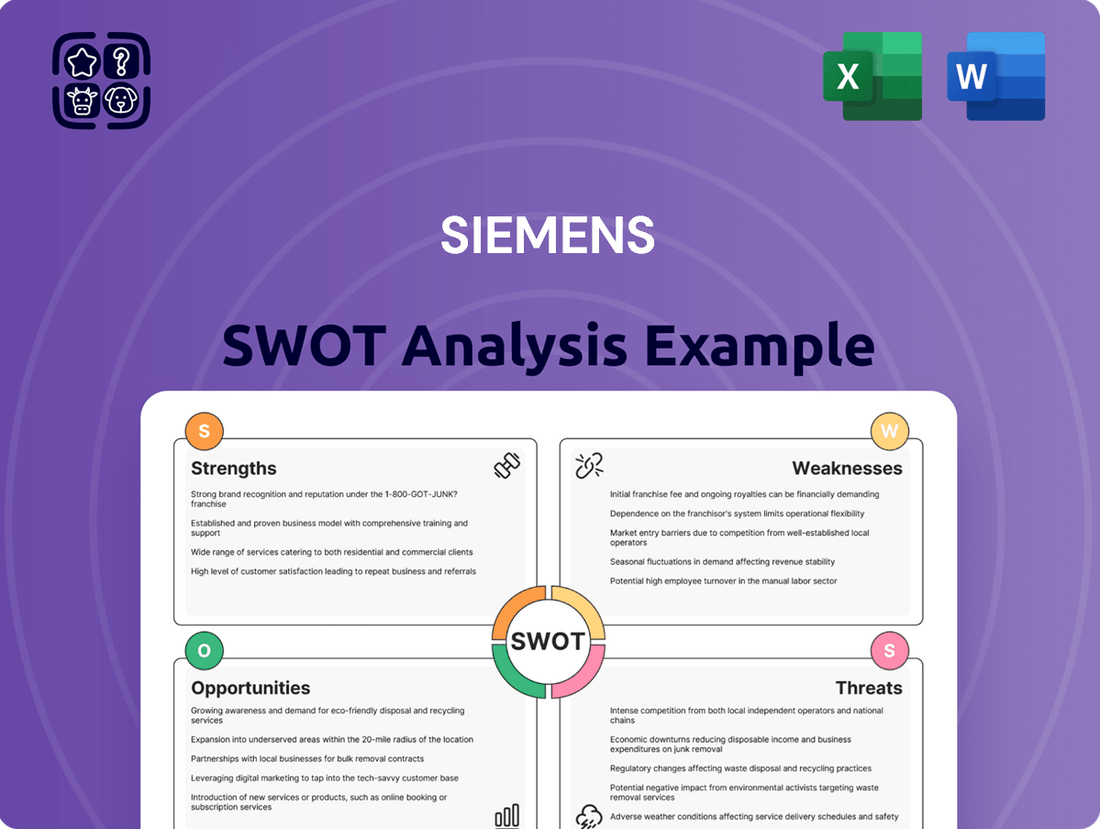

Analyzes Siemens’s competitive position through key internal and external factors.

Simplifies complex competitive landscapes, allowing Siemens to quickly identify actionable strategies and mitigate risks.

Weaknesses

Siemens' broad diversification across numerous complex industrial and technological sectors, including healthcare, energy, and mobility, inherently creates significant organizational complexity. This can slow down decision-making and reduce operational agility, making it harder to respond quickly to market shifts. For instance, managing the distinct operational demands and regulatory environments of Siemens Healthineers alongside Siemens Mobility requires substantial coordination. This intricate structure can also pose challenges for investors and analysts trying to fully understand the company's diverse revenue streams and strategic priorities.

Siemens' extensive global footprint, while a strength, also exposes it to the vagaries of worldwide economic shifts. Macroeconomic downturns, geopolitical unrest, and trade disputes in crucial regions like China and Europe can significantly dampen demand for its core industrial automation and infrastructure offerings.

For instance, a slowdown in European manufacturing, a key market for Siemens, directly translates to fewer orders for factory equipment and digital solutions. In 2023, Siemens' Digital Industries segment, which heavily relies on industrial investment, saw order growth moderate in certain regions facing economic headwinds.

This inherent susceptibility means Siemens must continuously track and adjust to volatile global economic conditions to mitigate potential revenue declines and maintain its competitive edge in diverse international markets.

Siemens operates in highly competitive markets, facing formidable rivals like General Electric, Schneider Electric, ABB, and Philips across its diverse business segments. This intense rivalry puts constant pressure on Siemens' profit margins, requiring significant and ongoing investment in research and development to stay ahead. For instance, in the industrial automation sector, competition from companies like Rockwell Automation is fierce, driving the need for continuous product innovation and aggressive pricing strategies to defend market share.

Challenges in Specific Business Units

Siemens' Digital Industries segment has experienced headwinds, including softer demand in crucial markets and heightened competition, which has necessitated workforce reductions. For instance, in fiscal year 2023, the company announced plans to cut around 2,500 jobs, primarily in Germany, within this division to streamline operations and adapt to market conditions.

The wind power division, Siemens Gamesa, which Siemens AG maintains a significant interest in, has been grappling with substantial quality-related problems. These issues have resulted in considerable financial burdens and write-downs, impacting Siemens' consolidated financial results. In the first half of fiscal year 2024, Siemens Gamesa reported a net loss of €886 million, highlighting the ongoing severity of these challenges.

These sector-specific difficulties, particularly within Digital Industries and Siemens Gamesa, can exert downward pressure on Siemens' overall financial performance and profitability. The need to address these operational and quality issues requires significant management attention and capital allocation, potentially diverting resources from growth initiatives.

- Digital Industries: Faced muted demand and increased competition, leading to job cuts impacting approximately 2,500 roles in fiscal year 2023.

- Siemens Gamesa: Encountered significant quality issues and associated costs, contributing to a net loss of €886 million in the first half of fiscal year 2024.

- Financial Impact: These segment-specific struggles can negatively affect Siemens' overall profitability and require substantial resource allocation for remediation.

Potential for Intellectual Property Rights (IPR) Risks

Siemens faces significant intellectual property rights (IPR) risks due to its global operations, particularly in regions with less robust legal frameworks for IP protection. As competitors in emerging markets advance technologically, the likelihood of Siemens' proprietary technologies and patents being infringed upon increases. This poses a direct threat to its hard-won innovative edge and overall competitive standing. In 2023, Siemens reported investing €5.6 billion in research and development, highlighting the substantial value of its IP portfolio that requires constant vigilance and defense.

The challenge of safeguarding its extensive array of patents and trade secrets is paramount. This includes ensuring that its innovations in areas like industrial automation, digital industries, and smart infrastructure are adequately protected against unauthorized replication or exploitation. Failure to do so could lead to a dilution of its market leadership and a reduction in the return on its significant R&D investments. For instance, protecting innovations in areas like its Digital Industries portfolio, which saw significant growth in 2024, is crucial for maintaining its competitive advantage.

- Global Exposure: Operating in over 160 countries increases the surface area for potential IPR violations.

- Emerging Market Threat: As local R&D capabilities grow in emerging economies, the risk of IP theft by technologically advanced competitors escalates.

- Portfolio Value: Siemens' substantial investment in innovation, evidenced by its ongoing R&D spending, necessitates strong IP protection to preserve value.

- Competitive Edge: The misuse or theft of Siemens' intellectual property can directly erode its competitive advantage and market share.

Siemens Gamesa has been a significant drag on Siemens' performance due to persistent quality issues and associated costs. These problems have led to substantial financial write-downs and losses, impacting the company's overall profitability. For example, in the first half of fiscal year 2024, Siemens Gamesa reported a net loss of €886 million, underscoring the severity of these ongoing challenges.

The company's broad diversification, while a strategic advantage, also introduces considerable complexity. Managing distinct business units like healthcare and mobility requires intricate coordination and can slow down decision-making processes. This can make it harder for Siemens to react swiftly to dynamic market changes across its diverse portfolio.

Intense competition across its various sectors, from industrial automation to energy, necessitates continuous and significant investment in research and development. Rivals like General Electric, Schneider Electric, and ABB constantly challenge Siemens' market share, putting pressure on profit margins and demanding ongoing innovation to maintain leadership.

Siemens' extensive global operations expose it to risks related to intellectual property rights (IPR), particularly in regions with less stringent legal protections. Protecting its vast portfolio of patents and trade secrets is crucial, as infringement could diminish its competitive edge and the return on its substantial R&D investments. The company invested €5.6 billion in R&D in 2023, highlighting the value of its IP.

Same Document Delivered

Siemens SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing an actual excerpt of the Siemens SWOT analysis. Once purchased, you’ll receive the full, editable version, offering a comprehensive understanding of Siemens' strategic position.

Opportunities

The global push towards digitalization and Industry 4.0 is creating a massive opportunity for Siemens. As businesses across sectors increasingly adopt smart manufacturing and automation, Siemens' expertise in industrial software and digital twin technology positions it to lead. For instance, the industrial automation market alone was valued at approximately $230 billion in 2023 and is projected to grow significantly, with AI integration being a key driver.

Siemens is well-equipped to benefit from this trend, leveraging its strong portfolio in automation, electrification, and digital solutions. By expanding its AI-powered product and service offerings, the company can unlock deeper market penetration and cultivate new revenue streams, capitalizing on the growing demand for intelligent and connected industrial systems.

The intensifying global commitment to sustainability and the urgent need for decarbonization are creating substantial opportunities for Siemens. As countries and corporations prioritize resource efficiency, demand for Siemens' advanced smart infrastructure, electric mobility solutions, and renewable energy technologies is surging. This trend is particularly evident as governments implement policies aimed at reducing carbon footprints and fostering green economies.

Siemens' proactive stance in developing eco-friendly products and its significant involvement in ambitious hydrogen projects, such as those announced in 2024 and early 2025, directly capitalize on this growing green investment wave. These initiatives not only align with Siemens' internal DEGREE sustainability framework but also significantly enhance its market appeal to environmentally conscious investors and customers worldwide.

Emerging markets represent a significant avenue for growth, with developing economies actively investing in infrastructure and industrial upgrades. Siemens is well-positioned to capitalize on this, particularly as urbanization accelerates. For instance, in 2024, regions like Southeast Asia saw substantial investments in smart city technologies and renewable energy projects, areas where Siemens possesses strong expertise.

The ongoing industrialization in many emerging economies drives demand for automation, digitalization, and efficient power solutions. Siemens’ comprehensive portfolio, from factory automation to grid modernization, directly addresses these needs. The company’s 2024 order intake in these sectors demonstrated a growing reliance on advanced industrial technologies.

Healthcare infrastructure is another key area for expansion. As middle classes grow in emerging markets, so does the demand for advanced medical equipment and digital health solutions. Siemens Healthineers’ focus on accessible and innovative healthcare technologies aligns perfectly with these evolving market requirements, showing promising revenue growth in these geographies throughout 2024.

By tailoring its product and service offerings to the specific economic and regulatory environments of individual emerging markets, Siemens can unlock substantial new business opportunities. This localized approach, combined with strategic partnerships, is crucial for navigating the complexities and maximizing the potential of these dynamic economies in 2025 and beyond.

Strategic Acquisitions and Partnerships

Siemens can significantly boost its technological prowess and market presence through strategic acquisitions and partnerships. For instance, the 2022 acquisition of Dotmatics for $736 million and Altair Engineering's software business in 2024 underscore a commitment to expanding its digital and software offerings, crucial for future growth.

These moves are vital for strengthening Siemens' competitive edge in key industries. Collaborations, particularly within the dynamic healthcare sector, are also instrumental in fostering innovation and securing leadership positions. These alliances allow Siemens to tap into new markets and accelerate the development of cutting-edge solutions.

Key opportunities include:

- Acquiring specialized software companies to bolster its digital portfolio.

- Forming strategic alliances in emerging technology areas like AI and sustainable energy.

- Expanding market reach in high-growth regions through joint ventures.

- Integrating acquired technologies to create comprehensive end-to-end solutions for customers.

Leveraging Data and Predictive Maintenance

Siemens can capitalize on the immense data generated by its extensive installed base of industrial and infrastructure equipment. This data is a goldmine for creating sophisticated data analytics and predictive maintenance solutions. For instance, by Q1 2025, Siemens' MindSphere platform is expected to process data from millions of connected devices, enabling proactive issue detection and service recommendations.

By offering these advanced, value-added services, Siemens can cultivate new, predictable recurring revenue streams. These services directly benefit customers by boosting their operational efficiency and significantly minimizing costly equipment downtime. This strategy perfectly complements Siemens' overarching digitalization initiatives, reinforcing its market position.

- Enhanced Service Revenue: Predictive maintenance services are projected to contribute significantly to Siemens' Digital Industries segment, with an estimated annual growth rate of 10-15% through 2025.

- Customer Loyalty: Improving asset uptime for customers, by an average of 20% through predictive analytics, fosters deeper customer relationships and reduces churn.

- Digitalization Synergy: The integration of data analytics into service offerings directly supports Siemens' stated goal of increasing its digital revenue share to over 60% of total revenue by 2027.

- Operational Efficiency Gains: Clients utilizing Siemens' predictive maintenance solutions have reported an average reduction in unscheduled downtime of up to 30%.

Siemens is strategically positioned to benefit from the accelerating global demand for sustainable energy solutions and smart infrastructure. The company's investments in renewable energy technologies, such as wind turbines and grid modernization, align with governmental decarbonization targets and a growing corporate focus on ESG principles, with significant order growth anticipated through 2025.

The company's robust portfolio in electrification, automation, and digitalization provides a comprehensive offering for customers aiming to improve energy efficiency and reduce their carbon footprint. Siemens' commitment to hydrogen technologies, evidenced by projects progressing into 2025, further solidifies its role in the energy transition.

Emerging markets present substantial growth opportunities for Siemens, driven by rapid urbanization and industrial development. The company's expertise in infrastructure, automation, and digital solutions is highly relevant to these growing economies, with significant infrastructure spending projected in regions like Asia and Africa through 2025.

Siemens' ability to tailor its offerings to local needs, combined with strategic partnerships, will be key to capturing market share in these dynamic regions. The healthcare sector in these markets also offers considerable potential, with increasing demand for advanced medical technology and digital health services from Siemens Healthineers.

Strategic acquisitions and partnerships are crucial for Siemens to enhance its technological capabilities and expand its market reach. The company's ongoing investments in software and digital solutions, such as the 2024 acquisition of Altair's software business, demonstrate a clear strategy to bolster its competitive position in key growth areas.

These collaborations and integrations are vital for developing comprehensive, end-to-end solutions that address complex customer needs. By focusing on high-growth technology areas like AI and sustainable energy, Siemens aims to solidify its leadership and create new revenue streams through 2025.

Leveraging the vast data generated from its installed base through platforms like MindSphere offers a significant opportunity for Siemens to develop advanced analytics and predictive maintenance services. These data-driven solutions can create recurring revenue streams by improving customer operational efficiency and minimizing downtime, with substantial growth expected through 2025.

| Opportunity Area | Key Driver | Siemens' Strength | Projected Impact (2024-2025) |

|---|---|---|---|

| Digitalization & Industry 4.0 | Global push for smart manufacturing and automation | Leading portfolio in industrial software, automation, digital twin | Significant revenue growth in Digital Industries segment |

| Sustainability & Decarbonization | Urgent need for resource efficiency and carbon reduction | Advanced smart infrastructure, electric mobility, renewable energy tech | Increased demand for green solutions, growth in energy management |

| Emerging Markets Growth | Infrastructure investment, industrialization, urbanization | Comprehensive portfolio for automation, power, and infrastructure needs | Expansion of market share in high-growth regions |

| Strategic Acquisitions & Partnerships | Enhancing digital capabilities and market presence | Proven track record of acquiring and integrating technology firms | Strengthened competitive edge in software and digital services |

| Data Analytics & Services | Maximizing value from installed base data | MindSphere platform, expertise in predictive maintenance | New recurring revenue streams from value-added services |

Threats

Global geopolitical tensions and escalating trade disputes, including ongoing trade friction between major economic blocs, present a significant threat to Siemens. These issues can severely disrupt the company's intricate global supply chains, leading to increased operational costs and restricted access to key markets. For instance, a significant downturn in global trade volumes, projected to be around 1.5% in early 2025 according to some economic forecasts, directly impacts Siemens' ability to source components and deliver products efficiently.

Economic uncertainties, as highlighted in the fiscal 2025 outlooks, further exacerbate these risks. A slowdown in industrial investments and a tendency for clients to defer large projects, particularly in emerging markets where Siemens has substantial operations, can directly impact revenue streams. For example, a projected 2% contraction in capital expenditure by key industrial sectors in certain regions during 2025 could translate into billions of euros in lost project opportunities for Siemens.

These external factors, largely outside of Siemens' direct control, represent substantial strategic risks. The company's reliance on globalized operations means it is particularly vulnerable to shifts in international trade policies and economic stability. The potential for increased tariffs or sanctions could force costly reconfigurations of supply chains and manufacturing footprints, impacting profitability and market competitiveness.

The relentless pace of technological evolution, especially in areas like digitalization and AI, presents a significant risk of product obsolescence for Siemens. If the company cannot innovate at a speed that matches or exceeds these advancements, its existing product lines could quickly become outdated, impacting revenue streams and market competitiveness.

New, agile competitors and startups are continuously emerging with disruptive technologies, capable of carving out market share and challenging Siemens' established positions. This dynamic landscape demands constant vigilance and a proactive approach to market shifts.

Maintaining a leading edge in these rapidly evolving sectors necessitates ongoing and substantial investment in research and development. For instance, Siemens' R&D expenditure in fiscal year 2023 reached approximately €5.6 billion, a figure that underscores the commitment required but also highlights the financial pressure to ensure these investments translate into market-leading innovations.

Siemens' growing dependence on digital platforms and interconnected systems amplifies its vulnerability to cyber threats. This includes the potential for data breaches, theft of valuable intellectual property, and disruptions to critical operations. For instance, a significant cybersecurity incident in 2023 could have led to substantial operational downtime and recovery costs, impacting its diverse business segments from automation to smart infrastructure.

The paramount importance of safeguarding sensitive customer information and proprietary data cannot be overstated. A major security failure could irreparably harm Siemens' brand reputation and result in severe financial liabilities and legal repercussions. The global cost of data breaches continued to rise in 2024, with average costs exceeding $4.45 million, a figure Siemens would strive to avoid.

Supply Chain Disruptions and Raw Material Volatility

Global supply chain vulnerabilities, including shortages of critical components and raw material price fluctuations, present a significant threat to Siemens. These issues can disrupt production schedules, inflate manufacturing costs, and lead to project delivery delays. For instance, the semiconductor shortage experienced globally through 2023 and into early 2024 directly impacted industries reliant on advanced electronics, a key area for Siemens' offerings.

Siemens' extensive reliance on a complex, interconnected network of global suppliers leaves it susceptible to external shocks. Unexpected events, such as geopolitical instability or natural disasters in key manufacturing regions, can ripple through this network, affecting profitability and potentially damaging customer relationships due to unfulfilled orders. The company's robust supply chain management is continually tested by these volatile conditions.

- Component Shortages: Continued shortages in key electronic components, particularly semiconductors, can hinder production of industrial automation and digital factory solutions.

- Raw Material Price Spikes: Fluctuations in prices for metals like copper and aluminum, essential for electrical engineering products, can increase cost of goods sold. For example, copper prices saw significant volatility in 2024, impacting energy infrastructure projects.

- Logistical Bottlenecks: Port congestion and increased shipping costs, persisting from earlier disruptions, can delay the delivery of both incoming materials and finished goods.

- Geopolitical Risks: Regional conflicts or trade disputes can directly impact sourcing of materials or the ability to deliver projects in affected areas.

Regulatory Changes and Compliance Burden

Siemens operates in highly regulated sectors like energy and industrial automation, making it susceptible to evolving environmental standards and data privacy laws such as GDPR. For instance, in 2024, the EU continued to refine its digital services and data protection regulations, requiring significant investment in compliance across its European operations. Failure to adhere to these diverse and often changing rules can lead to substantial financial penalties, legal challenges, and a tarnished brand image, impacting market trust and investor confidence.

The constant need to adapt to new or modified regulations across its global footprint, including in areas like cybersecurity and sustainability reporting, increases operational complexity and incurs considerable costs. This ongoing compliance burden diverts resources that could otherwise be allocated to innovation and growth. For example, Siemens' investments in updating its manufacturing processes to meet stricter emissions standards in 2025 will be a significant factor in its operational expenditure.

- Regulatory Volatility: Siemens faces potential disruptions from sudden shifts in governmental policies and international trade agreements, impacting its global supply chains and market access.

- Compliance Costs: The expense of ensuring adherence to a patchwork of national and international regulations, from product safety to labor laws, represents a continuous operational overhead.

- Data Governance: Increasingly stringent data privacy laws worldwide necessitate robust data management systems, posing a threat if breaches occur or compliance is inadequate.

- Environmental Mandates: New or strengthened environmental regulations, particularly concerning emissions and sustainable manufacturing practices, can require costly upgrades to Siemens' infrastructure and processes.

Intensifying global competition from both established players and agile new entrants poses a significant threat, especially as they leverage advanced digital technologies. This necessitates continuous innovation and strategic pricing to maintain market share. For instance, in the rapidly evolving industrial automation sector, competitors are increasingly offering integrated software solutions that challenge Siemens' traditional hardware-centric models.

| Threat Category | Specific Risk | Impact on Siemens | Example/Data (2024/2025) |

|---|---|---|---|

| Competition | Emergence of disruptive startups | Market share erosion, pressure on pricing | Startups in AI-driven industrial analytics gaining traction, potentially impacting Siemens' digital services revenue. |

| Competition | Increased competition in emerging markets | Reduced growth opportunities, need for localized strategies | Local players in Asia offering cost-effective automation solutions, impacting Siemens' market penetration. |

| Technological Obsolescence | Rapid advancements in AI and IoT | Risk of existing product lines becoming outdated | Failure to integrate next-generation AI into automation platforms could lead to a competitive disadvantage by 2025. |

| Supply Chain | Component shortages (e.g., semiconductors) | Production delays, increased costs | Continued semiconductor scarcity in 2024-2025 could impact delivery times for automation and electrification products. |

SWOT Analysis Data Sources

This Siemens SWOT analysis is constructed using a comprehensive blend of reliable data sources. These include Siemens' official financial reports, in-depth market research from reputable industry analysts, and insights from expert commentary and verified industry publications.