Siemens Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Bundle

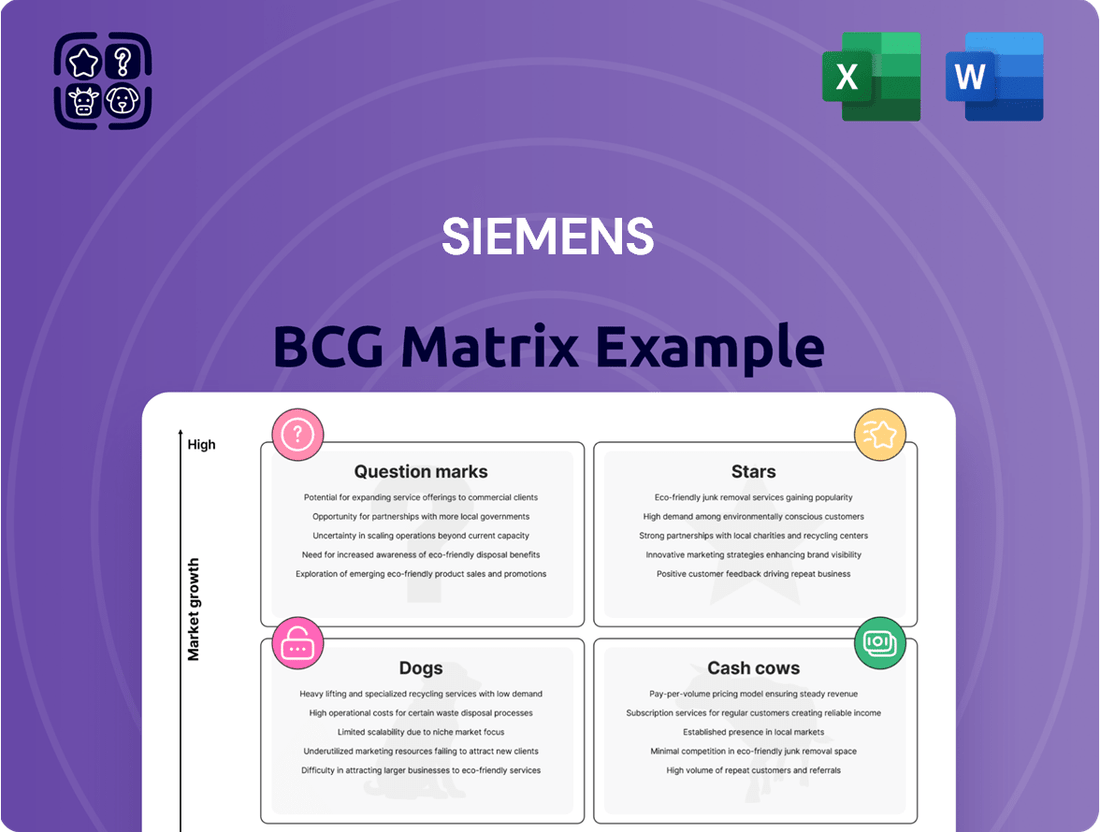

Curious about Siemens' strategic product portfolio? Our BCG Matrix analysis reveals their market positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their investments are paying off and where they might be faltering.

This isn't just a theoretical exercise; it's a crucial tool for understanding competitive advantage and future growth. Gain a clear visual representation of Siemens' product landscape and the strategic implications for each category.

Want to move beyond this initial overview? Purchase the full BCG Matrix report for a comprehensive breakdown, including data-driven insights and actionable recommendations tailored to each quadrant.

Equip yourself with the knowledge to make informed decisions about resource allocation and future product development. The complete analysis will provide a roadmap for optimizing Siemens' market presence.

Don't miss out on the strategic clarity this report offers. Invest in the full BCG Matrix and unlock a deeper understanding of Siemens' competitive strategy.

Stars

The Siemens Xcelerator platform is a cornerstone of Siemens' digital strategy, acting as an open ecosystem for IoT-enabled hardware, software, and digital services. It’s designed to speed up digital adoption across industries like manufacturing, smart buildings, and transportation.

Since its introduction in mid-2022, the platform has experienced remarkable traction, with user traffic multiplying by four times, underscoring its growing importance. This expansion is fueled by a continuously broadening array of solutions and an increasing network of partners.

Siemens is strategically positioning its Digital Twin technology as a star performer, reflecting significant investment and a clear path for future growth within the industrial sector. This technology is paramount for optimizing product lifecycles, from initial design and engineering through to sophisticated manufacturing processes.

The company's commitment to digital twins is not just about efficiency; it's a cornerstone for driving innovation and integrating crucial circularity principles, aiming for more sustainable product development. Siemens anticipates substantial market penetration as businesses increasingly recognize the value of merging physical operations with their digital counterparts.

For instance, in 2024, Siemens reported a considerable increase in customer adoption of its digital twin solutions, particularly within the automotive and aerospace sectors, citing enhanced product quality and reduced time-to-market. This surge in demand underscores the technology's ability to boost efficiency, build greater resilience into supply chains, and significantly improve sustainability metrics for its clients.

Siemens is heavily investing in AI-powered industrial automation, exemplified by its Siemens Industrial Copilot for Operations, designed to accelerate product development and streamline manufacturing. This strategic push includes acquisitions like Altair in March 2025, significantly enhancing its industrial AI and simulation capabilities. These advanced AI solutions are instrumental in optimizing shop floor operations through real-time data analysis, driving efficiency and innovation across diverse industries.

Data Center Infrastructure Solutions

Siemens Smart Infrastructure (SI) is making substantial investments in its digital offerings, with a particular focus on the rapidly growing data center sector. This strategic move positions Siemens to capitalize on the increasing demand for advanced infrastructure solutions. The company's commitment to this high-growth area is evident in its recent performance and future projections.

In fiscal year 2024, Siemens' data center business experienced remarkable growth, exceeding 50% and securing €3.6 billion in orders. This strong performance indicates a robust market demand and Siemens' competitive edge in delivering essential infrastructure. The outlook for 2025 remains highly promising, suggesting continued expansion.

The broader data center industry is projected to expand at a compound annual growth rate of 10% through 2030. This sustained growth trajectory underscores the critical role Siemens plays as a key supplier of essential electrical equipment.

- Data Center Growth: The industry is expected to grow 10% annually until 2030.

- Siemens SI Performance (FY24): Data center business grew over 50%, with €3.6 billion in orders.

- Siemens' Position: A leading provider of critical electrical equipment for the expanding data center market.

Advanced Medical Imaging (Siemens Healthineers)

Siemens Healthineers' Advanced Medical Imaging segment is a clear Star in the BCG matrix. In Q1 fiscal year 2025, this division achieved a robust comparable revenue growth of 7.6%, showcasing its market dominance and innovative edge in diagnostic imaging. This performance underscores its vital role within Siemens Healthineers' broader strategy, contributing substantially to the company's overall momentum.

The segment's continued success is fueled by its leadership in a high-tech, rapidly evolving healthcare sector. Key drivers include ongoing investment in advanced technologies and a strong demand for sophisticated diagnostic solutions.

- Market Leadership: Holds a leading position in the diagnostic imaging market.

- Strong Growth: Achieved 7.6% comparable revenue growth in Q1 FY2025.

- Innovation Hub: Drives technological advancements in healthcare imaging.

Siemens' Digital Twin technology is a prime example of a Star within the BCG matrix. This technology is crucial for optimizing product lifecycles and driving innovation, particularly in sectors like automotive and aerospace. The company reported significant customer adoption increases in 2024, leading to enhanced product quality and faster time-to-market for its clients.

Siemens' AI-powered industrial automation, including solutions like the Siemens Industrial Copilot for Operations, also represents a Star. Acquisitions like Altair in March 2025 further bolster these capabilities, focusing on enhancing industrial AI and simulation for optimizing shop floor operations and driving efficiency.

The data center business within Siemens Smart Infrastructure (SI) is another clear Star. In fiscal year 2024, this segment saw over 50% growth, securing €3.6 billion in orders. This performance is set against a backdrop of a data center industry projected to grow at a 10% CAGR through 2030, highlighting Siemens' strong position.

Siemens Healthineers' Advanced Medical Imaging segment is also a Star, achieving 7.6% comparable revenue growth in Q1 fiscal year 2025. This demonstrates market leadership in the high-tech healthcare sector, driven by continuous investment in advanced technologies and strong demand for diagnostic solutions.

| Business Unit/Technology | BCG Category | Key Performance Indicators (as of latest available data) | Growth Drivers |

|---|---|---|---|

| Digital Twin Technology | Star | Increased customer adoption (FY24), improved product quality, reduced time-to-market | Optimizing product lifecycles, circularity principles, merging physical and digital operations |

| AI-Powered Industrial Automation | Star | Enhanced industrial AI and simulation capabilities (post-Altair acquisition, March 2025) | Accelerating product development, streamlining manufacturing, real-time data analysis for shop floor optimization |

| Siemens Smart Infrastructure (Data Centers) | Star | >50% growth, €3.6 billion orders (FY24) | High demand in data center sector (10% CAGR projected through 2030), essential electrical equipment provision |

| Siemens Healthineers (Advanced Medical Imaging) | Star | 7.6% comparable revenue growth (Q1 FY25) | Leadership in diagnostic imaging, investment in advanced technologies, demand for sophisticated solutions |

What is included in the product

The Siemens BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

This framework guides Siemens in resource allocation, highlighting which units to invest in, harvest, or divest for optimal portfolio performance.

A clear visual map of Siemens' portfolio, identifying strategic priorities and resource allocation needs.

Cash Cows

Siemens Mobility's rail rolling stock and rail automation segments are true cash cows, generating consistent and substantial profits. These businesses boast robust order backlogs, ensuring a steady stream of revenue well into the future. For fiscal year 2024, Siemens Mobility saw impressive gains in both orders and revenue, and they anticipate this momentum to continue with comparable revenue growth projected between 8% and 10% for fiscal year 2025.

The company’s strong market position in the rail sector means these divisions are reliable sources of significant cash flow for the broader Siemens organization. This stability allows Siemens to invest in other areas of its business or return value to shareholders, underscoring the importance of these segments to the company's overall financial health.

Siemens' Building Technologies & Automation, a cornerstone of its Smart Infrastructure division, represents a classic Cash Cow. These solutions, deeply embedded in modern infrastructure, are recognized market leaders, consistently delivering robust profitability.

The Buildings business unit, a significant contributor, made up 39% of Smart Infrastructure's total revenue in fiscal year 2024. This segment's performance highlights the maturity and strong cash-generating capabilities of Siemens' offerings in this established market.

Remarkably, the Buildings segment achieved a record profit margin of 17.3% in fiscal 2024, surpassing previous expectations. This strong financial performance underscores its status as a reliable source of cash for the company.

Siemens' Digital Industries, encompassing industrial automation hardware and software, is a cornerstone of its business, holding a high market share in established manufacturing sectors. This segment offers a dependable revenue stream, even as some areas experienced a slowdown in early 2025. However, the business saw significant growth in China by the end of the second quarter of 2025, fueled by the completion of inventory adjustments, showcasing its resilience.

Electrification Products (Smart Infrastructure)

Siemens' Electrification Products within Smart Infrastructure stands as a robust cash cow, demonstrating impressive performance. In Q2 fiscal year 2025, this segment experienced an 18% surge in growth, a testament to efficient backlog conversion.

The consistent upward trajectory of electrical products, building on an already strong foundation, highlights Siemens' dominant market share in this mature yet expanding sector. This sustained growth directly fuels stable and growing cash flows.

- 18% Growth in Q2 FY25: Driven by excellent backlog conversion, showcasing strong operational execution.

- Consistent Electrical Product Growth: Indicates a firm market position and demand in a mature but expanding segment.

- Capitalizing on Sustainability Trends: Leverages the global shift towards eco-friendly energy solutions for reliable cash generation.

Laboratory Diagnostics (Siemens Healthineers)

Siemens Healthineers' Laboratory Diagnostics business, though showing modest comparable revenue growth of 1.6% in Q1 FY25, remains a stable cash generator. This segment is a cornerstone of the company, providing crucial diagnostic solutions worldwide.

Despite a challenging demand environment, particularly in China, the diagnostics division continues to be a reliable source of cash. Transformation programs focused on cost reduction are instrumental in sustaining its profitability and cash flow generation capacity.

- Market Position: Established global presence in essential laboratory diagnostics.

- Revenue Growth (Q1 FY25): 1.6% comparable revenue growth.

- Profitability Drivers: Cost reductions from transformation programs are key.

- Cash Generation: Continues to be a strong cash flow contributor despite market headwinds.

Siemens Mobility's rail rolling stock and automation segments are prime examples of cash cows. Their substantial order backlogs provide predictable revenue streams, with comparable revenue growth anticipated between 8% and 10% for fiscal year 2025.

The Buildings business unit within Smart Infrastructure, a significant contributor, achieved a remarkable 17.3% profit margin in fiscal year 2024, underscoring its robust cash-generating capabilities.

Siemens' Electrification Products, also part of Smart Infrastructure, demonstrated an 18% surge in growth in Q2 fiscal year 2025, driven by efficient backlog conversion, solidifying its position as a consistent cash generator.

Siemens Healthineers' Laboratory Diagnostics, despite facing market challenges, contributes steadily to cash flow, supported by ongoing cost-reduction initiatives.

| Segment | Status | Key Financial Indicator (FY24/Q2 FY25) | Outlook/Driver |

|---|---|---|---|

| Siemens Mobility (Rail Rolling Stock & Automation) | Cash Cow | 8-10% comparable revenue growth projected for FY25 | Robust order backlogs, consistent demand |

| Smart Infrastructure (Buildings) | Cash Cow | 17.3% profit margin in FY24 | Market leadership, embedded solutions |

| Smart Infrastructure (Electrification Products) | Cash Cow | 18% growth in Q2 FY25 | Efficient backlog conversion, sustainability trends |

| Siemens Healthineers (Laboratory Diagnostics) | Cash Cow | 1.6% comparable revenue growth in Q1 FY25 | Cost reduction programs, stable market position |

What You See Is What You Get

Siemens BCG Matrix

The Siemens BCG Matrix preview you see is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive report, meticulously prepared by strategy professionals, offers a clear and actionable framework for analyzing Siemens' diverse business units and product portfolios. You can confidently use this fully formatted file for immediate integration into your strategic planning, executive presentations, or internal discussions, ensuring no surprises and maximum utility.

Dogs

Legacy conventional power generation technologies, once part of Siemens AG's broader portfolio before the spin-off of Siemens Energy, would likely be categorized as Dogs in a BCG matrix analysis if they were still fully integrated. These older assets face a declining market due to the global shift towards renewable energy sources. For example, in 2024, the demand for new coal-fired power plants in many developed nations has significantly diminished, impacting the growth prospects of related technologies.

These technologies typically exhibit low market share and low growth rates. The ongoing need for maintenance and upgrades on existing conventional power plants, without substantial new market opportunities, means they generate minimal returns. This situation is exacerbated as the energy sector increasingly prioritizes sustainability and decarbonization, making investments in traditional fossil fuel generation less attractive.

Siemens AG's strategic divestment from Siemens Energy, reducing its stake to below 15%, further underscores the diminished strategic importance of these legacy conventional power generation assets for the parent company. While Siemens Energy continues to operate in this space, for Siemens AG, these older technologies represent a category of business that demands capital for upkeep but offers limited potential for future expansion or significant profit generation in the current market environment.

Siemens' divestment of its non-core electrical wiring accessories business in Q1 2025 resulted in a notable boost to its net income. This strategic move aligns with the principles of the BCG Matrix, suggesting the wiring accessories segment was a 'Dog'—possessing low market share and operating in a low-growth industry.

By shedding this business, Siemens freed up capital and management focus. Resources can now be strategically redeployed towards its core competencies and higher-potential growth areas, such as digitalization and automation solutions, which are crucial for its future technological leadership.

Certain low-margin, standardized industrial components within Siemens' Digital Industries and Smart Infrastructure segments likely fall into the Dogs category of the BCG Matrix. These products, often commoditized, grapple with fierce price competition and minimal differentiation.

Consequently, they typically hold a low market share within mature, slow-growing sub-segments of the industrial market. For instance, basic electrical connectors or standard fasteners, while essential, offer little room for premium pricing or significant market expansion.

Siemens' strategic approach involves continuous portfolio optimization. Areas characterized by these low-margin, standardized components may be subject to de-emphasis or streamlining efforts to boost overall company profitability and resource allocation towards more promising ventures.

Outdated On-Premise Software Solutions with Limited Cloud Integration

Outdated on-premise software solutions with limited cloud integration at Siemens, facing a strategic shift towards Siemens Xcelerator's SaaS and cloud-native offerings, can be viewed as Dogs in the BCG Matrix. These legacy systems often struggle to keep pace with innovation and customer demands for scalability and flexibility. By mid-2024, a significant portion of the IT industry reported challenges in integrating legacy systems with cloud environments, impacting efficiency and incurring higher maintenance costs.

These products, while potentially still generating some revenue, are likely experiencing declining market share. The investment required to maintain and support them may not yield proportionate returns, especially as customers increasingly migrate to cloud-based, modular software. For instance, a report from early 2024 indicated that companies spending over 70% of their IT budget on maintenance for legacy systems often see slower growth compared to those prioritizing cloud adoption.

- Declining Market Share: Customers are prioritizing cloud-first solutions.

- High Maintenance Costs: Disproportionate support costs for diminishing returns.

- Limited Scalability: Inability to adapt to evolving customer needs and market trends.

- Reduced Innovation Potential: Lack of integration with newer, cloud-based technologies.

Specific Niche, Declining Traditional Manufacturing Equipment

Siemens might categorize certain highly specialized, traditional manufacturing equipment as Dogs if they cater to declining niche markets and lack broader integration into digitalization trends. These product lines could be experiencing low market share within their specific segments, coupled with minimal growth prospects, making them prime candidates for portfolio optimization through rationalization or divestiture.

Consider, for instance, a hypothetical Siemens division producing legacy textile machinery. While these machines might still serve a small, established customer base, the overall textile industry’s shift towards automated, digitally integrated production lines, and the declining demand for certain traditional fabric types, could position this segment as a Dog. In 2024, the global textile machinery market, while showing some resilience, is increasingly dominated by technologically advanced solutions, with traditional segments facing contraction.

- Declining Market Share: A specific niche equipment line might hold less than 5% of its specialized market segment.

- Stagnant Growth: Projections for this niche market show a compound annual growth rate (CAGR) of 0% or less.

- Low Profitability: Margins on these products could be shrinking due to increased competition and lack of scalability.

- Limited Investment Appeal: The segment may not attract further R&D or capital expenditure due to its unpromising future.

Products or business units within Siemens that fit the 'Dog' category in the BCG Matrix are those with low market share in low-growth markets. These typically require significant resources for maintenance but offer limited potential for future expansion or substantial returns.

The strategic divestment of less profitable or non-core segments, as seen with Siemens' sale of certain electrical accessories in early 2025, exemplifies the management of 'Dogs'. This allows for capital reallocation to more promising growth areas.

By 2024, many industrial sectors are consolidating, pushing older technologies with low market penetration and minimal growth prospects into the 'Dog' quadrant, necessitating careful portfolio management.

Siemens' focus on digitalization and automation means that legacy systems or products not aligned with these trends are prime candidates for being classified as Dogs, often facing divestment or significant restructuring.

Question Marks

Siemens is aggressively pursuing sustainability, evidenced by its EcoTech label applied to over 25,000 products, emphasizing resource efficiency and circular economy principles. This strategic move positions them to capture a piece of the burgeoning global sustainability solutions market, which is forecast to expand at an impressive 8.47% compound annual growth rate from 2024 through 2033.

While Siemens has a strong foundation, its market share within the truly nascent sustainability solution segments, beyond its existing portfolio, might still be developing. These emerging areas represent significant future growth opportunities where rapid market penetration and innovation are key to establishing a dominant position.

Siemens' strategic acquisitions of Altair in March 2025 and its planned acquisition of Dotmatics in July 2025 are poised to significantly enhance its industrial AI and simulation capabilities, particularly within the burgeoning life sciences sector. These moves are designed to integrate advanced AI into its Product Lifecycle Management (PLM) offerings, creating a more comprehensive digital twin ecosystem. While these AI-driven solutions represent high-growth potential, their market penetration is still in its infancy.

The integration of Altair's simulation and AI expertise, coupled with Dotmatics' data management solutions for life sciences, aims to position Siemens at the forefront of innovation. However, as these product lines are newly formed through acquisitions, their specific market share is yet to be definitively established. Significant investment will be crucial to nurture these nascent offerings, driving adoption and solidifying their position as market leaders, akin to the characteristics of a 'Star' in the BCG matrix.

As industrial digitalization accelerates, the need for robust cybersecurity for Industrial IoT (IIoT) is paramount. Siemens is actively addressing this by embedding security within its comprehensive Siemens Xcelerator platform, aiming to protect critical infrastructure and operational technology. The global IIoT cybersecurity market is projected to reach approximately $30 billion by 2026, indicating substantial growth potential. Siemens, while a leader in industrial automation, may currently hold a smaller share in this specialized, fast-moving IIoT cybersecurity segment, necessitating strategic focus and investment to capture a leading position.

New Ventures in Additive Manufacturing/3D Printing for Industrial Applications

Siemens is actively engaged in additive manufacturing, a sector experiencing robust growth within industrial applications. Their strategy involves integrating digital twin technology to refine designs specifically for 3D printing processes, enhancing efficiency and performance.

While Siemens holds a strong position in core industrial automation, its market share in dedicated industrial 3D printing hardware and specialized materials may be less dominant. This suggests that these additive manufacturing ventures, though high-growth, could be categorized as question marks requiring substantial investment to capture significant market share and achieve leadership.

- High Growth Potential: The global additive manufacturing market is projected to reach over $50 billion by 2027, highlighting significant expansion opportunities for Siemens.

- Digital Twin Integration: Siemens' use of digital twins allows for virtual prototyping and simulation, optimizing designs for 3D printing and reducing physical iteration costs.

- Strategic Investment Needed: To solidify its position in the competitive 3D printing hardware and materials space, Siemens will likely need to increase investment in research and development and potential acquisitions.

Expansion into Mid-Market Segment for Smart Buildings (Smart Infrastructure)

Siemens Smart Infrastructure is strategically focusing on the mid-market segment for smart buildings, a move designed to broaden its footprint beyond its traditional stronghold in large-scale projects. This expansion targets a segment experiencing rapid adoption of smart technologies, presenting a significant growth avenue.

The mid-market, encompassing a vast number of smaller and medium-sized buildings, is increasingly recognizing the benefits of smart infrastructure, from energy efficiency to enhanced occupant experience. For instance, the global smart buildings market was valued at approximately $80 billion in 2023 and is projected to reach over $200 billion by 2030, with the mid-market representing a substantial portion of this growth.

Siemens' initiative acknowledges the inherent challenges of this fragmented landscape. Gaining substantial market share will necessitate carefully calibrated investments and a sharp focus on strategic execution tailored to the specific needs and purchasing power of mid-market clients.

- Market Focus: Expansion into the mid-market segment for smart buildings.

- Growth Opportunity: Increasing adoption of smart technologies in smaller and medium-sized buildings.

- Strategic Challenge: Establishing significant market share in a fragmented mid-market.

- Investment Rationale: High-growth potential driven by widespread demand for smart building solutions.

In the context of Siemens' BCG Matrix, "Question Marks" represent business units or products that operate in high-growth markets but currently hold a low market share. These ventures require significant investment to increase their market share and potentially become future stars. Siemens' forays into advanced industrial AI, specialized additive manufacturing, and niche cybersecurity solutions for IIoT exemplify these Question Mark characteristics.

These areas offer substantial future growth potential, mirroring the high-growth market environments typical of Question Marks. For instance, the industrial AI market is expected to see a CAGR of over 37% between 2024 and 2030, while the IIoT cybersecurity market is projected to reach approximately $30 billion by 2026. Siemens' current market share in these specific, rapidly evolving segments is still being established, necessitating strategic focus and investment to capture a leading position.

The key challenge for these Siemens initiatives, aligning with the Question Mark profile, is the need for substantial capital infusion and strategic execution to gain traction. Without significant investment, these high-potential ventures risk remaining low-share players in fast-growing markets. The success of integrating Altair and Dotmatics, for example, hinges on nurturing these newly acquired capabilities into market-leading offerings.

Siemens' focus on the mid-market for smart buildings also fits the Question Mark category. While the smart buildings market is booming, with projections to exceed $200 billion by 2030, penetrating the fragmented mid-market requires tailored strategies and investment to build share against established players and diverse customer needs.

| Business Area | Market Growth | Siemens Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Industrial AI & Simulation (e.g., Altair/Dotmatics integration) | Very High | Low (Emerging) | Question Mark | Requires significant R&D and integration investment. |

| IIoT Cybersecurity | High | Low to Moderate | Question Mark | Needs focused development and market penetration strategy. |

| Additive Manufacturing (Hardware/Materials) | High | Low to Moderate | Question Mark | Investment in specialized offerings and market positioning is key. |

| Smart Buildings (Mid-Market Segment) | High | Low (Developing) | Question Mark | Requires tailored solutions and strategic market entry. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and industry expert opinions to provide a comprehensive view.