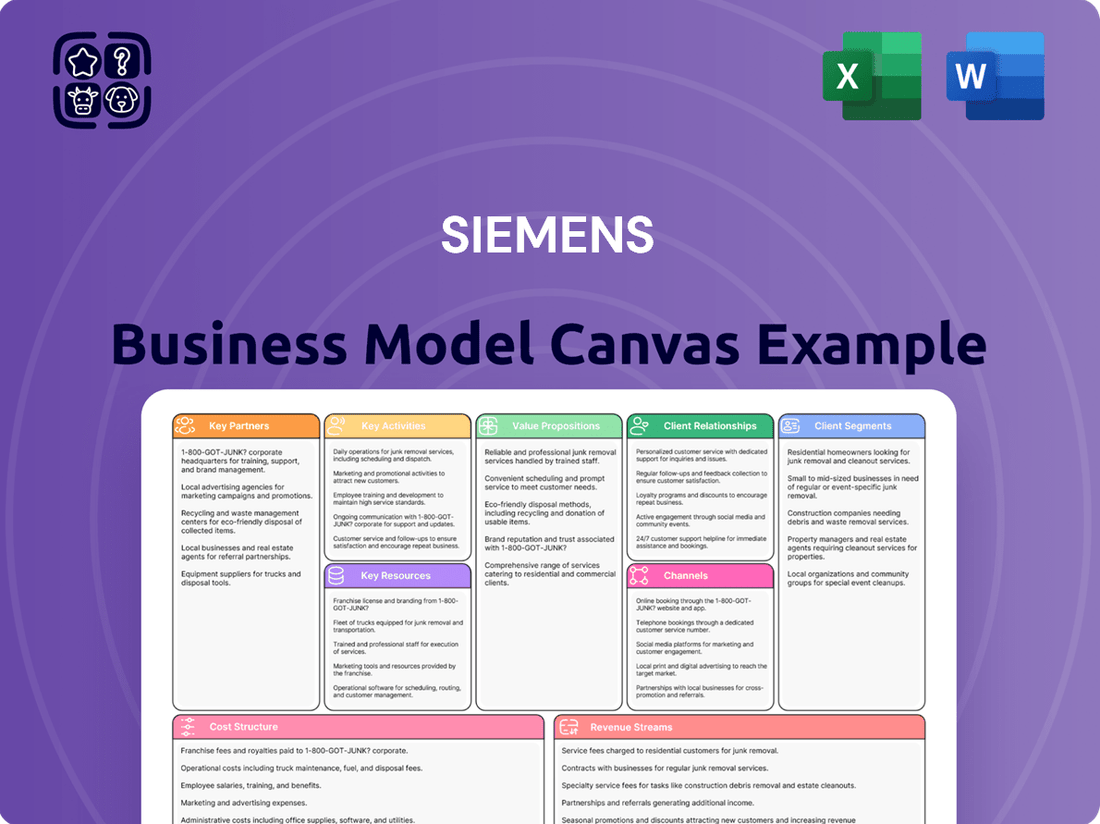

Siemens Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Bundle

Unlock the strategic DNA of Siemens with our comprehensive Business Model Canvas. This detailed breakdown illuminates how Siemens innovates, partners, and generates revenue across its diverse portfolio. Discover the core components that drive their global success and gain actionable insights for your own ventures.

Partnerships

Siemens actively cultivates technology and software alliances with key industry players. These partnerships are crucial for integrating advanced capabilities into their digital solutions. For instance, collaborations with cloud giants like Microsoft and specialized software firms bolster Siemens' industrial AI offerings.

A prime example of these strategic alliances is the Accenture Siemens Business Group. This joint venture focuses on co-developing and jointly marketing innovative solutions. These solutions effectively blend automation, industrial AI, and the comprehensive software suite available through the Siemens Xcelerator portfolio.

Siemens heavily relies on a vast global network of system integrators and channel partners to amplify its market presence and deliver integrated automation and digitalization solutions. These partners are instrumental in deploying intricate projects across diverse sectors, offering localized expertise and support that Siemens itself cannot always provide directly.

For instance, in 2024, Siemens continued to strengthen its relationships with key players like Accenture and Deloitte, who are vital for implementing its Industrial Edge and MindSphere platforms. These collaborations ensure that customers, from manufacturing plants to smart cities, receive tailored implementations and ongoing technical assistance, driving successful digital transformation initiatives.

Siemens actively collaborates with academic and research institutions to drive innovation and cultivate future talent. These partnerships are crucial for staying at the forefront of technological advancements and addressing complex industry challenges.

A prime example is Siemens' collaboration with A*STAR (Agency for Science, Technology and Research) in Singapore. This partnership specifically targets the development of smart and sustainable manufacturing solutions. Key areas of focus include industrial AI and digital twin technology, aiming to enhance efficiency and sustainability in manufacturing processes.

Suppliers and Component Manufacturers

Siemens relies heavily on a robust network of suppliers and component manufacturers to build its diverse range of products, from industrial automation systems to medical imaging equipment. These partnerships are crucial for sourcing specialized parts, ensuring consistent quality, and maintaining supply chain agility. For instance, in 2024, Siemens continued to foster long-term relationships with key electronics providers and semiconductor manufacturers, vital for its digital industries segment.

These collaborations go beyond mere procurement; they often involve joint development efforts and co-innovation. By working closely with suppliers, Siemens can integrate cutting-edge technologies into its offerings and drive innovation in areas like advanced materials and smart components. This strategic approach helps to build resilience against disruptions and ensures access to the latest technological advancements.

- Strategic Sourcing: Siemens maintains partnerships with over 70,000 suppliers globally, a significant portion of which are in component manufacturing.

- Quality Assurance: Suppliers are vetted for quality and reliability, with many adhering to strict Siemens standards, contributing to product durability.

- Innovation Collaboration: Joint projects with component manufacturers in 2024 focused on areas like energy-efficient semiconductors and advanced sensor technologies.

- Supply Chain Resilience: Diversifying its supplier base and fostering strong relationships mitigates risks and ensures continuity of operations.

Joint Ventures and Strategic Collaborations for Large Projects

Siemens frequently engages in joint ventures and strategic collaborations for major infrastructure and mobility undertakings. These alliances are crucial for tackling complex projects, like modernizing national rail networks or building new energy facilities, by pooling specialized knowledge and financial capacity.

These partnerships allow Siemens to share risks and rewards, access new markets, and combine complementary technologies. For instance, in 2024, Siemens Mobility partnered with Alstom on a significant high-speed rail project in Europe, combining their respective strengths in rolling stock and signaling systems.

- Project Scale and Complexity: Joint ventures are essential for managing the immense scale and intricate technical demands of projects like metro system upgrades or large-scale renewable energy installations.

- Resource and Expertise Sharing: Collaborations allow Siemens to leverage partner capabilities, from local market knowledge to specialized engineering skills, enhancing project execution and competitiveness.

- Risk Mitigation: By sharing financial and operational risks with partners, Siemens can undertake more ambitious projects than it might alone, particularly in emerging markets or highly regulated sectors.

- Market Access and Innovation: Strategic alliances can open doors to new geographic regions and foster innovation through the integration of diverse technological solutions, as seen in smart city initiatives.

Siemens' Key Partnerships are diverse, spanning technology, software, system integration, research, and joint ventures. These collaborations are fundamental to its strategy of delivering integrated digital and automation solutions across various industries.

In 2024, Siemens continued to deepen its alliances with cloud providers like Microsoft and software specialists to enhance its industrial AI capabilities. The Accenture Siemens Business Group, for example, remained a cornerstone for co-developing and marketing advanced solutions, blending automation, AI, and the Siemens Xcelerator portfolio. This focus underscores the importance of these strategic alliances in driving innovation and market reach.

| Partner Type | Example Partner | 2024 Focus/Impact |

|---|---|---|

| Technology & Software | Microsoft, Specialized Software Firms | Integrating industrial AI and cloud capabilities |

| System Integrators | Accenture, Deloitte | Deploying Industrial Edge and MindSphere platforms, ensuring tailored customer implementations |

| Research Institutions | A*STAR (Singapore) | Developing smart manufacturing solutions, focusing on AI and digital twins |

| Suppliers | Global electronics and semiconductor manufacturers | Sourcing specialized components, ensuring quality and supply chain resilience; innovation in energy-efficient semiconductors |

| Joint Ventures | Alstom | Collaborating on major infrastructure projects like high-speed rail, sharing expertise and risks |

What is included in the product

Siemens' Business Model Canvas outlines its strategy for delivering innovative digital and automated solutions across various industries, focusing on strong customer relationships and a robust ecosystem of partners.

Siemens' Business Model Canvas acts as a pain point reliever by offering a structured, visual representation that clarifies complex strategies, preventing confusion and enabling focused problem-solving.

It alleviates the pain of information overload by condensing Siemens' multifaceted operations into a single, easily digestible page, fostering clearer understanding and more efficient decision-making.

Activities

Siemens dedicates significant resources to research and development, focusing on key growth areas such as automation, digitalization, artificial intelligence, and sustainable technologies. This commitment fuels innovation across its broad portfolio, from industrial software to cutting-edge medical technology.

In fiscal year 2023, Siemens reported R&D expenses of €5.5 billion, underscoring its strategic emphasis on staying ahead of technological curves. This investment is crucial for developing next-generation products and solutions that address evolving market demands and global challenges.

The company's R&D efforts are central to its strategy of providing integrated solutions that enhance efficiency and sustainability for its customers. By continuously advancing its technological capabilities, Siemens reinforces its position as a leader in industrial innovation.

Siemens' core activities revolve around manufacturing and producing a diverse portfolio of high-tech hardware. This spans critical sectors, including industrial automation components like programmable logic controllers (PLCs) and drives, advanced medical imaging equipment such as MRI and CT scanners, and large-scale infrastructure like rail vehicles and signaling systems.

The company operates a global network of state-of-the-art manufacturing facilities. In 2024, Siemens continued to invest in these sites, focusing on digitalization and automation to enhance production efficiency and product quality. For example, their Amberg electronics plant is renowned for its highly automated processes, achieving significant productivity gains.

A key focus for Siemens in manufacturing is the optimization of production processes for both efficiency and sustainability. This includes adopting Industry 4.0 principles, utilizing advanced robotics, and implementing energy-saving technologies across their plants. In fiscal year 2023, Siemens reported a significant reduction in CO2 emissions from its own operations, highlighting this commitment.

Siemens' core activities heavily involve creating advanced industrial software and comprehensive digital platforms. Key examples include Siemens Xcelerator, a business platform designed to accelerate digital transformation, Building X for smart building management, and Solid Edge X for product design and engineering.

These offerings are crucial for enabling customers to digitize their entire value chains, from initial product design and simulation to operational efficiency and data analytics. This focus on digital solutions positions Siemens as a key enabler of Industry 4.0.

In 2024, Siemens continued to invest heavily in these digital areas. For instance, its Digital Industries segment, which encompasses much of this software development, reported significant revenue growth, underscoring the market's demand for these digital transformation tools.

Project Management and System Integration

Siemens excels in managing intricate projects, a cornerstone of its business model. This involves seamlessly integrating diverse technologies and systems to deliver comprehensive solutions across vital sectors. For instance, in 2024, Siemens continued to lead in large-scale infrastructure development, securing significant contracts for smart grid modernization and high-speed rail projects, underscoring its project management prowess.

The company's system integration capabilities are crucial for orchestrating complex deployments. This means bringing together various hardware, software, and digital components into a cohesive, functional whole, often for industrial automation and smart city initiatives. In the first half of fiscal year 2024, Siemens reported a substantial backlog in its Digital Industries segment, largely driven by integrated solutions for manufacturing clients seeking enhanced operational efficiency.

- Project Orchestration: Siemens manages end-to-end project lifecycles, from initial design and engineering to implementation, commissioning, and ongoing support for complex industrial and infrastructure systems.

- System Interoperability: A key activity is ensuring that disparate technologies, including automation, IT, and digital platforms, communicate and function together seamlessly within a unified ecosystem.

- Stakeholder Coordination: Effective management involves coordinating numerous stakeholders, including clients, suppliers, government bodies, and internal teams, to ensure project alignment and successful delivery.

- Technological Integration: Siemens integrates a broad spectrum of its own technologies with those of third-party providers to create bespoke solutions that meet specific customer needs in sectors like energy, transportation, and manufacturing.

After-Sales Service and Maintenance

Siemens’ after-sales service and maintenance are crucial for maintaining the longevity and optimal performance of its complex industrial products. This involves offering a spectrum of services from routine check-ups to emergency repairs, ensuring their installed base remains reliable and efficient.

These services are designed to build strong, lasting relationships with customers, driving loyalty and repeat business. For instance, in fiscal year 2023, Siemens reported that its Digital Industries segment, heavily reliant on these services, saw a significant increase in its order backlog, partly due to the demand for ongoing support and upgrades.

The company actively provides technical support and upgrades to keep its systems current and competitive. This proactive approach minimizes downtime for clients and enhances the value they derive from Siemens' offerings. In 2024, Siemens continues to invest heavily in digital service platforms to streamline support and predictive maintenance.

- Maintenance Programs: Offering scheduled and on-demand maintenance to prevent failures and ensure operational continuity.

- Technical Support: Providing expert assistance through various channels to resolve issues quickly and efficiently.

- Upgrades and Modernization: Delivering enhancements to existing systems to improve performance, efficiency, and compliance with new standards.

- Spare Parts Management: Ensuring availability of genuine spare parts to minimize repair times and maintain product integrity.

Siemens' key activities encompass robust research and development, focusing on automation, digitalization, and sustainable technologies to drive innovation. The company manufactures a diverse range of high-tech hardware, from industrial automation components to advanced medical equipment, supported by investments in automated and efficient global production facilities. Furthermore, Siemens develops sophisticated industrial software and digital platforms, such as Siemens Xcelerator, to accelerate customer digital transformation, with significant revenue growth reported in this area in 2024.

The company excels in orchestrating complex projects and integrating disparate technologies, ensuring seamless functionality for clients in sectors like energy and transportation. This is evidenced by significant contract wins in 2024 for smart grid modernization and rail projects. Complementing its product offerings, Siemens provides comprehensive after-sales services, including maintenance, technical support, and system upgrades, to ensure optimal performance and customer loyalty, with a notable increase in its digital services investment in 2024.

What You See Is What You Get

Business Model Canvas

The Siemens Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it represents the complete and final deliverable. Once your order is confirmed, you will gain full access to this comprehensive analysis, ready for immediate use.

Resources

Siemens holds an extensive collection of intellectual property, including a significant number of patents, software, and unique technical knowledge. This is especially prominent in areas like industrial automation, artificial intelligence for industry, and advanced medical technology. These intangible assets are crucial for maintaining Siemens' edge in the market and driving its innovation efforts.

As of fiscal year 2023, Siemens had a robust patent portfolio with over 70,000 active patents worldwide. This vast intellectual property base underpins its strong competitive position, particularly in its core businesses. The company consistently invests in research and development, which is reflected in its ongoing patent filings, ensuring a continuous stream of new technologies and solutions.

The strategic management of its intellectual property, including patents, allows Siemens to protect its innovations and create licensing opportunities. This not only safeguards its market share but also generates additional revenue streams. The value derived from these intangible assets is a key component of Siemens' overall business strategy and valuation.

Siemens maintains a robust global infrastructure with numerous research and development centers and state-of-the-art manufacturing plants strategically positioned across the world. This extensive network is critical for innovation and production, allowing the company to design, build, and distribute its wide array of products and solutions efficiently.

These facilities are instrumental in ensuring Siemens remains close to its diverse customer base, fostering localized product development and responsive service. For instance, in 2023, Siemens invested significantly in expanding its digital manufacturing capabilities, with a notable focus on smart factory technologies in Europe and Asia, enhancing production flexibility and speed.

The global footprint of these R&D and manufacturing sites directly supports the company's ability to manage complex supply chains and adapt to regional market demands. By having production and development capabilities spread internationally, Siemens can mitigate risks and optimize logistics, ensuring timely delivery of its offerings, which are crucial for industries like automation and digital industries.

Siemens relies heavily on its highly skilled workforce, a critical resource encompassing engineers, software developers, data scientists, and project managers. This talent pool is the engine behind their ability to develop cutting-edge technologies and deliver complex projects.

The expertise of Siemens' employees is fundamental to their success, enabling the creation of advanced solutions and the provision of specialized services to a global customer base. In 2024, Siemens continued to invest in talent development, recognizing that human capital is paramount for innovation and competitive advantage in the technology sector.

Strong Brand Reputation and Customer Trust

Siemens’ extensive history, stretching back over 175 years, has been foundational in cultivating a powerful brand reputation and profound customer trust. This enduring legacy is built on a consistent track record of delivering high-quality, reliable solutions across diverse industries.

This strong brand equity acts as a significant intangible asset for Siemens, directly contributing to its market leadership positions and facilitating customer acquisition and retention across its various business segments.

For instance, in 2023, Siemens reported a brand value of approximately $18.4 billion, underscoring the financial impact of its reputation. This trust translates into a willingness from customers to invest in Siemens' innovative technologies and integrated solutions.

Key aspects contributing to this strength include:

- Commitment to Quality: Siemens consistently focuses on engineering excellence and product durability, fostering reliability.

- Customer-Centric Approach: The company prioritizes understanding and meeting customer needs, building long-term relationships.

- Innovation and Technology Leadership: Continuous investment in R&D keeps Siemens at the forefront of technological advancements, reinforcing its trusted image.

- Global Presence and Support: A widespread network ensures reliable service and support, further solidifying customer confidence.

Financial Capital for Investment and Acquisitions

Siemens leverages robust financial capital to fuel its strategic initiatives, including significant investments in research and development and the expansion of its global operations. This financial strength is a cornerstone for its ability to adapt to rapidly changing market dynamics and technological advancements.

The company's financial resources are instrumental in pursuing acquisitions that bolster its technological capabilities and strengthen its competitive standing in key markets. For instance, in 2023, Siemens completed the acquisition of Brightly, a leading asset and maintenance management software company, for $1.6 billion, enhancing its digital offerings for building operations.

- Research & Development Investment: Siemens consistently allocates substantial funds to R&D, with figures often reaching billions of Euros annually, demonstrating its commitment to innovation. For fiscal year 2023, Siemens reported R&D expenses of €5.0 billion.

- Acquisition Strategy: The company actively seeks strategic acquisitions to broaden its technology portfolio and market reach. Recent acquisitions, like that of Brightly, underscore this approach.

- Global Expansion Funding: Financial capital supports Siemens’ expansion into emerging markets and the strengthening of its presence in established regions, ensuring a wider distribution network and customer base.

- Operational Financing: Sufficient financial resources ensure the smooth operation of its diverse business segments and the ability to weather economic downturns or invest in new growth areas.

Siemens' key resources include a vast intellectual property portfolio, a global infrastructure of R&D and manufacturing sites, a highly skilled workforce, a strong brand reputation built over decades, and substantial financial capital. These elements collectively enable Siemens to innovate, produce, and deliver advanced solutions across its diverse business segments.

Value Propositions

Siemens' value proposition centers on delivering solutions that dramatically boost operational efficiency and productivity for clients in industrial and infrastructure sectors. They achieve this by integrating automation, digitalization, and smart systems designed to optimize how resources are used and how tasks flow. For example, in 2024, their industrial automation solutions contributed to an average 15% reduction in production cycle times for manufacturers adopting their platforms.

Siemens provides advanced digital transformation solutions, such as IoT platforms and digital twins, to guide clients into the digital age. These innovations empower data-driven choices and predictive maintenance.

The company's AI-powered tools enable the creation of novel business models. For instance, in 2023, Siemens' digital industries segment saw significant growth, with revenue increasing by 9% to €29.4 billion, reflecting strong demand for these smart solutions.

These smart solutions are crucial for optimizing operations and fostering innovation. Siemens' commitment to digitalization is evident in its continued investment in research and development, aiming to deliver enhanced value and efficiency for its customers.

Siemens' commitment to reliability, safety, and quality is a cornerstone of its value proposition, particularly within critical sectors like healthcare, transportation, and infrastructure. In 2024, the company continued to invest heavily in research and development to ensure its solutions not only meet but exceed the demanding standards of these industries.

For instance, in healthcare, Siemens Healthineers' diagnostic imaging equipment, such as MRI and CT scanners, are designed for exceptional uptime and precision, crucial for patient care. In the transportation sector, Siemens Mobility's trains and signaling systems are engineered for unparalleled safety, contributing to millions of passenger journeys daily with minimal disruption.

The company's focus on quality translates into robust product lifecycles and reduced operational risks for clients. This is evidenced by Siemens' consistent performance in industry benchmark studies, where its infrastructure solutions often score high marks for durability and adherence to international safety regulations.

In 2023, Siemens reported a significant portion of its revenue derived from these core infrastructure and healthcare segments, underscoring the market's trust in its reliable and safe offerings. This trust is built on a legacy of engineering excellence and a forward-looking approach to innovation.

Sustainability and Energy Efficiency

Siemens is fundamentally enabling its customers to achieve greater sustainability and energy efficiency. This is a core part of their value proposition, offering technologies that directly tackle environmental challenges.

They provide solutions designed to significantly reduce CO2 emissions and optimize how energy is consumed across various industries. By focusing on these areas, Siemens helps businesses align with global environmental megatrends and meet their own sustainability targets.

The company actively promotes circular economy principles, encouraging resource reuse and waste reduction within customer operations. This holistic approach ensures that sustainability isn't just an add-on, but an integrated aspect of their offerings.

- CO2 Reduction: Siemens' digital solutions for buildings and industry can cut energy-related CO2 emissions by up to 50% for their customers.

- Energy Optimization: Their smart grid technologies and building management systems aim to improve energy efficiency by 20-30%.

- Circular Economy: Siemens is investing in technologies that support product longevity and material recycling, aiming to increase the use of recycled materials in their own products.

- Customer Impact: In 2023, Siemens reported that its portfolio of products and solutions enabled customers to avoid approximately 150 million tons of CO2 emissions.

Integrated, End-to-End Solutions

Siemens provides comprehensive, integrated solutions that cover the entire customer journey, from initial design and engineering through to ongoing operations and dedicated services. This end-to-end capability simplifies complex industrial challenges by delivering holistic systems instead of just isolated components.

This integrated approach translates into significant benefits for customers. For instance, in 2023, Siemens’ Digital Industries segment reported revenue of €27.1 billion, highlighting the demand for its integrated hardware and software offerings that streamline product development and manufacturing processes.

- Streamlined Operations: Customers benefit from simplified management and reduced complexity by engaging with a single, integrated provider.

- Holistic System View: Siemens' solutions offer a complete perspective on the entire value chain, enabling better optimization and control.

- Enhanced Efficiency: Integrating design, engineering, and operations leads to improved productivity and faster time-to-market for clients.

- Lifecycle Support: The end-to-end offering includes ongoing services and support, ensuring long-term performance and value.

Siemens’ value proposition extends to empowering customers with a flexible and scalable digital ecosystem. This allows for continuous adaptation to evolving market demands and technological advancements, fostering long-term competitiveness.

Siemens' commitment to innovation and digital transformation is a key driver of its value proposition. By offering advanced technologies like AI and digital twins, they enable clients to optimize operations and create new business models.

Reliability and safety are paramount in Siemens' offerings, especially for critical infrastructure and healthcare. This focus ensures reduced operational risks and builds trust with clients in demanding sectors.

Siemens is a leader in providing sustainable solutions, helping clients achieve significant CO2 reductions and energy efficiency. Their integrated approach supports environmental goals and promotes circular economy principles.

The company's end-to-end solutions simplify complex industrial processes, from design to operation. This integrated capability enhances efficiency and provides clients with a holistic view of their value chain.

| Value Proposition Pillar | Key Benefit | 2024 Data Point/Example |

| Operational Efficiency & Productivity | Boosts output and resource utilization | 15% reduction in production cycle times (industrial automation) |

| Digital Transformation | Enables data-driven decisions & predictive maintenance | 9% revenue growth in Digital Industries segment (2023) |

| Reliability, Safety & Quality | Minimizes operational risks and ensures high performance | Focus on high uptime for medical imaging equipment (Healthineers) |

| Sustainability & Energy Efficiency | Reduces emissions and optimizes energy consumption | Enabled customers to avoid ~150 million tons of CO2 (2023) |

| Integrated, End-to-End Solutions | Simplifies complexity and enhances overall value | €27.1 billion revenue from Digital Industries segment (2023) |

Customer Relationships

Siemens prioritizes forging long-term strategic partnerships with its core clientele, frequently securing multi-year agreements and engaging in joint product development. This deepens trust and allows for the creation of highly customized solutions that adapt to evolving customer requirements, especially within crucial industrial and infrastructure domains. For instance, their digitalization initiatives often involve co-creation with major industrial players, ensuring technology directly addresses specific operational challenges.

Siemens prioritizes customer relationships through dedicated key account managers and specialized support teams. These professionals offer personalized service, catering to the intricate needs of Siemens' broad customer spectrum. This approach fosters high levels of customer satisfaction and ensures prompt responses to inquiries and issues.

Siemens actively partners with clients to co-create bespoke solutions, directly addressing their specific operational needs. This collaborative method merges Siemens' deep technological prowess with the client's intimate understanding of their own industry. For instance, in the industrial automation sector, Siemens might work alongside a manufacturing firm to design a completely new control system, integrating AI for predictive maintenance, a process that directly enhances efficiency and reduces downtime.

Comprehensive Service and Maintenance Agreements

Siemens provides robust service and maintenance agreements that go far beyond the initial sale of their products. These comprehensive packages are designed to keep operations running smoothly and efficiently. For example, they offer predictive maintenance, using data analytics to anticipate and address potential issues before they cause downtime. Remote monitoring capabilities allow for constant oversight and quick intervention, ensuring assets perform at their peak. These agreements are crucial for extending the lifespan of valuable equipment.

The financial impact of these service agreements is significant for Siemens. They create predictable and recurring revenue streams, which are vital for stable business growth. This focus on after-sales support also fosters stronger customer loyalty, as clients rely on Siemens for the ongoing performance of their investments. By offering these services, Siemens differentiates itself in a competitive market.

- Predictive Maintenance: Utilizes data to forecast equipment failures, minimizing unplanned downtime.

- Remote Monitoring: Enables real-time tracking of asset performance and immediate response to anomalies.

- Extended Asset Lifecycles: Proactive maintenance ensures machinery operates effectively for longer periods.

- Consistent Revenue Streams: Service agreements provide a reliable source of income beyond product sales, contributing to financial stability.

Digital Platforms for Engagement and Value-Added Services

Siemens leverages digital platforms like Siemens Xcelerator and Insights Hub to foster deep customer relationships. These platforms act as central hubs for interaction, offering seamless access to essential software updates and a suite of value-added services designed to enhance operational efficiency and drive innovation for their clients.

- Siemens Xcelerator: This is an open, digital business platform designed to accelerate digital transformation across industries. It connects hardware, software, and digital services, providing a marketplace for partners and customers to co-create solutions.

- Insights Hub: Formerly known as MindSphere, Insights Hub is Siemens's industrial IoT as a service offering. It enables customers to connect their machines and infrastructure, collect data, and analyze it to gain actionable insights, improve performance, and develop new business models.

- Value-Added Services: Through these platforms, Siemens provides services such as predictive maintenance, remote monitoring, performance optimization, and customized software solutions, all aimed at increasing customer value and fostering long-term partnerships.

- Enhanced Engagement: These digital touchpoints allow for continuous customer engagement, enabling Siemens to better understand customer needs, gather feedback, and co-develop solutions, thereby strengthening loyalty and driving growth.

Siemens cultivates enduring customer bonds through dedicated key account management and specialized support teams, ensuring personalized service for diverse industrial and infrastructure clients. Their approach emphasizes co-creation, developing tailored solutions that directly address specific operational challenges. This deep engagement, particularly evident in digitalization projects, fosters trust and long-term partnerships, driving mutual value and innovation.

Siemens' commitment to customer relationships is underscored by robust service and maintenance agreements, including predictive maintenance and remote monitoring. These offerings not only ensure optimal asset performance and extended lifecycles but also generate significant, predictable recurring revenue for Siemens. For example, their industrial IoT platform, Insights Hub, facilitates data-driven insights, enhancing customer operational efficiency and solidifying loyalty.

| Customer Relationship Aspect | Siemens' Approach | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Key Account Management | Dedicated managers for strategic clients | Personalized service, deep understanding of needs | Multi-year agreements with major infrastructure projects |

| Co-Creation of Solutions | Collaborative development with clients | Bespoke solutions addressing specific operational challenges | Joint development of AI-powered automation systems for manufacturing |

| After-Sales Support | Predictive maintenance, remote monitoring | Maximized asset uptime, extended equipment life | Reduction in unplanned downtime for clients by up to 20% via predictive analytics |

| Digital Platforms | Siemens Xcelerator, Insights Hub | Enhanced customer engagement, access to services, co-innovation | Over 500 industrial partners utilizing Insights Hub for data analysis in 2024 |

Channels

Siemens leverages a direct sales force and specialized key account teams as a crucial element of its business model. This approach is particularly effective for engaging with large industrial clients, government entities, and significant infrastructure developers. The direct interaction facilitates the nuanced selling of complex, integrated solutions.

This direct engagement fosters deep, lasting customer relationships, essential for understanding and addressing the intricate needs of major clients. In 2024, Siemens reported significant revenue streams from its industrial automation and digital industries segments, areas heavily reliant on this direct sales strategy for high-value projects.

Siemens leverages a comprehensive global network of regional offices and subsidiaries. This extensive infrastructure ensures a localized approach, allowing for tailored customer support and project execution across diverse international markets. For instance, in fiscal year 2023, Siemens reported significant revenue contributions from its Americas and Europe, Middle East & Africa segments, underscoring the importance of this geographical footprint.

Siemens actively cultivates a network of specialized solution partners and system integrators. These collaborators are crucial for extending Siemens' reach into diverse markets and ensuring effective deployment of its technological solutions.

These partners bring invaluable localized expertise, enabling tailored customization of Siemens' offerings to meet specific regional or industry needs. This collaborative approach ensures that Siemens' advanced technologies are implemented efficiently and effectively on the ground.

For instance, in 2024, Siemens' Digital Industries segment reported a revenue of €28 billion, with a significant portion of this growth driven by partner-led implementations of automation and digitalization solutions across various sectors.

The strategic engagement with system integrators allows Siemens to address complex customer requirements that might demand specialized skill sets or integration with third-party systems, thereby enhancing the overall value proposition.

Online Portals and Digital Marketplaces

Siemens leverages online portals and digital marketplaces as key channels for its software, digital services, and select products. These platforms offer customers streamlined access to the Siemens Xcelerator portfolio, simplifying the procurement and management of digital solutions. For instance, the Siemens Industry Mall acts as a comprehensive e-commerce platform where businesses can explore and purchase a wide array of industrial products and services. This digital approach enhances customer experience and operational efficiency.

These digital channels are crucial for distributing Siemens' growing digital offerings. By the end of fiscal year 2023, Siemens reported significant growth in its Digital Industries segment, with revenue increasing by 6% in the first quarter of fiscal year 2024 compared to the prior-year period, reaching €4.7 billion. This growth is partly attributable to the enhanced accessibility and customer engagement facilitated by these online portals, allowing for more direct and efficient transactions for digital products and services.

- Siemens Xcelerator Portfolio Access: Online portals provide a unified gateway for customers to discover, evaluate, and acquire Siemens' comprehensive digital solutions.

- Streamlined Procurement and Management: Digital marketplaces simplify the purchasing process for software and services, enabling efficient lifecycle management for clients.

- Enhanced Customer Engagement: These platforms foster direct interaction, offering support, updates, and personalized experiences for digital product users.

- Revenue Growth Driver: The digital channels contribute to the increasing adoption and revenue generation from Siemens' software and digital services offerings.

Industry Trade Shows and Conferences

Siemens leverages major industry trade shows and conferences as crucial channels to directly connect with its diverse customer base and showcase its latest innovations. These events are not merely about visibility; they are strategic platforms for lead generation and understanding market demands firsthand. For instance, participation in events like the 2023 Hannover Messe allowed Siemens to highlight its advancements in industrial automation and digitalization, attracting significant interest from potential clients and partners.

These gatherings are instrumental in demonstrating Siemens' technological leadership and fostering meaningful business relationships. The company actively participates in global and regional conferences tailored to specific sectors, such as the UITP Summit for public transport, where they present solutions for sustainable urban mobility. Such targeted engagement helps to solidify Siemens' position as a key player in these critical industries.

The financial impact of these channels is substantial. In 2023, industry events continued to be a significant driver for new business pipelines. Siemens' presence at key exhibitions often translates into direct sales opportunities and strengthens its brand equity, essential for maintaining market share in competitive sectors. Specific attendance figures and leads generated are proprietary, but the strategic importance is clear.

- Showcasing Innovation: Trade shows like Hannover Messe are prime venues for unveiling new products and technologies in areas such as digital factories and smart grids.

- Customer Engagement: Conferences provide direct access to customers, enabling discussions about specific needs and the development of tailored solutions.

- Market Intelligence: Observing competitor activities and gathering feedback at events offers valuable insights for strategic planning and product development.

- Brand Building: Consistent and impactful presence at industry-leading events reinforces Siemens' brand as a leader in technological advancement and reliability.

Siemens utilizes a multi-channel strategy, combining direct sales for complex solutions with digital platforms for software and services. Its extensive global network of offices and partners ensures localized support and market penetration. Industry events serve as vital touchpoints for innovation showcases and customer engagement.

The company's Digital Industries segment, a key beneficiary of these channels, reported substantial revenue growth. For instance, in the first quarter of fiscal year 2024, this segment's revenue reached €4.7 billion, up 6% year-over-year, partly due to the accessibility of digital offerings via online portals like the Siemens Industry Mall.

Partnerships with system integrators are crucial for extending reach and delivering customized solutions, particularly for complex projects. The success of these channels is evident in the continued strong performance across Siemens' industrial automation and digitalization portfolios.

| Channel Type | Key Characteristics | Impact & Data (FY23/Q1 FY24) | Examples |

|---|---|---|---|

| Direct Sales Force | Engages large industrial clients, government entities; facilitates complex solution selling. | Crucial for high-value projects; significant revenue from industrial automation and digital industries. | Key Account Teams |

| Global Network | Localized approach through regional offices and subsidiaries. | Ensures tailored support across diverse markets; significant contributions from Americas and EMEA segments (FY23). | Regional Offices, Subsidiaries |

| Solution Partners & System Integrators | Extend reach, provide localized expertise, customize solutions. | Drives efficient implementation; Digital Industries revenue of €28 billion (2024) partly partner-led. | Specialized Integrators |

| Online Portals & Digital Marketplaces | Streamlined access to software, digital services, and select products. | Simplifies procurement; Digital Industries revenue up 6% in Q1 FY24 to €4.7 billion. | Siemens Industry Mall, Siemens Xcelerator |

| Industry Trade Shows & Conferences | Direct customer connection, innovation showcase, lead generation. | Instrumental for business relationships and market intelligence; important for new business pipelines (2023). | Hannover Messe, UITP Summit |

Customer Segments

Large industrial enterprises, encompassing giants in automotive, aerospace, and heavy machinery manufacturing, as well as key players in chemical and pharmaceutical processing, represent a core customer segment. These businesses are heavily invested in optimizing their production lines through advanced automation, comprehensive digitalization strategies, and sophisticated industrial software. For instance, in 2024, the global industrial automation market was valued at over $200 billion, with a significant portion driven by investments from these large-scale manufacturers looking to enhance efficiency and output.

These enterprises are actively seeking solutions that streamline operations, improve product quality, and reduce operational costs. They are particularly interested in technologies that enable predictive maintenance, real-time performance monitoring, and integrated supply chain management. The demand for industrial software, which facilitates these digital transformations, saw substantial growth in 2024, reflecting the commitment of these large industrial players to future-proofing their operations.

Infrastructure Operators and Smart Cities are key customers for Siemens, representing utilities, building management firms, and urban planners. These entities are actively pursuing solutions that enhance the efficiency, sustainability, and interconnectedness of their critical assets. For instance, in 2024, global investment in smart city infrastructure was projected to reach over $150 billion, highlighting the significant demand for advanced technologies in this sector.

These customers are particularly interested in Siemens' offerings for intelligent buildings, distributed energy systems, and comprehensive smart city solutions. They aim to optimize resource management, reduce operational costs, and improve the quality of life for citizens. The drive towards net-zero emissions also fuels their adoption of smart grid technologies and renewable energy integration, areas where Siemens possesses considerable expertise.

Siemens AG is a key partner for public transport authorities and private railway operators worldwide. They offer a full suite of solutions for both rail and road, covering everything from the trains and trams themselves to the crucial signaling systems that keep them running safely. In 2023, Siemens Mobility reported revenue of €10.1 billion, highlighting their significant presence in this sector.

Their offerings extend beyond just the initial sale, encompassing long-term maintenance and service contracts. This ensures the reliability and operational efficiency of transportation networks. For instance, Siemens secured a major contract in 2024 to supply 30 Velaro MS high-speed trains to Deutsche Bahn, valued at over €1 billion, demonstrating their ongoing commitment to modernizing rail infrastructure.

These authorities and operators rely on Siemens for integrated solutions that improve passenger experience and operational performance. The company's expertise in electrification and digitalization is vital for creating sustainable and intelligent urban mobility systems. In 2023, Siemens’ rail infrastructure business saw strong growth, contributing to the overall demand for advanced transport technologies.

Healthcare Providers

Siemens Healthineers directly addresses the needs of hospitals, diagnostic centers, and a broad range of other healthcare providers. This customer segment is looking for cutting-edge medical imaging, sophisticated laboratory diagnostics, and integrated digital health solutions. The primary goal is to enhance patient care outcomes and boost operational efficiency within their facilities.

These providers rely on Siemens for technologies that enable earlier and more accurate diagnoses, streamline workflows, and ultimately improve the patient journey. For instance, in 2024, the demand for AI-powered diagnostic tools continues to surge, with many providers investing in solutions that can automate image analysis and identify anomalies with greater speed.

- Hospitals: Seeking comprehensive solutions for diagnostics, treatment planning, and patient management.

- Diagnostic Centers: Requiring specialized equipment for imaging and laboratory testing to serve a wider patient base.

- Clinics and Practices: Looking for cost-effective and integrated systems to improve diagnostic capabilities and patient throughput.

- Research Institutions: Needing advanced imaging and analytical tools for medical research and development.

Government Agencies and Public Sector

Siemens actively partners with government agencies and public sector entities, focusing on critical areas like smart city development, transportation infrastructure, and energy grid modernization. These collaborations often translate into substantial, multi-year contracts, reflecting the significant scale and long-term nature of public works. For instance, in 2024, Siemens secured a significant deal to upgrade signaling systems for a major European rail network, a project valued in the hundreds of millions of euros and expected to span several years.

The public sector segment requires adherence to stringent regulatory compliance and procurement processes. Siemens navigates these complexities by offering solutions that meet rigorous safety, environmental, and interoperability standards. Their involvement in digital transformation initiatives for governments, such as implementing smart grid technologies or enhancing public transportation efficiency through data analytics, demonstrates a commitment to improving public services and infrastructure resilience.

- Large-scale Infrastructure Projects: Siemens is a key player in developing and upgrading national infrastructure, including transportation networks and power grids.

- Digital Transformation Initiatives: The company provides digital solutions to public sector clients, aiming to enhance operational efficiency and service delivery.

- Long-term Contracts: Engagements with government bodies are characterized by lengthy contract durations, often spanning multiple years, ensuring sustained revenue streams.

- Regulatory Compliance: Siemens ensures its offerings meet the specific and often complex regulatory and compliance requirements of public sector projects.

Siemens serves a diverse customer base, including large industrial enterprises focused on automation and digitalization, and infrastructure operators and smart cities aiming for efficiency and sustainability. Public transport authorities and railway operators rely on Siemens for integrated mobility solutions, while healthcare providers, such as hospitals and diagnostic centers, utilize Siemens Healthineers' advanced medical technologies. Government agencies and public sector entities also form a crucial segment, engaging Siemens for large-scale infrastructure projects and digital transformation initiatives.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

| Large Industrial Enterprises | Production optimization, digitalization, automation | Global industrial automation market valued over $200 billion. |

| Infrastructure Operators & Smart Cities | Efficiency, sustainability, interconnected assets | Global smart city infrastructure investment projected over $150 billion. |

| Public Transport & Railway Operators | Safe, efficient, and modern transportation networks | Siemens Mobility reported €10.1 billion revenue in 2023. |

| Healthcare Providers | Enhanced patient care, operational efficiency, diagnostics | Surging demand for AI-powered diagnostic tools in healthcare. |

| Government & Public Sector | Infrastructure upgrades, digital services, regulatory compliance | Siemens secured multi-million euro contracts for rail signaling upgrades in 2024. |

Cost Structure

Siemens dedicates a substantial portion of its resources to research and development, underscoring its drive for innovation in automation, digitalization, and green technologies. This investment fuels the creation of cutting-edge software, advanced hardware, and sophisticated artificial intelligence solutions.

In fiscal year 2023, Siemens reported research and development expenses of €5.6 billion. This figure represents a significant commitment to maintaining its competitive edge and developing future growth engines across its diverse portfolio.

Personnel and human capital costs are a significant component of Siemens' cost structure, reflecting the company's reliance on a highly skilled global workforce. These expenses encompass competitive salaries, comprehensive benefits packages, and ongoing investment in training and development for its engineers, scientists, and project managers. In 2023, Siemens reported total employee-related expenses, including wages, salaries, and social contributions, amounting to a substantial figure, underscoring the value placed on its human capital.

Siemens' manufacturing and supply chain costs are significant, encompassing everything from raw materials to operating their extensive global production facilities. These expenditures are fundamental to their ability to deliver complex industrial products and solutions. For fiscal year 2023, Siemens reported a cost of sales of €50.2 billion, a substantial portion of which is directly tied to these manufacturing and supply chain operations.

Managing a sophisticated international supply chain involves considerable logistics, inventory management, and supplier relationships, all contributing to the overall cost structure. Siemens actively pursues ongoing initiatives to streamline these processes and reduce expenses, aiming for greater efficiency and cost optimization across its diverse business units.

Sales, Marketing, and Distribution Expenses

Siemens dedicates substantial resources to its Sales, Marketing, and Distribution efforts to connect with a wide array of customers across the globe. These expenditures are crucial for building brand awareness and driving product adoption in complex industrial markets.

Key components of this cost structure include maintaining a global direct sales force, which involves salaries, commissions, and travel expenses. Additionally, Siemens invests in robust channel partner programs, offering training, marketing support, and incentives to its distribution network. Participation in major international trade shows and industry-specific events also represents a significant outlay, facilitating direct engagement with potential clients and showcasing technological innovations.

- Global Sales Force: Costs associated with employing and supporting a worldwide team of sales professionals.

- Channel Partner Programs: Investments in training, marketing collateral, and incentives for distributors and resellers.

- Marketing Campaigns: Spending on digital marketing, advertising, public relations, and content creation to reach target audiences.

- Industry Events: Expenses for exhibiting at and sponsoring major trade shows and conferences to generate leads and build relationships.

Acquisition and Integration Costs

Siemens dedicates significant resources to acquisition and integration, a crucial part of its growth strategy. These costs encompass everything from the initial due diligence and legal fees to the complex process of merging acquired entities into Siemens' existing operations. For instance, during 2023, Siemens completed several strategic acquisitions, including the acquisition of a majority stake in Chargerhelp, a charging management software company, and the acquisition of Brightly, a provider of asset management software. These moves, while strategically vital, contribute to the overall acquisition and integration cost structure.

The financial impact of these activities is substantial. It includes not only the purchase price of the acquired companies but also the expenses associated with harmonizing IT systems, rebranding, aligning HR policies, and retraining staff. These integration efforts are critical for realizing the full value of acquisitions and ensuring a smooth transition, thereby directly affecting Siemens' cost base.

Siemens' approach to integration aims to unlock synergies and operational efficiencies. This often involves investing in new technologies and processes to support the combined entity. For example, the integration of recent acquisitions into Siemens' digital platforms is designed to enhance customer offerings and streamline internal operations, representing an investment within this cost category.

- Due Diligence and Legal Fees: Costs incurred in thoroughly investigating potential acquisition targets and handling legal documentation.

- Integration Expenses: Costs related to merging systems, processes, and personnel of acquired businesses.

- Technology Harmonization: Investment in aligning IT infrastructure and software platforms across the combined organization.

- Synergy Realization Costs: Expenses associated with achieving projected cost savings and revenue enhancements from acquisitions.

Siemens' cost structure is heavily influenced by its significant investments in research and development, essential for maintaining its leadership in automation and digitalization. The company also incurs substantial personnel costs, reflecting its reliance on a highly skilled global workforce, with employee-related expenses being a major component. Furthermore, manufacturing and supply chain operations, including raw materials and global production facility management, represent a considerable portion of its expenses.

| Cost Category | Description | Fiscal Year 2023 Impact |

| Research & Development | Investment in innovation for automation, digitalization, and green tech. | €5.6 billion |

| Personnel Costs | Salaries, benefits, and training for a skilled global workforce. | Substantial figure, reflecting value of human capital. |

| Manufacturing & Supply Chain | Raw materials, production facility operations, logistics, and inventory. | Cost of Sales was €50.2 billion. |

| Sales, Marketing & Distribution | Global sales force, channel partner programs, marketing campaigns, and events. | Crucial for market presence and product adoption. |

| Acquisition & Integration | Due diligence, legal fees, system harmonization, and rebranding for growth. | Significant due to strategic acquisitions like Chargerhelp and Brightly. |

Revenue Streams

Siemens generates substantial revenue from selling a broad spectrum of hardware and equipment. This includes vital components for industrial automation, such as programmable logic controllers and drives, and intelligent infrastructure solutions like building management systems and power distribution equipment. In fiscal year 2023, Siemens' Digital Industries segment, which encompasses much of its automation hardware, reported revenue of €22.7 billion, highlighting the significance of these product sales.

Siemens is increasingly shifting its revenue generation towards software licenses, subscriptions, and Software-as-a-Service (SaaS) models. This transition is prominently seen within its Siemens Xcelerator portfolio and its burgeoning industrial AI solutions.

This strategic move cultivates a robust and predictable stream of recurring revenue for the company, offering greater financial stability and visibility. For instance, Siemens Digital Industries reported a notable increase in software revenue, contributing significantly to its overall growth in recent fiscal periods, reflecting the success of this subscription-based approach.

Siemens secures significant recurring revenue through its extensive network of long-term service and maintenance contracts. These agreements are crucial for ensuring the ongoing operational reliability and peak performance of the vast installed base of Siemens products and systems across various industries.

These contracts not only provide a stable revenue stream but also foster deep customer relationships, often extending for many years. For example, in fiscal year 2023, Siemens reported that its Digital Industries segment, which heavily relies on service agreements for automation and digitalization solutions, saw robust growth, underscoring the importance of this revenue pillar.

Revenue from Large-Scale Project Execution

Siemens generates significant revenue from executing large-scale, complex projects across infrastructure, transportation, and industrial sectors. This revenue stream encompasses the entire project lifecycle, from initial planning and meticulous engineering to hands-on implementation and final commissioning. For instance, in fiscal year 2023, Siemens reported substantial order intake from major infrastructure development, contributing significantly to its overall revenue.

These projects often involve substantial upfront capital and long-term commitments, with Siemens securing revenue through milestone payments and final project completion. The company's expertise in delivering integrated solutions, such as smart grid technology or high-speed rail systems, allows it to command premium pricing.

- Project Lifecycle Revenue: Siemens earns from planning, engineering, implementation, and commissioning phases of complex projects.

- Sector Focus: Key sectors include infrastructure, transportation, and industrial automation.

- Revenue Drivers: Long-term contracts, integrated solutions, and successful project delivery are primary revenue drivers.

- 2023 Performance Indicator: Siemens' strong order backlog in its Digital Industries and Smart Infrastructure segments for 2023 highlights the importance of this revenue stream.

Consulting and Advisory Services

Siemens leverages its extensive industry expertise to offer specialized consulting and advisory services. These services focus on critical areas such as digital transformation, helping businesses integrate advanced technologies like IoT and AI into their operations. Additionally, Siemens advises clients on enhancing energy efficiency and optimizing overall operational performance. This revenue stream capitalizes on the company's deep understanding of complex industrial processes and emerging technological trends.

In 2024, the demand for such specialized consulting remains robust, particularly as companies navigate the complexities of Industry 4.0 and sustainability mandates. Siemens' ability to provide tangible solutions, backed by its product portfolio, makes its advisory services highly valuable.

- Digital Transformation Consulting: Advising on the implementation of smart factory solutions, automation, and data analytics.

- Energy Efficiency Optimization: Providing strategies and technical guidance to reduce energy consumption and carbon footprints.

- Operational Excellence Programs: Assisting clients in streamlining processes, improving productivity, and enhancing supply chain management.

- Cybersecurity and IT Integration: Offering expertise in securing industrial control systems and integrating IT/OT environments.

Siemens also derives revenue from financing solutions, particularly for large-scale projects and equipment purchases. This involves offering tailored financial packages, leasing options, and project financing to facilitate customer acquisitions.

Siemens Financial Services (SFS) plays a crucial role by providing these financial instruments, enabling customers to invest in Siemens' advanced technologies. In fiscal year 2023, SFS contributed to the overall revenue by supporting significant customer investments in areas like automation and electrification.

| Revenue Stream | Description | Fiscal Year 2023 Impact |

| Financing Solutions | Providing financial packages, leasing, and project financing for Siemens' products and projects. | Enabled substantial customer investment in automation and electrification solutions. |

Business Model Canvas Data Sources

The Siemens Business Model Canvas is built upon a foundation of extensive market research, internal operational data, and robust financial analysis. These diverse sources ensure that each component of the canvas, from customer segments to cost structures, is informed by accurate and actionable insights.