Siemens Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Bundle

Siemens masterfully crafts its product portfolio, from cutting-edge industrial automation to smart infrastructure solutions, ensuring innovation meets diverse market needs. Their pricing strategies are meticulously calibrated to reflect value and competitive positioning, balancing premium quality with market accessibility.

Explore how Siemens leverages its extensive global distribution network and strategic partnerships to ensure its products reach customers efficiently. Discover the nuanced promotional tactics employed, from digital marketing to industry-specific events, that build brand awareness and drive engagement.

This comprehensive analysis delves into each of the 4Ps, offering actionable insights into Siemens's successful marketing execution. Save hours of research and gain a competitive edge by accessing this ready-made, editable report.

Get the full, in-depth 4Ps Marketing Mix Analysis of Siemens, designed for business professionals, students, and consultants seeking strategic depth.

Product

Siemens boasts a diverse technology portfolio, strategically organized into key segments like Digital Industries, Smart Infrastructure, Mobility, and Siemens Healthineers. This comprehensive offering encompasses a blend of cutting-edge hardware, sophisticated software, and essential services, all designed to accelerate digital transformation for a wide range of industries.

The company's product strategy is fundamentally driven by a commitment to innovation and digitalization. Siemens actively integrates the physical and digital realms, a core tenet of its approach. This fusion aims to significantly boost efficiency and promote sustainability for its global customer base.

For instance, in fiscal year 2023, Siemens reported strong performance across its segments, with Digital Industries revenue growing by 7% and Smart Infrastructure by 8%. This growth underscores the market demand for their integrated digital solutions.

Siemens places a strong emphasis on innovation, particularly channeling resources into advancements in artificial intelligence, the Internet of Things (IoT), and cloud technologies. This strategic focus drives the development of sophisticated, future-ready solutions for its diverse customer base.

The company's dedication to innovation is underscored by substantial Research and Development (R&D) investments, with a reported €5.2 billion allocated in fiscal year 2023. This financial commitment aims to embed digital capabilities across Siemens' entire product and service portfolio, ensuring its offerings remain at the forefront of technological progress.

Through these digital integrations, Siemens strives to deliver advanced products that empower customers. The ultimate objective is to enhance their competitiveness, bolster their operational resilience, and promote greater sustainability within their respective industries.

The Siemens Xcelerator platform is central to Siemens' product strategy, acting as an open digital business platform. It provides a broad range of software and services aimed at speeding up digital transformation for customers.

This platform is built on Siemens' strong technological foundation, offering cloud-based solutions and Xcelerator as a Service (XaaS). This approach makes advanced digital capabilities accessible and scalable for businesses.

In 2023, Siemens reported significant digital revenue, with its Digital Industries segment generating approximately €27.1 billion, underscoring the importance of digital platforms like Xcelerator.

Siemens Xcelerator is designed to be a key enabler of the company's broader strategic goals, facilitating innovation and efficiency across various industries by connecting the physical and digital worlds.

Industry-Specific Solutions

Siemens excels by creating industry-specific solutions, recognizing that sectors like manufacturing, process industries, buildings, transportation, and healthcare each have unique operational demands. This targeted strategy allows them to provide tailored products and services that directly address customer pain points. For instance, in 2024, Siemens' focus on digitalizing manufacturing processes contributed significantly to its Industrial Automation segment, which saw robust growth driven by demand for smart factory technologies.

This specialization enhances customer satisfaction by offering relevant and effective solutions. By understanding the nuances of each market, Siemens can better position its offerings for deeper market penetration. Their investment in R&D for sectors like smart grid technology in the energy industry, a key area for 2025 expansion, underscores this commitment to industry-specific innovation.

Siemens’ approach to industry-specific solutions means:

- Tailored Product Development: Creating offerings that precisely match the technical and regulatory requirements of diverse sectors.

- Enhanced Customer Value: Delivering solutions that solve specific industry challenges, leading to improved efficiency and performance for clients.

- Strategic Market Focus: Concentrating resources on industries where their expertise can yield the greatest impact and competitive advantage.

- Digitalization Integration: Embedding digital technologies, like AI and IoT, into solutions for industries such as smart buildings and autonomous transportation.

Sustainability-Driven Offerings

Siemens' product strategy prominently features sustainability, offering eco-friendly technologies designed to help customers minimize their environmental footprint. This focus directly addresses the growing consumer and business demand for greener solutions.

A striking statistic underscores this commitment: over 90% of Siemens' business activities contribute to achieving their customers' sustainability objectives. This demonstrates a deep integration of environmental considerations across their entire portfolio.

Siemens' sustainability-driven offerings are diverse and impactful, encompassing key areas such as:

- Energy efficiency solutions for buildings and industrial processes, reducing energy consumption and associated emissions.

- Digitalization tools that optimize resource management and supply chains, leading to less waste.

- Electrification technologies for transportation and industry, promoting a shift away from fossil fuels.

- Renewable energy integration solutions that support the transition to cleaner power sources.

This product approach not only aligns with global environmental trends but also provides tangible value to clients seeking to enhance their own sustainability performance and meet regulatory requirements.

Siemens' product strategy is defined by its comprehensive technology portfolio, driven by innovation and digitalization, and tailored for specific industries with a strong emphasis on sustainability. The company's offerings, including hardware, software, and services, are designed to enhance customer efficiency, competitiveness, and environmental performance.

The Siemens Xcelerator platform serves as a cornerstone, enabling open digital business through cloud-based solutions and Xcelerator as a Service (XaaS). This strategy fosters innovation and accelerates digital transformation across various sectors.

Siemens' commitment to sustainability is evident, with over 90% of its business activities supporting customer sustainability goals. This includes a wide array of eco-friendly solutions for energy efficiency, resource optimization, electrification, and renewable energy integration.

| Product Area | Key Features | 2023/2024 Data Point | Strategic Focus |

|---|---|---|---|

| Digital Industries | Industrial Automation, Software for Product Lifecycle Management (PLM), Manufacturing Operations Management (MOM) | Revenue of approx. €27.1 billion in FY23 | Accelerating smart factory adoption, AI integration |

| Smart Infrastructure | Building management systems, grid control, electrification solutions | Revenue growth of 8% in FY23 | Enhancing building efficiency, grid digitalization |

| Mobility | Rail signaling, train control, fleet management software | Significant order intake for automated metro systems in 2024 | Sustainable and intelligent transportation solutions |

| Siemens Healthineers | Medical imaging, diagnostics, digital health solutions | Focus on AI-powered diagnostics and personalized medicine | Improving healthcare outcomes through digital innovation |

| Siemens Xcelerator Platform | Open digital business platform, cloud-based services | Central to digital transformation efforts, driving digital revenue | Enabling seamless integration of physical and digital worlds |

What is included in the product

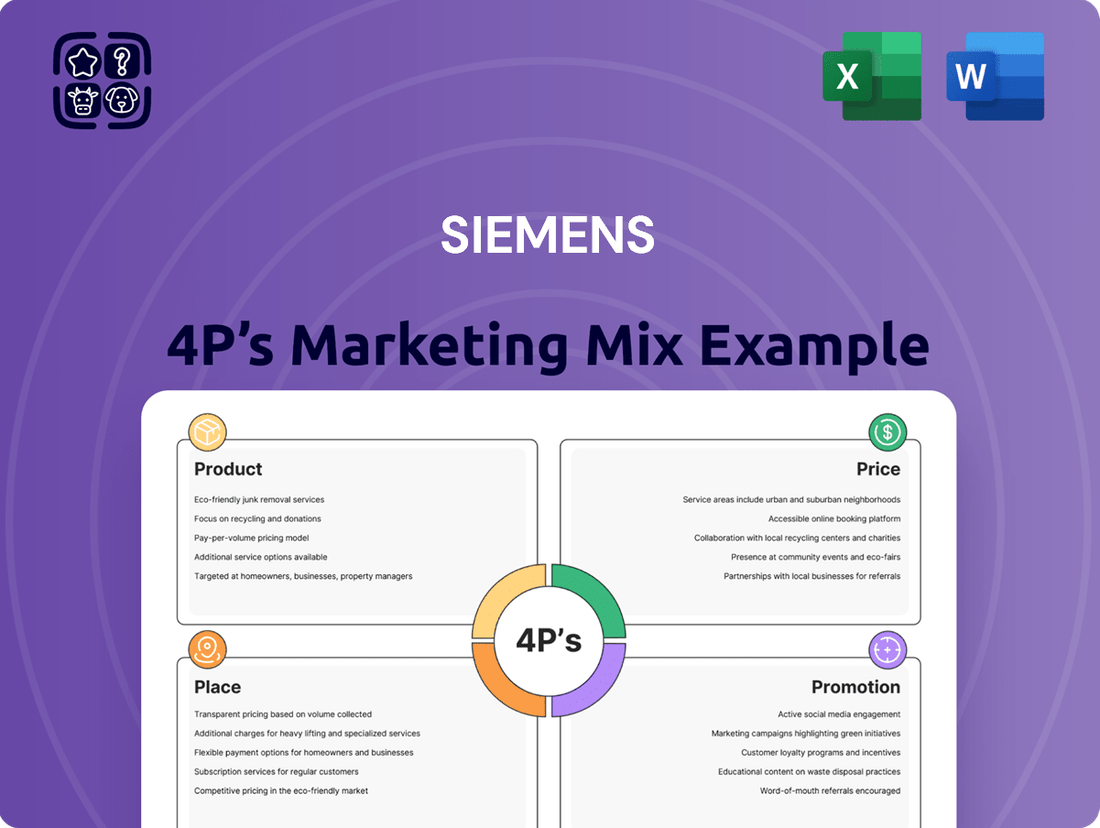

This Siemens 4P's Marketing Mix Analysis offers a comprehensive breakdown of the company's Product, Price, Place, and Promotion strategies, providing actionable insights for marketing professionals.

It delves into Siemens's actual brand practices and competitive context, making it an ideal tool for benchmarking and strategic planning.

Simplifies complex marketing strategies by clearly outlining Siemens' Product, Price, Place, and Promotion, alleviating confusion and streamlining decision-making.

Place

Siemens boasts an extensive global operational network, reaching customers in over 160 countries. This worldwide reach is crucial, allowing them to serve a diverse international clientele and tap into various markets. Their strategy emphasizes not just global scale but also a deep understanding of local nuances.

Supporting this vast operation are Siemens' regional headquarters and manufacturing sites strategically positioned across the globe. For instance, as of early 2024, Siemens maintained significant operational hubs in Europe, North America, and Asia, enabling tailored product development and service delivery that directly addresses specific regional demands and regulatory environments.

This localized approach is vital for Siemens' success. By having a physical presence and manufacturing capabilities in key regions, they can swiftly adapt their technology portfolios, such as their smart grid solutions or industrial automation systems, to meet the unique requirements and preferences of local markets, fostering stronger customer relationships and competitive advantage.

Siemens employs a robust multi-channel distribution strategy to maximize market reach. This network encompasses direct sales teams for major accounts, strategic alliances with regional distributors to tap into local markets, and collaborations with value-added resellers (VARs) who enhance Siemens' offerings with specialized solutions.

This diversified approach is crucial for Siemens' extensive product portfolio, ranging from industrial automation to smart infrastructure solutions. For instance, in 2023, Siemens reported that its Digital Industries segment, which heavily relies on these channels, saw significant growth in emerging markets, underscoring the effectiveness of its distributed model.

The company's commitment to a multi-channel network ensures that its complex technological products and services are accessible to a broad spectrum of clients, from multinational corporations requiring integrated solutions to smaller businesses seeking specific components or support.

Siemens heavily relies on its direct sales force for high-value, complex B2B transactions, particularly in sectors like industrial automation and energy. This direct engagement allows for tailored solutions and deep dives into client needs, fostering crucial long-term partnerships. For instance, in fiscal year 2023, Siemens’ Digital Industries segment, a major beneficiary of direct sales efforts, reported significant order growth, underscoring the effectiveness of this strategy for critical industrial equipment and software solutions.

Key account management is paramount for Siemens, focusing on strategic customers who represent substantial, ongoing business potential. These dedicated teams ensure a unified and informed customer experience, acting as central points of contact for a wide array of Siemens’ offerings. This focus on key accounts is a driver for recurring revenue and innovation partnerships, as evidenced by Siemens' continued investment in digital services and lifecycle management for its installed base.

Digital Sales Platforms and E-commerce

Siemens actively utilizes digital sales platforms and e-commerce to streamline customer interaction and broaden market reach. The Siemens Xcelerator marketplace, for instance, offers a centralized hub for customers to discover and acquire a wide array of Siemens products and solutions, from industrial automation hardware to digital services.

These digital channels are crucial for enhancing customer convenience and unlocking greater sales potential. They cater to both traditional product sales and increasingly sophisticated digital offerings, ensuring accessibility and ease of transaction in a rapidly evolving market. By investing in these platforms, Siemens aims to optimize the sales journey and foster stronger customer relationships.

Looking at recent performance, Siemens reported significant growth in its digital business. For fiscal year 2023, the company’s Digital Industries segment, which heavily relies on these digital sales channels, saw revenue increase by 10% to €21.7 billion. This growth underscores the effectiveness of their e-commerce strategies in driving sales and expanding their digital footprint.

- Siemens Xcelerator: A key digital platform offering integrated hardware, software, and digital services.

- E-commerce Growth: Digital Industries revenue reached €21.7 billion in FY2023, up 10% year-over-year.

- Customer Access: Digital platforms improve accessibility to Siemens' diverse product and solution portfolio.

- Sales Optimization: These channels are designed to maximize sales potential for both standard and digital offerings.

Service and Maintenance Centers

Siemens' commitment to its customers extends far beyond the initial sale, with a robust global network of service and maintenance centers. These facilities are crucial for ensuring that their sophisticated industrial automation and healthcare equipment remains operational and efficient. By offering prompt repairs, preventative maintenance, and technical support, Siemens aims to maximize product uptime and minimize disruptions for its clients.

This extensive service infrastructure is a key differentiator, directly impacting customer satisfaction and fostering long-term loyalty. For instance, in 2023, Siemens reported a significant increase in its service revenue, which includes maintenance contracts and support services, underscoring the value customers place on reliable post-sales assistance. The company's investment in these centers reflects a strategic focus on building enduring customer relationships through dependable performance.

- Global Reach: Siemens operates hundreds of service centers worldwide, ensuring localized support for diverse customer needs.

- Expert Technicians: Highly trained engineers and technicians are equipped to handle complex repairs and maintenance for advanced technologies.

- Proactive Maintenance: Services often include preventative checks and remote diagnostics to identify and address potential issues before they cause downtime.

- Customer Uptime: The primary goal is to maintain high levels of operational availability for Siemens' industrial and medical products, often exceeding 95% uptime for critical systems.

Siemens strategically places its operations and distribution centers to serve its global customer base effectively. This includes a strong presence in key markets, supported by regional hubs and manufacturing facilities that allow for localized product adaptation and service delivery.

The company utilizes a multi-channel approach, blending direct sales for complex B2B deals, partnerships with regional distributors, and value-added resellers. Digital platforms like Siemens Xcelerator are also central, enhancing customer access and streamlining transactions for its diverse technology portfolio.

| Distribution Channel | Key Characteristics | FY2023 Relevance |

|---|---|---|

| Direct Sales | High-value, complex B2B transactions; key account management | Significant order growth in Digital Industries |

| Regional Distributors | Tapping into local markets; localized reach | Crucial for emerging markets penetration |

| Value-Added Resellers (VARs) | Enhancing Siemens' offerings with specialized solutions | Expands solution capabilities |

| Digital Platforms (e.g., Siemens Xcelerator) | Streamlined customer interaction; e-commerce | €21.7 billion revenue in Digital Industries, up 10% |

Full Version Awaits

Siemens 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This Siemens 4P's Marketing Mix Analysis provides a comprehensive overview of the company's strategies across Product, Price, Place, and Promotion. It delves into how Siemens leverages its diverse product portfolio, pricing strategies, distribution channels, and promotional activities to maintain its market leadership. This insightful document is ready for immediate use upon purchase.

Promotion

Siemens leverages thought leadership and content marketing to solidify its position as a pioneer in technological innovation and digital transformation. This strategy involves publishing in-depth whitepapers, detailed case studies, insightful blog posts, and engaging webinars that highlight their expertise and showcase cutting-edge solutions. These resources are designed to educate and inform their diverse audience, ranging from industry professionals to academic stakeholders.

In 2023, Siemens reported significant investment in digital services and solutions, with their Digital Industries segment experiencing robust growth. This segment, heavily reliant on content marketing for showcasing its smart factory and automation offerings, saw revenue increase by approximately 10% year-over-year, underscoring the effectiveness of their thought leadership approach in driving business results.

The company's commitment to content creation aims to build trust and credibility, positioning Siemens as a go-to resource for understanding the future of industrial automation and digitalization. By consistently sharing valuable insights, Siemens attracts and retains customers by demonstrating a deep understanding of their challenges and offering tangible, innovative solutions.

Siemens strategically employs targeted digital advertising to connect with crucial decision-makers across its diverse industrial sectors. This includes sophisticated retargeting efforts, ensuring the brand remains visible to potential clients who have previously shown interest. In 2024, digital advertising spend for industrial B2B sectors saw significant growth, with companies like Siemens leveraging platforms like LinkedIn and industry-specific portals to pinpoint their audience.

The company's commitment to Search Engine Optimization (SEO) is a cornerstone of its digital presence. By prioritizing content that ranks highly for relevant industry keywords, Siemens effectively captures organic traffic from individuals actively seeking solutions for their challenges. This approach is vital for attracting leads in a competitive landscape, as studies in late 2024 indicated that over 70% of B2B buyers conduct extensive online research before making a purchase decision.

Siemens leverages industry events, trade shows, and virtual engagements as a key component of its 'Promotion' strategy. These gatherings are vital for showcasing its advanced industrial automation, digitalization, and electrification solutions to a global B2B audience.

For instance, Siemens regularly exhibits at major international trade fairs like Hannover Messe, a premier event for industrial technology. In 2024, Hannover Messe saw over 4,000 exhibitors, providing Siemens a platform to demonstrate its latest innovations in areas such as digital twins and sustainable manufacturing, directly engaging with potential clients and partners.

The company also hosts numerous virtual webinars and online events throughout the year. These digital engagements allow Siemens to reach a wider, geographically dispersed audience, offering deep dives into specific product functionalities and industry applications, thereby generating qualified leads and strengthening customer relationships.

Participation in these events is critical for lead generation and brand building within the competitive industrial sector. By actively engaging at these touchpoints, Siemens not only demonstrates its technological leadership but also gathers valuable market intelligence and fosters direct dialogue with its customer base.

Strategic Partnerships and Public Relations

Siemens actively cultivates strategic partnerships with major players like Microsoft to co-market innovative solutions, thereby expanding its market presence and accessing new customer segments. For instance, their ongoing collaboration in cloud and IoT platforms aims to drive digital transformation across industries. This approach allows Siemens to leverage complementary strengths and reach a wider audience more effectively.

Public relations is a cornerstone of Siemens' communication strategy, focusing on building and maintaining a robust, positive brand image. Through targeted media outreach and thought leadership, Siemens disseminates key messages about its technological advancements and sustainability commitments. In 2023, Siemens highlighted its contributions to green energy projects, reinforcing its image as an environmentally conscious innovator.

Key aspects of Siemens' strategic partnerships and public relations include:

- Collaborations with technology leaders: Partnerships with companies like Microsoft enhance joint marketing efforts and technological integration.

- Leveraging complementary expertise: These alliances enable Siemens to combine its industrial know-how with partners' digital capabilities.

- Amplifying market reach: Joint initiatives extend Siemens' brand visibility and access to new markets and customer bases.

- Building a positive brand image: Public relations activities focus on highlighting innovation, sustainability, and corporate responsibility.

Employee Advocacy and Brand Influencers

Siemens views its employees as powerful brand advocates, encouraging them to share their expertise and insights on professional networks. This approach taps into the genuine knowledge within the company to build credibility and foster connections with potential B2B clients.

By empowering employees to act as brand influencers, Siemens cultivates trust and maintains a consistent presence in the market. This strategy is particularly effective in the B2B space, where informed perspectives carry significant weight.

- Employee-generated content on platforms like LinkedIn can significantly boost brand reach and engagement, with studies showing that content shared by employees receives higher engagement rates than content shared directly by the company.

- Siemens' focus on thought leadership through its employees helps to humanize the brand and establish it as an authority in its various industrial sectors.

- This internal advocacy aids in building a strong community around the brand, reinforcing its reputation among industry peers and potential customers.

Siemens employs a multi-faceted promotional strategy that blends digital outreach with traditional engagement. Their focus on content marketing, thought leadership, and targeted digital advertising, particularly on professional platforms like LinkedIn, aims to capture B2B decision-makers. The company also actively participates in industry events and fosters strategic partnerships to amplify its message and expand market reach.

Siemens' approach to promotion emphasizes building credibility and demonstrating expertise, particularly in areas like industrial automation and digitalization. By leveraging employee advocacy and strategic public relations, they cultivate a positive brand image and foster deeper connections with their target audience. This comprehensive strategy ensures a consistent and impactful presence in the competitive industrial landscape.

Price

Siemens primarily employs a value-based pricing strategy, setting prices on the perceived value and long-term benefits its high-tech products offer customers. This strategy focuses on the return on investment customers gain through enhanced efficiency and productivity. For instance, Siemens' industrial automation solutions are priced considering the significant operational cost savings and increased output they enable for manufacturers, making the initial investment highly justifiable.

This approach highlights the tangible benefits, such as increased uptime and reduced energy consumption, directly contributing to a client's bottom line. In 2024, Siemens reported substantial growth in its Digital Industries segment, driven by demand for its smart factory solutions, underscoring the effectiveness of pricing based on delivered value and customer success.

Siemens employs segmented pricing, adjusting its strategies to match the unique demands and payment capacities of different customer groups and industries. This approach ensures that pricing is relevant whether it's for a small component or a comprehensive industrial system.

For substantial endeavors like major infrastructure projects or intricate technological solutions, Siemens frequently adopts project-based pricing. This method accounts for the specific scope of work, the project's timeline, and the overall complexity involved, reflecting the tailored value delivered.

In 2023, Siemens noted a significant portion of its revenue coming from large-scale projects, particularly in areas like automation and digitalization, where bespoke solutions command premium pricing. This reflects the effectiveness of their project-based approach in capturing value for complex, integrated offerings.

In emerging markets like China and India, where competition is fierce, Siemens frequently employs a competitive pricing strategy. This approach is crucial for gaining market share and maintaining relevance against local and international rivals. For example, in 2024, Siemens' energy division in India saw significant price adjustments to remain competitive in the rapidly growing renewable energy sector, aiming for a penetration pricing policy.

Dynamic Pricing and Software Subscription Models

Siemens leverages dynamic pricing for specific offerings, especially within its energy and healthcare divisions. This strategy allows prices to fluctuate based on real-time market conditions, regulatory shifts, and the pace of technological innovation. For example, in the energy sector, pricing for grid management software might adjust based on peak demand periods or changes in renewable energy integration.

The company is increasingly adopting subscription-based models, often referred to as Everything-as-a-Service (XaaS), for its extensive software and digital solutions. This shift provides customers with flexible access to cutting-edge technology and predictable costs. Siemens' digital factory solutions and industrial software platforms are prime examples of this transition, aiming to foster recurring revenue streams and deeper customer relationships.

As of early 2025, Siemens' digital services revenue, a significant portion of which is subscription-based, continues to show robust growth. Analysts project the industrial software market to reach over $120 billion globally by 2027, with XaaS models being a key driver. Siemens' commitment to this model is reflected in its strategic acquisitions and product development, focusing on cloud-based platforms and data analytics services.

- Dynamic Pricing in Energy: Siemens' smart grid solutions can dynamically adjust pricing based on real-time energy demand and supply, impacting grid efficiency and cost for utilities.

- Healthcare Software Subscriptions: For its medical imaging and diagnostic software, Siemens offers subscription packages that include updates and support, providing predictable operational expenses for hospitals.

- Industrial Software Growth: The company's Digital Industries segment, heavily reliant on software subscriptions for its automation and digitalization tools, reported strong double-digit growth in its fiscal year 2024.

- XaaS Expansion: Siemens aims to further expand its XaaS offerings across its portfolio, targeting sectors like building technology and mobility, to enhance customer value and recurring revenue.

Global Pricing Considerations and Financing Options

Siemens navigates complex global pricing by factoring in volatile exchange rates and diverse tariff structures across markets. For example, in 2024, the fluctuating Euro against the US Dollar directly impacted pricing for exported industrial equipment, requiring strategic adjustments to maintain competitiveness. These considerations are critical for ensuring profitability and market penetration in regions like North America and Asia.

Siemens Financial Services (SFS) plays a pivotal role in facilitating customer access to Siemens' extensive industrial solutions. By offering tailored financing, leasing, and risk management services, SFS can significantly lower the initial capital outlay for large projects. This is particularly relevant for infrastructure development and energy transition projects, where substantial upfront investment is typical.

- Exchange Rate Impact: In Q1 2025, a 5% depreciation of the Euro against the Pound Sterling necessitated price revisions for UK-bound machinery to avoid margin erosion.

- Tariff Adjustments: New import duties imposed by a South American nation in late 2024 led Siemens to re-evaluate pricing strategies for its automation components in that specific market.

- Financing Accessibility: SFS reported a 15% year-over-year increase in financing volume for renewable energy projects in 2024, underscoring the demand for accessible capital solutions.

- Project Scale Financing: For a major smart city project in Southeast Asia in early 2025, SFS structured a multi-year financing package exceeding $200 million, enabling the deployment of comprehensive Siemens technology.

Siemens' pricing strategy is deeply intertwined with the value its solutions deliver, often employing value-based, segmented, and project-based approaches. This ensures that pricing reflects the tangible benefits, such as cost savings and increased productivity, that customers receive. The company also utilizes dynamic and competitive pricing, particularly in emerging markets and for specific offerings like energy management software, to adapt to market conditions and gain share.

The shift towards subscription-based models (XaaS) for digital solutions is a key component, offering predictable costs and recurring revenue. This strategy is proving successful, with Siemens' digital services revenue showing strong growth as of early 2025, aligning with projections for the expanding industrial software market.

Siemens' pricing is also influenced by global economic factors like exchange rates and tariffs, requiring strategic adjustments. Siemens Financial Services plays a crucial role by providing financing options, thereby reducing initial capital barriers for customers, especially for large-scale projects. This integrated approach supports the adoption of Siemens' advanced technologies across various sectors.

| Pricing Strategy | Description | 2024/2025 Relevance/Example |

|---|---|---|

| Value-Based Pricing | Prices based on perceived customer benefits and ROI. | Industrial automation solutions priced on operational cost savings. |

| Segmented Pricing | Tailored pricing for different customer groups and industries. | Adjustments for small components versus comprehensive systems. |

| Project-Based Pricing | Pricing for specific scope, timeline, and complexity of large projects. | Revenue from major infrastructure and digitalization projects in 2023. |

| Competitive Pricing | Used in competitive markets to gain share. | Energy division in India adjusted prices in 2024 for renewable energy sector. |

| Dynamic Pricing | Prices fluctuate based on real-time market conditions. | Smart grid software pricing adjusts for peak demand periods. |

| Subscription-Based (XaaS) | Recurring revenue models for software and digital solutions. | Strong growth in digital services revenue as of early 2025. |

| Global Factors | Considers exchange rates and tariffs. | Euro depreciation impact on machinery pricing in early 2025. |

| Financing Services | Facilitates customer access through financing and leasing. | 15% increase in financing volume for renewable projects in 2024. |

4P's Marketing Mix Analysis Data Sources

Our Siemens 4P's Marketing Mix Analysis is grounded in a comprehensive review of official corporate communications, including annual reports and investor relations materials. We also leverage industry-specific market research and competitive intelligence to ensure our insights into Product, Price, Place, and Promotion are robust and reflective of Siemens' strategic positioning.