Siemens Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Siemens Bundle

Siemens operates within a complex industrial landscape shaped by powerful competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes is crucial for strategic success. This brief overview highlights key aspects of these forces impacting Siemens.

The complete report reveals the real forces shaping Siemens’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Siemens benefits from a vast and geographically spread supplier base for its wide array of components, raw materials, and sophisticated software. This broad network generally limits the influence any single supplier can exert.

However, for critical, highly specialized items like specific microchips or unique software platforms, the supplier pool shrinks considerably. This scarcity can significantly empower those select few suppliers, giving them greater bargaining leverage over Siemens.

Siemens' proactive approach to innovation and its expertise in integrating diverse technological solutions are key strategies to mitigate the risks associated with concentrated supplier power, ensuring operational continuity and cost management.

Siemens faces significant switching costs when changing suppliers, particularly for highly integrated industrial automation systems. For instance, transitioning to a new supplier for a critical component in their gas turbine manufacturing could involve substantial expenses related to re-qualification, re-engineering of existing designs, and potential disruptions to their established production lines. These embedded costs effectively raise the barrier for Siemens to switch, thereby enhancing the bargaining power of incumbent suppliers in these specialized markets.

When suppliers offer unique, patented, or highly specialized products and services, their bargaining power increases significantly. This is especially true for Siemens in areas like advanced AI solutions, proprietary industrial IoT sensors, or critical components for medical imaging equipment, where few alternatives exist.

Siemens' strategic alliances, such as its collaboration with Covestro, are designed to ensure a stable supply of essential materials and to jointly develop innovative solutions, thereby lessening the impact of supplier uniqueness. This approach allows Siemens to maintain a competitive edge by securing access to cutting-edge technologies and specialized inputs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Siemens' business is generally low, especially considering the vast and complex nature of Siemens' core industrial and digital solutions. However, a nuanced view reveals potential vulnerabilities.

While unlikely for major component suppliers to fully replicate Siemens' integrated offerings, niche players, particularly in software or specialized components, might develop proprietary solutions. For example, a supplier of advanced automation software could potentially bundle it with their hardware, offering a more complete package that competes directly with Siemens' digital factory solutions. This is a minor but present concern.

Siemens' strategic emphasis on its digital transformation portfolio, including platforms like MindSphere, creates a robust ecosystem. This integrated approach makes it significantly more challenging for individual suppliers to independently replicate the breadth and depth of Siemens' end-to-end solutions, thereby mitigating the forward integration threat.

The bargaining power of suppliers can be indirectly influenced by this potential for forward integration. If suppliers perceive a significant opportunity to capture more value by moving downstream, their willingness to accept less favorable terms from Siemens could diminish. For instance, a supplier of high-precision sensors, if they developed advanced analytics capabilities for their products, could potentially offer these as a service, directly competing with Siemens' analytics divisions.

Importance of Siemens to Supplier Revenue

For many suppliers, Siemens represents a significant customer, which can reduce their bargaining power. This dependence means suppliers are often more willing to accept Siemens' terms to secure a substantial portion of their revenue. For instance, in fiscal year 2023, Siemens reported revenues of €77.8 billion, indicating the sheer scale of its procurement across various industries.

Siemens' large purchasing volumes across its diverse segments, including Digital Industries, Smart Infrastructure, Mobility, and Healthineers, provide it with considerable leverage in negotiations. This broad operational scope allows Siemens to consolidate its buying power, making it a highly attractive, albeit demanding, client for its suppliers.

- Significant Customer Dependence: Suppliers often rely heavily on Siemens for a large percentage of their sales, diminishing their ability to dictate terms.

- Economies of Scale in Purchasing: Siemens' vast procurement operations across multiple business units enable it to negotiate favorable pricing and conditions due to high order volumes.

- Diversified Procurement Needs: Siemens' presence in sectors like industrial automation, energy infrastructure, transportation, and healthcare creates a wide supplier base, reducing reliance on any single supplier.

- Supplier Revenue Contribution: While specific figures vary by supplier, the sheer scale of Siemens' operations suggests that for many niche or specialized component providers, Siemens could represent tens, if not hundreds, of millions of euros in annual business.

The bargaining power of Siemens' suppliers is generally moderate, influenced by the company's scale and diversified operations. However, this power intensifies when suppliers offer unique, critical, or proprietary components, leading to higher switching costs for Siemens.

Siemens' immense purchasing volume, exemplified by its €77.8 billion in revenue for fiscal year 2023, often makes it a key customer for its suppliers, thereby limiting supplier leverage. Yet, for specialized inputs, such as advanced semiconductor chips or proprietary industrial software, the limited supplier pool empowers them to negotiate more favorable terms.

Siemens actively mitigates supplier power through strategic alliances and its integrated digital platforms like MindSphere, which create complex ecosystems difficult for individual suppliers to replicate. This strategy ensures operational continuity and cost management despite potential supplier concentration.

| Factor | Impact on Supplier Bargaining Power | Siemens' Mitigation Strategy |

| Supplier Concentration | High for specialized components, low for general materials | Diversified supplier base, strategic alliances |

| Switching Costs | High for integrated systems, moderate for standard parts | Long-term contracts, standardization efforts |

| Supplier Uniqueness/Differentiation | High for proprietary technology, low for commodities | In-house R&D, dual sourcing where possible |

| Threat of Forward Integration | Low for major suppliers, moderate for niche software providers | Ecosystem development (e.g., MindSphere), strong customer relationships |

| Customer Dependence (Supplier's perspective) | High for many suppliers due to Siemens' scale | Leveraging purchasing power, long-term partnership agreements |

What is included in the product

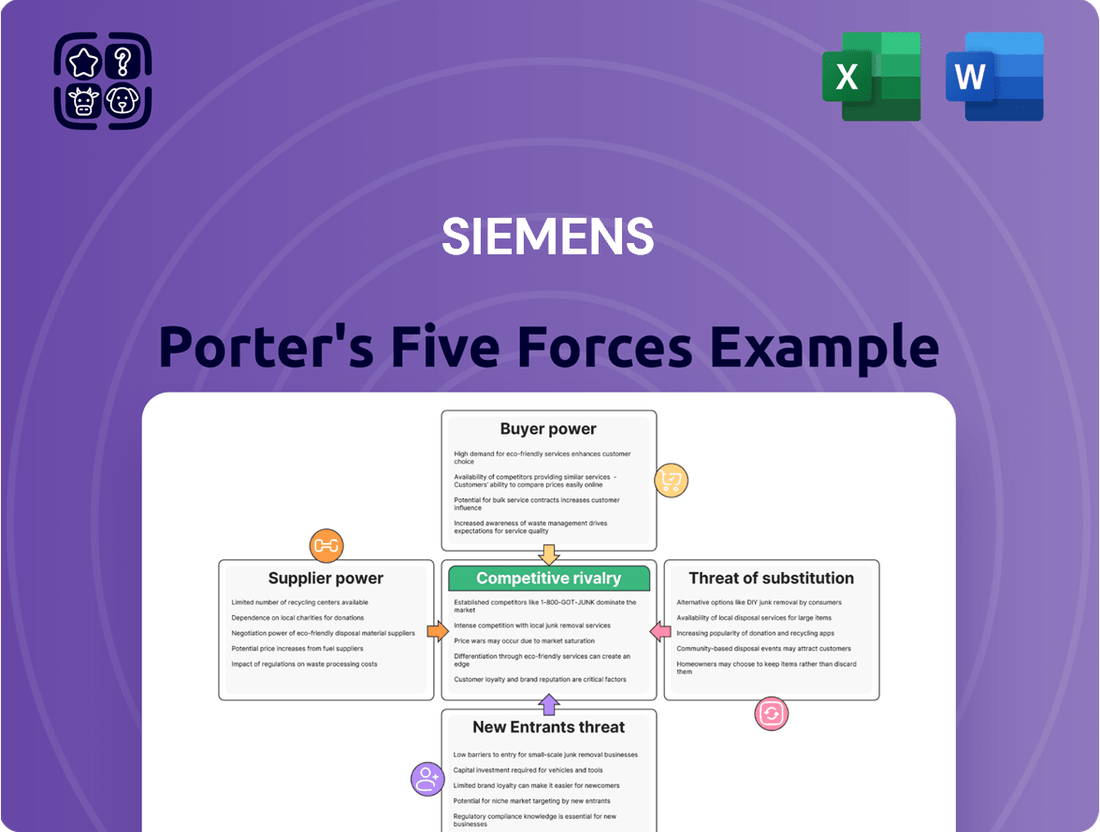

This analysis dissects the competitive landscape for Siemens, evaluating the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants and substitutes, and how these forces shape Siemens' profitability.

Instantly visualize competitive intensity with a dynamic, interactive dashboard of all five forces, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Siemens caters to a diverse clientele, from massive industrial corporations and government bodies to healthcare facilities and transportation networks. This broad reach generally dilutes the power of any single customer.

However, the bargaining power of customers can become concentrated when it comes to large, strategic projects. For instance, securing a major infrastructure or rail contract, which can be worth billions, gives that particular customer considerable leverage in negotiations.

In 2023, Siemens secured a significant €2.7 billion rail signaling and infrastructure upgrade contract for the Rhine-Ruhr Express network in Germany, illustrating the substantial influence a key customer can wield in such high-value engagements.

Customers often encounter substantial switching costs when considering a move away from Siemens' comprehensive offerings. This is particularly true in sectors like critical infrastructure, industrial automation, and advanced medical technology, where Siemens' solutions are deeply embedded.

The intricate intertwining of Siemens' hardware, specialized software, and ongoing service agreements creates significant hurdles for clients looking to transition. Beyond the technical integration, the need for retraining staff and adapting established operational workflows further amplifies these barriers to exit.

These high switching costs effectively fortify Siemens' relationship with its existing customer base. For instance, in the realm of industrial automation, a customer implementing a Siemens PLC system might also be using Siemens' HMI software and integrated safety modules, making a switch to a competitor a complex and costly undertaking.

Siemens reported substantial revenue from its Digital Industries segment, which heavily relies on these integrated solutions. In the fiscal year 2023, Digital Industries revenue reached approximately €20.7 billion, underscoring the economic significance of customer retention within these technology-dependent markets.

Siemens' sophisticated B2B customers are highly informed about market prices and alternative offerings. This deep market knowledge translates into significant price sensitivity, compelling Siemens to maintain competitive pricing structures. For instance, in the industrial automation sector, major clients often conduct extensive cost-benefit analyses, factoring in total cost of ownership, which directly influences their purchasing decisions.

Given this informed customer base, Siemens must not only focus on price but also strongly articulate the long-term value proposition of its products and services. This includes highlighting reliability, innovation, and the advanced technological capabilities that justify the investment. In 2024, Siemens' industrial sectors, like Digital Industries, reported strong order growth, partly driven by customers seeking efficiency gains and advanced solutions that improve their own operational performance and competitiveness.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while a theoretical concern, is exceedingly low for a company like Siemens. For a customer to produce Siemens' sophisticated industrial equipment or software in-house would necessitate massive capital expenditure on research and development, along with acquiring highly specialized engineering talent. The sheer complexity and scale of Siemens' product portfolio, which includes everything from advanced automation systems to power generation turbines, create formidable barriers to entry for any potential customer seeking to manufacture these items themselves.

Consider the automotive sector, a significant customer base for Siemens' industrial automation solutions. Even the largest automotive manufacturers, with their vast resources, would find it economically unfeasible to replicate Siemens' entire R&D and manufacturing capabilities for such specialized components. For instance, developing proprietary advanced robotics or integrated digital factory management software requires decades of focused innovation and significant investment, far exceeding the cost of purchasing from Siemens. This is further underscored by the fact that Siemens itself is a leader in driving efficiency and cost-effectiveness through its own advanced manufacturing processes, making in-house production by customers even less attractive.

- High R&D Costs: Developing cutting-edge industrial technology demands billions in research and development, a prohibitive cost for most individual customers.

- Specialized Expertise Required: Siemens employs thousands of highly skilled engineers and technicians; replicating this human capital is a significant hurdle.

- Economies of Scale: Siemens benefits from massive economies of scale in production, allowing them to offer products at a cost that is difficult for individual customers to match internally.

- Focus on Core Competencies: Most customers, even large ones, prioritize their own core business activities over backward integration into complex manufacturing equipment.

Product Differentiation of Siemens' Offerings

Siemens significantly curbs customer bargaining power through its robust product differentiation. The company champions advanced technology, digitalization, and continuous innovation, exemplified by its Siemens Xcelerator platform and Industrial AI. These offerings create unique value propositions that are difficult for customers to find elsewhere, thereby lessening their ability to demand lower prices or more favorable terms.

The company's commitment to innovation is evident in its substantial R&D investments, which in fiscal year 2023 reached €5.7 billion. This focus on cutting-edge solutions allows Siemens to command premium pricing and build customer loyalty, as switching to a competitor would mean sacrificing these specialized capabilities.

- Technological Superiority: Siemens integrates cutting-edge technologies like AI and IoT into its products, making them stand out.

- Digitalization Focus: The Siemens Xcelerator platform offers a comprehensive digital ecosystem, simplifying integration and enhancing value.

- Innovation Pipeline: Consistent investment in R&D ensures a steady stream of new and improved offerings, keeping customers tied to Siemens' advancements.

- Comprehensive Services: Beyond hardware, Siemens provides extensive support, maintenance, and software services, creating a sticky customer relationship.

While Siemens serves a broad customer base, the bargaining power of individual customers is often limited by high switching costs and significant product differentiation. However, major strategic projects can concentrate power, as seen in large infrastructure deals where customers leverage their substantial investment for better terms.

Preview the Actual Deliverable

Siemens Porter's Five Forces Analysis

This preview showcases the complete Siemens Porter's Five Forces Analysis, offering a detailed examination of the competitive forces shaping the company's industry landscape. The document you are viewing is the exact, professionally formatted report you will receive immediately upon purchase, ensuring no discrepancies or hidden elements. You can confidently expect this comprehensive analysis, covering threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors, to be fully available for your immediate use and strategic planning. Rest assured, what you see is precisely what you get—a ready-to-deploy competitive intelligence tool.

Rivalry Among Competitors

Siemens faces intense rivalry from a broad array of global giants like General Electric, ABB, Schneider Electric, Honeywell, Philips, and Alstom. This broad competitive set extends into various critical sectors including industrial automation, smart infrastructure, mobility solutions, and advanced healthcare technology.

The sheer number and diversity of these competitors mean that Siemens must continually innovate and adapt across multiple fronts. For instance, in the industrial automation space, companies like Rockwell Automation also present significant competition, highlighting the fragmented yet highly contested nature of the market.

In 2024, the global industrial automation market alone was valued at approximately $160 billion, with projections indicating continued robust growth. This vast market size attracts a multitude of players, from established conglomerates to agile, specialized firms, all vying for market share and technological leadership.

This competitive intensity necessitates significant investment in research and development, as well as strategic pricing and customer engagement to maintain and expand Siemens' market position within these dynamic industries.

Many of Siemens' core markets are experiencing impressive growth, which naturally fuels more intense competition. As these sectors expand, more players are drawn in, all eager to capture a piece of the increasing demand. This dynamic means companies like Siemens must constantly innovate and differentiate themselves to stay ahead.

Consider the Industrial Internet of Things (IIoT) sector, a key area for Siemens. Projections show this market reaching a substantial USD 286.3 billion by 2029. Similarly, the healthcare technology market is set for significant expansion, with estimates suggesting it will hit USD 1,251.38 billion by the same year. Such robust growth signals a highly attractive landscape, inevitably leading to heightened rivalry.

Competitive rivalry in the industrial sector, particularly for companies like Siemens, is intensely driven by a relentless pursuit of innovation and product differentiation. This means firms are constantly investing significant resources into research and development, digitalization initiatives, and the integration of artificial intelligence to carve out a competitive advantage.

Siemens actively addresses this rivalry by strategically leveraging its Siemens Xcelerator platform, a cornerstone for creating differentiated, integrated solutions. This digital business platform, which saw continued investment and expansion through 2024, allows Siemens to offer unique value propositions across its diverse portfolio.

Furthermore, Siemens' focus on Industrial AI and digital twin technology is a key element of its differentiation strategy. By embedding AI into its industrial software and hardware, and by developing sophisticated digital replicas of physical assets, Siemens provides customers with enhanced efficiency, predictive maintenance capabilities, and optimized performance, setting its offerings apart in a crowded market.

In 2023, Siemens reported strong growth in its Digital Industries segment, fueled by demand for automation and digitalization solutions, highlighting the effectiveness of its innovation-driven approach in combating intense competitive pressures.

Exit Barriers

Siemens faces substantial exit barriers in its core markets. High capital investments are a primary factor, as setting up manufacturing facilities and research and development for industrial automation or energy technology requires billions of dollars. For instance, building a state-of-the-art semiconductor manufacturing plant can cost upwards of $20 billion.

Specialized assets, often tailored to specific industrial processes, further tie companies to the market. These assets, like highly customized turbine components or sophisticated control systems for power grids, have limited resale value outside their intended application. This means a company cannot easily liquidate these investments if they decide to exit.

Long-term customer contracts, particularly in infrastructure and energy projects, also act as a significant exit barrier. Siemens often engages in multi-year agreements for installation, maintenance, and upgrades of its equipment. These contracts can span a decade or more, obligating the company to ongoing service and support, making a swift exit impractical and costly.

- High Capital Investments: The initial outlay for advanced manufacturing and R&D infrastructure in sectors like industrial automation and energy technology can run into billions of dollars, deterring new entrants and making exits expensive.

- Specialized Assets: Siemens' reliance on highly specific machinery and intellectual property for its products means these assets have little value outside their intended industrial application, increasing the cost of divestment.

- Long-Term Customer Contracts: Commitments for ongoing service, maintenance, and upgrades in projects such as power generation or transportation infrastructure lock companies into markets for extended periods, often 10 years or more.

Strategic Stakes

The high-tech sectors Siemens operates in are critical for national infrastructure, economic growth, and public health. This inherent strategic importance compels companies like Siemens and its competitors to make substantial, long-term investments aimed at securing market leadership, pushing competitive rivalry beyond simple profit motives.

This strategic commitment is evident in the substantial R&D spending. For instance, in fiscal year 2023, Siemens invested €5.5 billion in research and development, a figure indicative of the ongoing race for innovation and market dominance in areas like electrification, automation, and digitalization.

- High R&D Investment: Siemens' €5.5 billion R&D spend in FY23 highlights the capital-intensive nature of competing in advanced technology sectors.

- National Infrastructure Importance: Sectors like smart grids and advanced manufacturing are vital for a nation's economic stability and security, intensifying the will to win.

- Economic Development Driver: Companies are vying for market share in technologies that fuel national economic development and create high-value jobs.

- Public Health Impact: Innovations in medical technology and healthcare infrastructure also play a significant role, adding another layer of strategic imperative.

The competitive rivalry Siemens faces is fierce, fueled by significant R&D investments and the strategic importance of its core markets. Companies like General Electric, ABB, and Schneider Electric are formidable rivals, driving innovation in industrial automation, smart infrastructure, and healthcare technology.

Siemens’ commitment to innovation is underscored by its €5.5 billion investment in research and development for fiscal year 2023. This expenditure reflects the intense competition in sectors like Industrial Internet of Things (IIoT), projected to reach $286.3 billion by 2029, and healthcare technology, expected to hit $1,251.38 billion by the same year.

| Competitor | Key Sectors | 2023 Revenue (approx. USD billions) |

|---|---|---|

| General Electric | Industrial Automation, Energy | ~77.0 |

| ABB | Industrial Automation, Robotics | ~35.0 |

| Schneider Electric | Smart Infrastructure, Energy Management | ~36.0 |

| Honeywell | Building Technologies, Performance Materials | ~36.0 |

SSubstitutes Threaten

The threat of substitutes for Siemens' offerings primarily stems from alternative technologies addressing similar customer needs. This includes open-source automation platforms, generic cloud solutions, and emerging energy generation methods that could potentially replace specialized industrial equipment. For instance, while Siemens offers advanced industrial control systems, some clients might consider adopting more widely available, less integrated software solutions for certain automation tasks.

However, Siemens' integrated and specialized solutions often present a compelling advantage by providing superior reliability, robust security features, and optimized performance critical for industrial environments. For example, in the realm of energy, while renewable sources like solar and wind are growing, Siemens' comprehensive energy management systems and grid infrastructure solutions offer a level of integration and stability that many large-scale operations require. The company's extensive R&D investment, evidenced by its over €5 billion in research and development spending in fiscal year 2023, allows it to stay ahead of disruptive technologies and offer value beyond basic functionality.

While there are certainly cheaper alternatives to Siemens' offerings, these substitutes often demand significant compromises. For instance, a less integrated power management system might have a lower upfront cost, but its inability to scale efficiently or its lower energy efficiency can lead to a substantially higher total cost of ownership over time. This is a crucial consideration for businesses in 2024, where operational efficiency is paramount.

Siemens often differentiates itself by highlighting the advanced capabilities and long-term reliability of its solutions. Consider the automation sector; while a basic controller might be inexpensive, it lacks the sophisticated diagnostics and predictive maintenance features that Siemens' more advanced systems provide. This performance gap can translate into increased downtime and higher maintenance expenses for users opting for the cheaper option, a factor becoming increasingly apparent in industrial settings.

The trade-off for customers is clear: a lower initial investment with a substitute might seem attractive, but it frequently translates into diminished performance, reduced scalability, and ultimately, poorer long-term operational efficiency. Siemens' strategy leans into providing comprehensive solutions where the initial cost is justified by superior performance and a lower overall cost of ownership, a value proposition resonating strongly in the current economic climate.

Siemens operates in sectors where reliability is paramount, such as energy, healthcare, and industrial automation. For these customers, the cost of switching to a substitute is often very high, not just in monetary terms but also in terms of potential operational disruption and reputational damage. For instance, in the power generation sector, a substitute for Siemens' turbines or grid management systems would need to demonstrate equivalent or superior reliability and performance, a difficult bar to clear given the significant investments and safety considerations involved.

The high switching costs are a significant deterrent. Consider that in 2024, industrial control systems and critical infrastructure components often require extensive integration, training, and certification. The perceived risk of adopting a less established substitute, even if potentially cheaper, outweighs the benefits for most of Siemens' clientele. This low propensity to substitute is reinforced by the long lifecycle of the equipment and the need for guaranteed uptime and interoperability.

Evolution of Digital and AI Solutions

The threat of substitutes for Siemens is significantly influenced by the rapid evolution of digital and AI solutions. These advancements can create entirely new ways for customers to achieve their goals, potentially bypassing traditional Siemens products and services. For instance, sophisticated software-defined solutions or advanced remote service platforms could emerge as viable alternatives, offering comparable or even superior functionality at a lower cost or with greater flexibility.

Siemens is proactively addressing this threat by integrating cutting-edge digital and AI technologies directly into its own product portfolio. This strategy aims to neutralize potential disruptive substitutes by offering customers advanced capabilities within the Siemens ecosystem. Examples include the development and deployment of Industrial AI, which optimizes manufacturing processes, and digital twin technology, providing virtual replicas of physical assets for enhanced monitoring and simulation.

In 2024, the digital transformation across industries continued to accelerate, increasing the potential for software-based substitutes. Siemens reported significant growth in its Digital Industries segment, with revenue in the first half of fiscal year 2024 reaching €10.7 billion, up 7% organically. This growth underscores the company's commitment to leveraging digital innovation to maintain its competitive edge and mitigate the threat of substitutes.

- Digitalization as a Defense: Siemens' investment in areas like Industrial AI and digital twins directly counters the threat of software-defined substitutes by offering advanced, integrated solutions.

- Market Integration: By embedding these technologies into its core offerings, Siemens aims to retain customer loyalty and prevent market share erosion to external disruptive forces.

- Revenue Growth in Digital Sectors: The 7% organic revenue growth in Siemens' Digital Industries segment in H1 2024 highlights the success of its digital strategy in a competitive landscape.

Regulatory and Industry Standards

Strict regulatory requirements and industry-specific standards act as a significant deterrent to substitutes in sectors where Siemens operates, such as healthcare and transportation. For instance, in the medical device industry, new technologies must undergo extensive testing and validation, a process that can take years and cost millions, making it difficult for substitutes to gain traction. In 2024, the average time for FDA approval of new medical devices ranged from 1 to 3 years, depending on the device's risk classification.

These high compliance hurdles mean that alternative products or services must demonstrate equivalent or superior safety and efficacy to gain market acceptance. Siemens' long-standing commitment to meeting and often exceeding these stringent standards, evidenced by its numerous certifications and accreditations across its diverse business units, provides a substantial competitive moat against potential disruptors. For example, Siemens Healthineers holds CE marks for a vast portfolio of diagnostic imaging and laboratory equipment, a testament to its adherence to European Union health and safety regulations.

- High Compliance Costs: Developing substitute products that meet rigorous industry standards, such as those in aerospace or power generation, incurs significant R&D and testing expenses, often exceeding €10 million for complex systems.

- Regulatory Approval Times: The lengthy approval processes for new technologies in regulated industries, like securing certifications for new railway signaling systems, can span several years, delaying market entry for substitutes.

- Siemens' Certification Advantage: Siemens' established track record of compliance and numerous global certifications (e.g., ISO 9001, ISO 14001) de-risks adoption for customers and creates a barrier for unproven alternatives.

- Industry-Specific Standards: Sectors like energy require adherence to specific grid codes and safety protocols, making it challenging for substitutes to integrate seamlessly without meeting these established benchmarks.

The threat of substitutes for Siemens is mitigated by high switching costs and the critical need for reliability in its core markets. While cheaper alternatives exist, they often fall short on performance, scalability, and long-term operational efficiency, leading to a higher total cost of ownership for customers. Siemens' focus on integrated, specialized solutions with advanced features like diagnostics and predictive maintenance provides a clear value proposition that resonates in 2024.

Entrants Threaten

Entering Siemens' core markets, like industrial automation or medical technology, demands substantial capital. Think billions for research and development, state-of-the-art factories, and establishing worldwide sales and service operations. This financial hurdle is a significant deterrent for most newcomers.

For instance, developing a new generation of high-speed trains or advanced medical imaging equipment requires enormous upfront investment. Siemens' existing scale and global infrastructure mean new entrants would need to match this, a feat few can achieve without immense backing.

The sheer cost of building and maintaining these complex operations, coupled with the need for extensive regulatory approvals in sectors like healthcare, creates a formidable barrier. This high capital requirement effectively limits the number of potential competitors that can realistically challenge Siemens.

Siemens benefits from substantial economies of scale across its vast operations, from manufacturing and research to global procurement. In 2023, Siemens reported €77.8 billion in revenue, demonstrating the sheer volume of its production and market presence. New entrants would face immense difficulty replicating these cost efficiencies, hindering their ability to compete on price or fund the necessary innovation to challenge Siemens.

Siemens benefits immensely from a deeply ingrained brand identity, a significant barrier for newcomers. For instance, in 2024, Siemens Healthineers reported a substantial order intake, reflecting ongoing customer confidence in their established product lines and technological prowess. This loyalty, cultivated over decades, makes it incredibly difficult for new entrants to gain market share without a comparable level of trust and proven performance.

Access to Distribution Channels and Supply Chains

Siemens benefits immensely from its deeply entrenched global distribution channels and expansive sales networks. These established infrastructures, coupled with long-standing customer and supplier relationships, create substantial barriers to entry for newcomers. For instance, in 2024, Siemens continued to leverage its vast network of over 200 production sites and 400,000 employees worldwide to efficiently deliver its diverse product portfolio, from industrial automation to smart infrastructure solutions.

Building comparable access and integrating into Siemens' intricate, specialized supply chains presents a formidable challenge for potential new entrants. The sheer scale and complexity of these operations, often involving highly technical components and stringent quality control, require significant upfront investment and established expertise. New players would likely struggle to replicate Siemens' ability to secure reliable sourcing and manage the logistics of its sophisticated product lines, which in 2024 saw continued investment in areas like electrification and digitalization to maintain its competitive edge.

- Established Global Reach: Siemens operates through a vast network of sales offices and service centers across more than 190 countries, providing unparalleled market access.

- Supplier Integration: The company boasts deep, long-term partnerships with key suppliers, ensuring consistent quality and preferential terms, which are difficult for new entrants to secure.

- Customer Loyalty: Decades of reliable service and product innovation have fostered strong customer loyalty, making it challenging for new entrants to gain significant market share.

- Logistical Prowess: Siemens' mastery of complex global logistics, essential for its diverse industrial products, requires substantial investment and operational expertise that new firms lack.

Proprietary Technology and Patents

Siemens' robust patent portfolio, especially in automation and digitalization, presents a formidable barrier. For instance, in fiscal year 2023, Siemens continued its strong commitment to innovation, with R&D expenses amounting to €5.1 billion. This significant investment fuels the development of proprietary technologies in areas like industrial AI and advanced analytics, making it challenging for new entrants to replicate their technological capabilities and market position.

The company's strategic acquisitions also bolster its technological moat. By integrating cutting-edge solutions and talent, Siemens effectively raises the entry threshold for competitors. This continuous enhancement of its technology base, backed by substantial R&D spending, ensures that new players face an uphill battle in matching Siemens' innovative output and intellectual property.

- Extensive Patent Portfolio: Siemens holds thousands of patents globally, protecting its core technologies.

- High R&D Investment: Fiscal year 2023 R&D spending reached €5.1 billion, fostering continuous innovation.

- Proprietary Technologies: Advanced solutions in automation, digitalization, and AI are key differentiators.

- Strategic Acquisitions: Integration of acquired technologies further strengthens Siemens' competitive edge and raises entry barriers.

The threat of new entrants for Siemens is relatively low, primarily due to the immense capital required to compete in its core markets. Developing advanced industrial technologies, like those in automation or healthcare, demands billions for research, development, and global infrastructure. For example, Siemens' 2023 revenue of €77.8 billion highlights the scale necessary to achieve economies of scale, a feat difficult for newcomers to match.

Siemens' established brand loyalty and extensive distribution networks further deter new players. In 2024, Siemens Healthineers' strong order intake reflects existing customer trust, making it hard for new entrants to gain traction without comparable proven performance. The company's 2023 R&D investment of €5.1 billion also creates a technological moat, protected by a vast patent portfolio, making replication of their innovations a significant challenge.

| Barrier Type | Description | Example for Siemens (2023/2024 Data) |

|---|---|---|

| Capital Requirements | High initial investment for R&D, manufacturing, and global operations. | €77.8 billion in revenue (2023) indicates massive scale needed. |

| Economies of Scale | Cost advantages due to large-scale production and procurement. | Achieving cost efficiencies comparable to Siemens' vast operations is difficult. |

| Brand Loyalty & Reputation | Established trust and preference among customers. | Strong order intake for Siemens Healthineers (2024) shows customer confidence. |

| Intellectual Property | Patents and proprietary technologies create a technological advantage. | €5.1 billion R&D spending (FY2023) fuels continuous innovation and patent development. |

| Distribution Channels & Networks | Existing infrastructure for sales, service, and logistics. | Operations in over 190 countries with extensive sales and service centers. |

Porter's Five Forces Analysis Data Sources

Our Siemens Porter's Five Forces analysis is built upon a robust foundation of data, incorporating publicly available financial reports, industry-specific market research from firms like IDC and Gartner, and regulatory filings from government bodies. These sources provide critical insights into market trends, competitor strategies, and the overall economic landscape.