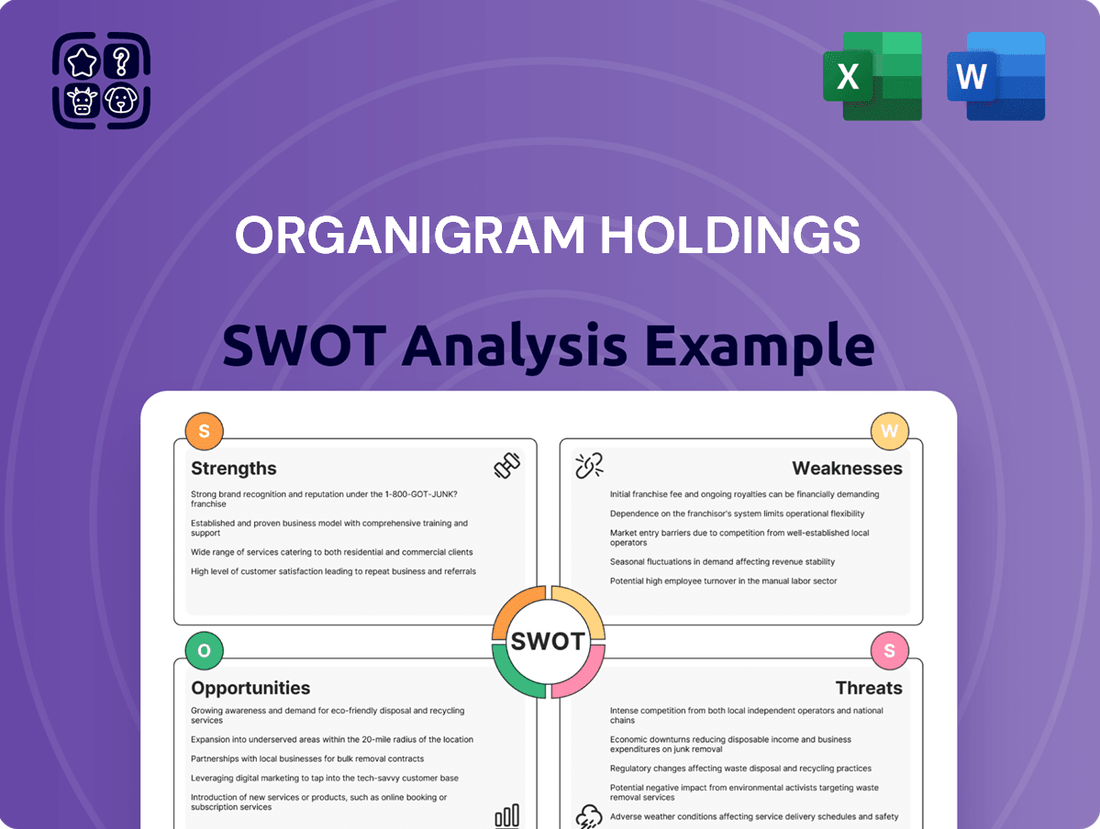

Organigram Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

Organigram Holdings demonstrates notable strengths in its brand recognition and diverse product portfolio within the cannabis sector. However, it faces significant challenges related to evolving regulatory landscapes and intense market competition. Understanding these dynamics is crucial for navigating the industry effectively.

Want the full story behind Organigram Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Organigram Holdings stands out as a premier licensed producer within Canada's burgeoning cannabis market. The company commands the top market share position, demonstrating a significant competitive advantage. This leadership extends across key product categories, including vapes, pre-rolls, milled flower, hash, and pure CBD gummies, indicating broad consumer appeal and strong product execution.

Organigram Holdings boasts a wide array of cannabis products, from traditional dried flower and pre-rolls to innovative edibles, vapes, and concentrates. This diverse offering ensures they can meet the varied demands of consumers across different segments of the market.

Their commitment to innovation shines through with products like Edison Sonics. These utilize advanced FAST™ nanoemulsion technology, which significantly speeds up absorption and enhances how well the body uses the cannabinoids, giving Organigram a distinct advantage in the edibles sector.

Organigram's strategic partnership with British American Tobacco (BAT) is a major strength, providing significant financial backing. This includes a substantial initial investment and the establishment of the 'Jupiter Pool' for future strategic initiatives. This backing offers Organigram considerable capital for expansion and operational improvements, reinforcing its financial health in a demanding sector.

Operational Efficiencies and Integration Synergies

Organigram Holdings has made significant strides in enhancing its operational efficiencies. A key factor has been the adoption of higher efficiency seed-based cultivation methods, which have directly contributed to increased harvests. This focus on optimizing cultivation processes is a core strength, improving output without a proportional increase in costs.

The successful integration of Motif Labs, finalized in December 2024, is another major operational strength. This acquisition is projected to unlock substantial annual cost synergies, estimated to be in the millions, which will bolster Organigram's gross margins. These synergies are crucial for improving the company's overall profitability and competitive standing in the market.

- Increased Harvests: Driven by more efficient seed-based cultivation techniques.

- Motif Labs Integration: Completed in December 2024, adding significant operational capacity.

- Cost Synergies: Expected to yield millions annually, boosting profitability.

- Enhanced Margins: Direct result of operational improvements and strategic acquisitions.

Expanding International Footprint

Organigram is making significant strides in expanding its global reach, with notable sales growth reported in key international markets including Germany, Australia, the United Kingdom, and Israel. This expansion is a critical strength, opening up new revenue streams and diversifying the company's market exposure. The company's strategic approach to international growth is designed to capitalize on emerging global cannabis markets.

Key initiatives supporting this international expansion include strategic investments, such as the investment in Sanity Group in Germany. This move positions Organigram to benefit from the burgeoning German cannabis market, which is expected to see further liberalization and growth. Such partnerships are vital for navigating complex regulatory landscapes and establishing a strong local presence.

Furthermore, Organigram's Moncton campus is anticipated to achieve EU-GMP certification. This certification is a crucial enabler for exporting cannabis products to European Union member states, significantly broadening market access. The EU-GMP certification is a rigorous standard, and achieving it underscores Organigram's commitment to quality and regulatory compliance, essential for international trade.

The company's growing international footprint is expected to contribute substantially to its overall revenue. For instance, Organigram reported that its international segment revenue increased by 47% to $14.5 million for the three months ended February 29, 2024, compared to $9.8 million in the prior year period. This demonstrates tangible progress in their international strategy.

- International Sales Growth: Organigram is experiencing increasing sales in Germany, Australia, the UK, and Israel, indicating successful market penetration.

- Strategic Investments: The investment in Sanity Group in Germany is a key move to leverage the growth potential of the European cannabis market.

- EU-GMP Certification: Anticipated EU-GMP certification for the Moncton campus will unlock significant export opportunities within the European Union.

- Revenue Contribution: International markets are becoming a more significant contributor to Organigram's revenue, with a reported 47% increase in international segment revenue for Q2 fiscal 2024.

Organigram's market leadership in Canada, particularly in high-demand categories like vapes and edibles, provides a strong foundation. Their strategic partnership with British American Tobacco (BAT) offers substantial financial backing, estimated at $125 million CAD for a 19.9% stake, bolstering capital for growth and innovation. The successful integration of Motif Labs in December 2024 is projected to deliver millions in annual cost synergies, directly enhancing profitability and operational efficiency.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Top market share in Canada across multiple product categories. | Leading positions in vapes, pre-rolls, milled flower, hash, and pure CBD gummies. |

| Financial Backing | Significant capital infusion and strategic alliance. | $125 million CAD investment from British American Tobacco (BAT). |

| Operational Synergies | Cost savings and margin improvement from acquisitions. | Expected millions in annual cost synergies from Motif Labs integration. |

| Product Innovation | Advanced technology for enhanced product performance. | Edison Sonics utilizing FAST™ nanoemulsion technology for rapid absorption. |

What is included in the product

Delivers a strategic overview of Organigram Holdings’s internal and external business factors, highlighting key strengths in product innovation and market penetration alongside weaknesses in production capacity and threats from intense market competition.

Organigram Holdings' SWOT analysis provides a clear, actionable roadmap to navigate market challenges and capitalize on emerging opportunities.

Weaknesses

Organigram Holdings continues to grapple with persistent net losses, a significant weakness. For instance, the company reported a $23 million net loss in the first quarter of fiscal year 2025. This follows a substantial $45.4 million net loss for the entirety of fiscal year 2024.

Even with rising revenues and better gross margins, achieving consistent profitability remains a major hurdle. This ongoing challenge in the highly competitive cannabis sector raises concerns about the company's long-term financial health and ability to generate shareholder value.

Organigram Holdings faces significant headwinds from an intensely competitive Canadian cannabis market. The sheer volume of licensed producers, particularly in categories like edibles, has driven down prices considerably. This price compression directly impacts Organigram's revenue potential and makes it challenging to maintain or grow market share against a crowded field of competitors.

Organigram Holdings' significant concentration within the Canadian market presents a notable weakness. Despite efforts towards international expansion, the majority of its revenue streams, and operational focus, remain anchored to Canada. For instance, in the fiscal second quarter of 2024, Canada represented the overwhelming majority of Organigram's net revenue.

This heavy reliance on a single jurisdiction exposes Organigram to heightened risks from Canadian-specific regulatory shifts, such as changes in excise taxes or provincial distribution policies. Furthermore, the Canadian cannabis market, while growing, is also subject to increasing saturation, which could pressure Organigram's market share and profitability if not managed effectively.

Regulatory Compliance Burden and Evolving Landscape

Organigram Holdings faces a significant weakness in navigating the complex and ever-changing regulatory framework of the cannabis industry. This includes substantial compliance requirements, stringent licensing protocols, and considerable tax obligations that directly impact operational costs and administrative overhead. For instance, in Canada, excise taxes on cannabis products can be substantial, affecting profit margins.

The dynamic nature of cannabis regulations presents a continuous challenge for Organigram. Potential shifts in policies, such as alterations to THC potency limits or new packaging and labeling mandates, necessitate ongoing adaptation and investment in compliance measures. These evolving rules can create uncertainty and require agile operational adjustments to remain competitive and compliant.

- High Compliance Costs: Adhering to diverse provincial and federal regulations in Canada, including Good Manufacturing Practices (GMP) and product safety standards, incurs significant operational expenses.

- Licensing Restrictions: Obtaining and maintaining various licenses for cultivation, processing, and distribution can be time-consuming and costly, limiting market entry and expansion opportunities.

- Taxation Burden: The cannabis sector is subject to excise taxes and other levies, which can affect pricing strategies and reduce net revenue compared to less regulated industries.

- Regulatory Uncertainty: Anticipating and responding to potential changes in regulations, such as potency caps or advertising restrictions, requires constant vigilance and resource allocation.

Fluctuations in B2B and Medical Sales

Organigram Holdings faced a notable downturn in its Canadian business-to-business (B2B) sales during the first quarter of fiscal year 2025. This decline contrasts with growth in other segments, highlighting a vulnerability in this specific sales channel.

While direct-to-patient medical sales and medical wholesale revenue remained relatively stable, the dip in B2B revenue introduces an element of unpredictability. This inconsistency across different sales streams can affect Organigram's overall revenue stability and financial forecasting.

Despite positive momentum in recreational and international markets, the fluctuations in B2B and medical sales present a clear weakness. For instance, Q1 FY2025 saw a decline in B2B sales, impacting the company's top-line performance.

- Q1 FY2025 B2B Sales Decline: Organigram reported a decrease in its Canadian B2B sales for the first quarter of fiscal 2025.

- Medical Segment Stability: Direct-to-patient medical and medical wholesale revenues remained largely flat during the same period.

- Revenue Instability Risk: Inconsistencies between growing recreational/international sales and underperforming B2B segments can lead to revenue volatility.

- Forecasting Challenges: The mixed performance across different sales channels can complicate financial planning and future revenue projections.

Organigram Holdings faces a persistent challenge in achieving consistent profitability, marked by significant net losses in recent fiscal periods. The company reported a $23 million net loss in Q1 FY2025, following a $45.4 million loss in FY2024, underscoring a key weakness in its financial performance despite revenue growth.

The intensely competitive Canadian cannabis market, characterized by price compression especially in categories like edibles, directly impacts Organigram's revenue potential and market share growth. This saturation makes it difficult to maintain healthy profit margins.

Organigram's heavy reliance on the Canadian market exposes it to risks from regulatory shifts and market saturation. While international expansion is pursued, the overwhelming majority of revenue, as seen in Q2 FY2024, remains tied to Canada.

Navigating the complex and evolving cannabis regulatory framework presents significant weaknesses. High compliance costs, licensing restrictions, substantial tax burdens, and ongoing regulatory uncertainty necessitate constant adaptation and resource allocation, impacting operational efficiency and profitability.

Fluctuations in sales channels, such as the decline in Canadian B2B sales in Q1 FY2025, introduce revenue instability and forecasting challenges, even as other segments show positive momentum.

Full Version Awaits

Organigram Holdings SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Organigram Holdings SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. The full, comprehensive report, including actionable insights and strategic recommendations, becomes available immediately upon purchase. No surprises, just the complete professional-grade analysis you need.

Opportunities

Organigram has a substantial runway for international growth as more countries embrace cannabis legalization. The company's strategic partnership with BAT, through the Jupiter Pool, specifically targets these emerging global markets, aiming to capitalize on new opportunities as they arise.

For instance, the European Union is a key focus, with countries like Germany progressively advancing their adult-use cannabis legislation. Organigram's established presence and product quality position it well to enter these expanding markets, potentially mirroring the success seen in Canada.

Organigram is poised to benefit from the expanding market for advanced cannabis products. The growing consumer preference for edibles, beverages, and specialized wellness items offers a significant avenue for growth. For example, the Canadian cannabis edibles market alone saw substantial year-over-year growth in 2023, indicating strong consumer adoption.

The company's strategic investments in cutting-edge, fast-acting delivery technologies are a key advantage. Furthermore, Organigram's acquisition of Collective Project, a company known for its expertise in hemp-derived beverages, directly targets a rapidly emerging and popular product category. This acquisition strengthens Organigram's ability to capture market share in these evolving segments.

The Canadian cannabis market is seeing a trend towards consolidation, which presents a significant opportunity for Organigram. This environment encourages strategic mergers and acquisitions, allowing companies to boost their production, streamline their supply chains, and ultimately capture a larger piece of the market.

Organigram has already shown its commitment to this strategy with its recent acquisitions of Motif Labs and Collective Project. These moves not only expand Organigram's portfolio but also strengthen its operational capabilities and market presence.

In 2024, the Canadian cannabis industry saw continued M&A activity. For instance, industry reports indicated that deals valued in the tens of millions were being completed, reflecting the ongoing consolidation. Organigram's proactive approach positions them to benefit from these market shifts.

Advancements in Cultivation Technology and Efficiency

Organigram's ongoing investment in advanced cultivation technologies, exemplified by its Moncton facility's LED retrofit, presents a significant opportunity. This strategic move is designed to boost crop yields, drive down operational expenses, and elevate the caliber of their product offerings. These improvements are vital for staying competitive and bolstering profit margins in the dynamic cannabis market.

The company's commitment to technological advancement directly translates into enhanced operational efficiency. For instance, the transition to LED lighting systems is projected to yield substantial energy savings, a key factor in managing production costs. This focus on efficiency is not just about cost reduction; it's about optimizing the entire cultivation process to deliver premium products consistently.

Furthermore, these technological upgrades enable Organigram to achieve greater control over its growing environment, leading to more predictable and higher-quality harvests. This can be a major differentiator, especially as consumer demand for consistent and potent cannabis products continues to grow.

The opportunities stemming from these technological advancements include:

- Increased Yields: Optimizing environmental controls and lighting can lead to more biomass per square foot.

- Reduced Operating Costs: Energy-efficient technologies like LED retrofits directly lower utility expenses.

- Enhanced Product Quality: Precise environmental management allows for better control over cannabinoid and terpene profiles.

- Improved Competitive Positioning: Greater efficiency and quality allow Organigram to offer more attractive pricing and superior products.

Increasing Consumer Acceptance and Market Maturation

Organigram is well-positioned to capitalize on the growing mainstream acceptance of cannabis. This acceptance, coupled with a noticeable shift from the illicit market to regulated, quality-controlled products, signals a maturing industry with increasing consumer demand. This trend directly benefits Organigram by providing a more stable and expanding customer base for its diverse product lines.

The Canadian adult-use cannabis market, for instance, has shown consistent growth. As of late 2024, provincial retail sales data indicated a continued upward trajectory, with consumers increasingly opting for legal, tested products over unregulated sources. This maturation of the market is a significant opportunity for Organigram to solidify its market share and attract new consumers.

Key indicators of this maturation and acceptance include:

- Expanding Product Categories: Consumers are embracing a wider array of cannabis products beyond traditional flower, including edibles, beverages, and concentrates, areas where Organigram has invested heavily.

- Brand Trust and Quality Focus: The shift towards regulated markets highlights a consumer preference for brands that prioritize quality, safety, and consistency, attributes Organigram emphasizes in its operations and product development.

- Market Normalization: As cannabis becomes more normalized, like other consumer packaged goods, it opens doors for broader marketing efforts and greater accessibility, further expanding the potential consumer pool for Organigram.

Organigram is strategically positioned to benefit from the global expansion of legal cannabis markets. The company's partnership with BAT, through the Jupiter Pool, is a significant advantage for tapping into emerging international opportunities, particularly in regions like the European Union where legalization is progressing, as seen with Germany's advancements in adult-use legislation by late 2024.

The company is also set to capitalize on the growing demand for innovative cannabis products, such as edibles and beverages, with the Canadian market for these categories showing robust growth through 2023. Organigram's acquisition of Collective Project, specializing in hemp-derived beverages, directly addresses this expanding consumer preference.

Consolidation within the Canadian cannabis sector presents a prime opportunity for Organigram to enhance its market position through strategic acquisitions, mirroring the M&A activity observed in 2024 where numerous deals were completed. Organigram's earlier acquisitions of Motif Labs and Collective Project demonstrate its commitment to this consolidation trend.

Investments in advanced cultivation technologies, like the LED retrofit at its Moncton facility, offer a pathway to increased yields and reduced operating costs, enhancing product quality and competitive positioning. These technological upgrades are crucial for maintaining profitability and meeting consumer demand for consistent, high-quality products in the maturing Canadian market.

Threats

Changes in the cannabis industry's regulatory framework, including potential shifts in taxation policies and product restrictions, pose a significant threat to Organigram. For instance, if new regulations introduce stricter THC potency caps, it could limit the appeal of some of Organigram's existing product offerings and necessitate costly product reformulation. The evolving landscape means companies like Organigram must remain agile to adapt to new licensing requirements and potential market access limitations.

Despite the significant expansion of the legal cannabis market, the illicit market remains a substantial challenge for licensed producers like Organigram. Unlicensed operators often circumvent regulatory costs and taxes, enabling them to offer products at considerably lower price points.

This price disparity directly impacts Organigram's revenue and profitability by diverting consumers away from legal channels. For instance, in Canada, while the legal market saw substantial growth, a portion of consumer spending, particularly in certain segments, still gravitates towards the black market due to price sensitivity.

The persistence of the illicit market can also affect Organigram's market share and growth potential. As of early 2025, reports indicate that while legal sales continue to climb, the shadow of the black market still accounts for a noticeable percentage of overall cannabis consumption, particularly in regions with less established legal frameworks or higher tax rates.

Organigram must contend with this competition by focusing on product quality, brand loyalty, and innovation to differentiate itself from cheaper, unregulated offerings. The ability to maintain competitive pricing within the legal framework will be crucial in mitigating the threat posed by illicit market operators.

The Canadian cannabis market's competitive landscape, especially in popular segments like edibles, is driving significant price erosion. This means Organigram, like its peers, faces constant pressure to lower prices, which directly squeezes their profit margins. For instance, in early 2024, average retail prices for dried flower continued to decline, impacting overall industry revenue per gram.

This persistent downward pressure on pricing makes achieving and maintaining healthy profit margins a considerable challenge for Organigram. As competition intensifies, companies must find ways to operate more efficiently to offset the shrinking revenue per unit sold. Reports from late 2023 indicated that while sales volumes were increasing, the average selling price for many cannabis products was decreasing year-over-year.

Shifting Consumer Preferences

The cannabis market is dynamic, with consumer tastes and preferences evolving at a rapid pace. Organigram, like its competitors, must continually innovate its product portfolio to align with these shifts. Failure to adapt could mean falling behind, impacting sales and market share. For instance, a growing consumer interest in specific cannabinoid ratios or novel consumption methods, such as edibles with precise dosing or infused beverages, demands strategic product development. Data from early 2024 indicated a strong upward trend in the demand for premium, craft cannabis products, suggesting a move away from mass-market offerings.

This constant evolution presents a significant threat. Companies that are slow to identify and respond to emerging trends risk alienating their customer base. Staying ahead requires robust market research and agile product development cycles. Organigram's ability to pivot its offerings in response to these changing preferences will be crucial for its sustained success. For example, a shift towards low-THC, high-CBD products for wellness-focused consumers could present a challenge if not anticipated.

- Rapidly Evolving Tastes: Consumer preferences in cannabis are not static, requiring constant product innovation.

- Risk of Obsolescence: Products that don't align with current trends can quickly become less desirable.

- Need for Agility: Companies must be able to quickly adapt their offerings to meet new consumer demands.

- Market Share Impact: Failure to innovate can lead to a loss of market relevance and declining sales.

Economic Downturns and Discretionary Spending

Economic downturns pose a significant threat to Organigram. Cannabis products, particularly those for recreational use, are often categorized as discretionary items. During periods of economic contraction, consumers tend to cut back on non-essential purchases, which could directly impact Organigram's sales volumes and revenue streams.

For instance, if a recession hits in late 2024 or 2025, consumers might prioritize essential goods over cannabis. This shift in spending habits could lead to lower demand for Organigram's diverse product offerings, from dried flower to edibles and vapes. The company's financial performance could be negatively affected by reduced sales and potentially lower pricing power in a more price-sensitive market.

- Discretionary Nature: Cannabis is largely considered a non-essential good, making it vulnerable to reduced consumer spending during economic slowdowns.

- Impact on Sales: An economic downturn could lead to a noticeable decrease in Organigram's sales volumes as consumers adjust their budgets.

- Financial Performance: Reduced sales and potential price pressures can directly impact Organigram's profitability and overall financial health.

- 2024/2025 Outlook: Analysts are monitoring consumer spending patterns closely, with projections for the 2024-2025 period suggesting a cautious approach to discretionary purchases amidst global economic uncertainties.

Intense competition within the Canadian cannabis market, particularly in high-demand categories like edibles and flower, continues to exert downward pressure on pricing. This trend, evident through early 2024 with declining average selling prices per gram for dried flower, directly impacts Organigram's profit margins, forcing a constant focus on operational efficiency to counteract shrinking revenue per unit.

The persistent presence of the illicit cannabis market remains a significant threat, as unlicensed operators can offer products at lower prices by avoiding regulatory compliance and taxes. Despite the legal market's growth, as of early 2025, a notable portion of consumer spending still flows to the black market, particularly in price-sensitive segments and less mature legal regions, potentially impacting Organigram's market share and growth.

Organigram faces the ongoing challenge of adapting to rapidly evolving consumer tastes and preferences in the dynamic cannabis sector. Failure to innovate and align product portfolios with emerging trends, such as increased demand for premium craft cannabis or specific cannabinoid ratios observed in early 2024, risks product obsolescence and a loss of market relevance.

Economic downturns pose a substantial risk, as cannabis products are often viewed as discretionary spending. Projections for late 2024 and 2025 suggest that consumers may reduce non-essential purchases, potentially leading to lower sales volumes and reduced pricing power for Organigram if economic uncertainties persist.

SWOT Analysis Data Sources

This Organigram Holdings SWOT analysis is constructed using a robust blend of data sources, encompassing their latest financial filings, comprehensive market research reports, and expert industry commentary to provide a well-rounded and strategic perspective.