Organigram Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

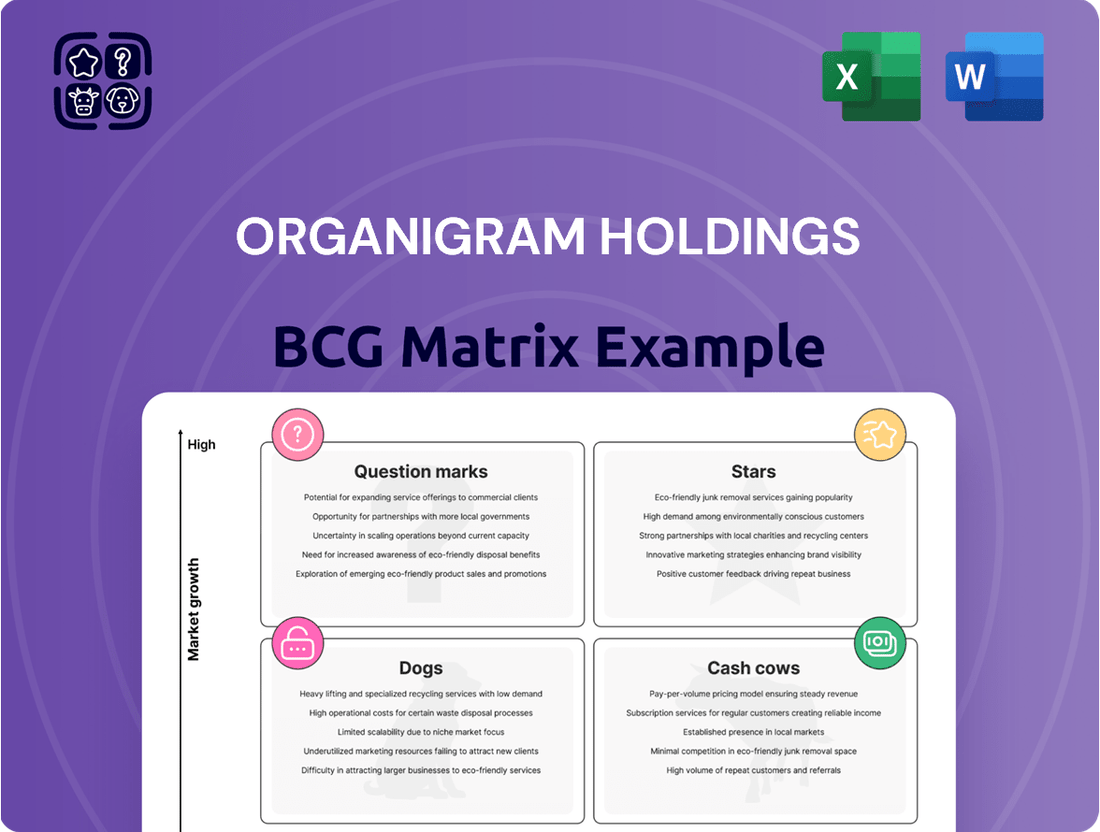

Curious about Organigram Holdings' strategic product positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their portfolio. Understanding these dynamics is crucial for any investor or industry observer aiming to grasp their market performance.

The full Organigram Holdings BCG Matrix report provides a comprehensive breakdown, detailing each product's placement in the Stars, Cash Cows, Dogs, or Question Marks quadrants. Equip yourself with the detailed analysis needed to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable insights that can guide your understanding of Organigram's competitive landscape. Purchase the complete BCG Matrix today to unlock a strategic roadmap for navigating the evolving cannabis market.

Stars

Organigram Holdings' BOXHOT brand, a flagship in its vape portfolio, is a clear star in their BCG Matrix. The company commands the number one market share in the Canadian vape sector, a significant and expanding segment of the overall cannabis market.

The strategic acquisition of Motif Labs in December 2024, which includes the high-performing BOXHOT brand, has further solidified Organigram's dominance. This segment is a prime focus for continued investment and growth initiatives. Organigram aims to leverage BOXHOT's success to maintain its leadership and capitalize on the increasing consumer demand for high-quality vape products.

Organigram Holdings holds a dominant position in the Canadian pre-roll market, with its SHRED brand being a key driver of this success. In 2024, the pre-roll category continued its trajectory of modest but steady growth within the national cannabis landscape. SHRED's strong consumer appeal translated into significant retail sales, underscoring its popularity and Organigram's strategic focus on this segment.

The company's commitment to innovation and marketing within the pre-roll space is paramount for maintaining its leadership. Given the pre-roll segment's consistent expansion, continued investment is essential for Organigram to solidify its high market share. This strategic approach ensures the SHRED brand remains a top performer in a maturing but still growing market.

Edison Sonics, featuring Organigram's proprietary FAST™ nanoemulsion technology, launched in late 2024. This innovation targets faster onset and enhanced bioavailability for consumers.

The edibles market is highly competitive on price, yet Edison Sonics is positioned as a premium, differentiated product. This strategy aims to secure a strong position in the growing edibles sector, with Organigram investing significantly to foster its success.

Milled Flower & Hash

Organigram Holdings commands a leading market share in both milled flower and hash categories within Canada. These specific product types, while falling under the broader, mature flower segment, highlight areas where Organigram has carved out significant dominance. This established leadership in niche markets contributes to stable revenue generation and strengthens the company's overall strong position in the Canadian cannabis landscape.

Organigram's strength in these categories is a key component of its BCG Matrix positioning.

- Market Dominance: Organigram leads in Canadian milled flower and hash markets.

- Mature Segment Niches: These products represent specialized areas within the established flower category.

- Stable Revenue: Dominance in these niches provides consistent income.

- Reinforced Market Share: Success here bolsters Organigram's overall Canadian market standing.

International Sales (Germany Focus)

Organigram is seeing a substantial surge in its international sales, with Germany emerging as a key growth market. This expansion is bolstered by Organigram's strategic investment in Germany's Sanity Group and the expected EU Good Manufacturing Practice (GMP) certification for its Moncton facility, which will unlock further European market access.

International revenue demonstrated robust year-over-year growth in both the first and second quarters of fiscal 2025, signaling promising opportunities in emerging cannabis markets. This upward trend highlights Organigram's successful penetration and potential for significant market share capture.

The company views its international sales, especially in Germany, as a critical strategic priority. With increasing market presence and the anticipation of regulatory approvals, this segment is poised to become a substantial cash generator for Organigram in the coming years.

- Germany Focus: Organigram's investment in the Sanity Group positions it strongly within the burgeoning German cannabis market.

- EU GMP Certification: Anticipated certification for the Moncton facility is crucial for expanding sales across the European Union.

- Q1 & Q2 2025 Growth: Significant year-over-year increases in international revenue underscore the high growth potential of these new markets.

- Strategic Priority: International sales are a key focus, with the aim of establishing a dominant market position and future cash flow generation.

Organigram's BOXHOT brand is a clear star, holding the number one market share in the Canadian vape sector as of 2024. The acquisition of Motif Labs in late 2024 further cemented this leadership. This segment is a high-growth area receiving substantial investment to maintain its dominant position and capitalize on increasing consumer demand for premium vape products.

The SHRED brand is another star, driving Organigram's leadership in the Canadian pre-roll market. This category saw steady growth in 2024, with SHRED's strong consumer appeal translating into significant retail sales. Organigram's continued focus on innovation and marketing in this segment is crucial for sustaining its high market share in this maturing but expanding market.

Edison Sonics, launched in late 2024 with proprietary FAST™ nanoemulsion technology, targets the premium edibles segment. Despite the highly competitive nature of the edibles market, Organigram is investing significantly to position Edison Sonics as a differentiated product, aiming for a strong foothold in this growing sector.

Organigram also demonstrates star-like performance in the milled flower and hash categories, holding leading market shares in these specific niches within the mature flower segment. These established leadership positions contribute significantly to stable revenue generation and reinforce Organigram's overall strong standing in the Canadian cannabis market.

International sales, particularly in Germany, represent a significant growth opportunity and a strategic priority for Organigram. Robust year-over-year growth in international revenue was observed in Q1 and Q2 of fiscal 2025. The anticipated EU GMP certification for its Moncton facility is expected to unlock further European market access, positioning this segment as a key future cash generator.

| Product Category | BCG Status | Key Performance Indicator (2024/2025) | Strategic Focus |

|---|---|---|---|

| Vapes (BOXHOT) | Star | #1 Market Share in Canada | Continued investment for leadership maintenance and growth |

| Pre-rolls (SHRED) | Star | Strong Retail Sales, Steady Market Growth | Innovation and marketing to sustain high market share |

| Edibles (Edison Sonics) | Question Mark/Potential Star | Late 2024 Launch, Premium Positioning | Significant investment to secure position in growing market |

| Milled Flower & Hash | Star | Leading Market Share in Niches | Maintain dominance for stable revenue generation |

| International Sales (Germany) | Question Mark/Potential Star | Robust YoY Growth (Q1 & Q2 FY25), EU GMP Anticipated | Strategic priority for market penetration and future cash flow |

What is included in the product

This BCG Matrix overview details Organigram's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

Organigram's BCG Matrix provides a clear, actionable view of its product portfolio, simplifying strategic decision-making.

Cash Cows

Organigram Holdings has secured the top spot in the Canadian cannabis market, a significant achievement reflecting its strategic growth. This leadership, bolstered by acquisitions such as that of Motif Labs, provides a robust and stable revenue base.

This dominant position in a consolidating Canadian market translates directly into consistent cash flow generation. As of early 2024, Organigram held a leading market share, demonstrating its ability to convert market presence into financial strength.

Despite a slight dip in the Canadian dried flower market, this segment still represents the largest portion of sales. Organigram is a major player, holding the third-largest producer position in this mature, high-volume category. This strong foothold guarantees consistent revenue generation for the company.

Organigram's established indoor cultivation facilities, like its Moncton campus, are true cash cows. These sites are designed for peak efficiency and consistently deliver high-quality cannabis, forming the backbone of their successful product lines. For instance, in the first quarter of fiscal 2024, Organigram reported a significant increase in cannabis biomass harvested, a direct testament to the ongoing optimization of these facilities.

Existing Distribution Network

Organigram Holdings benefits significantly from its established distribution network throughout Canada, reaching consumers via provincial cannabis boards and its own direct-to-consumer platforms. This broad accessibility is crucial for the high sales volumes enjoyed by its leading brands, effectively turning them into cash cows. The maturity of these channels means ongoing investment needs are minimal, contributing to consistent cash generation. For instance, in Organigram's fiscal second quarter of 2024, net revenue reached $77.1 million, a substantial increase driven by strong performance in key provinces and expanded product offerings.

- Existing Distribution Network: Organigram's robust network across Canada facilitates high sales volumes for leading brands.

- Low Investment Needs: Mature distribution channels require minimal new investment for maintenance, supporting cash flow.

- Provincial & DTC Reach: Access through provincial boards and direct-to-consumer sales ensures broad market penetration.

- Fiscal Q2 2024 Performance: Net revenue of $77.1 million highlights the effectiveness of their distribution strategy.

Pure CBD Gummies

Organigram's pure CBD gummies hold a dominant position, likely classified as a Cash Cow within its portfolio. In 2024, Organigram continued to lead the Canadian pure CBD gummy market, a testament to its established brand and product quality. This segment, while perhaps not experiencing explosive growth, functions as a reliable revenue stream, generating consistent cash flow for the company.

The product benefits from existing brand loyalty and established distribution channels, minimizing the need for significant new investment to maintain its market share. This allows Organigram to harvest profits from this mature product line. For instance, the Canadian cannabis market, including CBD products, saw continued consumer adoption throughout 2024, with gummies remaining a popular format.

- Market Leadership: Organigram is the number one player in Canada's pure CBD gummy market.

- Cash Generation: This segment is a strong cash generator due to its stable demand and market position.

- Low Investment: Existing consumer trust and distribution reduce the need for high ongoing market penetration investments.

- Steady Revenue: The product contributes to consistent revenue streams for Organigram.

Organigram's established indoor cultivation facilities are prime examples of Cash Cows, generating consistent revenue with minimal new investment. Their Moncton campus, a testament to efficient cultivation, consistently delivers high-quality product. This operational strength is reflected in their fiscal Q1 2024 results, which showed a notable increase in harvested biomass.

Organigram's leading brands, supported by a mature distribution network across Canada, function as reliable Cash Cows. These brands benefit from established consumer trust and broad accessibility through provincial boards and direct-to-consumer channels. The company's fiscal Q2 2024 net revenue of $77.1 million underscores the effectiveness of this strategy.

The company's pure CBD gummies are a clear Cash Cow, holding the top position in the Canadian market as of 2024. This segment leverages existing brand loyalty and distribution, requiring little additional investment to maintain its strong revenue stream. The consistent consumer demand for gummies in Canada further solidifies its Cash Cow status.

| Product/Segment | BCG Category | Key Financial Indicators (as of early-mid 2024) | Rationale |

|---|---|---|---|

| Indoor Cultivation Facilities (e.g., Moncton) | Cash Cow | Consistent high-quality yield, operational efficiency | Proven ability to generate steady revenue from established production capacity with optimized costs. |

| Leading Brands (supported by broad distribution) | Cash Cow | Fiscal Q2 2024 Net Revenue: $77.1M (driven by strong brand performance) | Mature, high-volume sales channels requiring minimal new investment, leading to predictable cash flow. |

| Pure CBD Gummies | Cash Cow | Market Leadership in Canada (2024) | Benefits from existing brand loyalty and distribution, providing a stable and reliable revenue stream. |

Full Transparency, Always

Organigram Holdings BCG Matrix

The Organigram Holdings BCG Matrix you are previewing is the exact, unwatermarked, and fully formatted document you will receive immediately after purchase, ready for strategic analysis. This comprehensive report has been meticulously prepared by industry experts to provide clear insights into Organigram's product portfolio, allowing for informed decision-making. You can confidently expect the same high-quality, professional content that you can edit, print, or present without any alterations or hidden elements. This is your direct access to a professionally designed, analysis-ready file that is instantly downloadable for immediate business planning and competitive strategy.

Dogs

Organigram's Canadian B2B sales have experienced a downturn, moving from the first quarter of 2024 to the first quarter of 2025. This segment is characterized by a low market share within what appears to be a slow-growth or contracting market. Consequently, this area of Organigram's business is positioned as a 'Dog' in the BCG matrix.

Organigram’s direct-to-patient medical cannabis revenue in Canada has remained a low contributor. For the fiscal year 2023, this segment generated approximately $6.5 million in revenue, a slight increase from $6.2 million in fiscal 2022. This indicates minimal growth, positioning it as a ‘Dog’ in Organigram’s BCG matrix.

The company’s presence in this niche market is small, reflecting a limited market share. While the medical cannabis sector continues to evolve, Organigram's focus has largely shifted to the recreational market, leaving this segment with subdued expansion prospects.

Currently, the direct-to-patient medical cannabis segment likely operates near break-even. It may consume marginal resources without significantly impacting overall profitability. Organigram’s strategic emphasis is clearly on higher-growth segments like recreational cannabis.

Organigram's traditional edibles, those not enhanced by their proprietary FAST™ technology, likely fall into the question mark category of the BCG matrix. The Canadian edibles market is a battlefield of price competition, squeezing profitability for standard offerings.

Despite Organigram's third-place standing in the overall edibles sector, these older products, without the innovation of FAST™, are probably in a slow-growth, low-profitability segment.

If these traditional edibles cannot differentiate themselves through pricing or unique features, they risk becoming cash traps, draining resources without significant returns.

For instance, in early 2024, the edibles market continued to see significant promotional activity, impacting the average selling price of many products. Organigram's non-FAST™ edibles would be directly exposed to this margin pressure.

Underperforming Legacy Brands/SKUs

Within Organigram's portfolio, certain legacy brands or specific stock-keeping units (SKUs) might be experiencing underperformance. These are often older products that haven't kept pace with evolving consumer preferences or newer, more innovative offerings. They typically hold a small share in established markets and contribute little to overall sales, potentially diverting valuable resources.

These underperforming assets can represent a drag on the company's financial health. For instance, if a specific cannabis strain or edible product line has consistently low sales volume, it might indicate a need for strategic reassessment. In 2024, the Canadian cannabis market continued to be competitive, with companies like Organigram needing to optimize their product mix for profitability.

- Low Market Share: These brands likely possess minimal market share in mature product categories.

- Minimal Revenue Contribution: Their sales figures are typically insignificant, not substantially boosting top-line revenue.

- Resource Diversion: They can tie up capital, manufacturing capacity, and marketing efforts without delivering commensurate returns.

- Need for Re-evaluation: Companies often consider discontinuing, reformulating, or repositioning such products to improve efficiency.

Inefficient Cultivation Practices (Pre-LED Retrofit)

Before Organigram Holdings implemented its LED retrofit at the Moncton facility, cultivation practices were likely less optimized. Older lighting systems and potentially outdated environmental controls contributed to higher energy consumption and, consequently, increased operational costs per gram of cannabis produced. These inefficiencies can be viewed as 'dogs' within the operational framework because they consumed significant resources without yielding comparable output levels.

For instance, older High-Pressure Sodium (HPS) lights, commonly used before LED adoption, are known for their lower energy efficiency and higher heat output, requiring more robust HVAC systems. This translates to a higher cost of goods sold (COGS) compared to facilities leveraging modern LED technology. While specific pre-retrofit COGS data isn't publicly detailed, the industry trend indicates significant cost reductions post-LED implementation.

- Higher Energy Consumption: Older lighting technologies consumed more electricity per unit of light output.

- Increased HVAC Load: Heat generated by older lights required more energy for cooling, further increasing operational costs.

- Suboptimal Yields: Less efficient spectrum control from older lights could lead to lower plant density or quality, impacting overall output efficiency.

- Elevated Unit Costs: The combination of higher energy and potentially lower yields directly increased the cost to cultivate each gram of cannabis.

Organigram's Canadian B2B sales experienced a downturn between Q1 2024 and Q1 2025, indicating a low market share in a slow-growth market. Similarly, their direct-to-patient medical cannabis revenue, generating approximately $6.5 million in FY2023, shows minimal growth and a small market presence. These segments, characterized by low market share and limited growth prospects, align with the 'Dog' category in the BCG matrix. They consume resources without significant profit contribution, necessitating a strategic review.

Question Marks

Organigram's acquisition of Collective Project in March 2025 positions them within the burgeoning US hemp-derived THC beverage sector. This market is anticipated to experience significant expansion, with projections indicating continued robust growth through 2025 and beyond.

Currently, Organigram holds a modest market share in this developing US market segment. However, the sector's high growth trajectory classifies it as a 'Question Mark' within the BCG matrix, necessitating strategic capital allocation to build market presence and potentially transition into a 'Star' performer.

Organigram's strategic expansion into the UK and Australia represents a move into markets identified with significant future growth potential for cannabis products. While specific market share data for Organigram in these regions as of mid-2025 is not yet publicly detailed, it is understood that their current presence is in the early stages, characteristic of a question mark in the BCG matrix.

These international ventures demand substantial capital investment and dedicated strategic planning to cultivate brand recognition and achieve profitability. Organigram's objective is to increase its shipments to these key territories, aiming to build a solid foundation for future market penetration and revenue generation, mirroring their approach in other developing global cannabis markets.

Organigram's collaboration with British American Tobacco is a key driver for next-generation cannabis products, moving beyond traditional flower. This partnership is specifically targeting non-combustible formats, tapping into a rapidly expanding segment of the market. These innovative products, while holding significant future promise, currently represent a small portion of Organigram's overall sales.

The development pipeline includes products like infused beverages and advanced edible technologies, areas where significant innovation is occurring. For instance, Organigram’s 2024 first-quarter revenue saw a notable increase, partly driven by the expansion of their product portfolio, including these newer formats.

These next-generation products are positioned as potential Stars in Organigram's BCG matrix. They operate in high-growth, albeit nascent, market segments. Significant investment in research and development, alongside substantial marketing spend for commercialization, is crucial to validate their long-term market viability and potential for rapid growth.

Canadian Cannabis Beverages (Collective Project)

The Canadian cannabis beverage market, while still nascent, is showing promising growth. In 2023, this segment represented approximately 2% of the total Canadian cannabis market, with projections indicating a compound annual growth rate (CAGR) of around 15% through 2028. Organigram's Collective Project is positioned within this evolving landscape.

Organigram's Collective Project currently holds a relatively small market share in the Canadian cannabis beverage sector. This segment is characterized by increasing consumer interest, fueled by new product formulations and a wider variety of flavor profiles, making it a prime candidate for strategic investment.

- Market Share: Collective Project's current market share in Canadian cannabis beverages is modest, reflecting the early stage of the product category.

- Growth Potential: The cannabis beverage market in Canada is experiencing significant expansion, with analysts predicting continued robust growth in the coming years.

- Investment Needs: To elevate Collective Project from a 'Question Mark' to a stronger position, Organigram needs to allocate substantial resources towards marketing initiatives and ongoing product innovation.

- Strategic Importance: Success in the beverage segment could offer Organigram a valuable new revenue stream and diversify its product portfolio beyond traditional dried flower and vapes.

Strategic Investments in US Cannabis Companies (e.g., Open Book Extracts, Phylos Bioscience)

Organigram Holdings' strategic minority investments in US-based cannabis companies, such as Open Book Extracts and Phylos Bioscience, position them as potential Stars within a BCG Matrix framework. These investments are designed to secure future market access and capitalize on innovation within the rapidly expanding US cannabis sector. Given current federal regulations that restrict Organigram's direct operational presence in the US, these are inherently speculative ventures with substantial long-term growth prospects, though immediate returns remain uncertain.

The value of these investments is linked to the evolving regulatory landscape and the performance of the target companies. For instance, in 2024, the US cannabis market is projected to continue its significant growth trajectory, with state-level legalizations driving expansion. Companies like Open Book Extracts, focusing on high-purity cannabinoid extracts, and Phylos Bioscience, a leader in cannabis genetics, represent strategic plays to tap into these growth drivers without direct operational entanglement.

- Strategic Alignment: Investments align with Organigram's goal to gain a foothold in the lucrative US market, mitigating regulatory barriers.

- Innovation Access: Partnerships provide exposure to cutting-edge product development and cultivation techniques in the US.

- High Growth Potential: The US cannabis market, projected to reach tens of billions in revenue by the mid-2020s, offers significant upside.

- Risk Mitigation: Minority stakes are less capital-intensive than full acquisitions, allowing Organigram to diversify its risk while pursuing US market entry.

Organigram's ventures into the US hemp-derived THC beverage market and early-stage international expansion in the UK and Australia are prime examples of 'Question Marks'. These areas show high growth potential but currently have low market share for Organigram, requiring significant investment to establish a stronger foothold.

The development of next-generation cannabis products, such as infused beverages and advanced edibles, also falls into the 'Question Mark' category. While these innovations tap into growing market segments, their sales contribution is still minimal, necessitating substantial R&D and marketing to prove their long-term viability.

Similarly, Organigram's minority investments in US cannabis companies, like Open Book Extracts and Phylos Bioscience, represent 'Question Marks'. These are strategic plays in a high-growth sector that are currently speculative due to regulatory hurdles and the early stage of these partnerships.

The Canadian cannabis beverage market, where Organigram's Collective Project operates, is a classic 'Question Mark'. Despite a projected 15% CAGR through 2028, Organigram's market share is modest, demanding further investment in marketing and innovation to capture this expanding segment.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Organigram's financial reports, industry growth projections, and market share analysis to accurately position each business unit.