Organigram Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

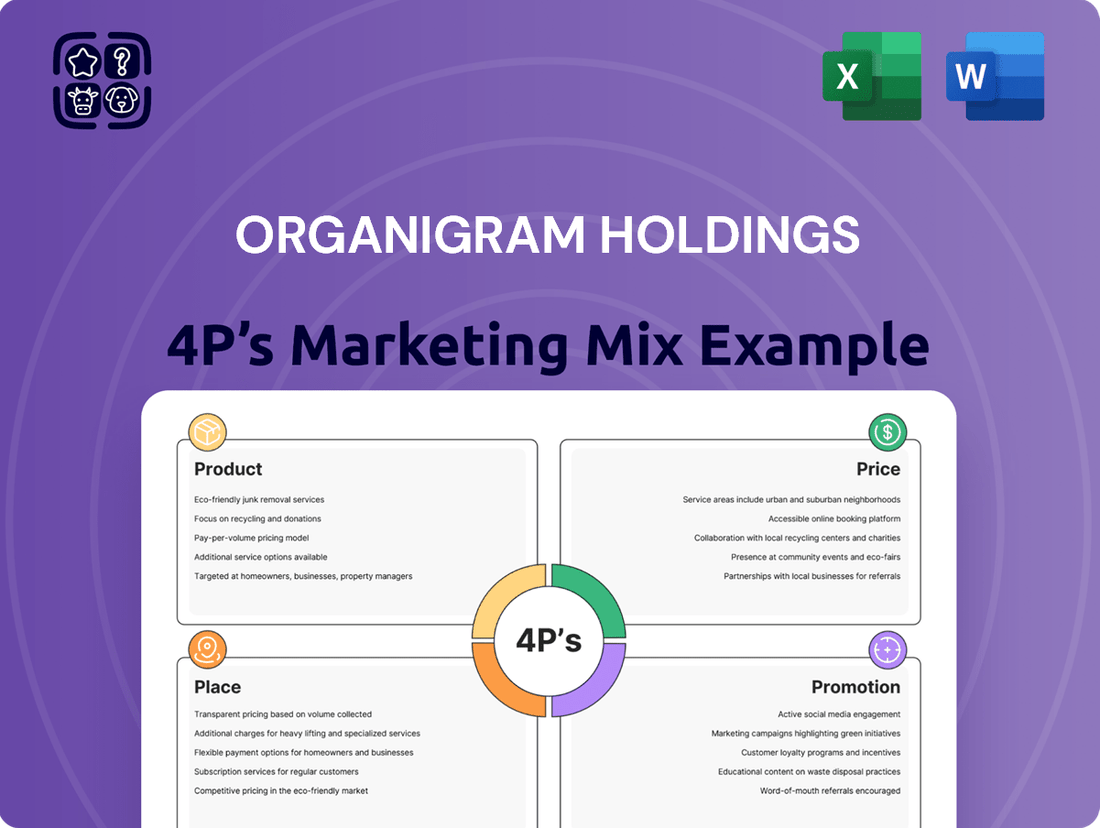

Organigram Holdings' marketing prowess is built on a carefully orchestrated 4Ps strategy. Their diverse product portfolio, from high-quality flower to innovative edibles, caters to a wide spectrum of consumer preferences within the burgeoning cannabis market. Understanding their pricing architecture reveals a balance between premium positioning and accessibility, ensuring market penetration.

The company's strategic placement in both recreational and medical channels, coupled with a strong online presence, highlights their commitment to accessibility. Organigram's promotional efforts, focusing on brand education and responsible consumption, resonate with a discerning customer base. To truly grasp the synergy of these elements and unlock actionable insights, dive into the complete Organigram Holdings 4Ps Marketing Mix Analysis.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

Organigram's product strategy centers on a diverse cannabis portfolio, encompassing dried flower, pre-rolls, edibles, vapes, and concentrates. This broad range ensures they can serve a wide spectrum of consumer needs and preferences across both medical and recreational channels in Canada. For example, their Shirley & Jones edibles brand saw significant growth in late 2023, reflecting strong consumer adoption of this product category.

This extensive product development allows Organigram to tap into various consumption occasions and cater to different user experiences, from traditional smoking to convenient edibles and discreet vapes. Their commitment to innovation is evident as they consistently introduce new SKUs, aiming to stay ahead of evolving market trends and capture a larger share of the Canadian cannabis market.

Organigram's Edison Sonics gummies represent a significant product innovation, leveraging their proprietary FAST™ nanoemulsion technology. This advanced formulation is designed for a quicker onset of effects, enhancing the consumer experience. In 2024, Organigram reported continued investment in R&D, aiming to bring such differentiated products to market.

The FAST™ technology’s key advantage lies in its ability to improve cannabinoid bioavailability. This means consumers can experience nearly double the cannabinoids at peak effect compared to conventional edibles, offering a more potent and predictable outcome. This focus on efficacy underscores Organigram's dedication to consumer needs.

Organigram Holdings champions strategic brand development through a diverse portfolio of adult-use recreational cannabis brands. This includes Edison, SHRED, BOXHOT, Big Bag O' Buds, Monjour, and Collective Project, each meticulously crafted for distinct consumer segments. For example, SHRED is known for its value-driven, high-potency products, appealing to a specific demographic seeking affordability and effect. This multi-brand approach allows Organigram to effectively target various niches within the Canadian cannabis market, fostering broader consumer engagement and market penetration.

Focus on High-Margin Categories

Organigram Holdings is sharpening its focus on product categories that deliver higher profit margins. This strategic move is evident in their emphasis on vapes and pre-rolls, segments where they've secured a dominant position within the Canadian market.

By prioritizing these premium and sought-after products, Organigram aims to boost its gross margins and overall financial performance. Innovations such as infused pre-rolls and sophisticated edibles further bolster this strategy, catering to consumer demand for advanced cannabis experiences.

For instance, in the fiscal year 2024, Organigram reported a significant increase in its average selling price per gram, driven by the product mix shift. This indicates the success of their high-margin category strategy, contributing to improved profitability.

- Leading Market Share: Organigram holds a leading position in the Canadian vape and pre-roll markets.

- Product Innovation: Investments in infused pre-rolls and advanced edibles enhance the premium product offering.

- Margin Improvement: The focus on high-margin categories directly contributes to better gross margins.

- Profitability Growth: This strategic shift is a key driver for Organigram's overall profitability enhancement.

Expansion into Hemp-Derived Beverages

Organigram's expansion into hemp-derived THC beverages in the U.S. via the Collective Project acquisition is a strategic play to capture a burgeoning market. This diversification moves beyond traditional cannabis products, tapping into a segment with significant growth potential. The U.S. hemp-derived cannabinoid market is projected for substantial expansion, with some analysts anticipating it to reach several billion dollars in the coming years, driven by consumer interest in alternative wellness products.

This expansion allows Organigram to establish a direct-to-consumer (DTC) channel across multiple U.S. states, a crucial element for brand building and customer relationship management. DTC sales offer higher margins and direct feedback loops, vital for product development and marketing refinement. The beverage category, in particular, is seeing strong consumer adoption within the alternative cannabinoid space, indicating a favorable market reception for such offerings.

- Market Entry: Acquisition of Collective Project for U.S. hemp-derived THC beverage market.

- Strategic Advantage: Leverages a growing market segment and establishes DTC presence.

- Portfolio Diversification: Expands beyond traditional cannabis formats into beverage innovation.

- Growth Potential: Targets a U.S. market segment with significant projected expansion.

Organigram's product strategy is a cornerstone of its marketing mix, focusing on a diverse and innovative cannabis portfolio. This includes dried flower, pre-rolls, edibles, vapes, and concentrates, catering to a wide range of consumer preferences in the Canadian market. Their commitment to high-margin categories like vapes and pre-rolls, exemplified by their leading market share in these segments, directly contributes to improved profitability. Furthermore, their expansion into U.S. hemp-derived THC beverages through the Collective Project acquisition diversifies their offerings and taps into a rapidly growing market.

| Product Category | Key Brands/Innovations | Market Position/Strategy | Financial Impact/Data (2024/2025 Projections) |

|---|---|---|---|

| Dried Flower & Pre-rolls | SHRED, BOXHOT, Big Bag O' Buds, Monjour | Value-driven, high-potency, infused pre-rolls | Strong market share, focus on premiumization driving average selling price increases. |

| Edibles | Shirley & Jones, Edison Sonics (FAST™ technology) | Innovation in onset time and bioavailability, targeting consumer experience | Shirley & Jones saw significant growth in late 2023; continued R&D investment in 2024 for advanced edibles. |

| Vapes | BOXHOT | Dominant position in the Canadian vape market | Key driver of margin improvement; Organigram holds a leading market share in this high-margin category. |

| U.S. Market Expansion | Collective Project (Hemp-derived THC Beverages) | Entry into a burgeoning U.S. market, establishing DTC channels | Targets significant U.S. market growth potential, projected to reach billions in coming years. |

What is included in the product

This analysis offers a comprehensive breakdown of Organigram Holdings' Product, Price, Place, and Promotion strategies, providing actionable insights for competitive positioning.

It's designed for professionals seeking a deep understanding of Organigram's marketing mix, grounded in real-world practices and strategic implications.

Simplifies Organigram's complex marketing strategy into actionable insights, relieving the pain of deciphering intricate details for quick strategic decision-making.

Place

Organigram Holdings leverages an extensive Canadian distribution network, primarily relying on provincial cannabis boards as its wholesale channels for recreational sales. This strategic approach grants the company access to licensed retailers across the nation, ensuring widespread product availability. For instance, as of early 2024, Organigram's products are available in key markets like Ontario, British Columbia, and Alberta through these provincial partnerships.

Beyond the recreational market, Organigram also maintains direct-to-patient sales channels within Canada for its medical cannabis offerings. This dual approach caters to both consumer segments, maximizing reach and revenue streams. The company's commitment to broad distribution is a key component of its market penetration strategy.

Organigram Holdings is strategically expanding its global reach through key international partnerships, a crucial element of its marketing strategy. These collaborations are designed to establish a strong presence in burgeoning cannabis markets worldwide. The company views these alliances as vital for both market penetration and revenue diversification.

Significant supply agreements are already in place with established partners in major international territories. For instance, Organigram has a robust relationship with Sanity Group in Germany, Avida Medical in the UK, and a presence in Australia. These agreements are not static; Organigram anticipates a notable increase in shipments to these markets throughout the 2024-2025 period.

Organigram Holdings leverages direct-to-consumer (D2C) channels to reach customers, primarily within Canada's medical cannabis sector. This approach allows for greater control over the customer experience and brand messaging.

The strategic acquisition of Collective Project in fiscal 2024 is a key enabler for Organigram's D2C expansion. This acquisition specifically targets the burgeoning U.S. market for hemp-derived THC beverages.

With the Collective Project integration, Organigram is poised to enter approximately 25 U.S. states, significantly broadening its market penetration and consumer access. This move represents a substantial step in diversifying its sales strategy beyond wholesale and international markets.

Multiple Cultivation and Processing Facilities

Organigram Holdings strategically leverages a network of cultivation and processing facilities to ensure a robust supply chain and diverse product offerings. Its primary operations are anchored by the flagship Moncton, New Brunswick campus, complemented by specialized facilities. This includes a dedicated edibles production site in Winnipeg, Manitoba, and a flower cultivation and hash production center located in Lac-Supérieur, Québec.

The strategic acquisition of Motif Labs significantly expanded Organigram's processing footprint, adding two key cannabis processing facilities in Southwestern Ontario, specifically in Aylmer and London. These additions are instrumental in optimizing the company's extraction, manufacturing, and distribution capabilities, thereby enhancing its market responsiveness and product innovation.

- Moncton, New Brunswick: Flagship campus, central to cultivation and processing.

- Winnipeg, Manitoba: Specialized facility for edibles production.

- Lac-Supérieur, Québec: Focuses on flower cultivation and hash production.

- Southwestern Ontario (Aylmer & London): Acquired through Motif Labs, enhancing extraction and manufacturing.

EU-GMP Certification for Global Exports

Organigram Holdings is actively pursuing EU-GMP certification for its Moncton facility, with operations anticipated by spring 2025. This strategic move is pivotal for unlocking direct flower and extract exports into Europe's regulated medical cannabis markets. Achieving this certification is expected to streamline operations by eliminating intermediaries, thereby enhancing Organigram's profit margins and significantly expanding its international sales potential.

The implications of this certification are substantial for Organigram's global market penetration strategy.

- EU-GMP certification expected by Spring 2025.

- Enables direct export of flower and extracts to European medical cannabis markets.

- Bypasses intermediaries, potentially increasing profit margins.

- Aims to boost international sales volumes.

Organigram Holdings' "Place" strategy is deeply rooted in its robust Canadian distribution network, utilizing provincial cannabis boards for recreational sales and direct-to-patient channels for medical cannabis. This ensures broad accessibility across Canada. The company is also strategically expanding its global footprint through key international partnerships, with significant supply agreements in place in Germany, the UK, and Australia, anticipating increased shipments in 2024-2025.

Full Version Awaits

Organigram Holdings 4P's Marketing Mix Analysis

The preview you see here is the actual Organigram Holdings 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive breakdown will equip you with a deep understanding of Organigram's strategic approach to Product, Price, Place, and Promotion. You'll gain insights into their product portfolio, pricing strategies, distribution channels, and promotional activities. This is the same ready-made analysis you'll download immediately after checkout, offering immediate value for your business insights.

Promotion

Organigram's recent rebranding to Organigram Global Inc. signifies a pivotal shift, moving beyond its Canadian roots to embrace a global market. This strategic evolution is visually represented by a new logo and a refreshed corporate identity, underscoring its transition into an international cannabis supplier.

The updated visual elements, including a redesigned corporate website, are meticulously crafted to convey Organigram's established leadership within the Canadian market while simultaneously projecting its expanding global reach and aspirations. This rebranding effort aims to resonate with a diverse international audience and investors.

Organigram's promotional strategy is deeply rooted in showcasing its commitment to product innovation. A prime example is the introduction of their Edison Sonics gummies, which feature groundbreaking FAST™ nanoemulsion technology. This technological advancement aims to provide a faster onset of effects, a key differentiator for consumers.

These product launches are frequently positioned as significant 'first-to-market' achievements within the Canadian cannabis sector. This strategic emphasis on novelty generates considerable consumer buzz and helps Organigram stand out in a crowded and highly competitive marketplace. For instance, in fiscal year 2023, Organigram reported strong performance driven by its premium product portfolio, indicating that innovation directly translates to market traction.

Organigram Holdings consistently highlights its standing as Canada's leading cannabis company by market share. This leadership is prominently featured in its marketing, emphasizing its strength in high-demand segments such as vapes and pre-rolls. For example, in Q3 2024, Organigram reported a national recreational market share of 9.2%, with even stronger performance in key provinces like Ontario and British Columbia.

This market leadership is a cornerstone of Organigram's communication strategy, designed to cultivate confidence among consumers and attract investment. By showcasing its number one position, particularly in growth areas like vapes, the company aims to reinforce its brand credibility and market dominance.

Strategic Partnerships and Investments

Organigram Holdings leverages strategic partnerships and investments as a core component of its marketing mix, underscoring its commitment to growth and market penetration. A prime example is the continued financial backing from British American Tobacco (BAT), which provides significant capital. For instance, in fiscal year 2024, BAT's investment played a crucial role in Organigram's financial strategy.

These alliances are not merely about capital infusion; they are actively promoted to bolster Organigram's balance sheet and accelerate its international expansion plans. The company's investment in Germany's Sanity Group, a significant player in the European cannabis market, exemplifies this strategy. This move is positioned to unlock new revenue streams and enhance Organigram's global footprint.

Furthermore, these collaborations are highlighted as enablers of joint product development, fostering innovation and expanding the company's product portfolio. This collaborative approach enhances Organigram's credibility in the market, reinforcing its narrative of robust growth and strategic foresight. The company aims to leverage these partnerships to create synergistic advantages and solidify its competitive position.

- Financial Strengthening: Continued investment from major partners like BAT bolsters Organigram's financial stability, crucial for funding expansion and R&D.

- International Expansion: Partnerships, such as the one with Sanity Group in Germany, are key to Organigram's strategy for entering and growing in new global markets.

- Product Innovation: Joint product development initiatives with strategic partners allow Organigram to bring new and innovative cannabis products to market more efficiently.

- Enhanced Credibility: Aligning with established international entities like BAT and Sanity Group elevates Organigram's market credibility and investor confidence.

Awards and Recognition

Organigram Holdings leverages industry awards as a key promotional strategy, effectively highlighting product excellence and innovation. A prime example is their Kind Magazine Award for SHRED X Rip-Strips Hash, which serves as a tangible endorsement of quality. These recognitions bolster Organigram's brand image, positioning it as a frontrunner in the premium cannabis market.

Such accolades directly contribute to consumer confidence and purchasing decisions. By showcasing awards, Organigram reinforces its commitment to superior product development and its competitive edge. This strategy is particularly effective in a crowded market where trust and quality validation are paramount for consumer engagement and loyalty.

- Awards as Validation: Industry awards like the Kind Magazine Award for SHRED X Rip-Strips Hash validate Organigram's product quality and innovation.

- Reputation Enhancement: These accolades reinforce Organigram's reputation as a leading producer of high-quality cannabis products.

- Consumer Trust: Awards build consumer confidence, influencing purchasing decisions in a competitive market.

- Competitive Advantage: Showcasing awards differentiates Organigram and highlights its commitment to excellence.

Organigram's promotional strategy centers on highlighting its product innovation, such as the Edison Sonics gummies with FAST™ nanoemulsion technology, aiming for faster consumer effects. The company actively promotes its 'first-to-market' achievements to generate buzz and differentiate itself in a competitive landscape. In fiscal year 2023, this focus on premium products contributed to strong financial performance, demonstrating the direct link between innovation and market success.

Organigram leverages its market leadership, particularly in high-demand categories like vapes and pre-rolls, as a key promotional tool. By consistently emphasizing its number one position, the company aims to build consumer trust and attract investors. This was evident in Q3 2024, where Organigram secured a 9.2% national recreational market share, with even stronger results in key provinces, reinforcing its brand credibility.

Strategic partnerships and investments, notably the financial backing from British American Tobacco (BAT), are prominently featured in Organigram's promotions to bolster its financial standing and fuel international expansion. The investment in Germany's Sanity Group, for example, is promoted as a critical step in accessing new revenue streams and expanding its global footprint. These collaborations also foster joint product development, amplifying innovation and portfolio growth.

Industry awards serve as a crucial element of Organigram's promotional efforts, validating product quality and innovation. Accolades like the Kind Magazine Award for SHRED X Rip-Strips Hash enhance brand image and consumer confidence. These recognitions reinforce Organigram's commitment to excellence, providing a competitive edge in a market where trust and quality are paramount for consumer engagement.

Price

Organigram navigates a fiercely competitive Canadian recreational cannabis landscape, where wholesale prices have dropped considerably. For instance, average dried flower prices across the Canadian market have seen consistent declines, impacting overall revenue streams for licensed producers.

To counter this, Organigram implements competitive pricing, especially for high-demand products like dried flower, aiming to secure and grow its market share. This strategy is crucial for maintaining customer loyalty amidst numerous alternatives.

Simultaneously, the company strategically emphasizes higher-margin product categories. This approach helps to absorb the impact of price reductions in core areas and improve overall profitability.

In Q1 2024, Organigram reported a net revenue of $73.4 million, demonstrating their ongoing efforts to balance competitive market positioning with margin management.

Organigram Holdings is focused on keeping its adjusted gross margin stable, targeting approximately 35% for the fiscal year 2025. This stability is a key part of their product strategy, ensuring profitability across their offerings.

To achieve this margin target, Organigram is implementing strategic price adjustments within specific flower product lines. This careful pricing approach is designed to optimize revenue without alienating their customer base.

Furthermore, the company is actively pursuing operational efficiencies to lower its unit costs. Improvements in cultivation practices are expected to yield better yields and reduce overall production expenses, directly supporting their gross margin goals.

Organigram Holdings strategically employs value-driven product tiers across its brand portfolio to capture diverse consumer segments. Brands such as SHRED and BOXHOT have demonstrated robust performance in the recreational cannabis market, directly translating into substantial retail sales contributions.

This tiered pricing model is key to Organigram's market penetration, effectively serving both budget-conscious consumers and those desiring premium cannabis experiences. For instance, in the first quarter of fiscal 2024, Organigram reported net revenue of $77.2 million, reflecting the success of their diverse product offerings and pricing strategies.

Impact of Excise Taxes and Operational Costs

Excise taxes are a substantial hurdle for Organigram, significantly eating into its gross revenue and shaping its net revenue figures. This means Organigram's pricing strategy in Canada must be carefully calibrated to absorb these government levies while still remaining competitive.

Beyond excise duties, Organigram faces a spectrum of operational costs, from cultivation and processing to distribution and marketing. These expenses, combined with the excise tax burden, directly influence the final price consumers see on Organigram's products, impacting the company's ability to achieve sustainable profitability in a dynamic market.

- Excise Tax Impact: Excise obligations are a major component of Organigram's cost structure.

- Pricing Strategy: Prices must reflect regulatory costs and operational expenses to ensure profitability.

- Canadian Market Focus: The Canadian market's regulatory environment heavily influences pricing decisions.

- Profitability Concerns: Balancing high taxes and operational costs is crucial for sustained financial health.

International Market Pricing Dynamics

Organigram's international pricing strategy must acknowledge diverse market conditions, regulatory hurdles, and competitor pricing in key expansion markets such as Germany, the UK, and Australia. For instance, in Germany, a mature market, pricing will likely be influenced by established domestic players and evolving consumer preferences for specific product formats.

The anticipated EU-Good Manufacturing Practice (GMP) certification is a significant factor. This certification is projected to enhance profit margins on international sales by streamlining supply chains and reducing operational costs associated with exporting to the European Union. This efficiency gain could allow for more competitive pricing or improved profitability on existing price points.

- Germany's cannabis market, estimated to reach €2.3 billion by 2025, presents a competitive landscape where Organigram will need to price strategically.

- The UK market, with its growing medical cannabis sector, offers opportunities for premium pricing if Organigram can establish a strong brand presence.

- Australia's regulatory environment, while evolving, may necessitate flexible pricing models to penetrate the market effectively.

- The EU-GMP certification is expected to reduce export costs by an estimated 5-10%, directly impacting the bottom line for international sales.

Organigram strategically employs a tiered pricing structure across its brands like SHRED and BOXHOT to appeal to various consumer segments in Canada. This approach, coupled with efforts to stabilize adjusted gross margins around 35% for fiscal 2025, aims to balance market competitiveness with profitability. The company also focuses on operational efficiencies to lower unit costs, directly supporting these margin goals.

Excise taxes and operational costs significantly influence Organigram's pricing in Canada, requiring careful calibration to remain competitive while absorbing these expenses. International expansion, particularly into markets like Germany (projected €2.3 billion market by 2025), necessitates adaptable pricing strategies influenced by local competition and consumer preferences.

| Market | 2024/2025 Pricing Consideration | Key Factor |

|---|---|---|

| Canada (Recreational) | Competitive pricing on high-demand products, value-tiered offerings | Declining wholesale prices, excise taxes, operational costs |

| Germany (Medical) | Strategic pricing influenced by established domestic players | Market size (€2.3B by 2025), evolving consumer preferences |

| UK (Medical) | Potential for premium pricing with strong brand presence | Growing medical cannabis sector |

| Australia (Medical) | Flexible pricing models for market penetration | Evolving regulatory environment |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Organigram Holdings leverages a robust blend of public disclosures, including SEC filings and investor relations materials, alongside industry-specific reports and competitive intelligence. We meticulously examine their product portfolio, pricing strategies, distribution channels, and promotional activities to provide a comprehensive market overview.