Organigram Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

Organigram Holdings operates within a dynamic cannabis industry, heavily influenced by evolving political landscapes and shifting government regulations. Economic factors like consumer spending power and market growth significantly impact their revenue streams. Technological advancements are crucial for innovation in cultivation and product development, while societal attitudes towards cannabis continue to shape market acceptance. Environmental concerns are also paramount, affecting cultivation practices and supply chain sustainability. Understanding these multifaceted external forces is key to Organigram's strategic success. Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Organigram Holdings. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The Canadian cannabis industry, including Organigram Holdings, navigates an evolving regulatory landscape. Health Canada is actively adjusting rules to ease the load on licensed producers while upholding public health and safety standards.

Significant amendments introduced in March 2025 have brought about key changes, such as increased cultivation and processing limits for micro-licenses. These adjustments aim to foster growth and innovation within the sector.

Furthermore, updated packaging and labeling regulations are set to offer Organigram more leeway in product presentation and market appeal. These regulatory shifts are expected to enhance operational flexibility and encourage new product development for the company.

Global cannabis law reform continues to evolve rapidly, with many nations actively considering or enacting changes to cannabis access. Organigram Holdings is strategically positioned to capitalize on these shifts, with a particular focus on emerging European markets where medical cannabis acceptance is growing. For instance, Germany's progressive stance on medical cannabis and its ongoing discussions around recreational legalization in 2024 present significant opportunities for companies like Organigram.

While the trend leans towards liberalization, the pace varies. Conservative political environments can still present hurdles to market entry or expansion for cannabis companies. Furthermore, existing international drug control treaties, such as the UN Single Convention on Narcotic Drugs, continue to impose restrictions on the cross-border trade of adult-use cannabis, impacting Organigram's global export potential.

The Canadian government and the public are increasingly acknowledging the cannabis sector's substantial impact on the national GDP and employment. In the first quarter of 2025, the industry contributed CA$9.1 billion to Canada's GDP, underscoring its economic importance.

This burgeoning sector is a significant job creator, providing employment for approximately 80,000 Canadians, many of whom are located in smaller communities.

Organigram, as a prominent entity within this landscape, stands to gain from this heightened recognition.

There are growing discussions and advocacy for policy adjustments aimed at fostering further growth and enhancing the industry's global competitiveness.

Excise Tax Framework Review

The excise tax framework in Canada is a significant political factor impacting Organigram Holdings. Many in the cannabis industry, including Organigram, view the current structure as misaligned with market realities, creating substantial hurdles for profitability. For instance, excise taxes are levied on cannabis products, directly affecting the cost and competitiveness of Organigram's offerings.

Calls for a review of this excise tax system are growing louder. The industry anticipates that potential changes could alleviate some of the financial pressures on licensed producers. This review is crucial because it directly influences Organigram's ability to generate sustainable profits and invest in growth.

- Excise Tax Burden: Cannabis companies like Organigram face considerable excise tax liabilities, directly impacting their bottom line.

- Market Alignment: Industry stakeholders believe the current excise tax framework does not accurately reflect the evolving cannabis market.

- Profitability Impact: High excise taxes can suppress profitability, making it challenging for companies to achieve financial stability and growth.

- Policy Review: There is a strong push for a government review and potential reform of the excise tax system to support the industry's financial health.

Health Canada's Oversight on Medical Cannabis

Health Canada is tightening its grip on medical cannabis, especially concerning high-dose prescriptions. This increased scrutiny stems from worries about public health impacts and the potential for diversion into the illegal market. For Organigram Holdings, this means navigating potentially more rigorous guidelines for healthcare providers prescribing their products.

This regulatory shift could influence the accessibility and prescribing patterns for medical cannabis, directly affecting Organigram's medical segment. For instance, in 2023, the Canadian government reported that licensed cultivators produced approximately 500,000 kilograms of cannabis, highlighting the scale of the industry now subject to evolving oversight.

- Stricter Authorization: Health Canada's focus on high-dose prescriptions may lead to more stringent requirements for medical cannabis authorizations.

- Public Health Concerns: The oversight aims to mitigate risks associated with high-potency products and prevent diversion.

- Impact on Medical Segment: Organigram's medical cannabis sales could be affected by changes in prescribing practices and patient access.

- Regulatory Landscape: The evolving regulatory environment necessitates adaptability for companies like Organigram to maintain compliance.

Government policies significantly shape the Canadian cannabis market, influencing Organigram's operations. The ongoing review of the excise tax framework, a critical issue for industry profitability, is a key political focus. Furthermore, evolving regulations from Health Canada, particularly concerning medical cannabis, require careful navigation by Organigram to ensure compliance and market access.

What is included in the product

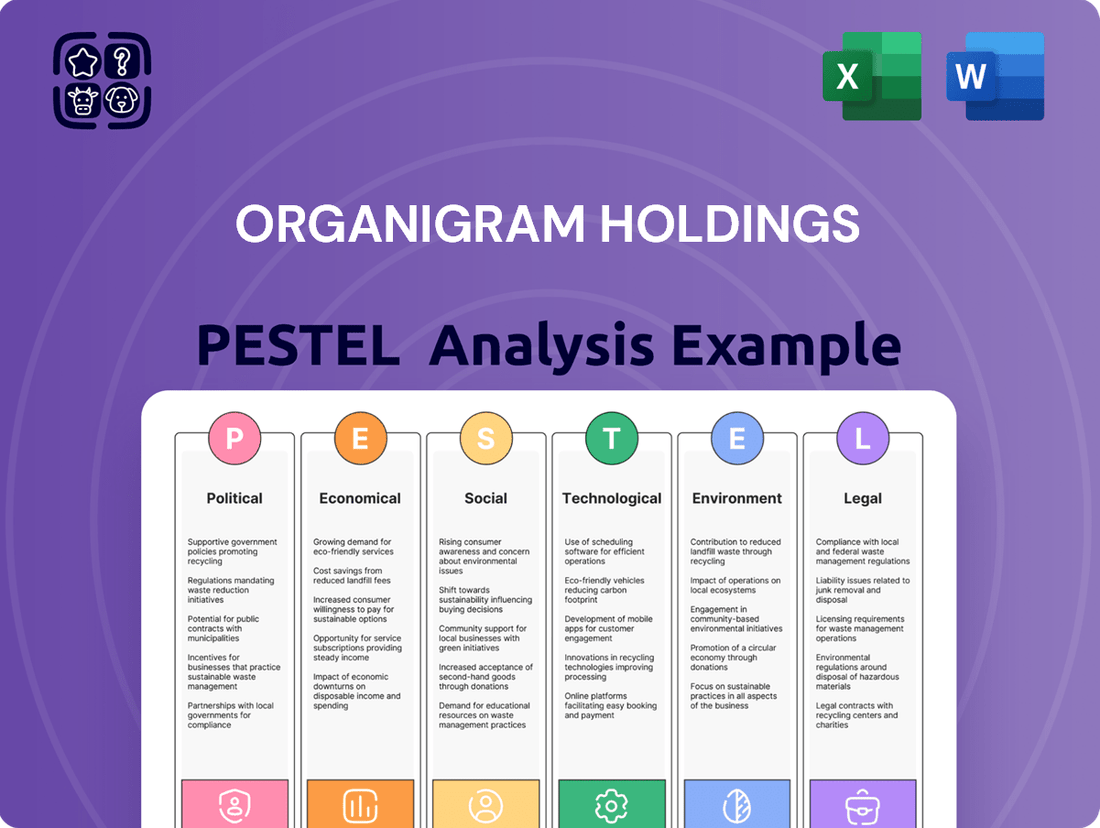

Organigram Holdings's PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors impact its operations and strategy, providing actionable insights for navigating the cannabis industry.

Provides a clear, actionable breakdown of Organigram's PESTLE factors, simplifying complex external influences for strategic decision-making.

Economic factors

The Canadian legal cannabis market is anticipated to see robust expansion, with projected revenues expected to hit US$5.97 billion by 2025. This upward trend is fueled by continuous product innovation and a widening consumer demographic.

Alongside this growth, the industry is experiencing significant consolidation. Major players, such as Organigram, are strategically acquiring smaller firms to enhance market efficiency and expand their reach.

Organigram solidified its position as Canada's largest cannabis company by market share following its pivotal acquisition of Motif Labs in late 2024, demonstrating a clear trend towards industry consolidation.

Canadian cannabis companies, Organigram included, are grappling with escalating costs that are squeezing profit margins despite revenue increases. A significant majority, 80%, of these companies pinpoint rising costs as their primary threat to profitability. These expenses encompass everything from cultivation and packaging to administrative overhead and the substantial burden of federal excise taxes.

Organigram has actively addressed these pressures through strategic efficiency improvements. In fiscal year 2024, the company successfully achieved $9.1 million in cost savings, demonstrating a commitment to operational optimization and mitigating the impact of these challenging economic factors.

Household spending on legal cannabis in Canada saw a significant increase of 10.6% in 2024, a trend that directly benefits Organigram's established sales channels as consumers increasingly favor regulated products. This upward trajectory in legal market participation suggests growing consumer confidence in the quality and safety of legal cannabis offerings.

Despite the overall positive growth in legal spending, the total household final consumption expenditure on cannabis experienced a minor dip in the first quarter of 2025 when compared to the preceding quarter. This moderation might signal a maturing Canadian cannabis market, where initial rapid growth phases are giving way to more stable, albeit still positive, expansion.

International Sales Contribution

Organigram Holdings has seen a notable uplift in its international sales, which is becoming an increasingly important driver of its net revenue growth. As the Canadian cannabis market continues to mature and grapple with oversupply issues, the company is strategically expanding its reach into global medical cannabis markets, which are showing significant promise.

This international expansion is crucial for Organigram's economic stability. It allows the company to diversify its revenue streams, reducing reliance on the increasingly competitive domestic market. Furthermore, Organigram can leverage Canada's established and rigorous quality control standards in its international exports, which can be a significant competitive advantage in discerning global markets.

- Diversification of Revenue: International sales offer a vital hedge against domestic market saturation.

- Leveraging Quality Standards: Canada's reputation for quality cannabis supports Organigram's global market entry.

- Market Growth Opportunities: Emerging international medical cannabis markets present substantial growth potential.

- Economic Resilience: A diversified revenue base enhances the company's overall economic stability and reduces risk.

Capital and Liquidity Position

Organigram Holdings has demonstrated a robust capital and liquidity position, significantly bolstered by strategic investments. As of September 30, 2024, the company reported substantial cash and cash equivalents, partly attributed to its partnership with British American Tobacco. This financial strength is crucial for funding ongoing operations, pursuing research and development, and exploring strategic growth opportunities.

The company's healthy liquidity allows for flexibility in managing its financial obligations and investing in market expansion. This strong balance sheet is a key enabler for Organigram to capitalize on emerging trends within the cannabis industry, whether through organic growth or potential mergers and acquisitions. The ability to access capital readily supports sustained investment in product innovation and operational enhancements.

- Strong Liquidity: Organigram reported approximately $200 million in cash and cash equivalents as of September 30, 2024.

- Strategic Investments: Funding from partners like British American Tobacco has significantly strengthened its capital base.

- Investment Capacity: The company is well-positioned to fund strategic initiatives, including R&D and market expansion.

- Financial Stability: This capital position provides a cushion for operational resilience and future growth opportunities.

Rising operational costs, including cultivation and excise taxes, remain a significant economic challenge for Canadian cannabis companies like Organigram. Despite revenue growth, 80% of firms identify cost escalation as a primary threat to profitability. Organigram, however, managed to achieve $9.1 million in cost savings in fiscal year 2024, demonstrating effective operational efficiencies to counter these pressures.

Household spending on legal cannabis in Canada increased by 10.6% in 2024, benefiting Organigram's sales channels. However, a slight moderation in total cannabis expenditure was observed in Q1 2025 compared to the prior quarter, suggesting market maturation.

Organigram's international sales are increasingly driving net revenue, as the company diversifies into promising global medical cannabis markets to offset domestic oversupply. This global reach leverages Canada's rigorous quality standards, offering a competitive edge in discerning markets.

Organigram maintained a strong financial position, reporting approximately $200 million in cash and cash equivalents as of September 30, 2024, partly due to its partnership with British American Tobacco. This liquidity supports R&D, market expansion, and strategic growth initiatives.

| Metric | Value (FY2024/2025 Data) | Significance |

|---|---|---|

| Canadian Cannabis Market Revenue Projection | US$5.97 billion by 2025 | Indicates substantial market growth potential. |

| Organigram Cost Savings (FY2024) | $9.1 million | Demonstrates operational efficiency in managing rising costs. |

| Household Spending on Legal Cannabis (2024) | +10.6% increase | Shows growing consumer adoption of regulated products. |

| Organigram Cash & Equivalents (Sept 30, 2024) | ~$200 million | Highlights strong liquidity for strategic investments and operations. |

Preview the Actual Deliverable

Organigram Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Organigram Holdings PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations. It provides a comprehensive overview of the external forces shaping the Canadian cannabis industry, offering valuable insights for strategic decision-making.

Sociological factors

While cannabis is legal in Canada, a lingering stigma around its use persists, despite growing public support for legalization. Data from 2024 indicates a notable shift in how Canadians view cannabis consumption, with a segment of the population increasingly perceiving regular use as carrying higher risks, especially concerning mental health impacts. Organigram Holdings must carefully consider these evolving societal views, emphasizing responsible marketing and creating products that appeal to a more health-aware consumer demographic.

Consumer preferences are shifting as the Canadian cannabis market matures, with a strong and consistent demand for a wide array of products. This includes traditional dried flower, convenient pre-rolls, various edibles, popular vapes, and potent concentrates. Organigram, recognizing this, has strategically focused on product innovation and robust brand development to cater to these evolving tastes.

The success of Organigram's brands, such as SHRED, highlights the importance of this diversification strategy. SHRED, known for its innovative approach to cannabis products, has seen significant uptake, demonstrating the market's appetite for well-executed and differentiated offerings. This focus is vital for Organigram to not only meet current consumer demands but also to secure and grow its market share in a competitive landscape.

The increasing recognition of cannabis's potential health benefits, especially CBD for managing anxiety and pain, is a significant market driver. This growing consumer interest is directly influencing product development and demand. For example, by early 2024, the global CBD market was projected to reach over $15 billion, indicating substantial consumer adoption and belief in these wellness applications.

Organigram Holdings can capitalize on this by strengthening its medical cannabis portfolio and creating products specifically for the wellness sector. This strategic alignment is supported by continuous research, including ongoing clinical trials exploring cannabis's therapeutic properties. The company's ability to innovate in this space will be crucial for capturing market share as consumer awareness and acceptance continue to rise.

Social Equity and Community Engagement

The cannabis sector is placing a growing emphasis on social responsibility, which includes fair labor standards and active community involvement. Organigram, by maintaining operations in smaller communities like Moncton, New Brunswick, directly supports local economies through job creation and procurement. For instance, as of early 2024, Organigram reported employing over 900 individuals, many of whom are from the surrounding areas, underscoring its role as a significant local employer.

By actively engaging in initiatives such as prioritizing local hiring and contributing to community programs, Organigram can solidify its social license to operate. This approach not only fosters goodwill but also aligns with evolving public expectations for corporate citizenship within the burgeoning cannabis industry. In 2023, Organigram announced a partnership with a local environmental group, demonstrating a tangible commitment to community well-being.

- Community Impact: Organigram's presence in smaller towns like Moncton generates local employment, contributing to economic stability.

- Social License: Proactive community engagement and fair labor practices are crucial for maintaining public acceptance and operational continuity.

- Corporate Citizenship: Investing in local initiatives and partnerships enhances Organigram's reputation and strengthens its relationship with stakeholders.

- Economic Contribution: The company's procurement from local suppliers further bolsters the economic health of the regions in which it operates.

Demographic Shifts in Consumption

Demographic shifts significantly influence cannabis consumption patterns in Canada, a key consideration for Organigram Holdings. While youth cannabis use rates have remained relatively stable, overall past 12-month usage has seen an increase. This trend highlights a growing acceptance and integration of cannabis into the broader population.

Understanding age-related differences in stigma and consumption is crucial. For instance, older demographics might exhibit different preferences and attitudes towards cannabis compared to younger generations, impacting product development and marketing approaches. Organigram needs to navigate these nuances to effectively reach diverse consumer segments.

- Increased Past 12-Month Use: Data indicates a rise in Canadians reporting cannabis use within the last year.

- Stable Youth Usage: Rates among younger Canadians have shown consistency, suggesting established consumption habits.

- Daily/Almost Daily Users Steady: The segment of frequent users has maintained its size, pointing to a core consumer base.

- Age-Specific Stigma and Patterns: Different age groups show varying levels of social acceptance and preferred consumption methods.

Societal attitudes towards cannabis continue to evolve, with a growing segment of the Canadian population embracing its use while others maintain reservations. This nuanced public perception necessitates careful messaging from Organigram Holdings, focusing on responsible consumption and product safety. By 2024, while overall acceptance had grown, specific concerns regarding mental health impacts remained a point of discussion for some consumers.

The company's commitment to social responsibility is evident in its deep roots within communities like Moncton, New Brunswick. As of early 2024, Organigram employed over 900 individuals, many from the local area, highlighting its role as a significant community employer and economic contributor. This local engagement, including partnerships with regional entities, enhances its social license to operate and builds trust with stakeholders.

Demographic trends reveal a broadening acceptance of cannabis, with increased usage reported across various age groups in the past year. While youth consumption has remained stable, the overall trend points to a more integrated presence of cannabis in Canadian society. Organigram must tailor its product development and marketing to cater to these diverse age-related preferences and varying levels of social acceptance.

Technological factors

Technological advancements are dramatically reshaping cannabis cultivation, particularly through Controlled Environment Agriculture (CEA), artificial intelligence (AI), and automation. Organigram, with its focus on indoor cultivation, is well-positioned to benefit from these innovations. For instance, advancements in LED lighting and sophisticated data analytics allow for the precise optimization of growing conditions, leading to higher yields and more efficient resource use. This was evident in Organigram's Q4 2024 performance, where they achieved record yields, demonstrating the tangible impact of these technological integrations.

Organigram Holdings is heavily influenced by technological advancements in cannabis product innovation. Innovations in extraction methods and equipment are key, allowing for the creation of purer and more potent concentrates and extracts. This directly impacts their ability to produce high-quality cannabis products that meet consumer expectations.

The company's strategy to offer a wide range of products, including edibles, vapes, and concentrates, necessitates ongoing investment in these evolving technologies. Staying competitive means consistently improving production processes to ensure product quality and consistency, which is crucial for capturing market share in the dynamic cannabis industry.

For instance, advancements in CO2 extraction and solventless techniques are enabling Organigram to develop premium products that command higher prices. As of Q1 2024, the Canadian adult-use cannabis market saw continued growth in premium segments, highlighting the importance of technological capabilities in product differentiation.

Automation and robotics are increasingly common in cannabis cultivation, handling tasks like planting, watering, harvesting, and packaging. This technology not only cuts down on labor expenses but also minimizes mistakes. For instance, Organigram Holdings has been actively working to boost its operational efficiency and lower cultivation costs, partly by using advanced seed-based technologies, which fits perfectly with the industry's move towards more automated processes.

Data Analytics and AI in Operations

Organigram's operational efficiency stands to gain significantly from advanced data analytics and artificial intelligence. These technologies are increasingly vital for optimizing cultivation, forecasting yields, and enabling data-informed strategic decisions within the cannabis industry.

By integrating AI-powered systems, Organigram can achieve finer control over environmental conditions in its cultivation facilities, leading to more predictable outcomes and reduced waste. This technological adoption is key to enhancing resource management, from water and nutrient allocation to energy consumption, thereby boosting overall productivity and profitability. For instance, in the broader agricultural technology sector, AI-driven precision agriculture saw significant investment and adoption in 2024, with companies reporting yield improvements of up to 15% through optimized environmental controls.

- Optimized Cultivation: AI algorithms can analyze vast datasets from sensors to fine-tune temperature, humidity, and light, maximizing plant growth and cannabinoid production.

- Predictive Yield Analysis: Machine learning models can forecast harvest volumes with greater accuracy, aiding in inventory management and sales planning.

- Resource Management: AI can optimize irrigation and nutrient delivery, reducing input costs and environmental impact.

- Data-Driven Decision Making: Analytics provide actionable insights into operational performance, identifying areas for continuous improvement.

Supply Chain Transparency and Traceability

Technological advancements are profoundly reshaping the cannabis industry, with blockchain and seed-to-sale tracking solutions emerging as key drivers for Organigram Holdings. These technologies are instrumental in enhancing transparency and ensuring compliance throughout the entire cannabis supply chain. For Organigram, integrating these systems offers a significant advantage in improving product traceability, verifying authenticity, and adhering to the rigorous regulatory frameworks governing the sector. This enhanced oversight not only streamlines operations but also cultivates greater consumer confidence in the quality and safety of Organigram's offerings, a critical factor in a highly regulated market.

By adopting advanced tracking solutions, Organigram can proactively manage its supply chain, from cultivation to final sale. This meticulous tracking capability is particularly valuable in meeting the stringent requirements of jurisdictions like Canada, where Organigram operates. For instance, the Canadian cannabis market, which saw retail sales reach an estimated CAD $3.4 billion in 2023, demands robust systems to prevent diversion and ensure product integrity. Organigram's investment in such technologies directly addresses these demands, allowing for precise monitoring of every stage and reinforcing its commitment to regulatory adherence and consumer safety.

- Blockchain for enhanced security: Secures transaction data and prevents tampering, crucial for regulatory compliance.

- Seed-to-sale tracking: Provides end-to-end visibility, ensuring product authenticity and quality control.

- Regulatory compliance: Facilitates adherence to strict legal requirements, minimizing risks and penalties.

- Consumer trust: Builds confidence through verifiable product information, supporting brand loyalty.

Technological advancements in cultivation, such as AI-driven environmental controls and advanced LED lighting, significantly boost Organigram's yield efficiency and product quality. These innovations allow for precise optimization of growing conditions, mirroring trends in precision agriculture which saw up to 15% yield improvements reported in 2024 through similar methods. This focus on technology is crucial for Organigram to maintain its competitive edge in producing high-quality cannabis products.

Organigram's product innovation pipeline heavily relies on evolving extraction technologies, enabling the development of premium concentrates and extracts. This is vital as the Canadian adult-use market, valued at an estimated CAD $3.4 billion in 2023, shows a growing demand for differentiated, high-potency products. Investing in technologies like CO2 extraction supports Organigram's strategy to capture market share in these premium segments.

Automation and robotics are being integrated into cultivation and packaging processes to reduce labor costs and enhance operational efficiency. Organigram's adoption of advanced seed technologies and automated processes aligns with the industry's broader shift towards cost reduction and error minimization. This technological integration is a cornerstone of their strategy to lower cultivation expenses.

Blockchain and seed-to-sale tracking systems are enhancing Organigram's supply chain transparency and regulatory compliance. These technologies are critical for product traceability and consumer trust in highly regulated markets like Canada. By ensuring end-to-end visibility, Organigram reinforces its commitment to product integrity and adherence to stringent legal frameworks.

Legal factors

Organigram Holdings operates within the stringent framework of Canada's Cannabis Act and its accompanying Health Canada regulations. These rules dictate every facet of the cannabis industry, from obtaining licenses and growing plants to how products are made, packaged, and sold.

A significant development occurred in March 2025 with amendments to these regulations. These changes were designed to simplify the process, notably by increasing the production limits for micro-cultivation and micro-processing facilities. This adjustment presents a potential advantage for Organigram, offering a pathway to expand its production capabilities and potentially achieve greater operational efficiency.

Organigram Holdings navigates a complex legal landscape shaped by stringent product standards, particularly concerning THC limits, and evolving labelling requirements. Health Canada's ongoing efforts to modernize these regulations directly impact how Organigram can present its products.

Recent amendments, for instance, permit innovations like transparent immediate packaging and view-windows on dried cannabis packages. This allows for greater consumer engagement and product visibility, presenting new marketing opportunities within the legal framework.

These regulatory shifts are crucial for Organigram's strategy, as compliance with updated standards and leveraging new packaging allowances are essential for maintaining market competitiveness and consumer trust in the Canadian cannabis sector.

The Canadian cannabis sector operates under stringent advertising and marketing regulations aimed at safeguarding young people. Organigram Holdings must meticulously adhere to these rules, emphasizing brand building and product innovation within the defined promotional boundaries. This careful navigation is crucial for maintaining market presence and consumer engagement.

A notable change effective March 2025 removes the annual reporting requirement for promotional expenses. This adjustment could potentially streamline administrative processes for companies like Organigram, allowing for a greater focus on strategic marketing initiatives rather than extensive compliance documentation.

International Regulatory Compliance

Organigram's international expansion hinges on navigating a complex web of global cannabis regulations. Each new market presents unique challenges, from differing medical cannabis export requirements to varying permissible THC levels. For instance, as of late 2024, the European Union continues to refine its medical cannabis import and distribution frameworks, impacting Organigram's potential market access.

Securing certifications like EU-Good Manufacturing Practice (GMP) is paramount for Organigram's Moncton facility. This certification is a key enabler for entering and growing within international medical cannabis markets, where stringent quality and safety standards are enforced. By achieving EU-GMP, Organigram can unlock opportunities in regions with developing, yet strict, legal frameworks.

The evolving nature of these international legal landscapes necessitates continuous monitoring and adaptation. Organigram must remain agile to comply with new legislation and amendments that could impact product formulations, packaging, and distribution channels. The global cannabis industry, while growing, operates within a dynamic and often unpredictable legal environment.

Key considerations for Organigram's international regulatory compliance include:

- Adherence to varying THC limits: Different jurisdictions impose strict caps on tetrahydrocannabinol content in cannabis products, requiring precise formulation and testing.

- Medical cannabis export regulations: Obtaining necessary permits and licenses for exporting medical cannabis products is a complex and country-specific process.

- Product registration and approval: Each target market may have its own requirements for registering and approving cannabis-based products for sale.

- Compliance with import/export controls: Navigating customs regulations and phytosanitary requirements is essential for the smooth transit of goods.

Intellectual Property Protection

Protecting intellectual property (IP) is paramount for Organigram Holdings, especially concerning its unique cannabis strains, innovative product formulations, and distinct branding. In the rapidly evolving cannabis industry, securing patents, trademarks, and other IP rights is a legal necessity for maintaining a competitive advantage, particularly as the market continues to consolidate.

Organigram actively seeks to safeguard its innovations. For instance, as of early 2024, companies in the cannabis sector were increasingly investing in IP protection to differentiate themselves. While specific numbers for Organigram's IP filings are proprietary, the trend indicates a significant focus on this area within the industry to prevent unauthorized use of proprietary genetic material and product recipes.

- Patents: Securing patents for novel cannabis strains or extraction methods provides exclusive rights, preventing competitors from using or selling them.

- Trademarks: Protecting brand names, logos, and product names ensures that Organigram's identity is legally recognized and shielded from infringement.

- Trade Secrets: Confidential information, such as proprietary cultivation techniques or specific cannabinoid ratios in formulations, can be protected as trade secrets.

- Copyright: This applies to creative works like marketing materials, packaging designs, and website content, preventing unauthorized reproduction.

Organigram Holdings operates under strict Canadian cannabis regulations, including licensing, cultivation, and product sales. Amendments in March 2025 simplified processes, increasing production limits for micro-cultivators, which could benefit Organigram's expansion and efficiency.

The company must also adhere to evolving product standards and labeling requirements, with recent changes permitting innovations like transparent packaging for dried cannabis, offering new marketing avenues.

These regulatory shifts are critical for Organigram's strategy, ensuring market competitiveness and consumer trust through compliance and leveraging new packaging allowances.

Environmental factors

Organigram's reliance on indoor cultivation, a method requiring substantial energy for lighting, climate control, and humidity management, presents a significant environmental challenge. Research indicates that indoor cannabis operations contribute notably to global warming potential, particularly in regions with colder climates that necessitate more extensive heating. For instance, studies from the late 2010s and early 2020s have consistently shown that energy consumption per kilogram of cannabis produced indoors can be orders of magnitude higher than outdoor cultivation. Organigram's strategic approach must therefore prioritize investments in energy-efficient technologies and explore the integration of renewable energy sources to reduce its environmental impact and operational costs.

Organigram's cannabis cultivation is water-intensive, making efficient water management crucial. As of the first quarter of fiscal 2025, Organigram reported a 34% increase in revenue, highlighting their growth and the increasing demand for their products, which in turn escalates water needs. Implementing advanced irrigation, such as drip systems, can significantly reduce water usage compared to traditional methods. For instance, drip irrigation can be up to 90% efficient in delivering water directly to plant roots, minimizing evaporation and runoff. This not only conserves a vital resource but also lowers operational costs associated with water purchase and treatment.

Exploring rainwater harvesting presents another avenue for Organigram to enhance its water sustainability. Collecting and utilizing rainwater can decrease dependence on municipal water sources, thereby reducing strain on local water infrastructure and associated costs. Given the increasing focus on environmental, social, and governance (ESG) factors by investors and consumers alike, such initiatives align Organigram with broader sustainability goals. This proactive approach to water conservation can bolster brand reputation and appeal to a growing segment of environmentally conscious consumers in the Canadian cannabis market, which saw total retail sales exceeding CAD $3.8 billion in 2023.

The cannabis industry, including companies like Organigram, faces significant challenges with waste generation, encompassing plant trimmings, processing by-products, and packaging materials. For instance, a 2023 report indicated that cannabis cultivation can produce a substantial amount of biomass waste per kilogram of flower produced. Organigram's sustainability efforts are crucial here, with a focus on implementing advanced waste management practices and exploring circular economy principles to reduce its environmental impact.

Organigram's approach to waste management and recycling is vital for its long-term environmental stewardship. This involves not only the proper disposal of cultivation by-products but also a proactive strategy to minimize waste at the source. By prioritizing recyclable and compostable packaging solutions, Organigram aims to lessen the burden on landfills and align with growing consumer and regulatory expectations for eco-friendly operations.

Carbon Footprint Reduction Initiatives

Organigram Holdings, like many in the cannabis industry, faces increasing pressure from consumers and regulators to adopt more environmentally sustainable practices. This is driving a focus on reducing the sector's carbon footprint, a key environmental consideration in any PESTLE analysis. The company is exploring various avenues to achieve this, reflecting a broader industry trend towards greener cultivation methods and operational efficiencies.

Organigram is actively investigating strategies to minimize its environmental impact. These include the potential adoption of organic cultivation techniques, which can reduce reliance on synthetic inputs and associated emissions. Furthermore, enhancing energy efficiency across its cultivation and processing facilities is a critical component of its carbon reduction efforts.

The company is also considering innovative approaches such as industrial symbiosis. This could involve co-locating facilities with sources of carbon dioxide emissions, allowing Organigram to potentially capture and utilize CO2, thereby reducing waste and its overall carbon footprint. Such strategic partnerships are becoming increasingly important for environmental stewardship in the industry.

For instance, the Canadian cannabis industry's energy consumption is a significant factor. In 2023, reports indicated that energy costs represented a substantial portion of operational expenses for licensed producers, underscoring the financial and environmental imperative for efficiency improvements. Organigram's commitment to these initiatives positions it to meet evolving stakeholder expectations and regulatory demands.

- Organic Cultivation: Exploring methods that reduce synthetic inputs and their associated environmental impact.

- Energy Efficiency: Implementing technologies and processes to lower energy consumption in cultivation and processing.

- Industrial Symbiosis: Investigating partnerships for CO2 capture and utilization, potentially with nearby industrial emitters.

- Consumer Demand: Responding to growing consumer preference for sustainably produced cannabis products.

Climate Change and Supply Chain Resilience

Climate change presents significant environmental challenges for Organigram Holdings, particularly impacting the agricultural sector, which includes cannabis cultivation. Increasingly severe weather events, such as extreme heat, droughts, and floods, can disrupt agricultural yields and damage crops. While Organigram's focus on indoor cultivation mitigates some direct weather-related risks, the broader implications for supply chain resilience are substantial.

The availability and cost of essential resources like water and energy, crucial for indoor farming operations, can be affected by climate change impacts on regional infrastructure and natural resources. Disruptions to transportation networks due to extreme weather can also hinder the movement of raw materials and finished products. For instance, in 2024, several regions experienced significant agricultural losses due to unseasonable weather patterns, highlighting the vulnerability of even controlled environments to wider systemic disruptions.

Organigram must proactively integrate climate change risk assessments into its long-term strategic planning to ensure operational continuity and mitigate potential supply chain vulnerabilities. This includes diversifying sourcing, investing in resilient infrastructure, and exploring innovative cultivation techniques that can adapt to changing environmental conditions.

- Increased frequency of extreme weather events threatens agricultural output globally, impacting inputs for cannabis cultivation.

- Indoor cultivation offers protection but supply chain resilience against climate-driven disruptions to infrastructure and resources remains a key concern.

- Organigram must factor climate change risks into its operational and strategic planning to ensure long-term stability.

- Water scarcity and energy price volatility, exacerbated by climate change, could impact the cost-efficiency of indoor grow operations.

Organigram's environmental impact is primarily linked to its energy-intensive indoor cultivation, a process demanding significant power for lighting, climate control, and humidity. Studies from the early 2020s consistently highlight that indoor cannabis production can consume exponentially more energy per kilogram than outdoor methods, especially in colder climates requiring extensive heating. For instance, in 2023, energy costs were a substantial operational expense for Canadian licensed producers, emphasizing the financial and environmental drive for efficiency.

PESTLE Analysis Data Sources

Our Organigram Holdings PESTLE Analysis is built upon a robust foundation of data sourced from reputable industry publications, government reports, and leading market research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.