Organigram Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

Organigram Holdings operates in a dynamic cannabis market, facing moderate threats from new entrants due to high startup costs and regulatory hurdles, yet the bargaining power of buyers is growing with increased product availability. The threat of substitutes, while present in other recreational or medicinal alternatives, is less pronounced within the regulated cannabis sector itself. Intense rivalry among existing players, including Organigram, significantly shapes market conditions.

The complete report reveals the real forces shaping Organigram Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Organigram Holdings, like many in the cannabis industry, depends on specialized equipment for its indoor cultivation. This includes advanced lighting systems, climate control (HVAC), and automated growing technologies, crucial for optimizing yield and quality.

The market for highly specialized, proprietary equipment often features a limited number of suppliers. This scarcity can translate into significant bargaining power for these providers, influencing pricing and contract terms for cannabis producers such as Organigram.

For instance, in 2024, the demand for cutting-edge cultivation technology remained strong, driven by the industry's continuous pursuit of efficiency and higher yields. Suppliers offering patented or unique solutions could command premium prices, impacting the cost structure for companies like Organigram.

This dependence on a few key suppliers for essential, advanced technology means Organigram may face challenges in negotiating favorable terms, particularly when adopting the latest innovations that offer a competitive edge.

As Organigram Holdings expands its product range to include edibles, vapes, and concentrates, the need for specialized and compliant packaging materials intensifies. This diversification means Organigram requires more than just basic packaging; it needs child-resistant designs and innovative solutions, potentially concentrating the supplier pool for these niche items and increasing their bargaining power. For instance, the demand for specific, food-grade, and tamper-evident packaging for edibles, compliant with evolving regulations, can limit supplier options and thus enhance supplier leverage.

Organigram's reliance on specialized nutrients and growing media for its indoor cultivation operations gives certain suppliers significant leverage. While many agricultural inputs are commoditized, the demand for specific organic or high-quality inputs that differentiate Organigram's products can concentrate power in the hands of a few providers. For example, in the fiscal year 2024, Organigram continued to emphasize premium product lines, suggesting a sustained need for these specialized inputs.

Skilled Labor and Expertise

The cannabis industry, including cultivation and product innovation, requires a specialized workforce. This includes master growers, scientists, and quality assurance experts. The limited availability of these highly skilled individuals translates to considerable bargaining power for them or for consulting firms they may represent. This power can influence wages, benefits, and service fees, directly impacting Organigram's operational expenses.

For instance, in 2024, the demand for experienced cannabis cultivators saw salary ranges increase by as much as 15% year-over-year in certain key markets due to this scarcity. Companies like Organigram must often compete for talent, which can drive up labor costs. This specialized expertise is critical for maintaining product quality and developing new, competitive offerings.

- High Demand for Specialized Skills: Master growers, cannabis scientists, and QA personnel are in short supply.

- Wage and Benefit Pressure: Scarcity drives up compensation expectations for skilled cannabis professionals.

- Consulting Firm Leverage: Expert consultants can command higher fees due to industry-specific knowledge.

- Impact on Operational Costs: Increased labor expenses directly affect Organigram's profitability.

Regulatory Compliance and Consulting Services

The bargaining power of suppliers for Organigram Holdings, particularly concerning regulatory compliance and consulting services, is significant due to the intricate and constantly shifting legal framework in Canada. Firms specializing in Health Canada regulations and provincial cannabis laws hold considerable sway.

These specialized service providers are critical for Organigram’s operational continuity. The cost of non-compliance is exceptionally high, ranging from hefty fines to license suspension, which amplifies the leverage of these niche consultants. For example, in 2024, the cannabis industry continued to grapple with evolving provincial distribution models and product testing standards, requiring ongoing expert guidance.

- High Switching Costs: For Organigram, switching regulatory consultants can be time-consuming and may lead to temporary compliance gaps, making it costly to change providers.

- Specialized Expertise: The deep, sector-specific knowledge required for Canadian cannabis regulations is not widely available, concentrating power among a few expert firms.

- Critical Nature of Service: Maintaining compliance is non-negotiable for Organigram's license to operate, making these suppliers indispensable.

- Industry Growth and Complexity: As the Canadian cannabis market matures and regulations become more nuanced, the demand for specialized compliance services is likely to increase, further strengthening supplier power.

Organigram Holdings faces considerable bargaining power from its suppliers, particularly those providing specialized cultivation equipment and proprietary nutrient blends. The limited number of providers for advanced lighting and climate control systems in 2024 allowed these suppliers to dictate terms, impacting Organigram's cost structure. Similarly, the demand for specific, high-quality inputs for premium product lines further concentrated power among a select few nutrient providers.

The cannabis industry's reliance on highly skilled labor, such as master growers and scientists, also grants significant leverage to these professionals and consulting firms. In 2024, increased demand for experienced cultivators led to a reported 15% year-over-year rise in salaries in some regions. This scarcity directly inflates Organigram's operational expenses and highlights the suppliers' power in the talent market.

Furthermore, regulatory compliance consultants wield substantial influence due to the complex and evolving legal landscape in Canada. The high stakes of non-compliance, including severe penalties and license suspension, make Organigram dependent on these niche service providers. The ongoing need for expert guidance on shifting provincial distribution models and product testing standards in 2024 amplified their leverage.

| Supplier Type | Key Dependency for Organigram | Impact of Supplier Power (2024 Trends) | Examples of Leverage |

|---|---|---|---|

| Specialized Cultivation Equipment | Advanced lighting, climate control, automation | Limited suppliers led to premium pricing and less favorable contract terms. | Patented technologies commanding higher costs. |

| Specialized Nutrients & Growing Media | Premium product lines, differentiation | Concentrated power among providers of specific organic or high-quality inputs. | Sustained demand for inputs supporting premium offerings. |

| Skilled Labor (Master Growers, Scientists) | Product quality, innovation, operational expertise | Wage inflation due to scarcity, increasing labor costs. | Reported 15% YoY salary increase for cultivators in key markets. |

| Regulatory Compliance Consultants | Navigating Health Canada and provincial laws | Critical service; high switching costs and specialized knowledge amplify power. | Ongoing need for guidance on evolving distribution and testing standards. |

What is included in the product

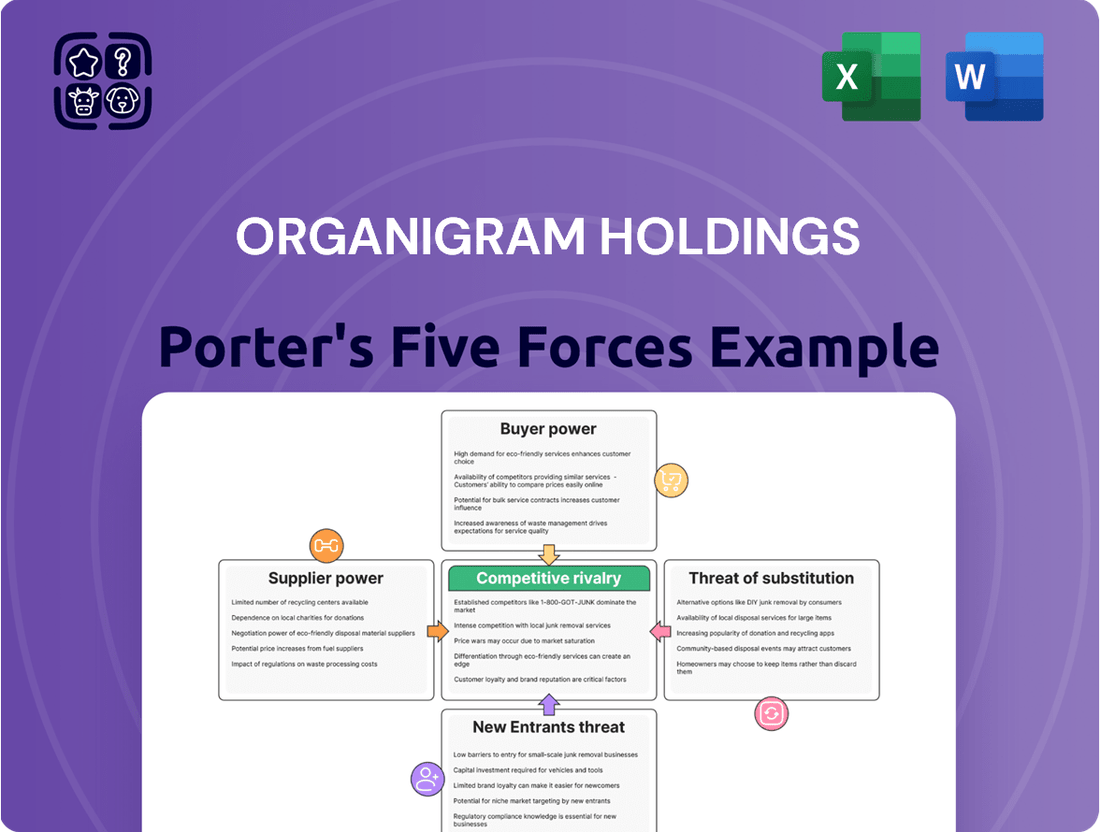

Organigram Holdings' Porter's Five Forces analysis reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the Canadian cannabis market.

Instantly identify Organigram's competitive landscape by visualizing the impact of each of Porter's Five Forces with a concise, actionable summary.

Customers Bargaining Power

Provincial cannabis boards in Canada are Organigram's main wholesale customers for recreational products. These boards are large, consolidated buyers, and their significant purchasing volumes grant them considerable leverage.

Their control over distribution channels means they can heavily influence pricing and product selection, directly impacting Organigram's recreational sales performance. For instance, in fiscal 2023, Organigram reported net revenue of $127.4 million from its Canadian adult-use recreational segment, highlighting the importance of these provincial relationships.

While Organigram Holdings engages with direct-to-consumer (D2C) channels, the individual customer within this segment typically wields minimal bargaining power. Their purchasing decisions, in isolation, have little sway over the company's broad strategies.

However, the collective voice of these consumers carries significant weight. Shifts in aggregate consumer preferences, such as a growing demand for specific product formats like cannabis-infused edibles or vaporizers, can directly influence Organigram's product innovation pipeline and pricing structures. For example, in 2024, the Canadian cannabis market saw continued growth in the edibles and beverages category, a trend Organigram would need to monitor and potentially adapt to.

Retailers, while not directly purchasing from Organigram, hold significant indirect influence. By selecting which licensed producer products to stock from provincial boards, they shape consumer availability and indirectly guide Organigram's product desirability. This means Organigram needs to ensure its offerings are appealing not only to the provincial boards but also to the retail environment where consumers make their final choices.

Brand Loyalty and Product Differentiation

Organigram Holdings actively cultivates brand loyalty through its commitment to product innovation and brand development, exemplified by its popular SHRED brand. This strategic focus aims to resonate with end-consumers by offering unique and desirable cannabis products.

By fostering strong brand recognition and developing differentiated offerings, such as distinctive cannabis strains, edibles, and vapes, Organigram seeks to diminish customer price sensitivity. This differentiation is a key lever in mitigating the bargaining power of customers.

- Brand Loyalty Initiatives: Organigram’s investment in brands like SHRED aims to build a dedicated consumer base.

- Product Differentiation: Unique strains, edibles, and vapes distinguish Organigram's offerings in a competitive market.

- Reduced Price Sensitivity: Strong brands and unique products make consumers less likely to switch based on price alone.

- Mitigating Customer Power: Ultimately, these strategies work to decrease the overall bargaining power of customers.

Price Sensitivity and Market Competition

The Canadian cannabis market is intensely competitive, with numerous licensed producers vying for market share. This saturation naturally leads to heightened price sensitivity among consumers, as they have ample choices for similar products. In 2024, the average price per gram of dried cannabis in Canada has seen fluctuations, influenced by this competitive pressure.

Organigram Holdings faces significant customer bargaining power due to this market dynamic. If Organigram's product offerings aren't perceived as distinct or competitively priced, customers can readily shift their loyalty to competitors. This forces Organigram to carefully manage its pricing strategies to remain attractive to consumers.

- High Number of Competitors: The Canadian cannabis sector features a large number of licensed producers, increasing customer choice and bargaining power.

- Price Sensitivity: Consumers are increasingly comparing prices, making it easier for them to switch brands if Organigram's pricing is not perceived as competitive.

- Differentiation is Key: Organigram's ability to differentiate its products beyond price is crucial in mitigating customer bargaining power.

Organigram's bargaining power with customers is influenced by both wholesale provincial boards and individual consumers. Provincial cannabis boards, as large consolidators, exert significant leverage due to their purchasing volume and control over distribution, directly impacting Organigram's pricing and product selection in the recreational market. For example, Organigram's fiscal 2023 net revenue from the Canadian adult-use recreational segment was $127.4 million, underscoring the importance of these relationships.

While individual direct-to-consumer customers have minimal power, their collective preferences shape market trends, necessitating Organigram's adaptation to evolving demands, such as the growing edibles market in 2024. Retailers also indirectly influence Organigram by deciding which products to stock, making brand appeal crucial for product desirability.

Organigram counters customer power by fostering brand loyalty through initiatives like its SHRED brand and by differentiating its product offerings, including unique strains, edibles, and vapes. This strategy aims to reduce price sensitivity among consumers, making them less likely to switch based solely on price, which is particularly important in the highly competitive Canadian cannabis market of 2024 where price fluctuations are common.

Preview the Actual Deliverable

Organigram Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Organigram Holdings, detailing the competitive landscape within the cannabis industry. You're viewing the exact document you'll receive immediately after purchase, providing actionable insights into buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry. This professionally formatted analysis is ready for your immediate use, offering no placeholders or surprises. Understand the strategic positioning of Organigram Holdings through this complete and ready-to-use file.

Rivalry Among Competitors

The Canadian cannabis sector is crowded, with a large number of licensed producers all vying for consumer attention and market share. This high volume of players intensifies rivalry, pushing companies to innovate and differentiate their offerings. As of the fourth quarter of 2023, Canada boasted 1,280 licensed producers, a number that underscores the fragmentation and fierce competition within the industry.

The Canadian cannabis sector is experiencing significant consolidation. Major players are acquiring smaller operations to expand their reach and operational efficiencies. This trend is reshaping the competitive landscape as companies vie for greater market control.

Organigram Holdings recently solidified its position as Canada's largest cannabis company by market share after acquiring Motif Labs. This strategic move highlights the intense competition and the drive for dominance within the industry, demonstrating a clear shift in market power dynamics.

Competition within the cannabis sector is intensely fueled by a constant stream of product innovation and diversification. Companies are actively developing offerings across a wide spectrum, including dried flower, convenient pre-rolls, various edibles, efficient vapes, and potent concentrates. This dynamic environment compels players like Organigram Holdings to continually introduce novel formats and unique cannabis strains to capture consumer attention and establish distinct market positions in an increasingly mature landscape.

Price Competition and Excise Taxes

The Canadian cannabis market, including players like Organigram Holdings, experiences significant price competition. This intense rivalry among licensed producers often forces companies to lower prices to gain market share, which directly squeezes profitability margins. For instance, in 2023, the average price per gram of dried cannabis in Canada saw a continued decline, putting pressure on producers to optimize costs.

Adding to this competitive pressure are substantial excise taxes levied on cannabis products. These taxes increase the final price for consumers, but a significant portion of that burden falls on the producers who must remit the taxes. Organigram, like its peers, has to navigate this delicate balance: offering competitive pricing to consumers while absorbing or passing on these tax costs, which can exacerbate price wars.

- Price Wars: The combination of oversupply and competitive pressures frequently triggers price wars, impacting revenue and profit for all licensed producers.

- Tax Burden: High excise tax rates, which vary by province and product type, add a significant cost component that producers must manage alongside market pricing strategies.

- Margin Erosion: Constant price competition, coupled with tax obligations, leads to a continuous erosion of profit margins for companies like Organigram if they cannot differentiate through product quality or brand loyalty.

International Expansion as a Competitive Avenue

As the Canadian cannabis market matures, Organigram Holdings, like its domestic peers, is increasingly targeting international expansion for growth. This strategic pivot intensifies competitive rivalry as companies vie for limited opportunities in emerging global markets. The race is on to secure lucrative supply agreements and establish brand presence in regions where cannabis is being legalized for medical or recreational use, such as Germany and Australia.

- Intensified Competition: Canadian Licensed Producers (LPs) are directly competing with established international players and other emerging market entrants for global market share.

- Supply Agreement Scramble: Securing long-term supply contracts with foreign governments or distributors is a key battleground, with successful agreements providing significant revenue streams.

- Regulatory Hurdles: Navigating diverse and often complex international regulations adds another layer of competition, favoring companies with robust compliance and adaptable business models.

- Market Entry Costs: The significant investment required to enter new international markets means that only well-capitalized companies, like Organigram, can realistically pursue this avenue, creating a barrier to entry for smaller players but heightening competition among the larger ones.

The competitive rivalry within the Canadian cannabis sector is exceptionally high due to a large number of licensed producers, with over 1,000 operating as of late 2023. This saturation drives intense price competition and necessitates continuous product innovation, such as new strains and product formats like vapes and edibles. Organigram Holdings' acquisition of Motif Labs in late 2023, making it Canada's largest producer by market share, exemplifies the ongoing consolidation and the aggressive pursuit of market dominance among key players.

| Metric | Organigram Holdings (Q1 FY24) | Canadian Cannabis Market (Approx.) |

|---|---|---|

| Market Share | Largest in Canada (post-Motif acquisition) | Fragmented, ~1,280 LPs |

| Average Price/Gram (Dried Cannabis) | N/A (Company Specific) | Declining trend in 2023 |

| Product Innovation Focus | Flower, Pre-rolls, Vapes, Edibles, Concentrates | Broad spectrum across all categories |

SSubstitutes Threaten

The illicit cannabis market continues to pose a significant threat of substitution for Organigram. Despite increasing legal access, this underground market offers products that are often cheaper due to the absence of taxes and regulatory compliance costs. While this presents a clear pricing advantage, it also means these products lack the safety and quality assurances that legal dispensaries provide, a crucial differentiator for consumers prioritizing health and reliability.

Estimates indicate that the illicit market still commands a substantial portion of Canadian cannabis sales, ranging from 25% to 40% as of recent data. This persistent market share demonstrates the ongoing challenge for legal operators like Organigram to fully capture consumer demand. The accessibility and lower price points of illicit products remain a powerful incentive for a segment of the consumer base, directly impacting the potential market size for regulated entities.

Consumers looking for recreational experiences have numerous alternatives to cannabis, including alcohol and tobacco. These established substances benefit from widespread social acceptance and deeply ingrained cultural norms, presenting a significant challenge to the cannabis industry's market share. For instance, the global alcohol market was valued at approximately $1.6 trillion in 2023, demonstrating its substantial existing consumer base.

For consumers looking for wellness or therapeutic benefits, numerous alternatives exist that can act as substitutes for medical cannabis. These include traditional pharmaceuticals prescribed by doctors, a vast array of natural health products like herbal supplements, and even hemp-derived CBD products which offer similar relaxation or pain-relief properties without the psychoactive effects of THC. Other relaxation methods, such as yoga or meditation, also compete for consumer attention in the wellness space. The global wellness market is substantial, with the U.S. health and wellness market alone valued at over $1.5 trillion in 2023, indicating a significant pool of potential substitute spending.

Emerging Cannabinoids and Delivery Methods

The emergence of novel cannabinoids beyond THC and CBD, such as CBN and CBG, along with advancements in synthetic cannabinoid research, presents a significant threat of substitutes for Organigram. These new compounds, often marketed for specific effects like sleep or anxiety, can attract consumers seeking alternatives to Organigram's core offerings. Similarly, innovative delivery methods like advanced tinctures, topical creams, and cannabis-infused beverages provide consumers with new ways to consume cannabis, potentially diverting market share from traditional flower and pre-rolls. For instance, the Canadian cannabis beverage market saw significant growth in 2023, indicating a clear consumer shift towards these alternative formats.

- Emerging Cannabinoids: Development of minor cannabinoids (CBN, CBG) and synthetic cannabinoids offers consumers new product choices.

- Innovative Delivery Methods: Tinctures, topicals, and beverages provide alternatives to traditional dried flower and vapes.

- Market Diversion: These substitutes can attract consumers looking for specific effects or different consumption experiences.

- R&D Imperative: Organigram must invest in research and development to adapt its product portfolio to these evolving consumer preferences.

Changing Consumer Preferences and Societal Norms

A significant threat to Organigram stems from changing consumer preferences and evolving societal norms. As public perception of cannabis continues to shift, there's a parallel rise in interest for alternative wellness products, including adaptogens, CBD-only options, and other non-cannabis-based relaxation or therapeutic solutions. This diversification of the wellness market means consumers have more choices, potentially diverting demand away from traditional cannabis products.

Organigram must remain agile to adapt to these evolving trends. For instance, the market is seeing a notable increase in demand for products with specific cannabinoid profiles, such as those emphasizing lower THC levels or a balanced THC-CBD ratio. This indicates a consumer base seeking nuanced effects rather than solely high-potency THC experiences. By failing to innovate and cater to these shifting demands, Organigram risks losing market share to competitors who are more attuned to these emerging preferences.

- Shifting Consumer Focus: Growing consumer interest in non-cannabis wellness alternatives like adaptogens and CBD-only products presents a direct substitute threat.

- Product Innovation Demand: Consumers are increasingly seeking low-THC or balanced THC-CBD formulations, signaling a need for Organigram to diversify its product portfolio beyond high-THC offerings.

- Market Diversification: The broader wellness industry offers numerous substitutes, diluting the overall demand for cannabis if Organigram does not meet evolving consumer needs.

- Societal Norms Impact: Changes in societal attitudes could lead consumers to explore a wider array of relaxation and therapeutic options, not exclusively cannabis-based.

The threat of substitutes for Organigram is multifaceted, encompassing both the illicit market and a broader array of consumer goods. The illicit cannabis market, estimated to still hold between 25% and 40% of Canadian sales, offers a significant price advantage due to its avoidance of taxes and regulatory costs. However, this comes at the expense of safety and quality assurances that legal markets provide.

Beyond cannabis itself, established legal markets for alcohol and tobacco represent substantial substitutes, bolstered by widespread social acceptance and deeply ingrained cultural norms. The global alcohol market, valued at approximately $1.6 trillion in 2023, highlights the scale of this competition. Furthermore, the burgeoning wellness industry presents alternatives for consumers seeking therapeutic benefits, including pharmaceuticals, herbal supplements, and even non-cannabis relaxation techniques like yoga and meditation.

The landscape is further complicated by emerging cannabinoids like CBN and CBG, alongside innovative delivery methods such as beverages and topicals, which cater to evolving consumer preferences for specific effects and consumption experiences. Organigram must actively innovate to retain market share against these diverse and evolving substitutes.

| Substitute Category | Key Characteristics | Market Value/Share (Illustrative) | Implication for Organigram |

|---|---|---|---|

| Illicit Cannabis Market | Lower price, no taxes/regulations | 25%-40% of Canadian sales | Direct price competition, consumer risk |

| Alcohol & Tobacco | Established social acceptance, cultural norms | Alcohol market ~$1.6T (2023) | Competition for recreational spending |

| Wellness Products (Non-Cannabis) | Therapeutic/relaxation focus, diverse options | US Health & Wellness market >$1.5T (2023) | Diversion of wellness-focused consumers |

| Novel Cannabinoids & Delivery Methods | Specific effects, new consumption experiences | Growth in cannabis beverages (2023) | Need for product portfolio adaptation |

Entrants Threaten

The Canadian cannabis sector is characterized by substantial regulatory obstacles, primarily stemming from Health Canada's rigorous licensing framework. Acquiring licenses for cultivation, processing, and retail operations is a protracted, intricate, and financially demanding undertaking. This complexity significantly curtails the influx of new players into the market, thereby reinforcing the position of established entities like Organigram.

Establishing compliant indoor cultivation facilities, processing plants, and robust distribution networks demands substantial upfront capital investment. For instance, Organigram Holdings itself invested heavily in its Moncton facility, which required significant financing to bring to operational capacity and meet stringent regulatory standards.

This high cost of entry, often in the tens or even hundreds of millions of dollars, deters many potential new players who lack the necessary financial resources. The cannabis industry has seen considerable consolidation, partly driven by smaller entities being unable to scale or meet ongoing capital expenditure requirements.

New companies entering the Canadian cannabis market, like Organigram, face significant hurdles in building brand awareness. This is largely due to stringent advertising and marketing regulations that limit how products can be promoted. For instance, health claims are heavily scrutinized, and direct consumer advertising is restricted.

Established companies like Organigram have had years to develop their brand identity and customer base, often through strategic partnerships and investments in product development, which are less accessible to newcomers. This makes it tough for new entrants to compete on brand recognition alone.

In 2023, the Canadian cannabis market saw continued consolidation and a focus on brand differentiation. Companies that invested heavily in product innovation and a strong digital presence, despite marketing restrictions, were better positioned. Organigram, for example, has focused on its premium product offerings and a streamlined supply chain to maintain its market position against potential new entrants.

Access to Distribution Channels

Access to distribution channels presents a significant hurdle for new entrants in the cannabis market. Organigram, like other established players, has secured crucial agreements with provincial cannabis boards, which effectively manage the lion's share of recreational cannabis sales across Canada. These existing relationships and entrenched supply chains make it exceptionally difficult for newcomers to gain shelf space and compete effectively.

For instance, in 2023, provincial retailers accounted for the vast majority of Canadian cannabis sales, highlighting the gatekeeping power of these entities. New companies often find themselves on the outside looking in, unable to replicate the established presence and logistical networks that Organigram and its peers have cultivated over time. This creates a substantial barrier, limiting the ability of new entrants to reach a broad consumer base and establish a foothold in the market.

- Provincial Control: Provincial cannabis boards act as primary gatekeepers for recreational market access.

- Established Relationships: Organigram benefits from pre-existing agreements and strong ties with these boards.

- Shelf Space Competition: New entrants face intense competition for limited retail visibility against established brands.

- Supply Chain Advantages: Existing licensed producers possess robust and efficient supply chains that are hard for newcomers to match.

Economies of Scale and Experience Curve of Incumbents

Established players like Organigram leverage significant economies of scale, particularly in cultivation, processing, and distribution. This allows them to spread fixed costs over a larger output, leading to lower per-unit production costs. For instance, in 2024, Organigram reported a substantial increase in production capacity, aiming to further solidify its cost advantages against potential new market entrants.

The experience curve also plays a crucial role. Over time, Organigram has refined its operational processes, improving efficiency and reducing waste. This accumulated knowledge and optimization mean they can produce at a lower cost and potentially higher quality than a newcomer. New entrants will struggle to match these established efficiencies and cost structures without substantial upfront investment and a considerable learning period.

- Economies of Scale: Organigram's larger operational footprint in 2024 allows for bulk purchasing of inputs and more efficient logistics, directly reducing per-unit costs.

- Experience Curve: Years of operational refinement have honed Organigram's production techniques, leading to improved yields and reduced manufacturing overhead.

- Cost Competitiveness: New entrants face a significant hurdle in matching Organigram's established cost efficiencies, making price-based competition challenging.

- Barriers to Entry: The cost and time required to achieve similar economies of scale and experience create a substantial barrier for new companies entering the market.

The threat of new entrants into Organigram Holdings' market is significantly low due to substantial barriers. High capital requirements for licensing, cultivation, and distribution facilities, coupled with stringent regulatory compliance, demand immense financial resources. For instance, establishing a licensed cannabis operation in Canada can easily cost tens of millions of dollars, a sum many potential entrants cannot secure.

Furthermore, established brands like Organigram benefit from years of experience in navigating complex regulations and building consumer trust, which is difficult for newcomers to replicate quickly. The Canadian cannabis market in 2023 and 2024 continued to show a trend of consolidation, indicating that smaller, undercapitalized new entrants struggle to gain traction against well-established players with significant economies of scale.

| Barrier Type | Description | Impact on New Entrants | Example for Organigram |

|---|---|---|---|

| Capital Requirements | High upfront investment for licensing, facilities, and operations. | Deters entrants lacking substantial funding. | Organigram's significant investment in its Moncton facility. |

| Regulatory Hurdles | Complex and time-consuming licensing and compliance processes. | Prolongs time-to-market and increases initial costs. | Health Canada's rigorous framework for cultivation and sales. |

| Brand Loyalty & Marketing Restrictions | Established brand recognition versus limited advertising channels. | Difficulty in competing for consumer attention. | Organigram's focus on premium products and digital presence despite ad limits. |

| Distribution Access | Securing agreements with provincial boards is crucial. | New entrants struggle to get products onto shelves. | Organigram's established relationships with provincial cannabis retailers. |

| Economies of Scale | Lower per-unit costs due to large-scale production. | Price-based competition is challenging for smaller players. | Organigram's increased production capacity in 2024 leading to cost advantages. |

Porter's Five Forces Analysis Data Sources

Our Organigram Holdings Porter's Five Forces analysis is built upon a foundation of comprehensive data, including publicly available financial filings (SEC, SEDAR), investor presentations, and industry-specific market research reports from reputable firms like BDS Analytics and Hifyre.