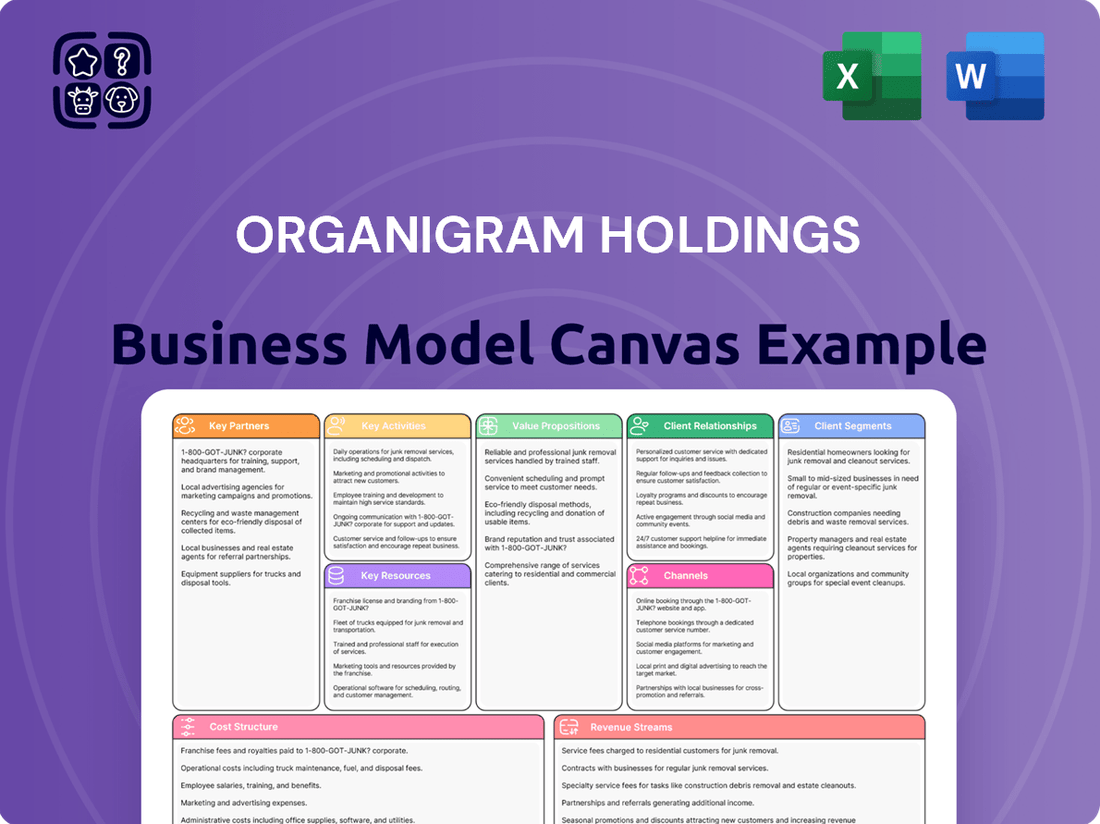

Organigram Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Organigram Holdings Bundle

Unlock the full strategic blueprint behind Organigram Holdings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Organigram Holdings benefits immensely from its key partnership with British American Tobacco (BAT). This collaboration isn't just about investment; it's a deep dive into product innovation, specifically targeting the development of next-generation non-combustible cannabis products. This strategic alliance leverages BAT's global reach and expertise in consumer goods alongside Organigram's cannabis product development capabilities.

A cornerstone of this partnership is BAT's significant equity investment. Notably, BAT made a substantial follow-on investment of $124.6 million during the 2024-2025 period. This influx of capital is crucial for Organigram, fueling its expansion into new markets and supporting its ongoing growth initiatives.

Provincial cannabis boards are essential partners for Organigram, acting as the primary gatekeepers for distributing recreational cannabis products throughout Canada.

Organigram actively collaborates with these governmental bodies to navigate complex regulatory frameworks, ensuring all products meet stringent compliance standards. This close working relationship is vital for Organigram to gain access to the vast Canadian recreational market.

These partnerships represent a crucial distribution channel, allowing Organigram to reach a wide consumer base and ensure broad product availability across the country.

For instance, in 2024, Organigram's significant presence in key provincial markets demonstrates the effectiveness of these relationships. The company continues to leverage these provincial boards to expand its market reach and solidify its position in the Canadian cannabis industry.

Organigram has strategically broadened its reach by forging supply agreements with partners in crucial international markets. These include significant inroads into Germany, the UK, Australia, and Israel, demonstrating a clear commitment to global expansion. These alliances are fundamental to accelerating international sales and solidifying Organigram’s position as a prominent player in the worldwide cannabis industry.

The company's proactive approach involves continuously assessing new global partnership prospects. This ongoing evaluation is key to furthering its international growth trajectory and capitalizing on emerging market opportunities. For instance, in fiscal year 2023, Organigram reported a substantial increase in its international revenue, largely attributed to these strategic supply agreements.

Sanity Group (Germany)

Organigram Holdings' strategic partnership with Sanity Group, a prominent German cannabis cultivator and distributor, is pivotal for accessing the burgeoning European medical cannabis market. Organigram's $21 million investment in Sanity Group in early 2024 solidified this relationship, aiming to capitalize on Germany's expanding medical cannabis program.

This collaboration is built upon an existing supply agreement, with Organigram anticipating a substantial increase in its cannabis exports to Germany. The German market represents a significant growth opportunity, and Sanity Group’s established infrastructure and market knowledge are invaluable assets.

Further enhancing this partnership is Organigram's ongoing efforts to achieve EU Good Manufacturing Practice (EU-GMP) certification. This certification is crucial for enabling direct, compliant exports of cannabis products into Germany and other European Union member states, streamlining market entry and ensuring product quality standards are met.

- Sanity Group Partnership: Strategic investment of $21 million by Organigram Holdings to secure a foothold in the German medical cannabis market.

- Market Expansion: Leverages Sanity Group's position to increase Organigram's cannabis export volumes to Germany.

- Regulatory Compliance: Organigram's pursuit of EU-GMP certification facilitates direct exports, adhering to stringent European quality standards.

- European Focus: The partnership underscores Organigram's commitment to expanding its presence across the European continent.

Motif Labs

Organigram Holdings' acquisition of Motif Labs in December 2024 was a pivotal partnership, significantly enhancing its processing capacity and expanding its offerings, especially in the burgeoning cannabis 2.0 product sector. This strategic move propelled Organigram to become Canada's largest cannabis company based on market share. The integration of Motif Labs is anticipated to foster margin expansion through achieving economies of scale and better absorption of fixed costs, while also generating considerable cost synergies.

The key benefits derived from this partnership include:

- Enhanced Processing Capabilities: Motif Labs brought advanced extraction and product formulation expertise, boosting Organigram's ability to create a wider range of high-quality cannabis products.

- Market Leadership: The acquisition solidified Organigram's position as the leading cannabis company in Canada by market share, providing a significant competitive advantage.

- Synergistic Cost Savings: Organigram projected substantial cost synergies from the integration, aiming for improved operational efficiency and profitability.

- Product Portfolio Diversification: The partnership expanded Organigram's product line, particularly in the high-growth category of cannabis 2.0 products, catering to evolving consumer preferences.

Organigram's key partnerships are fundamental to its operational success and market expansion. The collaboration with British American Tobacco (BAT) provides not only significant financial backing, with a $124.6 million follow-on investment in 2024-2025, but also access to global expertise. Provincial cannabis boards are essential distribution channels, ensuring Organigram's products reach consumers across Canada, a relationship vital for market penetration, as evidenced by Organigram's strong 2024 presence in these markets.

The company's strategic alliances extend internationally, with supply agreements in Germany, the UK, Australia, and Israel contributing to a notable increase in international revenue in fiscal year 2023. A key example is the $21 million investment in Germany's Sanity Group in early 2024, aimed at tapping into the European medical cannabis market, with Organigram pursuing EU-GMP certification to facilitate direct exports.

Furthermore, the December 2024 acquisition of Motif Labs significantly bolstered Organigram's processing capabilities and market share, positioning it as Canada's largest cannabis company. This integration is expected to drive margin expansion and cost synergies, particularly in the high-growth cannabis 2.0 product sector.

| Partnership Type | Key Partner | Strategic Importance | Financial Impact / Investment | Market Reach |

| Equity Investment & Product Development | British American Tobacco (BAT) | Global expertise, next-gen product innovation | $124.6 million follow-on investment (2024-2025) | Global |

| Distribution | Provincial Cannabis Boards | Access to Canadian recreational market | N/A (regulatory access) | Canada |

| Supply Agreements | Germany, UK, Australia, Israel | International sales acceleration | N/A (revenue generation) | International |

| Strategic Acquisition | Motif Labs | Processing capacity, market share, cannabis 2.0 | Acquisition in December 2024 | Canada (largest by market share) |

| Market Entry & Supply | Sanity Group (Germany) | European medical cannabis market | $21 million investment (early 2024) | Germany / Europe |

What is included in the product

Organigram Holdings' Business Model Canvas is a detailed blueprint for their strategy in the Canadian cannabis market, focusing on their cultivation, processing, and distribution of high-quality cannabis products.

It comprehensively outlines their target customer segments, diverse distribution channels, and unique value propositions, reflecting their operational approach and market positioning.

Organigram Holdings' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their operations, simplifying complex strategies for stakeholders and facilitating targeted problem-solving within the cannabis industry.

Activities

Organigram's primary activities center on the meticulous indoor cultivation of premium cannabis. This involves the precise management of sophisticated grow room environments to maximize yield per plant and consistently produce flower with elevated THC concentrations.

The company is strategically adopting seed-based cultivation methods to enhance operational efficiency and drive down production costs. Organigram aims for approximately 20% of its total harvests to originate from seed-based operations by fiscal year 2025, a move designed to streamline the growing process and improve cost-effectiveness.

Organigram Holdings actively pursues product development and innovation, expanding its diverse portfolio to include dried flower, pre-rolls, edibles, vapes, and concentrates. This commitment is fueled by consumer insight-driven research and development.

A prime example of this innovation is the introduction of the Edison Sonics line, featuring proprietary FAST nanoemulsion technology designed for quicker onset. This focus on advanced delivery systems directly addresses evolving consumer demand for faster-acting products.

In its fiscal year 2024, Organigram reported a significant increase in its cannabis 2.0 product revenue, driven by strong performance in its edibles and vapes segments. This growth underscores the success of their innovative product development strategies in capturing market share.

The company continuously aims to meet changing consumer preferences and maintain a competitive edge by introducing novel product offerings and enhancing existing categories, ensuring relevance in the dynamic cannabis market.

Organigram Holdings is deeply invested in brand development, cultivating a diverse portfolio of adult-use recreational cannabis brands. Key players in their stable include Edison, Holy Mountain, Big Bag O' Buds, SHRED, SHRED'ems, and Monjour. This multi-brand strategy allows Organigram to target specific consumer segments with tailored product offerings and distinct marketing campaigns, aiming to capture broader market share and foster brand loyalty.

The company's marketing efforts are designed to resonate with these segmented audiences, creating unique brand identities that stand out in a competitive landscape. For instance, SHRED is known for its focus on value and innovation in the dried flower category, while Edison appeals to a more discerning consumer seeking premium quality. This approach is essential for building brand recognition and driving sales growth.

In 2024, Organigram continued to refine its brand positioning. The company reported that its SHRED brand, in particular, has seen significant success, contributing substantially to its revenue streams. This highlights the effectiveness of their strategy in creating brands that not only appeal to consumers but also translate into strong financial performance.

Distribution and Sales

Organigram's distribution strategy focuses on leveraging provincial cannabis boards for the Canadian recreational market. This approach ensures wide product availability across regulated retail channels. For medical cannabis, Organigram engages in direct-to-consumer sales, providing a more personalized experience.

The company also actively participates in wholesale activities, supplying a diverse range of cannabis products to other retailers and wholesalers. This expands their reach beyond direct provincial contracts. In the fiscal year 2024, Organigram reported net revenue of $141.6 million, reflecting the strength of these distribution channels.

- Provincial Distribution: Primary channel for Canadian recreational market.

- Direct-to-Consumer: Focus for the Canadian medical cannabis market.

- Wholesale: Supplying products to other retailers and wholesalers.

- International Expansion: Growing through supply agreements and strategic foreign investments.

International sales represent a significant growth avenue for Organigram. The company is actively pursuing this by establishing supply agreements and making strategic investments in key foreign markets. This global push aims to diversify revenue streams and capitalize on evolving international cannabis regulations.

Strategic Acquisitions and International Expansion

Organigram Holdings strategically targets acquisitions to broaden its product offerings and operational scale. A prime example is its acquisition of The Edibles & Infusions Company (EIC), which bolstered its edibles portfolio. Furthermore, its acquisition of Trai, a leading Canadian producer of infused beverages, significantly enhanced its beverage capabilities.

The company is actively pursuing international growth, with a keen focus on Germany and the United States. Organigram has established a joint venture with Windsor, Germany-based Psyre, to manufacture and distribute its cannabis products in the German medical market. This strategic move aims to tap into the burgeoning European cannabis market.

Organigram's expansion strategy includes building a robust international presence through key investments and partnerships. The company's focus on markets like Germany, which has shown significant growth in medical cannabis, underscores its commitment to global reach. For instance, by the end of fiscal 2023, Organigram had made significant progress in its international strategy, with a particular emphasis on establishing a foothold in key European markets.

- Acquisition of EIC: Strengthened edibles product line.

- Acquisition of Trai: Enhanced cannabis beverage capabilities.

- Psyre Joint Venture: Entry into the German medical cannabis market.

- Focus on Germany and U.S.: Key targets for international expansion.

Organigram's key activities encompass the cultivation of cannabis, product development across various formats like edibles and vapes, and robust brand building for recreational markets. The company also focuses on distribution through provincial channels and direct-to-consumer sales for medical cannabis, alongside wholesale operations. Strategic international expansion and targeted acquisitions further define its operational scope.

In fiscal year 2024, Organigram reported net revenue of $141.6 million, underscoring the effectiveness of its diverse business activities and distribution networks in a competitive market.

| Key Activity | Description | Fiscal Year 2024 Data/Impact |

|---|---|---|

| Cultivation | Indoor cultivation of premium cannabis, focusing on yield and THC concentration. | Strategic adoption of seed-based cultivation targeting 20% of harvests by FY2025 for efficiency. |

| Product Development | Innovation in dried flower, pre-rolls, edibles, vapes, and concentrates. | Strong growth in Cannabis 2.0 revenue, particularly from edibles and vapes. Introduction of Edison Sonics with FAST nanoemulsion technology. |

| Brand Development | Cultivating diverse adult-use recreational cannabis brands. | Success of brands like SHRED contributing substantially to revenue. Portfolio includes Edison, Holy Mountain, Big Bag O' Buds, etc. |

| Distribution | Leveraging provincial boards for recreational, direct-to-consumer for medical, and wholesale. | Net revenue of $141.6 million in FY2024 reflects strong channel performance. |

| International Expansion & Acquisitions | Pursuing global growth through supply agreements, investments, and acquisitions. | Joint venture with Psyre for German market entry. Acquisitions of EIC and Trai bolstered edibles and beverage capabilities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Organigram Holdings Business Model Canvas preview you see is the actual, unedited document you will receive upon purchase. This means all sections, including key partners, value propositions, customer relationships, revenue streams, key resources, activities, channels, cost structure, and customer segments, are presented exactly as they will be delivered. You are viewing a direct snapshot of the complete file, ensuring no discrepancies between the preview and your purchased product, ready for immediate use and analysis.

Resources

Organigram Holdings operates sophisticated indoor cannabis cultivation facilities, notably in Moncton, New Brunswick, and Lac-Supérieur, Quebec. These sites are crucial for their ability to consistently produce premium cannabis products.

The infrastructure within these facilities is designed for specialized cultivation, featuring dedicated grow rooms and advanced processing areas. This setup allows for meticulous control over the growing environment, ensuring optimal plant health and cannabinoid development.

A key strategic focus for Organigram has been significant investment in expanding its cultivation capacity. This expansion is directly linked to meeting growing market demand and increasing their overall output volume.

Furthermore, the company is actively accelerating automation across its operations. This drive towards automation aims to significantly boost efficiency, reduce operational costs, and ultimately enhance the consistency and volume of their product.

Organigram’s processing and manufacturing footprint expanded significantly with the acquisition of the Motif Labs facilities in Aylmer and London, Ontario. These additions bolster its capabilities alongside the existing edibles manufacturing site in Winnipeg, Manitoba.

These strategically located facilities are equipped with advanced CO2 and hydrocarbon extraction technologies. They are specifically optimized for refining formulations, processing minor cannabinoids, and handling pre-roll production.

The integrated nature of these sites allows for streamlined labeling, packaging, and national distribution. This operational efficiency is crucial for Organigram’s market reach and ability to meet diverse consumer demands across Canada.

Organigram Holdings boasts a wide array of cannabis products, encompassing dried flower, pre-rolls, edibles, vapes, and concentrates. This extensive selection is offered across well-recognized brands such as SHRED, Edison, Holy Mountain, and Monjour, ensuring broad market appeal.

This diversified product and brand strategy is a cornerstone of Organigram's business model, enabling them to effectively target different consumer demographics and market niches. For instance, SHRED is known for its value-driven milled flower, while Edison focuses on premium offerings.

The company's commitment to ongoing product development and portfolio expansion is crucial for maintaining its competitive edge and leadership position in the dynamic Canadian cannabis market. This continuous innovation ensures they can adapt to evolving consumer tastes and regulatory landscapes.

Intellectual Property and R&D Capabilities

Organigram Holdings' commitment to research and development fuels its competitive edge, exemplified by its proprietary FAST nanoemulsion technology. This innovation is designed to accelerate the onset of effects in cannabis products, a significant differentiator in the market. In 2024, continued investment in R&D supports Organigram's pipeline of novel product formats.

Further bolstering its capabilities, Organigram secures crucial genetics licenses. This includes access to advanced seed-based cultivars from partners like Phylos Bioscience Inc., providing access to high potency THC, CBG, CBC, and CBDV. These genetic resources are fundamental to developing differentiated and high-performing cannabis products.

- Proprietary Technologies: Development and application of innovations such as the FAST nanoemulsion technology.

- Genetics Access: Licensing agreements for high-potency and rare cannabinoid cultivars.

- Competitive Advantage: Intellectual property and unique genetic profiles create market differentiation.

Strategic Capital and Financial Strength

Organigram Holdings boasts a robust financial foundation, characterized by a substantial cash reserve and minimal debt. This strong balance sheet is significantly reinforced by strategic investments, notably from British American Tobacco (BAT), which injected C$126 million into the company in 2023.

This financial resilience provides Organigram with ample liquidity to pursue its strategic goals. These objectives include potential acquisitions to expand its market presence and funding for international growth initiatives, allowing for agile responses to market opportunities.

The company has specifically earmarked funds, known as the 'Jupiter Pool,' dedicated to exploring and capitalizing on emerging opportunities within the cannabis sector. This forward-thinking allocation ensures resources are available for innovative ventures and early-stage investments.

- Strong Balance Sheet: Organigram maintains a healthy financial position with significant cash and low debt.

- BAT Investment: A substantial C$126 million investment from British American Tobacco (BAT) in 2023 bolstered financial strength.

- Liquidity for Growth: Financial reserves support strategic objectives like acquisitions and international expansion.

- 'Jupiter Pool': Dedicated funds are allocated for exploring and investing in emerging cannabis opportunities.

Organigram Holdings' key resources include its advanced cultivation facilities in New Brunswick and Quebec, processing and manufacturing sites in Ontario and Manitoba, and proprietary technologies like FAST nanoemulsion. Access to crucial genetics licenses further enhances its product development capabilities. These assets, supported by a strong financial position including a C$126 million investment from BAT in 2023, are vital for its market strategy and growth initiatives.

Value Propositions

Organigram Holdings places a strong emphasis on high-quality, indoor-grown cannabis. This approach ensures a meticulously controlled environment, allowing for precise management of light, temperature, humidity, and nutrients. This level of oversight is critical for cultivating cannabis with consistent potency and desirable terpene profiles, leading to a superior product for consumers. In 2024, Organigram continued to refine its indoor cultivation techniques across its facilities, including its Moncton campus, to maintain its reputation for premium flower.

Organigram Holdings boasts a diverse and innovative product portfolio designed to meet a wide range of consumer preferences in the cannabis market. Their offerings span dried flower, pre-rolls, edibles, vapes, and concentrates, ensuring broad market appeal. This variety allows Organigram to tap into different segments of the cannabis consumer base.

Innovation is a cornerstone of Organigram's strategy, exemplified by products like Edison Sonics. These products feature advanced FAST nanoemulsion technology, which provides consumers with faster onset times, a distinct competitive advantage. Such technological advancements highlight Organigram's commitment to evolving product development.

This comprehensive and forward-thinking approach to product development directly contributes to Organigram's ability to capture diverse market segments. By consistently introducing innovative products that address evolving consumer demands, Organigram strengthens its market position and revenue potential. For instance, in fiscal 2023, Organigram reported net revenue of $130.4 million, reflecting the market's positive reception to their product strategy.

Organigram Holdings boasts strong brand recognition and market leadership within the Canadian cannabis sector. Their portfolio includes popular adult-use recreational brands like SHRED, Holy Mountain, and Edison, which have successfully captured consumer interest. This brand strength is further amplified by strategic moves, such as the acquisition of Motif Labs, positioning Organigram as Canada's largest cannabis company based on market share.

Reliable Supply and Distribution

Organigram Holdings, as a licensed cannabis producer, prioritizes a consistent and dependable supply chain. Their advanced cultivation and processing infrastructure are designed to meet the demands of both the Canadian and expanding global markets. This operational strength underpins their ability to deliver products reliably.

Their established distribution network is a key asset. By leveraging relationships with provincial cannabis boards in Canada and forging partnerships in international territories, Organigram ensures its products reach consumers efficiently. This broad market access is vital for sustained growth and brand presence.

The reliability of supply and distribution directly impacts customer loyalty and market share. For instance, in the Canadian market, consistent product availability is crucial for maintaining strong relationships with provincial retailers, who rely on timely deliveries to meet consumer demand. This predictability builds trust and encourages repeat business.

- Cultivation & Processing Capacity: Organigram operates state-of-the-art facilities, contributing to a stable output of diverse cannabis products.

- Distribution Network: Access to all Canadian provincial distribution boards and growing international export agreements ensure broad market reach.

- Market Impact: Reliable supply chain management in 2024 helps Organigram capture market share by ensuring product availability against competitors.

Commitment to Research and Development

Organigram Holdings places a strong emphasis on science-backed innovation and robust research and development (R&D) to create sophisticated cannabis products and enhance cultivation efficiencies. This dedication is clearly demonstrated through their strategic Product Development Collaboration with British American Tobacco (BAT) and significant investments in cutting-edge genetic technologies.

This commitment to scientific advancement is designed to provide consumers with superior product experiences while simultaneously optimizing production costs. For instance, Organigram's investment in advanced cultivation techniques aims to improve yields and reduce resource consumption, a key factor in maintaining a competitive edge in the evolving cannabis market.

- Science-Backed Innovation: Organigram prioritizes R&D for advanced cannabis product development and cultivation improvements.

- Strategic Collaborations: The Product Development Collaboration with BAT highlights their commitment to leveraging external expertise and resources.

- Genetic Technology Investment: Investments in genetic technologies underscore their focus on improving plant quality and cultivation efficiency.

- Value Creation: This scientific focus aims to deliver enhanced consumer experiences and optimize production costs for long-term value.

Organigram Holdings cultivates premium, indoor-grown cannabis, meticulously controlling environmental factors for consistent potency and terpene profiles. This dedication to quality, evident in their 2024 operations, ensures a superior product for consumers seeking premium flower.

Their diverse product portfolio caters to a wide array of consumer preferences, spanning dried flower, pre-rolls, edibles, vapes, and concentrates. This breadth allows Organigram to effectively tap into various market segments, enhancing their appeal.

Organigram's commitment to innovation is showcased through advanced product technologies like Edison Sonics' FAST nanoemulsion, offering consumers faster onset times. This technological edge is a key differentiator in the competitive cannabis landscape.

Strong brand recognition, with popular brands like SHRED and Edison, underpins Organigram's market leadership. Strategic acquisitions, such as Motif Labs, have further solidified their position as a major player in the Canadian cannabis sector.

Customer Relationships

Organigram Holdings cultivates robust relationships with provincial cannabis boards, essential gatekeepers for the recreational market in Canada. These partnerships are built on consistent communication, strict adherence to provincial regulations, and reliable order fulfillment, ensuring Organigram's products reach consumers effectively.

In 2024, Organigram's commitment to these provincial boards translated into widespread product availability. For instance, they successfully navigated complex provincial distribution networks, maintaining a presence in key markets that drive significant revenue. This strategic engagement is crucial for Organigram's market access and consistent sales performance.

Organigram Holdings directly engages with patients for its medical cannabis offerings, acting as a key customer relationship strategy. This direct-to-patient model prioritizes personalized support, ensuring individuals receive detailed product information and appropriate care guidance.

Utilizing online platforms and dedicated customer service teams, Organigram facilitates this direct interaction. This approach allows for a more tailored experience, fostering trust and loyalty among the medical cannabis patient community.

In fiscal year 2023, Organigram reported net revenue of $130.4 million, with its medical cannabis segment contributing significantly to this growth. The company’s focus on direct patient relationships is instrumental in driving repeat business and expanding its market share in this specialized sector.

Organigram Holdings cultivates relationships with a diverse wholesale network, encompassing retailers and fellow licensed producers across Canada and global markets. This strategic approach is vital for their business-to-business sales strategy and market penetration.

The company actively manages these partnerships through detailed supply agreements, ensuring consistent and punctual product delivery. This operational efficiency is key to maintaining client satisfaction and fostering long-term wholesale engagement.

Furthermore, Organigram provides crucial product education and dedicated marketing support to its wholesale partners. This empowers them to effectively promote and sell Organigram's product portfolio, thereby amplifying brand presence and driving sales volume.

In fiscal year 2024, Organigram reported a significant increase in its wholesale revenue, driven by strategic partnerships and expanded distribution channels. This growth underscores the effectiveness of their wholesale partner management strategy in capturing a larger share of the market.

Brand Community Building

Organigram Holdings fosters brand community by engaging consumers across its diverse portfolio, aiming for deep loyalty. Initiatives include targeted marketing and active social media engagement, as seen in their efforts to connect with cannabis consumers beyond simple transactions.

The company prioritizes consumer feedback, using it to refine offerings and strengthen relationships. This approach helps build a sense of belonging among users, encouraging repeat business and advocacy.

- Brand Community: Organigram builds communities through its various brands, fostering loyalty beyond initial purchases.

- Engagement Channels: Targeted marketing, social media presence, and consumer feedback mechanisms are key to this engagement.

- Loyalty Focus: The core aim is to create lasting connections with consumers, ensuring sustained brand affinity.

- Consumer Feedback: Actively incorporating consumer input strengthens relationships and refines product development.

Investor Relations and Transparency

Organigram Holdings prioritizes robust investor relations and transparency. The company engages with its financial stakeholders through quarterly earnings calls, detailed financial reports, and investor presentations, ensuring a clear flow of information. This dedication to open communication is fundamental to cultivating investor trust and securing support for its ongoing strategic initiatives.

For the fiscal year ended September 30, 2023, Organigram reported net revenue of $122.7 million, a notable increase from the previous year. This financial performance underscores the company's commitment to growth and operational efficiency. By consistently providing comprehensive financial data, Organigram aims to foster long-term financial backing and promote market stability.

- Regular Communication: Organigram conducts quarterly earnings calls and provides detailed financial reports.

- Investor Presentations: The company utilizes investor presentations to convey its strategic direction and financial health.

- Building Confidence: Transparency in financial reporting helps build and maintain investor confidence.

- Long-Term Support: A commitment to clear communication fosters enduring financial backing and market stability.

Organigram Holdings nurtures relationships with provincial cannabis boards, crucial for accessing the recreational market. Their engagement involves consistent communication, regulatory adherence, and reliable fulfillment, ensuring product availability. In 2024, this strategic approach secured Organigram's presence in key revenue-driving provincial markets.

Channels

Provincial cannabis boards are Organigram's primary gateway to the Canadian recreational market. These government-run entities act as wholesale distributors, purchasing products from licensed producers like Organigram and then allocating them to licensed retailers within their provinces.

Organigram's ability to consistently supply these provincial boards is crucial for its market penetration and sales volume. In 2023, Organigram reported net revenue of $119.4 million, underscoring the importance of these distribution channels for generating revenue.

The success of Organigram’s recreational segment is directly tied to its relationships and performance with these provincial boards. Effective inventory management and product placement with these entities are key to maximizing sales across Canada.

Organigram's diverse product portfolio, including dried flower, pre-rolls, and vapes, reaches consumers through a network of licensed cannabis retailers overseen by provincial boards. This distribution model is fundamental to the company's market penetration strategy in the adult-use cannabis sector.

The company actively works to secure shelf space and visibility within these critical retail touchpoints across Canada. By partnering with provincial boards, Organigram ensures its offerings are accessible to a broad consumer base, driving sales and brand recognition.

In 2024, the Canadian cannabis retail landscape continued to mature, with increasing store counts and evolving consumer preferences. Organigram's success hinges on its ability to consistently supply these channels with high-quality, in-demand products, thereby solidifying its position in a competitive market.

Organigram Holdings leverages its direct-to-consumer (DTC) channel to serve registered medical cannabis patients across Canada. This approach bypasses traditional retail and focuses on a digital-first engagement, primarily through its online platform. This allows for a more personal connection with patients, offering tailored support and discreet delivery of their prescribed medical cannabis.

The DTC channel is crucial for Organigram to meet the specific needs of patients who require particular formulations for their medical conditions. By controlling the sales process, the company ensures product integrity and accessibility, especially for individuals with mobility issues or those who prefer the convenience of home delivery. In 2024, Organigram continued to see growth in its medical cannabis segment, with DTC sales forming a significant portion of its revenue as patient adoption of online purchasing solidified.

International Wholesale Partners

Organigram Holdings leverages international wholesale partners to effectively distribute its medical cannabis and cannabis-derived products into key foreign markets. These strategic alliances are vital for entering and expanding presence within highly regulated international cannabis sectors.

These partnerships are particularly instrumental in markets such as Germany, the United Kingdom, Australia, and Israel. By working with established wholesale entities, Organigram streamlines its market entry and navigates the complex regulatory landscapes of these countries.

The company's global leadership aspirations are significantly supported by this channel. For instance, in 2024, Organigram continued to focus on expanding its international footprint, with Germany representing a primary target market for medical cannabis exports.

The success of these wholesale relationships directly impacts Organigram's revenue streams from international sales. These partnerships are critical for achieving economies of scale and building brand recognition in diverse global markets.

- Germany: A key market for Organigram's medical cannabis, facilitated through wholesale partners.

- United Kingdom, Australia, Israel: Other significant markets where wholesale distribution is employed.

- Market Entry & Expansion: These partnerships are crucial for overcoming regulatory hurdles and establishing a presence.

- Global Leadership: The international wholesale channel underpins Organigram's strategy for global market leadership in the cannabis industry.

E-commerce Platform (Collective Project - US)

Organigram Holdings' acquisition of Collective Project has paved the way for a direct-to-consumer e-commerce platform in the United States, specifically for hemp-derived THC beverages. This strategic move allows Organigram to tap into the burgeoning U.S. cannabis market, offering a new and significant revenue stream by enabling direct sales to consumers across multiple states. The platform leverages Collective Project's existing brand recognition and established distribution networks to facilitate these sales.

This channel is crucial for Organigram's U.S. market entry strategy, bypassing traditional wholesale models to capture higher margins and build direct customer relationships. By utilizing e-commerce, Organigram can efficiently reach a wider consumer base, test market demand, and gather valuable consumer data. The company is well-positioned to capitalize on the growing consumer interest in cannabis-infused beverages, a segment projected to see substantial growth in the coming years.

- U.S. E-commerce Expansion: Organigram’s U.S. e-commerce platform, powered by Collective Project, facilitates direct-to-consumer sales of hemp-derived THC beverages.

- New Revenue Stream: This channel represents a significant new revenue opportunity, expanding Organigram's market reach beyond Canada.

- Strategic Market Entry: The platform serves as a key entry point into the U.S. market, leveraging an established brand and direct shipping capabilities.

- Market Growth Potential: The U.S. market for cannabis beverages is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond.

Organigram's primary distribution channels are provincial cannabis boards in Canada, its direct-to-consumer (DTC) platform for medical patients, and international wholesale partners. The company also utilizes a U.S. e-commerce platform for hemp-derived THC beverages, acquired through Collective Project.

These channels are critical for Organigram's revenue generation and market penetration. In fiscal 2023, Organigram's net revenue reached $119.4 million, with the recreational segment heavily reliant on provincial board relationships. The DTC medical channel saw continued patient adoption in 2024, contributing significantly to revenue. International wholesale efforts, particularly in Germany, are key to global expansion.

| Channel | Primary Focus | Key Markets/Activities | 2023 Net Revenue Contribution (Illustrative) |

|---|---|---|---|

| Provincial Boards | Canadian Recreational Market | Wholesale distribution to licensed retailers across Canadian provinces. | Significant portion of recreational segment revenue. |

| Direct-to-Consumer (DTC) | Canadian Medical Market | Online platform for registered medical cannabis patients, offering discreet delivery. | Growing segment, important for patient access and tailored support. |

| International Wholesale | Global Medical Market Expansion | Partnerships in key markets like Germany, UK, Australia, Israel for medical cannabis distribution. | Supports global leadership aspirations and diversified revenue. |

| U.S. E-commerce (Collective Project) | U.S. Hemp-Derived THC Beverages | Direct-to-consumer sales platform for hemp-derived THC beverages across multiple U.S. states. | New, significant revenue stream targeting U.S. market growth. |

Customer Segments

Canadian adult-use recreational consumers represent Organigram’s most significant customer base. This broad segment includes adults across Canada who legally purchase cannabis for personal enjoyment, seeking diverse product experiences.

Organigram caters to this varied market through a robust multi-brand approach. They offer a spectrum of products, from classic dried flower and convenient pre-rolls to modern vapes, edibles, and potent concentrates, ensuring options for different tastes and consumption preferences.

The company strategically positions its brands to appeal to a wide range of consumers, from budget-conscious individuals to those seeking premium or high-potency selections. This segmentation allows Organigram to capture a larger share of the recreational market by meeting specific consumer needs and price sensitivities.

In 2024, the Canadian cannabis market continued to mature, with recreational sales forming the bulk of the industry's revenue. Organigram, as a key player, leverages its understanding of these consumer preferences to drive sales and brand loyalty within this vital segment.

Canadian Medical Cannabis Patients are individuals who have received prescriptions to use cannabis for therapeutic purposes. They are looking for products that offer precise cannabinoid levels and reliable quality to manage their health conditions.

Organigram Holdings caters to this segment by offering a variety of medical cannabis products. These often feature enhanced cannabinoid consistency and come in specific forms designed to meet the needs of medical users. For instance, Organigram has focused on developing standardized formulations to ensure predictable effects for patients.

The company distributes its medical products through direct sales channels, allowing patients to access them easily. Additionally, Organigram utilizes medical wholesale partnerships, extending its reach to a broader patient population across Canada.

In 2024, the medical cannabis market in Canada continued to evolve, with patient numbers showing steady growth. Organigram's commitment to product quality and patient-focused offerings positions it to serve this important customer base effectively. While specific patient numbers for Organigram are proprietary, the overall Canadian medical cannabis market saw a significant increase in registered patients over the past few years.

Organigram targets medical cannabis patients and distributors in regulated international markets like Germany, the UK, Australia, and Israel. These markets have strict quality and regulatory demands, requiring EU-GMP certified products. This segment offers substantial growth for Organigram's premium, indoor-grown medical cannabis.

In 2024, Germany's medical cannabis market was projected to reach approximately €2.4 billion, with continued expansion anticipated. Organigram's commitment to EU-GMP certification positions it well to capture a share of this growing European demand, especially as the market matures beyond initial supply constraints.

The UK market for medical cannabis, while still developing, showed strong potential in 2024, with an increasing number of prescriptions being issued. Australia and Israel, with their established medical cannabis programs, also represent key strategic targets for Organigram, allowing for diversification and access to new patient bases seeking high-quality, regulated products.

U.S. Hemp-Derived THC Beverage Consumers

Organigram Holdings, following its acquisition of Collective Project, is now actively pursuing U.S. consumers interested in hemp-derived THC-infused beverages. This strategic move taps into a rapidly growing market segment. The company plans to reach these consumers primarily through e-commerce channels and a curated selection of retail partners across various states where such products are legally permitted. This approach leverages the evolving legal framework and increasing consumer appetite for novel cannabis-derived alternatives.

This customer segment is characterized by a desire for discreet and convenient consumption methods, with a growing preference for beverages over traditional smoking methods. Market data from 2024 indicates a significant uptick in consumer interest in low-dose, precisely formulated THC beverages, with projections suggesting continued robust growth. For example, the U.S. cannabis beverage market was valued in the hundreds of millions of dollars in 2023 and is expected to see double-digit annual growth rates through 2028. Organigram's strategy is to meet this demand by offering a diverse portfolio of high-quality, innovative hemp-derived THC beverages.

- Target Demographic: U.S. adults interested in novel cannabis experiences, particularly those seeking alternatives to traditional cannabis products.

- Distribution Channels: E-commerce platforms and select brick-and-mortar retail locations in states with favorable regulations for hemp-derived THC products.

- Market Opportunity: Capitalizing on the expanding U.S. market for hemp-derived THC products, driven by evolving state laws and consumer preferences.

- Product Focus: Infused beverages offering controlled dosing and appealing flavor profiles, differentiating from existing market offerings.

B2B Wholesale Customers (Canadian & International)

Organigram Holdings serves a critical B2B wholesale customer base, encompassing other licensed cannabis producers, processors, and bulk purchasers. These entities rely on Organigram for high-quality cannabis biomass, extracts, and other derivative products to integrate into their own manufacturing and product development pipelines. This segment is driven by the need for secure and consistent supply chains. In 2024, Organigram continued to leverage its production capabilities to meet these wholesale demands, contributing significantly to its revenue streams.

Key B2B wholesale customer types include:

- Other Licensed Producers: Seeking raw materials or semi-finished goods to expand their product offerings.

- Processors and Extractors: Requiring bulk cannabis inputs for distillation and refinement into various product formats.

- Provincial Boards and Distributors: Acting as intermediaries for retail distribution within Canadian provinces.

- International Distributors: Facilitating market access for Organigram's products in global markets where regulations permit.

Organigram Holdings' customer segments are diverse, ranging from Canadian adult-use recreational consumers seeking varied experiences to medical cannabis patients requiring reliable, therapeutic products. The company also targets regulated international markets like Germany, the UK, Australia, and Israel for its premium medical cannabis, recognizing the significant growth potential in these regions, particularly Germany's projected €2.4 billion market by 2024.

A notable expansion in 2024 includes targeting U.S. consumers interested in hemp-derived THC-infused beverages, a segment showing rapid growth and a preference for discreet consumption. Additionally, Organigram serves a crucial B2B wholesale customer base, supplying other licensed producers and distributors with high-quality cannabis biomass and extracts to bolster their own product lines and market reach.

| Customer Segment | Key Characteristics | 2024 Market Context/Focus |

| Canadian Recreational Consumers | Broad base, diverse product preferences (flower, vapes, edibles) | Mature market, continued demand for variety and value. |

| Canadian Medical Patients | Seeking therapeutic benefits, precise cannabinoid profiles | Steady patient growth, focus on quality and consistency. |

| International Medical Markets (e.g., Germany) | Strict regulatory demands, need for EU-GMP certified products | Significant growth potential, Germany's market projected at €2.4 billion in 2024. |

| U.S. Hemp-Derived THC Beverage Consumers | Interest in novel, discreet, low-dose products | Rapidly expanding segment, driven by evolving regulations and consumer trends. |

| B2B Wholesale (Producers, Distributors) | Need for consistent supply of biomass, extracts | Essential for revenue, supporting industry supply chains. |

Cost Structure

Organigram's Cost of Goods Sold (COGS) encompasses the direct expenses tied to bringing their cannabis products to market. This includes everything from the initial cultivation and harvesting stages to the final processing and packaging. For fiscal year 2023, Organigram reported a COGS of $148.7 million, a significant portion of which is allocated to these direct production activities.

Key elements within this cost structure are the essential inputs like seeds and nutrients, crucial for successful cultivation. Labor costs for the skilled teams involved in growing and processing are also a major component. Furthermore, the substantial energy requirements for their indoor cultivation facilities, particularly electricity, contribute heavily to COGS. In Q4 2023, Organigram highlighted efficiency gains through their seed-based cultivation strategy and automation efforts, aimed at managing and reducing these direct costs.

Selling, General & Administrative (SG&A) expenses for Organigram Holdings, which include marketing, sales, and corporate overhead, are a key component of their business model. These costs are essential for building brand awareness and reaching their target consumer base. For instance, in the first quarter of fiscal 2024, Organigram reported SG&A expenses of $36.8 million, reflecting their investment in these crucial areas.

Organigram actively invests in marketing and advertising campaigns designed to enhance brand recognition and drive sales within the competitive cannabis market. Their sales force is also a significant part of this cost structure, directly contributing to revenue generation. Managing these expenditures efficiently is vital for maintaining strong profitability.

The company has demonstrated a commitment to optimizing its SG&A spend, implementing various efficiency initiatives. These efforts have resulted in notable annual cost savings, bolstering the company's bottom line. For example, Organigram achieved approximately $10 million in annualized cost savings through a strategic review and optimization program initiated in fiscal year 2023.

Organigram Holdings dedicates significant resources to Research and Development (R&D), focusing on pioneering new products, enhancing existing strains, and refining its operational processes. This investment covers a broad spectrum of activities, from conducting rigorous scientific studies and developing innovative product formulations to advancing proprietary technologies like their nanoemulsion platform. For instance, in fiscal year 2024, Organigram continued to invest in its R&D pipeline, aiming to solidify its market position through unique offerings.

Distribution and Logistics Costs

Distribution and logistics costs are a significant component for Organigram, encompassing the expenses associated with moving cannabis products from their cultivation sites to various points of sale, including provincial liquor boards, licensed retailers, and international clients. These costs are influenced by warehousing needs, transportation fees, and the overall efficiency of their supply chain management. For example, in fiscal year 2023, Organigram reported substantial investments in streamlining its distribution network, aiming to reduce per-unit shipping expenses.

Organigram actively seeks to optimize its logistics network to control these expenditures. The strategic establishment of new distribution hubs, such as their facility in London, Ontario, is a key initiative designed to improve delivery times and reduce transportation overhead. This approach is crucial for maintaining competitive pricing and ensuring product availability across diverse markets. The company's focus on integrated logistics solutions aims to mitigate the impact of fluctuating fuel prices and carrier rates.

Key aspects of Organigram's distribution and logistics costs include:

- Warehousing: Costs associated with storing finished goods and raw materials in secure, compliant facilities.

- Transportation: Expenses related to shipping products via various carriers, including trucking and potentially air freight for expedited deliveries.

- Handling: Costs incurred for loading, unloading, and managing inventory throughout the distribution process.

- International Logistics: Additional expenses for compliance, customs, and specialized shipping for export markets.

Excise Duties and Taxes

As a licensed cannabis producer, Organigram Holdings faces substantial excise duties and other taxes on its cannabis products, a significant cost factor in its operations, particularly within the Canadian market.

These duties represent a considerable percentage of gross revenue, directly impacting Organigram's net revenue and overall profitability. For instance, in fiscal year 2023, Organigram reported total revenue of $131.5 million, with taxes and duties being a material deduction. Effective financial management necessitates meticulous planning and accounting for these regulatory expenses.

- Excise Duties Impact: These duties are levied on cannabis products sold, directly reducing the revenue retained by Organigram.

- Profitability Reduction: A significant portion of gross sales is allocated to taxes, thereby lowering net profit margins.

- Regulatory Compliance: Organigram must navigate complex tax regulations, ensuring compliance while optimizing its financial strategy.

- Cost Management: Understanding and forecasting these tax liabilities is crucial for accurate financial projections and operational efficiency.

Organigram's cost structure is heavily influenced by direct production expenses, including cultivation inputs, labor, and energy for its facilities. The company also invests significantly in SG&A for marketing and sales, alongside R&D for product innovation. Distribution and logistics are crucial for market reach, while excise duties and taxes represent a substantial financial obligation. In fiscal year 2023, Organigram's COGS was $148.7 million, with SG&A reaching $146.2 million for the full year.

| Cost Category | FY 2023 (Millions CAD) | FY 2024 Q1 (Millions CAD) |

|---|---|---|

| Cost of Goods Sold (COGS) | $148.7 | $35.2 |

| Selling, General & Administrative (SG&A) | $146.2 | $36.8 |

| Research & Development (R&D) | Not separately disclosed as a distinct line item in annual reports, but investments are ongoing. | Not separately disclosed as a distinct line item in quarterly reports, but investments are ongoing. |

| Distribution & Logistics | Included within COGS and SG&A, with specific investments in network optimization. | Included within COGS and SG&A, with specific investments in network optimization. |

| Excise Duties and Taxes | Significant deduction from gross revenue; specific figures vary based on sales volumes. | Significant deduction from gross revenue; specific figures vary based on sales volumes. |

Revenue Streams

Organigram’s recreational cannabis sales in Canada represent its principal revenue engine. This segment encompasses a diverse product portfolio, including dried flower, pre-rolls, edibles, vapes, and concentrates, which are sold to provincial cannabis authorities for onward distribution to licensed retail outlets nationwide.

The company has secured a substantial portion of the Canadian recreational cannabis market, with these sales directly fueling Organigram's overall revenue expansion. For the fiscal third quarter of 2024, Organigram reported net revenue of $51.6 million, a notable increase driven by strong performance in the recreational segment.

Market demand, consumer preferences, and the continuous introduction of innovative new products are key factors influencing the performance of this crucial revenue stream. Organigram’s strategic focus on product development and market penetration continues to bolster its position in this competitive landscape.

Organigram Holdings generates revenue from the international wholesale of medical cannabis and related products. Key export markets include Germany, the United Kingdom, Australia, and Israel. This segment is experiencing robust growth.

International sales typically offer higher profit margins than domestic transactions for Organigram. In fiscal year 2023, Organigram reported a significant increase in international revenue, demonstrating its growing contribution to overall financial performance and underscoring the strategic importance of global expansion for future growth.

Organigram's revenue from medical cannabis sales in Canada includes direct-to-patient purchases and wholesale distribution to medical retailers. This segment, while smaller than recreational sales, offers a predictable income source, serving a dedicated patient base that values product reliability and quality.

For the fiscal year 2023, Organigram reported total net revenue of $137.8 million, with the medical segment contributing a significant portion, demonstrating its importance as a foundational revenue stream. This consistent demand highlights the company's commitment to serving the medical cannabis market.

Hemp-Derived THC Beverage Sales (U.S.)

Organigram Holdings is tapping into the burgeoning U.S. market with hemp-derived THC infused beverages, a new revenue stream bolstered by the acquisition of Collective Project and its brand, The Drinkable Company. This strategic expansion targets both direct-to-consumer e-commerce sales and established retail partnerships across the United States, aiming to capture significant market share in this emerging beverage category.

This diversification into the U.S. beverage sector is a calculated move to unlock new avenues for growth and revenue generation. The U.S. cannabis beverage market is experiencing rapid expansion, with projections indicating substantial growth in the coming years. For instance, the U.S. cannabis-infused beverage market was valued at approximately $1.5 billion in 2023 and is expected to reach over $5.2 billion by 2028, according to industry analysis.

- Emerging U.S. Market Entry: Leverages the recent acquisition of Collective Project and its brand, The Drinkable Company, to establish a foothold in the U.S. hemp-derived THC beverage market.

- Dual Sales Channels: Utilizes both direct-to-consumer e-commerce platforms and strategic retail partnerships within the U.S. to maximize reach and sales.

- Market Diversification: Represents a significant strategic initiative to diversify revenue streams beyond existing Canadian operations and capitalize on the growth potential of the U.S. beverage industry.

B2B Wholesale Sales (Cannabis Biomass/Extracts)

Organigram Holdings generates revenue through B2B wholesale sales of cannabis biomass and extracts. This involves selling intermediate products like dried flower, trim, and various cannabis oils to other licensed cannabis companies. These sales are crucial for Organigram to leverage its production capacity and distribute specialized components throughout the wider cannabis industry supply chain. For instance, the company might sell bulk cannabis oil to a competitor for their edibles production.

This revenue stream is vital for optimizing resource utilization and capitalizing on market opportunities beyond Organigram's direct-to-consumer brands. It allows them to monetize any surplus production or specific product fractions not immediately used in their own finished goods. In the fiscal year 2024, Organigram reported consistent growth in its wholesale segment, contributing to overall financial stability as the Canadian cannabis market continues to mature and consolidate.

- Wholesale Revenue: Sales of bulk cannabis biomass and extracts to other licensed producers and processors.

- Supply Chain Support: Facilitates the broader cannabis industry by providing essential intermediate products.

- Capacity Monetization: Allows Organigram to generate income from excess production capacity or specialized product components.

- Market Reach: Extends Organigram's influence by supplying raw materials for other companies' manufacturing processes.

Organigram's revenue streams are diverse, encompassing both domestic and international markets, with a strong focus on recreational and medical cannabis sales. The company also strategically ventures into new markets like the U.S. beverage sector and engages in B2B wholesale operations.

In fiscal year 2023, Organigram reported total net revenue of $137.8 million. The company's performance in the fiscal third quarter of 2024 saw net revenue reach $51.6 million, largely driven by its Canadian recreational cannabis segment.

International medical cannabis sales, particularly to markets like Germany and Australia, are a growing contributor and typically yield higher profit margins. The U.S. market entry with hemp-derived THC beverages, following the acquisition of Collective Project, represents a significant diversification strategy targeting a rapidly expanding sector.

| Revenue Stream | Description | Key Markets/Products | Fiscal Year 2023 Contribution (Approximate) |

|---|---|---|---|

| Canadian Recreational Cannabis | Sales of dried flower, pre-rolls, edibles, vapes, and concentrates to provincial authorities. | Nationwide Canada; diverse product portfolio. | Majority of total revenue. |

| International Medical Cannabis | Wholesale of medical cannabis and related products. | Germany, UK, Australia, Israel. | Significant and growing contribution. |

| Canadian Medical Cannabis | Direct-to-patient sales and wholesale to medical retailers. | Canada; reliable product for dedicated patient base. | Foundational revenue stream. |

| U.S. Hemp-Derived Beverages | Entry into the U.S. market with THC-infused beverages. | United States; direct-to-consumer and retail partnerships. | Emerging revenue stream; high growth potential. |

| B2B Wholesale | Sales of cannabis biomass and extracts to other licensed companies. | Cannabis industry supply chain; bulk oils, flower, trim. | Supports capacity utilization and market reach. |

Business Model Canvas Data Sources

Organigram Holdings' Business Model Canvas is informed by a blend of public financial disclosures, industry-specific market research reports, and internal operational data. These sources provide a comprehensive view of the company's strategic positioning and market performance.