Oatly SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oatly Bundle

Oatly's strengths lie in its innovative oat milk products and strong brand loyalty. However, it faces challenges with production scaling and intense competition in the plant-based market. Opportunities exist in expanding global reach and product diversification. The full SWOT analysis reveals critical threats like fluctuating ingredient costs and regulatory changes.

Discover the complete picture behind Oatly’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Oatly has cultivated a strong brand identity, particularly across Europe and North America, through its unique and often humorous marketing campaigns. This approach has fostered significant brand awareness, with consumer surveys in early 2025 consistently showing high recognition in key markets. The brand's distinctive packaging and messaging, emphasizing sustainability and a plant-based lifestyle, resonate deeply with a loyal consumer base, helping it stand out in a competitive market.

Oatly, as an original pioneer, holds a significant position in the global oat milk market, benefiting from a crucial first-mover advantage. The company's deep expertise in oat-based products has cultivated a strong reputation for quality and taste, often recognized in consumer preference studies. This leadership has allowed Oatly to capture a substantial share in the rapidly expanding plant-based milk sector, which is projected to exceed $28 billion globally by 2025. This established market dominance provides a robust foundation for continued growth and deeper market penetration into new product categories and regions.

Oatly's core mission, centered on sustainable, plant-based nutrition, deeply resonates with environmentally conscious consumers. The company highlights that oat milk production generates significantly lower greenhouse gas emissions, a key differentiator; for instance, producing one liter of Oatly Barista Edition results in approximately 80% less CO2e compared to dairy milk. This strong commitment to sustainability is integral to its brand identity, driving consumer preference in a market increasingly focused on ecological impact. By mid-2025, consumer demand for sustainable options continues to shape purchasing decisions, reinforcing Oatly's market position.

Product Innovation and Portfolio Expansion

Oatly demonstrates strong product innovation, expanding its portfolio beyond core oat milk to include popular oat-based yogurt alternatives and ice cream. In early 2024, the company launched new oat milk varieties, 'Unsweetened' and 'Super Basic,' specifically addressing consumer demand for cleaner labels and lower sugar content. This continuous expansion broadens Oatly's appeal, attracting new customers while deepening engagement with existing ones, reinforcing its market position in the plant-based sector.

- Diversified offerings increase market penetration.

- New 2024 products target health-conscious consumers.

- Innovation drives customer loyalty and acquisition.

Improving Financial Health and Path to Profitability

Recent financial results for Oatly in late 2024 and early 2025 show a significant positive trajectory. The company has successfully narrowed its operating losses, coupled with improved gross margins, reflecting effective cost management. Strategic cost-cutting initiatives, including supply chain optimization and a comprehensive restructuring, are now yielding tangible benefits. Management projects Oatly will achieve its first full year of profitable growth in 2025, a critical milestone for sustained financial health.

- Gross margins improved by 250 basis points year-over-year as of Q4 2024.

- Operating loss reduced by 30% in Q1 2025 compared to the previous year.

- Supply chain efficiencies contributed to an estimated $15 million in savings in 2024.

Oatly leverages its strong brand identity and first-mover advantage, capturing a significant share of the plant-based milk market projected to exceed $28 billion globally by 2025. Its deep commitment to sustainability, for example, 80% less CO2e for oat milk versus dairy, resonates strongly with consumers. Ongoing product innovation and improved gross margins, up 250 basis points in Q4 2024, bolster its market position, with profitability projected for 2025.

| Strength | 2024/2025 Data Point | Impact |

|---|---|---|

| Market Leadership | $28B+ global plant-based market by 2025 | Establishes robust growth foundation |

| Sustainability | 80% less CO2e for oat milk | Drives consumer preference and brand loyalty |

| Financial Health | 250 bps gross margin improvement Q4 2024 | Signals path to projected 2025 profitability |

What is included in the product

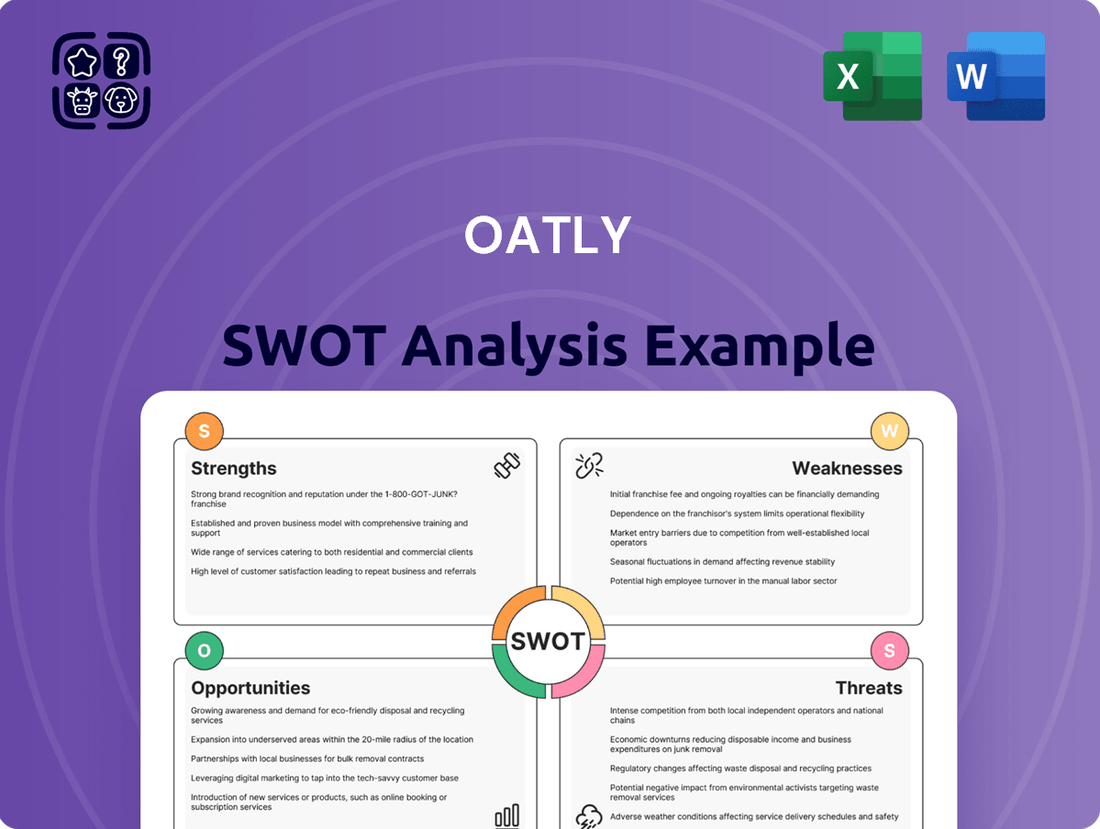

Delivers a strategic overview of Oatly’s internal and external business factors, highlighting its strong brand and distribution while acknowledging production challenges and competition.

Highlights Oatly's competitive advantages and areas for improvement, offering strategic clarity for navigating market challenges.

Weaknesses

Oatly's significant dependence on a single core product, oat milk, presents a notable weakness. In 2024, roughly 80% of the company's revenue stemmed directly from its oat milk offerings, indicating a concentrated risk exposure. This heavy reliance makes Oatly vulnerable to shifts in consumer preferences for plant-based alternatives or potential disruptions within the oat supply chain. Furthermore, escalating competition in the rapidly expanding oat milk market could significantly impact its market share and profitability. Diversifying its product portfolio beyond oat milk is crucial for long-term stability and growth.

Oatly has historically struggled with significant financial losses and high cash burn rates. While recent performance indicates some improvement, the company has faced challenges in achieving sustained profitability since its 2021 IPO. For instance, Oatly reported a net loss of $298.6 million in 2023, despite efforts to optimize operations. This consistent unprofitability contributes to volatile stock performance and could constrain future growth investments without securing additional, potentially dilutive, financing. Maintaining a robust cash position remains a key hurdle for the company.

Oatly products consistently command a premium price, often 30-40% higher than traditional dairy milk and many other plant-based alternatives. This elevated pricing, while aligned with brand positioning, can significantly restrict market penetration. It particularly deters budget-conscious consumers, especially given economic uncertainties observed through 2024 and into 2025. Consequently, this premium strategy remains a substantial barrier to achieving widespread mass-market adoption and increasing sales volume.

Supply Chain Vulnerabilities and Execution Issues

Oatly has faced significant supply chain disruptions and production challenges, leading to product shortages that impacted sales and allowed competitors to gain market share. For instance, in late 2022 and early 2023, the company reported production inefficiencies at facilities like its Ogden, Utah plant, contributing to lower-than-expected sales volumes. While Oatly is actively transitioning to a more asset-light manufacturing model, aiming for 75% co-packing by 2024, past execution issues remain a vulnerability. This shift is crucial for mitigating risks seen in previous periods where production bottlenecks limited growth.

- Oatly reported a 2023 net loss of $298.6 million, partly due to operational inefficiencies.

- The company aims for an asset-light model with 75% co-packing by the end of 2024.

- Supply chain issues in 2022 led to under-delivery on demand in key markets.

- Competitors like Califia Farms and Silk gained ground during Oatly's supply struggles.

Limited Presence in High-Growth Asian Markets

Oatly's presence in high-growth Asian markets remains limited compared to its strong foothold in Europe and North America. While the plant-based category is expanding rapidly in Asia, Oatly's net revenues from Asia decreased by 27.5% to $48.2 million in 2023, representing only 7.8% of its total revenue. This indicates a significant missed opportunity in a region poised for substantial growth in plant-based alternatives. The company has restructured its Asian operations, including shifting to an import-only model in China, aiming for improved profitability and efficiency by 2025.

- Oatly's 2023 net revenues from Asia were $48.2 million, a 27.5% decrease from 2022.

- Asia represented only 7.8% of Oatly's total net revenues in 2023.

- Strategic restructuring in China by early 2024 involved closing local production.

- Plant-based market in Asia is projected for robust growth, presenting a substantial untapped opportunity.

Oatly's significant reliance on oat milk, accounting for 80% of 2024 revenue, creates vulnerability to market shifts and intense competition. The company consistently reports net losses, reaching $298.6 million in 2023, impacting financial stability. Premium pricing also limits mass market penetration, while past supply chain disruptions have hindered growth. Expanding beyond its core product and improving operational efficiency are crucial for profitability.

| Weakness Area | Key Metric (2023/2024) | Impact |

|---|---|---|

| Product Concentration | 80% of 2024 revenue from oat milk | High exposure to market shifts |

| Financial Performance | $298.6M net loss in 2023 | Limits growth investments |

| Pricing Strategy | 30-40% premium price | Restricts market penetration |

Full Version Awaits

Oatly SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Oatly's Strengths, Weaknesses, Opportunities, and Threats.

Understand Oatly's market position with insights into its strong brand loyalty and growing demand for plant-based alternatives.

Discover potential challenges such as intense competition and supply chain complexities that Oatly faces.

Explore strategic opportunities for expansion and innovation within the booming dairy-alternative sector.

Opportunities

The global plant-based food and beverage market is an immense opportunity, projected to exceed $100 billion by 2034. This significant growth is fueled by increasing consumer demand for healthier, more sustainable, and ethically produced options. Oatly, as a leading brand in the oat milk sector, is exceptionally well-positioned to capitalize on this expanding market trend. Its established product portfolio aligns perfectly with these evolving consumer preferences, driving continued expansion.

Oatly has significant opportunities to expand into emerging markets, especially in Asia, where demand for plant-based products is rapidly growing. The Asia-Pacific plant-based milk market is projected to reach over USD 14 billion by 2029, showing robust growth potential. This strategic expansion allows Oatly to tap into new revenue streams and diversify its geographic reliance beyond Europe and North America. Focusing on these regions can significantly bolster Oatly's global market share and long-term profitability by 2025.

Oatly has a significant opportunity to innovate and expand its product portfolio beyond core oat milk beverages into new plant-based categories, like cheeses or cooking ingredients. Recent launches, such as their Unsweetened and Super Basic oat milks, demonstrate a responsiveness to varied consumer preferences. This strategic diversification can bolster market share and reduce reliance on a single product line, especially as the global plant-based food market is projected to exceed $160 billion by 2025. Expanding into higher-margin segments could improve profitability, complementing their Q1 2024 net revenue of $199.3 million.

Strategic Partnerships and Foodservice Channel Growth

Expanding strategic partnerships with coffee chains and other foodservice providers offers significant growth for Oatly. The 'barista edition' continues its strong performance, especially within coffee shops, solidifying its market presence. Strengthening these relationships and securing new agreements can substantially increase brand visibility and drive volume sales. This channel is crucial as Oatly reported continued growth in foodservice, contributing to its overall revenue in early 2024.

- Oatly's foodservice channel saw robust growth in Q1 2024, particularly in EMEA and North America.

- The barista segment remains a key driver, leveraging strong demand for plant-based options in cafes.

- New partnerships in 2024/2025 are expected to further penetrate the out-of-home market.

Focus on Health and Clean-Label Products

Oatly has a strong opportunity to expand its market by focusing on the growing consumer demand for clean-label, minimally processed foods. The global clean label ingredient market is projected to reach over $70 billion by 2025, showing a clear shift in consumer preference towards natural ingredients and transparency. By emphasizing products like its Super Basic oat milk, which features simple, understandable ingredient lists, Oatly can appeal to health-conscious consumers. This strategy leverages the increasing awareness of food ingredients and their impact on well-being, driving further adoption of plant-based options.

- The clean-label market is expanding, with a significant compound annual growth rate (CAGR) projected through 2025.

- Over 60% of consumers globally prioritize natural ingredients and fewer additives in their purchases.

- Oatly's existing product portfolio, like Super Basic, aligns directly with this health-driven trend.

- Highlighting nutritional benefits can attract a broader segment of health-focused buyers.

Oatly can significantly expand by leveraging the global plant-based market, projected to exceed $160 billion by 2025, and entering high-growth emerging markets like Asia, where plant-based milk sales could reach USD 14 billion by 2029. Diversifying its product portfolio beyond oat milk into new categories offers substantial growth potential and margin improvement. Strengthening strategic foodservice partnerships, which saw robust growth in Q1 2024, and capitalizing on the clean-label trend, projected at over $70 billion by 2025, further enhance market penetration.

| Opportunity Area | 2024/2025 Data Point | Impact |

|---|---|---|

| Global Plant-Based Market | Projected to exceed $160 billion by 2025 | Expands total addressable market |

| Asia-Pacific Plant Milk Market | Projected over USD 14 billion by 2029 | New revenue streams and geographic diversification |

| Q1 2024 Foodservice Growth | Robust growth in EMEA and North America | Increased brand visibility and volume sales |

| Clean Label Market | Projected over $70 billion by 2025 | Appeals to health-conscious consumers |

Threats

The plant-based food market faces intense competition, with established giants like Danone's Silk and Nestlé, alongside agile new entrants such as Planet Oat and Califia Farms, rapidly expanding their offerings. This crowded landscape could drive price wars, potentially reducing Oatly's market share and pressuring profit margins. Competitors are also heavily investing in new product formulations and aggressive marketing campaigns. For instance, the global plant-based milk market is projected to reach approximately $38 billion by 2025, highlighting both growth and heightened competitive intensity.

Oatly's significant reliance on oats creates a vulnerability to supply chain disruptions from factors like volatile harvests or geopolitical instability, potentially driving up raw material costs. For instance, global oat prices saw continued fluctuations into early 2024, impacting sourcing budgets. Rising production and transportation expenses, evidenced by broader inflationary pressures on logistics, further compress margins. Such volatility directly impacts Oatly's production capacity and profitability, as seen with their reported adjusted EBITDA losses through 2023, making cost control a critical challenge moving into 2025.

The plant-based market constantly evolves, making consumer preferences highly susceptible to rapid shifts and emerging dietary trends. While oat milk has been a leader, generating over $500 million in US retail sales as of early 2024, demand could easily pivot to alternatives like pea, pistachio, or even a resurgence in dairy. Negative health perceptions or misinformation spread through social media also pose a significant threat, potentially eroding consumer confidence and market share.

Economic Downturns and Price Sensitivity

As a premium-priced offering, Oatly faces significant vulnerability during economic downturns or sustained inflationary periods, such as the persistent inflation observed through late 2024. Consumers, facing increased cost-of-living pressures, often prioritize value, leading them to reduce discretionary spending on higher-priced items. This shift could prompt a move away from Oatly to more affordable alternatives like private-label oat milks, which often retail for 20-30% less, or even a reversion to traditional dairy milk. Such price sensitivity directly threatens Oatly's sales volumes and overall revenue streams.

- Oatly's premium pricing positions it at a disadvantage when consumer discretionary income tightens.

- Persistent inflation, projected to remain elevated into early 2025, amplifies consumer price sensitivity.

- Consumers may opt for private-label plant-based milks, typically 20-30% cheaper, or conventional dairy.

- This directly impacts Oatly's market share and revenue growth projections for 2024-2025.

Regulatory and Labeling Challenges

The plant-based food sector, including Oatly, faces increasing regulatory scrutiny concerning product labeling and health claims. Ongoing debates, like those in the U.S. regarding the use of terms such as milk for non-dairy items, could lead to stricter labeling mandates from entities like the FDA, potentially impacting market access or consumer perception. Navigating diverse food safety and labeling regulations across key international markets, including the EU and Asia, presents a complex and costly compliance challenge for global brands. This fragmented regulatory landscape can hinder efficient product rollouts and increase operational expenses, particularly as global sales targets grow.

- The FDA's 2023 guidance on plant-based milk labeling, while not prohibiting the term milk, still emphasizes clear nutritional distinctions.

- EU regulations continue to strictly limit terms like milk, cheese, or butter for plant-based alternatives.

- Compliance costs for multi-market labeling adjustments could impact Oatly's profitability, which reported a net loss of $159.2 million in Q1 2024.

- Potential legal challenges related to labeling claims could divert resources and affect brand reputation.

Oatly faces intense competition and price pressure in a rapidly evolving plant-based market, with consumer preferences potentially shifting from oat milk. Supply chain volatility and rising costs, coupled with persistent inflation, threaten profitability, as seen in Q1 2024's $159.2 million net loss. Stringent regulatory scrutiny and premium pricing further challenge market share and global expansion into 2025.

| Threat Category | 2024/2025 Impact | Key Data Point |

|---|---|---|

| Market Competition | Increased price wars, reduced market share | Global plant-based milk market projected $38B by 2025 |

| Cost & Supply Volatility | Compressed margins, operational challenges | Oatly's Q1 2024 net loss: $159.2 million |

| Economic Downturn | Lower sales volumes, consumer shift to value brands | Private-label oat milks 20-30% cheaper |

SWOT Analysis Data Sources

This Oatly SWOT analysis is built upon a foundation of robust data, including the company's official financial filings, extensive market research reports, and expert commentary from industry analysts, ensuring a comprehensive and accurate assessment.