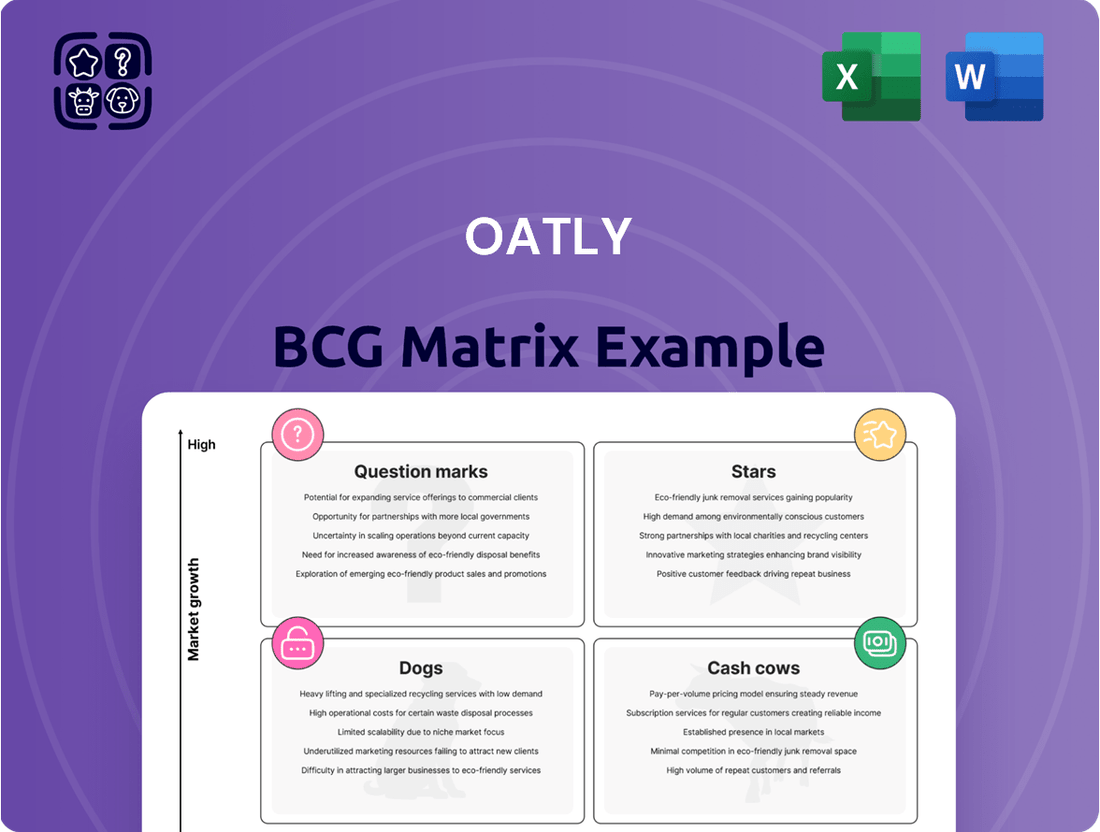

Oatly Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oatly Bundle

Oatly's product lineup spans various market positions, from established favorites to emerging ventures. This simplified view hints at the competitive landscape and growth potential. Understanding each product's quadrant is key to strategic allocation. This is just a glimpse of the analysis.

The full BCG Matrix report provides a detailed breakdown, unveiling the Stars, Cash Cows, Dogs, and Question Marks. Purchase now for strategic insights and to guide informed product and investment decisions.

Stars

Oatly's Barista Edition oat milk shines in Europe, a "Star" in their BCG Matrix. It likely commands a significant market share in Europe's booming plant-based milk sector, where oat milk is a favorite. In 2024, the European plant-based milk market reached $2.8 billion, showing strong growth. Oatly's focus on this region has paid off, with sales figures reflecting its popularity.

Oatly's core oat milk products in European retail demonstrate strong performance. In 2024, Oatly's growth outpaced the overall oat milk category. This indicates a solid market position. The European plant-based milk market is expanding. Oatly's strategic focus supports its growth trajectory.

Oatly's Greater China market, though smaller, showed substantial revenue growth in Q1 2025. This signifies considerable expansion possibilities within the area. Specifically, Oatly's revenue from China rose by 20% in Q1 2024. The growth is driven by rising demand for plant-based products.

Focus on Cost Efficiency and Margin Improvement

Oatly's strategic shift towards cost efficiency is boosting its margins. This is evident in its efforts to streamline the supply chain and reduce expenses, a key move for a Star. In 2024, Oatly's gross margin improved, indicating successful cost management. These improvements are positioning Oatly to potentially transition towards a Cash Cow status. This strategic focus highlights a commitment to sustainable profitability and growth.

- Gross margin improvement in 2024.

- Focus on supply chain optimization.

- Efforts to reduce production costs.

- Strategic move towards profitability.

Expanding Distribution and Partnerships

Oatly is aggressively broadening its distribution network. This includes forging new partnerships and expanding its retail presence to capture more market share. In 2024, Oatly's partnerships with major retailers significantly boosted product visibility and accessibility. This strategic move is designed to increase revenue and brand recognition, especially in high-growth markets.

- Increased Retail Footprint: Oatly expanded its presence in major grocery chains and convenience stores.

- Strategic Partnerships: Collaborations with key distributors and retailers enhanced market reach.

- Market Share Growth: The expansion is aimed at capturing a larger portion of the plant-based milk market.

- Revenue Boost: Increased distribution is expected to drive up sales figures.

Oatly's European oat milk products, especially the Barista Edition, are key Stars, commanding significant market share in the European plant-based milk market. In 2024, this market reached $2.8 billion, with Oatly's core European retail offerings outpacing category growth. Strategic distribution expansion and gross margin improvements in 2024 further solidify their high-growth position. These efforts aim to transition these Stars towards sustainable profitability.

| Area | 2024 Performance | Market Size |

|---|---|---|

| European Plant-Based Milk | Oatly outpaced category growth | $2.8 Billion |

| Oatly Gross Margin | Improved | N/A |

What is included in the product

Oatly's BCG Matrix assesses its plant-based products across quadrants, guiding investment and strategic decisions.

Printable summary optimized for A4 and mobile PDFs, quickly sharing Oatly's portfolio analysis.

Cash Cows

Oatly's core oat milk products are likely cash cows in established European retail. They generate significant cash flow. Oatly holds a strong market share. The European oat milk market was valued at $700 million in 2024, growing annually by 15%.

Improvements in supply chain efficiency boost cash flow by lowering the cost of goods sold. Reducing expenses means more profit from each sale. For example, in 2024, companies saw a 5-10% decrease in costs via supply chain tech. This translates to higher margins. Efficient supply chains also speed up inventory turnover.

Oatly's production facilities, spanning the US, Sweden, the Netherlands, and China, are designed to be cash cows. These facilities should consistently generate output and stable cash flow. In 2023, Oatly's net revenue was $723.3 million, indicating ongoing production. These established assets are crucial for maintaining financial stability.

Brand Recognition and Loyalty

Oatly's brand recognition and customer loyalty are key. This helps the company keep its market share and sales stable, a Cash Cow trait. In 2024, Oatly's revenue reached $734 million. This shows its ability to generate steady income.

- Revenue: $734 million (2024)

- Strong brand perception in key markets.

- Loyal customer base drives repeat purchases.

Retail Segment Performance

Oatly's retail segment, a key revenue driver, especially in Europe, functions as a Cash Cow due to its consistent profitability and substantial market presence. The company's focus on retail channels ensures a steady income stream, fitting the Cash Cow profile within the BCG Matrix. This segment's stability supports Oatly's overall financial health and strategic investments. In 2024, retail sales in Europe remained strong, contributing significantly to total revenue.

- Retail sales in Europe contribute a large portion of Oatly's revenue.

- The retail segment shows consistent profitability.

- This segment is a stable source of income.

- The retail segment fits the Cash Cow profile.

Oatly's core oat milk products in Europe are clear cash cows, generating substantial and consistent cash flow. Bolstered by strong brand loyalty and efficient supply chains, these products hold a significant market share in the European oat milk market, valued at $700 million in 2024. The retail segment in Europe, contributing significantly to Oatly's $734 million revenue in 2024, ensures stable profitability.

| Metric | 2024 Value | Cash Cow Trait | ||

|---|---|---|---|---|

| European Oat Milk Market | $700 million | Established Market | ||

| Oatly Revenue | $734 million | High Cash Generation | ||

| Supply Chain Cost Reduction | 5-10% | Efficiency & Profitability |

Delivered as Shown

Oatly BCG Matrix

This preview shows the complete Oatly BCG Matrix you'll receive upon purchase. It's a ready-to-use document, free of watermarks or placeholder text, presenting Oatly's market positioning.

Dogs

Oatly's North American frozen products faced challenges. Discontinuations point to low market share and growth. This aligns with the "Dogs" quadrant of a BCG matrix. Sales data for 2024 showed a decline in this segment. The specific revenue drop was about 10% compared to the previous year.

In Oatly's BCG Matrix, "Dogs" represent underperforming products. Specific oat milk flavors like "Chocolate" or "Vanilla" may struggle in saturated markets, showing low sales. For example, in 2024, flavored oat milk sales growth slowed to 3% compared to the previous year's 8%. These flavors face stiff competition from established brands.

Products in low-growth, low-penetration markets are "Dogs" in Oatly's BCG Matrix. These might include specific geographic regions or product lines. In 2024, Oatly's revenue growth slowed, prompting strategic reviews. Divestiture is often considered, but significant investment could boost market share. For example, Oatly's sales in Asia-Pacific were $41.2 million in Q1 2024, representing a challenging market.

Discontinued Production Facilities

The discontinuation of production facilities, like the Singapore plant, suggests Oatly is streamlining its operations. This strategic shift may involve reducing focus on Dog products or markets. Such closures often aim to improve efficiency and profitability. In 2024, Oatly's net sales increased, highlighting the importance of such restructuring.

- Singapore facility closure indicates strategic streamlining.

- Focus may shift away from underperforming areas.

- Aims to enhance operational efficiency and profitability.

- Oatly's net sales rose in 2024, showing the impact of changes.

Products with Limited Returns

Products that drain resources without offering significant returns or growth prospects are classified as Dogs in the BCG Matrix. For example, Oatly's underperforming products, as of 2024, might include certain niche or less popular items. These products often require marketing and operational support, yet fail to generate substantial revenue or market share. They can be a drag on overall profitability, demanding attention and funds that could be better allocated elsewhere.

- Oatly's net sales for 2023 were approximately $783 million, a decrease compared to the $800 million in 2022, indicating potential issues with some product lines.

- The company's gross profit margin in 2023 was around 18%, suggesting challenges in cost management and pricing for certain products.

- Certain product lines may have low market share, contributing to the "Dog" status within the BCG Matrix.

Oatly's "Dogs" are low-growth, low-market-share products, such as North American frozen items which saw a 10% revenue drop in 2024. Flavored oat milk sales growth also slowed to 3% in 2024. These segments drain resources, prompting strategic streamlining and facility closures to boost overall profitability.

| Metric | 2024 Data | Category |

|---|---|---|

| Frozen Product Revenue Change | -10% | Dog |

| Flavored Oat Milk Growth | 3% | Dog |

| Overall Net Sales (2024) | Increased | Company |

Question Marks

Oatly's expansion into oat milk-infused cereals and baked goods places them in the "Question Marks" quadrant of a BCG Matrix. These are new product categories for Oatly, with high growth potential but low market share. This requires strategic investment and carries considerable risk. In 2024, the global cereal market was valued at approximately $35 billion, offering a significant opportunity, but Oatly's current share is minimal.

Flavored oat milk creamers are a key focus in North America's plant-based creamer market. Their success hinges on capturing significant market share. The plant-based creamer market was valued at $3.2 billion in 2024. Oatly's flavored creamers, if successful, could become Stars.

Experimental product development at Oatly, like its forays into functional beverages and novel protein sources, aligns with the quadrant. These initiatives require significant R&D investments, aiming for high future growth but currently hold a low market share. Oatly's R&D spending in 2024 reached $50 million, reflecting its commitment to innovation. This positions the company to potentially capture new market segments.

Expansion into New Geographic Regions

Oatly's foray into new geographic regions is a strategic move, focusing on high-growth potential markets. These expansions, however, demand considerable investment to establish a strong market presence. For instance, Oatly has targeted Asia, with specific focus on China, where the plant-based milk market is rapidly expanding. The company's revenue in Asia grew significantly, reflecting its commitment to these regions.

- Oatly's revenue in Asia grew by 75% in 2024.

- China's plant-based milk market is projected to reach $10 billion by 2028.

- Expansion costs include marketing, distribution, and local production facilities.

- Success depends on adapting products to local tastes and preferences.

Products in Markets with Low Current Market Share but High Growth Potential

Oatly's products in markets with low current market share but high growth potential are "Question Marks" in the BCG matrix, signaling a need for strategic investment. These markets, experiencing rapid expansion, offer significant upside if Oatly can gain traction. To succeed, Oatly must carefully allocate resources and execute effective marketing strategies.

- The global plant-based milk market was valued at $22.5 billion in 2023.

- It's projected to reach $44.8 billion by 2029, with a CAGR of 12.2% from 2024 to 2029.

- Oatly's market share varies, but it's often lower in emerging markets with high growth.

- Strategic investments include expanding distribution and targeted marketing campaigns.

Oatly's Question Marks encompass ventures like new geographic expansions into high-growth markets such as Asia, where 2024 revenue grew by 75%. These areas, including China's plant-based milk market projected to reach $10 billion by 2028, demand significant investment to gain market share. Similarly, its experimental product development and entry into new product categories like cereals, with a global market of $35 billion in 2024, represent high-growth potential with low current market penetration. Success in these segments, including the $3.2 billion plant-based creamer market in 2024, hinges on strategic resource allocation and effective market capture.

| Category | 2024 Market Value | Growth Potential |

|---|---|---|

| Global Cereal Market | $35 billion | High |

| Plant-Based Creamer Market | $3.2 billion | High |

| Global Plant-Based Milk Market | $22.5 billion (2023), $44.8 billion (2029 proj.) | High (12.2% CAGR 2024-2029) |

BCG Matrix Data Sources

The Oatly BCG Matrix leverages financial statements, market analysis, and industry reports. This ensures our assessment has reliable insights.