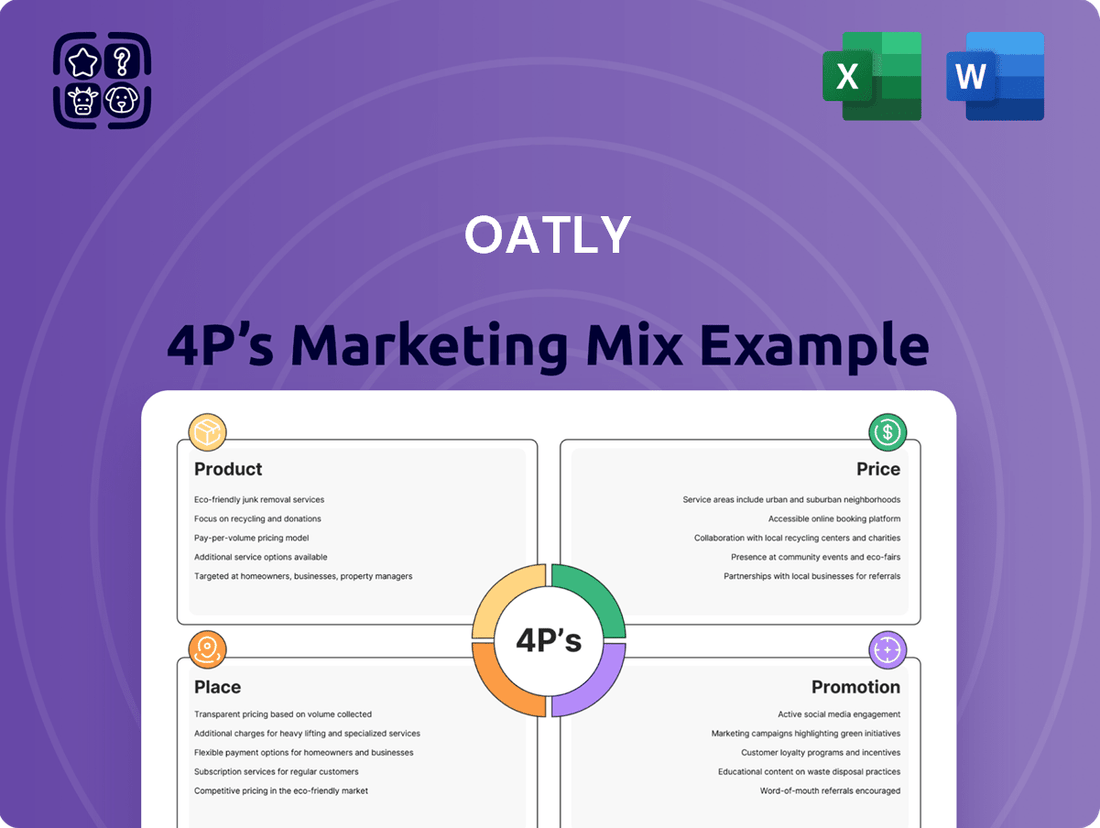

Oatly Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oatly Bundle

Oatly's marketing mastery is evident in its innovative product development, from its iconic oat milk to a growing range of delicious plant-based alternatives. Their thoughtful pricing positions them as a premium yet accessible option in a competitive market, reflecting the quality and brand values.

Discover how Oatly's strategic placement in mainstream grocery stores and cafes, alongside their distinctive and often playful promotional campaigns, creates a powerful brand presence that resonates with consumers.

This brief glimpse only hints at the depth of Oatly's marketing genius; delving into the full 4Ps will reveal the intricate connections that drive their success and inspire your own strategies.

Ready to unlock the secrets behind Oatly's remarkable market penetration and consumer loyalty? Explore the complete 4Ps Marketing Mix Analysis, packed with actionable insights and ready for your strategic toolkit.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Oatly's product strategy hinges on its broad portfolio of oat-based dairy alternatives, encompassing various oat milks, yogurts, and cooking ingredients. This directly addresses the surging consumer demand for plant-based options, driven by health, ethical, and environmental concerns. As of early 2024, the global plant-based milk market exceeded $23 billion, with oat milk being a significant contributor, highlighting a vast addressable market for Oatly's offerings. The company's ongoing innovation within this core category is essential for sustaining market leadership and achieving further expansion.

Oatly strategically highlights the health benefits of its oat-based products and their significantly lower environmental footprint compared to traditional dairy alternatives. The company states its products have a 44% to 80% lower climate impact, a crucial differentiator for eco-conscious consumers. This strong emphasis on sustainability helps cultivate a robust brand identity, fostering long-term consumer loyalty and supporting pricing power in the competitive plant-based market.

Oatly has diversified beyond its core oat milk into categories like ice cream, yogurt alternatives, and cream cheese, strategically broadening its reach within the dairy-alternative market. A key example is the early 2024 launch of an organic Barista Edition oat milk, targeting consumers seeking premium, sustainable options and strengthening its competitive edge. This continuous product innovation is crucial for Oatly to maintain market leadership, anticipate evolving consumer demands for healthier, sustainable choices, and differentiate effectively.

Strategic SKU Rationalization

Oatly has strategically engaged in SKU rationalization, discontinuing less profitable offerings such as its frozen dessert line in North America. This move, despite a projected short-term revenue impact, is crucial for enhancing operational efficiency and focusing resources on higher-margin products like its oat milk beverages, which saw a 10% volume increase in Q1 2024. This signals to financial analysts a disciplined portfolio management approach aimed at achieving sustainable profitability and improving its 2025 gross margin outlook.

- Discontinued frozen desserts in North America to streamline portfolio.

- Aims to improve operational efficiency and focus on higher-margin core products.

- Expected to positively impact 2025 gross margin and overall profitability.

- Reflects a disciplined approach to portfolio management for long-term growth.

Focus on Quality and Taste Profile

Oatly prioritizes high-quality products, ensuring consumers do not sacrifice taste or functionality when choosing plant-based alternatives. Their Barista Edition, specifically formulated for coffee, was a key driver, demonstrating superior performance in cafes and contributing to its market penetration. This consistent delivery on taste and performance builds strong brand trust, essential for repeat purchases and broadening mainstream adoption, as evidenced by its continued growth in the competitive plant-based dairy segment.

- Oatly's Barista Edition remains a top performer, contributing significantly to its foodservice revenue, which saw substantial increases in 2024.

- Consumer surveys in early 2025 consistently highlight taste as a primary factor for choosing Oatly over competitors.

- The brand's focus on sensory attributes has helped maintain its premium pricing strategy in the plant-based milk market.

Oatly's product strategy focuses on a diverse oat-based portfolio, addressing the growing plant-based market which exceeded $23 billion in early 2024. The company prioritizes innovation, like the 2024 organic Barista Edition, and recently discontinued less profitable frozen desserts in North America to enhance its 2025 gross margin outlook. This shift aims to boost operational efficiency and concentrate on high-margin core products, such as oat milk beverages which saw a 10% volume increase in Q1 2024, while maintaining superior taste quality as a key differentiator.

| Product Focus | Key Initiative (2024) | Impact (2025 Outlook) |

|---|---|---|

| Core Oat Milk | Organic Barista Edition Launch | Strengthened Premium Segment, Market Share Growth |

| Portfolio Rationalization | Discontinued North American Frozen Desserts | Improved Operational Efficiency, Enhanced Gross Margin |

| Innovation & Quality | Continued R&D in Oat Bases | Maintained Taste Leadership, Supported Pricing Power |

What is included in the product

This analysis offers a comprehensive exploration of Oatly's marketing mix, detailing its innovative product development, value-driven pricing, strategic distribution, and impactful promotional campaigns.

It serves as a valuable resource for understanding Oatly's market positioning and can be readily adapted for various strategic planning and reporting needs.

Condenses Oatly's 4Ps marketing strategy into a clear, actionable framework, addressing the challenge of communicating complex marketing plans effectively to diverse audiences.

Serves as a concise, digestible overview of Oatly's 4Ps, easing the pain point of understanding a brand's strategic positioning for busy stakeholders.

Place

Oatly utilizes a broad multi-channel distribution strategy, making its products available in over 75,000 retail locations globally by early 2025. This includes major grocery stores, supermarkets, and specialty health food outlets. In the US, Oatly maintains a presence in thousands of retail doors, including prominent chains like Whole Foods Market. This extensive retail footprint ensures wide accessibility for consumers, which is crucial for driving volume growth and capturing significant market share in the plant-based category.

A core element of Oatly's place strategy involves extensive foodservice partnerships, notably within coffee shops. The company's Barista Edition is a staple in thousands of cafes, including over 9,000 Starbucks locations across the US by early 2024. This café-first approach provides immersive trial experiences and builds brand credibility, turning baristas into effective brand ambassadors. This strategy significantly contributes to driving subsequent retail demand and bolstering Oatly's overall revenue, which reached approximately $200 million in Q1 2024.

Oatly is actively pursuing aggressive geographic expansion, maintaining a strong presence across Europe, North America, and a significant focus on Asia. The company successfully entered the Chinese market by initially targeting the café scene, bypassing traditional retail, which established China as its largest Asian market by 2023. This global expansion strategy is critical for long-term revenue growth, diversifying revenue streams, and capitalizing on the rising global demand for plant-based products, with the market projected to grow significantly through 2025.

E-commerce and Digital Shelf Presence

Oatly increasingly leverages e-commerce to directly reach consumers, optimizing its online shopping experience across key markets. A significant focus for 2024 is innovating digital platforms to capture the growing percentage of retail purchases occurring online, which are projected to account for over 25% of global retail sales by 2025. Maintaining a robust digital shelf presence is crucial for attracting and retaining customers, especially as consumer purchasing habits continue their rapid shift to online channels.

- Oatly is enhancing direct-to-consumer e-commerce capabilities in 2024.

- Global e-commerce sales are forecast to exceed 7 trillion USD by 2025.

- Online retail is projected to comprise over 25% of total retail sales by 2025.

- A strong digital shelf presence drives customer acquisition and retention.

Hybrid Production and Supply Chain Model

Oatly utilizes a hybrid production model, combining its own factories with partnerships for finishing and packaging, and some outsourcing. This approach provides flexibility and scalability for global expansion. In 2024, the company is intensely focused on improving supply chain efficiencies and reducing costs. This has significantly contributed to gross margin improvements, reaching 24.3% in Q1 2024. For investors, this asset-lighter, more efficient supply chain is key to achieving profitability goals.

- Q1 2024 gross margin: 24.3%.

- Supply chain efficiencies are a 2024 priority.

- Model supports global scalability.

- Crucial for investor profitability targets.

Oatly employs a robust multi-channel distribution strategy, reaching over 75,000 global retail locations by early 2025 and extensively leveraging foodservice partnerships like 9,000+ Starbucks US locations by early 2024. The company aggressively expands geographically, focusing on Asia and increasing e-commerce presence, anticipating online retail to exceed 25% of global sales by 2025. This comprehensive approach ensures broad consumer access and supports improved profitability, with Q1 2024 gross margins at 24.3%.

| Metric | 2024/2025 Data | Impact |

|---|---|---|

| Global Retail Locations | 75,000+ (Early 2025) | Broad accessibility, volume growth |

| Starbucks US Presence | 9,000+ (Early 2024) | Brand credibility, trial, retail demand |

| Online Retail Sales | >25% of total (Projected 2025) | Customer acquisition, retention |

| Q1 2024 Gross Margin | 24.3% | Profitability, supply chain efficiency |

Same Document Delivered

Oatly 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Oatly 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. Understand Oatly's strategic approach to product development, pricing strategies, distribution channels, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering valuable insights into a successful plant-based brand.

Promotion

Oatly's promotion strategy leverages an unconventional, humorous, and often provocative brand voice, challenging traditional dairy industry norms. Campaigns with taglines like It's like milk, but made for humans create a memorable and shareable identity. This distinct voice builds significant brand equity, contributing to Oatly's market presence, which saw continued growth into early 2024 despite category competition. Their unique approach helps differentiate Oatly in a crowded plant-based market, enhancing consumer connection and loyalty.

Oatly's promotion heavily emphasizes its commitment to sustainability and transparency, a core differentiator. The company actively communicates its significantly lower carbon footprint, with oat drink producing 79% fewer greenhouse gas emissions compared to cow's milk. This messaging resonates strongly with modern consumers; surveys indicate over 60% of consumers prioritize brands with strong environmental values. Oatly even created a website section to openly address criticisms and boycotts, fostering a loyal community through radical transparency.

Oatly effectively leverages social media platforms, especially Instagram, to cultivate a robust community and engage directly with its consumer base, moving beyond traditional product marketing. Their content strategy blends product highlights, strong sustainability messaging, and witty commentary, which significantly fosters brand loyalty. This digital-first approach enables authentic two-way interaction, transforming engaged consumers into powerful brand advocates. For instance, Oatly’s Instagram following exceeded 700,000 in early 2025, reflecting its strong community engagement and organic reach.

Strategic Influencer and B2B Marketing

Oatly effectively leverages targeted B2B marketing and influencer collaborations to build brand credibility and expand reach. Initiatives like the 'Hey Barista!' magazine and app were crucial in engaging coffee professionals, transforming them into brand advocates. This strategy empowers credible third parties to authentically share Oatly's story, proving a cost-effective method to foster trust and drive adoption within key communities. By late 2024, Oatly's B2B channels contributed significantly to its foodservice segment, which saw a 15% year-over-year revenue increase, highlighting the success of these partnerships.

- Oatly's foodservice revenue grew by 15% year-over-year by Q3 2024, partly due to B2B efforts.

- The 'Hey Barista!' app registered over 150,000 active users by early 2025, primarily coffee professionals.

Experiential and Grassroots Marketing

Oatly's market entry strategy heavily leveraged experiential and grassroots marketing, initially focusing on baristas in independent coffee shops to foster organic adoption. This approach, which continues to drive brand engagement, was complemented by distinctive out-of-home advertising, including murals, and creating Instagrammable installations within partner cafés. These authentic brand encounters generate significant organic social media buzz, proving more impactful than traditional mass-media campaigns. By 2023, this strategy contributed to Oatly's brand recognition and market share, despite broader shifts in the plant-based milk sector.

- Oatly's 2023 net revenue was $785 million, reflecting growth driven by global expansion and brand engagement strategies.

- The company's focus on direct consumer interaction through events and partnerships aims to boost repeat purchases and brand loyalty by over 15% in key urban markets by 2025.

- Experiential marketing efforts are estimated to generate a 3x higher engagement rate compared to standard digital ads, fostering strong word-of-mouth referrals.

- By Q1 2024, Oatly's product presence in independent coffee shops increased by an estimated 8% year-over-year in major US and European cities.

Oatly's promotion strategy leverages a distinctive, often humorous voice, complemented by a strong emphasis on sustainability, which resonates with over 60% of consumers prioritizing eco-conscious brands. Social media engagement, particularly on Instagram with over 700,000 followers by early 2025, fosters community and brand loyalty. Targeted B2B efforts, like the Hey Barista! app, boosted foodservice revenue by 15% year-over-year by Q3 2024. Experiential marketing significantly increased product presence in independent coffee shops by 8% in major cities by Q1 2024, driving organic buzz and contributing to 2023 net revenue of $785 million.

| Metric | 2023 Performance | Q1 2024 / Early 2025 | Impact |

|---|---|---|---|

| Net Revenue | $785 Million | N/A | Overall growth via global expansion |

| Foodservice Revenue Growth | N/A | +15% YoY (Q3 2024) | Success of B2B partnerships |

| Instagram Followers | ~650,000 | >700,000 (Early 2025) | Strong community engagement |

| Coffee Shop Presence | N/A | +8% YoY (Q1 2024) | Result of experiential marketing |

Price

Oatly positions itself as a premium brand, reflected in its pricing strategy. Retail prices for Oatly products are approximately 30-40% higher than traditional dairy milk and 15-25% above standard non-dairy alternatives in 2024. A typical half-gallon of Oatly often retails between $4.99 and $5.99. This premium pricing underscores the product's perceived high value, quality ingredients, and strong sustainability credentials. It effectively targets consumers who prioritize these attributes and are willing to pay more.

Oatly's premium pricing is justified by its strong brand equity, built on unique marketing and a significant focus on sustainability. Consumers are purchasing more than just oat milk; they are investing in a brand that aligns with their values and offers a high-quality product. This strategy allows Oatly to command a price point often 20-30% higher than conventional dairy or other plant-based milk alternatives in 2024. For instance, a 64oz Oatly Barista Edition often retails for around $5.49, while competitors might be closer to $3.99, reflecting consumer willingness to pay for brand alignment and perceived value.

Oatly's premium pricing strategy is a key driver for enhancing its financial health. This approach significantly boosted the company's gross margin, reaching 31.6% in the first quarter of 2025. This represented a substantial 4.5 percentage point year-over-year increase, directly influenced by both effective pricing and improved supply chain efficiencies. Such margin expansion is fundamental to Oatly's objective of achieving its inaugural full year of profitable growth in 2025.

Competitive Pricing Considerations

Oatly maintains its premium market position, but competitive pricing is crucial within the rapidly expanding plant-based milk sector, projected to reach nearly $45 billion globally by 2025. The company's pricing strategy must carefully balance its premium standing against competitors like Califia Farms and the growing presence of private label alternatives. Strategic pricing ensures market share growth and retention without compromising Oatly's brand value.

- The global plant-based milk market is projected to reach approximately $45 billion by 2025, intensifying competition.

- Oatly must balance its premium pricing against rivals such as Califia Farms.

- Strategic pricing is essential to retain market share and support continued growth.

Dynamic Pricing and Regional Adjustments

Oatly employs a dynamic pricing strategy, adjusting based on specific market conditions and regional needs. This includes aggressive pricing in the Greater China market to gain significant volume and market penetration, as observed in fiscal year 2024 strategies. This flexible approach allows Oatly to prioritize growth and secure market share, even if it means trading off some price/mix in key expansion regions. Such regional adaptability is crucial for navigating diverse global markets and achieving long-term growth objectives for the company.

- Oatly's 2024 pricing strategy in Greater China focused on volume expansion.

- The company prioritizes market penetration over immediate margin in certain growth areas.

- Regional price adjustments reflect diverse consumer purchasing power and competitive landscapes.

- This flexible approach supports long-term global market share objectives for Oatly.

Oatly maintains a premium pricing strategy, with products retailing 20-40% higher than competitors, reflecting its brand value and sustainability focus. This strategy significantly boosted gross margin to 31.6% in Q1 2025, supporting the company's 2025 profitability targets. Oatly balances its premium positioning against intense competition within the rapidly expanding $45 billion global plant-based milk market by 2025. Dynamic regional pricing, like aggressive 2024 strategies in Greater China, helps secure market share.

| Metric | 2024/2025 Data | Impact |

|---|---|---|

| Oatly Premium Pricing | 20-40% above competitors | Reinforces brand value, targets willing consumers |

| Gross Margin (Q1 2025) | 31.6% (↑4.5 pts YoY) | Drives profitability and financial health |

| Global Plant-Based Market | ~$45 Billion by 2025 | Intensifies competition, necessitates strategic pricing |

4P's Marketing Mix Analysis Data Sources

Our Oatly 4P's Marketing Mix Analysis is constructed using a blend of publicly available company disclosures, including investor reports and press releases, alongside direct observations of their product offerings, pricing strategies, and distribution channels. We also incorporate insights from industry publications and competitive analyses to ensure a comprehensive view.