Oatly Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oatly Bundle

Oatly navigates a dynamic plant-based milk market, facing intense rivalry from established dairy giants and agile startups alike. The threat of new entrants is moderately high, as the barrier to entry for oat milk production is not prohibitively expensive, though brand loyalty and scale offer advantages to incumbents.

The bargaining power of buyers, primarily consumers and retailers, is significant due to the proliferation of alternatives and price sensitivity in the grocery sector. Suppliers, particularly oat growers, hold some leverage, but the availability of alternative crops can temper their influence.

The threat of substitutes is a crucial consideration, with numerous plant-based milk options like almond, soy, and cashew milk constantly vying for consumer attention. This intense competitive landscape shapes Oatly's strategic decisions and market positioning.

The complete report reveals the real forces shaping Oatly’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global supply of high-quality oats, crucial for plant-based milk production, is notably concentrated among a few key players, particularly in regions like North America and Scandinavia. This limited number of specialized suppliers grants them considerable bargaining power over pricing and contract terms. As of 2024, the top five oat suppliers account for a substantial portion of the global market. This market structure allows suppliers to dictate higher prices, impacting Oatly's raw material costs and profitability.

Oatly's brand commitment to sustainability necessitates sourcing certified organic and sustainably farmed oats, which are premium ingredients. The demand for these specialized oats is growing faster than the available supply, significantly increasing the bargaining power of farmers and suppliers who meet these stringent standards. In 2024, the market for organic oats experienced a notable price increase, with some reports showing price surges of over 15% due to this high demand and limited supply. This reliance on a niche supply chain means Oatly faces higher input costs and potential supply chain vulnerabilities.

Oat production for Oatly is highly vulnerable to agricultural challenges like drought and adverse temperature variations, which can significantly reduce crop yields and quality. These climate-related issues, coupled with broader supply chain constraints observed throughout 2024, create shortages and increase price volatility for key ingredients. Such disruptions strengthen the bargaining position of reliable suppliers, as evidenced by rising raw material costs for many food manufacturers. This directly impacted Oatly's production expenses, reflecting the increased leverage of oat and other input suppliers.

Supplier certifications and unique capabilities

Suppliers providing certified organic or gluten-free oats hold significant bargaining power over Oatly. Oatly’s strong brand identity is built on these specialized product attributes, making it difficult to switch to non-certified or conventional sources without impacting its core promises. The global market for organic food, including oats, continues to expand, with projections showing steady growth through 2024, further empowering these niche suppliers with increased pricing leverage due to rising demand for their certified crops.

- Oatly’s dependence on specific organic and gluten-free oat suppliers creates high switching costs.

- The certified organic food market was valued at approximately $190 billion in 2023, showing sustained growth.

- Rising consumer demand for plant-based and certified products enhances supplier leverage.

Supplier concentration and contract terms

The oat supply market exhibits high concentration, meaning a few key players can significantly influence pricing and availability. This limits Oatly's ability to negotiate favorable terms, as there are often a constrained number of viable alternative suppliers for high-quality oats. The average contract duration in the agricultural commodities sector, including oats, is relatively short, often less than one year, exposing Oatly to frequent price renegotiations and potential volatility in raw material costs, impacting profitability.

- Oat production for 2024/2025 is projected at 23.4 million metric tons globally, indicating a concentrated supply base.

- Major oat-producing regions, such as Canada and the European Union, hold significant market power.

- Oatly's ingredient costs, primarily oats, were a substantial portion of its cost of goods sold in recent fiscal periods.

- Short-term contracts, typical in agricultural sourcing, expose Oatly to quarterly or bi-annual price adjustments.

Oatly faces strong supplier bargaining power from concentrated organic oat sources, particularly in North America and Scandinavia. The demand for certified organic oats, with prices rising over 15% in 2024, strengthens supplier leverage. Short-term contracts and climate vulnerabilities further expose Oatly to raw material cost volatility and high switching costs for its specialized ingredients.

| Metric | 2024 Data | Impact |

|---|---|---|

| Organic Oat Price Increase | >15% | Higher COGS |

| Global Oat Production (MMT) | 23.4 | Concentrated Supply |

| Organic Food Market Value | ~$190B (2023) | Demand-driven Power |

What is included in the product

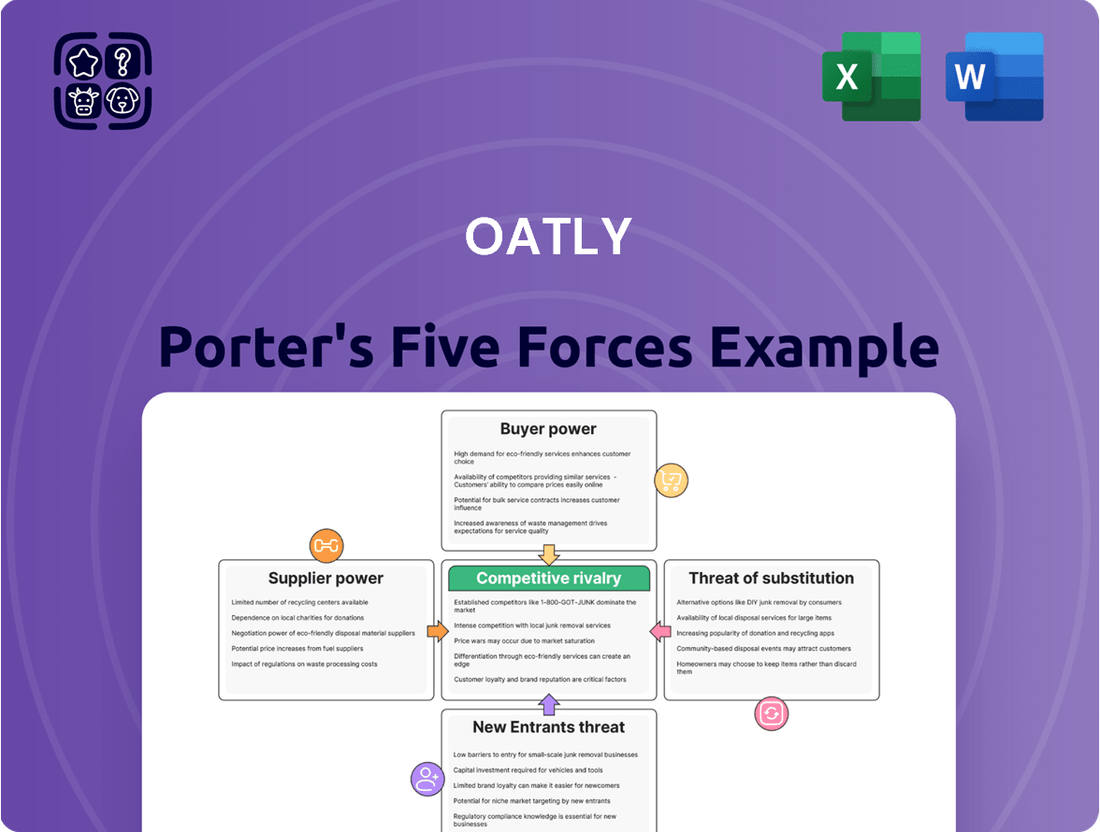

Analyzes the competitive intensity and profitability potential for Oatly by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and existing rivalry.

Visualize competitive intensity across all five forces—effortlessly identifying Oatly's strategic vulnerabilities and opportunities.

Customers Bargaining Power

Consumers face minimal costs when switching plant-based milk brands, giving them significant power. The market is highly saturated; for instance, the global plant-based milk market was valued at over $22 billion in 2024, offering numerous alternatives to Oatly. Customers can easily choose options based on price, taste, or promotions, which encourages competitive pricing among producers. This low friction empowers consumers to frequently shift preferences, impacting brand loyalty and sales volumes.

Oatly's customers possess strong bargaining power due to the vast array of choices available, extending beyond just oat milk brands to include dairy and other plant-based alternatives like almond, soy, and coconut milk. The global plant-based milk market, estimated at approximately USD 30.5 billion in 2024, reflects this extensive consumer choice. This wide selection means consumers can easily switch to competitors, pressuring Oatly to maintain a strong value proposition and competitive pricing. Such market dynamics necessitate continuous innovation and differentiation from Oatly.

Consumers exhibit significant price sensitivity, particularly as private-label oat milk options from major retailers have entered the market at considerably lower price points. This keen awareness of cost can impede the broader adoption of premium-priced brands such as Oatly, especially given economic uncertainties observed in 2024. Recent market analyses indicate that price remains a primary determinant for many consumers when selecting plant-based milk alternatives. For instance, private label oat milk can be 20-30% cheaper than leading brands, influencing purchasing decisions.

Influence of large retail and foodservice customers

The influence of large retail and foodservice customers significantly impacts Oatly. Major players like Starbucks and large grocery chains wield substantial bargaining power due to their immense purchase volumes. For instance, in 2024, these key B2B customers can often negotiate favorable pricing and extended payment terms, directly influencing Oatly's profitability and distribution strategies. While securing and maintaining these large accounts is crucial for market penetration and scale, it often comes at the cost of reduced margins for Oatly, impacting their financial performance.

- Major retailers and coffee chains hold significant leverage.

- Volume purchases enable favorable pricing negotiations.

- Impacts Oatly's profitability and distribution strategies.

- Gaining large accounts reduces margins but ensures market presence.

Access to information and brand perception

Today's consumers are highly informed, accessing extensive information on product health impacts and sustainability claims. Negative press or misinformation can quickly shift purchasing decisions, as seen with online discussions regarding environmental footprints. Oatly must actively manage its brand image and counter misinformation to retain customer loyalty in this transparent market.

- Global plant-based milk market reached $22.6 billion in 2024, driven by consumer health and environmental awareness.

- Social media sentiment significantly impacts brand perception, with 70% of consumers trusting online reviews.

- Oatly's brand perception is crucial for its market share, which stood at approximately 4.5% of the global plant-based milk market in 2024.

- Consumer scrutiny over sustainability claims, like water usage or carbon footprint, directly influences purchasing choices.

Customers hold significant power due to low switching costs and a highly saturated market, valued at over $30.5 billion in 2024, offering diverse plant-based alternatives. Price sensitivity is high, with private labels 20-30% cheaper, impacting Oatly's premium pricing. Large retailers also wield substantial leverage, negotiating terms for volume purchases.

| Factor | Impact on Oatly | 2024 Data |

|---|---|---|

| Switching Costs | Low | Global plant-based market $30.5B |

| Price Sensitivity | High | Private labels 20-30% cheaper |

| Retailer Influence | Significant | Volume purchases drive negotiations |

Full Version Awaits

Oatly Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase, detailing a comprehensive Porter's Five Forces analysis of Oatly. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the oat milk industry. The document you see here is the same professionally written analysis you'll receive—fully formatted and ready to use.

Rivalry Among Competitors

The plant-based milk market is intensely competitive, featuring a high number of direct and indirect rivals for Oatly. Global brands like Danone's Silk, Alpro, and Califia Farms dominate significant segments, alongside a growing array of private-label products. Oatly faces stiff competition not only from other oat milk producers but also from diverse alternatives such as almond and soy milk. In 2024, the market remains highly contested, with dozens of active competitors vying for consumer preference and market share.

Competitors in the plant-based milk sector aggressively invest in marketing and brand-building to capture consumer attention. This high level of promotional spend, crucial for differentiation, is evident as companies vie for market share. Oatly itself reported significant selling, general, and administrative expenses, which include marketing, totaling $103.5 million for the full year 2023, reflecting intense competitive pressure. Such substantial investments are necessary to stand out in a crowded market and foster brand loyalty among consumers.

The global plant-based food and beverage market is experiencing rapid expansion, attracting a continuous stream of new entrants. This dynamic environment means competitive pressures are constantly evolving, requiring established players like Oatly to be agile. The market value, projected to reach over $74 billion by 2024, highlights this intense growth. Such rapid expansion necessitates innovation from Oatly to protect its market share against numerous competitors.

Product differentiation as a key strategy

To compete effectively in the plant-based milk market, companies heavily focus on differentiating their products through aspects like taste, nutritional value, sustainability credentials, and innovative packaging. Oatly has historically stood out with its distinctive branding and high-quality offerings, especially its Barista Edition, which captured significant market share by 2024. However, competitors are increasingly adopting similar strategies, making sustained differentiation a constant challenge for Oatly.

- Oatly's 2024 Barista Edition sales remain a key differentiator.

- New market entrants are mirroring Oatly's branding and product focus.

- Sustainability claims are now a standard expectation, not a unique selling point.

- The global plant-based milk market is projected to reach $61.05 billion by 2029, intensifying rivalry.

Presence of large, diversified food companies

Oatly faces intense competitive rivalry from large, diversified food and beverage companies like Danone and Nestlé, who have aggressively entered the plant-based market. These established giants leverage their extensive distribution networks, strong brand recognition from their traditional product lines, and substantial financial backing. For instance, Danone’s plant-based sales reached approximately €3.2 billion in 2023, showcasing their scale. This formidable presence creates significant pressure on specialized players such as Oatly, impacting market share and pricing strategies.

- Danone’s plant-based sales reached approximately €3.2 billion in 2023.

- Nestlé continues to expand its Garden Gourmet and Wunda brands globally in 2024.

- Large competitors allocated significant marketing budgets, often exceeding Oatly’s, for their plant-based lines in 2024.

Oatly faces intense rivalry in the plant-based milk market, marked by numerous competitors and aggressive marketing. Large players like Danone (with €3.2 billion in plant-based sales in 2023) leverage scale and distribution. Innovation and differentiation, crucial for Oatly's Barista Edition, are increasingly mirrored by new entrants in 2024, challenging its unique selling points.

| Competitor Type | Impact on Oatly | 2024 Trend |

|---|---|---|

| Global Food Giants | Market share pressure, pricing strategies | Increased plant-based portfolio expansion |

| Specialized Plant-Based Brands | Direct competition in oat/almond milk | Mimicking Oatly's branding/product focus |

| Private Labels | Price competition, consumer choice | Growing presence in retail channels |

SSubstitutes Threaten

The primary substitutes for Oatly's oat-based products are other widely available plant-based milks, including almond, soy, coconut, and rice milk. These alternatives are well-established, offering consumers diverse choices based on taste profiles, nutritional content, and price points. As of 2024, almond milk continues to dominate the plant-based milk market, holding approximately 60% of the U.S. market share, with soy milk remaining a strong competitor. This broad availability and consumer preference for established alternatives present a significant competitive threat to Oatly's market position. The ease with which consumers can switch between these options heightens the pressure on Oatly to differentiate its offerings.

Conventional dairy milk remains a formidable substitute, deeply ingrained as the default choice for most consumers globally. Despite the growth of plant-based options, the established dairy industry benefits from long-standing consumer habits and widespread availability. Its lower price point, often around $3-4 per gallon in early 2024 compared to oat milk's higher per-ounce cost, is a significant draw. This cost advantage, combined with perceived nutritional benefits, ensures traditional milk continues to be a major competitor to Oatly.

Consumers have the option to make their own plant-based milk at home, which can be a significantly cheaper alternative to commercial offerings like Oatly. The availability of numerous online recipes and simple preparation methods for homemade oat milk poses a tangible threat. While convenience favors store-bought products, the potential cost savings of a do-it-yourself approach are appealing to budget-conscious consumers, especially given persistent food inflation trends observed in 2024. This DIY trend offers a direct substitute for a fraction of the price, impacting market share for branded solutions.

Emerging and novel milk alternatives

The threat of substitutes for Oatly intensifies with rapid innovation in the food technology space. Emerging milk alternatives, like those derived from peas and hemp, are expanding consumer choices, with the global pea protein market projected to grow significantly in 2024. Furthermore, advancements in cellular agriculture and precision fermentation are poised to create lab-grown dairy proteins, representing a profound long-term disruption to the entire milk market.

- The global plant-based milk market size was valued at over $20 billion in 2023, with continued growth expected in 2024.

- Newer alternatives like pea milk and potato milk are gaining traction, diversifying the competitive landscape beyond traditional soy and almond.

- Investments in precision fermentation startups reached significant levels in 2023, signaling future market entry of lab-grown dairy.

- This technological evolution creates a powerful long-term substitution risk for established plant-based brands like Oatly.

Other beverage categories

Beyond traditional milk and milk alternatives, consumers have a vast array of other beverages, including water, juice, tea, and coffee. While these are not direct replacements for all uses of oat milk, they intensely compete for a consumer's 'share of throat,' especially for hydration or refreshment. The global non-alcoholic beverage market, encompassing these categories, was valued at over $1.1 trillion in 2023, showcasing the immense competitive landscape. Consumers often make beverage choices based on immediate needs, with coffee and tea consumption remaining robust in 2024, and bottled water sales continuing their upward trend.

- Global non-alcoholic beverage market size reached over $1.1 trillion in 2023.

- Consumers consider water, juice, tea, and coffee as alternatives for hydration and refreshment.

- Situational consumption drives choices away from milk alternatives for many occasions.

- Tea and coffee remain dominant beverage categories globally in 2024.

Oatly faces significant threats from established plant-based milks, with almond milk holding about 60% of the U.S. market share in 2024, and from cheaper conventional dairy milk, often $3-4 per gallon. Emerging alternatives like pea milk and future lab-grown dairy proteins, fueled by 2023 investments in precision fermentation, also pose a growing risk. Additionally, consumers frequently choose other beverages like water, juice, tea, and coffee, which compete for share in the over $1.1 trillion global non-alcoholic beverage market.

| Substitute Category | Key Examples | 2024 Market Data/Trend |

|---|---|---|

| Other Plant-Based Milks | Almond, Soy, Coconut, Rice | Almond milk ~60% U.S. market share. Global plant-based milk market over $20B in 2023. |

| Conventional Dairy Milk | Cow's Milk | Often $3-4 per gallon; deeply ingrained consumer habit. |

| Emerging Alternatives | Pea Milk, Hemp Milk, Lab-Grown Dairy | Pea protein market growing; significant 2023 investments in precision fermentation. |

| Other Beverages | Water, Juice, Tea, Coffee | Global non-alcoholic beverage market over $1.1T in 2023; robust tea/coffee consumption. |

Entrants Threaten

While building a strong brand like Oatly is challenging, the fundamental technology for producing oat milk is not proprietary, enabling new companies to enter the market with relative ease. The expanding plant-based milk market, projected to exceed $35 billion globally by 2024, acts as a significant incentive for new players. This low barrier to entry is evident in the numerous plant-based milk brands launched recently, intensifying competition.

The threat from private label competition is high for Oatly, as major retailers like Kroger and Target have successfully launched their own oat milk products. These store brands leverage existing distribution and prominent retail space, often at a lower price point, with some private-label oat milks retailing for under $3 per carton in 2024. This directly challenges established brands, posing a substantial threat to Oatly’s market share. This trend puts significant downward pressure on prices and profit margins across the entire plant-based milk industry, intensifying competition.

Securing prime shelf space in major supermarkets and forging partnerships with large foodservice chains presents a significant hurdle for new entrants in the plant-based dairy market. Established players like Oatly have already cultivated robust relationships and extensive distribution networks, which are incredibly difficult for new brands to replicate quickly. For instance, Oatly's widespread availability in 2024 across key retailers and coffee shops exemplifies this deeply entrenched access. This formidable barrier to entry creates a substantial competitive advantage for incumbent companies.

Brand recognition and marketing scale are significant hurdles

Building a strong, recognizable brand like Oatly demands significant and sustained investment in marketing and advertising. New entrants face an uphill battle, competing for consumer attention in a crowded plant-based dairy market against brands with established loyalty and high visibility. Overcoming this brand barrier is a major challenge, as consumers often stick with trusted names. Oatly, for instance, has invested heavily in its distinct brand identity, making it difficult for newcomers to quickly gain traction and market share.

- Oatly's brand recognition is a formidable barrier to entry.

- New entrants require substantial marketing budgets to compete.

- Established consumer loyalty favors existing brands like Oatly.

- The cost of building awareness deters potential competitors in 2024.

Economies of scale and production efficiency

Oatly, as an established leader in the oat milk market, leverages significant economies of scale in raw material sourcing and production. This allows for lower unit costs, a crucial advantage that new entrants find challenging to replicate. For instance, Oatly’s 2024 operational improvements continue to enhance its production efficiency, making it difficult for smaller players to compete on price without severely impacting their margins. New companies entering the plant-based dairy sector face substantial capital outlays to achieve similar efficiencies.

- Oatly’s established supply chains significantly reduce per-unit production costs.

- New entrants struggle with higher initial production costs, impacting price competitiveness.

- Oatly’s ongoing efficiency gains further widen the cost gap for new competitors.

The threat of new entrants for Oatly is mixed. While the basic technology for oat milk is accessible, the expanding plant-based market, projected over $35 billion globally by 2024, incentivizes new players, including private labels selling for under $3 per carton. However, securing prime shelf space, building a strong brand, and achieving Oatly's economies of scale remain significant hurdles for newcomers in 2024.

| Factor | Threat Level | 2024 Impact |

|---|---|---|

| Technology Accessibility | High | Low barrier to entry |

| Market Growth | High | Market >$35B globally |

| Private Label | High | Products <$3/carton |

| Distribution & Brand | Low | Oatly's established presence |

| Economies of Scale | Low | Oatly's cost advantage |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Oatly leverages a robust data foundation, drawing from publicly available financial reports, industry-specific market research, and competitor disclosures. We also incorporate insights from trade publications and economic databases to ensure a comprehensive understanding of the competitive landscape.