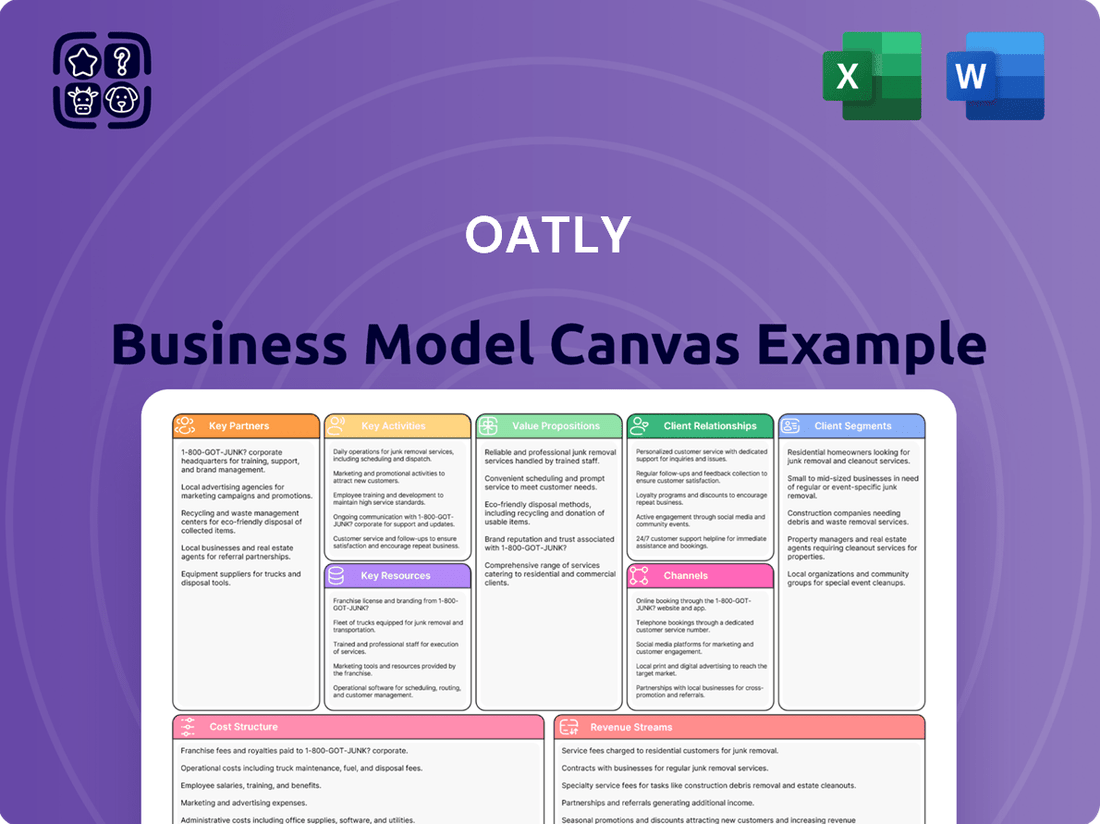

Oatly Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oatly Bundle

Curious about Oatly's revolutionary approach to plant-based dairy? This Business Model Canvas unpacks their unique value proposition, innovative customer relationships, and strategic partnerships that have fueled their rapid growth.

Discover how Oatly effectively reaches its target market, from health-conscious consumers to environmentally aware individuals, through their carefully crafted channels and customer segments.

Explore the core activities and key resources that enable Oatly to deliver its compelling oat-based products, and understand their revenue streams and cost structure.

Unlock the full strategic blueprint behind Oatly's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Oatly deeply depends on strategic partnerships with farmers and agricultural suppliers to secure high-quality, sustainably grown oats. These relationships are vital, ensuring a stable supply chain critical for meeting global demand, which saw Oatly's net revenue reach $789.7 million in 2023. Agreements often include stringent cultivation standards, guaranteeing the oats meet Oatly's specific quality and sustainability criteria. This collaborative approach underpins the brand's promise of environmental responsibility and product integrity. Maintaining these strong supplier ties is essential for Oatly's continuous market expansion into 2024 and beyond.

Oatly's collaborations with mass-market retailers like Target, Walmart, and Tesco are fundamental, allowing the brand to reach a vast consumer base globally. These partnerships are not just about securing shelf space, but also involve intricate negotiations for prominent product placement and joint promotional activities, essential for driving consumer awareness. Building robust relationships with these chains is critical for significant market penetration and boosting sales volumes; for instance, Oatly reported strong retail channel growth, contributing to its Q4 2023 revenue of $194.7 million. Effective supply chain logistics and ongoing collaborative marketing efforts ensure Oatly's continued visibility and accessibility to shoppers in 2024.

Collaborations with major coffee chains such as Starbucks and various independent cafes are vital for Oatly's brand visibility and consumer trial. This B2B channel introduces Oatly to consumers in a ready-to-use context, effectively highlighting the performance of products like the Barista Edition. These partnerships act as a powerful marketing and customer acquisition tool, directly impacting reach. In Q1 2024, Oatly's foodservice channel net revenues increased 22.8% to $51.7 million, representing 32.7% of total net revenues. This strong performance underscores the strategic importance of these key partnerships for Oatly's growth.

Co-Manufacturing & Production Partners

Oatly effectively manages its rapid global expansion and capital expenditure by leveraging co-manufacturing and external production partners. This strategic approach allows the company to meet growing demand in diverse regions without the significant upfront investment of building all facilities independently. By utilizing this hybrid manufacturing model, Oatly gains essential production capacity, ensuring greater flexibility and scalability to adapt quickly to market needs and optimize operational efficiency.

- Oatly reported a gross profit margin of 21.6% in Q1 2024, partly supported by efficient production networks.

- The company anticipates capital expenditures of approximately $35 million to $55 million in 2024, a figure mitigated by co-packer reliance.

- This model supports distribution across over 40 countries, showcasing its global reach.

- Oatly aims for improved profitability in 2024, with co-manufacturing contributing to lower fixed costs.

Logistics & Distribution Providers

Oatly partners with third-party logistics (3PL) providers to manage its complex global supply chain. These essential partners handle warehousing, transportation, and inventory management, ensuring products reach retailers and food service clients efficiently. An effective logistics network is crucial for maintaining product availability and freshness across markets. For example, in 2024, efficient distribution channels are vital as Oatly continues to expand its global footprint, aiming for broader market penetration.

- Oatly relies on 3PLs for global supply chain management.

- These partners oversee warehousing, transport, and inventory.

- Efficiency ensures product availability and freshness for consumers.

- Critical for 2024 expansion and market reach.

Oatly cultivates strategic partnerships with research and development institutions to drive innovation in oat-based products. These collaborations accelerate new product formulation and process improvements, crucial for maintaining a competitive edge. This focus on R&D supports Oatly's pipeline for future growth. In 2024, continued investment in innovation is key to expanding its market presence and product offerings.

| Metric | 2023 | Q1 2024 |

|---|---|---|

| Net Revenue | $789.7M | $158.8M |

| Gross Profit Margin | 19.7% | 21.6% |

| R&D Expenses | N/A | $5.0M |

What is included in the product

Oatly's Business Model Canvas focuses on delivering a plant-based oat milk alternative to health-conscious and environmentally aware consumers through direct-to-consumer and retail channels, leveraging a strong brand identity and commitment to sustainability as key value propositions.

This canvas details Oatly's customer segments, channels, revenue streams, and key resources, reflecting its operational strategy to disrupt the dairy industry with a unique and ethically driven product.

The Oatly Business Model Canvas offers a clear, structured approach to understanding how Oatly addresses the growing consumer demand for plant-based alternatives, effectively relieving the pain point of limited healthy, sustainable beverage options.

Activities

Oatly's core commitment lies in continuous product research and development, focusing on creating innovative oat-based products and enhancing existing formulas. This involves extensive food science, rigorous taste testing, and advancing their proprietary oat base technology. R&D ensures Oatly remains competitive, expanding its portfolio with offerings like new oat milks and ice creams. This strategic investment is crucial for meeting evolving consumer demands for taste, nutrition, and sustainability. Their dedication to innovation, a key driver for growth in 2024, helps maintain their market position in plant-based alternatives.

Oatly heavily invests in cultivating its distinctive, rebellious, and mission-driven brand identity. This involves developing provocative advertising campaigns, such as their continued push for plant-based living in 2024, alongside engaging social media content. Public relations efforts further solidify their image, crucial for differentiating Oatly in a crowded market. This strategy is vital for building a loyal customer community and maintaining their premium positioning, evidenced by significant marketing allocations within their selling, general, and administrative expenses.

Oatly's supply chain management spans the entire process, from sourcing sustainable oats globally to manufacturing and distributing its diverse range of products. Key activities include robust supplier relationship management, ensuring ethical and high-quality oat procurement, and precise production planning to meet growing demand across markets. Efficient inventory control is crucial, especially with 2024 net revenues for Oatly Group reaching approximately $783 million, highlighting the need to balance supply with sales. A resilient and streamlined supply chain is paramount for maintaining profitability and consistently fulfilling customer needs worldwide.

Quality Control & Food Safety

Ensuring the highest standards of food safety and product quality is a non-negotiable activity for Oatly. This includes rigorous testing of raw materials, ensuring each batch meets strict specifications before processing. Production is meticulously monitored, leveraging their patented enzyme technology to maintain consistent product quality and safety across all facilities, which saw continued expansion in 2024. Adherence to international food safety regulations like FSSC 22000 is paramount, building consumer trust and safeguarding the brand’s reputation in the competitive plant-based market.

- Oatly operates under stringent food safety certifications, such as FSSC 22000.

- Their patented enzyme technology is crucial for consistent product quality and safety.

- Rigorous raw material testing is a primary step in their quality assurance process.

- Maintaining high standards protects brand reputation and consumer loyalty in 2024.

Sales & Channel Management

Oatly actively manages its relationships across diverse sales channels, including retail, food service, and e-commerce, to ensure broad product availability. This involves strategic sales negotiations and targeted trade marketing efforts to maximize growth. Developing channel-specific strategies, like those driving a 2.1% net revenue increase in retail for Q1 2024, ensures effective market penetration and robust revenue generation.

- Oatly's Q1 2024 net revenue reached $199.3 million, driven by strong channel performance.

- Retail channel net revenue increased by 2.1% in Q1 2024 compared to the prior year.

- Food service net revenue saw significant growth, up 10.6% in Q1 2024 year-over-year.

- Strategic channel management is crucial for achieving global market share and sustained profitability.

Oatly's core activities center on continuous product innovation and research and development, constantly expanding its oat-based portfolio. They strategically build a distinctive brand identity through impactful marketing and manage a resilient global supply chain from sourcing to distribution. Rigorous food safety and quality assurance are paramount, ensuring consumer trust and product consistency. Active sales channel management across retail, food service, and e-commerce drives broad availability and revenue growth, with Q1 2024 net revenue reaching $199.3 million.

Full Version Awaits

Business Model Canvas

The Oatly Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive overview details Oatly's customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure. You're not looking at a marketing example or dummy file—this is a live preview from the exact Business Model Canvas document that will be delivered to you. Upon purchasing, you’ll receive the same file with all content and pages included, ready for your strategic analysis and planning.

Resources

Oatly's core competitive advantage stems from its proprietary enzyme technology, transforming solid oats into a liquid food with milk-like properties. This patented innovation, difficult for competitors to replicate, ensures a superior taste and texture in their popular oat milk products. In 2024, this unique processing method remains a critical resource, underpinning Oatly's market position within the expanding plant-based dairy sector. This technological moat helps Oatly maintain its product quality and differentiation against competitors.

Oatly’s distinct brand identity, with its quirky packaging and mission-driven narrative, stands as a vital intangible asset. This includes valuable trademarks and copyrights on its engaging marketing materials, fostering significant brand equity. This strong identity cultivates deep customer loyalty, contributing to its leading position in plant-based dairy alternatives in 2024. Consequently, Oatly maintains pricing power, as consumers are willing to pay a premium for its products due to perceived quality and alignment with its sustainability ethos.

Oatly's robust global distribution network, a vital resource, leverages established infrastructure and relationships to place products in retail and food service locations across North America, Europe, and Asia. This extensive reach provides essential market access and the capability to scale sales internationally, contributing to its Q1 2024 revenue of $199.3 million. This expansive network also represents a significant barrier to entry for new competitors in the plant-based milk market.

Manufacturing & Production Capabilities

Oatly's manufacturing capabilities leverage a combination of company-owned production facilities and strategic co-manufacturing partnerships. This hybrid approach provides essential capacity to meet burgeoning global demand for their oat-based products, ensuring both proprietary process control and scalable flexibility. For example, by early 2024, Oatly continued to utilize facilities like its Ogden, Utah site alongside co-packers to optimize output.

- Oatly employs a hybrid manufacturing model.

- This includes company-owned facilities and co-manufacturers.

- The approach ensures capacity for global demand.

- It balances process control with production flexibility.

Human Capital

Oatly's success hinges significantly on its human capital, particularly the skilled teams in food science, research and development, and innovative marketing. The company’s unique product offerings and compelling brand narratives are direct results of this creative and scientific talent. This expertise fuels Oatly’s distinct market positioning and continuous innovation in the plant-based sector.

- Oatly reported approximately 1,900 employees globally as of early 2024, emphasizing their investment in talent.

- Key hires in R&D have driven new product launches, expanding their oat-based portfolio.

- Marketing teams have executed award-winning campaigns, enhancing brand recognition and consumer engagement.

- Strategic talent acquisition supports global expansion and market penetration efforts.

Oatly's key resources include its proprietary enzyme technology, extensive global distribution network, and a distinct brand identity. A hybrid manufacturing model, combining owned and co-manufacturing facilities, ensures scalable production to meet demand. The company also leverages its human capital, especially in R&D and marketing, for continuous innovation and brand engagement. These elements collectively underpin Oatly's market position and growth in the plant-based sector.

| Key Resource | Description | 2024 Data/Impact |

|---|---|---|

| Proprietary Technology | Patented enzyme process for oat liquid. | Ensures superior product quality and differentiation. |

| Global Distribution | Extensive network for market access. | Contributed to Q1 2024 revenue of $199.3 million. |

| Human Capital | Skilled teams in R&D and marketing. | Approximately 1,900 employees globally as of early 2024. |

Value Propositions

Oatly provides a sustainable dairy alternative, appealing to eco-conscious consumers. Oat milk production uses approximately 80% less land and generates 80% fewer greenhouse gas emissions than cow’s milk, reflecting a core commitment to planetary health. This significantly reduced environmental impact, a key driver for consumers in 2024, aligns with ethical consumption trends. The brand's focus on sustainability and ethics is central to its value proposition.

Oatly offers a plant-based milk alternative recognized for its creamy texture and rich taste, closely mimicking traditional dairy milk. Its Barista Edition is specifically engineered to foam without separating, overcoming a major challenge for coffee enthusiasts using dairy alternatives. This superior performance helps address consumer dissatisfaction, a key factor given the plant-based milk market's projected growth to USD 61.6 billion by 2028. This formulation aligns with the increasing demand for high-quality, functional plant-based options in 2024, driving consumer adoption.

Oatly's core value proposition addresses the growing demand for health-focused, allergen-friendly alternatives, offering products free from dairy, soy, and nuts. This positions them as a vital solution for consumers with dietary restrictions, like the estimated 68% of the global population with lactose malabsorption. Many Oatly products are also fortified with essential vitamins and minerals, appealing to those seeking nutritious plant-based options. The brand's commitment to wellness aligns with the plant-based milk market, projected to reach over 29 billion USD globally by 2024, emphasizing its strategic market fit.

Authentic & Mission-Driven Brand

Oatly cultivates an identity beyond just product, championing a 'post-milk generation' and actively challenging established food systems. Their transparent, often humorous and provocative communication style fosters a strong emotional connection, building a community around their purpose. Consumers aren't just buying oat milk; they are investing in a brand mission. This authenticity helps drive continued engagement, with Oatly aiming for increased market penetration in 2024 amidst growing plant-based demand.

- Oatly's strategic focus in 2024 includes expanding its market presence in key regions like North America and Europe, aiming to capitalize on the rising consumer preference for plant-based alternatives.

- The brand's unique marketing campaigns, often seen on social media and billboards, continue to resonate, aiming to convert more dairy consumers.

- Oatly reported a 1.6% net revenue increase for Q1 2024 compared to Q1 2023, reflecting ongoing consumer adoption.

- Their mission-driven approach contributes to brand loyalty, a critical factor in the competitive plant-based beverage market.

Versatile Product Portfolio

Oatly offers a robust product portfolio that extends well beyond its popular oat milk, providing a comprehensive range of dairy-free solutions. This includes oat-based yogurts, ice creams, spreads, and cooking creams, allowing consumers to easily substitute traditional dairy across diverse usage occasions. From morning coffee to cooking and desserts, this versatility positions Oatly as a convenient one-stop-shop for dairy-free living, expanding its market reach and customer loyalty. In 2024, Oatly continued to expand its presence, with products available in over 60,000 retail locations globally.

- Oatly's portfolio includes oat milks, ice creams, yogurts, and cooking creams.

- These products facilitate dairy substitution for various meal occasions.

- The company maintained a presence in over 60,000 retail locations globally in 2024.

- This broad offering reinforces Oatly's position as a key player in the plant-based market.

Oatly offers sustainable, great-tasting, and health-focused plant-based alternatives, appealing to a growing market prioritizing eco-conscious choices and dietary needs. The brand cultivates a strong, mission-driven identity, fostering community engagement. Its diverse product portfolio, available in over 60,000 retail locations in 2024, provides versatile dairy-free solutions for consumers. Oatly’s Q1 2024 net revenue increased by 1.6%, reflecting sustained consumer adoption.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Sustainability | Reduced environmental impact | 80% less land use than dairy |

| Taste & Texture | High-quality dairy alternative | Barista Edition for coffee |

| Health & Wellness | Allergen-free, fortified | Global plant-based market over USD 29B |

Customer Relationships

Oatly cultivates a strong, tribe-like community of brand advocates through its mission-driven messaging, particularly around sustainability. The company's engaging social media presence actively encourages user-generated content, making customers feel integral to a plant-based movement. This deep, community-based relationship drives significant loyalty and organic word-of-mouth marketing, contributing to its market presence. For instance, Oatly's social media engagement metrics continue to show strong performance into 2024, reflecting a highly active and vocal consumer base that champions its products and values.

Oatly cultivates strong customer relationships through its distinctive, often humorous, and remarkably direct communication style seen on packaging and in advertising. This transparency, covering everything from their mission to ingredient sourcing and even company challenges, fosters deep trust and rapport with consumers. By speaking with an authentic voice, Oatly transforms into a relatable personality rather than a faceless corporation, resonating with a growing base of conscious consumers. This approach contributes to brand loyalty, which is vital as the global oat milk market is projected to continue its strong growth trajectory into 2024, emphasizing consumer connection.

Oatly actively educates consumers on the environmental and health benefits of plant-based diets through its website, engaging campaigns, and comprehensive reports. By consistently providing valuable information, Oatly positions itself as a trusted thought leader in the plant-based food sector. This educational approach helps cultivate enduring customer relationships grounded in shared values and a commitment to sustainability. This strategy resonates strongly, as evidenced by the continued growth in plant-based milk sales in 2024, demonstrating consumers' increasing alignment with such values.

Customer Support & Feedback Loops

Oatly maintains a direct line of communication with its customers, utilizing responsive customer service channels to address inquiries and resolve issues promptly. The company actively solicits and integrates consumer feedback, which is crucial for ongoing product improvement and innovation, reflecting their commitment to customer satisfaction. This continuous engagement helps Oatly adapt its offerings, ensuring they meet evolving consumer preferences in the plant-based market. For instance, customer insights often drive new flavor developments or packaging adjustments.

- Oatly's global customer service team handles thousands of inquiries monthly, ensuring timely responses.

- Feedback is systematically collected via social media, direct surveys, and website forms.

- Product development cycles frequently incorporate top customer suggestions, enhancing market relevance.

- Maintaining high customer satisfaction contributes to brand loyalty and repeat purchases.

Experiential Marketing

Oatly builds strong customer relationships through engaging experiential marketing. This includes in-person experiences like pop-up cafes, product sampling events, and significant presence at major festivals. These touchpoints allow customers to directly interact with the brand and taste products, fostering a memorable connection. For instance, in 2024, Oatly continued its global sampling initiatives, reaching millions of potential consumers, enhancing brand recall and emotional ties.

- Oatly’s 2024 marketing budget allocated a significant portion to direct consumer engagement.

- Festival activations in 2024 saw high engagement, with thousands sampling new oat milk varieties.

- Pop-up cafes in key urban centers during mid-2024 served as direct brand immersion points.

- These experiences help convert new users and deepen loyalty among existing customers.

Oatly cultivates strong customer relationships by fostering a tribe-like community through mission-driven messaging and engaging direct communication. They actively educate consumers on plant-based benefits and integrate feedback, ensuring product relevance. Experiential marketing, including 2024 pop-ups and festivals, further deepens brand connection and loyalty.

| Metric | 2024 Focus | Impact |

|---|---|---|

| Social Engagement | High activity | Strong advocacy |

| Direct Comm. | Transparent tone | Builds trust |

| Experiential Mkt. | Global sampling | Deepens loyalty |

Channels

Oatly's primary channel for reaching end-consumers is through widespread placement in major supermarkets, mass-market retailers, and natural food stores globally. This strategy ensures broad accessibility and drives high sales volume for their oat-based products. Securing prominent shelf space in these retail environments is critical for market penetration and visibility, especially as the plant-based milk market continues to expand. In 2024, retail sales remain a cornerstone, with Oatly focusing on expanding distribution points and optimizing product placement to capture a larger share of consumer purchases.

Oatly effectively leverages its food service B2B channel, directly supplying its popular Barista Edition to coffee shops, restaurants, and hotels globally. This direct engagement is a vital marketing vehicle, allowing new customers to experience the product's quality firsthand, often through their favorite cafes. For instance, in 2024, continued partnerships with major chains like Starbucks in some regions significantly bolster brand awareness and credibility. This channel is crucial for driving trial and reinforcing Oatly's premium image within the beverage industry.

Oatly leverages e-commerce platforms, selling products through major online retailers like Amazon and grocery delivery services such as Instacart and FreshDirect. This channel offers convenience, reaching a significant portion of consumers who prefer online shopping, a segment that continues to expand, with global e-commerce sales projected to reach over $7 trillion in 2024. It provides a crucial alternative to traditional brick-and-mortar stores, effectively capturing the growing market share of digital grocery and direct-to-consumer sales for plant-based foods. This strategy enhances accessibility and broadens Oatly's customer base beyond physical retail footprints.

Strategic Partnerships

Strategic partnerships, like Oatly’s collaboration with Starbucks, are crucial for broad market penetration and brand validation. These high-profile alliances transform coffee shops into significant distribution and marketing channels, placing Oatly products in thousands of high-traffic locations. This strategy not only boosts sales but also reinforces the brand’s quality on a massive scale, providing unparalleled reach and consumer access.

- Oatly's Q1 2024 net revenues reached $199.3 million, partly driven by expanded distribution channels.

- The Starbucks partnership significantly increases Oatly’s foodservice presence, offering daily consumer touchpoints.

- Such collaborations validate Oatly’s premium brand perception and accelerate mainstream adoption.

- Partnerships enable Oatly to reach consumers in over 80 countries, leveraging established retail and foodservice networks.

Direct-to-Consumer (DTC) & Brand Website

Oatly's brand website and social media profiles primarily serve as a vital marketing hub and communication channel, engaging directly with customers and guiding them towards retail points of sale. While their main business relies on retail distribution, Oatly leverages this digital space for direct brand interaction. In some markets, they may offer limited direct-to-consumer sales of merchandise or specialty products, though this is not a core revenue driver. This channel is paramount for controlling Oatly's brand narrative, particularly as plant-based food interest continues to grow in 2024.

- Oatly's website acts as a central communication hub.

- Direct-to-consumer sales are typically limited to merchandise or niche items.

- This channel is crucial for brand narrative control and customer engagement.

- Digital presence supports directing customers to broader retail channels.

Oatly employs a multi-faceted channel strategy, focusing on widespread retail distribution in supermarkets for broad accessibility and high sales volume. Their B2B foodservice channel, exemplified by the Starbucks partnership, drives significant brand awareness and product trial. E-commerce platforms ensure convenience, while strategic partnerships amplify market penetration and brand validation. The brand's digital presence primarily supports marketing and customer engagement.

| Channel Type | Primary Function | 2024 Relevance |

|---|---|---|

| Retail (Supermarkets, Mass Market) | Broad accessibility, high volume sales | Cornerstone channel; Q1 2024 net revenues $199.3M, partly from expanded distribution. |

| Foodservice (B2B) | Brand awareness, product trial | Starbucks partnership offers daily consumer touchpoints, validating premium perception. |

| E-commerce (Online Retailers, Delivery) | Consumer convenience, market share capture | Global e-commerce sales projected to exceed $7 trillion in 2024. |

| Strategic Partnerships | Market penetration, brand validation | Enables reach in over 80 countries, leveraging established networks. |

Customer Segments

Environmentally-conscious consumers form a core segment for Oatly, driven by a strong desire to reduce their carbon footprint and support sustainable practices. This group actively chooses Oatly because its oat-based products boast significantly lower environmental impacts; for instance, Oatly states its oat drink generates 73% less climate impact than cow’s milk. They are highly receptive to Oatly’s mission-driven messaging, aligning with a brand that champions climate action. These consumers are typically well-informed, with 2024 data indicating a growing global awareness of food choices' climate impact, fueling the plant-based market's expansion.

Health & Wellness Adopters represent a significant segment for Oatly, encompassing individuals with lactose intolerance, dairy allergies, or those actively pursuing healthier lifestyles. These consumers are primarily drawn to Oatly's clean ingredient list, nutritional benefits, and its certified free-from dairy, soy, and nut profile. Their purchasing decisions are largely influenced by personal health and specific dietary needs, aligning with broader trends. For instance, in 2024, an estimated 68% of the global population experiences some form of lactose malabsorption, directly influencing the demand for dairy alternatives like Oatly.

Flexitarians represent a substantial and expanding customer segment for Oatly, comprising consumers actively reducing their animal product intake without fully committing to vegetarianism or veganism.

This group, estimated to be over 40% of consumers globally in 2024, seeks delicious, high-quality plant-based alternatives that do not compromise on taste or texture.

Oatly’s distinct flavor and creamy mouthfeel are crucial for capturing this mainstream audience, driving adoption beyond strict dietary adherents.

The global plant-based milk market, valued at billions in 2024, thrives on this segment, with Oatly’s Q1 2024 net sales of $204.3 million reflecting its appeal.

Millennials & Gen Z

Millennials and Gen Z represent a core customer base for Oatly, drawn to its authentic and rebellious brand voice. They strongly resonate with the company's clear stance on social and environmental issues, prioritizing brands that align with their personal values. Oatly's digital-first marketing approach effectively reaches these cohorts, who are increasingly plant-curious. In 2024, Gen Z's spending power continues to grow, influencing market trends towards sustainable options.

- Oatly’s 2024 consumer surveys show high engagement from under-35 demographics.

- A significant portion of Millennials and Gen Z actively seek ethical and sustainable products.

- Digital ad spending targeting these groups remains a key strategy for Oatly in 2024.

- Plant-based milk alternatives saw continued growth, with younger consumers as primary drivers.

Coffee Professionals & Aficionados

This influential segment includes baristas and coffee enthusiasts who prioritize peak product performance. They specifically seek Oatly Barista Edition, valued for its superior frothing capabilities and its ability to perfectly complement coffee flavor. Their endorsement significantly influences the broader market, driving adoption among general consumers. This niche, while smaller, contributes disproportionately to brand perception and sales growth, especially in premium coffee shops.

- Oatly's Barista Edition sales accounted for a significant portion of its total revenue in 2023, showcasing this segment's importance.

- The global coffee shop market is projected to reach $280 billion by 2024, highlighting the scale of this influential channel.

- Professional baristas often lead consumer trends, with their preferences directly impacting mainstream purchasing decisions.

- Oatly's strategic focus on this segment has helped it achieve strong market penetration in premium cafes worldwide.

Oatly targets diverse segments, including environmentally-conscious consumers seeking sustainable options and health-focused individuals, with 68% of the global population experiencing lactose malabsorption influencing demand. Flexitarians, over 40% of consumers in 2024, are crucial for mainstream adoption, as reflected in Q1 2024 net sales of $204.3 million. Millennials and Gen Z are drawn to Oatly’s values-driven brand, while baristas influence premium market penetration, with their preferences impacting the $280 billion global coffee shop market by 2024.

| Segment | Key Driver | 2024 Insight |

|---|---|---|

| Environmental | Sustainability | 73% less climate impact than cow’s milk |

| Health | Dietary Needs | 68% global lactose malabsorption |

| Flexitarian | Taste & Quality | Over 40% of consumers globally |

Cost Structure

The Cost of Goods Sold (COGS) stands as Oatly's most substantial cost component, encompassing the direct expenses tied to producing its plant-based products. This includes raw materials like oats, enzymes, and vitamins, alongside essential packaging materials. Direct manufacturing costs, such as labor and utilities for production facilities, are also significant. For 2024, managing the fluctuating price of oats, which can be impacted by global supply chain dynamics, remains crucial. Optimizing production efficiency across its expanding global operations is key to controlling these substantial costs.

Oatly allocates a significant portion of its budget to brand-building, including global advertising and social media campaigns. These costs are considered a crucial investment to build brand equity and differentiate from competitors in the plant-based market. This aggressive strategy is a primary driver of Oatly’s selling, general, and administrative (SG&A) expenses. For the fiscal year 2024, marketing and advertising continued to be a substantial component of their operational outlays, reflecting their commitment to market penetration.

Logistics and distribution expenses are significant for Oatly, covering the entire journey from manufacturing facilities to global distribution centers and finally to retail and food service customers.

As a global company dealing with perishable plant-based products, these costs are substantial, encompassing warehousing, cold chain management, and transportation across various regions. For instance, in 2024, maintaining refrigerated shipping and storage across diverse markets like North America, Europe, and Asia continues to be a major operational expenditure.

Research & Development (R&D)

Oatly continuously invests in Research & Development to innovate new plant-based products and enhance its core oat-milk technology. This strategic cost includes salaries for food scientists and researchers, specialized lab equipment, and pilot testing for product validation. R&D is crucial for Oatly's long-term growth, enabling new product launches and maintaining a competitive edge in the rapidly evolving plant-based market.

- Oatly's R&D expenses were a significant part of its operating costs, reflecting ongoing innovation efforts.

- The company reported R&D costs of $18.4 million for the nine months ended September 30, 2023, signaling continued investment into 2024.

- These investments support new offerings like flavored oat drinks and culinary oat products.

- A focus on proprietary enzyme technology ensures product quality and differentiation.

General & Administrative Expenses (SG&A)

General & Administrative Expenses for Oatly encompass all overhead costs not tied directly to production, including corporate staff salaries, office leases, and IT infrastructure. These costs also cover professional services fees essential for global operations. Efficiently managing SG&A is critical as Oatly scales, impacting overall profitability. For instance, Oatly reported SG&A expenses of $105.7 million for Q1 2024, a notable component of their operational costs.

- Oatly's Q1 2024 SG&A reached $105.7 million.

- Salaries for corporate staff are a significant part of these expenses.

- Office leases and IT infrastructure contribute to overhead.

- Professional services fees are included within G&A.

Oatly's cost structure is heavily influenced by its Cost of Goods Sold, particularly raw materials like oats and direct manufacturing expenses, alongside substantial logistics for global distribution. Significant investments in brand-building and R&D are crucial for market differentiation and innovation. General and administrative expenses, which reached $105.7 million in Q1 2024, cover corporate overhead and support global operations.

| Cost Category | 2024 (Q1) | 2023 (9 months) |

|---|---|---|

| SG&A Expenses | $105.7 million | Not specified |

| R&D Expenses | Ongoing investment | $18.4 million |

| Oat Prices | Fluctuating | Variable |

Revenue Streams

The primary revenue stream for Oatly stems from the robust sales of its diverse oat milk portfolio, including popular varieties like Original, Low-Fat, Chocolate, and the high-margin Barista Edition. This category serves as the financial backbone for the company, significantly contributing to its total net revenues, which reached $800.7 million in fiscal year 2023, with continued growth projected for 2024. These products are broadly distributed through both retail channels, such as grocery stores, and the expanding food service sector, including cafes and restaurants. The Barista Edition, particularly, commands strong demand and higher profitability margins. This core product line drives the majority of Oatly's market presence and financial performance.

Oatly diversifies its revenue significantly by expanding beyond oat milk into a broader portfolio of plant-based products. This includes popular items like oat-based ice cream, yogurts known as Oatgurts, cooking creams, and various spreads. This strategy leverages Oatly's strong brand equity to capture a larger share of consumer food spending, particularly as the global plant-based food market continues its robust growth, projected to reach over $160 billion by 2024. These product extensions contributed to Oatly's net revenue of $783.7 million in 2023, showcasing the importance of a diversified product offering.

Oatly generates a significant and strategic revenue stream through bulk sales to B2B customers in the food service industry. This includes major coffee chains like Starbucks, independent cafes, restaurants, and universities globally. These are often high-volume, recurring sales that also serve a crucial marketing function, introducing consumers to Oatly products. For instance, in 2024, the food service channel continued to be a key growth driver, with Oatly focusing on expanding partnerships to increase market penetration.

Retail Channel Sales

Oatly generates significant revenue through its extensive retail channel, encompassing sales to a broad network of brick-and-mortar and online retailers. This includes major grocery chains, mass merchandisers, and specialized natural food stores globally. This channel consistently accounts for the majority of Oatly's consumer-packaged-goods volume, driving its market presence. For instance, in Q1 2024, retail sales represented a substantial portion of Oatly's net revenues.

- Global retail distribution across over 40 markets.

- Majority of Oatly's net revenue derived from retail sales.

- Strategic partnerships with leading grocery and mass merchandiser chains.

- Continual expansion into new retail points of sale in 2024.

Geographic Market Expansion

Geographic market expansion significantly drives Oatly's revenue growth, stemming from sales generated and scaled within new international territories. Each new country or region, spanning North America, Europe, and Asia, represents a distinct and crucial revenue stream. This strategic geographic diversification is a core pillar of the company's long-term growth trajectory. For instance, in 2024, Oatly reported full-year revenue of $788.1 million, with substantial contributions from its key segments.

- EMEA (Europe, Middle East, and Africa) generated $435.0 million in 2024.

- Americas contributed $220.5 million to 2024 revenue.

- Asia added $132.6 million to the company's 2024 sales.

Oatly's revenue primarily stems from its core oat milk products and an expanding range of plant-based foods sold across retail and food service channels. Strategic B2B partnerships and a strong global presence in EMEA, Americas, and Asia are crucial drivers. In 2024, Oatly reported full-year net revenue of $788.1 million, showcasing robust contributions from all key segments.

| Region | 2024 Revenue (Millions) | Contribution |

|---|---|---|

| EMEA | $435.0 | 55.2% |

| Americas | $220.5 | 28.0% |

| Asia | $132.6 | 16.8% |

Business Model Canvas Data Sources

The Oatly Business Model Canvas is informed by a blend of proprietary sales data, consumer behavior insights, and extensive market research on plant-based alternatives. This data ensures each component accurately reflects Oatly's operational realities and market positioning.