Oatly PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Oatly Bundle

Oatly's journey is deeply influenced by the evolving political landscape, from trade policies to food regulations. Understanding these shifts is crucial for anticipating market access and operational challenges. Our PESTLE analysis dives deep into these factors, offering you a clear roadmap.

Economically, inflation, consumer spending habits, and global supply chain dynamics significantly impact Oatly's pricing and profitability. We dissect these economic currents to reveal potential opportunities and threats. Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Oatly.

Socially, the growing consumer demand for plant-based alternatives and health-conscious products is a major driver for Oatly. We explore these trends and their impact on market growth. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy.

Technologically, innovations in food production and packaging are key for Oatly's competitive edge. Our analysis highlights advancements that could redefine the dairy-alternative market. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government policies and evolving dietary guidelines significantly boost the market for plant-based products like Oatly. Initiatives such as the European Union's Farm to Fork Strategy, aiming for more sustainable food systems by 2030, directly support plant-forward diets. Similarly, sections within the 2020-2025 Dietary Guidelines for Americans encourage plant-based food choices, aligning with health and environmental goals. This regulatory push fosters increased consumer awareness and demand, creating a highly favorable operating environment for oat-based alternatives.

International trade policies and tariffs significantly impact Oatly's operational costs and market access. Agreements like the US-Mexico-Canada Agreement (USMCA) directly influence the cost of sourcing key raw materials such as oats, which saw a 2024 average price fluctuation. Geopolitical instability, including ongoing trade tensions, and changes in tariff regulations, for instance, potential EU-China tariff shifts in 2025, can increase production and distribution costs. This directly affects Oatly's profitability and competitive pricing strategies in global markets.

The legal definitions of terms like 'milk' present a significant political challenge for Oatly, directly affecting their product labeling. In early 2025, the plant-based industry secured a victory as France and the Czech Republic overturned proposed bans on using 'meaty' or 'dairy' terms for plant-based products. However, a UK court ruled in late 2024 that Oatly could not use its 'Post Milk Generation' slogan, citing EU regulations that reserve 'milk' for dairy products. This ongoing regulatory landscape creates uncertainty for plant-based brands' marketing efforts.

Sustainability and environmental regulations

Policies focused on climate change and sustainability, like the European Union Green Deal, directly support Oatly’s plant-based business model. These regulations encourage environmentally friendly practices, enhancing Oatly's brand reputation and market position as consumers increasingly prioritize sustainable choices. Government incentives for sustainable food production, such as potential tax credits for reducing carbon emissions, further present significant opportunities for the company's operational efficiency and growth into 2025.

- The EU Green Deal aims for a 55% reduction in net greenhouse gas emissions by 2030, boosting demand for low-impact products.

- The global plant-based food market is projected to reach $95 billion by 2025, driven by sustainability concerns and supportive policies.

- Some governments offer subsidies, like those seen in the Netherlands in 2024, for companies investing in sustainable agricultural practices.

Food safety and health claim standards

Oatly must adhere to stringent food safety regulations imposed by bodies like the FDA in the US and the European Food Safety Authority (EFSA), which are crucial for market access and consumer trust. These regulations govern everything from sustainable production processes to the specific health claims permitted on packaging, directly influencing product development and marketing strategies. For instance, the EU’s ongoing Farm to Fork strategy for 2025 emphasizes stricter labeling and transparency, requiring Oatly to meticulously verify its oat sourcing and processing. Increased demand for transparent and stricter labeling laws, particularly concerning plant-based alternatives, continues to reshape global food production standards and compliance costs.

- FDA and EFSA compliance: Essential for Oatly’s operations in major markets like North America and Europe.

- Health claim scrutiny: Regulations dictate how Oatly communicates nutritional benefits, impacting marketing.

- Transparency trends: Driven by consumer demand, leading to evolving labeling laws for 2024/2025.

- Regulatory costs: Compliance necessitates ongoing investment in quality control and legal expertise.

Government policies, including the EU Farm to Fork Strategy for 2025, significantly support plant-based diets, boosting Oatly’s market. Trade policies, like potential EU-China tariff shifts in 2025, can impact sourcing costs, while legal rulings on product labeling, such as the UK 2024 court decision against Oatly’s slogan, create marketing challenges. Climate initiatives like the EU Green Deal, aiming for a 55% emissions reduction by 2030, align with Oatly’s sustainable model, fostering market demand projected to reach $95 billion by 2025 for plant-based foods.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Dietary Guidelines | Increased Demand | EU Farm to Fork 2025; US Guidelines |

| Trade Tariffs | Cost Volatility | EU-China Tariff Shifts 2025; Oat Prices 2024 |

| Labeling Laws | Marketing Constraints | UK Court Ruling 2024; France/Czech Republic 2025 |

What is included in the product

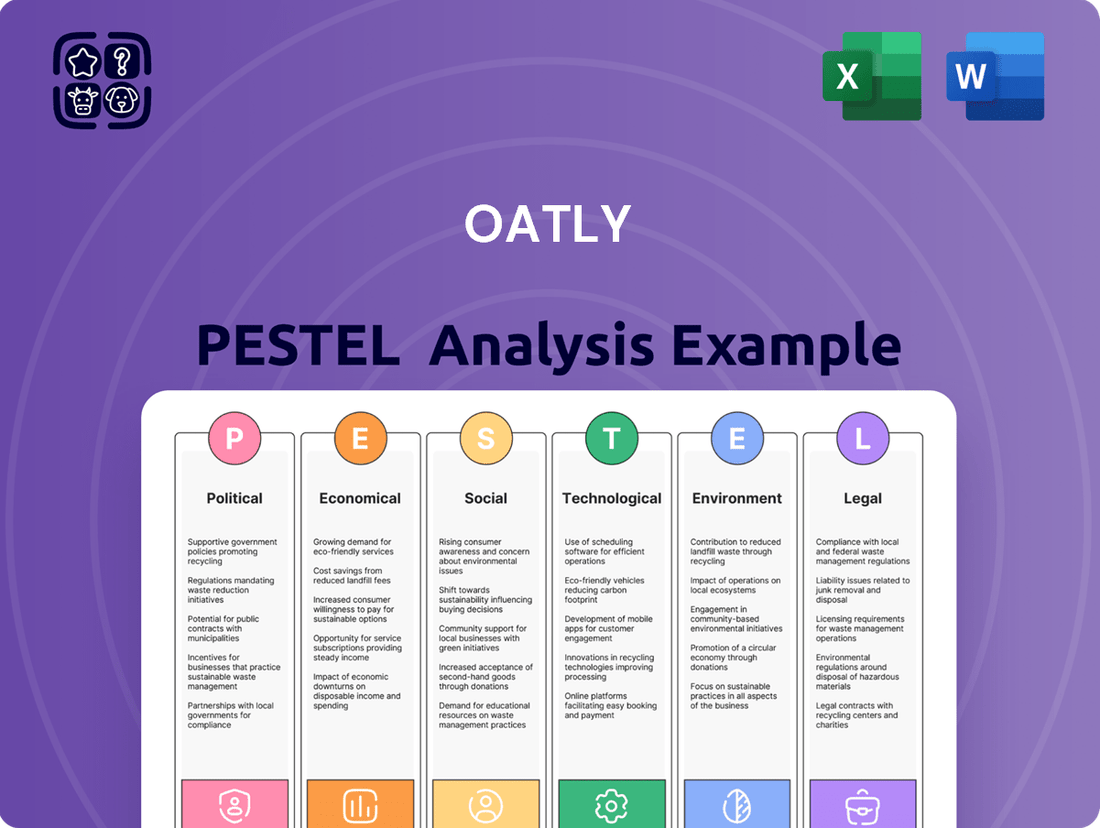

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing Oatly across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these factors create both strategic opportunities and potential threats for Oatly’s operations and growth.

The Oatly PESTLE analysis provides a clear and simple language summary, making it accessible to all stakeholders and helping to relieve the pain point of complex business jargon during planning sessions.

Economic factors

Rising inflation, projected near 2.7% globally for 2024, significantly impacts consumer spending habits. Economic uncertainty pushes many consumers to become more price-conscious, prioritizing value over premium offerings. While the broader food market sees growth, this trend could lead consumers to trade down from higher-priced products like Oatly to more affordable plant-based or dairy alternatives. This shift poses a challenge for Oatly's sales and market share in the 2024-2025 period.

The plant-based milk market continues its robust expansion, with oat milk emerging as a dominant segment, reflecting strong consumer adoption. Despite this market tailwind, Oatly has experienced revenue increases alongside persistent financial challenges, as evidenced by its net losses in recent periods. The company is strategically focused on achieving its first full year of profitable growth in 2025, with projections indicating a positive adjusted EBITDA for that fiscal year. This financial turnaround is crucial for investor confidence and sustained operational viability within a competitive landscape.

Oatly faces significant supply chain costs, including logistics and sourcing raw materials, which impact its profitability. The company has actively restructured operations, such as closing its Singapore facility in late 2023, aiming to reduce capital expenditures and improve efficiency. This strategic move aligns with efforts to streamline production networks and lower overall operational overhead. Furthermore, labor availability challenges and rising wage pressures, particularly in key markets, continue to contribute to increased operational expenses for Oatly.

Global economic volatility

Global economic volatility significantly impacts Oatly, with the potential for new tariffs and ongoing trade disruptions creating an uncertain operating environment. For instance, shifting trade policies between major blocs, like the EU and China, could alter supply chain costs for 2024-2025. Fluctuations in foreign currency exchange rates, particularly the Chinese Yuan against the Euro or US Dollar, directly affect Oatly's profitability given its substantial presence in Greater China, which accounted for a significant portion of its sales. Economic slowdowns in key markets also pose risks, potentially dampening consumer spending on premium plant-based products.

- Global trade uncertainty continues into 2025, with potential for new tariffs impacting ingredient sourcing and distribution costs.

- Currency volatility, especially between USD/EUR and CNY, directly influences Oatly's reported earnings and cost of goods.

- Economic growth forecasts for major markets like China show continued moderation, affecting consumer discretionary spending.

- Supply chain resilience remains a focus as geopolitical tensions could disrupt global logistics in 2024-2025.

Investment in the green economy

Investment in the green economy presents significant opportunities for Oatly. Global sustainable investment assets are projected to surpass $50 trillion by 2025, reflecting a growing capital allocation towards eco-friendly ventures. Oatly's deep commitment to reducing its environmental footprint, including its target of net-zero emissions, strongly aligns with these trends. This focus attracts investors prioritizing Environmental, Social, and Governance (ESG) criteria. Their sustainability efforts, like achieving a 34% reduction in Scope 1 and 2 greenhouse gas emissions per liter of finished product in 2023 compared to 2019, serve as a key differentiator in the increasingly eco-conscious consumer market and for impact investors.

- Sustainable investment assets are projected to exceed $50 trillion by 2025 globally.

- Oatly aims for net-zero emissions, aligning with green investment criteria.

- The company reduced Scope 1 and 2 GHG emissions by 34% per liter from 2019 to 2023.

- ESG-focused funds increasingly prioritize companies with strong environmental commitments.

Oatly faces economic headwinds from global inflation, projected at 2.7% for 2024, driving consumer price sensitivity. While the plant-based market expands, the company focuses on achieving positive adjusted EBITDA in 2025 amidst ongoing net losses and high supply chain costs. Furthermore, currency volatility, especially CNY against USD/EUR, and potential new tariffs in 2024-2025, directly impact profitability and operational expenses.

| Economic Factor | 2024 Outlook | 2025 Outlook |

|---|---|---|

| Global Inflation | ~2.7% | Expected moderation |

| Adjusted EBITDA | Negative | Target: Positive |

| Supply Chain Costs | High | Restructuring impact |

Preview Before You Purchase

Oatly PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Oatly PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the brand. You'll gain a clear understanding of the external forces shaping Oatly's market position and future strategies.

Sociological factors

A significant societal trend driving Oatly's growth is the expanding consumer shift towards plant-based and healthy eating, motivated by health, environmental, and ethical concerns. This movement underpins the surge in the plant-based dairy market, which is projected to reach approximately $61.4 billion globally by 2025, creating a robust core customer base for Oatly. Consumers are increasingly prioritizing nutrient-dense foods that support overall well-being. Data from early 2024 indicates over 50% of consumers globally are actively reducing or eliminating dairy from their diets, directly benefiting companies like Oatly. This sustained interest in wellness and sustainability is expected to continue shaping dietary preferences through 2025.

Consumer focus on sustainability significantly shapes purchasing decisions, with a growing segment prioritizing environmentally responsible brands. By early 2025, an estimated 70% of global consumers are expected to consider a brand's environmental impact before buying. Oatly's core identity strongly emphasizes its environmental commitment, including efforts to reduce its carbon footprint. For instance, Oatly reported a 28% reduction in carbon emissions per liter of finished product between 2019 and 2022, a key selling point. This alignment with eco-conscious values, such as using recyclable packaging and promoting a plant-based diet, resonates deeply with its target demographic.

While many consumers are drawn to Oatly's brand and sustainability values, price remains a significant barrier for some. Oatly's oat milk products are typically priced higher than conventional dairy and even some competing plant-based alternatives, often retailing above $4.00 per half-gallon in early 2025. During periods of economic pressure, such as the inflationary environment observed in 2024, consumers frequently prioritize affordability over premium or niche sustainable options. This price sensitivity can limit market penetration despite strong brand loyalty among its core demographic, impacting sales volume growth.

Importance of taste and texture

Consumers require plant-based alternatives to closely match the taste and texture of traditional dairy, which is fundamental for adoption. Oatly's significant success, particularly with its Barista Edition, stems from its ability to foam and blend comparably to milk in coffee. This sensory appeal directly influences repeat purchases and market penetration, as evidenced by rising plant-based milk sales projected to reach $36.7 billion globally by 2029. Ongoing innovation in product formulation remains critical for Oatly to maintain its competitive edge and expand its consumer base.

- Oatly's Barista Edition captured a significant market share due to its functional similarity to dairy in coffee.

- Consumer acceptance hinges on meeting high expectations for mouthfeel and flavor profiles.

- Innovations in oat protein and fat emulsification are key for future product development.

- Market research in 2024 shows taste as the primary driver for plant-based food adoption.

Brand perception and lifestyle association

Oatly has successfully cultivated a strong brand image, resonating with consumers as a lifestyle choice beyond just a product. The company employs humor and a distinctive, relatable voice in its marketing, fostering a community around its brand. This strategy cultivates loyal customers aligned with Oatly's mission, contributing to its significant market presence in the plant-based category. In 2023, Oatly reported revenue of $783.3 million, reflecting the success of its brand appeal.

- Oatly's distinct marketing fosters strong consumer identification.

- Humor and relatable messaging build brand community.

- Brand perception drives customer loyalty and market share.

- This approach supports continued growth in the competitive plant-based sector.

Sociological factors show a strong consumer shift towards plant-based diets, with global plant-based dairy projected to hit $61.4 billion by 2025. This trend is fueled by health, environmental, and ethical concerns, as over 50% of consumers globally reduced dairy by early 2024. However, price sensitivity, especially during 2024 inflation, presents a barrier for Oatly's premium products, often retailing above $4.00 per half-gallon. Taste and texture are also critical, with 2024 market research highlighting taste as the primary driver for adoption, key to Oatly's success with its Barista Edition.

| Sociological Factor | Impact on Oatly | Relevant Data (2024/2025) |

|---|---|---|

| Plant-Based Shift | Expands core market | Plant-based dairy market: ~$61.4B (2025) |

| Sustainability Focus | Aligns with consumer values | 70% consumers consider environmental impact (early 2025) |

| Price Sensitivity | Limits broader adoption | Oatly often >$4.00/half-gallon (early 2025) |

| Taste & Texture | Drives product acceptance | Taste primary driver for plant-based adoption (2024 research) |

Technological factors

Oatly's market position is underpinned by its patented enzyme technology, converting oats into a creamy liquid while preserving nutritional benefits. Continued investment in food technology research and development is crucial for enhancing product quality, taste, and nutritional profiles. This commitment extends to developing new product categories, like the expanding oat-based yogurt and ice cream lines, further diversifying their portfolio. For instance, Oatly reported significant R&D expenditures to drive these innovations, strengthening its competitive edge in the plant-based market.

Oatly actively invests in research and development to advance sustainable oat farming. This includes initiatives focused on improving soil health and biodiversity, crucial for long-term agricultural viability. For instance, programs in 2024 aim to reduce carbon emissions in cultivation by optimizing input usage, targeting a significant decrease in environmental footprint. These technological advancements not only enhance raw material quality but also ensure more consistent yields, supporting Oatly's supply chain stability into 2025.

Efficient supply chain management is critical for Oatly to meet consumer demand and control operational costs. The company is investing in advanced technologies, including AI-powered route optimization and real-time inventory management systems, aiming to enhance delivery efficiency and reduce logistics expenses by late 2024. Oatly has also adapted its supply chain infrastructure to dynamically reallocate production between foodservice and retail channels, ensuring product availability. This flexibility helps optimize inventory turnover and supports its projected revenue growth in 2025.

Digital marketing and consumer engagement

Oatly effectively leverages digital marketing and social media platforms to foster direct consumer engagement and cultivate a robust brand community. Its distinctive and often humorous online presence, including campaigns like Oatly Will Sue You, helps it significantly differentiate from competitors. This innovative digital strategy is central to transforming Oatly from a product into a lifestyle movement, especially among younger demographics. The company's digital reach continues to expand, with its Instagram following exceeding 1 million as of early 2025, demonstrating strong online influence.

- Oatly's digital campaigns drive high engagement rates, crucial for its brand identity.

- Social media platforms like Instagram and TikTok are pivotal for lifestyle branding.

- The company's online humor enhances brand recall and consumer loyalty.

- Digital marketing supports Oatly's market expansion into new regions globally.

Sustainable packaging innovations

Oatly is significantly investing in technological advancements to improve the sustainability of its packaging, aiming for 100% recyclable solutions. This commitment responds directly to escalating consumer demand for eco-friendly products, with 2024 market trends showing strong preference for sustainable options. Furthermore, increasing regulatory pressures, like potential 2025 EU directives on packaging waste, accelerate these innovations. Such efforts position Oatly favorably in a market prioritizing environmental responsibility.

- Oatly targets 100% recyclable packaging through new technologies.

- Consumer demand for sustainable options drives innovation in 2024.

- Anticipated 2025 regulations on packaging materials influence development.

- The company is exploring fiber-based alternatives and advanced recycling.

Oatly's technological edge stems from its patented enzyme process, underpinning product innovation and R&D for new categories like oat-based yogurts. Strategic investments in AI-powered supply chain optimization and real-time inventory management aim to boost efficiency by late 2024. The company also prioritizes sustainable farming technologies and is advancing packaging innovations for 100% recyclability by 2025. Digital marketing continues to leverage platforms like Instagram, exceeding 1 million followers in early 2025, for strong consumer engagement.

| Technological Focus | Key Initiative | 2024/2025 Impact |

|---|---|---|

| Product Innovation | Patented Enzyme Tech R&D | New oat-based product lines expanded |

| Supply Chain | AI-powered Optimization | Reduced logistics costs by late 2024 |

| Sustainability | Packaging Recyclability | Targeting 100% by 2025 |

Legal factors

Food labeling presents a significant legal challenge for plant-based food companies like Oatly.

In the US, the FDA issued draft guidance in 2023, requiring plant-based milk alternatives to clearly identify their plant source, such as oat milk, to avoid consumer confusion regarding nutritional equivalence to dairy.

These regulations aim to ensure product labels are truthful and not misleading, impacting how Oatly markets its popular oat-based beverages and potentially influencing its 2024-2025 marketing spend and product naming conventions.

Oatly has been actively involved in legal battles to safeguard its brand and intellectual property. A notable case involved a five-year dispute with Dairy UK concerning its Post Milk Generation slogan. Oatly ultimately lost this specific appeal in the UK Court of Appeal in late 2024, underscoring the significant legal hurdles in the plant-based milk market. Such ongoing intellectual property challenges can impact marketing strategies and operational costs for companies like Oatly as they navigate a highly competitive landscape.

Oatly must rigorously comply with stringent food safety and health regulations across its global markets. Agencies such as the U.S. FDA and European EFSA enforce these critical standards, ensuring product integrity and consumer confidence. Adherence involves continuous quality control and rigorous testing throughout the production process, from sourcing to final packaging. Non-compliance can lead to significant financial penalties, market withdrawal, and reputational damage, underscoring the importance of these legal frameworks for Oatly's operational viability and market access.

Advertising standards

Oatly's advertising claims face strict legal scrutiny, especially concerning health and nutritional benefits, as regulators worldwide, including the UK's Advertising Standards Authority (ASA) and the US Federal Trade Commission (FTC), actively monitor to prevent misleading consumers. Their bold marketing, often challenging the dairy industry, must carefully navigate these regulations to avoid penalties; for instance, the ASA upheld complaints against Oatly's environmental claims in 2023, requiring modifications. Maintaining compliance is crucial for Oatly, particularly as consumer awareness around greenwashing intensifies heading into 2025.

- Regulatory bodies like the ASA and FTC scrutinize health and environmental claims in advertising.

- Oatly's unique, often provocative marketing style requires careful adherence to truth-in-advertising laws.

- Past rulings, such as the 2023 ASA decision regarding Oatly's sustainability claims, underscore the importance of factual accuracy.

- Compliance with evolving advertising standards is critical for Oatly's brand reputation and market access in 2024-2025.

Environmental law compliance

Oatly's global operations must strictly comply with evolving environmental regulations, which are becoming increasingly stringent for food and beverage manufacturers. This includes adhering to national and regional rules governing wastewater discharge, air emissions, and waste management at their production facilities across Europe and North America. The company routinely conducts internal and external audits to ensure compliance and identify further opportunities for reducing its ecological footprint, aiming for continuous improvement.

- Oatly targets a 50% reduction in Scope 1 and 2 greenhouse gas emissions by 2029, from a 2021 baseline.

- The company aims for zero waste to landfill at its production sites, reflecting stringent waste management protocols.

- Water efficiency initiatives are critical, with efforts focused on reducing freshwater intake per liter of oat drink produced.

- Compliance with EU Green Deal and US EPA standards is crucial for market access and operational continuity.

Oatly faces significant legal challenges across food labeling, intellectual property, and advertising, particularly with evolving regulations in 2024-2025.

Compliance with stringent food safety and environmental standards is crucial for global market access and operational viability.

Recent rulings, like the late 2024 Dairy UK appeal loss and 2023 ASA decisions, highlight ongoing legal scrutiny impacting marketing and operational costs.

| Legal Area | Key Challenge (2024-2025) | Impact on Oatly |

|---|---|---|

| Food Labeling | FDA draft guidance (2023) for plant-based milk clarity. | Influences 2024-2025 marketing spend; ensures product truthfulness. |

| Intellectual Property | Lost UK appeal (late 2024) for Post Milk Generation slogan. | Affects brand protection strategy and legal costs. |

| Environmental | Targeting 50% GHG reduction by 2029 (from 2021 baseline). | Requires continuous investment in sustainable operations. |

Environmental factors

Oatly's core mission centers on providing products with a lower carbon footprint than traditional dairy milk. The company has established ambitious targets to significantly reduce its greenhouse gas emissions by 2050, aligning with global climate goals. However, despite these long-term commitments, Oatly's corporate climate footprint saw an increase during 2024. This rise was primarily driven by strategic changes in its ingredient sourcing, presenting a challenge to its immediate environmental objectives.

Oatly actively promotes sustainable farming practices within its supply chain, crucial for its environmental footprint. Its regenerative agriculture program financially incentivizes farmers, with initiatives projected to cover 10,000 hectares by 2025, to adopt methods that enhance soil health and biodiversity. This strategy aims to significantly reduce the environmental impact of its raw materials, aligning with consumer demand for eco-friendly products. By 2024, Oatly reported investments in trials demonstrating up to 30% reduction in greenhouse gas emissions from oat cultivation through these practices.

Oatly actively prioritizes water conservation, significantly reducing usage across its production facilities. For instance, the company reported a 28% decrease in water withdrawal per liter of finished product in its European facilities by late 2023, compared to its 2019 baseline. All Oatly-operated factories consistently manage their wastewater discharge, ensuring full compliance with local environmental permits and regulations for 2024. This commitment to efficient water management and responsible discharge supports operational sustainability and reduces environmental impact.

Packaging and waste reduction

Oatly prioritizes packaging innovation, aiming for fully renewable or recycled materials to minimize environmental impact. The company is actively working towards eliminating waste sent to landfills, a key component of its ambitious sustainability agenda. By late 2023, Oatly had already achieved a significant reduction in waste-to-landfill, reaching its target ahead of schedule. These efforts directly address growing consumer demand for sustainable products and are central to Oatly's brand identity and long-term strategy.

- Oatly aims for 100% renewable or recycled packaging materials by 2025.

- The company reported a 90% reduction in waste sent to landfills at its production sites by 2023.

- Packaging accounts for approximately 40% of Oatly's product carbon footprint.

- Oatly is exploring alternative packaging solutions like reusable systems and bio-based plastics.

Climate solutions and industry leadership

Oatly positions itself as a climate solutions company, empowering consumers to reduce their environmental footprint by choosing plant-based alternatives over dairy. Their strategic goal is for the majority of sales to come from products with significantly lower emissions than the dairy category average, framing their offerings as a direct solution to climate concerns. This commitment aligns with growing consumer demand for sustainable options, with projections showing the plant-based milk market continuing to expand through 2025. By emphasizing its role in combating climate change, Oatly enhances its brand appeal and market position.

- Oatly aims for over 50% of its product sales to have emissions significantly below the dairy average by 2025.

- The global plant-based milk market is projected to reach approximately $38 billion by 2025, driven by environmental consciousness.

- Switching from dairy to Oatly can reduce individual climate impact by up to 80%, based on internal lifecycle assessments.

Oatly prioritizes environmental sustainability, aiming for a lower carbon footprint despite a 2024 increase due to sourcing shifts. The company targets 100% renewable or recycled packaging by 2025, with packaging contributing 40% of its carbon footprint. Initiatives like regenerative agriculture, covering 10,000 hectares by 2025, aim to reduce emissions. Oatly also reduced water withdrawal by 28% in European facilities by late 2023, aligning with 2024 regulatory compliance.

| Environmental Focus | Metric | 2024/2025 Target/Status | ||

|---|---|---|---|---|

| Packaging Materials | Renewable/Recycled | 100% by 2025 | ||

| Waste-to-Landfill | Reduction at Production Sites | 90% by 2023 (achieved) | ||

| Sustainable Farming | Regenerative Hectares | 10,000 by 2025 | ||

| Water Usage | Reduction per Product Liter (EU) | 28% by late 2023 (vs. 2019) |

PESTLE Analysis Data Sources

Our Oatly PESTLE Analysis is built on a robust foundation of data from reputable sources, including market research firms, industry-specific publications, and government reports. We analyze economic indicators, legislative changes, technological advancements, and consumer behavior shifts to provide a comprehensive overview.