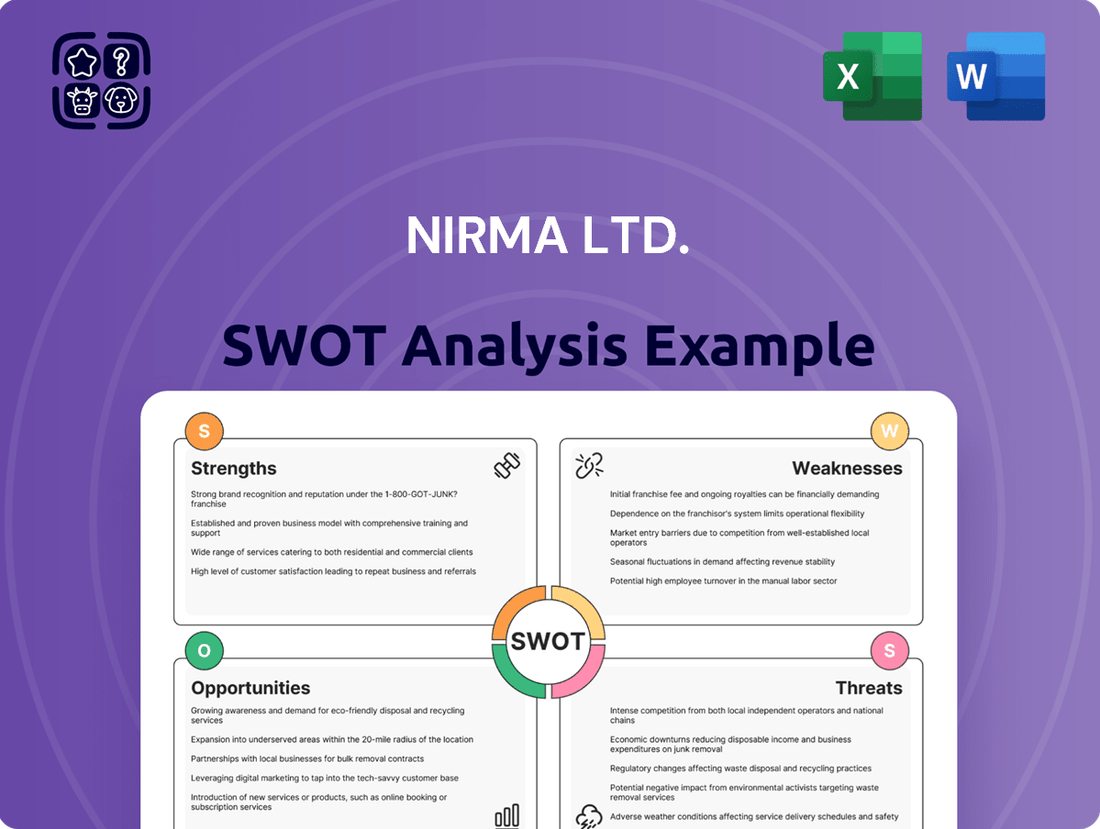

Nirma Ltd. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nirma Ltd. Bundle

Nirma Ltd.'s SWOT analysis reveals a strong brand presence and cost leadership as key strengths, but also highlights potential threats from increasing competition and evolving consumer preferences. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Nirma's market position and future growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your planning and research.

Strengths

Nirma's brand recognition is a powerful asset, deeply ingrained in Indian households thanks to its long-standing presence and value-driven products. This has translated into a significant market share, especially within the mass-market consumer goods sector.

The company's commitment to affordability has cemented its status as a household name, particularly in the detergent and soap categories. This strong brand recall is a direct result of its consistent focus on value-for-money propositions.

This established market presence allows Nirma to effectively compete, even against global giants. Consumer trust, built over decades, particularly in price-sensitive regions, underpins its competitive edge.

For instance, in the detergent market, Nirma has historically held substantial market share, often estimated to be in the double digits, demonstrating its deep penetration.

Nirma's strength lies in its impressively diversified business portfolio, extending well beyond its well-known consumer goods. The company has strategically expanded into critical industrial sectors such as chemicals, with significant operations in soda ash and linear alkyl benzene (LAB), and cement manufacturing. This multi-sector approach is a key advantage, providing a robust buffer against the volatility inherent in any single industry, thereby stabilizing revenue and enhancing overall business resilience.

This diversification strategy proved particularly beneficial in the recent past. For instance, while the consumer staples sector might experience slower growth, Nirma's chemical division, particularly soda ash, benefits from strong demand in industries like glass and detergents. In 2023-24, Nirma's chemicals segment continued to be a significant contributor to its revenue, showcasing the stability this diversification brings.

The company's commitment to expansion is further underscored by its strategic acquisition of Glenmark Life Sciences in March 2024, now rebranded as Alivus Life Sciences. This move marks Nirma's entry into the pharmaceutical sector, adding another layer of diversification and significantly broadening its business profile. This expansion into pharmaceuticals is expected to create new avenues for growth and profitability, leveraging Nirma's established operational capabilities.

Nirma's core strength lies in its relentless pursuit of cost leadership, offering high-quality products at prices that resonate with a vast consumer base. This strategy has been instrumental in carving out a significant market share, particularly within the mass market segment.

The company's ability to maintain this compelling value proposition is underpinned by its efficient manufacturing operations and a strategic focus on backward integration for critical raw materials. For instance, Nirma's control over key inputs aids in consistent cost management.

In fiscal year 2023, Nirma reported a revenue of approximately INR 11,600 crore, demonstrating the market's strong reception to its value-driven offerings. This financial performance is a testament to the success of its cost-conscious approach.

This competitive pricing, coupled with consistent product quality, has allowed Nirma to build strong brand loyalty and achieve a dominant position in segments like detergents and soaps.

Extensive Distribution Network

Nirma Ltd. benefits immensely from its extensive distribution network, a significant strength that allows its consumer products to reach virtually every corner of India, from bustling cities to remote villages. This deep and wide-reaching presence is critical for fast-moving consumer goods, ensuring that Nirma's products are readily available to a vast customer base, thereby driving consistent sales volumes. This established network acts as a formidable competitive barrier, enabling efficient market penetration and swift adaptation to diverse regional consumer preferences and demands. For instance, Nirma's commitment to reaching rural markets was evident in its strategy to ensure availability of its detergent products even in the smallest towns, a key factor in its early success.

The robustness of this distribution system is a cornerstone of Nirma's market strategy:

- Broad Market Access: Nirma's network covers over 2 million retail outlets across India, providing unparalleled reach for its diverse product portfolio.

- Rural Penetration: The company has a strong focus on rural distribution, ensuring product availability where larger competitors may struggle to penetrate.

- Logistical Efficiency: An optimized supply chain allows for timely delivery and inventory management, crucial for maintaining product freshness and availability.

- Competitive Advantage: This extensive reach significantly reduces the cost and effort required for new product launches and market expansion compared to rivals with less developed networks.

Backward Integration in Key Industries

Nirma Ltd. benefits significantly from backward integration, particularly in its core chemical manufacturing operations. The company's substantial production capacity in soda ash and linear alkyl benzene (LAB) acts as a crucial advantage, as these are fundamental raw materials for its extensive detergent and soap product lines. This vertical integration guarantees a consistent and reliable supply of essential inputs, directly supporting cost management and operational stability for its fast-moving consumer goods (FMCG) segment.

Further reinforcing this integrated strategy, Nirma operates captive mines for limestone, a key component in its cement manufacturing business. This control over raw material sourcing for cement production enhances its competitive cost structure and supply chain resilience. For example, as of late 2024, Nirma's cement division contributes significantly to its overall revenue, bolstered by these cost efficiencies derived from backward integration.

- Chemical Dominance: Nirma is a major producer of soda ash and LAB, essential for its consumer goods.

- Supply Chain Security: Backward integration minimizes reliance on external suppliers for critical raw materials.

- Cost Efficiency: Control over raw material sourcing, like limestone for cement, directly impacts profitability.

- Market Advantage: Stable supply and cost control allow for competitive pricing in its consumer product segments.

Nirma's brand strength is a cornerstone, built on decades of providing value-for-money products that resonate deeply with Indian consumers. This has cultivated exceptional brand recall and loyalty, particularly in the mass-market segments like detergents and soaps, securing a substantial market share. For instance, Nirma has historically commanded a significant portion of the Indian detergent market, often in the double digits, a testament to its widespread consumer acceptance and trust.

Nirma's diversified business model is a significant strength, extending beyond its iconic consumer goods into chemicals and cement. This multi-sector approach, exemplified by its robust soda ash and Linear Alkyl Benzene (LAB) production and its growing cement business, provides resilience against sector-specific downturns. The strategic acquisition of Glenmark Life Sciences in March 2024, now Alivus Life Sciences, further bolsters this diversification by entering the pharmaceutical space, adding new revenue streams and growth potential.

The company's unwavering focus on cost leadership is a key differentiator, enabling it to offer competitive pricing without compromising quality. This is achieved through efficient manufacturing processes and strategic backward integration, such as securing raw materials like limestone for its cement division. In FY 2023, Nirma reported revenues of approximately INR 11,600 crore, highlighting the market's positive response to its value-driven strategy and operational efficiencies.

Nirma's extensive distribution network is a critical asset, ensuring product availability across India, including rural and semi-urban areas. This deep market penetration, reaching over 2 million retail outlets, provides a significant competitive advantage and facilitates efficient market access for its diverse product portfolio. The company's commitment to rural distribution, for example, has been instrumental in its sustained growth and market leadership in key categories.

What is included in the product

Delivers a strategic overview of Nirma Ltd.’s internal and external business factors, highlighting its strong brand recognition and cost leadership while also identifying potential challenges in market saturation and diversification.

Uncovers key vulnerabilities and competitive threats, enabling proactive risk mitigation for Nirma Ltd.

Weaknesses

Nirma's strategy of offering value-for-money products has been a key driver of its market share growth. However, this also leads to a significant dependence on price-sensitive consumer segments. This reliance can constrain Nirma's ability to increase prices and potentially impact profit margins, particularly when input costs rise or competition intensifies. For instance, in the detergent market, where Nirma holds a substantial share, price fluctuations directly affect consumer purchasing decisions.

Nirma operates in highly competitive markets, facing formidable rivals such as Hindustan Unilever Limited (HUL) and Procter & Gamble (P&G). These larger players, with their substantial financial resources and vast product ranges, exert significant pressure on Nirma's market share and pricing power.

The extensive marketing budgets of these major competitors allow them to build stronger brand recall and reach a wider consumer base. This disparity in marketing investment presents a continuous challenge for Nirma to effectively communicate its value proposition and maintain its competitive edge.

In the chemicals segment, Nirma also contends with established domestic and international companies that possess advanced technologies and economies of scale. This intense rivalry necessitates ongoing innovation and cost management to remain competitive.

For instance, in the detergent market, Nirma's penetration has been historically strong, but the market share of players like HUL remains substantial. In fiscal year 2023, HUL reported a revenue of over ₹50,000 crore, illustrating the scale of competition Nirma faces.

Nirma's chemical segment, a major revenue driver, faces considerable risk from fluctuating global commodity prices and local supply-demand imbalances for key inputs such as soda ash and caustic soda. These price swings directly impact profitability. For instance, the company experienced a moderation in its profitability during FY2024, largely attributed to weakening demand and softening prices in these crucial chemical markets.

The company's profit margins are also susceptible to volatility in raw material costs and foreign exchange rates. These external factors can create significant headwinds, eroding earnings even when operational efficiency remains strong. The chemical division’s performance is intrinsically tied to these global market dynamics, making it a key area of vulnerability.

Brand Perception Challenges

Nirma's long-standing identity as a value-for-money brand presents a significant hurdle in its aspiration to move into premium product categories. This deep-rooted perception makes it challenging to convince consumers that Nirma can offer higher-priced, superior quality goods.

Transitioning from a "value" image to a "premium" one demands substantial resources and a strategic overhaul. This includes hefty investments in advanced product development, innovative marketing campaigns, and a complete re-evaluation of brand messaging. For instance, in 2023, the Indian FMCG market saw companies investing heavily in premiumization strategies; however, Nirma's historical pricing structure means its path will likely be more gradual and resource-intensive.

The company faces the difficult task of reshaping consumer mindsets, a process that often takes years and requires consistent reinforcement of new brand attributes. While Nirma's 2024 sales figures demonstrate continued strength in its core segments, its ability to command premium pricing in new ventures remains a significant question mark.

- Brand Association: Strong link to affordability may limit premium product entry.

- Perception Shift: Moving from value to premium requires significant investment in branding and marketing.

- Market Entry: Entering higher-end segments will be a slow and challenging process.

- Consumer Mindset: Reshaping consumer perceptions is a long-term, resource-intensive endeavor.

Moderated Financial Metrics Post-Acquisition

Nirma's acquisition of Glenmark Life Sciences, while strategically beneficial, has temporarily impacted its financial leverage. The debt-funded nature of this significant transaction resulted in a moderation of Nirma's credit metrics in FY2024. For instance, the company's debt-to-equity ratio saw an increase following the acquisition, reflecting the borrowed capital used.

While analysts anticipate an improvement in these financial metrics for FY2025 and FY2026 as deleveraging efforts take hold, the immediate aftermath of the acquisition presents a financial strain. This increased debt burden necessitates careful financial management and a focused strategy for debt reduction to restore optimal creditworthiness.

- Increased Debt Burden: The acquisition was financed through debt, leading to higher leverage ratios in the short term.

- Moderated Credit Metrics: Financial indicators like debt-to-equity and interest coverage ratios experienced a temporary decline post-acquisition.

- Deleveraging Expectations: Nirma is expected to actively reduce its debt levels in FY2025 and FY2026, improving its financial profile.

- Strain Management: The company must carefully manage its cash flows to service the increased debt and execute its deleveraging plan effectively.

Nirma faces intense competition from larger, well-resourced players like HUL and P&G, whose significant marketing budgets create a substantial barrier to entry and brand visibility. The company's value-for-money positioning limits its ability to command premium pricing, making it vulnerable to input cost fluctuations and price wars. For example, in FY2023, HUL's revenue exceeded ₹50,000 crore, highlighting the scale disparity.

The chemicals segment, a key revenue contributor, is susceptible to global commodity price volatility and supply-demand imbalances for inputs like soda ash. This was evident in FY2024, where softening prices and weakening demand impacted Nirma's profitability. Furthermore, Nirma's acquisition of Glenmark Life Sciences in 2023, financed by debt, led to increased financial leverage, with its debt-to-equity ratio rising, although deleveraging is anticipated in FY2025-26.

| Weakness | Description | Impact | Example/Data Point |

|---|---|---|---|

| Intense Competition | Facing larger players with greater financial and marketing resources. | Pressure on market share and pricing power. | HUL FY2023 Revenue: >₹50,000 crore. |

| Brand Perception | Strong association with value-for-money hinders premium product entry. | Difficulty in shifting consumer mindset for higher-priced offerings. | Requires significant investment in brand repositioning. |

| Chemical Market Volatility | Exposure to fluctuating global commodity prices and supply-demand issues. | Direct impact on profitability and margins. | FY2024 moderation in profitability due to softening chemical prices. |

| Increased Financial Leverage | Debt-funded acquisition of Glenmark Life Sciences. | Temporary moderation of credit metrics post-acquisition. | Increased debt-to-equity ratio in FY2024. |

Preview the Actual Deliverable

Nirma Ltd. SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Nirma Ltd. SWOT analysis, complete with detailed insights into its Strengths, Weaknesses, Opportunities, and Threats. Upon purchase, you'll gain access to the full, comprehensive report, allowing you to leverage this valuable strategic information. No surprises, just the in-depth analysis you need.

Opportunities

India's extensive rural and semi-urban areas represent a substantial, largely untapped market for Nirma's cost-effective consumer goods. As these regions see rising incomes and better infrastructure, the demand for everyday necessities is expected to climb significantly.

Nirma can capitalize on this by developing specific products and distribution networks suited to these markets. This strategic approach is crucial, especially considering that rural FMCG sales growth has recently outpaced urban areas, with projections indicating continued strong performance in the coming years.

Nirma is well-positioned to benefit from the robust growth anticipated in the specialty chemicals and cement industries. These sectors are experiencing a surge fueled by ongoing industrialization, significant infrastructure projects, and government housing initiatives.

The company can leverage this expanding market by focusing on higher-value chemical products and advanced construction materials. This strategic alignment plays directly into Nirma's existing strengths and operational capabilities.

Looking ahead, cement demand is projected to increase by 7-8% in fiscal year 2026, underscoring a strong near-term outlook. Simultaneously, the specialty chemicals segment is expected to see a compound annual growth rate of nearly 11% over the next five years, presenting substantial opportunities for Nirma.

Nirma has a significant opportunity to enhance its product portfolio by introducing premium variants and exploring new categories. For instance, developing eco-friendly detergents or specialized cleaning agents could tap into a growing consumer demand for sustainable products. This aligns with the broader FMCG trend of premiumization, where consumers are increasingly willing to pay more for enhanced features and benefits.

Leveraging its recent expansion into pharmaceuticals with Alivus Life Sciences presents another avenue for diversification and margin improvement. Focusing on high-margin active pharmaceutical ingredients (APIs) could significantly boost profitability. This strategic move allows Nirma to enter a sector with strong growth potential and potentially higher returns compared to its traditional segments.

Expanding into higher-grade cement products also offers a pathway to premiumization. By offering specialized cement formulations for specific construction needs, Nirma can capture a segment of the market willing to invest in quality and performance. This strategy aims to broaden the company's customer base and improve its overall profit margins.

Leveraging Digitalization and E-commerce

Nirma can significantly boost its efficiency and market reach by embracing digital transformation across its supply chain, marketing, and distribution networks. This digital shift is crucial for staying competitive in today's rapidly evolving market landscape.

Expanding Nirma's presence in e-commerce channels presents a substantial opportunity to tap into new sales avenues, especially in urban centers and through direct-to-consumer strategies. This online expansion is key to reaching a broader customer base.

The e-commerce sector for Fast-Moving Consumer Goods (FMCG) is experiencing robust growth, with projections indicating a continued upward trend through 2024 and into 2025. This presents Nirma with a clear pathway to enhance consumer engagement and significantly broaden its market penetration.

- Digital Supply Chain: Implementing digital tools for inventory management and logistics can streamline operations, reducing costs and improving delivery times. For instance, advanced analytics can optimize stock levels, preventing shortages and overstocking.

- E-commerce Expansion: Leveraging online marketplaces and developing Nirma's own direct-to-consumer platform can unlock new revenue streams. In 2024, online retail sales for FMCG in India were estimated to reach over $15 billion, a figure expected to climb further.

- Enhanced Consumer Engagement: Digital marketing strategies, including social media campaigns and personalized offers, can foster stronger customer relationships and brand loyalty. These digital interactions are vital for understanding and catering to evolving consumer preferences.

- Data-Driven Insights: Digitalization allows for the collection and analysis of vast amounts of consumer data, providing valuable insights into purchasing behavior and market trends. This data can inform product development and marketing strategies, ensuring Nirma remains responsive to market demands.

Strategic Acquisitions and Partnerships

Nirma has a proven history of integrating acquired businesses, notably its acquisition of Glenmark Life Sciences for approximately INR 5,651 crore in 2023, and earlier strategic moves into the cement sector. This successful integration capability positions Nirma to continue exploring opportunistic acquisitions of smaller companies or forming strategic alliances with technology firms. Such moves could bolster its product portfolio, expand market access, or upgrade operational efficiencies.

These opportunities could grant Nirma entry into novel technological domains, established brands, or expanded distribution networks. For instance, partnering with a digital solutions provider could streamline supply chain management or enhance customer engagement. This proactive approach to strategic expansion is crucial for accelerating growth and solidifying its competitive standing in a dynamic market landscape.

- Acquisition of Glenmark Life Sciences: Completed in 2023 for approximately INR 5,651 crore, demonstrating Nirma's acquisition expertise.

- Cement Sector Entry: Past strategic acquisitions in the cement industry highlight Nirma's diversification capabilities.

- Technology Partnerships: Potential collaborations with tech firms for enhanced product development and operational upgrades.

- Market Expansion: Opportunities to gain access to new markets and customer segments through strategic alliances.

Nirma can leverage the growing demand in rural and semi-urban markets by tailoring products and distribution for these areas, as rural FMCG sales growth recently outpaced urban areas. The company is also set to benefit from the expansion in specialty chemicals, projected for an 11% CAGR over the next five years, and the cement sector, expecting 7-8% demand increase in fiscal year 2026, driven by industrialization and infrastructure projects.

Threats

Nirma operates in fiercely competitive consumer goods and chemical sectors, where aggressive pricing by rivals could significantly squeeze its profit margins, particularly given its established value-for-money strategy. For example, in the detergent market, competitors have increasingly employed promotional pricing, impacting overall industry profitability.

The constant threat of intensified price wars, fueled by both established domestic players and emerging international brands, directly challenges Nirma's market share and its ability to maintain profitability. This competitive pressure is a persistent concern for the company's financial performance.

The recent entry of major conglomerates like Reliance Industries into the Fast-Moving Consumer Goods (FMCG) space, with substantial resources and a proven track record in retail and distribution, adds another layer of significant competitive pressure on Nirma. This strategic move by Reliance is expected to further escalate market competition.

Nirma's profitability faces a considerable threat from the volatile nature of its key raw material prices, including crude oil derivatives, soda ash, and various other chemicals. For instance, fluctuations in crude oil prices, a significant input for many of Nirma's products, directly impact manufacturing costs. Energy costs, another critical component, also contribute to this vulnerability.

Global supply chain disruptions, a persistent issue in recent years, further amplify this price volatility. These disruptions can lead to unexpected increases in input costs, creating a challenge for Nirma to fully pass these higher expenses onto consumers without affecting demand. This can squeeze profit margins and impact overall financial performance.

For example, the average price of soda ash, a primary ingredient for detergent manufacturing, saw significant upward movement in 2022 and early 2023 due to production issues and strong global demand, directly affecting companies like Nirma. Similarly, disruptions in shipping and logistics during 2024 continue to add cost pressures, impacting the landed cost of imported raw materials.

These combined factors of raw material price swings and supply chain unpredictability pose a direct threat to Nirma's operational stability and its ability to maintain consistent profitability. The company must navigate these external forces carefully to mitigate their impact on its financial results.

Consumers are increasingly prioritizing sustainable, eco-friendly, and health-conscious options, a significant shift impacting the FMCG sector. Nirma may need to invest in reformulating its products and overhauling manufacturing to align with these evolving demands, potentially impacting its cost structure and supply chain.

Failure to adapt to these sustainability trends could erode Nirma's market share, particularly among a growing segment of environmentally conscious consumers. For instance, by 2025, reports indicate that over 60% of global consumers are willing to pay a premium for sustainable products, a trend Nirma cannot afford to ignore.

Stringent Environmental Regulations and Compliance Costs

Nirma Ltd., operating in sectors like chemicals and cement, faces significant challenges from evolving environmental regulations. For instance, India's push for cleaner air and water means companies must invest heavily in upgrading pollution control equipment. Non-compliance can lead to substantial fines and even temporary closures, as seen with various industrial units facing regulatory action in recent years.

These stringent environmental standards necessitate ongoing capital expenditure. Nirma's commitment to sustainability requires continuous investment in advanced technologies, such as efficient waste management systems and reduced emissions equipment. This investment directly impacts operational costs and, consequently, the company's profit margins in the highly competitive chemical and cement markets.

- Increased investment in pollution control technologies to meet evolving environmental standards.

- Risk of significant financial penalties and operational disruptions due to non-compliance.

- Potential impact on profitability from rising compliance costs.

- Reputational damage if environmental performance falls short of public and regulatory expectations.

Economic Slowdown and Inflationary Pressures

An economic slowdown in India or globally presents a significant threat, potentially curbing consumer spending, especially on discretionary goods. While Nirma's core products lean towards staples, a broad economic downturn could still impact overall demand.

Persistent inflationary pressures are another concern, as they erode consumer purchasing power. This could lead to consumers opting for cheaper alternatives or reducing consumption of even essential items, directly affecting Nirma's sales volumes and revenue streams. The FMCG and construction sectors, where Nirma operates, are particularly vulnerable to these macroeconomic shifts.

- Economic Slowdown Impact: A general economic contraction could reduce discretionary spending, indirectly affecting Nirma's sales even for staple goods.

- Inflationary Pressures: Rising inflation directly impacts consumer purchasing power, potentially leading to trading down or reduced consumption volumes.

- Sector Vulnerability: Both the FMCG and construction sectors are susceptible to economic headwinds and inflationary pressures, posing a direct risk to Nirma's financial performance.

Intensified competition, especially from new entrants like Reliance in the FMCG sector, poses a significant threat to Nirma's market share and profitability. Price wars, a common tactic in the detergent market, could further squeeze margins.

The volatility of raw material prices, such as soda ash and crude oil derivatives, coupled with global supply chain disruptions, directly impacts Nirma's manufacturing costs and ability to maintain consistent pricing. For instance, soda ash prices saw substantial increases in 2022-2023.

Evolving consumer preferences towards sustainable and health-conscious products necessitate product reformulation and potential manufacturing overhauls, which could increase costs. By 2025, over 60% of global consumers are reportedly willing to pay a premium for sustainable goods.

Stricter environmental regulations require ongoing capital expenditure for pollution control, increasing operational costs and posing risks of fines for non-compliance, as seen with other industrial units facing regulatory actions.

SWOT Analysis Data Sources

This SWOT analysis for Nirma Ltd. is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and insights from industry experts. This multi-faceted approach ensures a well-rounded and accurate assessment of the company's strategic position.