Nirma Ltd. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nirma Ltd. Bundle

Nirma Ltd.'s marketing prowess is a fascinating case study in strategic execution. Their product innovation, from detergents to soaps and even cement, has consistently targeted mass market needs with quality. This thoughtful product development is a cornerstone of their success.

The brand's pricing strategy is famously aggressive, making essential products accessible to a vast consumer base. This "value for money" approach has been instrumental in Nirma's ability to disrupt established players and build immense brand loyalty.

Nirma's distribution network is a masterclass in reaching the Indian hinterlands. Their extensive "Place" strategy ensures availability, making their products a household name across diverse geographies.

The company's "Promotion" has often relied on memorable jingles and widespread visibility, creating an emotional connect with consumers. This effective communication has cemented Nirma's position in the market.

Go beyond these highlights—get access to an in-depth, ready-made Marketing Mix Analysis covering Nirma Ltd.'s Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Nirma Ltd.'s diverse consumer goods portfolio is a cornerstone of its market strategy, featuring a wide range of affordable essentials. Key products include their iconic Nirma Washing Powder, along with various bath soaps and dishwashing solutions in both bar and liquid formats. This broad offering ensures Nirma caters to fundamental household needs across India.

The company's initial triumph was built on delivering quality cleaning products at exceptionally competitive prices, democratizing access to these goods for a vast consumer base. This focus on value-for-money remains central, reinforcing their appeal to budget-conscious households. For instance, Nirma's detergent segment alone has historically captured significant market share, demonstrating the effectiveness of their pricing strategy.

Nirma's strategic diversification into the chemicals sector, particularly with key products like soda ash and caustic soda, positions it as a major industrial player. This move goes beyond its consumer goods heritage, establishing Nirma as one of the largest domestic manufacturers of these essential chemicals. For fiscal year 2023-2024, Nirma reported robust growth in its chemicals segment, contributing significantly to its overall revenue, driven by strong demand from sectors like glass and textiles.

These chemical products are not merely external sales; they represent a crucial element of Nirma's backward integration. By producing its own soda ash and Linear Alkyl Benzene (LAB), Nirma secures vital raw materials for its detergent and other consumer product manufacturing. This internal supply chain management in 2024 offers substantial cost control benefits and ensures production stability, a key advantage in a competitive market.

The diversification into chemicals provides Nirma with a more stable and predictable revenue stream compared to the often-cyclical consumer goods market. This segment's performance in the first half of 2024 remained strong, demonstrating resilience and contributing to Nirma's overall financial health. This creates a solid foundation for sustained profitability and further investment.

Nirma's expansion into cement manufacturing, primarily through Nuvoco Vistas Corporation Ltd., is a significant strategic play. Nuvoco Vistas already boasts a robust presence, and the company is actively working to boost its production capacity. By 2025, Nirma aims to achieve an impressive production capacity exceeding 30 million tons per annum, demonstrating a clear commitment to growth in this sector.

This expansion is directly aligned with India's burgeoning infrastructure development needs. With substantial government spending on infrastructure projects, the demand for cement is projected to remain strong. Nirma's increased capacity positions it to effectively meet this growing demand and capture a larger market share.

The cement business is a strong complement to Nirma's existing industrial portfolio. It creates synergies by leveraging Nirma's established distribution networks and operational expertise. This vertical integration strengthens Nirma's overall business model and contributes meaningfully to its consolidated financial performance.

In 2023-24, Nuvoco Vistas reported a notable revenue growth, signaling the positive impact of its ongoing capacity expansions and market penetration strategies. The company's focus on efficiency and cost optimization within its cement operations further enhances its competitive edge in the market.

Recent Entry into Pharmaceuticals

Nirma's strategic entry into the pharmaceutical sector, initiated by its acquisition of a 75% stake in Glenmark Life Sciences (now Alivus Lifesciences) in March 2024, represents a significant diversification. This move targets the high-margin active pharmaceutical ingredients (APIs) and contract development and manufacturing operations (CDMO) segments.

The acquisition allows Nirma to tap into a specialized product portfolio and leverage the inherent profitability of the pharmaceutical industry. This expansion into APIs and CDMO services is designed to complement Nirma's existing strengths and unlock new revenue streams.

- Product: Active Pharmaceutical Ingredients (APIs) and Contract Development and Manufacturing Operations (CDMO) services.

- Price: Not explicitly stated for the acquisition in available data, but Nirma acquired a 75% stake.

- Place: Global pharmaceutical markets, leveraging existing and new distribution channels.

- Promotion: Focus on quality, regulatory compliance, and R&D capabilities to attract pharmaceutical clients.

Focus on Value and Quality

Nirma's product strategy centers on delivering exceptional value by combining effectiveness with affordability. This core philosophy ensures that consumers receive satisfactory quality across Nirma's wide product range, from its well-known detergents to its accessible soaps.

The company's commitment to 'value for money' is evident in products like its detergents, specifically formulated to be gentle on hands while maintaining strong cleaning performance. This focus resonates with a broad consumer base, particularly those seeking cost-effective solutions for everyday needs.

Nirma's approach to product development is dynamic, consistently adapting to evolving consumer requirements and prioritizing cost management. This ensures that their offerings remain competitive and appealing, especially in price-sensitive markets.

- Value Proposition: Nirma consistently aims to provide high-quality products at prices that offer a clear advantage over competitors, a strategy that has historically driven significant market share.

- Product Differentiation: While maintaining affordability, Nirma strives to differentiate its products through specific features, such as the skin-friendly formulations in its detergent lines, catering to a key consumer concern.

- Market Reach: The 'value for money' product strategy allows Nirma to penetrate diverse market segments, reaching a wide demographic of Indian households.

Nirma's product portfolio is extensive, encompassing household essentials like detergents and soaps, alongside a significant presence in industrial chemicals such as soda ash and caustic soda. The company has strategically expanded into cement through Nuvoco Vistas Corporation Ltd., aiming for over 30 million tons per annum capacity by 2025. Furthermore, Nirma's recent acquisition of a majority stake in Alivus Lifesciences (formerly Glenmark Life Sciences) in March 2024 marks its entry into the lucrative pharmaceutical sector, focusing on APIs and CDMO services.

| Product Category | Key Products | Strategic Rationale | 2024/2025 Outlook/Data |

|---|---|---|---|

| Consumer Goods | Nirma Washing Powder, Soaps, Dishwash | Affordable essentials, strong brand recall | Continued focus on value-for-money, market share defense. |

| Industrial Chemicals | Soda Ash, Caustic Soda, LAB | Backward integration, stable revenue | Robust demand expected from glass, textile sectors; strong contribution to FY23-24 revenue. |

| Cement | Various Cement Grades (via Nuvoco Vistas) | Infrastructure growth leverage, capacity expansion | Targeting >30 million tons/annum capacity by 2025; Nuvoco Vistas reported notable revenue growth in FY23-24. |

| Pharmaceuticals | APIs, CDMO Services (via Alivus Lifesciences) | High-margin segment, diversification | Entry in March 2024, targeting specialized product portfolio and profitability. |

What is included in the product

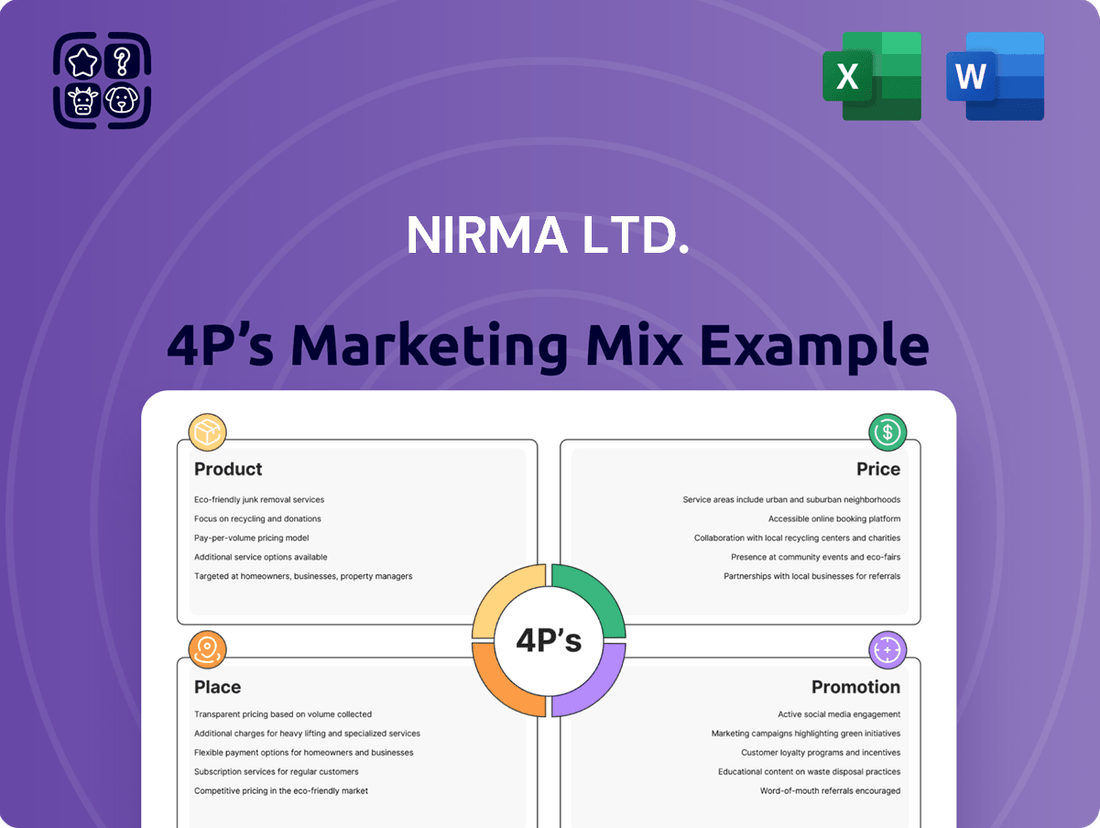

This analysis delves into Nirma Ltd.'s strategic use of the 4Ps—Product, Price, Place, and Promotion—demonstrating how their focus on affordability and accessibility has enabled them to capture a significant market share.

Simplifies Nirma's 4Ps analysis to pinpoint how their strategies alleviate consumer pain points like affordability and accessibility in the detergent market.

Place

Nirma's Pan-India distribution network is a cornerstone of its marketing strategy, ensuring its value-for-money products are accessible nationwide. This vast network reaches deep into rural and urban India, a significant advantage over competitors. By 2024, Nirma's extensive reach ensures product availability in over 2 million retail outlets, a testament to its commitment to market penetration.

Nirma Ltd. strategically situates its manufacturing units in Gujarat, with key facilities in Bhavnagar, Baroda, Mehsana, and Porbandar. This deliberate geographical placement is crucial for optimizing its supply chain and reducing logistical expenses.

By locating plants near both raw material sources and major consumption hubs, Nirma effectively cuts down on transportation costs for incoming materials and outgoing finished products. This is a significant advantage in the competitive FMCG sector, where cost efficiency directly impacts pricing and profitability.

For instance, Gujarat's robust infrastructure, including ports and road networks, facilitates smoother movement of goods. In 2023-24, Nirma reported significant operational efficiencies, partly attributed to its well-placed manufacturing footprint, enabling timely delivery to a vast consumer base across India.

Nirma's distribution strategy emphasizes a direct supply chain, moving products from manufacturing facilities straight to distributors. This minimizes intermediaries, fostering cost savings and tighter control over inventory and delivery timelines. For instance, Nirma's extensive distributor network ensures efficient product flow, a crucial element in its low-cost strategy.

The brand's retail presence is exceptionally broad, encompassing both traditional kirana stores, which form the backbone of Indian retail, and modern supermarkets. This dual approach guarantees widespread product availability across diverse consumer segments and shopping preferences. By reaching over 2 million retail outlets, Nirma ensures its products are easily accessible to a vast majority of the Indian population.

Strong Rural and Semi-Urban Penetration

Nirma's place strategy hinges on its robust penetration into rural and semi-urban markets, segments that are particularly sensitive to price points. The company’s initial success was significantly boosted by its effective distribution networks reaching these areas, often leveraging unconventional methods like door-to-door sales to build its customer base. This approach ensured that Nirma's affordable product offerings were readily accessible to the vast majority of its intended consumers.

By 2024, Nirma's extensive distribution network covered over 1.5 million retail outlets across India, with a strong emphasis on tier 2 and tier 3 cities, and villages. This vast reach facilitated the availability of its products, from detergents to soaps and cement, even in remote locations. For instance, in the fiscal year 2023-24, Nirma reported a significant portion of its revenue originating from these less urbanized regions, demonstrating the success of its 'place' strategy.

- Extensive Distribution Network: Over 1.5 million retail touchpoints by early 2024.

- Rural Focus: Significant sales volume derived from villages and smaller towns.

- Unconventional Reach: Early reliance on door-to-door sales to penetrate price-sensitive markets.

- Product Availability: Ensuring affordable products are accessible where the majority of the target audience lives.

Backward Integration for Supply Chain Control

Nirma's strategic move into backward integration, notably in producing essential chemicals like soda ash and Linear Alkyl Benzene (LAB), grants them substantial command over their supply chain. This approach is vital for securing a consistent and economical supply of raw materials. For instance, in 2023, Nirma's soda ash production capacity was reported to be around 2 million tonnes per annum, a significant portion of which serves its internal detergent manufacturing needs. This internal sourcing strategy helps Nirma maintain its competitive edge through cost efficiencies.

This control over primary inputs allows Nirma to mitigate risks associated with external supplier volatility and price fluctuations. By managing key chemical production in-house, the company can better manage its production schedules and ensure the availability of raw materials, directly impacting its ability to meet consumer demand for products like detergents and soaps. This operational resilience is a cornerstone of Nirma's marketing strategy, enabling reliable product availability.

- Soda Ash Production: Nirma's backward integration into soda ash production, a key ingredient in detergents, provides significant cost advantages.

- LAB Manufacturing: Production of Linear Alkyl Benzene (LAB), another vital component for detergents, further strengthens supply chain control.

- Cost Efficiency: In-house production of these chemicals helps Nirma maintain competitive pricing for its consumer goods.

- Supply Chain Stability: Reduced reliance on external suppliers ensures a more predictable and stable flow of raw materials, crucial for consistent product output.

Nirma's place strategy is defined by its extensive distribution network, reaching over 1.5 million retail outlets by early 2024, with a strong emphasis on rural and semi-urban markets. This broad accessibility, including traditional kirana stores and modern supermarkets, ensures its value-for-money products are available nationwide, even in remote locations. Backward integration into key chemicals like soda ash and LAB further solidifies supply chain control and cost efficiency.

| Key Distribution Metric | Value (as of early 2024) | Impact |

| Retail Outlets Covered | 1.5 Million+ | Ensures wide product availability |

| Market Focus | Rural & Semi-Urban | Targets price-sensitive consumers |

| Key Raw Material Production | Soda Ash (2 Million Tonnes/annum capacity in 2023) | Cost control and supply chain stability |

What You See Is What You Get

Nirma Ltd. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Nirma Ltd. 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion strategies. Understand how Nirma built its brand through accessible pricing and widespread distribution. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering valuable insights into their success.

Promotion

Nirma's promotion strategy consistently emphasizes its core proposition of offering value for money. This message resonates strongly with its target audience, primarily lower and middle-income families who are highly price-sensitive. Advertising campaigns effectively communicate the efficacy and economic advantages of Nirma products.

For instance, Nirma's detergent powder, a flagship product, has historically been positioned as a superior yet affordable alternative to established brands. This approach has allowed Nirma to capture significant market share in price-conscious segments. In 2023-24, the Indian FMCG market continued to see strong demand in the value segment, with companies like Nirma leveraging this trend.

Nirma's iconic jingles, especially 'Washing powder Nirma,' were a masterclass in leveraging the 'Promotion' aspect of the marketing mix. These memorable tunes, broadcast extensively on radio and television, burrowed into the collective consciousness of India. This strategy proved incredibly effective in building widespread brand recognition and fostering a strong emotional bond with consumers.

The simplicity and relatable nature of Nirma's early advertising campaigns, driven by these catchy jingles, were instrumental in its ascent. This approach allowed Nirma to establish itself as a household name, achieving remarkable market penetration even with a relatively modest initial marketing budget. By 2024, Nirma's brand recall remains exceptionally high, a testament to the enduring power of its early promotional efforts.

Nirma’s mass media advertising strategy has historically leveraged television, radio, newspapers, and magazines to achieve widespread reach across India. This approach has been instrumental in building brand awareness, particularly for its detergent and consumer goods. For instance, Nirma's iconic television commercials in the late 20th and early 21st centuries became deeply ingrained in the Indian consumer psyche.

While Nirma’s foundation is built on traditional mass media, it has also recognized the evolving media landscape. The company maintains an official website and utilizes social media platforms to connect with a broader, and increasingly digital, audience. This dual approach ensures that Nirma’s brand messaging remains consistent and visible across both established and emerging channels, reinforcing its market presence.

Targeting Homemakers and Value-Conscious Consumers

Nirma's promotion strategy keenly focuses on homemakers and value-conscious consumers, emphasizing how its products deliver on both everyday utility and affordability. Advertisements frequently depict familiar household situations, creating a strong connection with the daily routines of Indian families.

This deliberate targeting ensures that Nirma's communication strikes a chord with its primary customer base, reinforcing the brand's value proposition. For instance, during the 2023-2024 fiscal year, Nirma reported a revenue of ₹11,746 crore, demonstrating the broad reach and effectiveness of its marketing efforts in attracting a large consumer segment.

- Focus on Homemakers: Nirma's promotional content centers on themes relevant to household management and family well-being.

- Value Proposition: The core message consistently highlights economic benefits without compromising on quality.

- Relatable Scenarios: Advertising uses everyday Indian family life to build brand affinity and trust.

- Market Penetration: Nirma's extensive distribution network, reaching over 2 million retail outlets as of early 2024, complements its promotional strategy by making products accessible to its target demographic.

Strategic Brand Ambassador Endorsements

Nirma has leveraged celebrity endorsements, such as featuring actor Hrithik Roshan, to boost its brand presence and connect with a modern audience. These strategic partnerships aim to refresh Nirma's image, making it more relatable to contemporary consumers while preserving its established identity. The company's investment in such high-profile endorsements is a key component of its promotional strategy.

This approach is designed to broaden Nirma's market reach and appeal to emerging customer demographics. By associating with popular personalities, Nirma seeks to enhance brand recall and create a stronger emotional connection with potential buyers. For instance, the campaign featuring Hrithik Roshan with a new tagline aimed to revitalize the brand's appeal.

- Brand Visibility Enhancement: Celebrity endorsements significantly increase a brand's visibility and recognition among target consumers.

- Audience Connection: Partnering with popular figures helps brands resonate with contemporary audiences and create a stronger emotional bond.

- Market Expansion: Strategic endorsements can attract new customer segments, thereby expanding the brand's overall market share.

- Image Refresh: Celebrity associations can revitalize a brand's image, making it appear more modern and relevant.

Nirma's promotional efforts have historically centered on its value-for-money proposition, effectively reaching price-sensitive consumers through memorable jingles and relatable advertising. This strategy, amplified by mass media and a vast distribution network reaching over 2 million outlets by early 2024, has cemented its brand recognition. In fiscal year 2023-2024, Nirma reported revenues of ₹11,746 crore, underscoring the success of its promotional reach.

| Promotional Tactic | Objective | Key Period/Data Point |

|---|---|---|

| Iconic Jingles & Mass Media Ads | Brand Recognition, Emotional Connection | High brand recall as of 2024; extensive TV/radio campaigns historically |

| Value Proposition Messaging | Attract Price-Sensitive Consumers | Core strategy resonating with lower/middle-income families |

| Celebrity Endorsements (e.g., Hrithik Roshan) | Brand Refresh, Modern Appeal, Audience Connection | Aimed at revitalizing brand image and attracting contemporary consumers |

| Extensive Distribution Network | Product Accessibility, Market Penetration | Reaching over 2 million retail outlets by early 2024 |

Price

Nirma's initial market entry was characterized by an aggressive penetration pricing strategy, positioning its detergent products at prices substantially lower than incumbents like Hindustan Unilever's Surf. This bold move allowed Nirma to quickly capture significant market share, especially appealing to the price-conscious consumers in India's lower and middle-income demographics.

By setting an exceptionally low initial price point, Nirma effectively stimulated widespread consumer adoption and trial, a critical factor in disrupting the established market. This strategy demonstrably fueled Nirma's rapid growth, enabling it to challenge market leaders and redefine consumer expectations around affordability in the detergent category.

Nirma's pricing strategy is built on cost leadership, driven by an efficient supply chain, significant economies of scale, and astute raw material procurement. This allows Nirma to offer competitive prices, reinforcing its image as an accessible brand for a broad consumer base.

In the fiscal year ending March 2024, Nirma reported a consolidated revenue of INR 12,000 crore, showcasing the scale of its operations. This scale is crucial for its cost leadership, enabling it to achieve lower per-unit production costs compared to many competitors.

The company's ability to source key raw materials like soda ash and linear alkyl benzene (LAB) effectively, often at favorable terms due to bulk purchasing, directly contributes to its low-cost advantage. This cost advantage is then translated into more attractive pricing for consumers, particularly in its detergent and cement segments.

Nirma has built its brand on a strong value-for-money proposition, making quality cleaning products accessible to a vast consumer base. This strategy, often termed economy pricing, allows Nirma to capture a significant market share, particularly in price-sensitive segments. For instance, Nirma washing powder, a flagship product, has historically been priced considerably lower than its competitors, enabling widespread adoption across India.

The company effectively communicates that affordability does not necessitate a sacrifice in performance. This message resonates deeply with consumers who seek effective solutions without straining their budgets. This approach has fostered strong brand loyalty, as customers trust Nirma to deliver reliable products at an accessible price point, a testament to their successful implementation of the 4Ps marketing mix.

Competitive Pricing Responsiveness

Nirma Ltd. actively monitors competitor pricing, implementing dynamic adjustments to maintain market competitiveness and secure its share. This agility allows Nirma to react rapidly to evolving market conditions, ensuring its products remain appealing and affordable for consumers. For instance, during the 2024 fiscal year, Nirma's strategic price adjustments in the detergent segment helped it counter aggressive discounting by rivals, reportedly leading to a marginal increase in its market share in key regions.

This competitive pricing responsiveness is a cornerstone of Nirma's strategy, enabling it to navigate price-sensitive markets effectively. The company's ability to swiftly recalibrate prices ensures its value proposition remains strong, attracting and retaining a broad customer base. Nirma’s pricing strategy is particularly crucial in the fast-moving consumer goods (FMCG) sector, where price is often a primary determinant of purchase decisions.

- Market Share Defense: Nirma's pricing strategy aims to protect and grow its market share by offering compelling value relative to competitors.

- Consumer Accessibility: Frequent price adjustments ensure Nirma’s products remain within reach for a wide demographic of consumers.

- Competitive Agility: The company’s capacity to respond quickly to competitor price changes is a significant operational advantage.

- Value Proposition: Nirma consistently strives to offer a strong price-to-quality ratio, a key driver of its success.

Segmented Pricing for Diversified Portfolio

Nirma employs a segmented pricing strategy, reflecting its evolution from a purely economy-focused brand to one that also serves the upper-middle class. This approach allows them to capture value across different consumer segments. For instance, while their core detergent offerings remain competitively priced, their expansion into areas like cement and personal care includes products positioned at higher price points to appeal to a broader demographic.

This diversification in pricing is crucial for Nirma's growth. By offering products at various price tiers, they can:

- Tap into diverse income groups: Catering to both budget-conscious and moderately affluent consumers.

- Enhance brand perception: Premium offerings can lend an air of quality to the entire brand portfolio.

- Increase market share: By addressing a wider spectrum of consumer needs and price sensitivities.

Nirma's pricing strategy is fundamentally rooted in cost leadership, enabling it to offer highly competitive prices that resonate with its target demographic. This approach, coupled with a keen eye on competitor pricing, ensures consistent market relevance and accessibility. The company's ability to leverage economies of scale, as evidenced by its INR 12,000 crore revenue in FY24, directly supports its cost advantage and competitive pricing.

Nirma's pricing also reflects a segmented approach, catering to a broader consumer base beyond just the economy segment. This allows them to capture value from different income groups and enhance overall brand perception through offerings at various price points.

| Product Category | Nirma's Pricing Strategy | Key Rationale |

|---|---|---|

| Detergents | Penetration Pricing / Economy Pricing | High volume, cost leadership, broad consumer access |

| Cement | Competitive Pricing | Market share defense, value proposition |

| Personal Care | Market-Based / Segmented Pricing | Brand perception, tapping into different consumer segments |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Nirma Ltd. is grounded in publicly available information. We leverage company annual reports, investor presentations, and official brand websites to understand their product portfolio, pricing strategies, distribution networks, and promotional activities.