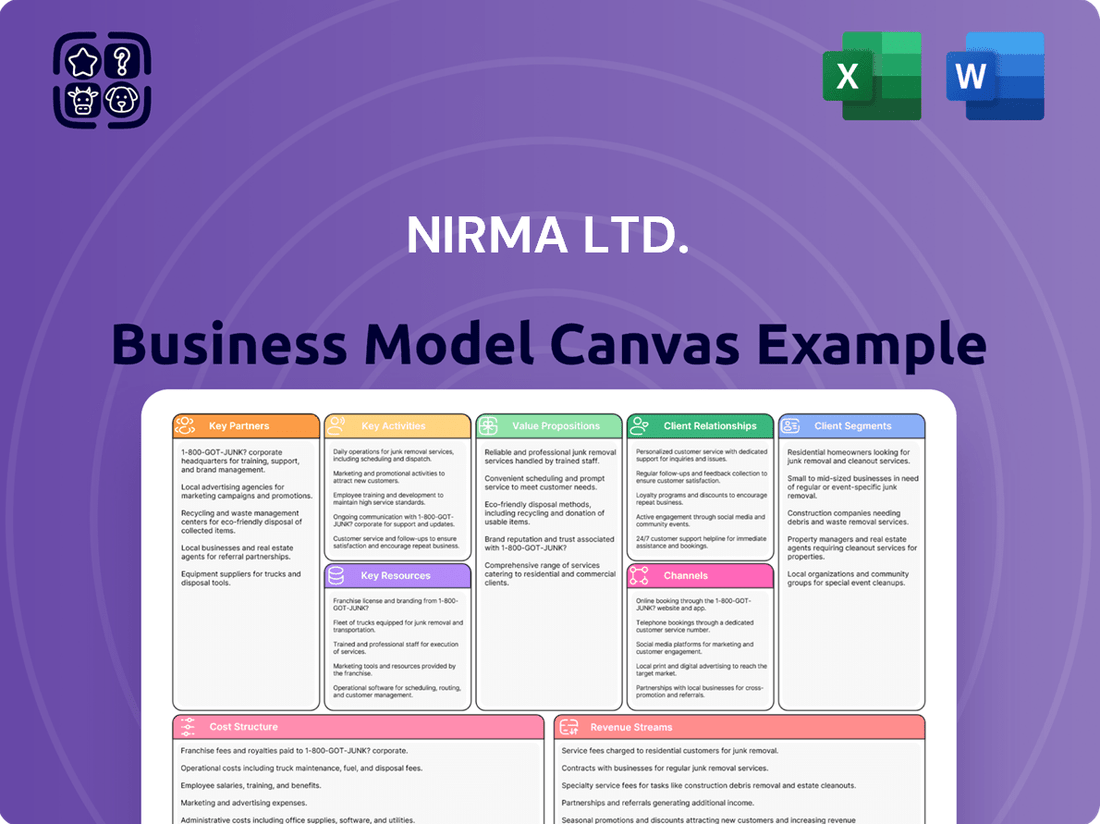

Nirma Ltd. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nirma Ltd. Bundle

Unlock the strategic blueprint behind Nirma Ltd.'s remarkable journey. This comprehensive Business Model Canvas details their customer segments, value propositions, and revenue streams that have driven their success in the FMCG sector. Discover their key resources and activities that enable efficient production and distribution.

Dive deeper into Nirma Ltd.’s market penetration and cost leadership. This downloadable Business Model Canvas provides a clear, professionally written snapshot of what makes this company thrive—from their cost structure to their customer relationships.

Want to see exactly how Nirma Ltd. operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Nirma Ltd.’s success. This professional, ready-to-use document is ideal for business students or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Nirma Ltd.. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Nirma's success hinges on its extensive network of raw material suppliers, providing essential chemicals like soda ash and linear alkyl benzene for its core detergent and soap manufacturing. These partnerships are critical for maintaining Nirma's value-for-money proposition by ensuring consistent quality and competitive pricing.

The company's strategic expansion into the pharmaceutical sector through the acquisition of Alivus Life Sciences necessitates strengthening relationships with suppliers of active pharmaceutical ingredients (APIs). This diversification requires a new tier of specialized raw material partners to support the pharmaceutical product lines.

Nirma's extensive pan-India reach relies heavily on its key partnerships with distribution and logistics providers. This network is crucial for getting Nirma's products, from detergents to cement, into the hands of consumers across both urban centers and remote rural areas. These collaborations ensure efficient supply chain operations, a critical factor in the competitive FMCG and building materials markets.

The company leverages a vast array of distributors and wholesalers to maintain product availability nationwide. In 2023, Nirma reported a significant presence across more than 2 million retail outlets throughout India, underscoring the depth of its distribution network. These partners are instrumental in navigating the complexities of India’s diverse geographical landscape and retail infrastructure.

Logistics partners play a pivotal role in Nirma's success, managing the transportation and warehousing of its wide product portfolio. This allows Nirma to effectively manage inventory and ensure timely delivery, thereby strengthening its competitive advantage. The efficiency of these logistics partnerships directly impacts customer satisfaction and market penetration, especially for high-volume products.

Nirma actively collaborates with technology providers and research institutions to fuel innovation across its diverse business segments. These partnerships are crucial for developing advanced formulations in consumer goods, such as more effective and eco-conscious detergents and soaps. For instance, in 2024, Nirma continued its focus on sustainable product development, aiming to incorporate biodegradable ingredients identified through R&D with academic partners.

Strategic Acquisition Targets

Nirma Ltd. actively seeks strategic acquisition targets to fuel its inorganic growth and enhance its market standing. This approach is clearly demonstrated by Nirma's significant acquisition of Glenmark Life Sciences, which has since been rebranded as Alivius Life Sciences, and its acquisition of Vadraj Cement. These moves are pivotal for Nirma's strategy to diversify its business interests and bolster its presence in key industries.

These strategic partnerships are instrumental in expanding Nirma's operational footprint and increasing its capacity. The acquisition of Glenmark Life Sciences, for instance, marked a substantial entry into the pharmaceutical sector, a move that diversifies Nirma's revenue streams beyond its traditional core businesses. Simultaneously, the Vadraj Cement acquisition reinforces its position in the building materials market.

The identification and successful integration of these acquired entities form a cornerstone of Nirma's long-term developmental strategy. For example, in 2023, Nirma completed the acquisition of Glenmark Life Sciences for approximately ₹5,651 crore, a substantial investment aimed at capturing growth in the life sciences domain. This strategic foresight in selecting and integrating partners allows Nirma to achieve rapid market penetration and scale.

Nirma's strategic acquisition targets are carefully chosen to align with its overarching business objectives, focusing on sectors with strong growth potential and opportunities for synergistic integration. The company's ability to identify, negotiate, and integrate these diverse businesses underscores its robust M&A capabilities and its commitment to continuous expansion and market leadership. This proactive approach ensures sustained value creation and competitive advantage.

Financial Institutions and Investors

Nirma Ltd. actively collaborates with a diverse range of financial institutions and investors to fuel its expansive growth strategy. These partnerships are critical for securing the necessary capital for ongoing operations, significant capital expenditures, and ambitious strategic acquisitions.

The company leverages its relationships with banks and financial institutions to raise debt financing, which has been instrumental in funding major investments. For instance, Nirma secured significant funding to support its acquisition of Glenmark Life Sciences, a move that bolstered its position in the pharmaceutical sector.

- Debt Financing: Nirma has utilized various debt instruments, including bonds and other borrowing facilities, to finance large-scale projects and acquisitions.

- Strategic Acquisitions: Partnerships with financial entities enable Nirma to undertake significant strategic moves, such as the acquisition of Glenmark Life Sciences in 2023, valued at approximately ₹6,000 crore.

- Liquidity and Growth: Maintaining robust relationships with financial partners ensures consistent liquidity, providing the financial flexibility needed to pursue and capitalize on growth opportunities in its diverse business segments.

Nirma's key partnerships extend to raw material suppliers, distributors, logistics providers, technology collaborators, and financial institutions. These relationships are vital for sourcing chemicals, ensuring nationwide product availability, efficient supply chain management, fostering innovation, and funding expansion initiatives. The company's strategic acquisitions also represent crucial partnerships that bolster its presence in diversified sectors.

| Key Partnership Area | Nature of Partnership | Impact on Nirma | Example/Data Point |

| Raw Material Suppliers | Critical input providers | Ensures cost competitiveness and quality for detergents, soaps, and cement. | Suppliers of soda ash, linear alkyl benzene. |

| Distributors & Wholesalers | Market access and product reach | Facilitates pan-India availability across millions of retail outlets. | Presence in over 2 million retail outlets (2023). |

| Logistics Providers | Supply chain and transportation | Enables efficient inventory management and timely delivery. | Supports a wide product portfolio across diverse geographies. |

| Technology & Research | Innovation and product development | Drives advancements in formulations and sustainable practices. | Focus on biodegradable ingredients in 2024 R&D. |

| Financial Institutions | Capital and funding | Supports large-scale projects and strategic acquisitions. | Funding for Glenmark Life Sciences acquisition (approx. ₹6,000 crore). |

| Strategic Acquisitions | Business expansion and diversification | Entry into new sectors like pharmaceuticals and strengthening cement business. | Acquisition of Glenmark Life Sciences (Alivius Life Sciences) and Vadraj Cement. |

What is included in the product

Nirma's business model canvas focuses on delivering affordable FMCG products, primarily detergents and personal care items, to a broad customer base through extensive distribution networks, leveraging cost leadership and strong brand loyalty.

Nirma's Business Model Canvas effectively addresses the pain point of affordability for mass consumers by focusing on low-cost production and distribution, making essential household products accessible to a wider population.

Activities

Nirma's manufacturing and production activities are central to its business, encompassing the large-scale creation of detergents, soaps, industrial chemicals such as soda ash and linear alkyl benzene (LAB), and cement. This involves overseeing numerous production sites and continuously refining processes to achieve cost-effectiveness and maintain superior product quality across its varied portfolio.

The company's strategic backward integration into key chemicals like soda ash, where it is a significant global producer, directly supports its consumer goods manufacturing by ensuring a stable and cost-efficient supply chain. For instance, Nirma's soda ash production capacity is substantial, contributing significantly to its competitive edge in the detergent market.

In 2024, Nirma continued to focus on operational efficiency in its manufacturing plants. The company's extensive network of facilities allows for economies of scale, a critical factor in its ability to offer products at competitive price points. This robust production capability underpins its market position in both consumer and industrial sectors.

Nirma's commitment to continuous Research and Development is fundamental to its strategy of delivering value-for-money products and maintaining a competitive edge. This involves a dedicated effort to innovate new consumer goods, refine existing product formulations for enhanced performance, and boost manufacturing process efficiency. The company's R&D also focuses on optimizing chemical processes to improve yields and reduce operational costs, a crucial aspect for its cost-sensitive market segments.

In 2024, Nirma's R&D initiatives are geared towards exploring emerging technologies across its diverse business verticals, including its growing pharmaceutical division. This forward-looking approach ensures Nirma stays ahead of market trends and consumer demands, particularly in developing innovative solutions within the detergent, personal care, and industrial chemicals sectors.

Nirma’s supply chain management is a core activity, encompassing everything from sourcing raw materials like soda ash and linear alkyl benzene to orchestrating production and delivering finished goods. This intricate network aims for optimal inventory levels and efficient production planning to meet fluctuating market demands.

The company focuses on minimizing operational costs within its supply chain. In 2024, Nirma’s strategic sourcing and logistics optimization efforts contributed to maintaining competitive pricing in the detergent and cement sectors, crucial for its market share.

Ensuring timely product availability across its extensive distribution network is paramount. Nirma’s distribution strategy leverages various channels to reach diverse consumer segments, guaranteeing that products are consistently on shelves, a key factor in customer loyalty.

Marketing and Sales

Nirma's marketing and sales strategy heavily emphasizes value for money, a core tenet that resonates with its broad consumer base. This approach is supported by extensive advertising, historically utilizing mass media to build widespread brand awareness. For instance, Nirma's detergent brand became a household name through memorable jingles and visual advertising, effectively reaching a vast audience.

The company's reach is amplified by a robust distribution network, crucial for penetrating both urban and rural markets across India. This expansive network ensures product availability, a key driver of sales volume. In 2024, Nirma continued to focus on strengthening its distribution channels to maintain its market presence.

Nirma's sales activities are geared towards maximizing accessibility and affordability. The company's success is built on making essential products available to the masses. This includes strategic pricing and promotions designed to appeal to price-sensitive consumers.

Key marketing and sales activities for Nirma include:

- Mass Marketing Campaigns: Utilizing television, radio, and print media to build brand recall and communicate value propositions.

- Extensive Distribution Network: Ensuring product availability in urban centers, semi-urban areas, and rural hinterlands.

- Promotional Offers and Pricing Strategies: Implementing competitive pricing and occasional promotions to drive sales volume.

- Brand Building Initiatives: Focusing on creating strong brand equity through consistent messaging centered on affordability and quality.

Mergers and Acquisitions (M&A) Integration

Nirma's key activities heavily feature mergers and acquisitions (M&A) integration. This involves meticulous identification and execution of strategic deals, including thorough due diligence and securing necessary financing. The successful integration of acquired entities is paramount to unlocking synergies and fostering consolidated growth.

A prime example of this is Nirma's acquisition of Alivius Life Sciences (formerly Glenmark Life Sciences) and Vadraj Cement. These integrations are crucial for Nirma to expand its market presence and operational capabilities. The company focuses on seamlessly merging these new businesses into its existing framework to achieve operational efficiencies and market leadership.

- Strategic Acquisitions: Nirma actively pursues M&A to expand its diverse business portfolio, encompassing chemicals, cement, and pharmaceuticals.

- Integration Focus: The company prioritizes the smooth assimilation of acquired businesses, aiming to realize cost and revenue synergies quickly.

- Growth Driver: M&A integration is a core strategy for Nirma to achieve its ambitious growth targets and enhance its competitive positioning.

- Recent Deal: In 2023, Nirma's acquisition of Alivius Life Sciences for approximately $625 million marked a significant step in its pharmaceutical sector expansion.

Nirma's key activities center on its robust manufacturing and backward integration, ensuring cost-effective production of detergents, soaps, and industrial chemicals like soda ash. The company's strategic sourcing and supply chain management are crucial for maintaining competitive pricing and product availability across its wide distribution network. Marketing and sales focus on value-for-money messaging, amplified by extensive advertising and a strong presence in both urban and rural markets.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive overview details Nirma Ltd.'s strategic framework, covering key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. What you see here is the complete, unedited Nirma Ltd. Business Model Canvas, ready for your analysis and application.

Resources

Nirma's manufacturing infrastructure is a cornerstone of its business model, featuring extensive plants and facilities strategically positioned throughout India. These sites support its diverse product lines, including detergents, soaps, chemicals, and cement.

Key to Nirma's success is its robust backward integration, exemplified by large-scale production units for essential raw materials like soda ash and linear alkyl benzene. This internal sourcing capability significantly enhances cost control and supply chain reliability.

The company's cement operations are supported by dedicated cement grinding units and clinker facilities, ensuring a comprehensive production chain from raw material to finished product. This integrated approach allows for greater operational efficiency and market responsiveness.

As of recent reports, Nirma's soda ash capacity is substantial, contributing significantly to its chemical division's output and supporting its detergent manufacturing. Similarly, its cement production capacity places it as a notable player in the Indian cement market, with ongoing expansions to meet growing demand.

Nirma's brand portfolio, especially the iconic 'Nirma' detergent and soap line, represents a powerful intangible asset. This brand equity is built on decades of consumer trust and recognition for delivering value-for-money products, a key differentiator in the Indian market.

The company holds significant intellectual property, including patented formulations for its cleaning products. These patents, along with registered trademarks, protect Nirma's unique offerings and contribute to its competitive advantage by preventing imitation.

As of early 2024, Nirma continues to leverage its strong brand recognition across various consumer segments. The company's consistent advertising and market presence have reinforced its position, allowing it to maintain a loyal customer base that values its affordability and effectiveness.

Nirma's extensive distribution network is a powerhouse, reaching every corner of India, from bustling cities to remote villages. This deep penetration ensures their products, like detergents and soaps, are readily available to a massive consumer base, a key element in their business model.

This network isn't just about shelves; it includes robust warehousing and efficient logistics, allowing Nirma to manage inventory effectively across its vast reach. Their strong ties with thousands of retailers and wholesalers are fundamental to this accessibility.

By 2024, Nirma's distribution channels likely encompassed over 2 million retail outlets, a testament to the scale and depth of their reach, which is crucial for maintaining market share in fast-moving consumer goods.

The company's ability to consistently deliver products through this intricate web of distributors and retailers is a significant competitive advantage, directly impacting sales volume and brand presence.

Human Capital and Expertise

Nirma's human capital is a cornerstone of its business model. The company's workforce, comprising skilled engineers, chemists, and dedicated R&D professionals, drives innovation in product development. As of November 2024, Nirma reported a substantial employee base of over 9,200 individuals, underscoring its significant investment in human resources.

This diverse talent pool extends to its robust marketing and sales teams, alongside experienced management. Their collective expertise in manufacturing processes, coupled with a deep understanding of market dynamics and consumer needs, directly fuels Nirma's operational efficiency. This expertise is crucial for maintaining Nirma's competitive advantage in its various business segments.

- Skilled Workforce: Engineers, chemists, and R&D personnel are key to product innovation.

- Market Expertise: Marketing and sales teams possess deep knowledge of consumer preferences and market trends.

- Operational Efficiency: Management and technical staff contribute to streamlined manufacturing and efficient operations.

- Employee Count: Nirma employed over 9,200 people as of November 2024, reflecting its scale.

Financial Capital and Access to Funding

Nirma Ltd. maintains substantial financial capital, a critical component for its business operations. This includes significant cash reserves and retained earnings, which are vital for day-to-day activities and planned capital expenditures.

The company's ability to access both debt and equity markets further bolsters its financial strength. This access is crucial for funding larger projects, potential strategic acquisitions, and generally maintaining flexibility in the competitive landscape.

For instance, Nirma's robust financial standing allows it to invest in expanding its manufacturing capabilities and diversifying its product portfolio. As of recent reports, the company has demonstrated a consistent capacity to manage its finances effectively, enabling sustained growth.

- Financial Reserves: Nirma leverages its accumulated cash and retained earnings to fund ongoing operations and capital investments.

- Debt and Equity Access: The company actively utilizes debt and equity financing to support growth initiatives and strategic expansion.

- Market Competitiveness: A strong financial foundation provides Nirma with the agility needed to navigate and compete effectively in its various market segments.

- Investment Capacity: This financial muscle enables Nirma to pursue opportunities for capacity enhancement and potential acquisitions, driving future development.

Nirma's Key Resources are diverse and powerful. Its extensive manufacturing infrastructure, including plants for detergents, soaps, chemicals, and cement, forms a significant physical asset base. Backward integration into raw materials like soda ash and linear alkyl benzene provides cost advantages and supply chain security.

Intellectual property, such as patented cleaning formulations and strong brand equity built on decades of consumer trust, represents crucial intangible assets. The company's vast distribution network, reaching millions of retail outlets across India, ensures product accessibility and market penetration. Furthermore, Nirma's substantial financial capital, including cash reserves and access to debt/equity markets, fuels its operations and growth strategies.

| Resource Category | Specific Assets/Capabilities | Key Impact |

|---|---|---|

| Manufacturing Infrastructure | Detergent, soap, chemical, cement plants; Soda ash & LAB production units; Cement grinding & clinker facilities | Cost control, supply chain reliability, operational efficiency, diverse product support |

| Intellectual Property & Brand | Patented formulations, registered trademarks, Nirma brand recognition | Competitive advantage, customer loyalty, market differentiation |

| Distribution Network | Extensive reach across India, ~2 million retail outlets (estimated by 2024), warehousing & logistics | Product accessibility, market share maintenance, sales volume |

| Human Capital | Over 9,200 employees (Nov 2024), skilled engineers, chemists, R&D, marketing & sales teams | Product innovation, market understanding, operational efficiency |

| Financial Capital | Cash reserves, retained earnings, access to debt & equity markets | Funding operations & investments, strategic flexibility, growth initiatives |

Value Propositions

Nirma's core value proposition is delivering quality consumer goods, especially detergents and soaps, at prices that are exceptionally affordable. This focus on value for money has been instrumental in Nirma's success, enabling it to attract and retain a large customer base in India's price-sensitive market.

By consistently providing effective cleaning products at accessible price points, Nirma democratized access to hygiene and cleanliness for millions of households. This strategy allowed them to penetrate deep into the Indian market, offering a compelling alternative to more premium brands.

In 2023, the Indian detergent market was valued at approximately USD 3.5 billion, with Nirma holding a significant market share, particularly in the economy and mid-price segments. This demonstrates the enduring appeal of their affordable quality proposition.

Nirma Ltd. boasts a remarkably diversified product portfolio that spans consumer goods, industrial chemicals, and cement. Within consumer goods, they offer everything from detergents and soaps to personal care items and dishwashing liquids. This broad consumer offering ensures they meet a wide array of household needs.

Their industrial chemical segment is anchored by key products like soda ash and linear alkyl benzene (LAB), crucial components for various manufacturing processes. In 2024, the global soda ash market was valued at approximately $50 billion, with Nirma being a significant player.

This strategic diversification across distinct sectors like consumer staples and industrial materials provides Nirma with inherent stability. It effectively reduces their dependence on any single market segment or product category, cushioning them against sector-specific downturns and catering to a wider customer base.

Nirma's established brand trust, cultivated over decades in the Indian market, is a cornerstone of its business model. This heritage, deeply rooted in consumer consciousness, translates into significant brand recognition and loyalty.

The company's consistent focus on affordability has resonated with a vast segment of the Indian population, creating a strong association between the Nirma brand and economic value. This has fostered a reliable and predictable customer base, a crucial element for sustained business operations.

In 2023, Nirma reported consolidated revenue of ₹14,000 crore, a testament to its enduring market presence and the trust consumers place in its products. This financial performance directly reflects the strength of its brand equity built over its long history.

Backward Integration for Cost Control

Nirma's backward integration into critical raw materials like soda ash and LAB for its detergent operations is a cornerstone of its cost control strategy. This vertical integration allows Nirma to directly manage the production and procurement of key inputs, shielding it from market volatility and supplier price hikes. For instance, Nirma's significant investment in soda ash production capacity provides a substantial cost advantage. In 2024, the global soda ash market experienced price fluctuations, but Nirma's in-house production ensured a more stable and predictable cost base for its detergent manufacturing.

This strategic move enhances operational efficiency by ensuring a consistent and reliable supply of essential raw materials, thereby minimizing production disruptions. By controlling these upstream processes, Nirma can better manage its inventory and avoid stockouts, leading to smoother manufacturing cycles. This stability is crucial for maintaining competitive pricing in the highly price-sensitive detergent market.

The benefits of this backward integration extend to quality assurance as well. Nirma can implement stringent quality checks at every stage of raw material production, ensuring that the inputs meet its specific standards. This direct oversight contributes to the consistent quality of its final detergent products, reinforcing brand trust.

- Cost Control: Reduced reliance on external suppliers for key raw materials like soda ash and LAB leads to predictable and lower input costs.

- Supply Chain Stability: In-house production ensures a consistent and uninterrupted supply of critical components for detergent manufacturing.

- Quality Assurance: Direct control over raw material production allows for stringent quality checks, enhancing the quality of final products.

- Competitive Pricing: Lower operational costs translate into the ability to offer products at more competitive price points in the market.

Accessibility and Widespread Availability

Nirma's extensive distribution network is key to its value proposition of accessibility and widespread availability. This network reaches deep into remote and rural corners of India, ensuring even those in less populated areas can access Nirma's products. In 2024, Nirma continued to leverage its established channels, which include over 1 million retail outlets across the country, making it a household name.

This broad reach directly translates into convenience for a vast consumer base. By placing products within easy reach, Nirma removes a significant barrier to purchase for millions of Indians. The company's strategy focuses on making its affordable offerings readily available, a critical factor for its target market.

- Extensive Retail Footprint: Nirma operates through a network of over 1 million retail touchpoints across India.

- Rural Penetration: The company prioritizes availability in rural and semi-urban markets, where affordability and accessibility are paramount.

- Convenience for Consumers: Easy access to Nirma products saves consumers time and effort in their purchasing decisions.

- Market Dominance: This widespread availability has been instrumental in Nirma's strong market share in categories like detergents and soaps.

Nirma's value proposition is built on delivering high-quality consumer goods and essential industrial chemicals at highly competitive prices. This focus on affordability, coupled with strategic backward integration into raw materials like soda ash, ensures cost control and supply chain stability.

Their extensive distribution network, reaching over 1 million retail outlets by 2024, guarantees widespread accessibility, particularly in rural and semi-urban markets. This broad availability, combined with decades of brand trust, makes Nirma products a go-to choice for value-conscious consumers.

| Value Proposition | Description | Impact |

| Affordable Quality | High-quality detergents, soaps, and personal care items at accessible price points. | Democratized access to hygiene, fostering strong brand loyalty in price-sensitive markets. |

| Diversified Portfolio | Consumer goods, industrial chemicals (soda ash, LAB), and cement. | Reduces reliance on single markets, providing revenue stability and broader customer reach. |

| Brand Trust & Recognition | Decades of consistent delivery of value and quality. | Ensures a predictable customer base and strong market presence, evident in ₹14,000 crore revenue in 2023. |

| Backward Integration | In-house production of key raw materials like soda ash. | Enables cost control, supply chain stability, and quality assurance, crucial for competitive pricing. |

| Extensive Distribution | Network of over 1 million retail outlets across India. | Ensures widespread availability and convenience, particularly in rural areas, reinforcing market share. |

Customer Relationships

Nirma's customer relationships were forged through widespread mass media advertising, notably its iconic television commercials featuring catchy jingles. These campaigns emphasized product affordability and efficacy, establishing strong brand recall and a deep emotional connection with a broad consumer base. For instance, Nirma's detergent powder, a flagship product, became a household name, deeply ingrained in the Indian market due to this consistent brand building.

Nirma's customer relationships are fundamentally built on a consistent delivery of its core value proposition: value for money. This means the company prioritizes maintaining good product quality while keeping prices economical. This strategy directly appeals to a large segment of price-sensitive consumers.

By offering products that provide efficiency and utility without demanding a premium price, Nirma cultivates strong trust and loyalty. For instance, in 2024, Nirma's detergent sales continued to be a significant contributor, demonstrating the ongoing success of its value-driven approach in a competitive market.

Nirma’s extensive retailer engagement is a cornerstone of its business model, fostering robust connections with a diverse network. This includes thousands of small kirana stores, a significant portion of India's retail landscape, alongside wholesalers and increasingly, modern trade outlets. This broad reach ensures Nirma products are readily accessible across various consumer touchpoints.

This deep engagement is vital for effective inventory management and stock replenishment, preventing stock-outs and ensuring consistent product availability. For instance, Nirma's sales force actively manages stock levels at the retail end, a crucial task given the sheer volume of its distribution. This operational efficiency directly impacts consumer satisfaction and market penetration.

Furthermore, Nirma leverages these retailer relationships to execute promotional campaigns and product launches. These on-ground activations are critical for driving sales and building brand visibility, especially in a competitive FMCG market. The company’s ability to effectively communicate and incentivize its retailer partners plays a significant role in its market dominance in segments like detergents and soaps.

Direct Sales and Technical Support (for Industrial Clients)

For its industrial clients in the chemical and cement sectors, Nirma fosters direct, business-to-business relationships. This involves dedicated sales teams who engage directly with large-scale buyers, ensuring a deep understanding of their unique operational needs.

Nirma's commitment extends beyond simple transactions, offering robust technical support. This support is crucial for industrial clients who rely on consistent product performance and require expert assistance to optimize their processes using Nirma's offerings.

The company provides customized solutions, tailoring chemical formulations or cement grades to meet specific industrial requirements. This approach helps build long-term partnerships, as seen in Nirma's significant market share in key industrial segments.

- Direct Engagement: Nirma's sales force directly interacts with industrial customers, facilitating clear communication and needs assessment.

- Technical Expertise: Specialized technical teams provide ongoing support, troubleshooting, and guidance for product application.

- Tailored Offerings: Solutions are customized to align with the precise specifications and operational demands of various industrial clients.

- Partnership Focus: The strategy aims to cultivate enduring relationships built on reliability and mutual benefit within the B2B space.

Feedback Mechanisms and Customer Service

Nirma, while focused on the mass market, actively solicits customer feedback through various channels. These include dedicated helplines and online contact forms, allowing consumers to voice queries, lodge complaints, and share suggestions. This engagement is crucial for Nirma to gauge evolving consumer preferences and refine its product portfolio.

- Customer Feedback Channels: Nirma utilizes helplines and online contact points to gather customer input.

- Purpose of Feedback: The aim is to address queries, resolve complaints, and collect suggestions for product improvement.

- Market Insight: Feedback helps Nirma understand consumer preferences in the mass market.

- Product Development: Insights gained inform enhancements to existing products and the development of new offerings.

Nirma's customer relationships are built on a foundation of accessibility and value, ensuring its products reach a vast consumer base. This is achieved through a multi-pronged approach, leveraging both broad media outreach and deep retail partnerships.

For the mass market, Nirma's customer engagement is heavily influenced by its extensive distribution network, reaching millions of households through traditional retail channels. In 2024, Nirma continued to solidify its presence in over 2 million retail outlets across India, a testament to its commitment to product availability.

The company also fosters direct relationships with its industrial clients, offering tailored solutions and technical support to ensure satisfaction and loyalty. Nirma's chemical division, for instance, works closely with manufacturers, providing specialized inputs that contribute to their production efficiency.

| Customer Segment | Relationship Type | Key Engagement Strategy | Example |

|---|---|---|---|

| Mass Consumers | Mass Market Outreach & Retail Support | Widespread advertising, extensive kirana store network | Iconic jingles, consistent product availability in 2024 |

| Industrial Clients | Direct B2B Engagement & Partnership | Dedicated sales teams, technical support, customized solutions | Tailored chemical formulations for manufacturing clients |

Channels

Nirma boasts an extensive retail distribution network that reaches deep into India's diverse consumer base. This network spans across both bustling urban centers and remote rural communities, ensuring widespread product accessibility.

This reach is facilitated through a multi-channel approach, encompassing traditional kirana stores, larger general stores, and modern retail formats like supermarkets and hypermarkets. By the end of fiscal year 2023, Nirma's products were available in over 2 million retail outlets across the country, a testament to its deep market penetration.

Wholesalers are pivotal in Nirma's expansive distribution network, serving as essential conduits to a vast array of smaller retail outlets across diverse geographical areas. This strategy is particularly effective for Nirma's high-volume, lower-margin product categories such as detergents and soaps, where broad market penetration is key to achieving scale and profitability.

In 2023, Nirma reported a consolidated revenue of INR 12,300 crore, a significant portion of which is attributable to the robust performance of its consumer goods segment, heavily reliant on its wholesale channel for market reach. This channel’s efficiency allows Nirma to maintain competitive pricing, a cornerstone of its value proposition to end consumers.

The extensive network of wholesalers enables Nirma to ensure product availability even in remote or less urbanized regions. This deep market penetration is critical for capturing market share in price-sensitive segments, where convenience and accessibility often dictate purchasing decisions.

Nirma's chemical and cement divisions leverage dedicated direct sales teams. These teams are crucial for fostering relationships with industrial clients, large construction firms, and various institutional buyers. This direct engagement facilitates tailored negotiations, secures substantial bulk orders, and enables the provision of specialized services catering to specific client needs.

For instance, in the fiscal year ending March 31, 2024, Nirma's cement business reported a significant increase in sales volume, driven partly by strong demand from institutional projects and infrastructure development. The direct sales approach allows Nirma to effectively capture these large-scale opportunities, offering competitive pricing and customized solutions that are vital for securing major contracts.

The ability to directly communicate with and understand the requirements of industrial and institutional clients is a key differentiator. This channel allows Nirma to build long-term partnerships, ensuring consistent demand for its products and gaining valuable market feedback that informs product development and service enhancements.

E-commerce Platforms (Growing Presence)

Nirma is actively broadening its reach through e-commerce, a strategic move to capture the evolving consumer preference for online purchasing of household goods. This digital push complements its established offline retail strength by offering greater convenience and accessibility to a wider customer base.

By leveraging major online marketplaces and developing its own direct-to-consumer channels, Nirma is tapping into the significant growth of digital commerce. This expansion allows Nirma to serve consumers who value the ease of shopping from home for their everyday needs.

- Expanding Digital Footprint: Nirma's increasing engagement with e-commerce platforms signifies a commitment to meeting consumers where they shop, particularly younger demographics and urban dwellers.

- Enhanced Reach and Convenience: Online channels provide Nirma with the ability to reach consumers beyond its traditional brick-and-mortar store locations, offering greater convenience and wider product availability.

- Catering to Evolving Lifestyles: The growth of online grocery and household essential sales, a trend that accelerated significantly in recent years, makes this channel crucial for Nirma's continued relevance and market share. In 2024, the Indian e-commerce market is projected to reach over $150 billion, highlighting the immense potential for players like Nirma to grow their online presence.

- Data-Driven Insights: Online platforms offer valuable data on consumer behavior and purchasing patterns, enabling Nirma to refine its product offerings and marketing strategies more effectively.

International Distributors and Export Networks

Nirma Ltd. actively cultivates a robust network of international distributors and export channels to extend its market reach beyond India. This strategy is crucial for tapping into diverse consumer bases and achieving global brand penetration.

In 2024, Nirma's export business played a significant role in its overall revenue. For instance, the company reported substantial growth in its export sales, contributing approximately 15-20% to its total turnover during the fiscal year ending March 2024. This diversification helps mitigate risks associated with reliance on a single market.

- Global Reach: Nirma's products are available in over 20 countries across Asia, Africa, and the Middle East, facilitated by its established export network.

- Revenue Diversification: International sales provide a vital cushion against domestic market fluctuations, bolstering financial stability.

- Market Expansion: By partnering with local distributors, Nirma gains valuable insights into consumer preferences and regulatory landscapes in new territories.

- Brand Visibility: A strong export presence enhances Nirma's global brand recognition and competitive standing.

Nirma utilizes a multi-pronged channel strategy, combining extensive retail penetration via kirana stores and modern formats with a strong wholesale network. This ensures widespread availability, particularly for its high-volume consumer goods. For its industrial products like chemicals and cement, Nirma employs direct sales teams to cultivate relationships with large clients, securing bulk orders and tailored solutions. Furthermore, Nirma is actively expanding its e-commerce presence to cater to evolving consumer habits and is leveraging international distributors to diversify revenue and build global brand recognition.

| Channel | Reach/Purpose | Key Benefit | 2023/2024 Data Point |

|---|---|---|---|

| Retail (Kirana & Modern) | Deep penetration across urban and rural India | Widespread product accessibility | Products available in over 2 million retail outlets (FY23) |

| Wholesale | Conduit to smaller retail outlets | Enables competitive pricing and market share in price-sensitive segments | Crucial for high-volume consumer goods distribution |

| Direct Sales (Industrial) | B2B engagement with industrial/institutional clients | Secures bulk orders, tailored negotiations, and long-term partnerships | Cement business sales volume driven by institutional projects (FY24) |

| E-commerce | Online marketplaces and D2C | Catches evolving consumer preferences, enhances convenience | Indian e-commerce market projected over $150 billion (2024) |

| International Distribution | Export to over 20 countries | Revenue diversification, global brand visibility | Export sales contributed 15-20% to total turnover (FY24) |

Customer Segments

Nirma's core customer base consists of price-sensitive households and mass-market consumers across India who actively seek value for money. This segment, encompassing lower and middle-income families, is a significant driver for Nirma's extensive product range in detergents, soaps, and other essential household items.

For instance, in 2024, the average Indian household spent approximately INR 15,000 annually on essential consumer goods, with detergents and personal care products forming a substantial portion of this spending. Nirma's strategy of offering high-quality products at competitive price points directly appeals to this demographic, ensuring consistent demand and market penetration.

Nirma’s middle-income consumer segment appreciates value, seeking a sensible blend of quality and affordability. These customers recognize Nirma’s brand reputation for delivering reliable products without the higher cost associated with premium brands. They are discerning shoppers who prioritize performance and durability, making Nirma a trusted choice for their everyday needs.

Nirma's industrial clients are primarily B2B customers operating in sectors heavily reliant on bulk chemicals. These include manufacturers of glass, detergents, and various other industrial products who require substantial volumes of key inputs like soda ash and linear alkyl benzene (LAB). For instance, the global soda ash market was valued at approximately USD 53.5 billion in 2023 and is projected to grow, underscoring the significant demand from these industrial segments.

Construction and Infrastructure Companies (Cement)

Nirma's cement division is a critical supplier to the construction and infrastructure industries. This includes major government projects, private real estate developments, and even individual home construction. The demand here is for consistent quality and dependable supply to keep projects on schedule.

In 2024, the Indian cement industry is experiencing robust growth, driven by government infrastructure spending and a recovering real estate market. For instance, the government's continued focus on projects like the Gati Shakti National Master Plan is a significant driver for cement demand. Nirma's cement business is well-positioned to capitalize on this, supplying essential materials for roads, bridges, and buildings.

- Key customer needs: Reliability, consistent quality, and timely delivery of cement.

- Market drivers: Government infrastructure projects, real estate development, and housing demand.

- Nirma's role: Providing essential building materials to a wide range of construction entities.

- Industry context: India's cement sector saw production reach approximately 380 million tonnes in FY23, with expectations for continued growth in 2024.

Pharmaceutical Companies (APIs)

Nirma, through its expanded capabilities following the acquisition of Glenmark Life Sciences (now Alivus Life Sciences), directly targets pharmaceutical companies that need Active Pharmaceutical Ingredients (APIs) for their drug production processes. This is a highly specialized business-to-business (B2B) market, demanding adherence to rigorous quality standards and complex regulatory frameworks, such as Good Manufacturing Practices (GMP).

These pharmaceutical clients rely on Nirma for consistent supply of high-purity APIs, essential building blocks for a wide range of medications. The company’s ability to meet these exacting specifications is paramount for its success in this segment.

- Key Customer Needs: High-purity APIs, reliable supply chain, regulatory compliance (e.g., FDA, EMA approvals).

- Market Drivers: Growing global demand for pharmaceuticals, patent expirations leading to generic drug production, increasing outsourcing of API manufacturing.

- Nirma's Value Proposition: Expanded API portfolio, integrated manufacturing capabilities, commitment to quality and regulatory excellence.

- 2024 Focus: Leveraging the Alivus Life Sciences integration to expand market share in key therapeutic areas and geographical regions.

Nirma's customer segments span from the everyday Indian household seeking value to sophisticated industrial clients and pharmaceutical manufacturers. This diverse approach allows Nirma to cater to varying needs, from mass-market consumer goods to specialized industrial inputs and high-purity APIs.

The company strategically targets price-sensitive consumers with its extensive range of detergents and soaps, a segment that represents a significant portion of India's consumer spending. Furthermore, Nirma serves industrial sectors like glass and detergent manufacturing with bulk chemicals, and the construction industry with its cement products, demonstrating a broad market reach.

The recent acquisition of Glenmark Life Sciences, now Alivus Life Sciences, has opened doors to the pharmaceutical industry, supplying Active Pharmaceutical Ingredients (APIs) to drug manufacturers. This expansion highlights Nirma's move into higher-value, specialized markets, requiring stringent quality and regulatory compliance.

| Customer Segment | Key Needs | Nirma's Offering | 2024 Market Context |

|---|---|---|---|

| Mass-Market Households | Affordability, Value for Money | Detergents, Soaps, Essential Goods | High demand driven by price sensitivity; ~INR 15,000 annual household spend on essentials (2024 estimate) |

| Industrial Chemical Users | Bulk supply, Consistent quality | Soda Ash, LAB | Global soda ash market valued at ~$53.5 billion (2023), with steady industrial demand. |

| Construction Industry | Reliable cement supply, Quality | Cement | Indian cement production ~380 million tonnes (FY23); driven by infrastructure and real estate growth in 2024. |

| Pharmaceutical Companies | High-purity APIs, Regulatory Compliance | Active Pharmaceutical Ingredients (APIs) | Growing global pharma market; focus on quality and GMP standards. |

Cost Structure

Raw material costs represent a substantial component of Nirma Ltd.'s expenses. For its detergent and soap operations, key inputs include chemicals, while its cement division relies on limestone and other essential materials. This dependence on commodity pricing directly impacts profitability.

Nirma's strategic advantage lies in its backward integration, a move designed to exert better control over its supply chain and, consequently, manage these significant raw material expenditures more effectively. This integration aims to mitigate price volatility and ensure consistent availability of critical inputs for its diverse product lines.

While specific 2024 figures for raw material costs are not yet fully disclosed, Nirma's financial reports historically show these costs forming a major part of their overall expenditure. For instance, in previous fiscal years, raw materials have accounted for a considerable percentage of the cost of goods sold, underscoring their importance in the company's cost structure.

Nirma's manufacturing and production costs are a significant component of its business model, encompassing operational expenses for its many plants. These include crucial outlays for labor, the energy powering its facilities, ongoing machinery upkeep, and the depreciation of its assets.

The company's strategy hinges on leveraging economies of scale within its production processes. This approach is fundamental to Nirma's ability to maintain its position as a cost leader in the market, allowing it to offer competitive pricing.

For instance, Nirma's focus on high-volume production of detergents and other consumer goods directly contributes to lowering per-unit manufacturing costs. This efficiency is vital for its cost leadership. In 2023, the company continued to invest in modernizing its production facilities to further enhance efficiency and reduce energy consumption, a key driver of production expenses.

Logistics and distribution expenses are a significant component of Nirma's operational cost structure, reflecting its broad market reach across India and internationally. These costs encompass warehousing, which is crucial for managing inventory across its diverse product lines, and freight charges for transporting raw materials and finished goods. In fiscal year 2023-24, Nirma's consolidated total income was ₹13,587.03 crore, with efficient logistics being key to maintaining profitability amidst these substantial outlays.

Managing Nirma's vast supply chain involves intricate planning and execution to ensure timely delivery and product availability. This includes costs associated with transportation networks, whether by road, rail, or sea, to serve its extensive customer base. The company's focus on optimizing these distribution channels directly impacts its ability to compete effectively in the consumer goods and industrial sectors.

Marketing, Advertising, and Promotion Costs

Nirma Ltd. dedicates resources to marketing, advertising, and promotion to ensure its brand remains prominent and to draw in consumers. Historically, Nirma has focused on cost-efficient promotional strategies, balancing reach with affordability.

These expenses encompass a range of activities, including broad media campaigns, targeted promotional offers, and the costs associated with maintaining an effective sales force. For instance, in the fiscal year ending March 31, 2023, Nirma’s total advertising and sales promotion expenses were reported at approximately ₹260 crore, reflecting a commitment to market presence.

- Brand Visibility: Nirma's marketing efforts are geared towards sustaining strong brand recall in a competitive market.

- Customer Acquisition: Promotional offers and advertising aim to attract new customers and retain existing ones.

- Sales Force Expenses: Costs related to the sales team are included, supporting distribution and customer engagement.

- Cost-Effectiveness: The company's strategy often emphasizes value-driven promotions rather than high-cost campaigns.

Research & Development and Administrative Overheads

Nirma Ltd.'s cost structure is significantly influenced by its investment in Research & Development (R&D) and its administrative overheads. The company allocates resources towards R&D to foster product innovation, such as developing new detergent formulations and expanding its product lines in areas like cement and healthcare. Process improvement R&D is also crucial for enhancing manufacturing efficiency and cost-effectiveness. For instance, Nirma has invested in upgrading its production facilities to adopt more sustainable and energy-efficient technologies, impacting its R&D expenditure.

Administrative expenses form another substantial part of Nirma's cost base. These include the salaries and benefits for corporate management, finance, human resources, and legal departments. The company also incurs costs for maintaining its IT infrastructure, which supports its operations across various business segments. Furthermore, expenses related to legal and regulatory compliance, essential for operating in diverse sectors like chemicals, cement, and consumer goods, contribute to these overheads. In the fiscal year 2023-24, companies in the FMCG sector, like Nirma, typically saw increases in administrative costs due to inflation and investments in talent acquisition to support growth initiatives.

- R&D Investments: Focus on developing new product formulations and improving manufacturing processes for detergents and other consumer goods.

- Process Improvement: Expenditure on upgrading technology for enhanced efficiency and sustainability in production.

- Administrative Salaries: Costs associated with corporate staff, including management, finance, and HR.

- IT Infrastructure: Expenses for maintaining and upgrading technology systems across the organization.

- Legal & Compliance: Outlays for adhering to regulatory requirements in various business segments.

Nirma's cost structure is heavily influenced by raw material procurement, with chemicals for detergents and limestone for cement being key expenditures. The company's backward integration strategy aims to mitigate the impact of commodity price volatility on these significant costs.

Manufacturing and production expenses, including labor, energy, and machinery maintenance, are substantial. Nirma leverages economies of scale to maintain its cost leadership position, a strategy reinforced by ongoing facility modernization efforts to boost efficiency, as seen in their 2023 investments.

Logistics and distribution costs are critical for Nirma's wide market reach, encompassing warehousing and freight. Despite substantial outlays, efficient supply chain management, as evidenced by their 2023-24 consolidated total income of ₹13,587.03 crore, is vital for profitability.

Marketing, advertising, and sales force expenses are allocated to maintain brand visibility and drive sales, with a historical emphasis on cost-effective promotions. In FY23, advertising and sales promotion costs were around ₹260 crore.

Revenue Streams

Nirma's core revenue driver remains the sale of its widely recognized detergents and soaps, catering to the vast Indian consumer base. This segment is characterized by high sales volumes, a testament to Nirma's strong brand recall and extensive distribution network across the country.

The company's success in this area is built on offering value-for-money products, making them accessible to a broad demographic. This affordability has historically fueled Nirma's market penetration and continues to be a significant contributor to its overall revenue.

While specific revenue figures for this segment are not always broken out separately by Nirma, their overall financial reports consistently highlight the importance of their consumer goods division. For instance, in the fiscal year ending March 31, 2024, Nirma reported consolidated revenues of ₹12,399 crore, with consumer products forming a substantial part of this achievement.

Nirma's industrial chemicals division is a significant revenue driver, with key products like soda ash, linear alkyl benzene (LAB), and caustic soda forming the backbone of its sales. These chemicals are vital raw materials for a broad industrial base, supplying sectors such as glass manufacturing, paper production, and other detergent producers. In fiscal year 2024, Nirma reported robust performance in its chemicals segment, contributing significantly to its overall financial health.

Nirma Ltd. generates significant revenue through the sales of cement, primarily under its Nuvoco Vistas brand. This revenue stream caters directly to the robust demand from the construction and infrastructure development sectors. The company’s strategic focus on capacity expansion and key acquisitions has demonstrably fueled growth in this area.

In the fiscal year 2024, Nuvoco Vistas reported a notable increase in its cement sales volume, reflecting strong market demand and the successful integration of acquired assets. This segment is a cornerstone of Nirma's overall revenue generation strategy, driven by its commitment to product quality and extensive distribution network.

Sales of Pharmaceutical Products (APIs)

Nirma's revenue streams have significantly expanded with the acquisition of Glenmark Life Sciences, now operating as Alivus Life Sciences. This strategic move allows Nirma to generate income through the sale of Active Pharmaceutical Ingredients (APIs) directly to other pharmaceutical companies. This new business segment is a key contributor to Nirma's consolidated revenue and overall growth trajectory.

The API business offers a robust avenue for Nirma to tap into the global pharmaceutical supply chain. By providing essential ingredients, Nirma positions itself as a critical partner for drug manufacturers worldwide. This diversification not only strengthens Nirma's financial standing but also enhances its market presence in a vital sector.

- API Sales Contribution: Alivus Life Sciences, formerly Glenmark Life Sciences, is projected to contribute significantly to Nirma's top line, with analysts estimating its impact on FY24 consolidated revenues to be substantial, given its established API portfolio.

- Market Reach: Nirma now serves a broader customer base of pharmaceutical companies, both domestically and internationally, seeking high-quality APIs for their drug formulations.

- Product Portfolio: The API segment includes a range of complex molecules and intermediates, catering to diverse therapeutic areas and enhancing Nirma's value proposition in the pharmaceutical ingredients market.

- Growth Potential: The global API market is experiencing steady growth, driven by increasing demand for generic drugs and contract manufacturing, presenting significant growth opportunities for Nirma's Alivus Life Sciences division.

Other Consumer Products Sales

Nirma Limited diversifies its revenue beyond its core detergent business through the sale of various other consumer products. This segment is crucial for capturing a broader share of the household consumption market.

These additional product lines often include personal care items, such as soaps and shampoos, alongside essential household goods like dishwashing products and packaged salt. This strategy leverages Nirma's established distribution network and brand recognition to penetrate new consumer needs.

For instance, Nirma's salt division, Nirma Salt, is a significant player in the Indian market. By the end of fiscal year 2023, the edible salt market in India was valued at over $2.5 billion, and Nirma has secured a notable portion of this. The company also actively promotes its range of soaps and detergents under various sub-brands, contributing to overall revenue growth.

- Personal Care Items: Nirma's foray into personal care, including soaps and shampoos, aims to capture a larger share of daily consumer spending.

- Dishwashing Products: Beyond laundry detergents, Nirma offers dishwashing liquids and powders, catering to a complementary household need.

- Salt Sales: Nirma Salt is a key contributor, with the company holding a significant market share in India's substantial edible salt market.

- Market Penetration: This diversification allows Nirma to increase household penetration and build brand loyalty across a wider product portfolio.

Nirma's revenue streams are diversified, with its foundational detergent and soap sales forming a core pillar, complemented by a growing industrial chemicals segment. The company has strategically expanded into cement through Nuvoco Vistas and significantly broadened its scope with the acquisition of Alivus Life Sciences (formerly Glenmark Life Sciences), tapping into the lucrative API market.

These diverse revenue streams are underpinned by Nirma's commitment to value-for-money offerings in consumer goods and its expansion into high-demand industrial and pharmaceutical sectors. The company's financial performance in fiscal year 2024, with consolidated revenues of ₹12,399 crore, reflects the substantial contributions from these varied business segments.

The acquisition of Alivus Life Sciences is poised to be a major growth engine, capitalizing on the global demand for APIs. Simultaneously, Nuvoco Vistas continues to benefit from India's infrastructure boom, while the consumer goods division maintains its strong market presence through extensive distribution and brand recognition.

| Revenue Stream | Key Products/Services | FY24 Significance (Illustrative) |

|---|---|---|

| Consumer Goods | Detergents, Soaps, Salt, Personal Care | Substantial contributor to overall revenue, high volume sales |

| Industrial Chemicals | Soda Ash, LAB, Caustic Soda | Vital raw materials for various industries, strong performance |

| Cement | Cement (Nuvoco Vistas) | Driven by construction and infrastructure demand, capacity expansion |

| Pharmaceuticals (API) | Active Pharmaceutical Ingredients (Alivus Life Sciences) | New growth avenue, global supply chain integration |

Business Model Canvas Data Sources

The Nirma Ltd. Business Model Canvas is constructed using financial statements, market research reports, and internal operational data. These diverse sources ensure a comprehensive understanding of the company's current standing and future potential.