Nirma Ltd. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nirma Ltd. Bundle

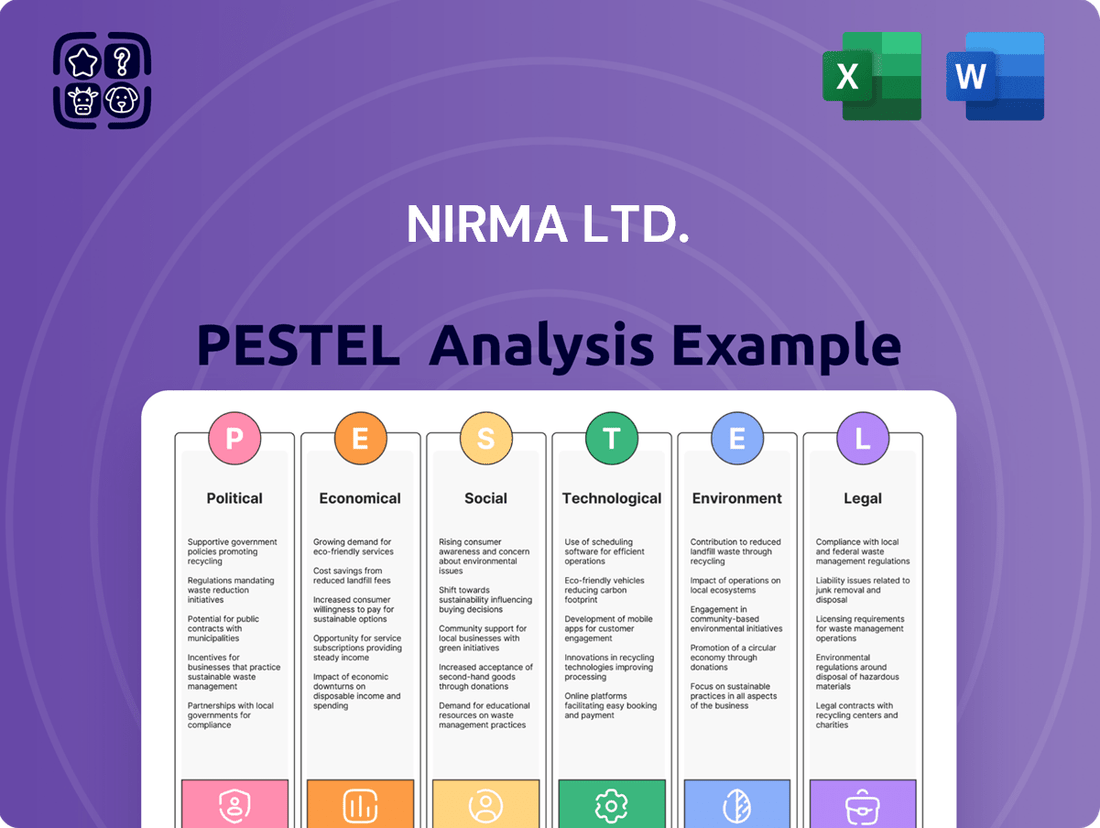

Nirma Ltd. operates within a dynamic external environment, shaped by a complex interplay of Political, Economic, Social, Technological, Legal, and Environmental factors. Understanding these forces is crucial for strategic planning and sustained growth. Our comprehensive PESTLE analysis delves into how evolving government policies, economic fluctuations, shifting consumer behaviors, technological advancements, regulatory changes, and environmental concerns are impacting Nirma's operations and market position. Gain a competitive edge by leveraging these actionable insights.

Navigate the complexities of Nirma Ltd.'s external landscape with our expertly crafted PESTLE analysis. Discover how political stability, economic growth, social trends, technological disruptions, legal frameworks, and environmental sustainability initiatives present both challenges and opportunities. This in-depth report provides the critical intelligence you need to make informed strategic decisions and enhance your market foresight. Download the full version now for immediate access to these vital insights.

Political factors

The Indian government's strong commitment to boosting manufacturing, evident in schemes like Production-Linked Incentives (PLI), directly supports Nirma's diverse business segments, especially chemicals and cement. This national focus translates into a more favorable policy environment and potential incentives for industrial growth, aligning Nirma with key development objectives.

Furthermore, the ongoing emphasis on infrastructure development is a significant tailwind for Nirma's cement division. For instance, the National Infrastructure Pipeline (NIP) aims for ₹111 lakh crore (approximately $1.3 trillion) in infrastructure investment by 2025, a substantial portion of which will drive demand for construction materials like cement.

The Securities and Exchange Board of India (SEBI) has been progressively enhancing Environmental, Social, and Governance (ESG) disclosure mandates for listed entities. Nirma, being a significant player in the Indian market, must align its reporting practices with these updated regulations, which now encompass detailed disclosures on areas like Green Credit mechanisms and the sustainability of its entire value chain.

These evolving regulations are designed to foster greater transparency and accountability in corporate operations, pushing companies like Nirma to embed sustainable practices more deeply into their business models. The emphasis on value chain sustainability, for instance, means Nirma will need to actively monitor and report on the ESG performance of its suppliers and partners, a move that could impact procurement strategies and collaboration efforts.

For Nirma, adapting to these changes involves not just data collection but also a strategic integration of ESG principles across its diverse business segments. This regulatory evolution supports a more responsible business environment and provides investors with more robust data for decision-making.

India's active role in global trade realignments, including efforts to diversify supply chains away from single sources, directly influences Nirma's international operations and its ability to secure essential raw materials. This strategic shift aims to build resilience against geopolitical disruptions.

While tariffs imposed by major importing nations, such as potential increases on Indian goods entering the US market, present immediate challenges for Nirma's export business, there's a significant upside. The global movement towards manufacturing reshoring and the development of more regionalized trade blocs could create new opportunities for Indian companies like Nirma to strengthen their competitive position and expand market access.

Stability of Regulatory Frameworks

The stability and predictability of India's regulatory landscape significantly influence Nirma Ltd.'s strategic planning and capital allocation decisions. While occasional adjustments to environmental statutes have occurred, the fundamental structure governing environmental adherence and corporate oversight remains robust, providing a degree of certainty for long-term investments.

Nirma must remain vigilant regarding evolving industrial and environmental policies, as shifts in these areas could materially impact its operational efficiency and cost structures. For instance, changes in pollution control norms or waste management regulations could necessitate additional capital expenditure or alter production processes.

Key considerations for Nirma include:

- Predictability of environmental compliance: Tracking the consistency of enforcement and potential future changes in environmental standards is vital.

- Stability of industrial policies: Understanding the government's approach to manufacturing, chemicals, and consumer goods sectors offers insight into potential growth or regulatory headwinds.

- Corporate governance adherence: Maintaining compliance with evolving corporate governance codes ensures continued investor confidence and operational legitimacy.

Impact of Electoral Politics on Economic Policy

Recent electoral outcomes in India, including the general elections held in June 2024, have underscored significant voter priorities such as job creation and managing inflationary pressures. While the government has continued with welfare schemes and subsidies, a more pronounced commitment to market-oriented reforms is crucial for accelerating economic growth. This political environment directly shapes economic policies that can influence consumer demand and industrial expansion, thereby affecting Nirma's performance within the domestic market.

The electoral mandate often translates into policy shifts that either support or challenge business environments. For instance, a government focused on fiscal consolidation might reduce subsidies, impacting demand for consumer goods, or conversely, a focus on infrastructure development could boost industrial activity. Nirma's strategic planning must account for these potential policy adjustments stemming from the evolving political landscape.

Key economic indicators reveal the impact of these political factors. For example, India's Gross Domestic Product (GDP) growth, which reached an estimated 7.6% in FY 2023-24, is sensitive to government spending and regulatory stability.

- Job creation remains a paramount concern for voters, influencing government spending priorities.

- Inflationary pressures directly affect consumer purchasing power, impacting demand for Nirma's products.

- The pace of market-oriented reforms will be a critical determinant of sustained economic growth.

- Government fiscal policies, including subsidies and tax reforms, will shape the overall economic climate.

India's political landscape, particularly the focus on job creation and inflation management post the June 2024 general elections, directly influences economic policies affecting Nirma. Government spending and regulatory stability are key, as demonstrated by India's projected GDP growth of 7.6% for FY 2023-24.

Policy shifts stemming from electoral outcomes can impact Nirma's market, with potential changes in subsidies or infrastructure spending directly affecting consumer demand and industrial activity.

The government's commitment to market-oriented reforms is crucial for sustained economic expansion, influencing Nirma's strategic planning and investment decisions in response to the evolving economic climate.

What is included in the product

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Nirma Ltd., offering a detailed understanding of the external forces shaping its strategic landscape.

It provides forward-looking insights and actionable recommendations for Nirma Ltd. to navigate market dynamics and capitalize on emerging opportunities.

This PESTLE analysis of Nirma Ltd. acts as a pain point reliever by providing a clear, summarized version of external factors, making it easy to reference during meetings and presentations.

It helps support discussions on external risks and market positioning during planning sessions, offering a valuable asset for consultants creating custom reports.

Economic factors

India's economic engine is set to roar, with projections indicating it will remain a leading growth market globally. For the fiscal year 2024-25, real GDP growth is anticipated to reach an impressive 6.4%. Looking ahead to FY 2025-26, this robust expansion is expected to continue, with forecasts placing growth between 6.3% and 6.8%.

This sustained economic momentum creates a fertile ground for companies like Nirma. The strong growth trajectory is underpinned by a dual engine of increasing domestic consumption and a healthy rise in investment across various sectors. Such an environment is highly conducive for Nirma's diverse business interests, from detergents to cement.

Rising disposable incomes across both rural and urban India, fueled by economic growth, are significantly boosting consumer spending power. This trend, coupled with an increasing emphasis on personal hygiene, is directly benefiting the demand for essential consumer goods such as detergents and soaps. Nirma's strategic emphasis on providing value-for-money products allows it to effectively tap into this expanding market segment.

The Indian soap and detergent market is on a strong growth trajectory, with projections indicating continued expansion. For instance, the market was valued at approximately USD 5.5 billion in 2023 and is expected to reach over USD 9 billion by 2029, growing at a CAGR of around 8.5%. This growth is underpinned by the aforementioned factors of increasing disposable incomes and heightened hygiene awareness.

The Indian manufacturing sector is demonstrating robust growth, with Q1 FY2025 reporting a significant uptick. This momentum is fueled by new domestic investments and a strategic shift from foreign companies looking to diversify their global supply chains, a trend that began to accelerate in 2023 and continues into 2024. This positive environment directly benefits Nirma Ltd.

Nirma's diversified manufacturing operations, spanning chemicals, cement, and consumer goods, are well-positioned to capitalize on the sector's expansion. The company can leverage this trend for enhanced production volumes and a larger market share across its various product lines. For instance, the chemicals segment, a key area for Nirma, saw India's chemical exports grow by approximately 5% in 2023 compared to the previous year.

Inflation and Interest Rate Trends

Inflationary pressures in India have been moderating, with the Consumer Price Index (CPI) easing. For instance, in early 2024, India's CPI inflation hovered around the 5% mark, a notable decrease from earlier peaks. This downward trend, coupled with a more accommodative monetary policy stance from the Reserve Bank of India (RBI), suggests a gradual decline in interest rates.

This shift towards lower borrowing costs is highly beneficial for companies like Nirma Ltd. It directly translates to reduced expenses on debt financing, which can improve profitability. Furthermore, as interest rates become more manageable, consumer disposable income tends to rise, potentially boosting demand for Nirma's diverse product portfolio, spanning industrial chemicals to consumer goods like detergents and soaps.

The stability in exchange rates observed in recent periods also provides a predictable operating environment. For Nirma, which may engage in import or export activities, stable currency fluctuations minimize foreign exchange risks, contributing to more reliable financial planning and forecasting.

- Moderating Inflation: India's CPI inflation trending downwards, aiming for the RBI's target range.

- Accommodative Interest Rates: Potential for lower borrowing costs and improved access to capital for Nirma.

- Increased Consumer Spending: Easing inflation and interest rates could boost purchasing power for Nirma's consumer products.

- Exchange Rate Stability: Predictable currency movements reduce financial risk for Nirma's international operations.

Acquisition-driven Financial Restructuring and Deleveraging

Nirma's acquisition of Glenmark Life Sciences for ₹5,650 crore in March 2024 has notably altered its financial landscape by increasing its debt levels. This move, which rebranded Glenmark Life Sciences as Alivus Life Sciences, represents a significant strategic push for Nirma in the life sciences sector.

The company is projecting a deleveraging strategy starting from fiscal year 2025. Nirma anticipates an improvement in its consolidated net debt to OPBDITA ratio as the acquisition-related debt is systematically reduced.

- Acquisition Cost: Nirma acquired Glenmark Life Sciences for ₹5,650 crore.

- Timing of Impact: The acquisition's financial impact, including increased debt, was realized in FY2024.

- Deleveraging Target: Nirma aims to deleverage from FY2025 onwards.

- Key Metric: Improvement expected in consolidated net debt/OPBDITA ratio.

India's economy is projected to grow robustly in FY2025 at 6.4%, with continued expansion expected in FY2026. This growth, driven by increased consumption and investment, benefits Nirma across its diverse sectors, particularly consumer goods like detergents due to rising disposable incomes and hygiene awareness.

The manufacturing sector is also expanding, supported by domestic investment and supply chain diversification trends evident since 2023. Nirma's operations in chemicals, cement, and consumer goods are poised to benefit from this positive manufacturing climate, with chemical exports alone growing approximately 5% in 2023.

Moderating inflation, with CPI around 5% in early 2024, and a potentially more accommodative monetary policy are favorable. Lower interest rates reduce Nirma's debt servicing costs and can boost consumer spending, while stable exchange rates minimize financial risks for international trade.

| Economic Factor | 2024-2025 Projection | Impact on Nirma |

|---|---|---|

| Real GDP Growth | 6.4% | Favorable for increased demand across Nirma's product lines. |

| Consumer Spending Growth | Positive | Directly benefits Nirma's detergent and soap segments. |

| Manufacturing Sector Growth | Robust | Supports Nirma's chemical and cement production volumes. |

| Inflation (CPI) | Moderating (approx. 5%) | Reduces operational costs and supports consumer purchasing power. |

| Interest Rates | Potentially declining | Lowers Nirma's borrowing costs and financial expenses. |

Preview Before You Purchase

Nirma Ltd. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Nirma Ltd. PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Nirma's strategic landscape. This detailed report offers actionable insights for informed decision-making.

Sociological factors

Societal shifts are profoundly impacting consumer behavior in India, with a noticeable rise in hygiene and health consciousness. Public awareness initiatives, coupled with evolving lifestyles, have significantly amplified the demand for cleaning and personal care items. This escalating awareness directly benefits companies like Nirma, whose product line heavily features detergents and soaps.

The market for these essential goods is not confined to metropolitan areas; it's experiencing robust growth in rural India as well. This expansion presents a considerable opportunity for Nirma to extend its reach and market penetration. For instance, in 2023, the Indian personal care market was valued at approximately $15 billion, with hygiene products forming a substantial segment, projected to grow at a CAGR of over 10% through 2028.

India's rapid urbanization is fundamentally reshaping consumer habits, with a growing number of households in cities embracing modern amenities. This shift is directly fueling demand for products like washing machines, which in turn increases the need for effective detergents. For instance, by 2023, urban households in India were estimated to have a significantly higher penetration of washing machines compared to rural areas, creating a substantial market for detergent manufacturers.

This evolving urban landscape is also driving a preference for convenience-oriented cleaning solutions, such as liquid detergents, over traditional powder forms. Consumers in metropolitan areas, often with busier lifestyles, are increasingly seeking products that offer ease of use and enhanced performance. Nirma's strategic adaptation to these changing urban consumer preferences, including its product development and marketing efforts, will be critical for deepening its market penetration in these key demographic segments.

Nirma's core strength lies in its enduring value-for-money proposition, a strategy that has deeply resonated with India's vast, price-conscious consumer demographic. This approach is particularly effective given the expanding middle class, where affordability remains a key driver of purchasing decisions. For instance, during fiscal year 2023-24, a significant portion of Indian households continued to prioritize cost-effective alternatives across various consumer goods categories, reflecting ongoing economic sensitivities.

Demographic Dividend and Youth Population

India's demographic dividend, characterized by a substantial youth population, offers Nirma a vast and growing consumer base. As of 2024, India's median age is around 28.7 years, indicating a significant proportion of the population is in their prime working and consuming years. This young demographic is increasingly urbanized, tech-savvy, and possesses evolving preferences, presenting opportunities for Nirma to tailor its product offerings.

Nirma can strategically capitalize on this demographic trend by focusing on innovation and targeted marketing. The company's ability to offer value-for-money products is particularly appealing to the price-sensitive youth segment. As purchasing power continues to rise across various income groups within this demographic, Nirma can expand its market share by introducing new products and adapting existing ones to meet changing consumer demands.

- Youthful Demographics: India's population under 30 years old constituted over 50% in 2024, representing a massive potential market.

- Evolving Preferences: This demographic is increasingly influenced by global trends, demanding quality and innovation.

- Purchasing Power Growth: With rising incomes, the disposable income of young Indians is expanding, boosting consumption.

- Digital Natives: The youth are heavy users of digital platforms, allowing for targeted online marketing strategies.

Rural Market Penetration and Demand

Nirma's robust distribution network is a key asset, particularly in reaching India's vast rural hinterlands. This penetration is crucial as rural areas are witnessing an uptick in disposable incomes, fueled by factors like agricultural advancements and supportive government initiatives. For instance, the Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) scheme, which provides direct income support to farmers, aims to boost rural consumption. By 2024, it's estimated that over 110 million farmer families have benefited, directly impacting their purchasing power for essential consumer goods.

This deep rural reach allows Nirma to effectively tap into the substantial demand from these markets. Rural consumers often prioritize affordability and value, segments where Nirma has historically excelled. The demographic shift, with a growing rural middle class, presents a significant opportunity for brands like Nirma that understand and cater to these specific needs.

Key aspects of Nirma's rural market penetration include:

- Extensive Reach: Nirma's distribution spans over 1 million retail outlets across India, with a significant portion in rural and semi-urban areas.

- Affordable Product Portfolio: Products like Nirma detergent and soaps are priced competitively, making them accessible to a broad rural consumer base.

- Government Support for Rural Economy: Initiatives like the National Rural Employment Guarantee Act (NREGA) and agricultural subsidies indirectly boost rural incomes and spending capacity.

- Growing Rural Aspirations: As rural incomes rise, so does the aspiration for better quality and branded products, a trend Nirma is well-positioned to capitalize on.

India's increasing health and hygiene consciousness directly benefits Nirma, particularly its detergent and soap segments, as consumers prioritize cleanliness. This heightened awareness is driving demand for personal care items, with the Indian personal care market valued at approximately $15 billion in 2023, and hygiene products expected to grow at over 10% CAGR through 2028.

Urbanization trends are reshaping consumer habits, leading to greater adoption of modern amenities like washing machines, which in turn fuels demand for detergents. India's median age in 2024 is around 28.7 years, indicating a large youth demographic with evolving preferences and increasing purchasing power, presenting opportunities for Nirma to innovate and market its value-for-money products effectively.

| Sociological Factor | Impact on Nirma | Data Point/Insight |

|---|---|---|

| Rising Health & Hygiene Awareness | Increased demand for detergents and personal care products. | Indian personal care market valued at ~$15 billion (2023); hygiene segment projected >10% CAGR. |

| Urbanization & Lifestyle Changes | Higher demand for convenience products and washing machines, boosting detergent sales. | Urban households show higher washing machine penetration, creating a strong detergent market. |

| Demographic Dividend (Youth) | Large, evolving consumer base; opportunities for targeted marketing and product innovation. | India's median age ~28.7 years (2024); >50% of population under 30 (2024). |

Technological factors

Technological advancements are significantly reshaping manufacturing, with automation and digitalization boosting efficiency. For Nirma, this means opportunities to streamline its cement and chemical production lines. For instance, the adoption of AI-powered predictive maintenance in its cement plants could reduce downtime, potentially saving millions in operational costs annually.

The integration of advanced materials, such as novel binders or additives, can also lead to higher quality products and potentially lower raw material consumption. Nirma's diversified portfolio allows it to explore these innovations across segments, enhancing competitiveness. By 2024, the global manufacturing execution systems (MES) market, which supports these digital transformations, was projected to reach over $15 billion, indicating strong industry investment.

There's a significant push for industries like Nirma to embrace sustainable and green manufacturing. This means looking at better ways to use energy, handle waste, and explore eco-friendly fuels and materials. For Nirma's chemical and cement businesses, adopting these technologies is crucial for meeting environmental targets and staying ahead of regulations.

In 2024, the global green manufacturing market was valued at approximately $30 billion, with projections indicating substantial growth driven by sustainability mandates. Nirma's investment in advanced energy-efficient kilns for its cement plants, for example, could reduce fuel consumption by up to 15%, directly impacting operational costs and its carbon footprint.

Furthermore, innovations in closed-loop water recycling systems for its chemical manufacturing processes can significantly cut down on water usage, a critical factor given increasing water scarcity concerns in many regions where Nirma operates. This aligns with the company's stated commitment to environmental stewardship and responsible resource management.

Nirma is actively embracing digital transformation, integrating technologies like the Internet of Things (IoT) and artificial intelligence (AI) to sharpen its manufacturing and operational edge. This shift is crucial as the broader industrial sector sees significant advancements in robotic process automation (RPA) and sophisticated data analytics.

For Nirma, the strategic implementation of AI-powered logistics and real-time monitoring systems is designed to bolster its supply chain's resilience. For instance, by optimizing delivery routes and predicting equipment maintenance needs, the company aims to significantly cut fuel consumption across its vast network, a move that aligns with growing environmental concerns and cost-saving imperatives.

The company's focus on data analytics allows for granular insights into production processes, enabling swift identification of inefficiencies. By leveraging AI for predictive maintenance, Nirma can preemptively address machinery issues, minimizing downtime and ensuring smoother, more reliable output from its extensive manufacturing facilities, a key factor in maintaining competitiveness in the dynamic chemical and consumer goods markets.

Product Innovation and Research & Development

Nirma Ltd. must continuously innovate its product formulations and development to align with evolving consumer demands and stringent industry standards. This is particularly relevant in the detergents and soaps sector, where there's a growing consumer preference for eco-friendly, bio-based, and specialized cleaning solutions. For instance, the global market for green cleaning products, which includes eco-friendly detergents, was projected to reach approximately $11.6 billion by 2022 and is expected to continue its upward trajectory, indicating a strong market pull for sustainable innovations. Nirma's investment in robust Research & Development (R&D) capabilities will be paramount in its strategy to introduce novel products and enhance its existing portfolio. This focus on R&D will enable Nirma to maintain its competitive edge in a dynamic market landscape. In fiscal year 2023-24, many FMCG companies, including those in the home care segment, allocated significant portions of their revenue to R&D, often in the range of 1-3%, to drive product differentiation and market share growth.

- Focus on Sustainable Formulations: Nirma needs to invest in R&D to develop biodegradable detergents and soaps using plant-derived ingredients, catering to the increasing demand for environmentally conscious products.

- Specialized Product Development: Innovation in specialized formulations, such as those for sensitive skin, specific fabric types, or advanced stain removal, can create niche market opportunities and command premium pricing.

- R&D Investment: Allocating a dedicated budget for R&D, possibly mirroring industry benchmarks of 1-3% of revenue, will be crucial for Nirma to foster a culture of continuous improvement and new product creation.

- Consumer-Centric Innovation: Utilizing consumer feedback and market research to guide R&D efforts ensures that new product development directly addresses unmet needs and preferences, thereby increasing adoption rates.

Backward Integration Technologies

Nirma's strategic advantage is deeply rooted in its backward integration technologies, particularly in securing key raw materials. This includes the efficient, in-house production of soda ash and linear alkyl benzene (LAB), crucial components for its detergent and other consumer products. By mastering the technology behind these inputs, Nirma ensures a consistent and cost-effective supply chain, directly impacting its competitive pricing strategy.

These technological capabilities in raw material production are not static; ongoing advancements are vital for maintaining Nirma's self-sufficiency and cost leadership. For instance, improvements in soda ash production efficiency could further solidify its position in a market where raw material costs are a major determinant of profitability. This focus on technological prowess in its upstream operations allows Nirma to better weather supply chain volatility and global price fluctuations.

- Soda Ash Production: Nirma operates its own soda ash manufacturing facilities, providing a significant buffer against market price swings.

- LAB Production: The company's backward integration into Linear Alkyl Benzene (LAB) production enhances control over a primary ingredient for its detergents.

- Cost Efficiency: In-house production of these raw materials contributes directly to Nirma's ability to offer competitive pricing in the consumer goods market.

- Supply Chain Stability: Technological control over these inputs minimizes reliance on external suppliers, ensuring uninterrupted production.

Nirma's technological edge is amplified by its backward integration into key raw materials like soda ash and linear alkyl benzene (LAB). This in-house production provides significant cost control and supply chain stability, crucial for its competitive pricing in consumer goods. By 2024, Nirma's soda ash capacity was a substantial contributor to its cost advantage, especially as global soda ash prices experienced volatility.

The company is also leveraging advancements in manufacturing technologies, including automation and AI, to enhance efficiency across its cement and chemical operations. For example, AI-driven predictive maintenance in its cement plants can reduce operational downtime. The global manufacturing execution systems (MES) market, supporting these digital shifts, was projected to exceed $15 billion in 2024, highlighting the industry's commitment to technological upgrades.

Nirma's R&D focus on sustainable formulations, such as biodegradable detergents, aligns with growing consumer demand. The green cleaning products market was projected to reach $11.6 billion by 2022, with continued growth expected. This necessitates ongoing investment in R&D, with many FMCG companies allocating 1-3% of revenue to innovation, a benchmark Nirma aims to meet.

| Key Technological Area | Nirma's Application/Benefit | Market Data/Projection |

| Backward Integration (Soda Ash, LAB) | Cost control, supply chain stability, competitive pricing | Global soda ash prices experienced volatility in 2024. Nirma's in-house capacity mitigates this. |

| Automation & AI in Manufacturing | Increased efficiency, reduced downtime (e.g., predictive maintenance) | Global MES market projected over $15 billion in 2024. |

| Sustainable Product Development | Meeting consumer demand for eco-friendly products, niche market opportunities | Green cleaning products market projected $11.6 billion by 2022. |

| R&D Investment | Product innovation, market competitiveness | FMCG sector often allocates 1-3% of revenue to R&D. |

Legal factors

The Companies Act, 2013, imposes Corporate Social Responsibility (CSR) mandates on Indian companies meeting specific thresholds, including profit and net worth criteria. Nirma, a significant player in the Indian industrial landscape, falls under these regulations, necessitating the allocation of a percentage of its average net profits from the preceding three financial years to CSR activities. For instance, in FY2023, companies were required to spend 2% of their average net profits on CSR, a figure that influences Nirma's operational budgeting and strategic planning for social impact initiatives.

Nirma Ltd.'s manufacturing operations, especially in chemicals and cement, are subject to stringent environmental regulations. Key legislation includes the Environment (Protection) Act, 1986, the Water (Prevention and Control of Pollution) Act, 1974, and the Air (Prevention and Control of Pollution) Act, 1981. Compliance with these acts is essential for maintaining legal operational status.

Securing and retaining permits such as Consent to Establish (CTE) and Consent to Operate (CTO) from regulatory bodies is a non-negotiable requirement for Nirma's plants. These permits ensure that the company adheres to emission standards and pollution control measures. For instance, in 2023, the Central Pollution Control Board (CPCB) reported that 30% of industrial units across India still faced challenges in meeting air quality norms, highlighting the ongoing regulatory scrutiny.

Failure to comply with these environmental laws can result in significant penalties, including hefty fines and temporary or permanent closure of facilities. Nirma's commitment to environmental stewardship is therefore not only a legal obligation but also crucial for its long-term business sustainability and corporate reputation, especially as environmental, social, and governance (ESG) reporting gains prominence.

Nirma Ltd. operates within a strict legal framework for waste management, directly impacted by rules like the Hazardous and Other Wastes (Management and Transboundary Movement) Rules, the E-Waste (Management) Rules, and the Plastic Waste Management Rules. These regulations mandate careful handling and disposal of industrial byproducts, packaging materials, and any potentially hazardous waste generated across Nirma's diverse operations.

Compliance requires significant investment in advanced waste management systems and meticulous record-keeping for reporting. For instance, in 2023, the Central Pollution Control Board (CPCB) reported that India generated approximately 3.4 million tonnes of e-waste, highlighting the scale of the challenge for companies like Nirma that utilize electronic components. Adherence to these rules is not just a legal obligation but also crucial for environmental stewardship and maintaining operational licenses.

SEBI Regulations on ESG Disclosures

The Securities and Exchange Board of India (SEBI) mandates Environmental, Social, and Governance (ESG) disclosures for top listed companies via the Business Responsibility and Sustainability Report (BRSR) framework. For Nirma Ltd., this means rigorous annual reporting on its environmental footprint, social impact, and governance practices, extending to its entire value chain.

Nirma must meticulously document its performance against key ESG metrics. This includes quantifiable data on emissions, water usage, waste management, employee welfare, and ethical business conduct.

- Environmental: Nirma’s BRSR will detail its carbon footprint reduction initiatives and water conservation efforts, with specific targets for FY2025.

- Social: The report will highlight Nirma's commitment to employee safety, diversity, and community engagement programs.

- Governance: Disclosures will cover board composition, executive compensation, and anti-corruption policies.

- Value Chain: Nirma is also required to report on the ESG performance of its suppliers and distributors.

Competition Law and Market Dominance

Nirma Limited, as a significant force in the Indian detergent and chemical sectors, navigates a landscape shaped by the Competition Act, 2002. This legislation aims to curb monopolistic practices and promote fair competition, requiring Nirma to scrutinize its pricing, distribution, and any potential mergers or acquisitions to ensure compliance. The Competition Commission of India (CCI) actively monitors market dynamics, imposing penalties for violations that could stifle competition.

The company's market share in key segments necessitates careful adherence to regulations concerning abuse of dominant position. For instance, in 2023, the CCI investigated several companies for alleged anti-competitive agreements in various sectors, highlighting the active enforcement environment. Nirma must ensure its actions do not lead to the creation or reinforcement of dominant positions that could harm consumers or other businesses.

- Regulatory Scrutiny: Nirma's operations are subject to oversight by the Competition Commission of India (CCI), which enforces the Competition Act, 2002.

- Market Dominance Concerns: As a major player, Nirma must ensure its market practices do not constitute an abuse of dominant position.

- Anti-Competitive Behavior: Pricing strategies, exclusive dealing arrangements, and acquisitions are areas requiring careful compliance to avoid anti-competitive outcomes.

- Enforcement Actions: The CCI has historically imposed penalties on companies for violations, underscoring the importance of proactive compliance for Nirma.

Nirma Ltd. must adhere to India's intellectual property laws, including the Patents Act, 1970, and the Trademarks Act, 1999, to protect its product formulations and brand identity. Safeguarding its innovations is crucial for maintaining a competitive edge, especially in fast-moving consumer goods where brand recognition drives sales. For instance, in 2023, there were over 15,000 patent applications filed in India, indicating a robust environment for IP protection that Nirma actively participates in.

Environmental factors

India's ambitious goal of achieving Net Zero carbon emissions by 2070, coupled with national strategies like the National Action Plan on Climate Change (NAPCC) and the Perform, Achieve and Trade (PAT) scheme, significantly impacts energy-intensive sectors such as cement and chemicals. Nirma, operating within these industries, faces increasing pressure to curtail its carbon footprint.

Consequently, Nirma must allocate capital towards adopting advanced technologies and sustainable practices that actively reduce greenhouse gas emissions throughout its manufacturing and operational processes. This strategic investment is crucial for compliance and long-term viability in an evolving regulatory landscape.

Water is absolutely essential for Nirma's manufacturing, particularly in creating chemicals and detergents. As water becomes scarcer, especially in regions where Nirma operates, the company faces increasing pressure from stricter rules on how much water it can use and what it can discharge. This means Nirma needs really smart ways to manage its water, like reusing wastewater and aiming for zero liquid discharge (ZLD) systems. For instance, India has seen significant rainfall deficits in recent years, impacting water availability for industries. Implementing advanced water management is key for Nirma's long-term sustainability and to avoid operational disruptions.

Nirma's broad manufacturing footprint, spanning detergents, chemicals, and cement, inevitably leads to diverse waste streams, encompassing both hazardous materials and significant volumes of packaging waste. For instance, the chemical division's processes can generate byproducts requiring careful handling and disposal, while the consumer goods segment contributes to post-consumer packaging challenges.

Navigating these environmental responsibilities requires strict adherence to regulations like India's Hazardous Waste Management Rules. Nirma's commitment to circular economy principles, focusing on waste reduction at source, material reuse, and robust recycling programs, is crucial not only for regulatory compliance but also for enhancing operational efficiency and conserving valuable resources. This approach can translate into cost savings, as seen in the global trend where companies adopting circular models report significant reductions in raw material expenditure.

Resource Depletion and Sustainable Sourcing

Nirma's operations, particularly in cement and chemicals, rely heavily on raw materials like limestone. The extraction of these finite resources contributes to the broader issue of resource depletion, a growing concern globally. For instance, global limestone reserves, while substantial, are not infinite, and increased demand for construction materials puts pressure on their availability.

Nirma's long-term viability is intrinsically linked to its ability to implement sustainable sourcing strategies. This involves not only ensuring a consistent supply chain but also minimizing the environmental footprint associated with material extraction. The company's commitment to this area will be crucial in navigating future regulatory landscapes and consumer expectations regarding environmental responsibility.

Exploring alternative raw materials or innovative processes that reduce reliance on virgin resources is a key strategic imperative. This could involve utilizing recycled materials in cement production or developing chemical processes that require less resource-intensive inputs. Such shifts are essential for resource security and mitigating the environmental impact of its operations.

By focusing on sustainable sourcing, Nirma can build resilience against potential supply chain disruptions and price volatility related to raw material availability. This proactive approach is vital for maintaining competitive advantage in an increasingly environmentally conscious market.

Pollution Control and Environmental Impact Assessments

Nirma's manufacturing operations, particularly in chemicals and detergents, face strict environmental regulations. The company must adhere to stringent pollution control norms for both air and water emissions from its plants. For instance, in 2024, the Central Pollution Control Board (CPCB) in India continued to emphasize stricter compliance for industrial units regarding particulate matter and wastewater discharge standards.

Large-scale industrial expansion or new projects undertaken by Nirma would necessitate comprehensive Environmental Impact Assessments (EIAs). These assessments are crucial for identifying, evaluating, and proposing mitigation strategies for potential environmental risks, ensuring that development projects align with sustainability goals. This is a standard requirement for projects exceeding certain thresholds, often reviewed by government environmental agencies.

Maintaining compliance and a positive environmental standing requires Nirma to engage in continuous monitoring of its emissions and invest significantly in advanced pollution control technologies. For example, companies in the chemical sector often allocate substantial capital expenditure towards upgrading effluent treatment plants (ETPs) and installing advanced air pollution control devices. Nirma's commitment in this area directly impacts its operational license and corporate reputation, with ongoing investments being a key factor in their environmental performance.

Key environmental considerations for Nirma include:

- Adherence to CPCB air quality standards for industrial emissions.

- Compliance with wastewater discharge regulations, including Total Dissolved Solids (TDS) and chemical oxygen demand (COD) limits.

- Regular submission of EIAs for new manufacturing units or significant process changes.

- Investment in Zero Liquid Discharge (ZLD) technologies where feasible to minimize water pollution.

India's commitment to Net Zero by 2070, alongside initiatives like the Perform, Achieve and Trade (PAT) scheme, places direct pressure on Nirma's energy-intensive operations in cement and chemicals to reduce their carbon footprint. This necessitates significant capital investment in advanced, emission-reducing technologies to ensure compliance and long-term operational sustainability. Water scarcity, a growing concern in India, also impacts Nirma’s manufacturing processes, leading to stricter usage and discharge regulations and driving the need for efficient water management solutions like Zero Liquid Discharge (ZLD) systems.

Nirma's diverse waste streams, from hazardous byproducts in chemicals to packaging in consumer goods, require adherence to regulations like the Hazardous Waste Management Rules, pushing for circular economy principles like waste reduction and recycling. The extraction of finite raw materials, such as limestone for cement, highlights resource depletion concerns, making sustainable sourcing and exploration of alternative materials critical for Nirma's future resource security and competitive edge.

Environmental regulations, including CPCB standards for air and water emissions, are increasingly stringent, requiring continuous monitoring and investment in pollution control technologies. For example, chemical companies often allocate substantial capital to upgrading effluent treatment plants. Large projects also demand comprehensive Environmental Impact Assessments (EIAs) to ensure alignment with sustainability goals, with ongoing investments in pollution control being vital for operational licensing and corporate reputation.

| Environmental Factor | Nirma's Impact/Response | Relevant Data/Regulation (2024-2025 Focus) |

|---|---|---|

| Carbon Emissions | Pressure to reduce footprint due to Net Zero goals | India's Net Zero target by 2070; PAT scheme driving energy efficiency. |

| Water Scarcity & Discharge | Need for efficient water management, ZLD systems | Increased water stress in industrial regions; stricter discharge norms for TDS/COD. |

| Waste Management | Handling hazardous and packaging waste; circular economy focus | Compliance with Hazardous Waste Management Rules; focus on waste reduction and recycling. |

| Resource Depletion | Reliance on finite raw materials like limestone | Global trend of increasing demand for construction materials; focus on sustainable sourcing. |

| Pollution Control | Adherence to air/water emission standards | CPCB emphasis on stricter compliance for particulate matter and wastewater discharge. |

PESTLE Analysis Data Sources

Our Nirma Ltd. PESTLE analysis is meticulously constructed using data from government publications, financial reports, industry-specific research, and market trend analyses. We draw upon official economic indicators, regulatory updates, and consumer behavior studies to ensure a comprehensive understanding of the macro-environmental landscape.