Nirma Ltd. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nirma Ltd. Bundle

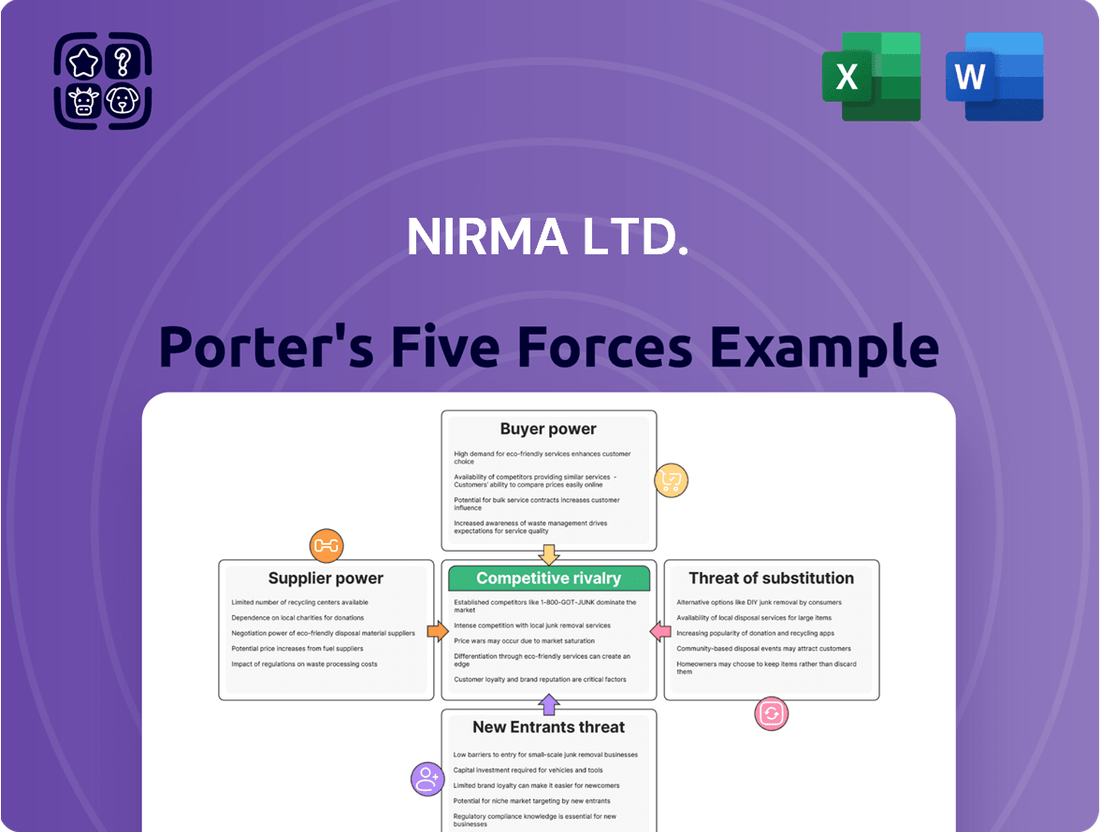

Nirma Ltd. navigates a competitive landscape shaped by several powerful forces, impacting its profitability and strategic direction. Understanding the intensity of rivalry, the bargaining power of buyers, and the threat of new entrants is crucial for any stakeholder. The influence of suppliers and the availability of substitutes also play significant roles in Nirma's market dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Nirma Ltd.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Nirma Ltd. navigates supplier concentration risks, especially for critical inputs like soda ash and linear alkyl benzene (LAB). While some consolidation in the soda ash market was observed in 2024, Nirma's strategic backward integration into chemical manufacturing, exemplified by its own plants, significantly reduces its reliance on external suppliers for these vital raw materials.

The chemical industry, where Nirma operates, is significantly influenced by the fluctuating costs of essential raw materials. Factors like global supply-demand dynamics and geopolitical situations can cause sharp price swings. For instance, late 2024 saw a notable 15-20% increase in raw material prices from Chinese suppliers impacting the Indian chemical sector.

This price volatility directly impacts Nirma's production expenses and overall profitability. Even with its backward integration strategies, the company remains susceptible to these external market forces. Managing these input cost pressures is a key challenge for Nirma in maintaining competitive pricing and healthy margins.

Nirma's extensive backward integration, encompassing the production of soda ash, caustic soda, and LAB, significantly diminishes the bargaining power of external suppliers for these vital inputs. This strategy grants Nirma greater control over its supply chain and raw material costs.

The company's strategic asset includes captive salt pans for its soda ash manufacturing and limestone mines dedicated to its cement operations. This ensures a consistent and sufficient supply of essential raw materials, directly mitigating price volatility and supply disruptions.

In 2023, Nirma's cement division, for instance, relied heavily on its captive limestone mines, a key factor in managing production costs amidst fluctuating commodity markets. Similarly, its detergent segment benefits from internal soda ash production, a crucial ingredient where external price hikes could otherwise impact margins.

Switching Costs for Nirma

Nirma faces relatively low switching costs for many of its key raw materials, particularly chemicals. This is because the company can source these inputs from a diverse range of suppliers, preventing any single supplier from holding significant leverage. For instance, in 2024, Nirma's procurement strategy emphasized multiple sourcing for essential chemicals like soda ash and linear alkylbenzene (LAB), contributing to competitive input pricing.

This diversified supplier base is a critical factor in limiting the bargaining power of individual suppliers. Nirma's ability to readily switch between providers for essential inputs means suppliers cannot easily dictate terms or prices. This flexibility was evident in their operational resilience during periods of global supply chain fluctuations in late 2023 and early 2024, where their alternative sourcing options helped mitigate price hikes.

- Diversified Sourcing: Nirma sources critical chemicals from multiple vendors, reducing reliance on any single entity.

- Low Switching Costs: The ease with which Nirma can change suppliers for many raw materials limits supplier pricing power.

- Competitive Input Pricing: A broad supplier network enables Nirma to negotiate favorable terms and maintain cost efficiency.

- Reduced Supplier Leverage: Nirma’s operational flexibility mitigates the risk of suppliers exploiting their position.

Supplier's Importance to Nirma

Nirma's bargaining power with suppliers is a mixed bag. For many commodity chemicals, Nirma's significant purchasing volume gives it considerable leverage, as suppliers often depend on large orders from companies like Nirma. This is particularly true in markets where suppliers are numerous and fragmented, allowing Nirma to play them off against each other.

However, the power dynamic shifts when Nirma requires specialized or niche raw materials where the supplier base is more concentrated. In such instances, suppliers can exert greater influence due to limited alternatives for Nirma.

- Nirma's backward integration into key raw material production, such as soda ash and linear alkylbenzene (LAB), significantly mitigates its reliance on external suppliers for these critical inputs.

- The fragmented nature of the industrial chemical market for many of Nirma's inputs generally favors Nirma as a large buyer, enhancing its negotiation power.

- For specialized chemicals, the bargaining power can shift towards suppliers if there are few domestic manufacturers or if imports face significant logistical challenges or tariffs.

- In 2023, Nirma's significant production volumes in detergent and cement, its core businesses, imply substantial purchasing power for its raw materials, likely ensuring favorable terms for commodity chemicals.

Nirma's backward integration, particularly in soda ash and linear alkyl benzene (LAB), drastically reduces its dependence on external suppliers for these key materials. This strategic move grants Nirma greater control over its supply chain and raw material costs, a crucial advantage in a volatile market. For instance, Nirma's captive salt pans and limestone mines ensure a steady supply, directly counteracting price fluctuations and potential disruptions. This internal control is a significant factor in its ability to manage supplier bargaining power effectively.

The company's broad sourcing strategy for many commodity chemicals, coupled with its substantial purchasing volume, generally gives it considerable leverage over suppliers. This is especially true in fragmented markets where suppliers are numerous, allowing Nirma to negotiate favorable terms. However, for more specialized inputs, the bargaining power can tilt towards suppliers if domestic production is limited or import logistics are challenging, a scenario that Nirma actively seeks to minimize through strategic partnerships and diversified sourcing.

In 2023, Nirma's substantial production volumes across its detergent and cement divisions underscored its significant purchasing power for raw materials. This strong market position likely translated into favorable contract terms for commodity chemicals, a trend that continued into 2024 with Nirma emphasizing multiple sourcing for essential chemicals like soda ash and LAB. This approach ensures competitive input pricing and mitigates the risk of any single supplier dictating terms.

Nirma's ability to source critical chemicals from multiple vendors significantly limits the bargaining power of individual suppliers. The ease with which Nirma can switch providers for many essential inputs means suppliers have limited ability to unilaterally increase prices or dictate terms. This operational flexibility was a key factor in their resilience during global supply chain disruptions experienced in late 2023 and early 2024.

What is included in the product

This analysis of Nirma Ltd. explores the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, providing a strategic overview of its competitive environment.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Nirma's market landscape, making strategic adjustments straightforward.

Customers Bargaining Power

Nirma's core customer base, predominantly lower and middle-income households across India, exhibits considerable price sensitivity. This means that even small increases in the cost of Nirma's products can prompt consumers to explore cheaper alternatives. For instance, in 2024, with rising inflation impacting disposable incomes, consumers of essential goods like detergents and soaps were observed to be even more vigilant about pricing.

The company's strategy of offering value-for-money products directly addresses this sensitivity. Customers are well-informed about competitive pricing in the mass market segment. Reports from early 2024 indicated that price differentials of even a few rupees could influence brand loyalty for everyday household items.

This heightened awareness of price grants substantial bargaining power to Nirma's widespread consumer base. They can readily switch to competing brands if Nirma's pricing becomes less attractive relative to the perceived quality and value offered by others.

In the Fast-Moving Consumer Goods (FMCG) sector, especially for products like detergents and soaps, customers face very low costs when deciding to switch brands. This means a consumer can easily move from one detergent brand to another if they find a better price, perceive a higher quality, or are enticed by a special promotion. Such flexibility directly amplifies the bargaining power of these customers.

This low switching cost significantly influences Nirma's strategy. It compels the company to consistently offer competitive pricing and ensure its products deliver on perceived quality and performance. For instance, in 2024, the Indian detergent market saw intense price competition, with brands actively using discounts and bulk offers to retain and attract customers, a direct consequence of this low switching cost dynamic.

The detergent and soap market is incredibly crowded, with many brands and product types available. Nirma faces stiff competition from traditional powders, modern liquids, and specialized cleaning agents. This saturation means customers have plenty of options, allowing them to easily switch if they find a better price or product elsewhere, significantly boosting their bargaining power.

Customers can readily find alternatives that meet their specific needs and price points. For instance, while Nirma has a strong presence, other established players and emerging brands offer comparable products. The rise of niche and premium detergents, alongside a growing consumer interest in sustainable and eco-friendly options, further diversifies customer choices, diminishing any single brand's pricing leverage.

Customer Information and Market Transparency

The digital age has significantly amplified customer bargaining power for companies like Nirma. With widespread internet access and the proliferation of online review sites and price comparison tools, consumers are now highly informed. This heightened market transparency empowers them to readily assess product quality, pricing, and competitor offerings, enabling them to negotiate better deals or readily switch brands. In 2024, for instance, the average Indian consumer spent an estimated 3.5 hours daily online, with a significant portion dedicated to researching purchases, a trend that continued to grow from previous years.

This increased customer savviness directly translates into a stronger collective voice. Customers can easily share their experiences and demand superior value, forcing businesses to remain competitive and responsive. For Nirma, this means a constant need to not only offer competitive pricing but also to ensure consistent product quality and effective customer service to foster loyalty. Failing to adapt to these informed expectations can lead to rapid erosion of market share, as demonstrated by the agility of newer D2C brands in the FMCG sector attracting significant customer bases through transparent pricing and direct engagement.

- Informed Consumerism: Digital platforms empower consumers to compare prices and product features across multiple brands, increasing price sensitivity.

- Switching Costs: Low switching costs in many consumer goods sectors allow customers to easily move to competitors offering better value, intensifying pressure on Nirma.

- Brand Loyalty: Nirma must focus on delivering a consistent value proposition, including quality and affordability, to counter the ease with which customers can switch.

- Online Reviews: The impact of online reviews and social media discussions means customer satisfaction or dissatisfaction can quickly influence purchasing decisions for a wide audience.

Diversified Customer Segments

Nirma's customer base is quite varied. While its detergent and personal care items are largely sold to individual consumers who are often sensitive to price, the company's expansion into chemicals like soda ash and linear alkylbenzene (LAB), along with cement and pharmaceuticals through Alivus Life Sciences, means it also deals with industrial and institutional buyers.

These business-to-business relationships can have different power dynamics. For instance, industrial customers might negotiate based on long-term supply agreements or specific quality certifications, which can influence their bargaining leverage. However, the broad spread of Nirma's customer segments, from individual households to large industries, helps to moderate the overall influence that any single customer group can exert on the company.

- Consumer Products: Nirma's core consumer goods target a price-conscious mass market, indicating a significant level of customer bargaining power due to readily available alternatives.

- Industrial Chemicals: In the chemicals segment, Nirma serves industrial clients who may have more concentrated buying power, but often engage in long-term contracts that can stabilize demand and pricing.

- Diversification Impact: The company's presence in sectors like cement and pharmaceuticals further diversifies its customer base, diluting the aggregated bargaining power of any single segment.

- B2B Dynamics: While specific B2B relationships might involve unique negotiation points like quality standards or volume commitments, the overall diversification strategy aims to create a more balanced power structure.

Nirma's extensive customer base, particularly in its core FMCG segment, exhibits substantial bargaining power. This is driven by high price sensitivity, low switching costs, and increased market transparency facilitated by digital platforms. In 2024, consumers demonstrated heightened vigilance on pricing for essential goods, readily comparing brands based on even minor price differences, a trend amplified by online research, where the average Indian consumer dedicated significant daily online time to purchase research.

While Nirma's diversification into industrial chemicals and other sectors introduces B2B relationships with potentially different negotiation dynamics, the sheer volume of individual consumers in its mass-market segments means customer bargaining power remains a significant force. The company must continuously balance competitive pricing with perceived quality to retain its broad customer base.

| Customer Segment | Key Bargaining Power Drivers | Nirma's Response/Impact |

|---|---|---|

| Individual Consumers (FMCG) | High Price Sensitivity, Low Switching Costs, Access to Online Price Comparisons | Requires competitive pricing, value-for-money proposition, and consistent quality to counter brand switching. |

| Industrial Clients (Chemicals) | Volume Commitments, Quality Certifications, Long-term Contracts | Negotiations impact supply agreements and pricing, but long-term contracts can offer some stability. |

| Diversified Customer Base | Varied needs and purchasing power across segments | Dilutes the concentrated bargaining power of any single customer group, creating a more balanced overall power structure. |

Same Document Delivered

Nirma Ltd. Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Nirma Ltd. Porter's Five Forces Analysis meticulously details the competitive landscape, covering the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors. This comprehensive assessment is crucial for understanding Nirma's strategic positioning and potential challenges within the fast-moving consumer goods sector.

Rivalry Among Competitors

The Indian Fast-Moving Consumer Goods (FMCG) sector, Nirma's core operating ground, is exceptionally competitive, hosting over 1,000 companies in 2024. This crowded landscape intensifies rivalry, requiring constant innovation and aggressive market strategies.

Nirma faces formidable competition, particularly in the detergent segment, from global behemoths like Hindustan Unilever Limited (HUL) and Procter & Gamble (P&G). For instance, HUL's revenue for the fiscal year ending March 2024 was approximately INR 61,000 crore, highlighting the financial muscle of its competitors.

This intense rivalry from well-established players with vast resources and brand recognition exerts significant pressure on Nirma. It challenges Nirma's ability to maintain and grow its market share and necessitates strategic pricing to remain competitive.

Nirma's strategic focus on the value-for-money segment places it in direct competition with a vast number of unorganized players. These smaller, often local businesses benefit from lower operational costs, allowing them to undercut prices. For instance, in the detergent market, which Nirma has historically dominated, the unorganized sector accounts for a significant share, estimated to be around 30-40% in various regions.

This intense rivalry necessitates Nirma's continuous efforts in cost optimization and efficient pricing strategies. Maintaining its competitive edge requires balancing affordability with product quality. The company's ability to leverage economies of scale in manufacturing and distribution becomes crucial in outmaneuvering these smaller, agile competitors who can react quickly to market price fluctuations.

The price sensitivity of this market segment means that even minor price adjustments by competitors can shift consumer loyalty. Nirma's success hinges on its ability to deliver consistent value, ensuring that its products remain attractive despite the presence of cheaper alternatives. This dynamic is particularly evident in rural and semi-urban markets where purchasing power is more constrained.

High exit barriers, like the substantial investments Nirma has made in its manufacturing plants for chemicals and cement, can keep companies in the market even when profits are slim. This means competition remains intense, potentially leading to price wars where everyone struggles to maintain margins.

Nirma's extensive distribution networks also act as a significant barrier to exit, making it costly and difficult to simply walk away from the business. Companies are essentially locked into the industry, which fuels sustained rivalry as they fight for market share.

For instance, the capital expenditure on Nirma's cement plants alone represents a massive commitment, making a swift exit impractical. This forces all players, including Nirma, to remain competitive and find ways to operate profitably despite the challenging landscape.

Market Growth Dynamics

Competitive rivalry within the Indian FMCG sector, particularly for Nirma Ltd., is characterized by a dynamic interplay of growth and deceleration across segments. While the broader Indian FMCG market is expected to expand robustly, specific categories such as liquid detergents and broader home and personal care are experiencing more nuanced growth trajectories.

Rural demand is emerging as a significant growth engine, contrasting with a noticeable deceleration in certain urban consumption patterns. This divergence necessitates strategic recalibration from players like Nirma.

The competition intensifies as companies vie for market share in both rapidly expanding rural markets and more mature, sometimes stagnant, urban segments. This push-and-pull creates a challenging environment for maintaining and growing market presence.

Key market dynamics influencing this rivalry include:

- Projected Indian FMCG Market Growth: The overall Indian FMCG market is anticipated to witness substantial expansion.

- Segmented Growth Rates: Liquid detergents and home and personal care segments exhibit varied growth rates, demanding tailored strategies.

- Rural vs. Urban Demand: Rural demand is a primary growth driver, while urban demand shows signs of slowing in select categories.

- Strategic Adaptation: Companies must adapt their strategies to capitalize on these shifting consumer behaviors, potentially increasing competitive intensity.

Product Differentiation and Innovation

Competitive rivalry in Nirma's core markets, particularly detergents and personal care, is intense. Competitors are actively pursuing product differentiation through novel formulations, eye-catching packaging, and specialized offerings like eco-conscious and premium product lines. For instance, in the Indian detergent market, which saw a compound annual growth rate of approximately 6% leading up to 2024, brands are constantly introducing variants with advanced cleaning technologies or unique fragrances.

Nirma itself needs to actively invest in its own product differentiation and innovation strategies to maintain customer engagement and foster loyalty. This means evolving beyond its established value-for-money proposition to address the shifting preferences of consumers who increasingly seek products catering to specific needs, such as sensitive skin formulations or sustainable packaging solutions. The company's ability to adapt and innovate will be crucial in navigating this dynamic competitive landscape.

- Innovation Focus: Competitors are launching new formulations and eco-friendly options.

- Consumer Evolution: Consumers are showing a preference for premium and specialized products.

- Nirma's Challenge: Nirma must move beyond its traditional value proposition.

- Strategic Imperative: Investing in R&D for differentiation is key to retaining market share and loyalty.

Nirma faces fierce competition in the Indian FMCG sector, especially from established giants like HUL and P&G, who possess significant financial resources and strong brand recognition. The intense rivalry, particularly in the detergent segment where Nirma has historically excelled, forces the company to constantly innovate and adopt aggressive pricing strategies to maintain its market share amidst a crowded marketplace.

The presence of a substantial unorganized sector, estimated to hold 30-40% of the detergent market in various regions, further intensifies rivalry. These smaller players often leverage lower operational costs to offer more competitive pricing, compelling Nirma to focus on cost optimization and efficient operations to remain attractive to price-sensitive consumers.

High exit barriers, such as Nirma's significant investments in manufacturing facilities, lock companies into the industry, fueling sustained competition. This means players must continually adapt to market shifts and evolving consumer preferences, such as the growing demand for specialized and eco-friendly products, to stay ahead.

The competitive landscape is dynamic, with rural demand emerging as a key growth driver while certain urban consumption patterns decelerate. This requires Nirma to strategically recalibrate its approach, focusing on product differentiation and innovation to cater to diverse consumer needs and maintain loyalty.

| Competitor | 2024 Revenue (Approx.) | Market Share Focus |

| Hindustan Unilever Limited (HUL) | INR 61,000 crore | Detergents, Personal Care, Home Care |

| Procter & Gamble (P&G) | Undisclosed (Global Revenue: ~$82 Billion USD in 2023) | Detergents, Baby Care, Personal Care |

| Unorganized Sector | N/A (Fragmented) | Detergents (30-40% share in certain regions) |

SSubstitutes Threaten

The shift towards liquid detergents poses a significant threat to Nirma's traditional powder detergent market. This trend is particularly pronounced in urban India, where factors like increased washing machine ownership and a desire for convenience are driving consumer preference. By 2023, the Indian liquid detergent market was estimated to be growing at a compound annual growth rate of over 9%, indicating a strong and sustained consumer shift.

Furthermore, rising environmental consciousness presents another potent substitute: eco-friendly and bio-based detergents. Consumers are increasingly seeking products with reduced environmental impact, creating a demand for detergents formulated with natural ingredients and biodegradable packaging. This segment, while still developing in India, represents a future competitive landscape where Nirma must innovate to remain relevant.

Beyond traditional detergents and soaps, consumers in India have a range of alternative cleaning solutions. These include dishwashing bars, specialized household cleaners, and even DIY or home remedies. For instance, while Nirma's core strength is in laundry detergents, other categories like dishwash bars, though not direct substitutes for laundry, cater to a similar household cleaning need, potentially drawing consumer spend.

These alternatives, especially those positioned for value, can siphon off demand from Nirma's offerings. Consider the widespread availability and affordability of dishwashing bars, which, while not for laundry, compete for a share of the household cleaning budget. Nirma's broad product range, encompassing soaps and other personal care items, helps to offset this threat by capturing consumer spending across multiple categories.

The threat of substitutes for Nirma's industrial chemicals, such as soda ash and LAB, is a significant consideration. Client industries might switch to alternative raw materials or employ different manufacturing processes that bypass the need for Nirma's products, thereby reducing demand.

For instance, in glass manufacturing, where soda ash is a key ingredient, advancements in glass technology could potentially lead to the development of new formulations that require less or no soda ash. Similarly, in the detergent industry, the primary consumer of LAB, innovations in surfactant technology could introduce biodegradable or synthetic alternatives that lessen reliance on LAB.

Price volatility of raw materials used by Nirma, such as salt and coal, can also indirectly increase the threat of substitutes. If Nirma's production costs rise significantly, its product prices will likely increase, making alternative solutions more financially attractive to its customers. For example, in 2023, fluctuations in global energy prices impacted chemical production costs across the board, prompting some downstream industries to re-evaluate their material sourcing strategies.

Price-Performance Trade-off of Substitutes

The willingness of consumers to switch to substitutes is heavily influenced by the perceived price-performance trade-off. If alternative products offer similar or even better quality for a similar or lower price point, the threat of substitution for Nirma's products increases significantly.

Nirma's long-standing competitive advantage has been its focus on affordability. However, if competitors or new market entrants introduce substitutes that provide superior value, meaning better performance at a comparable or lower cost, Nirma's market share could be challenged. For instance, in the detergent market, while Nirma has traditionally competed on price, the emergence of premium-quality detergents offering advanced stain removal at moderate price increases could draw consumers away.

- Price-Performance Ratio: Consumers evaluate substitutes based on how much performance they get for the price.

- Nirma's Value Proposition: Nirma's historical success is built on offering value through low prices.

- Erosion of Market Position: If substitutes offer better value, Nirma risks losing market share.

- Competitive Landscape: The Indian FMCG sector, particularly detergents and personal care, sees constant innovation in product features and pricing strategies from players like Hindustan Unilever and P&G, impacting Nirma's pricing power.

Diversification Mitigates Substitution Risk

Nirma's strategic diversification significantly weakens the threat of substitutes. By operating across diverse sectors like detergents, soaps, chemicals, cement, and the burgeoning pharmaceuticals market via Alivus Life Sciences, Nirma reduces its vulnerability to substitution in any single product category. For instance, if traditional detergent brands face intense competition from newer, eco-friendly alternatives, Nirma's robust cement or chemical divisions are unaffected, providing a stable revenue base.

This broad portfolio acts as a buffer, ensuring that challenges in one area do not disproportionately impact the entire organization. Nirma's expansion into pharmaceuticals, a sector with high growth potential and diverse substitute products, further demonstrates this strategy. The company reported a revenue of approximately INR 7,000 crore for the fiscal year ending March 31, 2023, showcasing its substantial operational scale across various industries, making it resilient to sector-specific substitution pressures.

- Diversified Revenue Streams: Nirma's presence in multiple industries—consumer goods, chemicals, cement, and pharmaceuticals—means that a threat of substitution in one segment, such as detergents facing competition from newer cleaning agents, doesn't cripple the company.

- Cross-Segment Stability: For example, while the detergent market might see substitutes emerge, Nirma's cement division, which generated substantial revenue in its last reported fiscal year, remains insulated from these specific pressures.

- Reduced Overall Risk Exposure: This broad operational footprint inherently lowers Nirma's overall susceptibility to the threat of substitutes, as the company is not overly reliant on a single product category or market.

- Pharmaceuticals as a Growth Hedge: The recent foray into pharmaceuticals through Alivus Life Sciences adds another layer of insulation, tapping into a market with different substitute dynamics and growth drivers, further diversifying away from traditional consumer goods substitution risks.

The threat of substitutes for Nirma's core detergent business is evolving with the rise of liquid detergents and eco-friendly alternatives. Consumers are increasingly opting for convenience and sustainability, driving demand for products that Nirma's traditional powder detergents may not fully address. For instance, the Indian liquid detergent market experienced significant growth, exceeding 9% CAGR by 2023, highlighting a clear consumer preference shift.

Entrants Threaten

High capital requirements pose a significant threat to new entrants in industries where Nirma operates. Establishing manufacturing plants for FMCG products, chemicals, or cement demands massive upfront investment. For example, setting up a modern detergent plant alone can easily exceed $50 million, while the cement industry requires even larger capital outlays for quarries, kilns, and grinding facilities.

These substantial initial costs, covering production infrastructure, research and development, and building robust distribution channels, create a formidable barrier. Potential new players must secure considerable funding to even begin competing, making entry less appealing and less likely.

Nirma possesses a formidable advantage with its extensive distribution network, touching over 2 million retail outlets across India. This reach is particularly crucial in rural areas where establishing a presence is often more challenging.

Newcomers would face immense capital expenditure and logistical hurdles to build a comparable supply chain, a significant barrier to entry. Replicating Nirma's deep penetration into diverse markets requires substantial investment and time, making direct competition difficult.

Nirma's decades-long commitment to providing value has cultivated immense brand loyalty and consumer trust, especially in the detergent and soap segments. This deeply embedded trust acts as a significant barrier to new entrants.

New competitors would face the formidable task of overcoming Nirma's established reputation, requiring massive investments in marketing and advertising to even begin chipping away at its market position.

For instance, in 2024, while specific market share figures are proprietary, Nirma remains a dominant player in the Indian FMCG sector, with its brands consistently ranking high in consumer recall and preference studies for its price-value proposition.

Economies of Scale

Nirma's established position as a large-scale manufacturer, boasting backward integration, grants it substantial economies of scale in both production and raw material sourcing. This inherent cost advantage makes it exceptionally challenging for new entrants to compete effectively. For instance, in 2023, Nirma's significant production capacity allowed it to absorb fixed costs over a much larger output volume compared to a hypothetical new entrant. Without achieving comparable production levels, new players simply cannot achieve Nirma's cost efficiencies.

The threat of new entrants is therefore significantly mitigated by Nirma's economies of scale. New companies would require massive initial investment to even approach Nirma's production volumes and achieve similar cost per unit. This capital requirement acts as a substantial barrier to entry, protecting Nirma's market share and profitability.

- Economies of Scale: Nirma leverages its large manufacturing footprint to spread fixed costs, lowering the average cost per unit.

- Backward Integration: Control over raw material sourcing further enhances cost efficiency and predictability, a key advantage over potential newcomers.

- Cost Competitiveness: In 2023, Nirma's ability to offer competitive pricing was directly linked to its scale, a benchmark difficult for smaller firms to meet.

- Capital Intensity Barrier: Establishing production facilities capable of matching Nirma's scale demands significant upfront capital, deterring many potential entrants.

Government Regulations and Policies

Stringent government regulations, particularly those concerning environmental compliance in chemical manufacturing and waste management, significantly increase operational costs and complexity for Nirma and potential entrants. For instance, India's Central Pollution Control Board mandates strict adherence to emission and effluent standards, requiring substantial investment in advanced treatment technologies. These compliance burdens can deter new players, especially those lacking the capital or established infrastructure to navigate the Indian regulatory landscape.

These regulatory hurdles act as substantial barriers to entry, particularly for smaller firms or those without prior experience in the Indian market. Navigating permits, licenses, and ongoing compliance with bodies like the Ministry of Environment, Forest and Climate Change demands specialized expertise and financial resources. The Indian government’s increasing focus on sustainable manufacturing practices, as evidenced by initiatives like the National Clean Air Programme, further elevates these entry barriers.

- Environmental Regulations: Compliance with emission and effluent standards set by the Central Pollution Control Board.

- Licensing and Permits: Obtaining necessary approvals from various governmental bodies for chemical manufacturing operations.

- Evolving Standards: Adapting to increasingly stringent sustainability and waste disposal norms, such as those promoted by the National Clean Air Programme.

The threat of new entrants is considerably low due to Nirma's substantial capital requirements and established economies of scale. For instance, in 2023, Nirma's backward integration and vast production capacity allowed it to achieve cost efficiencies that new entrants would struggle to match without massive upfront investment.

Nirma's extensive distribution network, reaching millions of retail outlets across India, presents a significant logistical barrier. Additionally, its strong brand loyalty, built over decades, makes it difficult for newcomers to gain market traction without substantial marketing expenditure.

Stringent government regulations, particularly environmental compliance in its chemical and cement operations, further deter new players by increasing operational complexity and capital expenditure. For example, adherence to emission standards set by the Central Pollution Control Board requires significant investment in advanced technologies.

| Factor | Nirma's Advantage | Impact on New Entrants |

| Capital Requirements | High, e.g., $50M+ for a detergent plant | Significant barrier, requires substantial funding |

| Distribution Network | 2 million+ retail outlets | Difficult and costly to replicate |

| Brand Loyalty | Decades of consumer trust | Requires extensive marketing investment to overcome |

| Economies of Scale | Lower cost per unit due to high production volume | New entrants cannot match cost competitiveness initially |

| Regulatory Compliance | Established infrastructure to meet standards | Increased operational costs and complexity for newcomers |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Nirma Ltd. leverages data from annual reports, industry association publications, and consumer market research to understand competitive intensity and buyer behavior.

We integrate insights from financial news outlets, competitor public disclosures, and government economic data to assess supplier bargaining power and the threat of new entrants in the FMCG sector.