Nirma Ltd. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nirma Ltd. Bundle

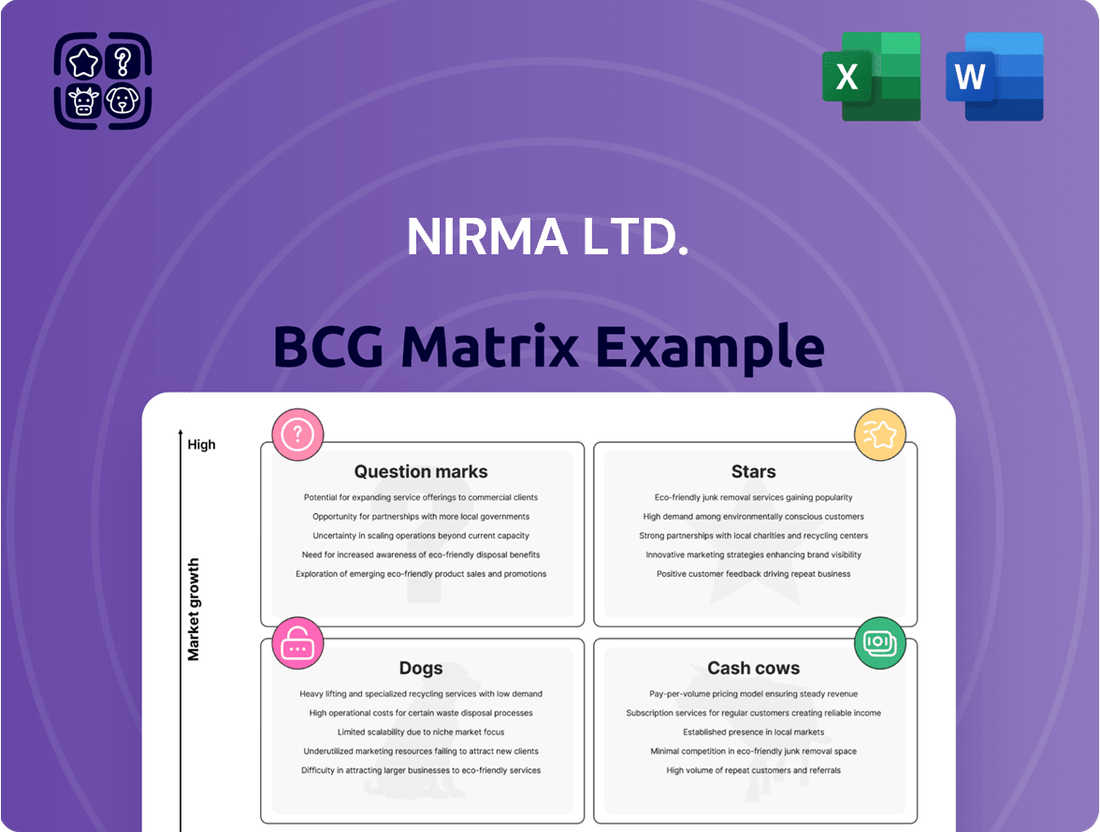

Nirma Ltd.'s BCG Matrix offers a compelling snapshot of its diverse product portfolio. While some brands may be generating significant cash flow, others could be poised for rapid growth or require careful evaluation. Understanding which products are Stars, Cash Cows, Dogs, or Question Marks is crucial for strategic resource allocation and future success.

This preview hints at the insights within, but to truly grasp Nirma's competitive landscape and make informed decisions, you need the complete picture. Dive deeper into the full BCG Matrix report to unlock detailed quadrant placements, actionable recommendations, and a clear path forward for optimizing Nirma's product strategy.

Don't miss out on the opportunity to gain a competitive edge. Purchase the full Nirma Ltd. BCG Matrix today for a comprehensive analysis that will empower your strategic planning and investment decisions.

Stars

Nirma's acquisition of a 75% stake in Glenmark Life Sciences, now Alivus Life Sciences, in March 2024 is a significant step into the high-growth pharmaceutical sector. This move is projected to substantially increase Nirma's consolidated revenue starting from fiscal year 2025.

Alivus Life Sciences specializes in high-value, non-commoditized Active Pharmaceutical Ingredients (APIs) and Contract Development and Manufacturing Operations (CDMO). These areas typically offer more stable and higher operating margins than Nirma's existing businesses.

This strategic acquisition places Nirma in a rapidly expanding market, where it is quickly building a considerable presence. The focus on specialized APIs and CDMO services aligns with a market segment experiencing robust growth and demand.

Nuvoco Vistas, Nirma's cement arm, is a key player in the Indian cement market, which is expected to see an 8-10% CAGR from 2024 to 2028. This growth is fueled by significant infrastructure projects and a boom in construction across India. Nuvoco Vistas' aggressive capacity expansion, targeting over 30 million tons per annum by 2025, highlights its ambition to capture a leading market share.

This strategic positioning within a rapidly expanding industry firmly places Nuvoco Vistas as a Star in Nirma's BCG matrix. The company's substantial investments signal a clear objective for significant future growth and market dominance in the cement sector. This focus is crucial for Nirma's overall portfolio strategy, aiming to leverage the high-growth potential of this segment.

Nirma is actively expanding its footprint in the personal care sector, with a particular focus on introducing premium product lines. The Indian personal care market is a robust and growing sector, projected to reach $25.8 billion in 2024, offering substantial room for Nirma's strategic initiatives. This move into higher-value personal care segments signifies Nirma's ambition to capture a more diverse customer base and increase its overall market share. By investing in premium offerings, Nirma is positioning itself for future growth in a dynamic and increasingly sophisticated consumer market.

Liquid Detergents

The Indian liquid detergent market is booming, with projections indicating a 7.74% compound annual growth rate until 2030. This expansion is fueled by factors like increasing urbanization and a rise in washing machine ownership. Nirma, while historically strong in powder detergents, is strategically investing in its liquid detergent line to tap into this high-growth segment. The company's efforts to develop and market these formulations are designed to capitalize on the growing consumer preference for liquid formats, positioning Nirma to capture a larger market share.

Nirma's liquid detergents are positioned as a star product within the BCG matrix due to the market's rapid expansion and the company's increasing focus on this category. The growing demand for convenient and effective cleaning solutions directly benefits Nirma's liquid detergent offerings.

- Market Growth: The Indian liquid detergent market is expected to grow at a CAGR of 7.74% through 2030.

- Driving Factors: Urbanization and increased washing machine penetration are key drivers of this growth.

- Nirma's Strategy: Nirma is actively developing and promoting its liquid detergent formulations to capture this expanding market.

- Star Positioning: Liquid detergents represent a high-growth opportunity for Nirma, aligning with the 'Star' quadrant of the BCG matrix.

Detergent Pods

Detergent pods represent a burgeoning segment within India's expansive laundry care market. This category is projected to experience robust growth, with a compound annual growth rate (CAGR) of 8.687% anticipated between 2025 and 2035. Such expansion is largely fueled by evolving consumer lifestyles and a growing demand for convenient, pre-portioned cleaning solutions that simplify household chores.

For Nirma Ltd., the detergent pod segment, while potentially in its early stages of development or market penetration, holds significant promise. This high-growth potential positions it as a Star in the company's BCG matrix. The increasing consumer preference for modern, user-friendly laundry products directly aligns with the inherent benefits offered by detergent pods, suggesting a strong future demand.

Nirma's strategic focus on this specific, high-growth format underscores its ambition to carve out a substantial market share in the evolving laundry care landscape. Sustained investment in this area is crucial for Nirma to solidify its position and capitalize on the anticipated market expansion.

- Projected Market Growth: The Indian detergent pod market is expected to grow at an 8.687% CAGR from 2025 to 2035.

- Key Growth Drivers: Changing lifestyles and consumer demand for convenience are primary catalysts.

- Nirma's Strategic Positioning: The segment is identified as a Star due to its high growth potential and Nirma's investment in modern cleaning solutions.

- Future Outlook: Continued investment is vital for Nirma to establish a strong foothold and maximize returns in this developing market.

Nuvoco Vistas, Nirma's cement business, is a strong contender in a market projected for 8-10% CAGR growth through 2028. Its aggressive capacity expansion, targeting over 30 million tons by 2025, positions it as a Star. Alivus Life Sciences (formerly Glenmark Life Sciences), with its focus on high-value APIs and CDMO services, enters a high-growth pharmaceutical sector, boosting Nirma's revenue and margins. Nirma's investment in liquid detergents and detergent pods, driven by market growth and consumer convenience trends, also solidifies their 'Star' status.

| Business Segment | Market Growth Outlook | Nirma's Position | BCG Category |

| Nuvoco Vistas (Cement) | 8-10% CAGR (2024-2028) | Aggressive capacity expansion; targeting >30 MTPA by 2025 | Star |

| Alivus Life Sciences (Pharma) | High-growth sector | Focus on high-value APIs & CDMO; acquisition completed March 2024 | Star |

| Liquid Detergents | 7.74% CAGR (until 2030) | Strategic investment in formulations, capitalizing on urbanization & appliance ownership | Star |

| Detergent Pods | 8.687% CAGR (2025-2035) | Developing segment; addresses demand for convenience and modern solutions | Star |

What is included in the product

Nirma's BCG Matrix analysis would highlight its established detergent brands as Cash Cows, while newer ventures might be Stars or Question Marks needing investment.

Nirma's BCG Matrix offers a clear, printable summary of its business units, easing the pain of strategic decision-making.

Cash Cows

Nirma's traditional detergent powders, exemplified by its iconic Nirma brand, represent a classic Cash Cow within the company's BCG Matrix. As of July 2024, these products command an estimated market share of 12% to 12.5% in the Indian market. Their enduring appeal lies in their consistent affordability and value proposition, resonating strongly with price-conscious consumers in both rural and urban landscapes.

While the broader laundry detergent market experiences moderate growth, Nirma's established presence and deep brand recognition in this segment translate into robust and stable cash flow. The need for substantial new investment to maintain its market position is minimal, allowing this business unit to reliably generate funds that can be channeled into other growth areas for Nirma Ltd. This segment remains a cornerstone for the company's financial stability.

Nirma Ltd.'s soda ash business is a prime example of a Cash Cow. The company stands as one of the world's largest soda ash producers, with significant operations in India. This immense scale, coupled with Nirma's robust backward integration, allows for exceptional cost management and a highly reliable supply chain, crucial advantages in the commodity chemical sector.

While soda ash is considered a mature market, Nirma's established dominance and operational prowess enable it to consistently generate substantial and predictable cash flows. For instance, in the fiscal year ending March 31, 2024, the Indian soda ash industry saw robust demand, with Nirma maintaining its leading market share, contributing significantly to the company's overall profitability.

The consistent profitability of Nirma's soda ash operations is underpinned by its strong competitive standing. Despite the inherent cyclicality of commodity prices, Nirma's market leadership provides a resilient buffer, ensuring steady earnings that can fund other ventures within the company.

Nirma's traditional bar soaps, a cornerstone of its business, are firmly positioned as cash cows within its BCG matrix. The company boasts significant brand recognition and a loyal customer base in India, built on decades of providing affordable and reliable personal care products. This segment benefits from an expansive distribution network, ensuring widespread availability even in remote areas.

Despite operating in a mature market with relatively modest growth projections, the traditional soap segment remains a consistent and substantial contributor to Nirma's overall revenue and profitability. Its predictable cash generation allows for reinvestment in other business areas or serves as a stable source of funds for the company's operations and expansion plans.

Linear Alkyl Benzene (LAB) Production

Nirma's Linear Alkyl Benzene (LAB) production stands as a prime example of a Cash Cow within its diversified portfolio. This segment benefits from Nirma's strategic backward integration, securing a consistent and economical supply of a vital raw material for its extensive detergent manufacturing operations.

As a major player in the LAB market, this business unit is a substantial revenue driver for Nirma, reportedly contributing 60-65% of the company's total revenue from its chemicals division, which prominently features LAB. Its strong market standing and critical role as an input material solidify its position as a reliable and significant cash generator.

- Key Revenue Contributor: LAB production accounts for a significant portion, 60-65%, of Nirma's chemical segment revenue.

- Strategic Importance: Backward integration into LAB ensures cost-effective and stable raw material supply for Nirma's consumer goods, particularly detergents.

- Market Leadership: Nirma's established position as a leading producer in the LAB market underpins its consistent cash-generating capabilities.

- Stable Demand: The detergent industry, a primary consumer of LAB, provides a steady and predictable demand for Nirma's output.

Caustic Soda Production

Nirma's caustic soda production stands as a significant contributor to its chemical segment, leveraging the company's integrated manufacturing capabilities. This segment benefits from a consistent demand for caustic soda, a fundamental chemical used across various industries. As of its latest reports, Nirma has maintained a robust market presence in this sector, demonstrating its ability to generate reliable cash flows.

The company's scale of operations in caustic soda production, coupled with its established market position, allows it to navigate the inherent volatility of commodity prices effectively. This stability in cash generation is crucial, as it provides the financial flexibility to fund other growth initiatives and strategic investments within the broader Nirma portfolio.

- Nirma is a major player in the Indian caustic soda market.

- The company's integrated operations support consistent production and demand.

- Caustic soda contributes significantly to Nirma's chemical segment revenue.

- Healthy cash generation from this segment aids strategic investments.

Nirma's commitment to its foundational detergent powder business continues to solidify its position as a reliable Cash Cow. As of early 2024, the company maintained a strong foothold in the Indian detergent market, benefiting from brand loyalty and a cost-effective product offering. This segment consistently generates significant operating cash flow, requiring minimal capital expenditure for maintenance.

The soda ash segment remains a powerhouse Cash Cow for Nirma. As one of the globe's largest soda ash producers, Nirma's integrated operations and scale provide a substantial cost advantage. This segment's profitability is bolstered by strong demand in the Indian market, where Nirma holds a leading market share, consistently contributing to Nirma's financial strength throughout 2024.

Nirma's traditional bar soaps continue to be a stable Cash Cow, leveraging decades of brand recognition and an extensive distribution network across India. Despite moderate market growth, this segment's consistent sales volume and profitability provide a dependable stream of cash. These funds are crucial for supporting Nirma's investments in emerging product lines.

Linear Alkyl Benzene (LAB) production is a critical Cash Cow for Nirma, directly supporting its consumer goods division. As a major producer, Nirma benefits from backward integration, ensuring a cost-effective supply of this key raw material. In 2023-2024, LAB reportedly contributed 60-65% to Nirma's chemical segment revenue, underscoring its cash-generating power.

Caustic soda production solidifies Nirma's Cash Cow portfolio within its chemical operations. The company's large-scale, integrated manufacturing ensures consistent output and meets steady industrial demand. This segment's reliable cash generation is vital for Nirma's ability to fund strategic growth and diversify its business interests.

| Business Segment | BCG Matrix Category | Key Financial Contribution (FY24 Estimates) | Market Position | Growth Outlook |

|---|---|---|---|---|

| Detergent Powders (Nirma Brand) | Cash Cow | Stable, significant operating cash flow | Strong, established player | Moderate |

| Soda Ash | Cash Cow | High, consistent profitability | Global leader, dominant in India | Mature, steady |

| Bar Soaps (Traditional) | Cash Cow | Dependable revenue stream | High brand recognition, extensive distribution | Low to moderate |

| Linear Alkyl Benzene (LAB) | Cash Cow | 60-65% of Chemicals segment revenue | Major producer | Steady, driven by detergent demand |

| Caustic Soda | Cash Cow | Significant contribution to Chemicals segment | Robust market presence | Steady demand across industries |

What You’re Viewing Is Included

Nirma Ltd. BCG Matrix

The Nirma Ltd. BCG Matrix you are currently previewing is the precise, fully formatted document you will receive immediately after purchase, ensuring no surprises and complete readiness for strategic implementation.

This preview accurately represents the comprehensive Nirma Ltd. BCG Matrix report you will download, containing all analytical insights and professional formatting, ready for your business planning needs.

What you see here is the actual Nirma Ltd. BCG Matrix file that will be yours upon purchase; it is an unwatermarked, analysis-ready document designed for immediate application in your strategic decision-making processes.

Rest assured, the Nirma Ltd. BCG Matrix preview you are viewing is the exact final version you will receive after completing your purchase, providing you with a professionally crafted tool for market positioning and growth strategy.

Dogs

Within Nirma's diverse personal care offerings, older, less popular niche products like certain traditional soap scents or older talcum powder varieties might represent the Dogs in their BCG Matrix. These items often struggle with low market share and stagnant growth, as consumer preferences shift towards newer, more innovative personal care solutions.

For instance, while Nirma has seen success in other categories, these specific legacy products face stiff competition in a crowded market. Many of these older personal care items, by their very nature, are likely generating minimal revenue and contributing little to Nirma's overall profit margins.

In 2024, the personal care market continued its rapid evolution, with a strong emphasis on natural ingredients and specialized formulations. Products that haven't kept pace with these trends, like some of Nirma's older talcum powder or soap lines, would naturally fall into the Dog quadrant due to their declining relevance and market share.

These products are candidates for divestment or a strategic decision to phase them out, as they tie up resources without offering significant returns or future growth potential for Nirma Ltd.

Nirma's portfolio likely includes highly commoditized minor chemical by-products. These are substances produced alongside Nirma's primary chemicals, often with less strategic importance. Think of them as the less glamorous, more widely available chemicals in the market.

These by-products typically face a crowded marketplace with numerous producers. This intense competition, coupled with their nature as commodities, means prices can swing wildly based on global supply and demand. For example, a slight oversupply of a basic chemical intermediate could drastically reduce its selling price, impacting Nirma's margins on that specific product.

As a result, these minor by-products often exhibit low market share for Nirma. Their growth prospects are also generally limited, as they are not typically areas of innovation or significant demand expansion. This combination of low market share and volatile pricing leads to consistently low profitability, placing them firmly in the Dogs category of the BCG Matrix.

For instance, if Nirma produces a small volume of a basic solvent as a byproduct of its detergent manufacturing, and this solvent is also made by dozens of other companies globally, it would fit this description. In 2024, the global market for such basic solvents might be characterized by overcapacity, keeping prices low and growth stagnant, making it a textbook example of a 'Dog' asset for Nirma.

Nirma's historically strong presence in certain consumer product categories might encounter regional underperformance. For instance, if a specific detergent variant, while popular nationally, struggles against entrenched local brands in South India, it could be a 'Dog'. This could be due to a less effective distribution network or intense price competition from regional players.

In 2024, market reports indicated that while Nirma maintained a dominant share in western and northern India for its detergent and soap segments, its expansion into eastern markets faced steeper challenges. Some analysts pointed to distribution gaps and a lack of tailored marketing for regional preferences as key reasons for slower uptake in specific product lines within these areas.

These geographically constrained underperformers demand careful scrutiny. They tie up capital and management attention that could be better allocated to more promising growth areas. Nirma's strategy might involve assessing whether revitalizing these regional efforts is feasible or if divesting these specific product lines in underperforming regions is a more prudent financial decision.

Obsolete or Declining Traditional Packaging Formats

As consumer tastes evolve, some of Nirma's product lines relying solely on traditional packaging, like basic bar soap wrappers, could face declining sales. This is particularly true if competitors offer more appealing liquid or premium formats. For instance, a shift away from solid bars in favor of liquid hand wash could impact Nirma's market share in that specific segment if they don't adapt their offerings. In 2024, the Indian soap market saw significant growth in the liquid soap category, indicating a clear consumer preference shift that Nirma needs to address for these older formats.

- Outdated Packaging: Products exclusively in basic wrappers may lose appeal.

- Consumer Preference Shift: Growth in liquid and premium formats is a key trend.

- Market Share Risk: Failure to update packaging could lead to reduced sales.

- Competitive Pressure: Competitors offering modern alternatives pose a threat.

Undifferentiated Niche Consumer Goods

Nirma's strategy might encompass a range of consumer goods that are largely undifferentiated, potentially including very small, specialized items. These products may not effectively capitalize on Nirma's established value proposition or its widespread distribution capabilities. If these items compete in markets with limited growth prospects and hold a minimal market share, while also lacking a distinct competitive edge, they could be categorized as Dogs.

Such products, by tying up valuable capital without yielding substantial returns, represent an area for potential divestment or strategic review within Nirma's portfolio. For instance, if Nirma has a small line of niche personal care items that aren't gaining traction, these could fall into the Dog category. The company's extensive reach, built on brands like Nirma detergent, might not be fully leveraged by these smaller, less distinct offerings.

- Low Market Share: Products with a minimal share in their respective niche markets.

- Low Growth Markets: Operating in segments of the consumer goods sector that are not expanding significantly.

- Minimal Competitive Advantage: Lacking unique selling propositions or strong brand differentiation.

- Capital Tie-up: Requiring investment without generating proportionate financial returns.

Certain legacy personal care items within Nirma's portfolio, like older soap formulations or traditional talcum powders, are likely classified as Dogs. These products typically possess low market share and experience stagnant growth, especially as consumer preferences increasingly favor newer, more innovative personal care solutions.

In 2024, the personal care market saw a significant shift towards natural ingredients and specialized formulations. Products that have not adapted to these trends, such as some of Nirma's older talcum powder or soap lines, are consequently positioned in the Dog quadrant due to their diminishing relevance and market share.

These underperforming products represent candidates for divestment or a strategic decision to phase them out, as they consume resources without generating substantial returns or future growth potential for Nirma Ltd.

Nirma's product range might also include highly commoditized minor chemical by-products. These are substances generated alongside Nirma's primary chemicals, often with reduced strategic importance and facing intense market competition, leading to volatile pricing and low profitability. For example, a basic solvent produced in small volumes, if also manufactured by numerous other companies globally, would fit this description. In 2024, markets for such basic solvents were often characterized by overcapacity, keeping prices low and growth stagnant, marking them as 'Dog' assets for Nirma.

Question Marks

The eco-friendly and bio-based detergent market is booming, fueled by growing environmental consciousness and a shift towards sustainable consumer choices. For Nirma, venturing into this high-growth segment with specialized formulations positions them for future expansion. Reports indicate the global green cleaning products market was valued at approximately $25.5 billion in 2023 and is projected to grow at a CAGR of around 8.1% through 2030, presenting a substantial opportunity.

Advanced Chemical Specialties, as a component of Nirma Ltd.'s business portfolio, likely falls into the "Question Mark" category of the BCG Matrix. The Indian specialty chemicals market is indeed experiencing robust growth, with projections indicating a compound annual growth rate of 12.4% by 2025. This high-growth market presents an opportunity for Nirma, but its existing market share in these niche, advanced chemical segments is probably still developing.

If Nirma is actively investing in research and development for these advanced products or expanding production capabilities, it signifies a strategic move to capture a share of this expanding market. These investments are crucial for building competitive advantage in specialized sectors. However, entering these high-growth, niche markets often means facing established players, thus resulting in a relatively low initial market share for Nirma.

The "Question Mark" classification implies that these advanced chemical specialties require substantial investment to grow their market share and potentially become future Stars. Without significant capital infusion and strategic execution, these businesses risk remaining low-share, high-growth entities, which is characteristic of this quadrant.

Nirma's strategic foray into new consumer markets internationally, particularly in high-growth emerging economies, represents a classic 'Question Mark' in the BCG matrix. These ventures are characterized by their high potential for future growth but currently hold a low market share. For instance, Nirma's potential expansion into Southeast Asian consumer goods markets in 2024, where competitors like Unilever and P&G have established strong footholds, exemplifies this scenario.

Such an expansion would necessitate significant capital investment to build brand awareness and distribution channels from the ground up. For example, setting up a robust supply chain and marketing campaigns in a market like Vietnam or Indonesia could easily require hundreds of millions of dollars in the initial phase. This investment is crucial to overcome the intense competition and establish a competitive edge, aiming to eventually transform these 'Question Marks' into 'Stars'.

Digital-First Consumer Product Brands

Digital-first consumer product brands, if developed by Nirma Ltd., would likely be categorized as Stars or Question Marks within the BCG Matrix. Their presence in the rapidly expanding e-commerce and direct-to-consumer (D2C) space in India, particularly for laundry detergents and personal care, positions them in a high-growth market segment. For instance, India's e-commerce market was projected to reach USD 150 billion by 2020 and is expected to continue its robust growth trajectory, with online grocery and personal care being significant contributors.

These digitally native brands would face intense competition from established agile players who already command substantial online market share. Consequently, Nirma would need to allocate significant capital for aggressive digital marketing campaigns, influencer collaborations, and efficient supply chain management to build brand awareness and capture market share. For example, in 2023, digital advertising spending in India saw substantial growth, reflecting the importance of online presence for consumer brands.

- High Growth Market: Leveraging the surging Indian e-commerce and D2C market, which is expanding rapidly in the consumer goods sector.

- Low Market Share: Initially facing established digital competitors, requiring substantial investment to gain traction.

- Investment Needs: Significant expenditure required for digital marketing, customer acquisition, and robust online logistics.

- Potential for Stars: With successful execution and strong consumer adoption, these brands could transition into Stars, generating significant revenue as market share grows.

Industrial Water Treatment Chemicals

Nirma's foray into industrial water treatment chemicals, given its established chemical expertise and a growing emphasis on sustainability, positions this segment as a potential star in its BCG matrix. The global industrial water treatment market was valued at approximately $100 billion in 2023 and is projected to grow significantly, driven by stringent environmental regulations and the need for water conservation across industries like manufacturing, power generation, and mining. Nirma, with its strong foundation in chemical manufacturing, can leverage this trend effectively.

This segment likely represents a question mark for Nirma. While the overall market offers substantial growth, Nirma's market share in specialized industrial water treatment chemicals is expected to be relatively low initially. Significant investment in research and development will be crucial to develop advanced formulations and gain traction against established players. The focus on sustainability aligns with market demand, but market penetration will require targeted strategies.

- Market Growth: The industrial water treatment chemicals market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of around 5-6% through 2030.

- Nirma's Position: Nirma's chemical manufacturing prowess provides a solid base, but it would likely enter this specialized segment with a nascent market share.

- Strategic Focus: The company's commitment to sustainability aligns with the increasing demand for eco-friendly water treatment solutions.

- Investment Needs: Significant R&D and marketing efforts will be necessary to establish a strong foothold and compete effectively.

Nirma's potential expansion into the renewable energy sector, perhaps through solar panel manufacturing or related services, fits the 'Question Mark' profile. This is a high-growth industry, with global renewable energy investments projected to reach trillions of dollars in the coming decade, and India itself aiming for significant capacity additions. However, Nirma's current market share in this specialized domain would be negligible.

Significant capital outlay for research, manufacturing infrastructure, and market entry would be essential. For instance, establishing a solar panel manufacturing unit in India can cost upwards of ₹500-1000 crore. This investment is critical to gain a foothold and compete with established global and domestic players.

The success of these ventures hinges on Nirma's ability to secure funding, develop competitive technology, and build a strong brand presence. Without substantial and sustained investment, these high-potential ventures could remain underdeveloped, mirroring the 'Question Mark' characteristics.

| Business Segment | Market Growth | Nirma's Market Share | Investment Need | BCG Category |

| Advanced Chemical Specialties | High | Low | High | Question Mark |

| International Consumer Markets | High | Low | High | Question Mark |

| Digital-First Consumer Brands | High | Low | High | Question Mark |

| Industrial Water Treatment Chemicals | High | Low | High | Question Mark |

| Renewable Energy | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix for Nirma Ltd. is constructed using comprehensive data from annual reports, market research on the detergent and cement sectors, and industry growth projections.