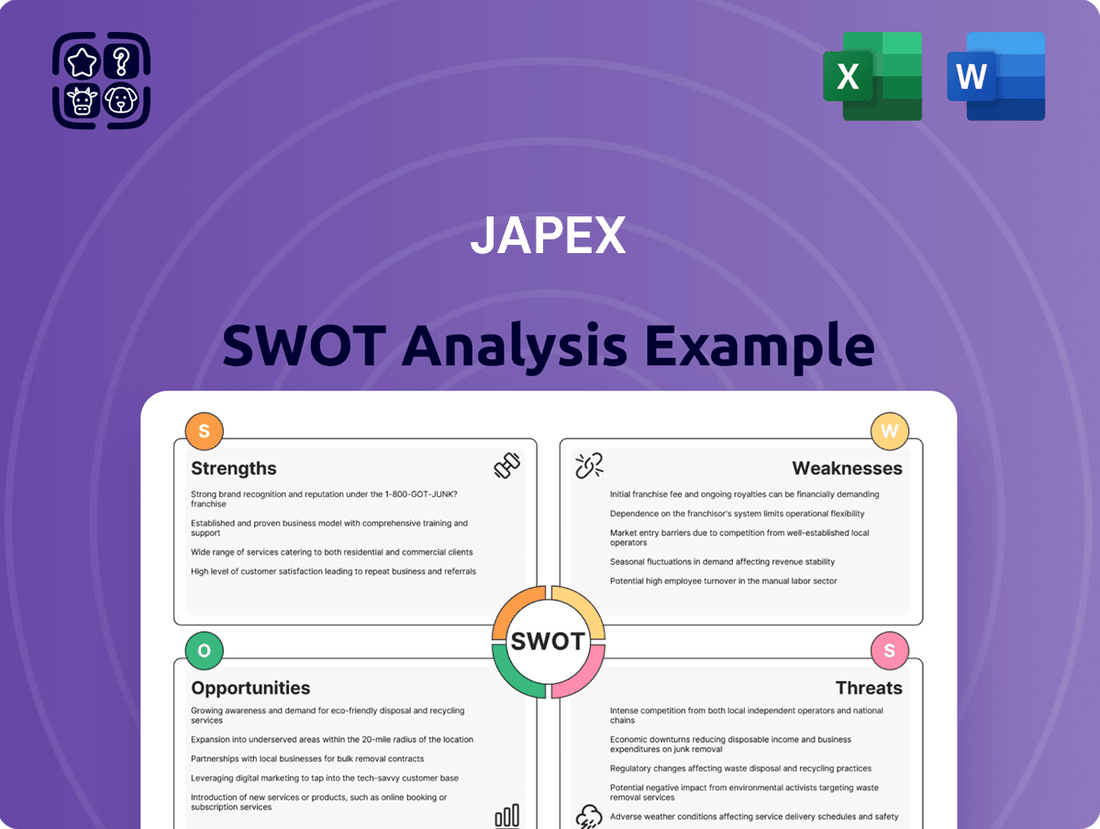

Japex SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Japex Bundle

Japex's strengths lie in its established market presence and technological expertise in the oil and gas sector. However, the company faces significant opportunities in emerging markets and renewable energy integration, alongside threats from fluctuating global energy prices and increasing environmental regulations.

Want the full story behind Japex's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

JAPEX's integrated operations span the entire energy value chain, from finding oil and gas to getting it to consumers. This end-to-end control allows for better efficiency and cost savings throughout its business. For example, in fiscal year 2024, JAPEX reported a consolidated operating revenue of ¥206.4 billion, demonstrating the scale of its integrated activities.

This comprehensive integration, covering exploration, development, production, transportation, storage, and refining, gives JAPEX a significant advantage. It allows for optimized resource management and a more streamlined approach to bringing energy to market. Their robust domestic natural gas supply infrastructure, built over years, serves as a strong operational base.

JAPEX is strategically broadening its energy offerings beyond traditional oil and gas. This includes significant investments in renewable energy, such as a grid-scale battery project in Chiba, which began construction in 2023, and ongoing collaborations for solar power facilities. This diversification is key to building a more stable financial foundation.

JAPEX demonstrated robust financial performance for the fiscal year ending March 31, 2025, with net sales and profit attributable to owners of parent showing significant increases. This healthy financial standing translates into a strong capital base, empowering the company to fund its ongoing exploration and production (E&P) operations.

The company's profitability is crucial for sustaining its growth trajectory and delivering value to shareholders. This financial strength also enables strategic investments in new energy ventures, positioning JAPEX for future expansion and diversification in the evolving energy landscape.

Extensive E&P Expertise and Experience

JAPEX boasts deep-seated expertise and robust technical skills in oil and natural gas exploration and production (E&P). This extensive experience, honed over many years in both Japanese and global operations, allows the company to tackle challenging projects and efficiently extract resources. For instance, as of the first half of fiscal year 2024, JAPEX's E&P segment contributed significantly to its overall revenue, demonstrating the ongoing value of its core competencies.

This E&P prowess is a key strength, empowering JAPEX to strategically expand into new and promising exploration areas. The company’s successful track record in managing complex E&P ventures, including those in challenging geological environments, reinforces its reputation and competitive edge.

- Decades of operational history in diverse E&P environments.

- Proven technical capabilities in resource assessment and extraction.

- Strategic advantage in pursuing new exploration and development opportunities.

Strategic International Expansion

Japex's strategic international expansion is a significant strength, with a clear focus on growing its oil and gas exploration and production (E&P) investments. The company is actively pursuing opportunities in key markets like the United States and Norway, with a strategic outlook extending to 2030. This geographical diversification is crucial for mitigating risks associated with reliance on a single market and for accessing regions with supportive energy policies.

By investing in the US and Norway, Japex aims to capitalize on favorable market conditions and secure new revenue streams. For instance, Norway's established offshore expertise and stable regulatory environment present attractive prospects for E&P ventures. Similarly, the United States offers diverse geological plays and a robust energy infrastructure, providing ample room for growth and profit generation from new projects.

This international push not only broadens Japex's asset portfolio but also positions the company to benefit from varying energy market dynamics. The strategic allocation of capital towards these regions underscores a commitment to long-term sustainability and profitability. Japex's proactive approach in expanding its global E&P footprint is a key driver of its competitive advantage.

- Focus on US and Norway: Japex is strategically increasing E&P investments in these regions through 2030.

- Asset Diversification: International expansion reduces reliance on any single market, enhancing stability.

- Favorable Policies: Leveraging supportive energy policies in the US and Norway to secure profitable projects.

- Long-Term Growth: Aiming for sustainable profits through new international E&P ventures.

JAPEX's integrated operations, from exploration to delivery, create significant cost efficiencies and operational control. This end-to-end model was reflected in their fiscal year 2024 consolidated operating revenue of ¥206.4 billion. Their established domestic natural gas infrastructure provides a strong, reliable foundation for these integrated activities.

The company's deep technical expertise in oil and gas exploration and production (E&P) is a core strength, enabling them to manage complex projects. This skill set is vital for expanding into new exploration areas and was evident in the E&P segment's significant contribution to revenue in the first half of fiscal year 2024.

JAPEX's strategic international expansion, particularly in the US and Norway through 2030, diversifies its asset base and mitigates market-specific risks. This global presence allows them to capitalize on favorable energy policies and varied market conditions, securing new revenue streams and long-term growth.

| Strength | Description | Supporting Data/Context |

| Integrated Operations | End-to-end control across the energy value chain enhances efficiency and cost savings. | FY2024 consolidated operating revenue: ¥206.4 billion. |

| Technical Expertise in E&P | Proven capabilities in oil and gas exploration and production, enabling complex project management and expansion into new areas. | E&P segment's significant revenue contribution in H1 FY2024. |

| International Expansion | Strategic focus on E&P investments in the US and Norway through 2030 diversifies assets and leverages favorable policies. | Active pursuit of opportunities in key international markets. |

| Financial Strength | Robust profitability and a strong capital base support ongoing operations and strategic investments in new energy ventures. | Significant increases in net sales and profit attributable to owners of parent in FY ending March 31, 2025. |

What is included in the product

Analyzes Japex’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address core business challenges.

Weaknesses

JAPEX faces a significant weakness in its substantial dependence on fossil fuels. Despite diversification initiatives, its oil and gas exploration and production segments are anticipated to remain the primary revenue generators, accounting for an estimated 70-80% of earnings through 2030. This deep reliance places the company at considerable risk as the world navigates the energy transition and prioritizes decarbonization. A swift global move away from fossil fuels could fundamentally challenge JAPEX's established business model and revenue streams.

As a significant producer of oil and natural gas, JAPEX faces considerable risk from the unpredictable swings in global commodity prices. For instance, Brent crude oil prices, a key benchmark, have seen significant volatility, trading around $80 per barrel in early 2024, a stark contrast to lows seen in prior years. This price instability directly affects JAPEX's revenue streams and the profitability of its exploration and production activities.

The inherent volatility in oil and gas markets makes accurate financial forecasting and long-term strategic planning a complex undertaking for JAPEX. Fluctuations can quickly alter the economic feasibility of new projects and impact existing operations, creating uncertainty in revenue projections. For example, a sharp decline in oil prices could reduce JAPEX's earnings per share, as seen when prices dropped significantly in 2020.

Japex's strategic push to increase oil and gas investments, notably through acquisitions and expansion in the United States and Norway, demands significant capital outlay. For instance, the company's investment in the US shale sector, while promising, necessitates substantial upfront costs for exploration and production.

Managing these large-scale projects, including the potential acquisition of tight oil operators, requires rigorous financial oversight and presents inherent risks in project execution. The company's historical performance, marked by past losses on substantial investments, underscores the need for a prudent strategy in capping project expenditures to safeguard financial health.

Challenges in Renewable Energy Profitability

JAPEX has openly discussed challenges in achieving satisfactory returns from specific renewable energy projects, notably offshore wind, largely driven by escalating costs. This suggests that their renewable energy ventures might not yet match the profitability of their established fossil fuel business, potentially impacting the speed of their transition to cleaner energy sources. The company will likely need to adapt its investment approaches within the renewable sector.

For instance, by mid-2024, the global offshore wind sector has seen project cost increases averaging 20-30% compared to initial estimates, impacting project economics for many developers, including those like JAPEX. This financial pressure necessitates a strategic re-evaluation of how these projects are financed and executed to ensure viability.

- Rising Offshore Wind Costs: JAPEX acknowledges difficulty in securing fair returns due to increasing offshore wind project expenses, a trend seen across the industry with cost hikes averaging 20-30% by mid-2024.

- Profitability Gap: The profitability of JAPEX's renewable energy portfolio may lag behind its fossil fuel operations, potentially slowing the pace of its energy transition strategy.

- Strategic Refinement Needed: The company is likely to require adjustments to its investment strategies within the renewable energy segment to overcome these profitability hurdles.

Environmental and Regulatory Pressures

Japex, as a significant player in the oil and gas sector, is under increasing pressure from environmental concerns and stricter regulations designed to curb carbon emissions. These mandates require substantial and continuous capital allocation towards environmental safeguards, regulatory adherence, and the research and development of carbon-neutral solutions. This can translate into higher operational expenses and a more complex operating environment for the company.

These pressures are not abstract; they have tangible financial implications. For instance, in 2024, global energy companies are collectively facing billions in potential fines and compliance costs related to emissions targets. Japex's own sustainability reports will likely detail specific investments in this area, potentially impacting its profitability and requiring strategic adjustments to its business model to align with a lower-carbon future. The company's ability to navigate these evolving regulatory landscapes will be crucial for its long-term viability.

- Regulatory Hurdles: Evolving climate policies and emissions standards worldwide present ongoing challenges.

- Compliance Costs: Significant investment is required for environmental protection measures and adherence to new regulations.

- Carbon Neutrality Investment: Developing and implementing carbon-neutral technologies demands substantial R&D funding.

- Operational Complexity: Increased environmental scrutiny adds layers of complexity to operational planning and execution.

JAPEX's considerable reliance on fossil fuels, projected to account for 70-80% of earnings through 2030, poses a significant weakness as the global energy transition accelerates. This dependence makes the company vulnerable to shifts away from hydrocarbons.

The company's profitability is susceptible to the volatile nature of oil and gas prices. For example, Brent crude prices fluctuated around $80 per barrel in early 2024, showcasing the inherent instability impacting JAPEX's revenue.

JAPEX faces challenges in achieving satisfactory returns from renewable energy projects, particularly offshore wind, due to escalating costs. Industry-wide, offshore wind project expenses saw increases of 20-30% by mid-2024, impacting the economic viability of these ventures for developers like JAPEX.

The company's significant capital investments in oil and gas expansion, such as in the US shale sector, carry inherent execution risks, especially given past instances of losses on substantial investments.

Preview Before You Purchase

Japex SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

Opportunities

The world's appetite for energy continues to grow, and natural gas is a key player in this landscape, often serving as a crucial bridge fuel during the ongoing energy transition. This persistent demand is a clear opportunity for JAPEX's foundational exploration and production (E&P) activities.

By strategically broadening its operational footprint into promising new territories, such as the United States and Norway, JAPEX is well-positioned to meet this escalating global energy need. These expansions allow the company to tap into diverse resource bases and secure vital, long-term supply contracts.

These agreements provide a stable market for JAPEX's primary outputs, offering a degree of certainty as the global energy landscape continues to evolve. For instance, global primary energy consumption is projected to increase by nearly 50% between 2020 and 2050, with natural gas playing a significant role in meeting this demand.

JAPEX's strategic investments in geothermal power generation, solar projects, and battery storage present a significant opportunity for growth in the rapidly expanding renewable energy market. This diversification allows the company to tap into new revenue streams, reducing reliance on traditional fossil fuels.

The company's commitment is evident in projects like the Chofu Biomass Power Plant and the Mihama Power Storage Station. These initiatives not only bolster JAPEX's renewable portfolio but also position it to play a crucial role in Japan's decarbonization efforts, aligning with global environmental goals.

By actively developing and commissioning these renewable energy assets, JAPEX is building a foundation for sustainable long-term expansion. This strategic move anticipates future market demands and regulatory shifts favoring cleaner energy sources, a trend expected to accelerate through 2025 and beyond.

JAPEX's engagement in carbon capture and storage (CCS) pilot projects and feasibility studies represents a significant opportunity to pioneer and commercialize vital technologies for a carbon-neutral future. This positions them to contribute directly to global emission reduction goals.

As the world increasingly prioritizes decarbonization, JAPEX's growing expertise in CCS can transform into a lucrative business avenue, enabling them to provide essential solutions for lessening the environmental footprint of energy operations.

For instance, advancements in CCS technology are crucial for industries like oil and gas, where JAPEX operates. The International Energy Agency (IEA) reported in 2024 that CCS could account for 13% of the cumulative emissions reductions needed by 2070 to meet net-zero targets, highlighting the market potential.

Strategic Partnerships and Acquisitions

JAPEX's strategic pursuit of acquisitions, particularly targeting US tight oil operators, presents a significant growth opportunity. This focus aligns with the increasing demand for unconventional oil resources and allows JAPEX to gain access to proven reserves and established infrastructure. For instance, the company's ongoing expansion of existing projects in Norway further solidifies its position in mature yet profitable markets, potentially yielding substantial profit generation through enhanced recovery techniques and optimized production.

Collaborations are another key avenue for JAPEX's strategic expansion. The partnership with IINO Kaiun Kaisha, Ltd. for a solar power plant exemplifies this approach, enabling JAPEX to tap into renewable energy markets and leverage specialized knowledge. Such alliances not only diversify JAPEX's energy portfolio but also provide access to new customer segments and revenue streams, reducing reliance on traditional hydrocarbon operations and fostering innovation.

- Acquisitions in US Tight Oil: JAPEX's strategic interest in acquiring US tight oil operators offers access to abundant reserves and advanced extraction technologies, crucial for meeting global energy demands.

- Norway Project Expansion: Continued investment in and expansion of existing projects in Norway capitalizes on established infrastructure and expertise, aiming for increased production and profitability.

- Solar Power Partnership: Collaboration on solar power plants with companies like IINO Kaiun Kaisha, Ltd. diversifies JAPEX's energy mix and opens doors to the growing renewable energy sector.

Leveraging Digital Transformation (DX)

JAPEX's commitment to digital transformation presents a significant opportunity to modernize its operations. By establishing a robust digital infrastructure and implementing Business Process Re-engineering (BPR), the company can unlock substantial gains in efficiency and productivity. This strategic focus is expected to improve data utilization, leading to more informed decision-making across all business segments.

The ongoing digital initiatives aim to streamline workflows and enhance operational performance. For instance, advancements in data analytics can provide deeper insights into market trends and resource allocation. JAPEX's investment in DX is a proactive step towards a more agile and competitive future, particularly relevant as the global energy sector increasingly relies on technological advancements.

- Digital Infrastructure Development: JAPEX is actively building a foundation for digital operations, aiming to integrate disparate systems and improve data flow.

- Business Process Re-engineering (BPR): The company is redesigning its core processes to eliminate inefficiencies and boost overall productivity.

- Enhanced Data Utilization: DX enables better collection, analysis, and application of data for strategic planning and operational adjustments.

- Productivity Gains: By automating tasks and optimizing workflows, JAPEX anticipates significant improvements in employee and operational output.

JAPEX is strategically positioned to capitalize on the growing global demand for natural gas, a key energy transition fuel. Expanding its exploration and production into new territories like the United States and Norway, coupled with securing long-term supply contracts, provides a stable revenue base. The company's diversification into geothermal, solar, and battery storage projects, such as the Chofu Biomass Power Plant, aligns with decarbonization goals and taps into new growth markets. Furthermore, JAPEX's involvement in carbon capture and storage (CCS) pilot projects offers a pathway to commercialize emission-reduction technologies, addressing the increasing global focus on sustainability.

The company's proactive approach to digital transformation, including investments in digital infrastructure and Business Process Re-engineering (BPR), is set to enhance operational efficiency and data-driven decision-making. These advancements are crucial for maintaining competitiveness in an increasingly technology-reliant energy sector.

Threats

JAPEX faces significant risks from volatile global energy markets. Fluctuations in crude oil and natural gas prices directly impact revenue and profitability. For example, Brent crude oil prices, a global benchmark, experienced considerable swings throughout 2024, averaging around $83 per barrel but with significant intra-year volatility, impacting exploration and production economics.

Unpredictable market conditions, often driven by geopolitical events and supply-demand imbalances, create financial instability. This unpredictability makes long-term investment planning challenging for JAPEX, as project viability can shift rapidly based on energy price forecasts. The ongoing geopolitical tensions in key oil-producing regions continue to exert upward pressure on prices, creating a challenging operating environment.

The global push for decarbonization presents a significant long-term threat to JAPEX, given its reliance on fossil fuels. As countries intensify efforts to combat climate change, policies are tightening, which could reduce the demand for oil and gas. For instance, by 2023, over 130 countries had pledged to achieve net-zero emissions by mid-century, a trend accelerating the shift away from hydrocarbons and potentially impacting JAPEX's asset valuations and future earnings.

Stricter environmental regulations and the potential for widespread carbon pricing mechanisms directly challenge the profitability of JAPEX's core business. If the transition to renewable energy sources accelerates more rapidly than anticipated, it could lead to a substantial decline in the market for traditional oil and gas products. This scenario, underscored by increasing global investment in renewables, which reached $1.7 trillion in 2023 according to the International Energy Agency, directly threatens JAPEX's established revenue streams.

JAPEX faces significant pressure from a dual threat: established global oil and gas giants and aggressive renewable energy developers. This intense rivalry impacts profit margins and makes acquiring new exploration rights increasingly difficult. For instance, in 2023, global oil majors continued to invest heavily in both traditional and new energy sources, outbidding smaller players for prime exploration blocks.

The rapid growth of renewable energy companies, supported by favorable government policies and technological advancements, presents another formidable challenge. These competitors often have lower operational costs and benefit from a growing demand for green energy solutions, directly impacting JAPEX's market share in emerging energy sectors.

Geopolitical Instability and Supply Chain Risks

JAPEX's global footprint means it's vulnerable to geopolitical shifts, like political unrest in nations where it operates or trade disagreements between countries. These situations can directly impact its ability to conduct business smoothly and affordably.

For instance, the ongoing conflict in Ukraine has shown how rapidly geopolitical events can cause energy price volatility and jeopardize supply security. This directly affects companies like JAPEX, impacting their operational stability and financial performance.

Supply chain disruptions, often exacerbated by geopolitical tensions, pose a significant threat. This can lead to delays in equipment delivery, increased transportation costs, and difficulties in securing necessary resources for JAPEX's projects.

- Geopolitical Vulnerability: JAPEX's international operations are subject to political instability and trade disputes in host countries.

- Supply Chain Disruptions: Global events can interrupt the flow of essential materials and equipment, increasing costs and causing project delays.

- Energy Price Volatility: Conflicts and geopolitical tensions directly influence global energy markets, impacting JAPEX's revenue and operational expenses.

- Operational Continuity: Threats to supply chains and political instability can hinder JAPEX's ability to maintain consistent operations and achieve its production targets.

Technological Disruption and Obsolescence

The energy sector is experiencing rapid technological shifts, especially in renewables and energy storage. This pace threatens the relevance of JAPEX's existing oil and gas infrastructure, risking obsolescence. For instance, the International Energy Agency reported in early 2024 that global renewable energy capacity additions are expected to surge by nearly 50% in 2024 compared to 2023, highlighting the accelerating transition. JAPEX needs substantial R&D investment to keep pace and avoid being overshadowed by nimbler, tech-focused rivals.

The continued advancements in battery technology and hydrogen fuel cells, for example, could diminish demand for traditional fossil fuels. JAPEX's substantial investments in exploration and production assets might face devaluation as cleaner alternatives become more cost-effective and widely adopted. By mid-2024, several major automakers have announced aggressive targets for phasing out internal combustion engines, signaling a significant shift in the automotive sector and, by extension, fuel demand.

Failure to adapt to emerging technologies, such as carbon capture utilization and storage (CCUS) or advanced biofuels, could leave JAPEX with stranded assets. The company's ability to pivot towards these new energy frontiers will be critical for its long-term viability. Reports in late 2023 indicated significant growth in venture capital funding for cleantech startups, demonstrating where innovation is rapidly progressing.

JAPEX faces a competitive disadvantage if it cannot match the innovation speed of competitors who are more aggressively integrating digital technologies and sustainable practices. This threat necessitates a strategic re-evaluation of its asset portfolio and a proactive approach to embracing technological evolution. The global energy market's trajectory, as analyzed by various financial institutions in early 2025, points towards increasing pressure on legacy fossil fuel operations.

JAPEX faces significant threats from market volatility and geopolitical instability, impacting revenue and investment planning. The global push for decarbonization and stricter environmental regulations pose long-term challenges to its fossil fuel-dependent business model, potentially devaluing assets as renewable energy gains traction. Additionally, rapid technological shifts in energy storage and alternative fuels risk making existing infrastructure obsolete, requiring substantial R&D investment to maintain competitiveness.

| Threat Category | Specific Threat | Impact on JAPEX | Relevant Data/Context (2024/2025) |

|---|---|---|---|

| Market & Geopolitical | Energy Price Volatility | Fluctuating revenue and profitability | Brent crude averaged ~$83/barrel in 2024, with significant intra-year swings. Geopolitical tensions continue to influence prices. |

| Market & Geopolitical | Geopolitical Instability | Operational disruption, supply chain issues | Ongoing conflicts impact energy security and price stability. Supply chain disruptions increase costs and cause delays. |

| Regulatory & Environmental | Decarbonization Push | Reduced demand for fossil fuels, asset devaluation | Over 130 countries pledged net-zero by mid-century (as of 2023). Global renewable investment reached $1.7 trillion in 2023. |

| Regulatory & Environmental | Stricter Environmental Regulations | Challenges to core business profitability | Increasing global investment in renewables directly threatens traditional revenue streams. |

| Competition & Technology | Technological Shifts (Renewables) | Risk of infrastructure obsolescence | Global renewable capacity additions expected to surge by ~50% in 2024 vs 2023. Advancements in battery and hydrogen tech. |

| Competition & Technology | Competitor Innovation | Loss of market share, need for adaptation | Cleantech startups saw significant VC funding growth in late 2023. Automakers are phasing out internal combustion engines. |

SWOT Analysis Data Sources

This Japex SWOT analysis is built upon a robust foundation of readily available public information. It draws from the company's official financial reports, industry-specific market analyses, and widely recognized energy sector publications to ensure a comprehensive and accurate assessment.