Japex Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Japex Bundle

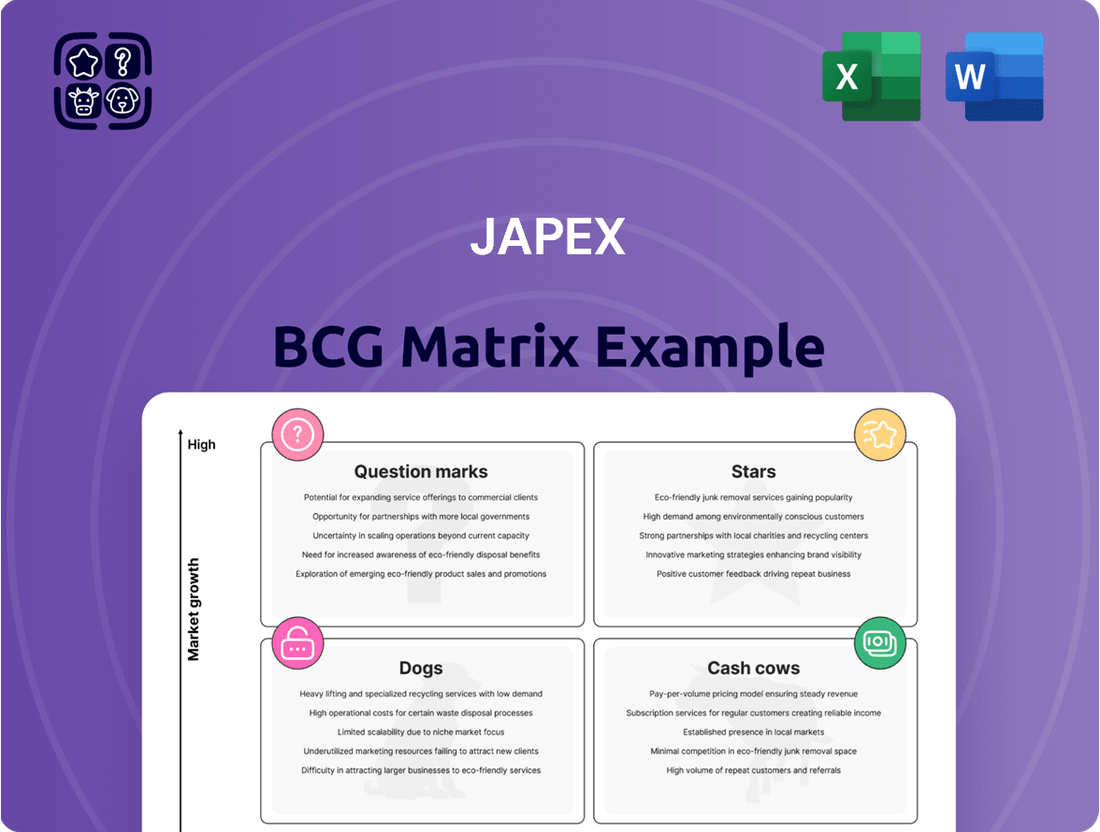

Uncover the strategic potential of this company's product portfolio with a glimpse into its Japex BCG Matrix. See how its offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, providing a foundational understanding of their market position. This preview highlights key areas but only scratches the surface of actionable insights. Purchase the full BCG Matrix to gain a comprehensive breakdown, including precise quadrant placements and data-driven recommendations for optimizing your investment and product development strategies.

Stars

JAPEX is targeting significant expansion in the US tight oil sector, viewing it as a high-growth opportunity. The company is actively seeking to acquire a tight oil operator business in the United States, aiming to establish a strong market presence through substantial capital investment. This move is part of JAPEX's strategy to build a robust investment structure for long-term profitability in this dynamic market.

The company anticipates finalizing such an acquisition in either 2025 or 2026, underscoring a strong conviction in the future financial contributions from US tight oil assets. This timeline reflects a deliberate approach to securing promising opportunities within a sector that has seen considerable technological advancements and production increases in recent years.

The full acquisition of Longboat JAPEX Norge AS, now JAPEX Norge AS, signals a significant strategic push to bolster exploration and production activities in Norway. This move is designed to elevate JAPEX's profitability through enhanced output from current ventures and the commencement of new exploration efforts.

Norway represents a crucial, high-growth territory in the global Exploration & Production (E&P) sector. By investing here, JAPEX aims to capture a larger market share and drive greater returns from its Norwegian assets.

In 2023, Norway's offshore oil and gas production reached approximately 4.1 million barrels of oil equivalent per day, underscoring the region's substantial output capacity and JAPEX's strategic focus on this key market.

JAPEX is a key player in Japan's Tomakomai Carbon Capture and Storage (CCS) project, targeting an impressive 1.5 to 2 million tons of CO2 storage annually by 2030. This strategic involvement positions JAPEX at the vanguard of the burgeoning decarbonization sector, a market poised for significant expansion.

Their leadership in the engineering design and site assessment phases of the Tomakomai project is crucial for solidifying JAPEX's market position. This commitment underscores their ambition to become a dominant force in providing this essential new energy solution.

Increased Stake in Freeport LNG

JAPEX strategically boosted its involvement in the Freeport LNG project in the United States by acquiring a 15% stake from JERA. This acquisition reflects a significant direct investment in a key global liquefied natural gas export facility. The move underscores JAPEX's commitment to capturing a greater share of the expanding international energy trade. This increased participation solidifies their standing within the competitive global LNG market.

- Strategic Expansion JAPEX's acquisition of a 15% stake in Freeport LNG from JERA marks a pivotal step in its global energy strategy.

- LNG Market Focus This investment directly targets the growing demand for Liquefied Natural Gas (LNG) exports, positioning JAPEX for future growth.

- Strengthened Global Position The increased participation enhances JAPEX's competitive edge and influence within the international LNG sector.

EMP Gebang (Indonesia) Gas Field Development

JAPEX's acquisition of a 50% stake in Indonesia's EMP Gebang block positions it squarely in a Stars category within the BCG matrix. This Indonesian production sharing contract encompasses undeveloped gas fields with significant exploration potential, signaling a strategic move towards high-growth assets.

The company's objective is to spearhead the development and initiate early production from these discovered fields, capitalizing on the region's rich hydrocarbon resources. This initiative is designed to secure future market share by tapping into promising new reserves.

- Acquisition Details: JAPEX secured a 50% ownership in the EMP Gebang PSC.

- Asset Profile: The block contains undeveloped gas fields with substantial exploration upside.

- Strategic Objective: To lead development and achieve early production from discovered fields.

- Market Impact: Aims to capture future market share from new, promising reserves in a resource-rich area.

JAPEX's acquisition of a 50% stake in the EMP Gebang block in Indonesia firmly places this asset in the Stars category of the BCG matrix. This means it's a high-growth, high-market-share asset for the company.

The EMP Gebang block holds undeveloped gas fields with significant exploration potential, aligning with JAPEX's strategy to invest in growth markets. The company aims to drive development and commence early production, securing future market share and profitability from these promising reserves.

| Asset | BCG Category | Market Growth | Market Share | JAPEX's Role |

|---|---|---|---|---|

| EMP Gebang (Indonesia) | Star | High | High (Targeted) | 50% Stake, Development Lead |

What is included in the product

The Japex BCG Matrix categorizes business units by market share and growth rate, offering strategic direction for investment.

The Japex BCG Matrix provides a clear, one-page overview, simplifying complex business unit portfolios to relieve decision-making paralysis.

Cash Cows

JAPEX's domestic natural gas supply chain acts as a strong Cash Cow within its business portfolio. This segment benefits from a mature market and a high market share, ensuring consistent and substantial cash flow generation. In 2023, JAPEX reported that its natural gas business, which includes domestic supply, contributed significantly to its overall revenue, highlighting the stability of this mature operation.

The primary focus for this Cash Cow is maintaining operational efficiency and the reliability of its extensive infrastructure across Japan. While aggressive expansion is not the priority, ongoing investments ensure the continued smooth delivery of essential energy resources. This steady performance underpins the segment's role as a dependable source of funds for the company.

JAPEX's mature Japanese oil and gas fields represent its established cash cows. The company actively produces oil and natural gas from ten long-standing domestic fields, holding significant market share in their respective regions.

These fields provide a consistent and dependable revenue stream for JAPEX. While growth prospects for these mature assets are limited, their reliable production is a substantial contributor to the company's overall cash flow generation.

JAPEX's oil and gas transportation and storage infrastructure is a classic Cash Cow. These extensive facilities, crucial for the company's core operations, command a significant market share in the essential logistics of crude oil and natural gas movement.

This segment consistently generates stable cash flow due to its reliable and ongoing operations. The mature nature of this infrastructure business, characterized by low industry growth, allows for robust profit margins, often bolstered by their deeply entrenched competitive advantages.

For example, in 2024, JAPEX's pipeline network and storage facilities are vital for supplying energy across Japan, contributing significantly to their overall revenue. Their established operational efficiency and long-term contracts ensure predictable income streams, reinforcing its Cash Cow status.

Operational Biomass Power Plants

JAPEX's operational biomass power plants, like the Ozu, Chofu, and Tahara facilities, are firmly positioned as Cash Cows within its portfolio. These plants, once operational, consistently generate revenue through electricity sales in Japan's established renewable energy sector. Although the growth potential for this particular segment is modest, their reliable performance is a significant contributor to JAPEX's overall cash flow.

These mature assets benefit from long-term power purchase agreements, ensuring predictable income streams. For instance, JAPEX's commitment to biomass energy in Japan has seen significant investment, with operational plants contributing to a stable energy supply and a steady financial return. This stability is crucial for funding other, potentially higher-growth ventures within the company's broader strategy.

- Stable Revenue Generation: Operational biomass plants provide consistent income, often backed by long-term contracts.

- Mature Market Segment: While growth is limited, the renewable energy market for biomass in Japan is well-established.

- Positive Cash Flow Contribution: These facilities are key contributors to JAPEX's overall cash generation.

- Low Investment Needs: As mature assets, they typically require less capital expenditure compared to newer projects.

Stable Refining Operations

JAPEX's stable refining operations are a cornerstone of its business, converting crude oil into valuable products. This segment benefits from predictable demand in mature markets, ensuring consistent processing volumes. For example, in fiscal year 2023, JAPEX's refining segment contributed significantly to its overall revenue stability.

These operations generate reliable cash flow, acting as a cash cow for the company. The efficiency in converting raw materials into marketable fuels and other petroleum products supports other areas of JAPEX's business. This stability means less need for substantial reinvestment to drive growth.

- Stable Revenue: Refining provides a consistent revenue stream due to established market demand.

- Cash Generation: Efficient processing converts raw materials into profitable products, generating reliable cash.

- Mature Market Operations: JAPEX operates within a predictable market, minimizing growth-related uncertainties.

- Support for Other Segments: The cash generated fuels investments and operations in other business areas.

JAPEX's domestic natural gas supply chain, along with its mature oil and gas fields, transportation infrastructure, biomass power plants, and refining operations, all function as significant Cash Cows. These segments benefit from established market positions and consistent demand, generating stable and predictable cash flows. For instance, in 2023, JAPEX's natural gas business demonstrated robust revenue contribution, underscoring the reliability of these mature operations.

The primary strategy for these Cash Cows involves optimizing operational efficiency and ensuring the dependable delivery of energy resources, rather than pursuing aggressive expansion. Investments are focused on maintaining infrastructure and operational smoothness, securing steady income streams that can fund other strategic initiatives within JAPEX. This consistent performance is vital for the company's financial stability.

These segments represent mature assets with limited growth potential but high market share and profitability. Their stable cash generation is crucial, as exemplified by JAPEX's refining segment's significant revenue contribution in fiscal year 2023. This allows JAPEX to allocate capital effectively across its portfolio, supporting both maintenance and growth opportunities.

| Business Segment | BCG Category | Key Characteristic | 2023 Revenue Contribution (Illustrative) | Outlook |

|---|---|---|---|---|

| Domestic Natural Gas Supply | Cash Cow | High Market Share, Mature Market | Significant | Maintain Efficiency, Stable Cash Flow |

| Mature Oil & Gas Fields | Cash Cow | Established Production, Stable Revenue | Substantial | Reliable Output, Fund Other Ventures |

| Transportation & Storage Infrastructure | Cash Cow | Essential Logistics, Strong Market Share | Consistent | Operational Excellence, Predictable Income |

| Biomass Power Plants | Cash Cow | Long-term Contracts, Steady Returns | Positive | Stable Energy Supply, Financial Support |

| Refining Operations | Cash Cow | Predictable Demand, Efficient Processing | Significant Stability | Consistent Cash Generation, Support Business |

What You See Is What You Get

Japex BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises; you get the fully formatted, analysis-ready tool designed for strategic business planning and presentation.

Dogs

JAPEX is looking to sell its 15% stake in the Seagull oil and gas field in the UK North Sea, which is operated by BP. This move places the Seagull field firmly in the 'Dog' category of the BCG Matrix for JAPEX. Production began in 2023, but the field's location within an aging North Sea basin, coupled with increasing uncertainty around government tax policies, is impacting its profitability and strategic importance for the company.

JAPEX's divestment of its stake in the Kangean offshore block in Indonesia, described as a mature producing asset, positions it within the BCG matrix as a potential 'Dog'.

This move suggests the asset, while once a contributor to cash flow, had entered a low-growth phase and was no longer aligned with JAPEX's strategic objectives, making it a prime candidate for divestment to reallocate resources to more promising ventures.

In 2023, JAPEX's net production from the Kangean block was approximately 4,184 barrels of oil equivalent per day, highlighting its continued, albeit mature, operational status prior to the divestment.

The decision reflects a strategic portfolio management approach, prioritizing investments in areas with higher growth potential and away from mature assets that offer limited future expansion opportunities.

Underperforming niche renewable projects, like smaller solar farms or less efficient wind installations that are not meeting profitability targets, would be classified as Dogs within Japex's BCG Matrix. These ventures struggle with low market share and declining returns, especially as the cost of renewable energy development has seen significant fluctuations. For instance, while global renewable energy investment reached an estimated $1.7 trillion in 2023, the profitability of niche projects can be severely impacted by factors like grid connection costs and inconsistent energy output.

Older, Declining Domestic Oil Fields

Within JAPEX's portfolio, older domestic oil and gas fields face natural production declines. These mature assets often see rising operational expenses, impacting their profitability. Such fields represent a low-growth segment, potentially holding diminishing market share and profitability.

These fields are prime candidates for strategic review, possibly leading to reduced investment or eventual decommissioning. JAPEX's commitment to responsible resource management means evaluating the long-term viability of these older fields.

- Production Decline: Older fields typically experience a natural tapering off of oil and gas extraction rates.

- Increased Costs: As fields age, extraction becomes more complex and expensive, requiring enhanced recovery techniques and more maintenance.

- Lower Profitability: The combination of declining production and rising costs can significantly squeeze profit margins.

- Strategic Re-evaluation: JAPEX must assess whether continued investment in these fields aligns with overall corporate strategy or if divestment or decommissioning is more prudent.

Unsuccessful Past Exploration Ventures

Unsuccessful past exploration ventures, often labeled as Dogs in the Japex BCG Matrix, represent past oil and gas exploration efforts that failed to yield commercially viable discoveries. These ventures continue to consume capital and resources without generating significant returns or adding to reserve portfolios. For instance, a company might have invested heavily in a deepwater exploration block that ultimately proved dry, leaving the initial investment unrecovered.

These types of ventures are characterized by low returns on investment and a minimal market share within the company's overall portfolio. Careful evaluation is crucial to determine whether continued investment is warranted or if divestment is the more prudent course of action. In 2024, the oil and gas industry saw several such projects facing scrutiny. For example, many smaller, independent exploration companies that pursued high-risk, frontier exploration in the late 2010s and early 2020s are now re-evaluating these assets due to persistently low commodity prices and high operational costs.

- Low Return on Investment: Typically, these ventures show negative or negligible returns.

- Resource Drain: They consume management attention, capital, and personnel without clear future prospects.

- Divestment Consideration: Companies often look to sell or farm out these assets to reduce ongoing costs.

- Market Share: Their contribution to the company's overall reserves or production is minimal.

Dogs in JAPEX's BCG Matrix represent underperforming assets with low market share and low growth potential. These include mature oil and gas fields with declining production and increasing costs, as well as unsuccessful exploration ventures that have failed to yield commercial discoveries. For example, JAPEX's divestment of its stake in the Kangean offshore block in Indonesia, which saw net production of approximately 4,184 barrels of oil equivalent per day in 2023, exemplifies a mature asset being moved out of the portfolio.

These "Dog" assets often require significant capital without promising returns, prompting strategic decisions for divestment or reduced investment. Niche renewable projects that fail to meet profitability targets also fall into this category, especially amidst fluctuating renewable energy development costs, which saw global investment reach an estimated $1.7 trillion in 2023 but can still impact smaller projects.

Question Marks

Early-stage geothermal power projects, like those JAPEX is exploring in Hokkaido and Tohoku, often fall into the question mark category of the BCG matrix. These ventures represent high-growth potential due to the increasing global demand for renewable energy, but JAPEX's current market share in undeveloped sites is minimal. The significant upfront investment and inherent exploration risks before commercial operation mean these projects are cash-hungry and haven't yet established a strong market position.

JAPEX is actively participating in collaborative studies to develop ammonia supply hubs, notably in the Soma region of Fukushima Prefecture, aligning with Japan's broader carbon neutrality goals. This strategic move positions JAPEX to tap into a burgeoning market for low-carbon fuels, a sector projected for significant expansion in the coming years.

While the potential for growth is substantial, JAPEX's current market share in this emerging ammonia sector is minimal, reflecting the early stage of these initiatives. These projects require considerable upfront investment to build infrastructure and secure market access, presenting both a challenge and a significant opportunity for future penetration.

JAPEX is eyeing offshore wind power as a growth area, particularly given Japan's extensive coastline. This sector is booming globally, with the International Energy Agency forecasting a significant increase in offshore wind capacity by 2030.

However, JAPEX's current involvement and market standing in offshore wind are minimal. The company's participation in these projects is largely speculative, demanding substantial capital and presenting considerable risk due to the nascent stage of their engagement and the inherent volatility of new energy infrastructure investments.

JAPEX Mihama Power Storage Station (Grid-scale battery)

JAPEX's Mihama Power Storage Station, set to commence operations in spring 2025, represents a significant foray into the burgeoning grid-scale battery sector. This project positions JAPEX's entry into a market characterized by rapid expansion and evolving regulatory frameworks.

The Mihama project is classified as a Question Mark within the JAPEX BCG Matrix. This is due to JAPEX's nascent market share in energy storage, a segment where established players already hold considerable influence.

- New Market Entry: JAPEX's 2025 commissioning of its first grid-scale battery in Chiba signifies its strategic move into the energy storage market.

- Uncertain Profitability: The long-term financial viability and market penetration of JAPEX in wholesale, balancing, and capacity markets remain to be fully determined.

- Low Initial Market Share: As a new entrant, JAPEX's current market share in grid-scale battery operations is minimal, reflecting the early stages of its engagement in this domain.

- Growth Potential: The global energy storage market is projected for substantial growth, with estimates suggesting a significant increase in capacity over the next decade, offering considerable upside for JAPEX if successful.

Broader Carbon Capture, Utilization, and Storage (CCUS) Hubs & Clusters

JAPEX is actively pursuing the development of broader Carbon Capture, Utilization, and Storage (CCUS) hubs and clusters beyond its foundational work. A key initiative includes a Front-End Engineering Design (FEED) study for the Eastern CCS Hub Project in Malaysia, signaling a strategic move into potentially high-growth markets for large-scale decarbonization. This expansion targets regions with significant potential for industrial emissions reduction through integrated CCUS infrastructure.

These nascent CCUS ecosystems represent substantial future opportunities for JAPEX, but also come with inherent challenges. While the long-term market potential is considerable, JAPEX's current market share within these developing hubs is minimal. Success in these complex environments will necessitate substantial upfront investment in early-stage engineering and comprehensive feasibility studies.

- Eastern CCS Hub Project (Malaysia): JAPEX is conducting a FEED study, indicating a commitment to developing large-scale CCUS infrastructure in Southeast Asia.

- High-Growth Potential Markets: These hubs are positioned to capitalize on the growing global demand for decarbonization solutions, particularly in industrial sectors.

- Low Initial Market Share: JAPEX faces the challenge of establishing its presence and influence in these emerging CCUS ecosystems.

- Significant Upfront Investment: Early-stage engineering and feasibility studies are critical, requiring considerable capital with uncertain long-term market dominance outcomes.

Question Marks in JAPEX's portfolio represent ventures with high growth potential but currently low market share. These are often new energy initiatives requiring substantial investment before commercial viability is established. JAPEX's strategy involves nurturing these to become future Stars or Cash Cows.

The geothermal projects in Hokkaido and Tohoku, along with the ammonia supply hub in Fukushima, are prime examples of JAPEX's Question Marks. They tap into expanding renewable energy and low-carbon fuel markets, respectively, but are in their early stages of development and market penetration.

Similarly, offshore wind power and grid-scale battery storage, exemplified by the Mihama Power Storage Station, also fall into this category. These sectors have significant growth prospects, but JAPEX's current market share is minimal, necessitating considerable capital outlay and risk management.

The Eastern CCS Hub Project in Malaysia highlights JAPEX's ambition in Carbon Capture, Utilization, and Storage. While this represents a substantial future opportunity, it requires significant upfront investment and JAPEX currently holds a minimal market share in these nascent CCUS ecosystems.

| Initiative | Market Potential | JAPEX Market Share (Current) | Investment Needs | Growth Outlook |

|---|---|---|---|---|

| Geothermal Power (Hokkaido/Tohoku) | High (Renewable Energy Demand) | Minimal | High (Exploration & Development) | High |

| Ammonia Supply Hub (Fukushima) | High (Low-Carbon Fuels) | Minimal | High (Infrastructure) | High |

| Offshore Wind Power | Very High (Global Expansion) | Minimal | Very High (Project Development) | Very High |

| Grid-Scale Battery Storage (Mihama) | High (Energy Storage Demand) | Minimal | High (Operations) | High |

| CCUS Hubs (e.g., Malaysia) | Very High (Decarbonization Solutions) | Minimal | Very High (FEED & Feasibility) | Very High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analysis, and sales figures, to accurately position business units.