Japex Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Japex Bundle

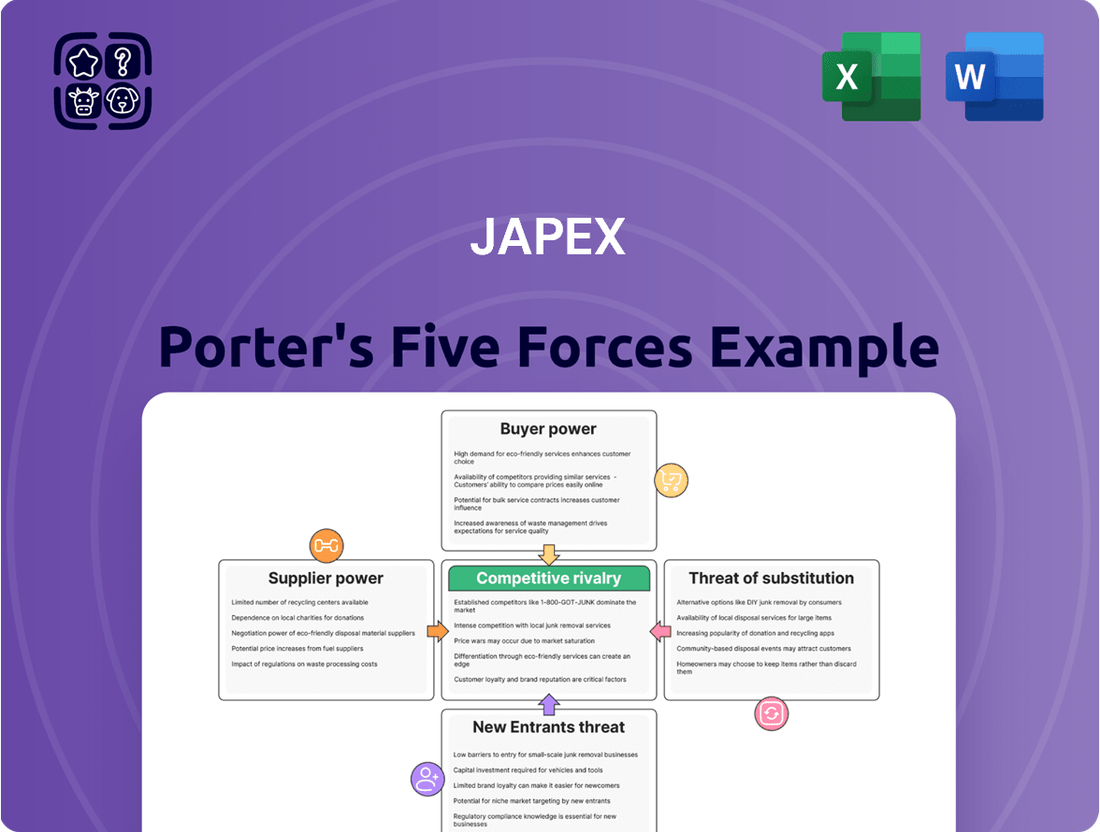

Japex operates within an industry shaped by powerful forces, influencing profitability and strategic choices. Understanding the intensity of buyer and supplier power, the threat of new entrants, and the pressure from substitutes is crucial for any stakeholder. This analysis provides a foundational understanding of Japex's competitive landscape.

However, this brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Japex’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for critical inputs significantly impacts JAPEX's bargaining power. If only a few global companies can provide specialized drilling technology or advanced seismic equipment, these suppliers hold considerable leverage. For instance, in 2024, the market for advanced subsea drilling systems is dominated by a handful of specialized manufacturers, meaning JAPEX has limited options if seeking to negotiate terms.

JAPEX's reliance on a narrow base of suppliers for unique exploration and production services also amplifies supplier power. Should there be a limited number of firms offering proprietary reservoir simulation software or specialized geological consulting, their ability to dictate terms, pricing, and availability increases. This concentration means JAPEX must maintain strong relationships to secure these essential services, potentially at higher costs.

JAPEX's bargaining power of suppliers is influenced by the switching costs associated with changing providers for critical components or services. If JAPEX faces substantial expenses, such as extensive retraining of staff, costly retooling of manufacturing systems, or lengthy procurement lead times for new machinery, then suppliers hold greater leverage. For instance, if a specialized sensor supplier demands a significant price increase, JAPEX might find it prohibitively expensive to source comparable components elsewhere, thereby empowering that supplier.

JAPEX's suppliers wield considerable bargaining power, particularly those offering specialized equipment and technical expertise crucial for exploration and production. For instance, advanced seismic imaging technology or proprietary drilling techniques can command premium pricing due to their uniqueness. This differentiation means JAPEX has fewer viable alternatives, increasing supplier leverage in negotiations.

Supplier Power 4

The bargaining power of suppliers is influenced by their potential for forward integration. If suppliers to JAPEX, particularly those providing essential raw materials or specialized services for exploration and production, could realistically enter JAPEX’s core business operations, their leverage would increase.

For instance, a major provider of drilling equipment or specialized geological surveying services might consider establishing their own exploration ventures if the profit margins and market opportunities appear attractive enough. This threat means suppliers could potentially dictate terms more forcefully, knowing they have an alternative avenue to capture value within the energy sector.

- Forward Integration Threat: Suppliers of key inputs to JAPEX, such as specialized drilling fluids or advanced seismic imaging technology, may possess the capability and incentive to enter JAPEX's exploration or production markets directly.

- Industry Examples: In the broader oil and gas sector, upstream service providers have sometimes integrated into production, and refining companies have acquired upstream assets, demonstrating the feasibility of this strategy.

- JAPEX's Dependence: JAPEX's reliance on a limited number of suppliers for critical, proprietary technologies or unique raw materials would amplify this supplier power.

- Market Conditions: High global demand for energy resources and tight supply chains for essential equipment, as observed in periods of significant market upswings, can embolden suppliers to consider such strategic moves.

Supplier Power 5

JAPEX's bargaining power with its suppliers is influenced by how crucial its business is to them. If JAPEX is a major client, accounting for a substantial part of a supplier's income, that supplier may have less leverage. For example, if a key raw material provider, like a specialized oil and gas equipment manufacturer, relies heavily on JAPEX for a significant percentage of its sales, they may be less inclined to dictate terms or raise prices aggressively. This dependency can shift the balance of power towards JAPEX, as the supplier would want to retain JAPEX's business.

Analyzing JAPEX's supplier relationships requires looking at its purchasing volume and the concentration of its spending across different supplier categories. In 2024, the energy sector saw continued volatility, influencing supplier pricing and availability. Companies like JAPEX, which operate in exploration and production, often secure long-term contracts for specialized equipment and services. The terms of these contracts, including volume commitments and pricing structures, directly reflect the bargaining power JAPEX wields.

- Supplier Dependence: If a supplier's revenue is heavily concentrated with JAPEX, their bargaining power is diminished, as they are more reliant on JAPEX's continued business.

- JAPEX's Purchasing Volume: Larger order volumes for critical components or services can give JAPEX more leverage in negotiating prices and terms with its suppliers.

- Availability of Alternatives: The presence of multiple capable suppliers for essential goods or services reduces the power of any single supplier, increasing JAPEX's options and bargaining strength.

- Industry Dynamics: The overall health and competitive landscape of JAPEX's supply chain industries play a role; a buyer's market for specific resources or services will naturally empower JAPEX.

The bargaining power of JAPEX's suppliers is significantly influenced by the concentration of specialized inputs and services within the industry. If a few dominant firms control critical technologies, like advanced seismic survey equipment or proprietary drilling fluids, JAPEX faces suppliers who can dictate terms. In 2024, the market for high-pressure drilling components, for example, remained consolidated, granting these few providers considerable leverage over purchasers like JAPEX.

JAPEX's reliance on suppliers with unique offerings, such as specialized reservoir modeling software, also empowers these entities. High switching costs, encompassing retraining and system integration, further bolster supplier influence. Consequently, suppliers of these niche services can command premium pricing and favorable contract terms, as JAPEX has limited viable alternatives.

The threat of forward integration by suppliers, where they might enter JAPEX's operational space, also increases their bargaining power. If a major supplier of exploration technology sees potential in directly undertaking exploration projects, they gain leverage to negotiate more aggressively with their current clients, including JAPEX.

| Factor | Impact on JAPEX's Supplier Bargaining Power | Example (2024 Context) |

| Supplier Concentration | High | Limited number of manufacturers for advanced subsea drilling systems |

| Switching Costs | High | Costly retooling and staff retraining for new geological software |

| Supplier Differentiation | High | Proprietary seismic imaging technology |

| Forward Integration Threat | Moderate | Potential for exploration service providers to enter production |

| JAPEX's Dependence on Supplier | Variable (depends on JAPEX's purchase volume) | A supplier heavily reliant on JAPEX for sales may have less power |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Japex's oil and gas operations.

Instantly identify and address competitive threats with a visual breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

JAPEX's customer base for oil and gas, and increasingly geothermal power, shows a notable concentration. Its sales to major industrial clients, power utilities, and international trading houses mean these buyers often purchase in large volumes, granting them considerable bargaining power. For instance, in 2023, a significant portion of JAPEX's crude oil and natural gas output was contracted with established energy companies and utilities, who can leverage their purchasing scale to negotiate favorable terms.

Japex's buyer power is influenced by the price sensitivity of its customers, particularly in the wholesale oil and gas markets. Customers with readily available alternatives or those for whom fuel costs represent a significant portion of their expenses will exert more pressure on pricing. For instance, in 2024, the volatility in natural gas prices directly impacted industrial consumers, who often have the flexibility to switch to other energy sources when costs rise, thereby increasing their bargaining leverage.

The profitability of Japex's customers also plays a crucial role. Highly profitable companies can absorb price fluctuations more easily, potentially reducing their immediate pressure. Conversely, less profitable customers are more sensitive to energy costs and may seek out more competitive suppliers or demand lower prices from Japex, especially if they are in industries with tight margins. This dynamic was evident in the automotive sector in 2024, where rising operational costs, including energy, led some manufacturers to re-evaluate their supply contracts.

The bargaining power of JAPEX's customers is significantly influenced by the availability of alternative energy sources. As of early 2024, the global energy landscape is increasingly diverse, with renewables like solar and wind power continuing to gain traction and become more cost-competitive. This means customers, particularly large industrial users, have more options beyond traditional fossil fuels that JAPEX supplies. For instance, many nations are actively pursuing energy diversification strategies, aiming to reduce reliance on any single source, which further empowers buyers.

Buyer Power 4

The bargaining power of JAPEX's customers is influenced by the potential for backward integration. If significant industrial clients or power generation companies possess the financial capacity and technical expertise to develop their own energy sources or invest in upstream oil and gas assets, their leverage over JAPEX would increase. This could manifest as customers demanding lower prices or more favorable contract terms, knowing they have alternatives. For instance, a large utility company might explore investing in exploration and production (E&P) ventures to secure its own supply chain.

The threat of backward integration is particularly relevant when considering the scale of JAPEX's operations and the capital-intensive nature of the energy sector. Customers with substantial capital reserves could, in theory, acquire existing upstream assets or fund greenfield projects to reduce their reliance on external suppliers like JAPEX. This strategic move would directly challenge JAPEX's market position and pricing power.

While direct backward integration into oil and gas exploration might be complex for many of JAPEX's typical industrial customers, the trend towards energy diversification and the pursuit of energy independence by large consumers presents a related concern. For example, major industrial users might increasingly invest in renewable energy sources like solar or wind power, thereby reducing their overall demand for fossil fuels supplied by companies like JAPEX. This shift effectively diminishes their dependence and enhances their bargaining position.

- Potential for Backward Integration: Large industrial customers and power generators could invest in their own upstream energy assets or alternative energy sources.

- Impact on Bargaining Power: Successful backward integration would enhance customer leverage, potentially leading to demands for lower prices or better contract terms from JAPEX.

- Customer Diversification: Investments by customers in renewable energy sources reduce their reliance on traditional fossil fuel suppliers like JAPEX.

- 2024 Context: Global energy market volatility and increasing governmental support for energy transition initiatives in 2024 may incentivize some large consumers to explore greater supply chain control and diversification strategies.

Buyer Power 5

JAPEX's customers, particularly large industrial buyers and energy utilities, possess significant bargaining power. This is amplified by the increasing availability of real-time market data, allowing them to easily compare pricing and terms across various energy suppliers. For instance, in 2024, the widespread adoption of digital platforms for energy procurement has made price transparency a norm, enabling buyers to identify the most competitive offers with greater ease.

The ability of customers to switch suppliers is a key driver of their power. With numerous global and regional energy providers, buyers can readily explore alternative sources if JAPEX’s pricing or contract terms are not perceived as optimal. This competitive landscape means that JAPEX must continually demonstrate value to retain its customer base, especially as forward-looking energy markets in 2024 and beyond emphasize flexibility and cost-efficiency.

- Information Availability: Customers have access to extensive market data, including spot prices, futures contracts, and competitor analyses, empowering informed purchasing decisions.

- Price Sensitivity: Large-volume buyers, such as industrial manufacturers and power generation companies, are highly sensitive to price fluctuations, increasing their negotiation leverage.

- Supplier Availability: The presence of multiple domestic and international energy suppliers provides buyers with viable alternatives, reducing their reliance on any single provider.

- Switching Costs: While some switching costs exist, they are often manageable for large buyers, further enhancing their ability to exert pressure on JAPEX.

JAPEX's customers, especially large industrial users and utilities, wield significant bargaining power due to their substantial purchasing volumes. This allows them to negotiate favorable pricing and contract terms. For instance, in 2023, major power generation companies represented a large portion of JAPEX's natural gas sales, enabling them to secure competitive rates.

The availability of alternative energy sources and suppliers further bolsters customer leverage. As of early 2024, the global energy market offers diverse options, including renewables, making it easier for buyers to switch if JAPEX's offerings are not cost-effective. This diversification trend empowers customers to demand better value.

Price sensitivity remains a key factor, particularly for industrial consumers in 2024 where energy costs significantly impact their profitability. Companies with flexible operations or those facing margin pressures actively seek the most economical energy solutions, increasing their bargaining power with suppliers like JAPEX.

Full Version Awaits

Japex Porter's Five Forces Analysis

This preview shows the exact Japex Porter's Five Forces Analysis you'll receive immediately after purchase. You're looking at the actual document, meticulously crafted to provide deep insights into Japex's competitive landscape. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic planning. No surprises, no placeholders—just a comprehensive analysis designed for immediate use.

Rivalry Among Competitors

Japex faces significant competitive rivalry in the oil and gas exploration and production sector. Major international oil companies (IOCs) and national oil companies (NOCs) are key competitors, often possessing greater financial resources and established operational footprints. For instance, in 2024, companies like ExxonMobil, Shell, and Saudi Aramco continue to dominate global production, holding substantial market shares and employing aggressive strategies to secure new reserves and market access.

Domestically in Japan, while Japex is a significant player, it competes with other Japanese companies involved in energy, though often in different capacities or market segments. Internationally, Japex's operations in countries like Canada and Indonesia place it directly against a diverse range of local and international E&P firms. The intensity of this rivalry is driven by the high capital requirements and the pursuit of finite, valuable hydrocarbon resources, leading to bidding wars for exploration licenses and strategic partnerships.

JAPEX operates in the oil and gas sector, which has historically experienced cyclical growth. While global oil demand saw a rebound in 2024, reaching an estimated 103.2 million barrels per day according to the IEA, the long-term outlook is influenced by the energy transition. The International Energy Agency projected that renewable energy sources will account for over 50% of global power generation by 2025, signaling a shift that could pressure traditional fossil fuel markets and intensify competition for JAPEX.

The growth rate in the oil and natural gas sectors can directly impact the intensity of competitive rivalry. In periods of slower growth, companies are often forced to fight harder for market share, leading to more aggressive pricing and marketing strategies. For instance, if global demand for oil stagnates or declines, JAPEX and its peers would likely engage in more intense competition to secure existing customers and contracts, potentially impacting profit margins.

Renewable energy, while a growth area, also presents its own competitive landscape. JAPEX's involvement in renewables means it faces competition not only from other energy majors diversifying into clean energy but also from specialized renewable energy developers. As the renewable sector matures, the rivalry here can also escalate as companies vie for project development opportunities, technology advancements, and government incentives.

Competitive rivalry within Japex's energy sector is intense, primarily due to the largely undifferentiated nature of its core products like oil and natural gas. This commodity status forces competition to center heavily on price, driving up rivalry. For instance, the global benchmark Brent crude oil price, a key factor for Japex, experienced significant volatility, trading around $75-$80 per barrel in mid-2024, reflecting this price-sensitive market.

While the fundamental energy sources are commodities, some differentiation emerges through specialized services or the growing adoption of cleaner energy solutions. Companies investing in advanced extraction technologies or offering integrated energy management services can carve out niche advantages. However, the sheer scale of global energy production and the presence of major international players mean that even these differentiated offerings face constant pressure from competitors striving for efficiency and cost leadership.

Competitive Rivalry 4

Competitive rivalry in the energy sector is intensified by substantial exit barriers. Companies in both oil and gas and renewable energy face significant challenges in leaving the market due to massive upfront investments in specialized infrastructure, such as offshore drilling platforms or large-scale solar farms.

These high fixed costs, coupled with long-term supply contracts and ongoing regulatory compliance requirements, lock companies into operations, even when profitability wanes. This creates a persistent competitive landscape where firms are compelled to remain active, often leading to price wars and reduced margins during market downturns.

- High Capital Expenditures: The oil and gas industry, for instance, saw global capital expenditure reach approximately $500 billion in 2023, with a significant portion tied to long-lived physical assets. Similarly, renewable energy projects require substantial initial investment, often in the billions for utility-scale developments.

- Specialized Assets: Equipment and facilities in both sectors are highly specialized and often lack alternative uses, making divestment difficult and costly. Think of a refinery or a wind turbine manufacturing plant – they are not easily repurposed.

- Long-Term Contracts and Obligations: Many energy companies operate under long-term power purchase agreements (PPAs) or supply contracts, committing them to production and delivery for decades, thus hindering swift market exit.

- Regulatory and Environmental Commitments: Decommissioning old oil wells or dismantling renewable energy installations involves significant environmental remediation and regulatory hurdles, adding further costs and complexity to exiting the market.

Competitive Rivalry 5

Japex operates within a highly fragmented and diverse competitive arena, where rivals vary significantly in their strategic approaches, origins, and core objectives. This diversity fuels a dynamic and often unpredictable rivalry.

The competitive landscape includes national oil companies (NOCs) with state-backed mandates, international oil majors (IOCs) focused on global scale and integrated operations, and an increasing number of specialized renewable energy firms. For instance, in 2024, IOCs like ExxonMobil and Shell continued to invest heavily in both traditional oil and gas exploration and burgeoning renewable sectors. Simultaneously, NOCs such as Saudi Aramco are diversifying their portfolios, investing in petrochemicals and renewable projects, aiming to secure long-term energy market relevance. This multi-faceted competition means Japex must contend with players pursuing different profit motives and investment horizons, from maximizing short-term hydrocarbon extraction to long-term decarbonization strategies.

- Diverse Competitor Strategies: Rivals range from integrated energy giants with vast capital to agile renewable energy startups, each employing distinct market penetration and growth tactics.

- Varied Origins: Competitors stem from national oil companies, international majors, and specialized independent producers, bringing different market access and resource bases.

- Conflicting Objectives: Competitors have diverse goals, including maximizing hydrocarbon profits, transitioning to low-carbon energy, and securing national energy independence, leading to varied competitive pressures.

- Impact on Rivalry: This heterogeneity creates an unpredictable environment where strategies can shift rapidly, requiring constant adaptation and strategic foresight from Japex.

Competitive rivalry is a significant force for Japex, stemming from the presence of major international oil companies (IOCs) and national oil companies (NOCs). These entities often possess superior financial clout and established global operations, enabling them to compete aggressively for reserves and market share. For example, in 2024, giants like Saudi Aramco and Shell continued to dominate production, impacting market dynamics.

Japex also faces competition from other Japanese energy firms, though often in more niche areas. Internationally, its operations in Canada and Indonesia put it against a broad spectrum of local and global exploration and production companies. This rivalry is fueled by the high capital demands and the finite nature of hydrocarbon resources, leading to intense bidding for exploration rights.

The intensity of competition is exacerbated by the commoditized nature of oil and gas, driving rivalry towards price. For instance, Brent crude prices hovered around $75-$80 per barrel in mid-2024, reflecting this price sensitivity. Even as companies diversify into renewables, they encounter competition from specialized developers and other energy majors, intensifying rivalry across the energy spectrum.

SSubstitutes Threaten

Japex faces a significant threat from substitutes, particularly in the energy sector. Alternative energy sources like solar, wind, hydro, and nuclear power are increasingly viable options for electricity generation and heating, directly competing with Japex's core oil and natural gas products. The global renewable energy market is projected to reach over $1.9 trillion by 2030, indicating a substantial shift away from fossil fuels.

Furthermore, advancements in battery storage technology are mitigating the intermittency issues associated with solar and wind power, making them more reliable substitutes. In 2024, global investment in renewable energy sources surpassed $500 billion, a testament to the growing acceptance and deployment of these alternatives.

Japex's investment in geothermal energy, while a diversification strategy, also places it in a market with numerous other renewable and even traditional energy providers. The increasing efficiency and decreasing costs of solar photovoltaic panels, for instance, continue to erode the cost competitiveness of conventional energy sources in many applications.

The threat of substitutes for JAPEX, primarily a petroleum exploration and production company, is significant and growing, especially from renewable energy sources. As the cost of solar and wind power continues to fall, their price-performance trade-off becomes increasingly competitive with traditional fossil fuels. For instance, in 2024, the global average levelized cost of electricity from onshore wind was around $0.033 per kilowatt-hour, and from utility-scale solar PV around $0.031 per kilowatt-hour, according to the International Renewable Energy Agency (IRENA). This makes renewables a more viable alternative for electricity generation, directly impacting demand for oil and gas.

The threat of substitutes for JAPEX's traditional energy products, primarily oil and gas, is intensifying. While switching costs for existing infrastructure are high, making immediate large-scale shifts difficult, the growing availability and declining costs of renewable energy sources like solar and wind present a significant long-term challenge. For instance, in 2024, global investment in renewable energy reached record highs, exceeding $700 billion, indicating a strong market push away from fossil fuels.

4

The threat of substitutes for traditional energy sources, particularly oil and gas, is significantly influenced by the evolving regulatory landscape and government incentives. Policies aimed at decarbonization, such as carbon taxes or emissions trading schemes, directly increase the cost of using fossil fuels, making substitutes more attractive. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, aims to level the playing field for industries facing carbon pricing, potentially increasing costs for imported goods reliant on carbon-intensive production.

Government subsidies and mandates for renewable energy sources also play a crucial role in shifting demand away from traditional fuels. Many nations have set ambitious renewable energy targets. By 2024, a significant portion of new power generation capacity globally is expected to come from renewables, driven by supportive policies. For example, the Inflation Reduction Act in the United States provides substantial tax credits for solar and wind energy, accelerating their deployment and adoption.

The accelerating pace of technological innovation in areas like battery storage, electric vehicles, and green hydrogen production further amplifies the threat of substitutes. These advancements are not only improving the efficiency and cost-effectiveness of alternative energy solutions but also expanding their applicability across various sectors. By 2025, the global electric vehicle market is projected to see continued rapid growth, with sales expected to reach millions of units annually, directly impacting demand for gasoline and diesel.

- Regulatory Push for Decarbonization: Policies like carbon taxes and emissions trading schemes make fossil fuels more expensive, enhancing the competitiveness of substitutes.

- Government Incentives for Renewables: Subsidies, tax credits, and renewable energy mandates directly support the adoption of cleaner energy alternatives.

- Technological Advancements: Innovations in battery storage, EVs, and green hydrogen are improving the viability and reducing the cost of substitute energy sources.

- Global Energy Transition Targets: National and international commitments to reduce carbon emissions drive investment and policy support for non-fossil fuel alternatives.

5

The threat of substitutes for traditional oil and gas products is intensifying, fueled by shifting consumer preferences and rapid technological progress. Growing environmental consciousness is a significant driver, pushing consumers and industries towards cleaner alternatives. For instance, electric vehicles (EVs) are gaining substantial traction, directly impacting demand for gasoline and diesel. In 2024, global EV sales are projected to reach over 18 million units, a significant leap from previous years, demonstrating this trend.

Breakthroughs in renewable energy technologies, particularly solar and wind power, coupled with advancements in battery storage, are making these alternatives increasingly viable and cost-competitive. Smart grid technologies further enhance the integration and reliability of renewable sources, reducing reliance on fossil fuels for electricity generation. This technological evolution presents a direct substitute threat to oil and gas in the power sector.

- Evolving Consumer Preferences: A growing segment of consumers prioritize sustainability, leading to increased demand for eco-friendly products and services, including EVs and renewable energy solutions.

- Technological Advancements: Innovations in battery technology, solar panel efficiency, and grid management are lowering the cost and improving the performance of substitutes.

- Environmental Awareness: Heightened global concern over climate change incentivizes governments and corporations to adopt policies and strategies that favor cleaner energy sources.

- Market Growth of Alternatives: The global renewable energy market is projected to reach trillions of dollars by the end of the decade, indicating a substantial shift away from traditional energy sources.

The threat of substitutes for Japex, primarily an oil and gas producer, is substantial and growing. Renewable energy sources like solar and wind are becoming increasingly cost-competitive, directly challenging fossil fuels in power generation. For example, in 2024, the global average cost of onshore wind electricity was around $0.033 per kilowatt-hour, and utility-scale solar PV was about $0.031 per kilowatt-hour, according to IRENA, making them attractive alternatives.

Technological advancements, particularly in battery storage and electric vehicles (EVs), further amplify this threat. These innovations improve the reliability and expand the applicability of alternatives. By 2025, EV sales are expected to continue their rapid ascent, directly impacting demand for Japex's core products.

Government policies and global energy transition targets also play a critical role. Subsidies for renewables and carbon pricing mechanisms make fossil fuels less competitive, accelerating the shift towards cleaner energy. In 2024, global investment in renewables exceeded $700 billion, signaling a strong market preference for alternatives.

| Substitute Energy Source | 2024 Cost (USD/kWh) | Projected Market Growth |

|---|---|---|

| Onshore Wind | ~0.033 | Significant global expansion |

| Utility-Scale Solar PV | ~0.031 | Continued rapid deployment |

| Electric Vehicles (EVs) | N/A (Impacts fuel demand) | Projected >18 million units sold globally in 2024 |

Entrants Threaten

The threat of new entrants into the oil and natural gas exploration and production (E&P) sector, as well as large-scale geothermal power generation, is significantly low due to immense capital requirements. Establishing operations demands billions of dollars for exploration, drilling, infrastructure development like pipelines and processing facilities, and securing land rights. For instance, a single offshore oil platform can cost upwards of $1 billion, and developing a new natural gas field often involves hundreds of millions in upfront investment. Similarly, geothermal projects, while offering long-term energy benefits, require substantial initial capital for drilling wells, installing turbines, and building power plants, with costs for utility-scale projects frequently reaching hundreds of millions.

The energy sector in Japan presents significant barriers to entry for new companies, largely due to stringent regulatory frameworks. Obtaining the necessary licenses and permits for operations, particularly in areas like electricity generation and distribution, involves navigating a complex web of approvals. For instance, as of early 2024, establishing a new power generation facility requires compliance with the Electricity Business Act and adherence to various safety and environmental standards set by agencies like the Ministry of Economy, Trade and Industry (METI).

Environmental regulations are particularly demanding. New entrants must contend with strict emissions standards, waste management protocols, and environmental impact assessments. These requirements can be costly and time-consuming, often necessitating substantial investment in pollution control technology. For example, projects involving fossil fuels face increasing scrutiny under Japan's decarbonization goals, potentially increasing the capital outlay for compliance.

Safety standards are also paramount, especially in the context of nuclear or advanced energy technologies. Companies must demonstrate robust safety management systems and undergo rigorous inspections. Obtaining certifications for these systems can be a lengthy process, adding to the overall time-to-market and deterring those without substantial resources or established expertise in safety protocols.

The threat of new entrants for JAPEX (Japan Petroleum Exploration Company) is relatively low, primarily due to the significant capital investment required to enter the oil and gas exploration and production sector. Established players like JAPEX benefit from substantial economies of scale in areas such as procurement of drilling equipment and services, and the development of extensive distribution networks. For instance, in 2023, the average cost for drilling an oil well can range from $1 million to over $10 million, depending on depth and complexity, a barrier that deters smaller, less capitalized new entrants.

Newcomers would find it exceedingly difficult to match JAPEX's operational efficiencies and cost advantages, which are honed through years of experience and optimized supply chains. Furthermore, securing the necessary exploration licenses and navigating complex regulatory environments in countries where JAPEX operates demands considerable expertise and established relationships, which are not easily replicated by new market participants. The long lead times and inherent risks associated with oil and gas exploration further amplify these entry barriers.

4

The threat of new entrants for JAPEX is moderate, largely due to the significant capital requirements and established relationships within the oil and gas sector. New companies would face considerable hurdles in replicating JAPEX's existing infrastructure and long-standing partnerships with suppliers and downstream customers. Building brand loyalty and trust in a mature market, where reliability and consistent supply are paramount, takes considerable time and investment.

JAPEX benefits from decades of operational experience and a deep understanding of the Japanese market dynamics. This translates into strong customer loyalty, particularly for its refined products and energy services. For instance, as of 2024, JAPEX continues to be a key player in Japan's domestic oil production and exploration, underscoring its entrenched market position. New entrants would need to demonstrate a compelling value proposition to displace these established connections.

Key factors influencing the threat of new entrants include:

- High Capital Investment: Entering the exploration, production, and refining business demands substantial upfront capital for exploration, drilling, infrastructure development, and regulatory compliance, acting as a significant barrier.

- Established Brand Loyalty and Relationships: JAPEX's long history in the Japanese market has fostered strong relationships with key industrial consumers and distributors, making it difficult for new players to gain market share without significant incentives.

- Regulatory and Environmental Hurdles: Navigating complex environmental regulations and obtaining necessary permits for exploration and production activities in Japan can be a lengthy and costly process for newcomers.

- Economies of Scale: Existing players like JAPEX often benefit from economies of scale in operations, procurement, and distribution, which can lead to lower per-unit costs that new entrants may struggle to match initially.

5

The threat of new entrants for Japex, particularly within the oil and gas sector, is significantly influenced by the formidable barriers to entry. Securing access to critical distribution channels, such as established pipelines and storage facilities, is a major hurdle. For instance, building new pipeline infrastructure involves extensive regulatory approvals and substantial capital investment, often running into billions of dollars, making it prohibitive for newcomers.

Furthermore, the industry demands highly specialized expertise, from geological surveying and extraction techniques to refining and marketing. New companies struggle to attract and retain experienced personnel who possess the intricate knowledge required to navigate complex operations and maintain safety standards. As of 2024, the global oil and gas workforce continues to face a skills gap, with many experienced professionals nearing retirement, further intensifying this challenge for any new players attempting to enter the market.

- Access to Distribution Channels: New entrants must overcome the high costs and regulatory complexities associated with building or acquiring pipeline networks and storage infrastructure, which are essential for market reach.

- Specialized Expertise: The industry requires a deep pool of skilled engineers, geologists, and operational staff, making it difficult for new firms to attract and retain the necessary talent to compete effectively.

- Capital Intensity: The sheer scale of investment needed for exploration, production, and infrastructure development acts as a significant deterrent to potential new entrants.

- Regulatory Environment: Stringent environmental regulations and permitting processes create additional layers of complexity and cost for any new company seeking to establish operations.

The threat of new entrants for JAPEX is significantly low, primarily due to the massive capital requirements for oil and gas exploration and production. Building necessary infrastructure, like pipelines, can cost billions, a substantial deterrent. For example, in 2023, the average cost to drill an oil well ranged from $1 million to over $10 million, depending on complexity.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific trade publications. This allows us to accurately assess competitive intensity and market dynamics.