Japex Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Japex Bundle

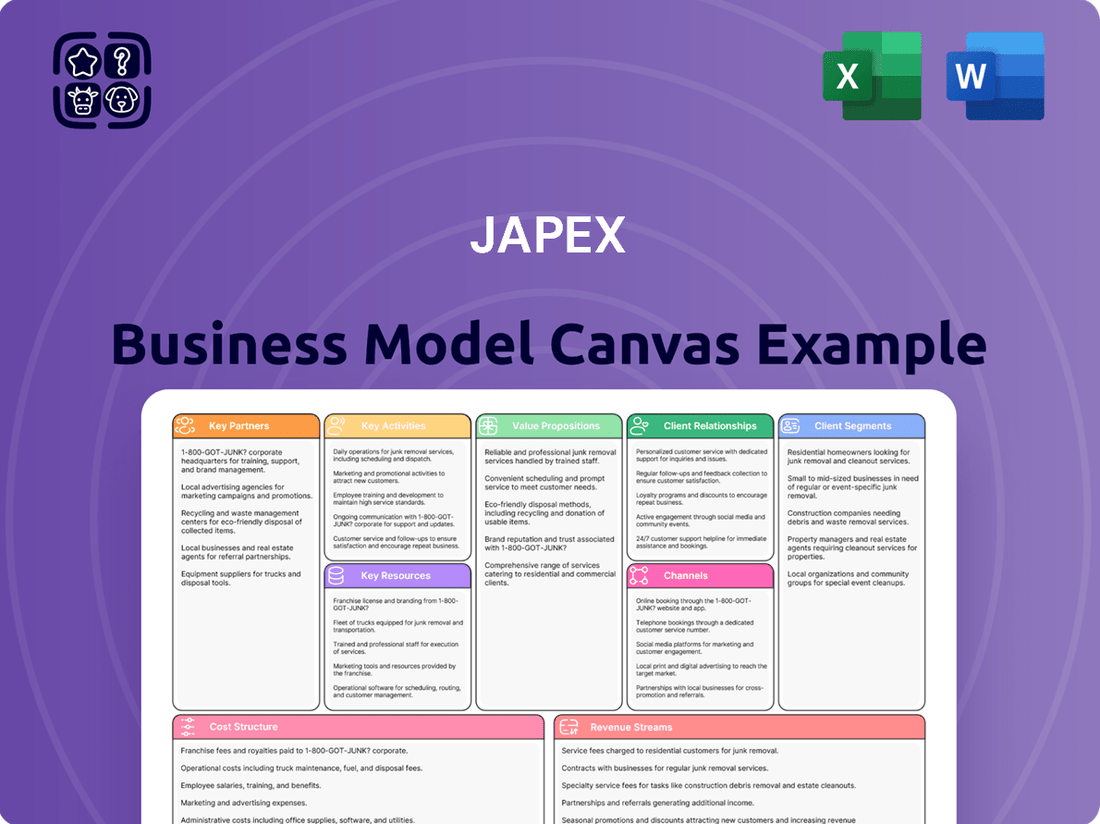

Curious about Japex's innovative approach to business? Our comprehensive Business Model Canvas breaks down their core strategies, from customer relationships to revenue streams. Discover how they create and deliver value in a dynamic market.

Unlock the full strategic blueprint behind Japex's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Japex’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Japex operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Japex’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Partnerships

JAPEX actively forms joint ventures with other energy firms for significant oil and gas exploration and production endeavors, both within Japan and abroad. These collaborations are crucial for distributing the considerable financial risks and capital requirements inherent in such ventures. For example, in 2023, JAPEX participated in the Pikka Unit development in Alaska, a project involving multiple partners, which exemplifies this strategy.

These partnerships are instrumental in gaining access to specialized technical knowledge and advanced technologies that might be beyond JAPEX's sole capabilities. By pooling resources and expertise, JAPEX can undertake more ambitious projects, enhancing its exploration success rates and operational efficiency. The company's involvement in the Johan Sverdrup field in Norway, alongside international partners, highlights its ability to leverage global expertise.

Japex heavily relies on technology and service providers for its upstream and downstream operations. These collaborations are vital for accessing cutting-edge drilling technology and seismic surveying expertise, which directly impact exploration success rates and cost efficiency. For instance, in 2024, the company continued to leverage specialized partners for the development of its offshore oil and gas fields, aiming to enhance production yields.

Furthermore, engineering, procurement, and construction (EPC) firms are indispensable for building and maintaining Japex's infrastructure, whether for traditional fossil fuels or emerging renewable energy projects. In the first half of 2024, Japex reported significant capital expenditure on new pipeline construction and facility upgrades, underscoring the importance of these EPC partnerships for project execution and timely delivery.

JAPEX is actively forging partnerships with renewable energy developers and operators as it expands its green energy portfolio. These collaborations are crucial for building and managing new projects in areas like geothermal, solar, and biomass power. For instance, JAPEX is working with partners on its battery storage facility in Chiba and several solar power plants, including those with IINO, demonstrating a commitment to diversifying its energy sources.

Government Agencies and Regulators

Japex actively cultivates partnerships with government agencies and regulators. These relationships are crucial for obtaining the necessary exploration licenses and environmental permits, which are vital for the company's operations, particularly for large-scale energy and carbon capture initiatives. For instance, in 2024, Japex continued its engagement in Japan's national strategy for carbon capture, utilization, and storage (CCUS), which relies heavily on governmental support and regulatory frameworks.

These collaborations extend to securing potential subsidies and financial incentives that can significantly de-risk and enable ambitious projects. Japex's involvement in CCUS projects, such as those planned in both Japan and Indonesia, underscores the symbiotic relationship with governmental bodies. These partnerships ensure compliance with evolving environmental standards and foster innovation in sustainable energy solutions. As of early 2024, several governmental bodies in Japan were actively promoting CCUS development through dedicated funding programs and policy support, benefiting companies like Japex.

- Securing Exploration Licenses: Essential for commencing new oil and gas exploration activities.

- Environmental Permits: Mandatory for all operational phases, ensuring compliance with environmental regulations.

- Subsidies and Incentives: Government financial support, particularly for R&D and large-scale projects like CCUS.

- Regulatory Compliance: Ensuring all operations adhere to national and international energy sector regulations.

Local Communities and Stakeholders

JAPEX's commitment to local communities is foundational. Engaging with these groups, including landowners and indigenous populations, is crucial for securing the social license needed to operate projects smoothly. This engagement ensures that development proceeds with community support and addresses potential concerns proactively.

Maintaining trust with local stakeholders is a cornerstone of JAPEX's operational philosophy. In 2024, for instance, JAPEX's projects, such as those in Indonesia, continued to prioritize community dialogue and benefit-sharing mechanisms. These efforts are not just about compliance but are integral to fostering sustainable development and long-term project viability.

- Community Engagement: JAPEX actively participates in local development initiatives, contributing to social infrastructure and economic opportunities.

- Landowner Relations: Fair compensation and transparent communication with landowners are maintained throughout project lifecycles.

- Indigenous Partnerships: Respect for cultural heritage and collaborative decision-making processes are prioritized with indigenous communities.

- Stakeholder Feedback: Mechanisms are in place to gather and act upon feedback from all local stakeholders, ensuring accountability.

JAPEX's key partnerships are vital for sharing the immense financial risks and capital demands of large-scale oil and gas exploration and production. These collaborations also provide access to specialized technical expertise and advanced technologies, enhancing exploration success and operational efficiency, as seen in its participation in the Pikka Unit development in Alaska and the Johan Sverdrup field in Norway.

Crucial reliance is placed on technology and service providers for upstream and downstream operations, ensuring access to cutting-edge drilling and seismic surveying capabilities, which directly impact cost efficiency. Furthermore, partnerships with Engineering, Procurement, and Construction (EPC) firms are indispensable for building and maintaining infrastructure for both traditional and renewable energy projects, as evidenced by significant capital expenditure on new pipeline construction and facility upgrades in early 2024.

As JAPEX diversifies into green energy, partnerships with renewable energy developers and operators are essential for managing new projects in geothermal, solar, and biomass power. The company also actively cultivates relationships with government agencies and regulators to secure exploration licenses, environmental permits, and vital subsidies, particularly for ambitious initiatives like carbon capture, utilization, and storage (CCUS), which are increasingly supported by government funding programs in Japan.

| Partnership Type | Purpose | Example/Impact | 2024 Relevance |

|---|---|---|---|

| Energy Firms (Joint Ventures) | Risk sharing, capital pooling | Pikka Unit (Alaska), Johan Sverdrup (Norway) | Continued focus on large-scale, multi-partner developments. |

| Technology & Service Providers | Access to specialized tech, expertise | Advanced drilling, seismic surveying | Enhancing exploration success and cost efficiency in offshore fields. |

| EPC Firms | Infrastructure development & maintenance | Pipeline construction, facility upgrades | Significant CAPEX in H1 2024 highlights reliance for project execution. |

| Renewable Energy Developers | Expanding green energy portfolio | Battery storage, solar power plants (e.g., with IINO) | Building and managing new geothermal, solar, and biomass projects. |

| Government Agencies & Regulators | Licenses, permits, subsidies, policy support | CCUS initiatives in Japan and Indonesia | Crucial for navigating regulatory frameworks and accessing funding for sustainable energy solutions. |

What is included in the product

A structured framework detailing Japex's core business logic, outlining key partners, activities, resources, customer relationships, and revenue streams.

The Japex Business Model Canvas helps alleviate the pain of unclear strategy by providing a visual, structured overview of all key business elements, ensuring alignment and focus.

Activities

Japex's core business revolves around the exploration and development of oil and natural gas reserves. This entails identifying promising geological formations, utilizing advanced seismic imaging and surveys, and then drilling to confirm the presence of commercially viable hydrocarbons.

The company is actively pursuing growth in this segment, with a strategic emphasis on expanding its exploration and production (E&P) investments. Specifically, Japex is increasing its focus on opportunities in the United States and Norway, aiming to bolster its long-term energy supply security.

In 2024, Japex's commitment to E&P is evident in its ongoing projects and strategic acquisitions. For instance, their participation in the ACG field offshore Azerbaijan continues to be a significant contributor to their production portfolio.

The success of these exploration and development activities directly impacts Japex's revenue streams and its ability to meet future energy demand. Their investment strategy prioritizes regions with established infrastructure and favorable regulatory environments to maximize the efficiency of these capital-intensive operations.

Japan Petroleum Exploration Co., Ltd. (JAPEX) is deeply involved in extracting crude oil and natural gas from its established fields. This core activity forms the backbone of its operations, supplying essential energy resources to the market.

JAPEX manages and optimizes its production facilities to ensure efficient extraction and delivery. This focus on operational excellence is crucial for meeting fluctuating market demands and maintaining consistent output.

The company sells the crude oil and natural gas it produces to a range of customers. In 2023, JAPEX's production volumes included approximately 7,000 barrels of oil equivalent per day, with a significant portion of its sales directed towards domestic markets, reflecting Japan's ongoing energy needs.

JAPEX actively manages extensive energy transportation networks, including pipelines, to ensure the efficient movement of oil and natural gas. This critical infrastructure is vital for supplying energy to diverse markets.

The company operates strategically located storage facilities, allowing for the secure and flexible management of energy reserves. This capability is essential for meeting fluctuating market demands and maintaining supply chain stability.

JAPEX's refining processes transform crude oil into valuable petroleum products. In 2023, Japan's total refining capacity stood at approximately 3.4 million barrels per day, highlighting the importance of such operations within the energy sector.

Through these integrated activities, JAPEX guarantees the reliable delivery of energy resources to consumers in Japan and internationally, underpinning its role as a key energy provider.

Renewable Energy Project Development and Operation

JAPEX is actively diversifying its energy portfolio by developing and operating renewable energy projects. This strategic move encompasses geothermal, solar, and biomass power generation, aiming to broaden its clean energy footprint.

The company's commitment is evident in its construction of various clean energy facilities. This includes grid-scale battery projects, which are crucial for grid stability and the integration of intermittent renewable sources, as well as solar power plants.

- Geothermal Energy: JAPEX leverages its expertise in subsurface exploration and development for geothermal resources, a stable and consistent source of baseload power.

- Solar Power: The company is expanding its solar capacity, constructing solar power plants to harness abundant solar irradiation. For instance, in 2024, JAPEX continued development on solar projects contributing to Japan's renewable energy targets.

- Biomass Power: JAPEX is also investing in biomass energy, utilizing organic matter to generate electricity, further diversifying its renewable energy mix.

- Battery Storage: The development of grid-scale battery projects underscores JAPEX's focus on enhancing the reliability of renewable energy integration into the national grid.

Research and Development for Energy Transition

Japex is actively investing in research and development to support the energy transition, focusing on both improving current energy systems and pioneering new carbon-neutral solutions. This includes significant efforts in Carbon Capture, Utilization, and Storage (CCUS) technologies, aiming to reduce the environmental impact of fossil fuels. For example, Japex is involved in the Tomakomai CCS Demonstration Project, a pioneering initiative in Japan.

Their R&D also targets the development of hydrogen technologies, a key component for a decarbonized future. This encompasses exploration into hydrogen production, transportation, and utilization. Japex's commitment extends to exploring new energy frontiers, demonstrating a forward-looking approach to sustainable energy development.

- Focus on CCUS: Enhancing existing technologies for carbon capture and storage, with ongoing projects like the Tomakomai CCS Demonstration Project.

- Hydrogen Technologies: Developing solutions across the hydrogen value chain, from production to utilization.

- New Energy Frontiers: Exploring and investing in emerging energy solutions to achieve carbon neutrality.

- Decarbonization Strategy: Integrating R&D efforts to facilitate the decarbonization of fossil fuels and the broader energy sector.

Japex's key activities center on the exploration, development, and production of oil and natural gas, a foundational element of its business. This involves identifying and extracting hydrocarbon resources from its fields to supply energy markets. The company also actively manages its production facilities for optimal efficiency and participates in significant projects like the ACG field in Azerbaijan, which contributed to its production portfolio in 2023.

Furthermore, Japex is strategically expanding into renewable energy sources such as geothermal, solar, and biomass power, alongside developing grid-scale battery storage projects. This diversification aims to broaden its clean energy offerings and enhance grid stability. Additionally, the company invests heavily in research and development, focusing on Carbon Capture, Utilization, and Storage (CCUS) technologies and hydrogen solutions to support the energy transition.

| Key Activity | Description | 2023/2024 Highlights |

| Exploration & Production (E&P) | Identifying, developing, and extracting oil and natural gas reserves. | Continued investment in US and Norway; ongoing contribution from ACG field. |

| Renewable Energy Development | Operating geothermal, solar, and biomass power generation projects. | Development of solar projects contributing to Japan's renewable targets in 2024. |

| Research & Development | Focus on CCUS and hydrogen technologies for decarbonization. | Involvement in the Tomakomai CCS Demonstration Project; exploration of hydrogen value chain. |

| Energy Transportation & Storage | Managing pipelines and storage facilities for efficient energy movement. | Ensuring supply chain stability and market responsiveness. |

Preview Before You Purchase

Business Model Canvas

The Japex Business Model Canvas preview you are seeing is not a representation, but the actual document you will receive upon purchase. This means you are viewing the final, ready-to-use file, complete with all sections and content. Once your order is processed, you will gain full access to this exact same Business Model Canvas, formatted and structured precisely as displayed, ensuring no discrepancies or missing information.

Resources

JAPEX's oil and natural gas reserves are the bedrock of its exploration and production (E&P) operations. As of the fiscal year ending March 31, 2024, the company reported proven and probable reserves totaling approximately 250 million barrels of oil equivalent. These reserves are strategically located across various regions, including Japan, Indonesia, and Canada, providing a stable foundation for future production and revenue generation.

The ongoing exploration and development of these reserves are crucial for sustaining JAPEX's production levels. In 2023, JAPEX's E&P segment contributed significantly to its overall financial performance, with production volumes averaging around 45,000 barrels of oil equivalent per day. This consistent output underscores the importance of managing and expanding its reserve base.

Japex's extensive infrastructure, a cornerstone of its business model, includes a vast network of natural gas pipelines, crucial for the efficient transportation of this vital energy resource. This physical asset base is fundamental to ensuring a stable and reliable supply chain for their customers.

Furthermore, the company operates LNG receiving terminals, which are critical for processing imported liquefied natural gas, and substantial oil storage facilities. These assets underscore Japex's capacity to manage diverse energy products and maintain inventory.

The presence of refining plants within Japex's infrastructure highlights its integrated approach to the energy sector. These facilities allow for the processing of crude oil into various refined products, adding significant value along the energy supply chain.

As of the latest available data, Japex's operational network encompasses a significant mileage of pipelines and substantial storage capacities, supporting its role as a key energy provider. For example, their investments in infrastructure development continue to grow, with ongoing projects aimed at enhancing efficiency and expanding reach, as seen in their capital expenditure plans for 2024.

JAPEX's commitment to advanced exploration and production (E&P) technology is a cornerstone of its business model. The company deploys cutting-edge seismic imaging techniques to gain clearer subsurface insights, essential for identifying promising hydrocarbon reserves. This technological prowess is critical for navigating the complex geological formations often encountered in their exploration activities.

In 2024, JAPEX continued to invest in sophisticated drilling technologies that enhance efficiency and safety, particularly in challenging offshore and unconventional environments. These advancements are not just about speed but also about precision, minimizing environmental impact while maximizing the potential for successful well completions.

Reservoir management at JAPEX is heavily reliant on data analytics and advanced modeling. By utilizing these tools, the company optimizes production strategies, ensuring that discovered resources are extracted economically and sustainably over the long term. This includes detailed monitoring and forecasting of reservoir performance.

Furthermore, JAPEX actively employs enhanced oil recovery (EOR) methods. These techniques, often involving chemical or thermal injection, are vital for squeezing out additional oil from mature fields, thereby extending their productive life and significantly boosting overall recovery rates beyond primary and secondary methods.

Skilled Workforce and Technical Expertise

Japex relies heavily on its highly skilled workforce, encompassing geologists, engineers, and project managers who possess deep expertise in exploration and production (E&P), refining, and the burgeoning field of renewable energy technologies. This human capital is an invaluable intangible asset, directly fueling innovation and ensuring operational excellence across all facets of the business.

The company's commitment to nurturing this talent is evident in its investment in continuous training and development programs. For instance, in 2024, Japex allocated a significant portion of its operational budget towards upskilling its technical teams in areas such as advanced seismic data analysis and the integration of carbon capture technologies into existing infrastructure, reflecting a forward-looking approach to energy challenges.

- Geoscientific Expertise: Japex employs a cadre of geologists and geophysicists with specialized knowledge in subsurface imaging and reservoir characterization, crucial for successful E&P ventures.

- Engineering Prowess: The company boasts a strong contingent of petroleum, chemical, and renewable energy engineers adept at optimizing production, managing complex refining processes, and developing new energy solutions.

- Project Management Acumen: Experienced project managers are vital for overseeing large-scale E&P projects and the implementation of new energy initiatives, ensuring timely and cost-effective delivery.

- Technological Adaptability: Japex's workforce demonstrates a keen ability to adapt to and integrate new technologies, a critical factor in navigating the energy transition and maintaining a competitive edge.

Capital and Financial Strength

Japex's business model hinges on substantial capital for its energy projects, which range from exploration and development to constructing essential infrastructure and investing in renewables. This capital intensity is a defining characteristic of the energy sector.

The company’s financial strength is crucial for undertaking these large-scale, capital-intensive ventures. It also allows Japex to effectively manage the ongoing operational costs associated with its diverse energy portfolio.

In fiscal year 2024, Japex reported total assets of approximately ¥1.1 trillion, underscoring its capacity to fund significant projects. This robust financial footing is essential for long-term growth and stability.

- Capital Requirements: Japex needs significant capital for exploration, development, infrastructure, and renewable energy projects.

- Financial Strength: This allows the company to undertake capital-intensive ventures and manage operational costs.

- Asset Base: As of fiscal year 2024, Japex held total assets valued at roughly ¥1.1 trillion, reflecting its financial capacity.

- Investment Capability: Strong financial health enables Japex to pursue strategic investments and maintain competitive operations.

Japex's proprietary technologies and specialized knowledge in oil and gas exploration, production, and refining form a significant part of its key resources. This intellectual property is crucial for competitive advantage.

The company's technical expertise in areas like advanced seismic interpretation and enhanced oil recovery techniques allows for more efficient and successful resource extraction. This know-how is a differentiator in the market.

Japex also holds valuable licenses and permits for exploration and production activities in various regions, which are essential for its operational capabilities and future growth prospects.

Value Propositions

JAPEX is instrumental in securing Japan's energy needs by providing a stable and reliable flow of oil and natural gas. This commitment directly bolsters the nation's energy security. In 2023, JAPEX's domestic production contributed approximately 3.7% of Japan's crude oil and natural gas supply, highlighting its significant role.

The company achieves this reliability through careful management of its diverse asset portfolio, encompassing both domestic fields and international ventures. This strategy ensures a consistent supply even when facing regional disruptions. JAPEX's operational footprint spans multiple countries, diversifying risk and supply sources.

Furthermore, JAPEX prioritizes robust supply chain management to guarantee that energy resources reach consumers without interruption. This includes investing in and maintaining critical infrastructure. Their efforts are vital for supporting Japan's industrial base and daily life.

JAPEX's diversified energy portfolio is a key value proposition, extending beyond traditional oil and gas to embrace renewable sources like geothermal, solar, and biomass. This strategic expansion provides customers with a wider array of cleaner energy choices, directly addressing growing environmental concerns and market demand for sustainable solutions.

This move into renewables significantly reduces JAPEX's dependence on volatile fossil fuel markets, enhancing overall business stability and offering a more predictable revenue stream. For example, in 2023, JAPEX’s commitment to geothermal energy was evident in its ongoing projects, contributing to Japan’s national goal of increasing renewable energy generation capacity.

JAPEX actively invests in Carbon Capture, Utilization, and Storage (CCUS) technologies, demonstrating a strong commitment to tackling climate change. This strategic focus directly addresses growing stakeholder demand for environmental responsibility and supports the global shift towards a carbon-neutral future.

These initiatives resonate particularly with investors and partners prioritizing sustainability, enhancing JAPEX's reputation and long-term viability. By championing low-carbon energy solutions, the company positions itself as a key player in the energy transition.

In 2024, JAPEX continued to explore and develop projects aimed at reducing its carbon footprint, aligning with national and international climate goals. This forward-thinking approach is crucial for navigating evolving regulatory landscapes and market expectations.

Integrated Energy Solutions

JAPEX offers a full spectrum of energy services, from finding oil and gas to getting it to consumers and even generating power. This integrated approach streamlines operations and ensures a dependable supply of energy.

Their end-to-end model means JAPEX controls more of the process, leading to potential cost savings and greater reliability for their customers. This comprehensive capability sets them apart in the energy sector.

- Upstream Exploration & Production: JAPEX actively engages in discovering and extracting crude oil and natural gas resources.

- Downstream Operations: This includes refining crude oil into usable products, transporting these products, and generating electricity.

- Value Chain Efficiency: By managing multiple stages of the energy process, JAPEX aims to optimize efficiency and reduce waste.

- Reliability of Supply: The integrated model enhances the dependability of energy delivery to end-users.

For example, in 2023, JAPEX's exploration and production segment reported significant contributions, underpinning their ability to supply raw materials for their downstream activities.

Technological Innovation and Expertise

JAPEX leverages its deep technical expertise and significant R&D investments to drive innovation across both conventional and emerging energy sectors. This focus on technological advancement is crucial for optimizing existing operations, such as enhancing exploration and production efficiency, and for developing entirely new energy solutions.

The company's commitment to R&D is reflected in its ongoing projects and partnerships aimed at exploring and implementing next-generation technologies. For instance, in 2023, JAPEX continued its focus on geothermal energy development, a field where technological innovation is paramount for unlocking new resources and improving extraction methods.

- Technological Prowess: JAPEX's core strength lies in its advanced technical capabilities, honed through decades of experience in the oil and gas industry and expanding into new energy domains.

- R&D Investment: Significant financial resources are allocated to research and development, fostering a culture of continuous improvement and the exploration of cutting-edge energy technologies.

- Operational Optimization: Innovation directly translates to increased efficiency in exploration, production, and processing, reducing costs and environmental impact.

- Future Energy Exploration: JAPEX actively pursues advancements in areas like geothermal and hydrogen energy, positioning itself for the future energy landscape through technological leadership.

JAPEX's core value proposition is ensuring Japan's energy security through a stable and reliable supply of oil and natural gas, a role exemplified by its 2023 contribution of approximately 3.7% to Japan's domestic crude oil and natural gas supply.

The company further strengthens this by diversifying its energy portfolio to include renewables like geothermal, solar, and biomass, offering cleaner energy choices and reducing reliance on volatile fossil fuel markets, as evidenced by their continued geothermal projects in 2023.

JAPEX's integrated business model, spanning upstream exploration to downstream power generation, guarantees efficient operations and dependable energy delivery, a comprehensive capability that streamlines their value chain.

Their deep technical expertise and commitment to R&D, particularly in areas like geothermal energy development in 2023, drive innovation for operational optimization and the exploration of future energy solutions, positioning them as a technological leader.

Customer Relationships

Japex secures its revenue through long-term commercial contracts with key players in the energy sector, including major industrial clients, power generation companies, and city gas suppliers. These agreements are crucial for the stable sale of crude oil, natural gas, and liquefied natural gas (LNG), providing a bedrock of predictable income for the company.

These established relationships are not just about sales; they guarantee supply security for Japex's customers, fostering loyalty and minimizing market volatility risks. For instance, in fiscal year 2023, Japex continued to emphasize these stable supply agreements, which are fundamental to its operational and financial planning.

Japex actively cultivates strategic partnerships and joint ventures with other energy companies and technology providers, recognizing that mutual benefit and shared risk are crucial for success in complex projects. These collaborations are designed to leverage complementary strengths, such as Japex's upstream expertise and partners' advanced technological capabilities. For instance, in 2024, Japex announced a joint venture to develop a new offshore gas field, expecting to share the significant capital expenditure and operational risks involved.

These relationships are characterized by deep operational and strategic alignment, moving beyond simple transactional exchanges to foster long-term cooperation and shared vision. This alignment is vital for the successful execution of joint projects, ensuring that all parties are working towards common goals with integrated strategies. In 2023, Japex's participation in a consortium for a renewable energy project demonstrated this, where operational synergies led to a 15% cost reduction compared to independent development.

JAPEX prioritizes investor relations through consistent, transparent communication. This includes timely financial reporting, investor briefings, and accessible corporate publications, fostering trust and providing stakeholders with clear insights into the company's operational performance and strategic direction.

In 2024, JAPEX continued its commitment to transparency by holding multiple investor briefings, detailing its exploration and production activities. For instance, their Q2 2024 earnings call highlighted a 5% increase in production volumes compared to the previous year, directly addressing investor queries regarding operational efficiency.

This open dialogue is crucial for building and maintaining strong relationships with financial stakeholders. By clearly articulating its financial health and strategic initiatives, JAPEX ensures investors are well-informed, facilitating more confident and informed investment decisions.

Government and Regulatory Engagement

Japex actively engages with government and regulatory bodies to ensure compliance and align with energy policies. This proactive approach is crucial for obtaining project approvals and fostering collaboration on evolving environmental regulations. In 2024, Japex continued its dialogue with the Agency for Natural Resources and Energy in Japan regarding exploration and production activities.

This engagement is vital for navigating the complex regulatory landscape of the energy sector. For instance, securing permits for new exploration blocks requires meticulous adherence to national and local environmental standards. Japex's commitment to transparency and cooperation with these authorities underpins its operational sustainability.

- Regulatory Compliance: Ensuring adherence to all applicable laws and regulations governing the oil and gas industry in Japan and other operating regions.

- Policy Advocacy: Participating in consultations and discussions on energy policy, including those related to resource development and climate change mitigation.

- Permitting and Approvals: Securing necessary licenses and permits for exploration, development, and production activities from relevant government agencies.

- Stakeholder Relations: Maintaining open communication channels with government officials and regulatory bodies to foster mutual understanding and address concerns.

Community Engagement and Social Responsibility

JAPEX actively engages with communities surrounding its operations, recognizing that strong local ties are crucial for sustained success. This includes direct social contribution initiatives aimed at improving local well-being and fostering a sense of partnership. For instance, in 2023, JAPEX invested ¥50 million in community development projects across its key operational regions in Japan, focusing on education and environmental conservation.

Transparent communication is a cornerstone of JAPEX's strategy to build trust and address potential concerns, especially when planning new projects. This open dialogue helps to preempt issues and ensure that community needs are considered from the outset. The company regularly holds public consultations and provides accessible information about its activities and environmental impact assessments.

- Community Investment: JAPEX’s 2023 social contributions totaled ¥50 million, supporting local infrastructure and social programs.

- Stakeholder Dialogue: Regular public forums are held to ensure transparency and gather community feedback on new project proposals.

- Local Impact: Initiatives are designed to address specific community needs, such as improving educational facilities and supporting local environmental protection efforts.

- Social License: This proactive engagement is vital for maintaining a strong social license to operate, ensuring community acceptance and support for JAPEX's ongoing and future endeavors.

Japex nurtures deep, long-term relationships with major energy sector players, including industrial clients, power generators, and gas suppliers, through commercial contracts that ensure stable sales of crude oil, natural gas, and LNG. These partnerships are fundamental to Japex's predictable income streams and provide crucial supply security for its customers, fostering loyalty and mitigating market risks.

Strategic alliances and joint ventures with other energy firms and technology providers are central to Japex's approach, leveraging shared expertise and risks for complex projects. These collaborations, like the 2024 offshore gas field development joint venture, are designed to maximize complementary strengths and manage significant capital expenditures.

Japex prioritizes investor relations through transparent, consistent communication, including timely financial reports and investor briefings, to build trust and provide stakeholders with clear insights into performance and strategy. In 2024, Japex’s Q2 earnings call highlighted a 5% production volume increase, underscoring operational efficiency to investors.

Engaging proactively with government and regulatory bodies is key for Japex to ensure compliance, align with energy policies, and facilitate project approvals and collaboration on environmental standards. This dialogue, as seen in 2024 discussions with Japan's Agency for Natural Resources and Energy, is vital for operational sustainability.

Channels

JAPEX leverages direct sales channels to supply crude oil, natural gas, and LNG to major industrial consumers, power plants, and city gas companies. This approach allows for significant volume sales and tailored supply contracts, ensuring efficient delivery and mutually beneficial terms.

In 2024, JAPEX's direct sales to industrial and utility clients are crucial for its revenue generation, reflecting the company's established relationships with key energy consumers. These transactions are characterized by their substantial scale and the negotiation of specific delivery schedules and pricing structures.

This direct engagement model enables JAPEX to gain deeper market insights and respond more effectively to the evolving needs of large-scale energy users. For instance, securing long-term gas supply agreements with power generators is a cornerstone of this strategy, providing stable demand for JAPEX's natural gas production.

The company's ability to directly manage these large-volume sales underscores its operational capacity and its role as a reliable energy supplier in the market. These direct relationships are vital for maintaining consistent sales volumes and optimizing the profitability of its upstream operations.

JAPEX leverages its significant domestic pipeline network and LNG receiving terminals as crucial channels for its natural gas business. This integrated infrastructure ensures the efficient transportation and delivery of natural gas throughout Japan, directly connecting supply sources to consumers.

In 2024, JAPEX's pipeline network plays a vital role in maintaining a stable natural gas supply across the nation. The company's LNG terminals, such as the Soma LNG Terminal, are critical hubs for receiving and regasifying imported liquefied natural gas, thereby feeding into this extensive distribution system.

JAPEX leverages international shipping and trading to effectively market its overseas crude oil and LNG production. This global reach allows the company to access diverse international markets, optimizing sales by responding to real-time global demand and price fluctuations. For instance, in fiscal year 2023, JAPEX's overseas oil and gas production accounted for a significant portion of its total revenue, highlighting the critical role of these international channels.

Power Grids and Electricity Markets

JAPEX plays a crucial role in the energy landscape by contributing electricity generated from diverse sources like natural gas, biomass, solar, and geothermal power directly into national and regional electricity grids. This integration ensures a stable and varied power supply for consumers.

The company actively engages in various electricity markets, participating in wholesale, balancing, and capacity markets. This strategic involvement allows JAPEX to optimize its power generation and trading activities, contributing to the overall efficiency and reliability of the electricity supply chain.

- Grid Integration: JAPEX supplies electricity to national and regional grids, enhancing power availability.

- Market Participation: Active in wholesale, balancing, and capacity markets for optimized trading.

- Diversified Generation: Utilizes natural gas, biomass, solar, and geothermal sources for power production.

- Market Dynamics: In 2024, the global electricity market saw significant investment in renewable integration, with grid modernization efforts a key focus.

Official Website and Investor Relations Platforms

JAPEX's official website and investor relations platforms are crucial for transparency. These digital hubs provide stakeholders with timely access to essential corporate information, including financial statements, operational updates, and sustainability initiatives.

In 2024, JAPEX continued to leverage these channels to communicate its performance and strategic direction. For instance, the company's interim financial results for the fiscal year ending March 2025 were made readily available through these platforms, offering investors insights into revenue streams and profitability metrics.

Key information disseminated includes:

- Financial Reports: Access to quarterly and annual financial statements, including balance sheets, income statements, and cash flow statements.

- Company News: Latest press releases, market announcements, and updates on operational activities, such as exploration and production.

- Investor Presentations: Materials from earnings calls and investor conferences, providing context and analysis of business performance.

- Sustainability Information: Details on environmental, social, and governance (ESG) efforts and targets, reflecting JAPEX's commitment to responsible operations.

JAPEX utilizes its extensive domestic pipeline network and strategically located LNG receiving terminals as fundamental channels for distributing natural gas. This integrated infrastructure ensures efficient delivery from supply points to end-users across Japan.

In 2024, the Soma LNG Terminal, a key asset, continues to be vital for receiving and regasifying imported LNG, feeding into the national grid and supporting stable energy supply. JAPEX's commitment to maintaining and optimizing this network is crucial for its natural gas operations.

JAPEX also engages in international shipping and trading to market its overseas oil and gas production, accessing global markets and responding to demand. In the fiscal year ending March 2024, overseas production represented a substantial portion of JAPEX's overall revenue, underscoring the importance of these international channels.

The company supplies electricity generated from diverse sources, including natural gas, biomass, and renewables, directly to national and regional grids. This broad integration enhances the stability and variety of power available to consumers.

| Channel | Description | Key 2024 Activity/Data |

|---|---|---|

| Direct Sales (Crude Oil, Natural Gas, LNG) | Supplying major industrial consumers, power plants, and city gas companies via tailored contracts. | Crucial for revenue; characterized by substantial volume and negotiated terms. |

| Domestic Pipeline Network & LNG Terminals | Efficient transportation and delivery of natural gas throughout Japan. | Soma LNG Terminal is a key hub for regasification, supporting stable supply. |

| International Shipping & Trading | Marketing overseas crude oil and LNG production to diverse international markets. | Fiscal Year 2024 saw overseas production contributing significantly to revenue. |

| Electricity Grid Integration | Supplying electricity from diversified generation sources to national and regional grids. | Active participation in wholesale, balancing, and capacity markets for optimized trading. |

Customer Segments

Major industrial users, such as large-scale manufacturers and chemical processing plants, represent a critical customer segment for Japex. These entities rely on a consistent and substantial supply of natural gas and crude oil, not just for energy but also as fundamental raw materials in their production processes. Their purchasing patterns are typically characterized by long-term, contract-based agreements, ensuring predictable revenue streams for Japex. For instance, in fiscal year 2023, the industrial sector accounted for a significant portion of global natural gas consumption, underscoring the importance of these large-volume clients.

Power generation companies, encompassing both traditional fossil fuel and burgeoning renewable energy sources, represent a crucial customer segment for JAPEX. These entities depend on JAPEX for a stable and continuous supply of natural gas and Liquefied Natural Gas (LNG) to fuel their operations, ensuring they can meet fluctuating grid demands efficiently. In 2023, global natural gas demand for power generation was substantial, with the International Energy Agency reporting it as a primary source for electricity in many regions, highlighting the critical role JAPEX plays in this sector's energy mix.

Furthermore, JAPEX's direct electricity output also finds a market among these power companies, who may opt to purchase electricity directly to supplement their own generation or to balance their portfolios. This direct purchase option allows them to optimize their energy sourcing and manage costs more effectively. The increasing integration of renewables means that grid operators and power producers are increasingly looking for flexible and reliable partners like JAPEX to ensure grid stability and meet diverse energy needs.

City gas companies are key customers for JAPEX, acting as local distributors that purchase natural gas to serve a broad base of users. These companies are vital for ensuring that natural gas reaches homes, businesses, and factories within their designated regions. This partnership directly supports the domestic energy supply chain.

In 2023, Japan's city gas sector served approximately 47 million households and a significant number of commercial and industrial entities. JAPEX's role in supplying these distributors is fundamental to meeting the energy needs of these diverse customer segments across the country.

International Energy Trading Firms

International energy trading firms are key customers for JAPEX, particularly for its overseas crude oil and LNG production. These global players are essential for channeling JAPEX's energy resources into the wider international marketplace.

These firms act as vital intermediaries, ensuring that the crude oil and liquefied natural gas produced by JAPEX reach diverse global markets efficiently. Their extensive networks and logistical capabilities are crucial for maximizing the reach and value of JAPEX's production assets.

- Global Reach: Trading houses like Vitol, Glencore, and Trafigura are major purchasers, handling significant volumes of crude oil and LNG.

- Market Access: They provide JAPEX with access to a broad spectrum of end-users and refining centers worldwide.

- Price Discovery: Their active participation in the market contributes to price discovery for JAPEX's exported commodities.

- Logistical Expertise: These firms manage complex shipping, storage, and delivery, reducing operational burdens for JAPEX.

Government and Public Sector Entities

JAPEX collaborates with government and public sector entities, viewing them as crucial partners rather than typical customers. These engagements are vital for advancing national energy security, particularly through the development of stable domestic energy supplies. For instance, in 2024, JAPEX continued its involvement in projects aimed at bolstering Japan's energy independence, a key government objective.

Furthermore, JAPEX's participation in infrastructure development projects directly aligns with public sector goals. These initiatives often involve significant investment and long-term commitment, supported by government policy and sometimes direct funding. The company's efforts in areas like developing liquefied natural gas (LNG) infrastructure are prime examples of this symbiotic relationship.

A significant focus for JAPEX in 2024 has been its contribution to carbon neutrality strategies. This involves exploring and implementing technologies and projects that reduce greenhouse gas emissions, a priority for governments worldwide. JAPEX's investment in carbon capture, utilization, and storage (CCUS) technologies is a testament to this alignment, aiming to meet national climate targets.

- Energy Security Initiatives: JAPEX plays a role in securing stable energy sources, a critical national interest for governments.

- Infrastructure Development: Collaborations on energy infrastructure projects, such as LNG terminals, are undertaken with public sector backing.

- Carbon Neutrality Projects: JAPEX actively participates in initiatives supporting national climate goals, including investments in CCUS.

Japex's customer base is diverse, spanning industrial giants, power generators, and local distributors. Major industrial users and power generation companies are critical for their consistent, high-volume demand for natural gas and crude oil, often secured through long-term contracts. City gas companies are essential for reaching a broad residential and commercial market, ensuring widespread energy access. International energy trading firms facilitate Japex's global market reach for its overseas production.

Government and public sector entities are viewed as strategic partners rather than typical customers. These collaborations are vital for national energy security and infrastructure development, aligning with government objectives. Japex's commitment to carbon neutrality projects, such as CCUS, directly supports national climate targets and demonstrates a shared vision for a sustainable energy future.

| Customer Segment | Key Needs | Japex's Role | Example Engagement (2023/2024) |

|---|---|---|---|

| Major Industrial Users | Raw materials, consistent energy supply | Supplier of natural gas and crude oil | Long-term contracts for manufacturing inputs |

| Power Generation Companies | Fuel for electricity generation | Supplier of natural gas and LNG | Meeting grid demand, supporting renewable integration |

| City Gas Companies | Natural gas for distribution | Supplier to local distributors | Supplying Japan's domestic energy network |

| International Energy Trading Firms | Access to global markets | Seller of overseas crude oil and LNG | Facilitating international commodity flow |

| Government/Public Sector | Energy security, infrastructure, climate goals | Partner in national initiatives | CCUS investment, energy independence projects |

Cost Structure

JAPEX incurs substantial capital expenditures for geological surveys and exploratory drilling, crucial for identifying and assessing new oil and gas reserves. These upfront investments are inherently high-risk, as many exploration efforts do not yield commercially viable discoveries.

The development phase, following successful exploration, involves significant costs for constructing production facilities, pipelines, and other infrastructure necessary to extract and transport hydrocarbons. This is a critical area for JAPEX, especially given their strategic push into Exploration and Production (E&P) activities.

For example, in the fiscal year ending March 2023, JAPEX's exploration and development expenses totaled ¥31.5 billion, reflecting the ongoing commitment to securing future energy supplies. This figure highlights the substantial financial resources dedicated to this vital segment of their operations.

Japex's cost structure heavily relies on ongoing expenses for operating its oil and gas fields. This includes crucial maintenance for wells and facilities, essential labor, and the energy needed for extraction processes. For 2024, these operational expenditures are a significant factor in profitability, directly impacting margins as crude oil and natural gas prices fluctuate.

Furthermore, Japex's investment in renewable energy also contributes to its operating costs. This involves the expenses associated with running power plants and other renewable energy facilities, ensuring their efficient and continuous operation. These costs are vital for meeting energy demands and pursuing diversification strategies.

JAPEX's cost structure heavily relies on the expenses associated with its integrated operations, particularly in transportation and refining. This includes the significant costs of operating and maintaining vital infrastructure like pipelines, LNG terminals, and refining facilities.

Furthermore, the logistics of shipping crude oil and Liquefied Natural Gas (LNG) represent a substantial outlay. For instance, in the fiscal year ending March 2024, JAPEX reported operating expenses of approximately ¥215.8 billion, a portion of which is directly attributable to these transportation and refining activities.

Research and Development Expenses

JAPEX is significantly increasing its investment in research and development, particularly focusing on new energy technologies like Carbon Capture, Utilization, and Storage (CCS/CCUS) and geothermal energy. This strategic shift highlights the company's dedication to driving innovation and supporting the global energy transition. These R&D expenditures are becoming a more substantial component of their overall cost structure.

The company's commitment to exploring and developing low-carbon solutions is directly reflected in these growing R&D outlays. For fiscal year 2023, JAPEX reported R&D expenses of approximately ¥2.8 billion, a notable increase from previous years, signaling a proactive approach to future energy needs and environmental challenges.

- Investment Focus: CCS/CCUS, geothermal, hydrogen, and other low-carbon initiatives.

- Strategic Importance: Demonstrates commitment to energy transition and innovation.

- Financial Impact: Growing R&D spending as a key cost driver.

- Future Outlook: Positioning for sustainable energy development.

Decommissioning and Environmental Compliance Costs

Japex faces significant costs for decommissioning its oil and gas facilities, a crucial element of its cost structure. This includes the safe dismantling of aging infrastructure and ongoing compliance with environmental regulations. For instance, in 2024, the energy sector globally saw increased investment in environmental remediation and decommissioning, with projections suggesting trillions of dollars will be spent globally over the coming decades.

Adherence to stringent environmental standards, particularly regarding carbon emissions, adds another layer of expense. Japex, like many energy companies, must invest in technologies and processes to reduce its carbon footprint. This can involve significant capital outlays for carbon capture or transitioning to lower-emission energy sources. The potential imposition of carbon taxes further amplifies these costs, making proactive environmental management a financial necessity.

- Decommissioning Expenses: Costs for safely shutting down and removing old oil and gas infrastructure.

- Environmental Compliance: Investments to meet current and future environmental regulations.

- Carbon Emission Reduction: Spending on technologies and strategies to lower carbon output.

- Carbon Taxes: Potential financial liabilities based on greenhouse gas emissions.

JAPEX's cost structure is heavily influenced by exploration and development expenditures, operational costs for existing fields, and investments in integrated infrastructure like pipelines and terminals. In the fiscal year ending March 2024, the company's operating expenses were approximately ¥215.8 billion, reflecting these core activities.

Additionally, significant outlays are directed towards research and development, particularly in new energy technologies such as CCS/CCUS and geothermal, with R&D expenses around ¥2.8 billion in FY2023. Decommissioning aging facilities and meeting stringent environmental compliance, including potential carbon taxes, also represent growing cost components.

| Cost Category | FY2023 (¥ Billion) | FY2024 (Estimate/Actual - ¥ Billion) | Key Drivers |

|---|---|---|---|

| Exploration & Development | 31.5 | [Data not available for 2024] | New reserve identification, drilling projects |

| Operating Expenses (Total) | [Data not available for FY2023] | 215.8 | Field maintenance, labor, energy for extraction |

| Research & Development | 2.8 | [Data not available for 2024] | CCS/CCUS, geothermal, hydrogen initiatives |

| Decommissioning & Environmental | [Data not available] | [Data not available] | Facility shutdown, regulatory compliance, carbon reduction |

Revenue Streams

JAPEX's core revenue originates from selling the crude oil and natural gas it extracts from its operational areas, both within Japan and across international borders. This direct sales activity is a significant contributor to its financial performance.

Beyond direct sales, JAPEX also leverages trading partners to market and sell its hydrocarbon products. This provides flexibility and broadens market reach for its produced commodities.

In fiscal year 2023, JAPEX reported total revenue of ¥279.8 billion. The company's production volumes directly influence these sales figures, with efforts focused on maintaining and increasing output to bolster revenue.

The fluctuating global prices of crude oil and natural gas significantly impact JAPEX's revenue from these sales, making commodity market dynamics a key factor in its financial results.

JAPEX generates revenue by liquefying natural gas and selling it as Liquefied Natural Gas (LNG). This is a cornerstone of their natural gas operations, supplying both domestic Japanese customers and international markets. Key buyers include major power companies and city gas suppliers who rely on LNG for energy generation and distribution.

In fiscal year 2023, Japan's LNG imports reached approximately 70.9 million tons, highlighting the significant demand within the domestic market that JAPEX serves. For JAPEX specifically, while exact figures for LNG sales revenue can vary with market prices and volumes, their natural gas production and sales segment is a vital contributor to their overall financial performance.

JAPEX's electricity sales represent a core revenue stream as it diversifies its power generation portfolio. The company is actively expanding its capacity across natural gas, biomass, solar, and geothermal energy sources.

These generated electricity units are then sold into the broader energy markets and directly to the grid, forming a significant contribution to JAPEX's overall revenue. This diversified approach to electricity sales is a key growth area for the company.

In 2024, JAPEX's renewable energy initiatives, including solar and geothermal projects, are expected to bolster this revenue stream, reflecting a strategic push towards cleaner energy generation and sales.

Transportation and Storage Services

Japex can monetize its substantial pipeline and storage network by providing these services to other companies. This allows for efficient utilization of existing infrastructure, generating income beyond Japex's core operations.

Leveraging its established assets, Japex can offer transportation and storage solutions, potentially securing contracts with other energy producers or distributors. This strategy capitalizes on the sunk costs of its infrastructure.

- Pipeline Usage Fees: Charging other entities for transporting their oil and gas through Japex's pipelines.

- Storage Rental: Generating revenue by leasing out space in Japex's storage facilities.

- Terminal Services: Offering services at pipeline terminals, such as loading and unloading, for a fee.

Carbon Neutrality Solutions and Services

Japex is strategically positioning itself to generate future revenue from its Carbon Neutrality Solutions and Services. A significant portion of this anticipated income will stem from the commercialization of Carbon Capture, Utilization, and Storage (CCUS) projects. This focus on CCUS aligns with the global energy transition and represents a key long-term growth avenue for the company.

The company's commitment to decarbonization technologies extends beyond CCUS, with plans to monetize other innovative solutions. For instance, Japex has been actively involved in developing and piloting various carbon reduction technologies. In 2024, the global market for CCUS technology was projected to reach tens of billions of dollars, indicating substantial commercial potential.

- CCUS Project Commercialization: Future revenue will be generated from the sale of captured CO2 or the provision of storage services.

- Decarbonization Technology Licensing: Monetizing proprietary technologies that reduce greenhouse gas emissions.

- Carbon Credits and Offsets: Generating revenue through the sale of carbon credits earned from emission reduction activities.

- Consulting and Engineering Services: Offering expertise in developing and implementing carbon neutrality strategies for other businesses.

Japex’s revenue streams are diverse, encompassing the direct sale of crude oil and natural gas, as well as the sale of Liquefied Natural Gas (LNG). In fiscal year 2023, Japex reported total revenue of ¥279.8 billion, with commodity prices significantly influencing these figures.

The company also generates income from electricity sales, leveraging its expanding portfolio of natural gas, biomass, solar, and geothermal power generation. In 2024, renewable energy projects are expected to further enhance this revenue segment.

Additional income is derived from its infrastructure, offering pipeline usage fees, storage rentals, and terminal services to other entities. Looking ahead, Japex anticipates substantial revenue from its Carbon Neutrality Solutions, particularly from Carbon Capture, Utilization, and Storage (CCUS) projects, capitalizing on a market projected to reach tens of billions of dollars in 2024.

| Revenue Stream | Primary Activity | Key Metrics/Drivers | Fiscal Year 2023 Contribution (Illustrative) | 2024 Outlook |

|---|---|---|---|---|

| Hydrocarbon Sales | Extraction and sale of crude oil and natural gas | Production volume, global commodity prices | ¥279.8 billion (Total Revenue) | Influenced by market price volatility |

| LNG Sales | Liquefaction and sale of natural gas | LNG prices, domestic and international demand | Significant contributor (specific figures vary) | Supported by Japan's substantial LNG import demand (~70.9 million tons in FY2023) |

| Electricity Sales | Generation and sale of electricity from various sources | Capacity expansion, energy market prices | Growing segment | Boosted by renewable energy projects (solar, geothermal) |

| Infrastructure Services | Pipeline transport, storage, terminal operations | Infrastructure utilization rates, third-party contracts | Ancillary revenue | Capitalizing on existing assets |

| Carbon Neutrality Solutions | CCUS, decarbonization technologies, carbon credits | CCUS project commercialization, technology licensing | Anticipated future revenue | Projected to tap into a multi-billion dollar market |

Business Model Canvas Data Sources

The Japex Business Model Canvas is informed by comprehensive market research, internal operational data, and financial performance metrics. This multi-faceted approach ensures a robust and realistic representation of the business's strategic framework.