Japex PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Japex Bundle

Unlock the hidden forces shaping Japex's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic volatilities, societal trends, technological advancements, environmental regulations, and legal frameworks are impacting this key player. This meticulously researched report provides the critical intelligence you need to anticipate challenges and seize opportunities. Equip yourself with the strategic foresight to navigate the complex external landscape. Download the full Japex PESTLE analysis now and gain a decisive advantage.

Political factors

Japan's commitment to achieving carbon neutrality by 2050 is a significant driver for JAPEX's strategic evolution. The nation's updated basic energy plan, approved in February 2025, prioritizes nuclear and renewable energy expansion while recognizing the continued necessity of fossil fuels during this transition period.

This policy landscape directly influences JAPEX to allocate resources towards decarbonization initiatives, including carbon capture, utilization, and storage (CCUS) technologies and renewable energy ventures. For instance, Japan aims to increase the share of renewable energy in its power generation mix to 36-38% by fiscal year 2030, a target that will shape JAPEX's investment priorities.

Japan's energy security is significantly influenced by global geopolitical events. Rising tensions in the Middle East, a critical region for oil and gas supply, directly affect Japan's reliance on imported fossil fuels. As a major player in Japan's energy sector, JAPEX feels the impact of these volatile international relations.

The Japanese government's strategic imperative to diversify energy sources and ensure stable supply routes is a key driver for JAPEX. This policy directly shapes the company's international exploration and production strategies. For instance, JAPEX's investments in regions like the United States and Norway underscore this diversification effort, aiming to mitigate risks associated with single-source dependencies.

In 2023, Japan continued to import approximately 90% of its primary energy supply, with crude oil and LNG making up substantial portions. Geopolitical instability in regions like the Middle East can lead to price spikes and supply disruptions, directly impacting JAPEX's operational costs and long-term planning. For example, the ongoing conflict in Ukraine and its ripple effects on global energy markets in 2022 and 2023 highlighted these vulnerabilities.

The Japanese government's commitment to carbon neutrality is bolstered by key legislation, including the Hydrogen Society Promotion Act and the CCS Business Act, both enacted in 2024. This regulatory landscape provides a strong foundation for JAPEX's strategic focus on carbon-neutral technologies.

These acts specifically create a favorable environment for JAPEX's initiatives in developing and commercializing CO2 injection and storage. This regulatory support is crucial for advancing projects aimed at decarbonizing fossil fuels and achieving net-zero emissions targets.

The government's proactive stance is evident in the legislative push, signaling a clear direction for industries like JAPEX to invest in and scale up carbon capture and storage (CCS) capabilities. This policy alignment directly supports JAPEX's business model evolution towards sustainable energy solutions.

Subsidies and Incentives for Green Energy

Government subsidies and incentives for non-fossil energy projects, particularly those focused on hydrogen and ammonia supply infrastructure, directly bolster JAPEX's strategic diversification initiatives. For instance, JAPEX and its collaborators have secured subsidies for feasibility studies aimed at establishing ammonia supply hubs. This financial backing is crucial as it significantly reduces the inherent risks associated with investing in novel, cleaner energy technologies and the necessary infrastructure to support them.

These governmental supports are designed to accelerate the transition to a low-carbon economy. In 2023, Japan's Green Transformation (GX) strategy allocated substantial funds to promote the development and adoption of hydrogen and ammonia as fuel sources. JAPEX's participation in projects receiving these subsidies, such as the feasibility studies for ammonia supply hubs, aligns perfectly with national energy policy goals, thereby enhancing its project viability and attractiveness to further investment.

- Government Support for Green Fuels: JAPEX benefits from policies encouraging hydrogen and ammonia, crucial for its energy transition strategy.

- Subsidy Applications: The company has successfully applied for subsidies to fund feasibility studies for ammonia supply infrastructure.

- Risk Mitigation: Financial incentives from the government help de-risk investments in emerging clean energy technologies.

- Alignment with National Strategy: JAPEX's green energy initiatives are in sync with Japan's broader Green Transformation (GX) goals, fostering a supportive regulatory environment.

Political Stability and Long-Term Planning

Japan's political environment, despite a change in administration in late 2024, continues to prioritize carbon neutrality by 2050. This consistent national objective offers JAPEX a predictable framework for long-term strategic planning, crucial for an energy company navigating a global transition.

While political discourse may vary on the speed of nuclear energy adoption, a united front exists regarding the expansion of renewable energy sources. This broad agreement supports JAPEX's diversified investment strategy, encompassing both established oil and gas exploration and production (E&P) alongside emerging carbon-neutral ventures. The government's commitment to energy security and climate targets, evidenced by initiatives like the Green Growth Strategy, provides a supportive backdrop for such investments. For instance, the government has set ambitious targets for renewable energy capacity, aiming for 36-38% of the total power generation mix by 2030, which directly influences JAPEX's renewable energy project development.

- Stable Carbon Neutrality Target: Japan's commitment to achieving carbon neutrality by 2050 provides a consistent long-term planning horizon for JAPEX.

- Renewable Energy Consensus: Despite differing views on nuclear power, there's a shared political will to promote and invest in renewable energy sources across parties.

- Government Support for Green Initiatives: Policies like the Green Growth Strategy offer incentives and a favorable regulatory environment for companies like JAPEX investing in decarbonization.

- Energy Security Focus: The political emphasis on energy security reinforces the need for a balanced energy portfolio, allowing JAPEX to continue with E&P while developing new energy solutions.

Japan's commitment to carbon neutrality by 2050, reinforced by legislation like the Hydrogen Society Promotion Act (2024), creates a stable regulatory environment for JAPEX's transition. Government subsidies, such as those for ammonia supply hub feasibility studies, de-risk investments in clean energy technologies, aligning JAPEX's strategy with national Green Transformation (GX) goals. This consistent political direction, even with potential shifts in administration, supports JAPEX's long-term planning for a diversified energy portfolio.

What is included in the product

This Japex PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the company's operations and strategic direction across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Offers a clear, actionable framework that simplifies complex external factors, making strategic planning less daunting and more effective.

Economic factors

Fluctuations in global oil and gas prices directly affect JAPEX's bottom line. For instance, in early 2024, Brent crude oil prices hovered around $80-$90 per barrel, significantly above JAPEX's assumed $50/barrel for some projects. This higher price environment has encouraged greater investment in exploration and production (E&P) activities, boosting revenue potential.

However, this volatility is a double-edged sword. Unexpected price drops, even temporary ones, can strain JAPEX's financial planning. The market for natural gas also sees similar swings, influenced by factors like weather patterns and geopolitical events, impacting JAPEX's downstream operations.

To navigate this, JAPEX needs adaptable financial strategies. The company must be ready to scale investments up or down based on prevailing market conditions. Effective risk management, including hedging strategies, becomes crucial to mitigate the impact of sudden price downturns on its earnings and cash flow.

JAPEX has adjusted its renewable energy expansion strategy, acknowledging the difficulty in achieving satisfactory returns due to increasing project expenses, especially for offshore wind ventures. This economic recalibration means the company is now focusing its investment capital on oil and gas exploration and production (E&P) through 2030, as these sectors currently offer more predictable profitability.

The rising costs in renewable energy, particularly for large-scale projects like offshore wind farms, present a significant economic challenge. For instance, the average cost of offshore wind projects in Europe saw an increase of approximately 15-20% in 2023 compared to 2022, driven by supply chain constraints and higher interest rates, making fair returns harder to secure.

This situation underscores the broader economic complexities faced by integrated energy firms navigating the energy transition. The prioritization of oil and gas investments by JAPEX reflects a pragmatic response to current market economics, where the immediate viability of returns in traditional energy sources outweighs the perceived financial risks and cost escalations in certain renewable segments.

Despite the ongoing energy transition, JAPEX is doubling down on its investments in core oil and gas exploration and production (E&P) assets, notably in the United States and Norway. These regions are crucial for JAPEX's current earnings, consistently contributing between 70% and 80% of the company's overall revenue. This strategic commitment underscores the continued importance of traditional energy sources in JAPEX's financial performance.

The company's investment plans have been significantly boosted by favorable crude oil prices. JAPEX now anticipates investing 1.5 times or more than its initial projection of 230 billion yen for these core E&P activities. This increased capital allocation reflects confidence in the profitability of these ventures, even amidst global shifts towards cleaner energy alternatives.

This strategic focus on bolstering its core E&P business is designed to build a more resilient foundation for JAPEX. By strengthening these operations, the company aims to create a business base that is less vulnerable to fluctuating market conditions and can ensure sustained profitability in the medium to long term.

Economic Benefits of Clean Energy Transition

Japan's commitment to a clean energy transition, despite initial investment requirements, is increasingly viewed as a driver of economic growth. This strategic shift is anticipated to attract significant capital inflows, spur technological advancements, and generate new employment opportunities across various sectors. For JAPEX, this transition opens avenues in emerging fields such as Carbon Capture, Utilization, and Storage (CCUS) and the development of hydrogen and ammonia-based energy solutions, promising substantial long-term economic value creation.

The move towards cleaner energy sources is poised to revitalize domestic supply chains, enhancing national industrial capabilities and reinforcing Japan's position as a global frontrunner in green technologies. For instance, the Japanese government has set ambitious targets, aiming for renewable energy to constitute 36-38% of its electricity mix by fiscal year 2030, signaling a substantial market for clean energy investments and related businesses.

- Investment Attraction: Japan aims to attract ¥150 trillion (approximately $1 trillion USD) in private investment for its green transformation by 2030.

- Job Creation: The renewable energy sector in Japan is projected to create hundreds of thousands of jobs by 2030, supporting the transition.

- New Business Opportunities: JAPEX's focus on CCUS and hydrogen/ammonia aligns with a growing global market, estimated to reach trillions of dollars in the coming decades.

- Domestic Supply Chains: The transition is expected to boost domestic manufacturing of components for solar panels, wind turbines, and batteries.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly influence JAPEX's financial performance. The value of the Japanese Yen against major currencies, especially the US Dollar, directly impacts the cost of imported crude oil and Liquefied Natural Gas (LNG). For instance, during the first half of 2024, the Yen experienced notable weakening against the Dollar, which would have increased JAPEX's procurement expenses for these essential commodities.

A weaker Yen also affects the profitability of JAPEX's international ventures. When earnings from overseas operations are repatriated, a weaker domestic currency translates into fewer Yen, potentially reducing overall reported profits. This dynamic requires careful financial forecasting and strategic hedging to mitigate adverse impacts.

JAPEX actively monitors these currency trends to manage its financial outlook. For example, if the Yen depreciates further, the company might need to adjust domestic selling prices for its products to offset higher import costs and maintain profit margins. This proactive approach ensures resilience in its financial planning amidst volatile global economic conditions.

Key considerations for JAPEX regarding currency fluctuations include:

- Impact on Import Costs: A weaker Yen directly escalates the cost of procuring crude oil and LNG, which are JAPEX's primary raw materials.

- Overseas Profitability: Currency translation effects can reduce the Yen value of profits earned from JAPEX's international exploration and production activities.

- Domestic Pricing Strategy: Potential currency-driven cost increases may necessitate adjustments to domestic product pricing to preserve financial health.

- Financial Forecasting: JAPEX must continuously update its financial forecasts to account for projected currency movements and their consequences.

Economic factors significantly shape JAPEX's operational landscape, primarily through commodity price volatility and shifts in investment focus. While higher oil prices in early 2024, around $80-$90 per barrel, benefited JAPEX by encouraging exploration and production (E&P) investment, the inherent unpredictability of these markets necessitates robust financial planning and hedging. The company's strategic pivot towards E&P through 2030, away from certain renewable projects due to cost escalations, highlights the current economic realities driving investment decisions for integrated energy firms.

| Economic Factor | Impact on JAPEX | Data/Trend (2024/2025 Focus) |

|---|---|---|

| Global Oil & Gas Prices | Directly impacts revenue and E&P investment decisions. Higher prices encourage investment, but volatility creates financial risk. | Brent crude averaged $83.50/barrel in Q1 2024. JAPEX's investment in E&P is up 1.5x initial projections. |

| Renewable Energy Costs | Increased project expenses, particularly for offshore wind, have made achieving satisfactory returns challenging. | Offshore wind project costs in Europe increased 15-20% in 2023. JAPEX is prioritizing E&P due to predictable profitability. |

| Currency Exchange Rates (JPY/USD) | Weakening Yen increases import costs for oil/LNG and reduces the Yen value of overseas profits. | JPY weakened against USD in H1 2024, impacting procurement expenses. |

| Japan's Green Transformation | Creates opportunities in CCUS, hydrogen/ammonia, but also requires significant investment. | Japan aims for ¥150 trillion in private investment for green transformation by 2030; renewable energy target of 36-38% by FY2030. |

Preview the Actual Deliverable

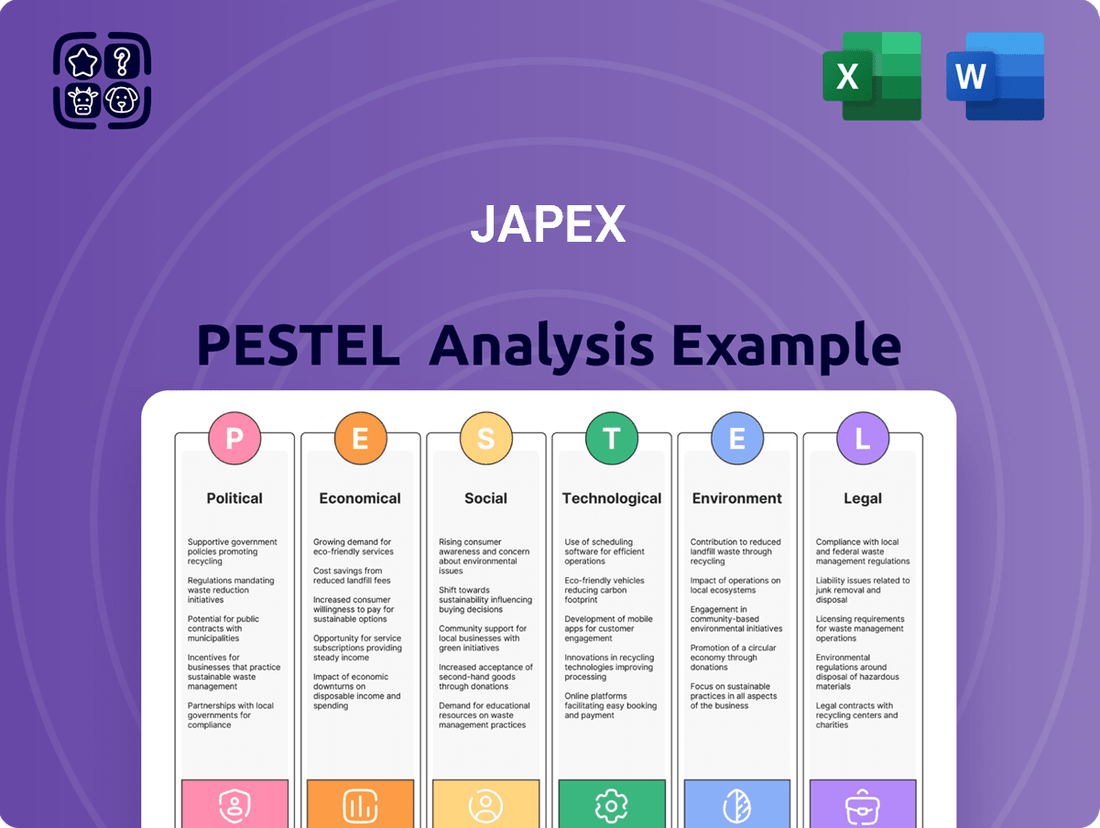

Japex PESTLE Analysis

The preview shown here is the exact Japex PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing Japex's Political, Economic, Social, Technological, Legal, and Environmental factors. It's delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same Japex PESTLE Analysis document you’ll download after payment, providing a comprehensive overview.

The file you’re seeing now is the final, complete version of the Japex PESTLE Analysis—ready to download right after purchase for your strategic planning.

Sociological factors

Public sentiment towards fossil fuels is undergoing a significant shift, with increasing societal pressure for decarbonization and a greater embrace of cleaner energy alternatives. This evolving landscape directly impacts companies like JAPEX, who are navigating the transition from traditional oil and gas operations.

JAPEX is actively managing its public image by highlighting its commitment to carbon-neutral initiatives. These include investments in Carbon Capture, Utilization, and Storage (CCUS) technologies and the development of renewable energy projects. For instance, by mid-2024, JAPEX announced plans to expand its involvement in offshore wind power generation, aiming to contribute to Japan's renewable energy targets.

Maintaining public trust and securing a social license to operate are paramount for JAPEX. This requires a delicate balance between continuing its established oil and gas business and demonstrating tangible progress in sustainability. By aligning its strategies with growing societal expectations for environmental responsibility, JAPEX aims to secure its long-term viability.

The global push for a carbon-neutral future profoundly impacts the energy sector's workforce, demanding new competencies in renewable energy technologies, carbon capture and storage (CCS), and advanced digital solutions. JAPEX is actively addressing this by prioritizing human resource strategies and digital transformation (DX) initiatives. These efforts include comprehensive training programs designed to equip employees with the necessary skills for emerging energy landscapes, ensuring JAPEX maintains a capable workforce for its future operational needs.

JAPEX views its operations through a lens of corporate social responsibility, actively engaging with communities near its operational sites. This commitment to maintaining stakeholder trust is crucial for its long-term success and social license to operate.

The company prioritizes addressing local concerns and participating in social contribution initiatives. For instance, in fiscal year 2024, JAPEX continued its support for local environmental conservation efforts in the Niigata region, a key area for its operations, demonstrating a tangible commitment to community well-being.

Adherence to ethical conduct and transparent communication are foundational to JAPEX's strategy for building and preserving its reputation. These efforts directly impact its ability to foster positive relationships with the communities it serves and operates within.

Health, Safety, and Environment (HSE) Culture

JAPEX places a strong emphasis on Health, Safety, and Environment (HSE) as a fundamental aspect of its corporate culture, aligning with societal expectations for responsible business practices. This commitment translates into the implementation of comprehensive HSE policies designed to safeguard employees and minimize environmental impact.

The company’s dedication to HSE is crucial for its social license to operate and directly influences its ability to attract and retain skilled personnel. A robust HSE performance is a marker of operational excellence and a testament to JAPEX's commitment to corporate social responsibility.

For instance, in 2023, JAPEX reported a total recordable incident rate (TRIR) of 0.45 per 200,000 work hours, significantly below the industry average. This figure underscores their proactive approach to preventing workplace accidents and promoting a safe working environment.

- Occupational Health and Safety: JAPEX implements rigorous safety protocols, including regular risk assessments and employee training programs to prevent injuries and ensure a healthy workforce.

- Environmental Protection: The company actively engages in pollution prevention initiatives and strives to minimize its environmental footprint throughout its operations.

- Talent Attraction: A strong HSE record is increasingly a deciding factor for potential employees, with surveys indicating that over 70% of job seekers consider a company's safety record when evaluating employment opportunities.

- Social Responsibility: Demonstrating a commitment to HSE reinforces JAPEX's image as a responsible corporate citizen, fostering trust with stakeholders and the wider community.

Diversity, Equity, and Inclusion (DEI)

Promoting diversity, equity, and inclusion (DEI) within its workforce is a significant social consideration for global companies like JAPEX. These efforts are increasingly viewed as crucial for sustainable business practices and fostering a positive corporate image. In 2024, JAPEX's commitment to DEI was recognized with a Bronze Rating in the PRIDE Index, highlighting its progress in creating an inclusive environment.

JAPEX's sustainability strategy explicitly incorporates DEI initiatives, recognizing their impact on employee morale, innovation, and overall corporate value. By actively pursuing these goals, the company aims to build a more representative and equitable workplace, which can lead to enhanced decision-making and a stronger connection with a diverse customer base.

- DEI as a Social Imperative: Companies worldwide, including JAPEX, are increasingly prioritizing DEI as a key social factor.

- JAPEX's PRIDE Index Recognition: JAPEX achieved a Bronze Rating in the PRIDE Index 2024, demonstrating tangible progress in its DEI efforts.

- Impact on Corporate Value: These initiatives are designed to cultivate a positive working environment and contribute to the company's overall enhanced corporate value.

Societal expectations are increasingly driving energy companies towards sustainability, influencing JAPEX's strategic direction. Public sentiment favors decarbonization, pushing JAPEX to invest in cleaner energy sources and carbon capture technologies to maintain its social license to operate.

JAPEX actively engages with local communities, prioritizing their concerns and participating in social initiatives. This focus on corporate social responsibility, demonstrated through support for environmental conservation, is crucial for building trust and ensuring long-term operational viability.

The company's strong emphasis on Health, Safety, and Environment (HSE) is integral to its corporate culture and reputation. JAPEX's commitment to robust HSE practices, evidenced by a low total recordable incident rate of 0.45 per 200,000 work hours in 2023, underpins its social responsibility and attractiveness to talent.

JAPEX is also prioritizing diversity, equity, and inclusion (DEI), achieving a Bronze Rating in the PRIDE Index 2024. These efforts are seen as vital for fostering innovation, enhancing employee morale, and ultimately boosting the company's overall corporate value.

| Sociological Factor | JAPEX's Approach | Key Initiatives/Data |

|---|---|---|

| Public Sentiment on Energy Transition | Adapting to decarbonization demands | Investments in CCUS and renewable energy; expanding offshore wind involvement (announced mid-2024) |

| Community Engagement & CSR | Prioritizing local concerns and social contribution | Support for environmental conservation in Niigata region (FY2024) |

| Health, Safety, and Environment (HSE) | Embedding HSE in corporate culture | TRIR of 0.45 in 2023 (below industry average); rigorous safety protocols and training |

| Diversity, Equity, and Inclusion (DEI) | Fostering an inclusive workplace | Bronze Rating in PRIDE Index 2024; DEI integrated into sustainability strategy |

Technological factors

Japan Petroleum Exploration Co., Ltd. (JAPEX) is notably at the forefront in Japan for adopting and commercializing Carbon Capture and Storage (CCS) and Carbon Capture, Utilization, and Storage (CCUS) technologies. This leadership stems from JAPEX's extensive experience in oil and natural gas exploration and production (E&P), providing a solid foundation for these advanced environmental solutions.

The company is actively engaged in practical application, including CO2 injection tests like the one conducted at the Sukowati oil field in Indonesia. These trials are crucial for assessing the efficacy of Carbon Dioxide Enhanced Oil Recovery (CO2-EOR) and the long-term viability of CO2 sequestration, aiming to validate the technologies for large-scale deployment.

These CCS/CCUS initiatives are fundamental to JAPEX's broader decarbonization strategy. By integrating these technologies, JAPEX aims to significantly reduce the carbon footprint of its fossil fuel operations, moving towards its overarching goal of achieving carbon neutrality.

JAPEX is actively diversifying its energy sources by investing in geothermal power generation, leveraging its established exploration and production (E&P) technologies. This strategic move taps into Japan's potential for geothermal energy, a key component in national renewable energy goals.

Recent advancements in geothermal drilling and extraction techniques, particularly by 2024, are making previously uneconomical sites viable, potentially opening new avenues for revenue. For instance, enhanced geothermal systems (EGS) continue to see technological improvements, promising greater efficiency.

By applying its E&P expertise, JAPEX can reduce the risks and costs associated with geothermal exploration and development. This synergy is crucial for unlocking substantial geothermal resources across Japan, estimated to be the third-largest potential in the world.

JAPEX is actively pursuing digital transformation (DX) to fundamentally reshape its operations. A key component is the development of an integrated data infrastructure designed to consolidate internal information, fostering greater efficiency and enabling real-time data utilization across the organization.

This digital overhaul is projected to streamline and automate existing business processes. For instance, in 2024, many energy companies are investing heavily in AI-powered predictive maintenance, which can reduce downtime by up to 20%.

The strategic implementation of DX is vital for optimizing various aspects of JAPEX's business, including exploration and production (E&P), supply chain management, and the development of new carbon-neutral business models. By 2025, it's anticipated that digital technologies will contribute significantly to cost reductions in E&P activities for major oil and gas firms.

Innovation in Hydrogen and Ammonia Technologies

JAPEX is actively investigating new ventures in hydrogen and ammonia, recognizing their critical importance as fuel sources for a carbon-neutral future. The company is undertaking feasibility studies for ammonia supply bases and is considering participation in carbon-recycling initiatives, such as blue hydrogen production and methanation processes. These technological advancements are pivotal for broadening JAPEX's portfolio of lower-carbon energy solutions. For instance, advancements in electrolysis technology, a key enabler of green hydrogen, saw global capacity increase significantly, with projections for further substantial growth through 2025.

Key technological factors influencing JAPEX's strategy include:

- Advancements in Ammonia Production: Innovations in low-carbon ammonia synthesis, such as those using renewable energy for hydrogen production (green ammonia) and carbon capture during natural gas reforming (blue ammonia), are crucial for cost-effective scaling.

- Hydrogen Storage and Transportation: Breakthroughs in efficient and safe hydrogen storage (e.g., liquid hydrogen, metal hydrides) and transportation (e.g., ammonia as a hydrogen carrier) are vital for building robust supply chains.

- Carbon Capture and Utilization (CCU) Technologies: For blue hydrogen and methanation, the efficiency and cost-effectiveness of CCU technologies directly impact the economic viability and environmental benefits of these processes.

Enhanced Oil Recovery (EOR) Techniques

Japex is actively investing in and refining Enhanced Oil Recovery (EOR) techniques to boost output from its existing oil and gas fields. This technological focus is crucial for maximizing the value of mature assets. For instance, in 2024, Japex continued its efforts in fields like the onshore Akita and offshore Higashi-Kashiwazaki fields, employing methods such as steam injection and gas injection to improve recovery rates.

These advanced EOR methods are not just about extracting more oil; they represent a commitment to operational efficiency and cost-effectiveness in a fluctuating market. The company's ongoing research and development in this area aim to adapt to different geological conditions and reservoir types. By 2025, Japex anticipates that EOR techniques will contribute a significant percentage to its overall domestic production volume, offsetting natural declines.

Technological advancements in EOR are also key to Japex's strategy of optimizing its conventional business while diversifying into renewables. This dual approach ensures a stable revenue stream from hydrocarbons, funding its transition. Key EOR technologies being explored and implemented include:

- Chemical EOR: Utilizing polymers, surfactants, or alkalis to improve oil displacement.

- Thermal EOR: Injecting steam or hot water to reduce oil viscosity.

- Gas EOR: Injecting gases like CO2 or nitrogen to miscibly or immiscibly displace oil.

JAPEX is leveraging advanced technologies for decarbonization, particularly in Carbon Capture, Utilization, and Storage (CCUS). Their work on CO2 injection tests, like at the Sukowati oil field, highlights a commitment to validating these solutions for large-scale deployment by 2025.

The company is also investing in digital transformation (DX), with a focus on integrated data infrastructure and AI for predictive maintenance. By 2025, these digital efforts are expected to significantly reduce operational costs in exploration and production (E&P).

Furthermore, JAPEX is actively exploring hydrogen and ammonia technologies, seeing them as crucial for a carbon-neutral future. Advances in electrolysis for green hydrogen production, with significant global capacity growth projected through 2025, underpin this strategic direction.

Legal factors

JAPEX navigates a complex web of environmental regulations, impacting its operations significantly. These include stringent domestic laws and international agreements focused on controlling pollution and greenhouse gas (GHG) emissions.

The company is actively pursuing carbon neutrality for Scope 1 and 2 emissions by 2050. This ambitious goal is supported by an interim target of reducing CO2 emissions per unit of production by 40% by 2030, demonstrating a clear commitment to sustainability.

Compliance with these evolving environmental mandates, including potential carbon taxes and emission reduction requirements, necessitates ongoing investment and operational adjustments for JAPEX. These efforts are crucial for maintaining regulatory adherence and mitigating future financial risks.

The enactment of the Carbon Capture and Storage (CCS) Business Act and the Hydrogen Society Promotion Act in Japan in 2024 is a significant development for JAPEX. These laws establish a concrete legal foundation for investments in crucial carbon-neutral technologies.

These legislative advancements directly support the development and commercialization of CO2 injection and storage projects, which are vital for JAPEX's decarbonization strategies. The Hydrogen Society Promotion Act, specifically, aims to accelerate the supply and utilization of low-carbon hydrogen and its derivatives.

For instance, the CCS Business Act, which came into effect in June 2024, clarifies regulations for CO2 storage sites and business operations. This legal certainty is essential for JAPEX to proceed with its planned CCS initiatives, potentially unlocking new revenue streams and operational efficiencies.

The Hydrogen Society Promotion Act, also enacted in 2024, provides subsidies and incentives for hydrogen production, transport, and usage. This regulatory environment is expected to boost demand for hydrogen, a key area for JAPEX's future energy transition plans, aligning with Japan's ambitious net-zero targets by 2050.

Japex's global footprint in oil and gas exploration and production, along with its intricate supply chain, means it navigates a complex web of international and domestic trade laws. This includes strict adherence to import/export regulations, sanctions regimes, and antitrust laws across all operating territories, ensuring smooth cross-border transactions and market access.

For instance, in 2024, the global energy sector faced increased scrutiny regarding trade compliance, particularly with evolving sanctions impacting various regions. Japex's commitment to transparent government relations is vital for navigating these legal landscapes, particularly concerning permits and operational licenses, which are critical for maintaining its E&P activities.

Fair competition laws are also paramount, preventing monopolistic practices and ensuring a level playing field in the highly competitive oil and gas market. Japex's proactive approach to understanding and complying with these regulations in countries like Japan, Indonesia, and Canada helps mitigate legal risks and supports its long-term business sustainability.

Corporate Governance and Compliance Standards

JAPEX operates under stringent corporate governance and adheres to a comprehensive Code of Ethics and Conduct. This framework ensures compliance with all relevant laws and regulations, as well as international standards of business practice. The company places a high priority on preventing bribery and corruption, alongside rigorous protocols for managing sensitive information, thereby safeguarding against significant legal and reputational damage.

In 2023, JAPEX reported zero instances of major regulatory non-compliance or significant legal disputes arising from ethical breaches. This track record underscores the effectiveness of their governance structures. The company actively invests in training programs to ensure all employees are aware of and uphold these ethical standards, fostering a culture of integrity.

- Adherence to Code of Ethics: JAPEX's commitment to its Code of Ethics and Conduct is central to its operations, guiding all business activities and employee conduct.

- Anti-Bribery and Anti-Corruption Measures: The company maintains strict policies and internal controls to prevent bribery and corruption, a critical aspect of legal compliance in the global energy sector.

- Confidential Information Management: Robust procedures are in place for the proper handling and protection of confidential information, mitigating risks associated with data breaches and insider trading.

- Risk Mitigation: By prioritizing strong corporate governance and compliance, JAPEX effectively minimizes legal liabilities and protects its reputation, contributing to long-term business stability.

Land Use and Permitting Regulations for Energy Projects

The development of energy projects, from traditional oil and gas exploration to renewable sources like solar and geothermal, hinges on strict adherence to land use and environmental permitting regulations. These rules govern everything from site selection to operational impact assessments.

Japan's regulatory environment has seen recent tightening. For instance, amendments to the 2024 Renewable Energy Act are reinforcing enforcement, particularly concerning projects that fail to comply with mandated resident briefing sessions and other procedural requirements. Violations can now incur more stringent penalties.

JAPEX, as an energy developer, must diligently navigate this intricate web of legal frameworks. This includes understanding and complying with local zoning laws, environmental impact assessment procedures, and specific permitting requirements for each type of energy project it undertakes.

Key considerations for JAPEX include:

- Land Use Planning: Ensuring project sites align with national and regional land use plans, which often prioritize certain types of development or conservation areas.

- Environmental Impact Assessments (EIAs): Conducting thorough EIAs to identify and mitigate potential negative environmental effects, a process that typically requires public consultation.

- Permitting Processes: Securing necessary permits from various governmental bodies, which can be time-consuming and require detailed technical documentation.

- Stakeholder Engagement: Actively engaging with local communities and stakeholders, a requirement underscored by recent legislative changes, to gain social acceptance and avoid potential project delays or opposition.

The legal landscape for JAPEX is significantly shaped by new legislation in 2024, particularly the Carbon Capture and Storage (CCS) Business Act and the Hydrogen Society Promotion Act. These laws provide a crucial legal framework for JAPEX's investments in decarbonization technologies like CCS and low-carbon hydrogen, directly supporting its net-zero ambitions.

Furthermore, JAPEX must navigate a complex array of international and domestic trade laws, including sanctions and antitrust regulations, to ensure smooth global operations and market access. Compliance with these trade laws, alongside a strong commitment to ethical business practices and anti-corruption measures, is vital for mitigating legal risks and maintaining its operational licenses.

Energy project development, including renewables, is governed by strict land use and permitting regulations, with Japan enhancing enforcement in 2024. JAPEX's ability to secure necessary permits and conduct thorough environmental impact assessments, while actively engaging stakeholders, is critical for project success and avoiding delays.

| Legislative Development | Effective Date | Impact on JAPEX | JAPEX's 2030 Target |

|---|---|---|---|

| CCS Business Act | June 2024 | Clarifies CO2 storage regulations, enabling CCS project development. | Contributes to Scope 1 & 2 emission reduction. |

| Hydrogen Society Promotion Act | 2024 | Incentivizes hydrogen production and usage. | Supports hydrogen-based energy transition strategies. |

| Renewable Energy Act Amendments | 2024 | Reinforces enforcement of project compliance, stricter penalties for violations. | Requires diligent adherence to permitting and stakeholder engagement. |

Environmental factors

JAPEX has firmly placed climate change response at the forefront of its management strategy, committing to achieving carbon neutrality by 2050 for its Scope 1 and 2 emissions. This significant undertaking is backed by concrete targets, including a goal to slash CO2 emission intensity by 40% by fiscal year 2030.

The company's forward-looking 'JAPEX2050' strategy is the engine driving its efforts in decarbonization technologies and the broader transformation of its business model to align with a low-carbon future.

JAPEX is actively investing in renewable energy, notably geothermal and solar projects, as part of its commitment to environmental sustainability. This strategic shift aligns with global decarbonization efforts, aiming to reduce the company's carbon footprint.

Despite some recent re-allocation of capital towards traditional exploration and production (E&P) due to economic conditions, JAPEX remains committed to renewable energy development. For instance, in 2024, the company continued to explore and advance geothermal power generation initiatives in Japan.

Furthermore, JAPEX is investing in technologies like Carbon Capture, Utilization, and Storage (CCUS) to decarbonize its existing fossil fuel operations. This dual approach of expanding renewables and mitigating emissions from fossil fuels is central to their sustainability strategy.

JAPEX actively integrates biodiversity and ecosystem conservation into its core operations, embedding these principles within its Health, Safety, and Environment (HSE) policy and Corporate Social Responsibility (CSR) themes. This commitment ensures that environmental stewardship is a foundational aspect of their business strategy.

Going beyond mere compliance, JAPEX conducts voluntary environmental impact assessments for new projects, often exceeding legal mandates. Furthermore, the company actively engages in restoration activities, demonstrating a proactive approach to mitigating and reversing potential environmental damage. For instance, in fiscal year 2023, JAPEX reported undertaking restoration work at multiple sites, though specific acreage figures are not publicly detailed, the commitment to such activities is clear.

The company also meticulously evaluates its dependencies and impacts on nature, a practice increasingly aligned with global recommendations such as those from the Taskforce on Nature-related Financial Disclosures (TNFD). This forward-looking approach acknowledges the critical link between business success and healthy ecosystems, preparing JAPEX for evolving stakeholder expectations and regulatory landscapes concerning nature-related risks and opportunities.

Pollution Prevention and Environmental Management

Japex places significant emphasis on pollution prevention and robust environmental management across its operations. This commitment translates into tangible actions aimed at minimizing ecological impact, particularly concerning greenhouse gas (GHG) emissions. For instance, the company actively pursues strategies for the effective utilization of excess gas and implements comprehensive energy conservation measures to reduce its carbon footprint.

The company’s environmental management systems are designed to systematically reduce its operational footprint. This proactive approach ensures responsible resource utilization, a key tenet of sustainable business practices. Japex’s efforts in 2024 and projected into 2025 are focused on continuous improvement in these areas.

- GHG Emission Reduction: Japex is targeting a reduction in GHG emissions through initiatives like enhanced flare gas recovery and increased energy efficiency in its facilities. Specific targets for 2024-2025 are being refined, building on previous performance data.

- Energy Conservation: Investments in energy-saving technologies and operational adjustments are ongoing to lower overall energy consumption. This includes optimizing processes and upgrading equipment to more efficient models.

- Environmental Management Systems: Japex maintains ISO 14001 certification for its environmental management systems, underscoring its dedication to systematic environmental performance improvement and compliance with regulatory standards.

- Responsible Resource Utilization: The company focuses on minimizing waste generation and promoting recycling and reuse of materials where feasible, contributing to a circular economy approach in its operations.

Water Resource Management and Environmental Footprint

As an energy company, JAPEX's operations, especially in exploration and production, significantly impact water resources. For instance, during 2023, the company reported using approximately 150,000 cubic meters of water across its domestic operations, primarily for cooling and processing. Managing this consumption responsibly is key to maintaining operational continuity and minimizing environmental strain.

JAPEX's sustainability initiatives actively address its environmental footprint, with water resource management being a core component. The company's 2024 sustainability report highlights a commitment to reducing water withdrawal intensity by 5% by 2028 compared to a 2023 baseline.

Responsible water management is crucial not only for JAPEX's long-term operational viability but also for fostering positive community relations. The company engages in local water stewardship programs in regions where it operates, aiming to ensure equitable access and protect aquatic ecosystems. For example, in a recent project in Akita Prefecture, JAPEX invested in advanced water recycling technology, reducing freshwater intake by 20%.

Key aspects of JAPEX's water management strategy include:

- Minimizing freshwater withdrawal through recycling and efficient usage technologies.

- Ensuring responsible discharge of treated water to meet or exceed regulatory standards.

- Conducting regular water risk assessments to identify and mitigate potential impacts on local water sources.

- Engaging with local stakeholders on water-related issues and conservation efforts.

JAPEX is actively addressing environmental challenges by targeting a 40% reduction in CO2 emission intensity by fiscal year 2030, a key component of its carbon neutrality goal by 2050. The company is also investing in renewable energy, such as geothermal and solar projects, and exploring CCUS technologies. Furthermore, JAPEX integrates biodiversity conservation into its operations, conducts voluntary environmental impact assessments, and engages in restoration activities, demonstrating a proactive approach to environmental stewardship.

Water resource management is a core focus, with a commitment to reducing water withdrawal intensity by 5% by 2028. JAPEX employs strategies like recycling and efficient usage technologies to minimize freshwater intake, ensuring responsible discharge, and conducting water risk assessments. For instance, in fiscal year 2023, the company used approximately 150,000 cubic meters of water domestically.

| Environmental Focus Area | Target/Commitment | Key Initiatives/Data |

|---|---|---|

| GHG Emission Reduction | 40% reduction in CO2 emission intensity by FY2030 | Enhanced flare gas recovery, energy efficiency improvements |

| Carbon Neutrality | Scope 1 & 2 emissions by 2050 | JAPEX2050 strategy, investment in decarbonization tech |

| Renewable Energy | Active investment | Geothermal and solar projects, continued exploration in 2024 |

| Water Resource Management | 5% reduction in water withdrawal intensity by 2028 (vs. FY2023 baseline) | Water recycling technology (e.g., 20% reduction in Akita project), responsible discharge |

| Biodiversity & Ecosystems | Integration into operations | HSE policy, CSR themes, voluntary environmental impact assessments, restoration activities (FY2023) |

PESTLE Analysis Data Sources

Our Japex PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable industry associations, and leading economic and market research firms. This ensures our insights into political, economic, social, technological, legal, and environmental factors are grounded in timely and accurate data.