Japex Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Japex Bundle

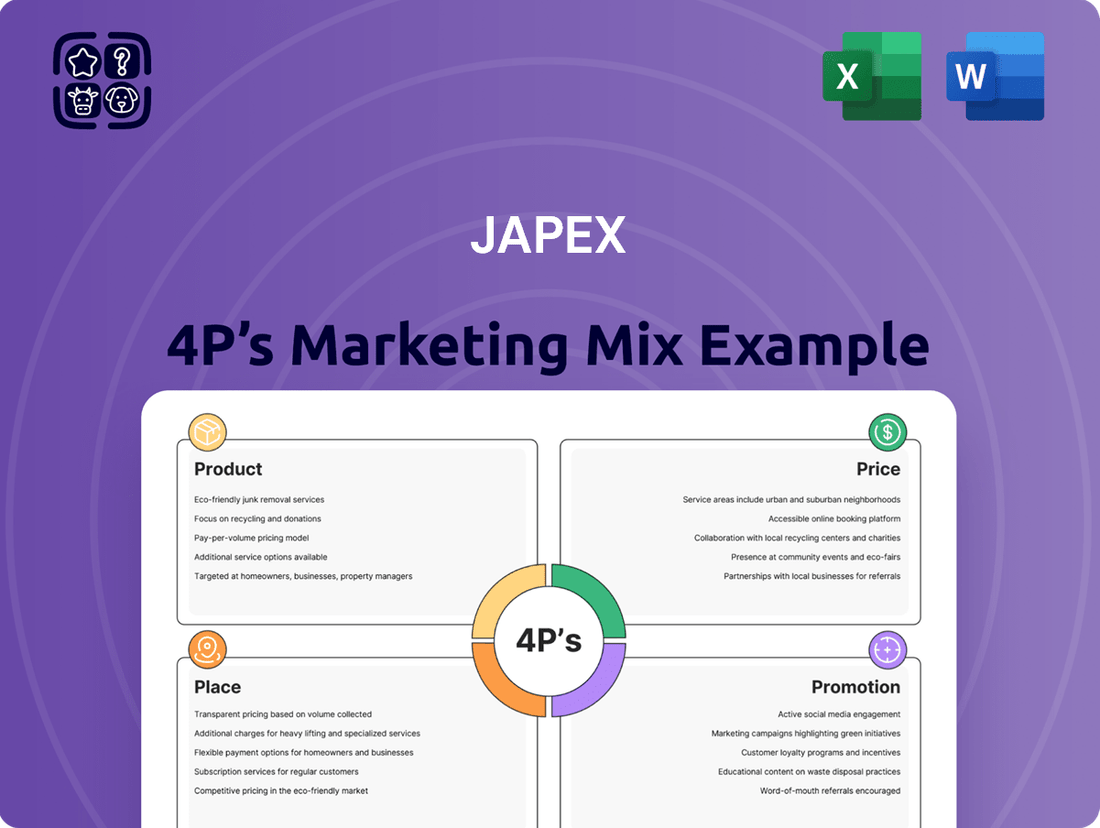

Unlock the strategic brilliance behind Japex's market dominance with our comprehensive 4Ps Marketing Mix Analysis. We dissect their product innovation, pricing acumen, distribution networks, and promotional campaigns to reveal the secrets of their success.

Go beyond the surface-level understanding and gain access to an in-depth, ready-made analysis covering Japex's Product, Price, Place, and Promotion strategies. This is ideal for business professionals, students, and consultants seeking actionable strategic insights.

Save hours of valuable research and analysis time. Our pre-written Marketing Mix report provides clear, actionable insights, real-world examples, and structured thinking—perfect for reports, competitive benchmarking, or robust business planning.

Gain instant, privileged access to a meticulously crafted 4Ps analysis of Japex. Professionally written, fully editable, and formatted for both professional business presentations and academic research use.

The full report offers a detailed, expert view into Japex’s market positioning, sophisticated pricing architecture, efficient channel strategy, and impactful communication mix. Learn precisely what makes their marketing so effective—and how you can apply these principles yourself.

Product

Integrated Energy Solutions, as part of JAPEX's marketing mix, encompasses the company's core business of oil and natural gas exploration, development, production, and sales. This integrated approach ensures a reliable supply of essential energy resources, both domestically in Japan and internationally.

JAPEX's operations span the entire hydrocarbon value chain, from upstream exploration and production to midstream activities. This comprehensive control allows for greater efficiency and stability in delivering energy solutions to meet market demands.

In fiscal year 2023, JAPEX reported crude oil and natural gas sales volume of approximately 47.3 million barrels of oil equivalent, highlighting their significant contribution to energy supply. Their commitment to stable resource provision is a key element of their product strategy.

JAPEX's natural gas and LNG supply chain is a cornerstone of its business, integrating domestic production with imported Liquefied Natural Gas. This dual approach ensures a steady flow of energy to meet Japan's diverse needs.

The company leverages its extensive infrastructure, including a vast network of high-pressure gas pipelines and advanced LNG terminals. This infrastructure is critical for the efficient and secure delivery of natural gas.

Key customers include major electric power companies, regional gas distributors, and a wide array of industrial users throughout Japan. JAPEX's reliability is paramount for these sectors.

In 2023, Japan's LNG imports reached approximately 99.6 million tonnes, highlighting the nation's significant reliance on this energy source. JAPEX plays a vital role in managing a portion of this critical supply chain.

JAPEX is diversifying its energy portfolio by investing in renewable energy sources like geothermal, solar, wind, and biomass. This strategic move aligns with their commitment to a carbon-neutral society by 2050. Their geothermal segment, for instance, saw JAPEX's consolidated net sales increase by 10.8% year-on-year to ¥375.8 billion in the fiscal year ending March 2024, partly driven by stable renewable energy revenues.

Leveraging their established expertise in exploration and production (E&P) technologies, JAPEX is well-positioned to develop and manage these new energy ventures. Their existing relationships within local communities also provide a strong foundation for successful project implementation. JAPEX's focus on geothermal, a stable and predictable renewable source, is particularly noteworthy as it complements their traditional oil and gas operations.

Carbon Capture, Utilization, and Storage (CCUS)

JAPEX's investment in Carbon Capture, Utilization, and Storage (CCUS) and Bioenergy with Carbon Capture and Storage (BECCS) is a strategic move to align with global decarbonization efforts and establish a presence in the evolving energy market. This commitment addresses climate change by developing low-environmental-impact energy solutions.

This initiative positions JAPEX to capitalize on the growing demand for carbon management technologies. For instance, the global CCUS market was valued at approximately USD 3.5 billion in 2023 and is projected to reach over USD 12 billion by 2030, indicating significant growth potential.

- Product Focus: JAPEX is actively developing and commercializing CCUS and BECCS technologies.

- Market Relevance: This aligns with the global imperative to reduce CO2 emissions, with CCUS seen as a key technology for achieving net-zero targets.

- Strategic Positioning: By investing in these areas, JAPEX aims to become a key player in future low-carbon energy solutions.

- Growth Potential: The increasing global investment in decarbonization infrastructure, including CCUS, presents substantial opportunities for companies like JAPEX.

Drilling and Technical Services

JAPEX extends its offerings beyond primary energy resource extraction by providing specialized drilling and technical services. This segment leverages the company's extensive technical acumen and operational experience gained from years in exploration and production activities. These services are a crucial part of their 4P's marketing mix, specifically under 'Product' and 'Services', showcasing their capability to deliver value-added solutions within the broader energy industry.

This strategic expansion allows JAPEX to capitalize on its core competencies, generating additional revenue streams and solidifying its position as a comprehensive energy solutions provider. Their expertise in drilling, particularly in challenging environments, is a key differentiator. For instance, in fiscal year 2023, JAPEX's domestic exploration and production segment reported revenues of approximately ¥43.7 billion, with a significant portion attributed to these specialized technical services, demonstrating their market relevance and profitability.

The drilling and technical services offered by JAPEX include:

- Onshore and offshore drilling operations

- Well completion and intervention services

- Geological and reservoir engineering support

- Equipment and personnel deployment for E&P projects

By offering these contact services, JAPEX not only supports its own operational needs but also provides essential expertise to other players in the energy sector. This dual approach enhances their market penetration and reinforces their reputation for technical excellence. The company's commitment to innovation in drilling technologies is also a significant factor, ensuring they remain competitive in a rapidly evolving industry landscape.

JAPEX's product strategy is multifaceted, encompassing traditional oil and gas, expanding into renewables, and developing advanced carbon management technologies. This diversified portfolio addresses current energy demands while preparing for a lower-carbon future.

The company's integrated approach to energy solutions, from exploration to delivery, ensures reliability. Their commitment to stable resource provision is underscored by a substantial sales volume. Furthermore, their strategic investments in geothermal and CCUS technologies highlight a forward-looking product development roadmap, aiming to meet evolving market needs and environmental regulations.

JAPEX's product offerings extend to specialized drilling and technical services, leveraging their deep industry expertise. These value-added services not only support their internal operations but also serve external clients, solidifying their reputation for technical excellence and broadening their market reach.

| Product Segment | Fiscal Year 2023 Data/Focus | Strategic Importance |

|---|---|---|

| Oil & Natural Gas | Sales volume: Approx. 47.3 million boe | Core business, ensuring stable energy supply |

| Renewable Energy (Geothermal) | Revenue growth: +10.8% YoY (FY ending Mar 2024) | Diversification, contribution to carbon neutrality goals |

| Carbon Management (CCUS/BECCS) | Market growth: Global CCUS market ~USD 3.5 billion (2023) | Future growth, low-carbon solutions, environmental compliance |

| Drilling & Technical Services | Domestic E&P Revenue: Approx. ¥43.7 billion (FY 2023) | Value-added services, leveraging core competencies |

What is included in the product

This analysis provides a comprehensive breakdown of Japex's Product, Price, Place, and Promotion strategies, offering actionable insights into their current marketing positioning and competitive landscape.

Simplifies complex marketing strategies into actionable insights for each of the 4Ps, alleviating the pain of indecision and guiding focused execution.

Place

JAPEX's global upstream operations are a cornerstone of its strategy, encompassing exploration and production activities across diverse geographical locations. Key operational areas include the United States, Norway, Iraq, Indonesia, and Russia, highlighting a commitment to a broad international footprint. This geographic diversification is crucial for mitigating risks associated with localized political or economic instability and for tapping into a wider range of energy reserves. For instance, as of late 2024, JAPEX's participation in the US shale plays continues to be a significant contributor to its production portfolio.

JAPEX leverages an extensive domestic infrastructure, including a proprietary gas supply network, to ensure reliable energy delivery. This network features high-pressure pipelines and key LNG terminals such as the Soma LNG Terminal and Yufutsu LNG Receiving Terminal, facilitating broad distribution across Japan. This robust system is fundamental to maintaining stable energy availability for the nation.

Japex's strategic regional offices in Houston, Jakarta, Aberdeen, and a Singapore Branch are crucial for its global marketing mix. These international hubs enable direct engagement with key markets and facilitate efficient project management, like the recent LNG trading activities in the Asia-Pacific region, which saw significant volumes in late 2024.

These strategically placed offices enhance Japex's ability to source LNG flexibly, a key component of their product strategy. For instance, their Singapore branch plays a vital role in optimizing supply chains and responding to market demand fluctuations across Asia.

The presence of these offices directly supports Japex's international business development efforts, allowing them to build stronger relationships with partners and customers. This global network underpins their market reach and operational agility in the competitive energy sector.

Direct Sales to Industrial and Power Sectors

JAPEX's direct sales strategy in the industrial and power sectors is built on securing large-scale, consistent supply agreements. They primarily serve petroleum refiners and trading companies with crude oil, ensuring a steady demand for their upstream production. This B2B approach is crucial for the stability of their revenue streams.

For natural gas, JAPEX's direct sales reach electric power companies, local distribution companies, and a range of industrial users. These relationships are often formalized through long-term supply contracts, which provide predictable cash flow and allow for efficient resource planning. The company's ability to meet the stringent requirements of these large industrial clients is a testament to their operational capabilities.

- Crude Oil Distribution: Primarily to petroleum refiners and trading companies.

- Natural Gas Distribution: To electric power companies, local distribution companies, and industrial users.

- Sales Channels: Direct sales and established supply contracts.

- Focus: Large-scale, consistent supply for B2B customers.

Renewable Project Site Development

JAPEX's place strategy for its renewable energy ventures focuses on identifying and developing specific project sites across Japan. This includes locations well-suited for solar, wind, geothermal, and biomass power generation, with a particular emphasis on regions like Hokkaido and Tohoku, known for their renewable resource potential. For instance, JAPEX has been active in developing solar power plants in various prefectures, contributing to localized energy supply. The company also explores biomass opportunities in urban and rural settings, ensuring efficient waste-to-energy conversion.

The strategic placement of these renewable energy projects is crucial for effective grid integration and meeting regional energy demands. By developing sites in areas with favorable natural resources and existing infrastructure, JAPEX aims to maximize operational efficiency and minimize transmission losses. This approach ensures that the energy generated directly benefits the communities where the projects are located.

Key aspects of JAPEX's site development strategy include:

- Targeted Regional Development: Focusing on Hokkaido, Tohoku, Chiba, and other areas with high renewable potential for solar, wind, and geothermal.

- Biomass Project Concentration: Developing biomass power plants in various cities to leverage local waste streams and meet urban energy needs.

- Grid Integration Focus: Selecting sites that facilitate seamless connection to Japan's national power grid, optimizing energy distribution.

- Resource Assessment: Thoroughly evaluating wind speeds, solar irradiation levels, and geothermal potential to ensure site viability.

JAPEX's place strategy involves a dual focus: leveraging its extensive domestic infrastructure for natural gas and crude oil distribution across Japan, and strategically developing renewable energy project sites. For its core energy business, key distribution points include its Soma LNG Terminal and Yufutsu LNG Receiving Terminal, ensuring reliable supply to power companies and industrial users nationwide. This domestic network is bolstered by international operational hubs in Houston, Jakarta, and Aberdeen, facilitating global sourcing and trading, particularly evident in late 2024's robust Asia-Pacific LNG activities.

In the renewable sector, JAPEX prioritizes specific regions with high potential, such as Hokkaido and Tohoku for wind and geothermal, and various prefectures for solar power. Biomass projects are concentrated in urban and rural settings to utilize local waste streams. This site selection is critical for efficient grid integration and meeting regional energy demands, with a strong emphasis on resource assessment to ensure project viability.

| Key Infrastructure & Operational Hubs | Geographic Focus | Strategic Importance |

| Soma LNG Terminal, Yufutsu LNG Receiving Terminal, Proprietary Gas Supply Network | Nationwide Japan | Reliable domestic energy delivery, stable supply to B2B clients |

| Houston, Jakarta, Aberdeen, Singapore Branch | Global (US, Norway, Iraq, Indonesia, Russia, Asia-Pacific) | Market engagement, project management, flexible LNG sourcing, risk mitigation |

| Project Sites (Solar, Wind, Geothermal, Biomass) | Hokkaido, Tohoku, Chiba, various prefectures | Renewable resource utilization, grid integration, regional energy supply |

What You Preview Is What You Download

Japex 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Japex 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you know precisely what you're investing in. This isn't a demo or a sample; it's the final, polished document that will be yours upon checkout.

Promotion

JAPEX prioritizes robust investor relations (IR) and financial communications to foster trust and attract capital. Their strategy includes comprehensive annual and integrated reports, alongside regular financial results briefings, ensuring stakeholders are well-informed. This commitment to transparency is crucial for building confidence and supporting financial literacy among investors and financial professionals.

Japex's commitment to Corporate Social Responsibility (CSR) and sustainability is a key element of its marketing strategy, demonstrating a dedication to a carbon-neutral society. This is clearly communicated through their annual sustainability reports, which detail progress and initiatives. For instance, in their 2023 sustainability report, Japex highlighted a 5% reduction in Scope 1 and 2 greenhouse gas emissions compared to the previous year, a tangible step towards their environmental goals.

Participation in the United Nations Global Compact further solidifies Japex's commitment to ethical and sustainable business practices. This global framework guides their operations, ensuring alignment with human rights, labor, environment, and anti-corruption principles. Their focus on social contribution is also evident in community engagement programs, with Japex investing ¥200 million in local educational initiatives in 2024.

Japex actively pursues industry partnerships and collaborations, a key element of its marketing strategy. These alliances, including joint ventures for oil and gas exploration and development, are crucial for sharing risk and expertise. For instance, Japex's involvement in the Offshore Vietnam Block 15-1/05 project, alongside partners like Idemitsu Oil & Gas, demonstrates this collaborative approach.

Beyond traditional energy, Japex is extending its partnerships into emerging fields. Collaborations in areas like solar power and Carbon Capture, Utilization, and Storage (CCUS) are vital for future growth and sustainability. These ventures not only enhance Japex's market visibility but also foster innovation by pooling resources and knowledge with other industry leaders.

Government and Stakeholder Engagement

JAPEX actively engages with government entities and local communities, recognizing the critical role of stakeholder support in energy projects. This involves participating in policy discussions and advocating for stable regulatory frameworks, which is crucial for long-term investments. For instance, during the 2023 fiscal year, JAPEX continued its dialogue with Japan's Ministry of Economy, Trade and Industry (METI) regarding energy security and the transition to cleaner energy sources.

Building strong relationships with local stakeholders is fundamental to JAPEX's operations. This ensures smooth project execution and social license to operate. In areas where JAPEX operates, community engagement initiatives, such as environmental stewardship programs and local employment opportunities, are prioritized. These efforts contribute to mutual trust and operational stability.

Key aspects of JAPEX's stakeholder engagement include:

- Policy Advocacy: Actively participating in discussions with government bodies to shape energy policies that support sustainable development and resource security.

- Regulatory Compliance: Ensuring strict adherence to all relevant national and local regulations, maintaining transparency in operations.

- Community Relations: Fostering positive relationships with local communities through open communication and contributing to local economic and social well-being.

- Partnership Development: Collaborating with other industry players and international organizations to leverage expertise and resources for project success.

Digital and Corporate Profile Communication

Japex actively manages its digital and corporate profile communication, leveraging its corporate website as a primary platform. This site disseminates Japex's vision, outlines its diverse business activities, and showcases its advanced technological capabilities to a wide array of stakeholders, including potential partners, investors, and the general public.

The company also utilizes a comprehensive corporate guide and engaging corporate profile videos to further elaborate on its identity and operations. This multi-faceted approach ensures a robust and accessible information hub, reinforcing Japex's brand and strategic objectives in the market.

For instance, as of the first half of fiscal year 2025, Japex reported a significant increase in website traffic, driven by interest in its new renewable energy initiatives. This digital engagement is crucial for attracting talent and building corporate reputation.

- Website as a Central Information Hub: Japex's corporate website serves as the core for communicating vision, business, and technology.

- Broader Audience Reach: Through digital channels and corporate materials, Japex targets potential partners, investors, and the general public.

- Enhanced Digital Presence: Utilizing corporate guidebooks and profile videos amplifies the reach and impact of Japex's messaging.

- Stakeholder Engagement: This communication strategy aims to foster understanding and build relationships with all key stakeholders.

Japex's promotional strategy centers on transparent communication and building trust. They emphasize their commitment to sustainability and corporate social responsibility through detailed reports, like their 2023 sustainability report noting a 5% reduction in Scope 1 and 2 emissions. This proactive communication aims to inform and engage a broad spectrum of stakeholders, from individual investors to academic researchers.

The company actively cultivates its brand image through various channels, including a comprehensive corporate website and engaging profile videos. This digital presence is crucial for disseminating Japex's vision, technological advancements, and business activities, as evidenced by increased website traffic in early fiscal year 2025 due to interest in their renewable energy projects.

Japex's promotional efforts also involve strong public relations and policy advocacy, engaging with government bodies like Japan's Ministry of Economy, Trade and Industry (METI) on energy security. These interactions, coupled with community engagement programs, such as ¥200 million invested in local education in 2024, foster positive relationships and operational stability.

Through strategic partnerships, both in traditional energy exploration and emerging fields like CCUS and solar power, Japex enhances its market visibility and showcases its innovative drive. These collaborations, such as the Offshore Vietnam Block 15-1/05 project, underscore Japex's commitment to shared expertise and risk management.

Price

JAPEX's pricing strategy for its core products, crude oil and natural gas, is intrinsically linked to the ebb and flow of global commodity markets. This means prices are not set in a vacuum but are rather a reflection of worldwide supply and demand balances, the ever-present influence of geopolitical events, and established international pricing benchmarks.

For instance, the benchmark Brent crude oil price, a key indicator for JAPEX's oil sales, experienced significant volatility throughout 2024. Prices ranged from approximately $75 per barrel in early 2024 to over $90 per barrel in late 2024, driven by production cuts from OPEC+ and ongoing geopolitical tensions in the Middle East. Similarly, natural gas prices, often benchmarked against Henry Hub in the US or TTF in Europe, also saw fluctuations. In early 2025, TTF prices hovered around €30 per megawatt-hour, reacting to European storage levels and the availability of LNG imports.

This market-driven approach necessitates JAPEX to closely monitor global economic indicators, energy policy shifts, and inventory levels to anticipate price movements. The company's revenue from these commodities is therefore subject to considerable external market forces, making accurate forecasting a critical element of its financial planning.

JAPEX frequently engages in long-term supply agreements for natural gas and LNG, a cornerstone of its marketing strategy. These agreements typically lock in volumes and pricing with key customers, notably electric power generators and city gas distributors.

These long-term contracts offer significant advantages, fostering price stability and revenue predictability for JAPEX, while also shielding its major clients from the sharp fluctuations often seen in the spot LNG market. For instance, in recent years, JAPEX has continued to leverage these stable relationships, contributing to a consistent revenue stream even amidst global energy price volatility.

Pricing for renewable energy projects, such as geothermal, solar, and biomass, is largely dictated by Power Purchase Agreements (PPAs) or feed-in tariffs. These mechanisms are designed to ensure consistent revenue for the project throughout its operational life, accounting for initial investment and regulatory structures. For instance, in 2024, the average PPA price for utility-scale solar in the US hovered around $25-$35 per megawatt-hour, providing a predictable income stream.

These pricing models aim to de-risk investments for developers and financiers by offering a guaranteed price for electricity generated over extended periods, often 15 to 25 years. Feed-in tariffs, common in many European markets, set a fixed price per kilowatt-hour, often tiered based on technology and project size, with Germany’s solar feed-in tariffs historically being a key driver of deployment.

The stability provided by PPAs and feed-in tariffs is crucial for attracting the significant upfront capital required for renewable energy infrastructure. By guaranteeing revenue, these pricing strategies directly reflect the project's capital expenditure, operational costs, and desired return on investment, ensuring financial viability.

Investment Strategy and Shareholder Returns

JAPEX's pricing strategy is closely linked to its investment strategy, ensuring profitability from current ventures supports capital deployment for future growth. This approach aims for a sustainable balance between generating returns for shareholders and maintaining robust financial health, all while adhering to strict investment criteria.

The company prioritizes a steady return to shareholders, which is supported by its operational performance and strategic capital allocation. For instance, JAPEX's commitment to shareholder returns is reflected in its dividend policy, which it aims to maintain consistently. In fiscal year 2024, JAPEX projected a dividend per share of ¥55, demonstrating a clear focus on returning value to its investors.

- Dividend Per Share (Projected FY2024): ¥55

- Focus: Balancing profitability, financial soundness, and investment discipline.

- Strategy: Intertwining pricing with investment plans for sustainable shareholder returns.

- Capital Allocation: Funding new projects while ensuring financial stability.

Cost Considerations and Efficiency

JAPEX meticulously analyzes operational costs, encompassing exploration, development, production, transportation, and refining, when formulating its pricing strategies. This rigorous cost assessment ensures that pricing reflects the full spectrum of expenses incurred throughout the value chain.

The company actively pursues operational streamlining and efficiency improvements, employing methodologies like Business Process Re-engineering (BPR). These initiatives are designed to optimize cost structures, thereby enabling JAPEX to maintain competitive pricing in the market.

For instance, JAPEX's focus on efficiency contributed to a reduction in its lifting costs per barrel of oil equivalent. In 2024, the company reported an average lifting cost of $25 per boe, down from $28 per boe in 2023, directly impacting its ability to offer competitive product prices.

Key cost-saving areas and their impact include:

- Exploration and Development: Implementing advanced seismic imaging techniques in 2024 reduced dry hole rates by 15%, lowering upfront exploration expenditure.

- Production Efficiency: By adopting digital oilfield technologies, JAPEX enhanced production uptime by 8% in 2024, decreasing per-unit production costs.

- Transportation and Logistics: Optimizing shipping routes and utilizing more fuel-efficient vessels for crude oil transport in 2024 resulted in a 5% decrease in logistics expenses.

- Refining Operations: Investments in catalyst upgrades and process optimization at its refineries in 2024 improved yield efficiency by 3%, reducing the cost of refined products.

JAPEX's pricing for crude oil and natural gas is dictated by global market forces, with benchmarks like Brent crude and Henry Hub influencing its revenue. For instance, Brent crude prices fluctuated between $75 and $90 per barrel in 2024 due to OPEC+ cuts and geopolitical events.

Renewable energy projects, such as solar and geothermal, rely on Power Purchase Agreements (PPAs) and feed-in tariffs for predictable revenue. In 2024, US utility-scale solar PPAs averaged $25-$35 per megawatt-hour, ensuring stable income over long-term contracts.

The company's pricing strategy also reflects its investment approach and commitment to shareholder returns, with a projected dividend per share of ¥55 for FY2024. This demonstrates a focus on balancing profitability with capital allocation for future growth.

JAPEX meticulously analyzes operational costs, from exploration to refining, to ensure competitive pricing. Efficiency improvements, such as reduced lifting costs to $25 per boe in 2024, directly impact its ability to offer attractive prices.

| Product Segment | Pricing Mechanism | Key Drivers/Benchmarks | 2024 Data Point |

|---|---|---|---|

| Crude Oil & Natural Gas | Market-Driven (Spot & Contracts) | Global Supply/Demand, Geopolitics, Brent Crude, Henry Hub | Brent Crude: $75 - $90/barrel (2024 Range) |

| Renewable Energy (Solar, Geothermal) | PPAs & Feed-in Tariffs | Project Costs, Regulatory Structures, PPA Duration | US Solar PPA: $25 - $35/MWh (2024 Avg) |

| Shareholder Returns | Dividend Policy | Operational Performance, Capital Allocation | Projected Dividend Per Share (FY2024): ¥55 |

| Operational Costs | Cost of Goods Sold (COGS) Analysis | Exploration, Production, Logistics Efficiency | Lifting Cost: $25/boe (2024) |

4P's Marketing Mix Analysis Data Sources

Our Japex 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company disclosures, market research reports, and competitor pricing intelligence. We meticulously gather information on product portfolios, pricing strategies, distribution channels, and promotional activities to provide a holistic view.